Introduction

Navigating Kentucky's revenue payment system can feel overwhelming, especially for individuals with disabilities who face unique financial challenges. We understand that the complexities of tax obligations can add to your worries. But there’s hope! By learning about available exemptions and strategies, you can discover significant benefits that may ease the burden of property and income taxes.

It's common to feel uncertain about how to maximize your entitlements while maintaining financial stability. You are not alone in this journey. Many individuals have found relief by exploring their options and seeking assistance. So, how can you ensure you're making the most of what’s available to you?

Let’s take this step by step. Together, we can navigate these intricacies and find the support you need.

Understand the Kentucky Revenue Payment System

Navigating the Kentucky revenue payments system can feel overwhelming, especially when it comes to understanding various tax obligations like property, income, and sales taxes. For individuals with disabilities, grasping this system is essential for accessing potential exemptions and benefits that can ease financial burdens. Let’s explore some key components that can make a difference:

-

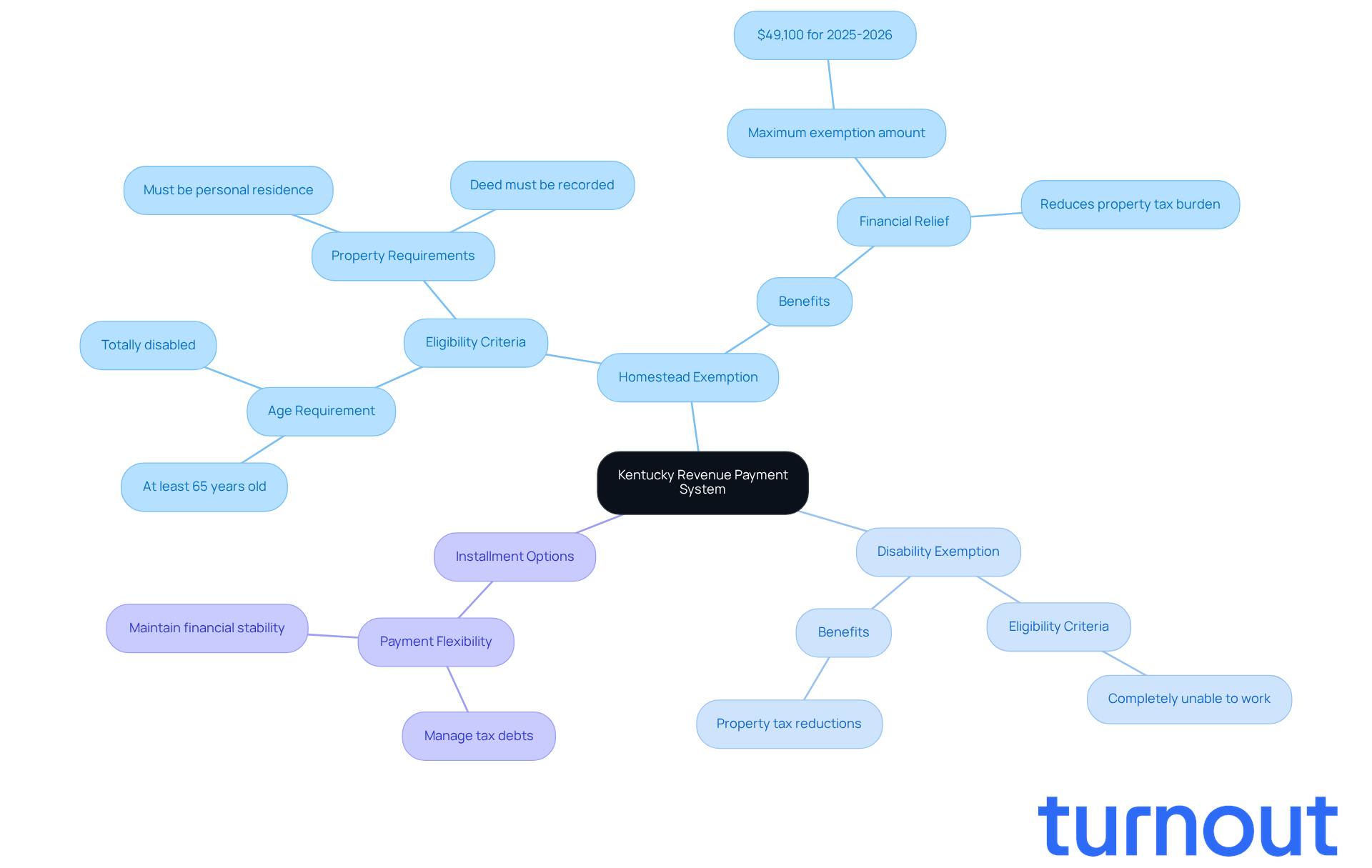

Homestead Exemption: If you’re a disabled homeowner, you might qualify for a homestead exemption that significantly lowers your property tax burden. To be eligible, you need to be designated as completely incapacitated and meet specific requirements set by the Kentucky Department of Revenue. In 2025, this exemption could provide substantial financial relief, with the maximum amount reaching $49,100.

-

Disability Exemption: This exemption offers property tax reductions for homeowners who are completely unable to work. Understanding the application process and eligibility criteria for Kentucky revenue payments is vital for maximizing these benefits and ensuring that you can effectively reduce your tax responsibilities.

-

Installment Options: If you’re facing challenges with tax debts, the Kentucky Department of Revenue provides installment options. These can be a helpful way for disabled individuals to manage financial obligations more effectively, allowing you to maintain stability while navigating your tax responsibilities.

By familiarizing yourself with these elements, you can better navigate the revenue compensation landscape and advocate for your rights. Remember, you deserve the benefits that can support you on this journey. We're here to help you every step of the way.

Implement Effective Payment Strategies

Managing revenue payments can feel overwhelming, especially for disabled individuals facing unique financial challenges. But there are several strategies you can adopt, supported by Turnout's services, to help ease this burden.

