Overview

Navigating the complexities of IRS tax settlements can feel overwhelming. We understand that many individuals face significant stress when dealing with tax issues. That’s why this article offers a comprehensive, step-by-step guide to help you through the process, focusing on methods like the Offer in Compromise (OIC) and the essential documentation and eligibility criteria.

Preparation is key. By taking the time to gather the necessary information and understand your options, you can create realistic proposals that resonate with the IRS. It’s common to feel uncertain about what to say or how to approach negotiations, but proactive communication can make a world of difference. Remember, you’re not alone in this journey; we’re here to help.

Consider these important steps:

- Thorough Preparation: Gather all relevant documents and understand your financial situation.

- Realistic Proposals: Present offers that reflect your ability to pay.

- Proactive Communication: Stay in touch with the IRS and respond promptly to their requests.

By following these guidelines, you can navigate common challenges and work towards a favorable resolution. It’s important to remember that achieving a tax settlement is possible with the right approach. You have the power to take control of your situation, and with careful planning, you can find a path forward.

If you’re feeling stuck or unsure, don’t hesitate to reach out for assistance. There are resources available to guide you through this process. Together, we can work towards a resolution that brings you peace of mind.

Introduction

Tax debt can feel like an overwhelming weight, leaving many unsure of where to turn for relief. We understand that this situation can be daunting. But there’s hope! The IRS provides pathways to negotiate settlements that can significantly reduce what you owe. One of the most effective methods is the Offer in Compromise (OIC).

This article will guide you through the step-by-step process of mastering IRS tax settlements. You’ll gain the knowledge needed to navigate eligibility requirements, negotiation tactics, and common pitfalls. It’s common to feel anxious about the stakes involved, especially with the fear of rejection looming overhead. But remember, understanding how to advocate for yourself can truly make a difference in achieving a favorable outcome.

You are not alone in this journey. We’re here to help you find the relief you deserve.