-

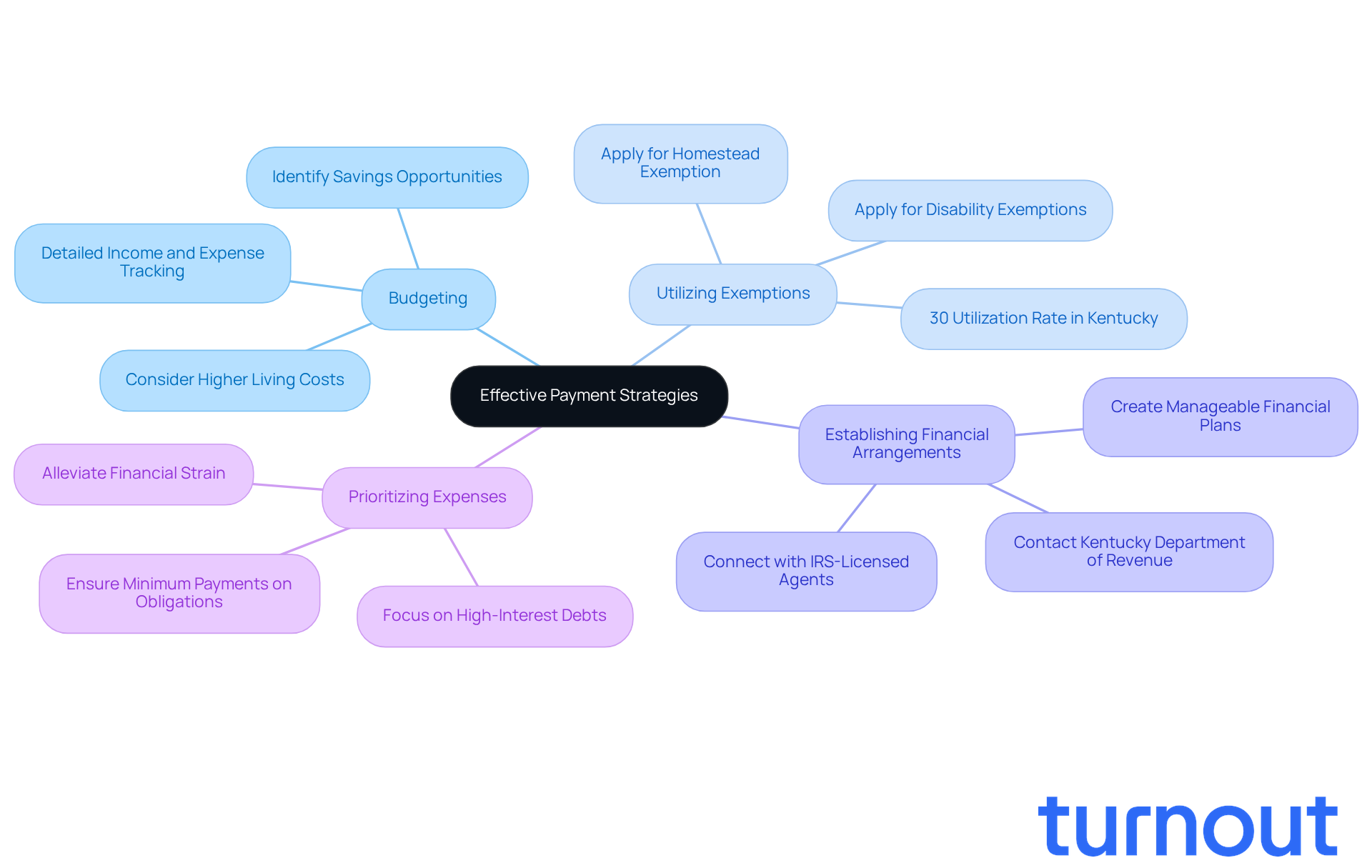

Budgeting is a great starting point. By creating a detailed budget that accounts for all your income sources and expenses, including taxes, you can identify areas where savings might be possible. Remember, it’s important to consider the higher living costs that often come with disabilities when planning your budget.

-

Utilizing Exemptions is another crucial step. Make sure to apply for all eligible exemptions, like the homestead and disability exemptions, to help reduce your tax liabilities. In Kentucky, around 30% of disabled individuals successfully take advantage of these exemptions, which can significantly lighten their financial load concerning Kentucky revenue payments.

-

If you find yourself facing tax debts, consider establishing financial arrangements. Reaching out to the Kentucky Department of Revenue can assist you in understanding Kentucky revenue payments to create a manageable financial plan. Turnout is here to assist you by connecting you with IRS-licensed enrolled agents who can guide you through tax debt relief options. This proactive approach can prevent penalties and interest from piling up, paving the way toward financial stability.

-

It’s also wise to prioritize your expenses. Focus on paying off high-interest debts first, while ensuring that you meet the minimum payments on other obligations. This strategy can help alleviate overall financial strain.

By applying these strategies, you can manage your financial responsibilities more effectively, leading to greater peace of mind. For instance, one individual who utilized a financing plan and exemptions was able to significantly lower their tax liability, allowing them to allocate more resources toward essential living costs. Turnout's approach simplifies access to government benefits and financial aid, ensuring you receive the support you need. Remember, you’re not alone in this journey; we’re here to help.

Stay Updated on Revenue Payment Changes

Managing revenue payments can feel overwhelming, especially for persons with disabilities. Staying informed about tax laws and regulations is crucial, and we’re here to help you navigate this journey. Here are some key strategies to ensure you remain updated:

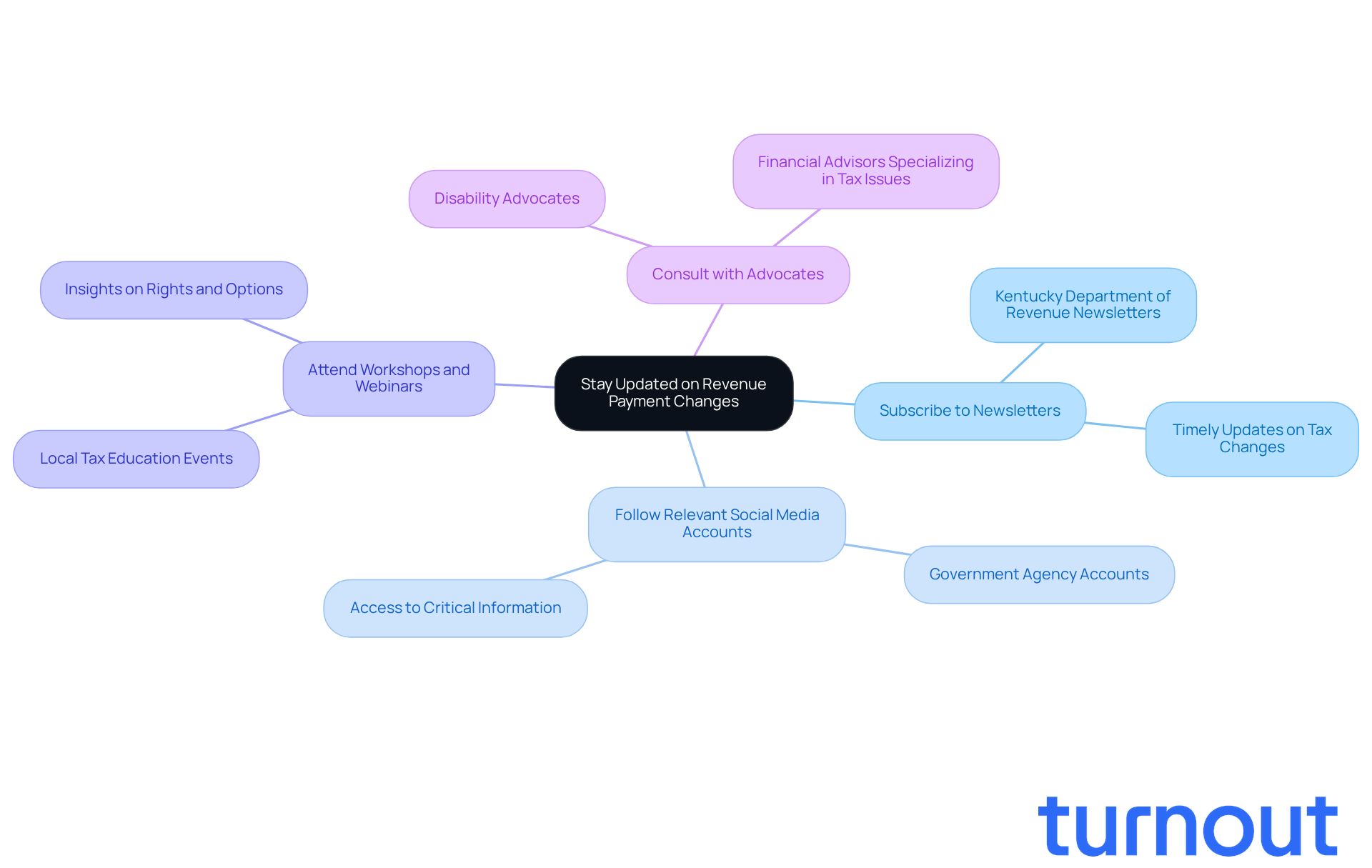

- Subscribe to Newsletters: Signing up for newsletters from the Kentucky Department of Revenue is essential. These newsletters provide timely updates on tax changes, deadlines, and new programs, ensuring that you’re always in the loop.

- Follow Relevant Social Media Accounts: Many government agencies share important updates on social media platforms. By following these accounts, you can quickly access critical information, making it easier to stay current.

- Attend Workshops and Webinars: Engaging in local workshops or webinars focused on tax education for people with disabilities can be incredibly beneficial. These events often offer valuable insights and updates on relevant changes, helping you understand your rights and options.

- Consult with Advocates: Regularly checking in with disability advocates or financial advisors who specialize in tax issues can provide personalized updates and advice based on the latest developments. Remember, staying informed is essential for navigating the complexities of tax systems effectively.