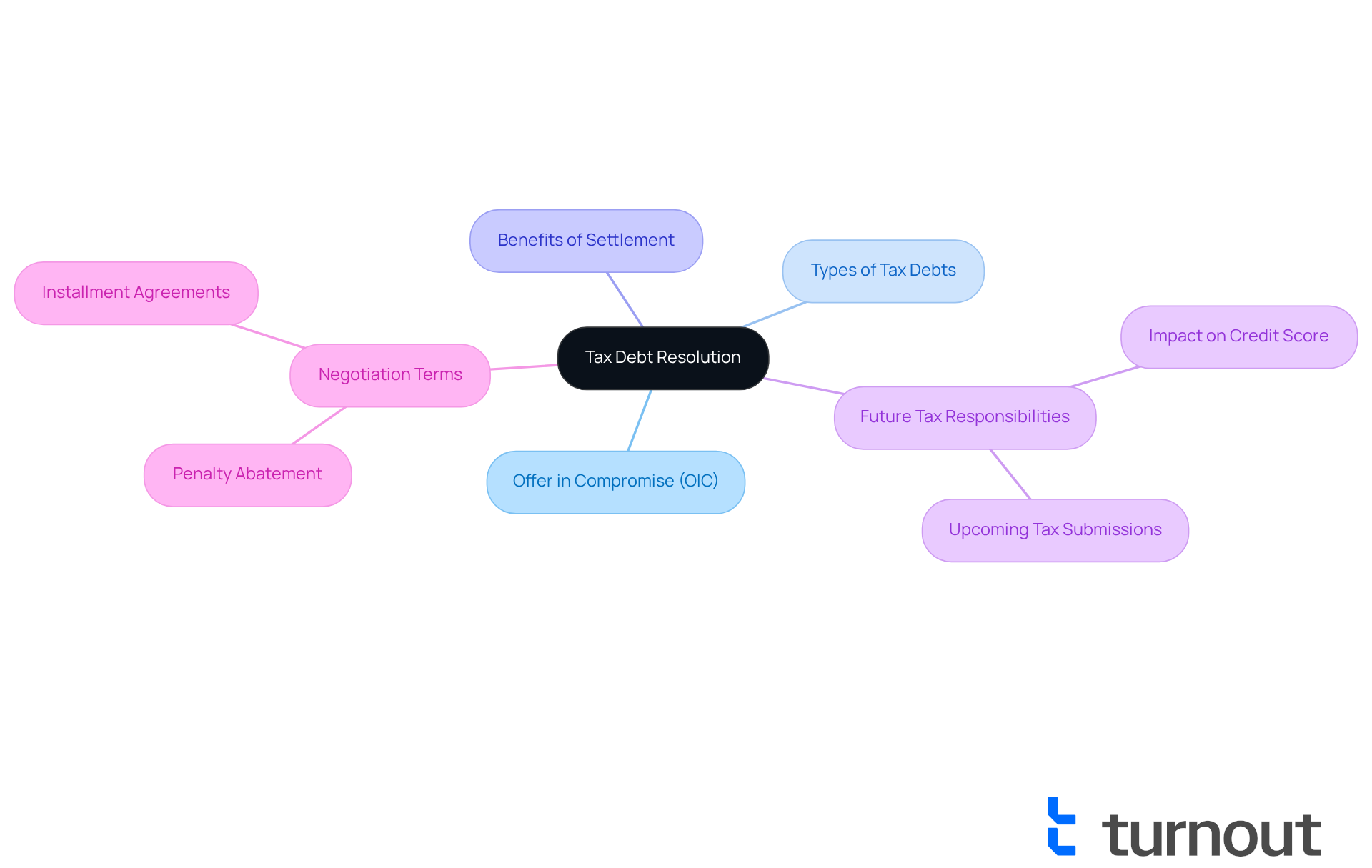

Understand Tax Debt Settlement Basics

Tax debt resolution can feel overwhelming, but you’re not alone in this journey. It’s about negotiating a tax settlement with the IRS to reduce what you owe, and one of the most common methods is through an Offer in Compromise (OIC), which is a type of tax settlement IRS accepts. This option allows you to pursue a tax settlement IRS for less than the full amount owed, which can be a real relief.

Understanding the basics is essential. Recognize the types of tax debts that can be resolved and the potential benefits of doing so. It’s also important to consider how these resolutions might impact your future tax responsibilities. Terms like 'penalty abatement' and 'installment agreements' often come up during negotiations, so familiarizing yourself with them can help.

We understand that you might be worried about how these agreements could affect your credit score or upcoming tax submissions. It’s common to feel anxious about these aspects, but knowing your options can empower you to take the next steps. Remember, we’re here to help you navigate this process.