Statistics show that a significant number of people with disabilities in Kentucky subscribe to tax newsletters, underlining their importance in understanding Kentucky revenue payments and obtaining essential information. By proactively seeking out these resources, you can manage the revenue compensation system more effectively and make informed choices. You're not alone in this journey; there are many resources available to support you.

Leverage Technology for Streamlined Navigation

Managing finances can be challenging, especially for individuals with disabilities. But technology offers some wonderful solutions to help make revenue transactions smoother and more efficient. Here are a few strategies that can truly make a difference:

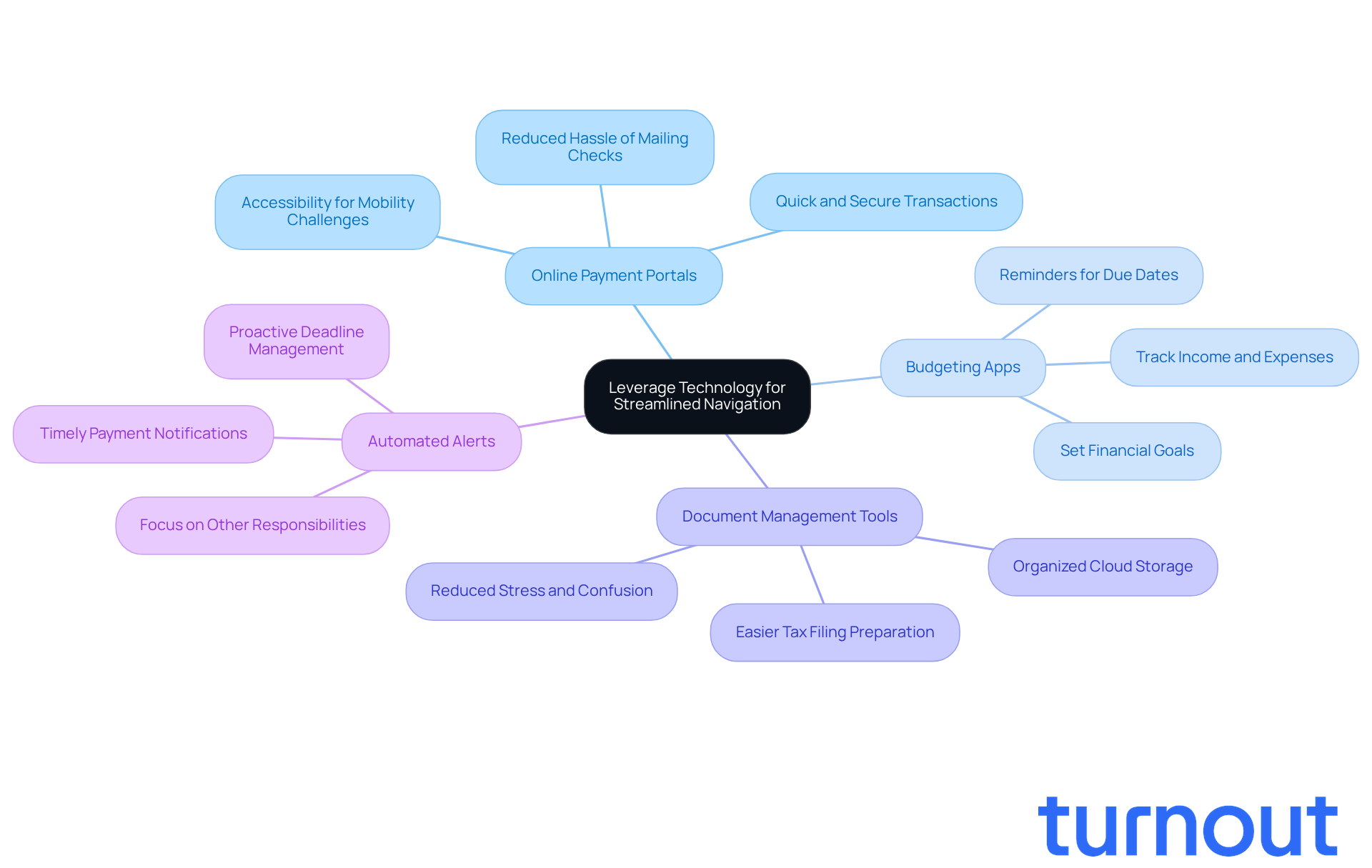

- Online Payment Portals: The Kentucky Department of Revenue is launching an online payment portal, MyTaxes, on March 14, 2025. This platform allows users to conduct transactions quickly and securely, saving time and reducing the hassle of mailing checks. This is particularly beneficial for those with mobility challenges. Just a heads up: there will be a two-week break from February 26 to March 14, 2025, during which business tax filers won’t be able to submit returns or receive refunds.

- Budgeting Apps: Have you ever felt overwhelmed trying to track your income and expenses? Budgeting apps can be a game-changer. They help set financial goals and send reminders for upcoming due dates, keeping you organized and on top of your responsibilities.

- Document Management Tools: Cloud storage solutions are fantastic for keeping important documents organized and easily accessible. This makes gathering paperwork for tax filings or exemption applications much simpler, reducing stress and confusion.

- Automated Alerts: Setting up automated notifications for due dates and tax deadlines can be a lifesaver. This proactive approach helps ensure timely payments, allowing you to focus on other important aspects of your life without the constant worry of missing deadlines.

By embracing these technological solutions, you can streamline your financial management processes, making it easier to stay on top of your Kentucky revenue payments. Remember, while Turnout offers guidance through trained nonlawyer advocates and IRS-licensed enrolled agents, it does not provide legal representation or establish an attorney-client relationship. We're here to help simplify access to government benefits and financial support, ensuring you have the tools you need to manage your obligations effectively. You are not alone in this journey.

Conclusion