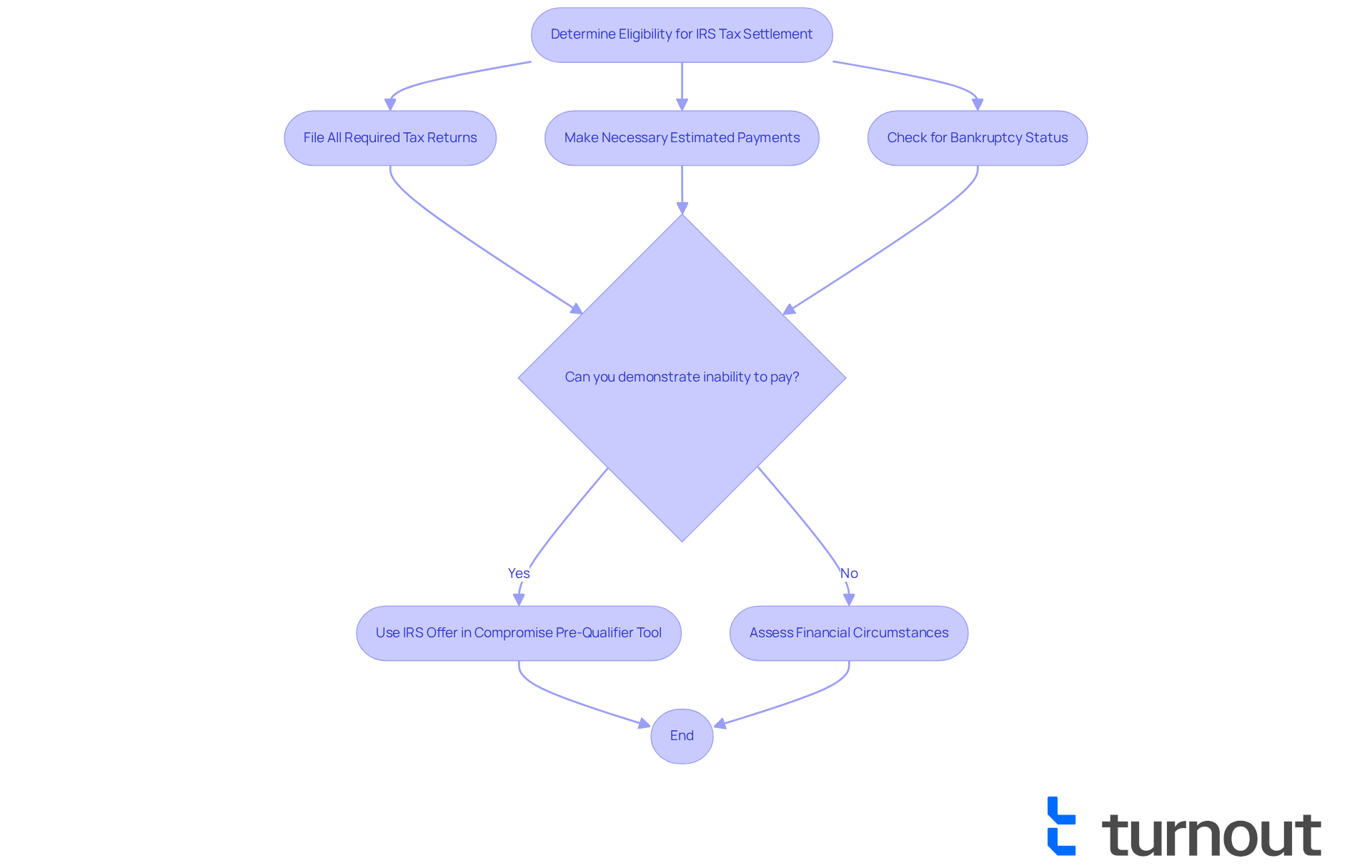

Determine Your Eligibility for IRS Tax Settlement

Navigating tax issues can be overwhelming, and we understand that you might be feeling anxious about your situation. To assess your eligibility for a tax settlement with the IRS, there are several important criteria to consider. First, it’s essential to ensure that you’ve filed all required tax returns and made any necessary estimated payments.

The IRS typically requires that you are not currently in bankruptcy and that you can demonstrate an inability to pay your tax settlement with the IRS in full. Have you thought about using the IRS Offer in Compromise Pre-Qualifier tool? It’s a helpful resource to assess your eligibility and can guide you through the process.

Additionally, take a moment to reflect on your financial circumstances, such as your income, expenses, and assets. These elements play a crucial role in your ability to negotiate an agreement. If you’ve experienced significant life changes—like job loss or medical emergencies—these factors can also support your case for a tax settlement with the IRS. Remember, you are not alone in this journey, and there are options available to help you find relief.

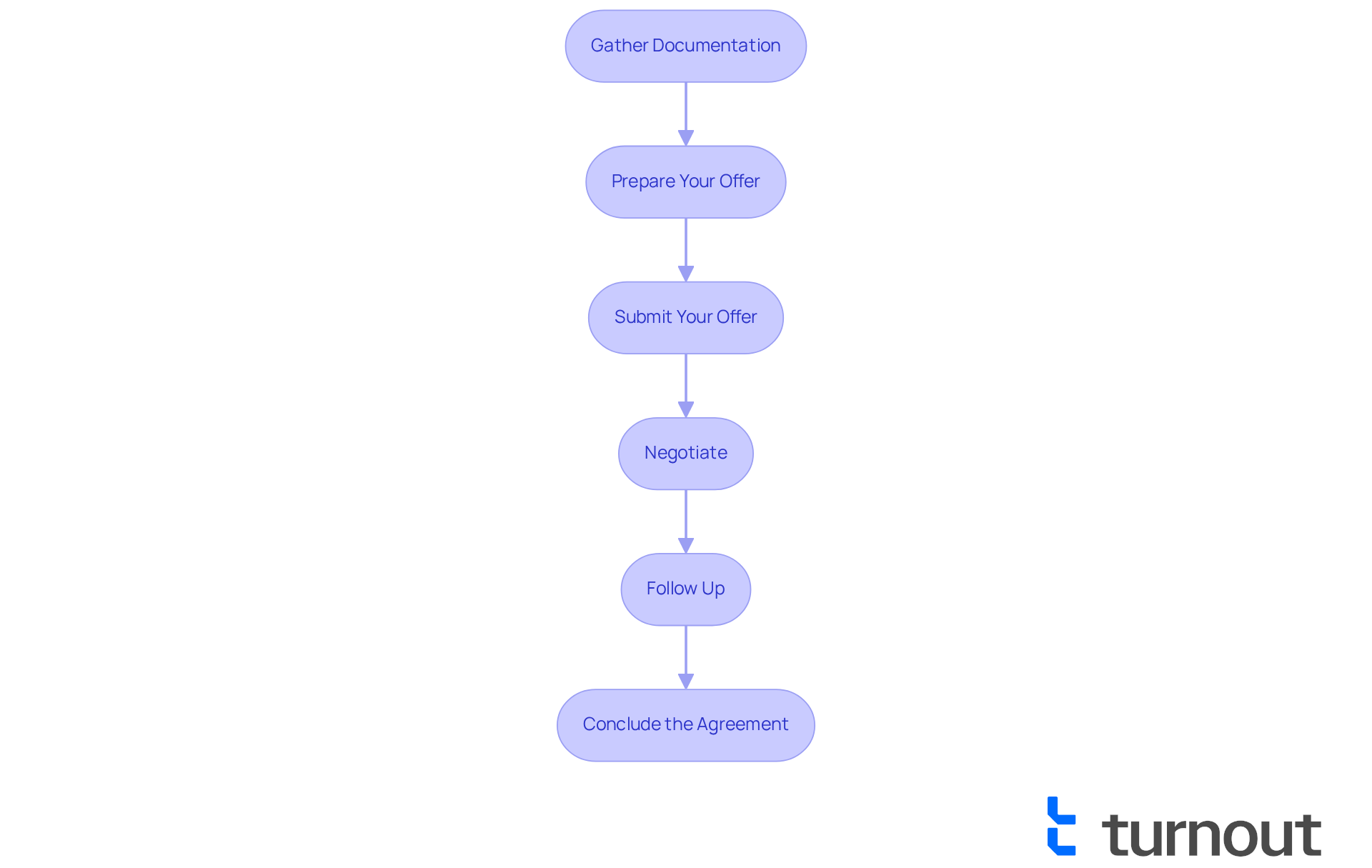

Negotiate Your IRS Tax Settlement: A Step-by-Step Process

-

Gather Documentation: We understand that starting this process can feel overwhelming. Begin by collecting all relevant financial documents, such as income statements, bank statements, and any correspondence related to your tax settlement with the IRS. This information is crucial in demonstrating your financial situation. As Marylyn, a senior tax advisor, emphasizes, having a professional by your side can significantly ease the process of gathering necessary documentation.

-

Prepare Your Offer: If you’re considering an Offer in Compromise, take a moment to calculate the amount you can realistically pay. The IRS will evaluate your ability to pay based on your income, expenses, and asset value. Remember, with the IRS currently facing a backlog of unpaid back taxes totaling $380 billion, pursuing a tax settlement IRS is essential to act quickly.

-

Submit Your Offer: Complete Form 656, Offer in Compromise, and submit it along with the required fee and initial payment. Ensure that all information is accurate and complete to avoid delays. It’s important to note that if the IRS does not reach a conclusion within two years, your proposal is automatically accepted. Keep this in mind as you move forward.