Navigating the Kentucky revenue payment system can feel overwhelming, especially for disabled individuals seeking financial relief. We understand that understanding available exemptions and payment strategies is essential to easing the burden of tax obligations. By familiarizing yourself with tools like the homestead and disability exemptions, and utilizing technology for efficient management, you can take meaningful steps toward achieving greater financial stability.

Key insights from this article emphasize the importance of budgeting, leveraging exemptions, and staying informed about changes in tax regulations. Strategies such as using online payment portals, subscribing to newsletters, and consulting with advocates can empower you to manage your financial responsibilities more effectively. These approaches not only alleviate immediate financial pressures but also support long-term stability.

Ultimately, your journey toward financial independence in Kentucky is supported by a wealth of resources and strategies. Embracing these tools and remaining informed can transform the daunting task of managing revenue payments into a more manageable and less stressful experience. Remember, you are not alone in this journey. Taking these steps ensures that you are equipped to navigate your current obligations and positioned to thrive in the future.

Frequently Asked Questions

What is the Kentucky revenue payment system?

The Kentucky revenue payment system involves understanding various tax obligations, including property, income, and sales taxes, which can be complex, especially for individuals with disabilities.

What is the Homestead Exemption in Kentucky?

The Homestead Exemption allows disabled homeowners to significantly lower their property tax burden. Eligibility requires being designated as completely incapacitated and meeting specific requirements set by the Kentucky Department of Revenue. In 2025, the maximum exemption amount could reach $49,100.

Who qualifies for the Disability Exemption?

The Disability Exemption is available for homeowners who are completely unable to work, providing property tax reductions. It is important to understand the application process and eligibility criteria to maximize these benefits.

What options are available for managing tax debts in Kentucky?

The Kentucky Department of Revenue offers installment options for individuals facing challenges with tax debts, which can help disabled individuals manage their financial obligations more effectively.

Why is it important for individuals with disabilities to understand the Kentucky revenue payment system?

Understanding the Kentucky revenue payment system is essential for individuals with disabilities to access potential exemptions and benefits that can alleviate financial burdens and help them advocate for their rights.