-

Negotiate: After submission, the IRS will evaluate your proposal. Be prepared to negotiate. They may respond to your proposal, so know your limits and be ready to justify your suggested amount. For instance, a self-employed individual successfully reached a tax settlement with the IRS for their back taxes by effectively negotiating their case, showing that resolution is possible even with substantial amounts owed.

-

Follow Up: Stay in contact with the IRS during the review process. If you don’t receive a response within a reasonable timeframe, don’t hesitate to follow up and inquire about the status of your proposal. Remember, you are not alone in this journey.

-

Conclude the Agreement: If your proposal is accepted, make sure you fully understand the conditions of the resolution. Fulfill any payment obligations as agreed to avoid future complications. Successful submissions often hinge on thorough preparation and clear documentation, as illustrated in various case studies where individuals effectively negotiated their tax debts. We’re here to help you navigate this process.

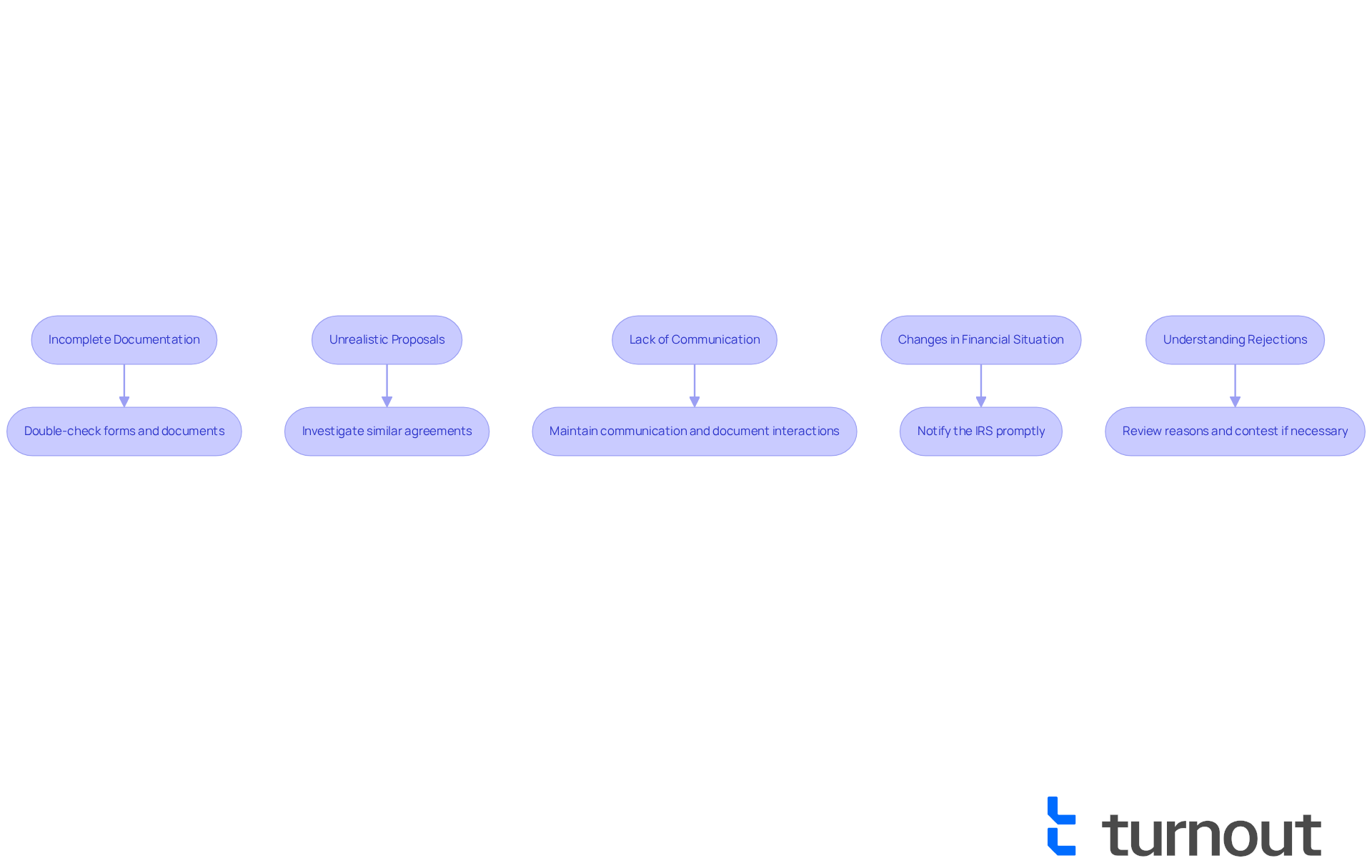

Troubleshoot Common Issues in Tax Settlement Negotiations

-

Incomplete Documentation: We understand that submitting forms can be overwhelming. One of the most common issues is submitting incomplete or inaccurate documentation. Always double-check your forms and ensure all required documents are included before submission. Taking this extra step can save you time and stress.

-

Unrealistic Proposals: It's common to feel uncertain about how to propose a settlement. If your proposal for a tax settlement IRS is too low, the IRS may dismiss it outright. Investigate similar agreements and make sure your proposal aligns with your financial situation. This way, you can present a more realistic offer that stands a better chance of acceptance.

-

Lack of Communication: We know how frustrating it can be when you don’t hear back from the IRS. If you do not receive a response, it may be due to a lack of follow-up. Maintain communication and document all interactions to keep track of your case. Remember, staying proactive can make a significant difference.

-

Changes in Financial Situation: Life can change unexpectedly, and we’re here to help you navigate those changes. If your financial circumstances alter after submitting your proposal, notify the IRS promptly. This can affect your eligibility and the terms of your settlement, so it’s important to keep them informed.

-

Understanding Rejections: If your proposal is rejected, it’s natural to feel discouraged. Review the IRS's reasons carefully. You can contest the decision or present a modified proposal that addresses their concerns. Be prepared to provide additional documentation or justification for your new offer. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Conclusion

Navigating the complexities of IRS tax settlement can feel overwhelming, but understanding the process is essential for finding relief from tax debt. We know how challenging this journey can be, and that’s why this guide outlines crucial steps to help you. From grasping the basics of tax debt resolution to determining your eligibility and effectively negotiating with the IRS, you can take control of your financial situation and work towards a more manageable outcome.

Key insights include the importance of:

- Gathering accurate documentation

- Preparing realistic offers

- Maintaining open communication with the IRS throughout the negotiation process

It’s common to encounter issues like incomplete submissions and unrealistic proposals, but being aware of these can significantly enhance your chances of a successful settlement. Each of these elements plays a pivotal role in achieving a favorable resolution.

Ultimately, you don’t have to face the journey to resolving tax debt alone. With the right information and support, you can navigate this process with confidence. Taking proactive steps today can lead to a brighter financial future. It’s essential to explore available options and seek assistance when needed. Remember, you have the opportunity to reclaim your financial stability and turn the page on tax-related stress.

Frequently Asked Questions

What is tax debt resolution?

Tax debt resolution involves negotiating a settlement with the IRS to reduce the amount owed on tax debts.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is a common method of tax settlement accepted by the IRS, allowing taxpayers to settle their tax debts for less than the full amount owed.

What types of tax debts can be resolved?

Various types of tax debts can be resolved, but the article does not specify which ones. It's important to understand the specific debts you may have.

What are the potential benefits of resolving tax debt?

Resolving tax debt can provide relief by reducing the amount owed and potentially alleviating stress associated with tax obligations.

How might tax debt resolutions impact future tax responsibilities?

The article emphasizes the importance of considering how tax debt resolutions may affect future tax responsibilities, although it does not provide specific details.

What terms should I be familiar with during tax debt negotiations?

Key terms to understand include 'penalty abatement' and 'installment agreements,' which are often relevant during negotiations.

Will tax debt agreements affect my credit score?

The article acknowledges concerns about how these agreements might impact your credit score, but it does not provide specific information on this topic.

What should I do if I feel anxious about tax debt resolution?

It's common to feel anxious about tax debt resolution, but knowing your options can empower you to take the next steps. Seeking assistance can also help navigate the process.