Overview

Navigating IRS tax debt relief can feel overwhelming, but you are not alone in this journey. This article offers a comprehensive step-by-step guide to help you explore various options available to you, such as:

- Installment agreements

- Offer in Compromise

- Currently Not Collectible status

Understanding the application processes for each option is crucial. We emphasize the importance of gathering the necessary documentation and being aware of potential challenges. By doing so, you can significantly enhance your chances of achieving successful relief.

Remember, seeking assistance is a brave step. We’re here to help you through this process, ensuring you feel supported every step of the way.

Introduction

Navigating the complexities of IRS tax debt can feel like an uphill battle. Many taxpayers find themselves overwhelmed and unsure of their options. We understand that this can be a daunting experience. Understanding the various avenues for tax relief is crucial, as it can pave the way toward financial stability and peace of mind.

But how does one effectively maneuver through the maze of relief programs and application processes? This guide offers a comprehensive step-by-step approach to mastering IRS tax debt relief. Our aim is to empower you to take control of your financial future and overcome common challenges along the way. Remember, you are not alone in this journey, and we're here to help.

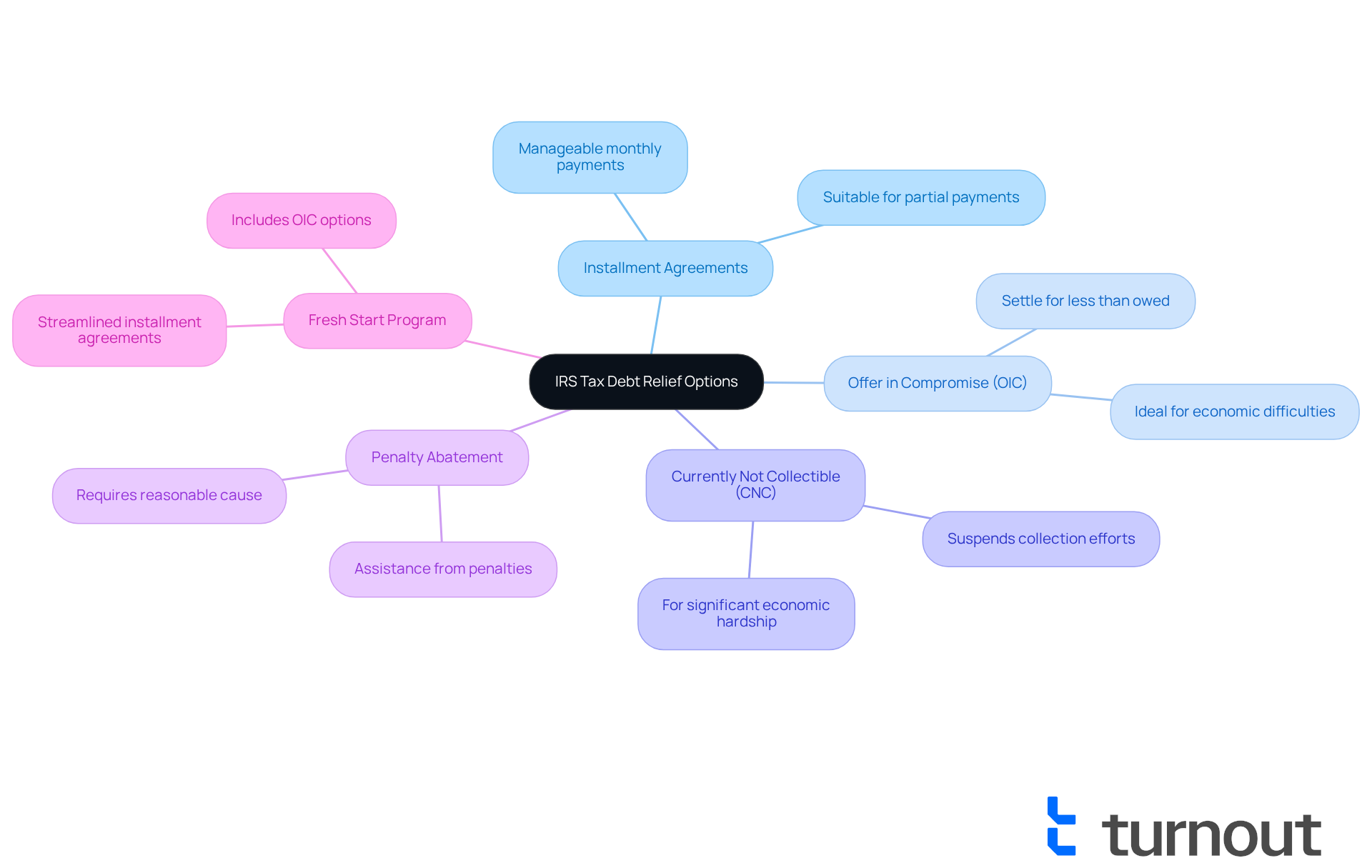

Understand Tax Debt Relief Options

Options for IRS tax debt relief can vary significantly based on individual circumstances, and we understand how overwhelming this can feel. Here are the primary options available to help you navigate your situation:

-

Installment Agreements: This option allows you to pay your tax debt in manageable monthly payments. If you can't pay your tax bill in full, but can afford smaller payments over time, this could be a suitable path for you.

-

Offer in Compromise (OIC): This program enables you to settle your tax debt for less than the total amount owed. It's perfect for those experiencing economic difficulties who find it challenging to cover their entire tax obligation.

-

Currently Not Collectible (CNC): If you can demonstrate that settling your tax obligation would cause significant economic hardship, you may qualify for CNC status. This status temporarily suspends collection efforts, providing you with some much-needed relief.

-

Penalty Abatement: You may qualify for assistance from penalties if you can show reasonable cause for failing to meet your tax obligations. This can lighten your burden significantly.

-

Fresh Start Program: This initiative offers various relief options, including streamlined installment agreements and OICs, all aimed at helping you restore your economic stability.

Comprehending these choices is the initial step toward effectively achieving IRS tax debt relief. Remember, you're not alone in this journey, and taking action now can lead to a more manageable economic future.

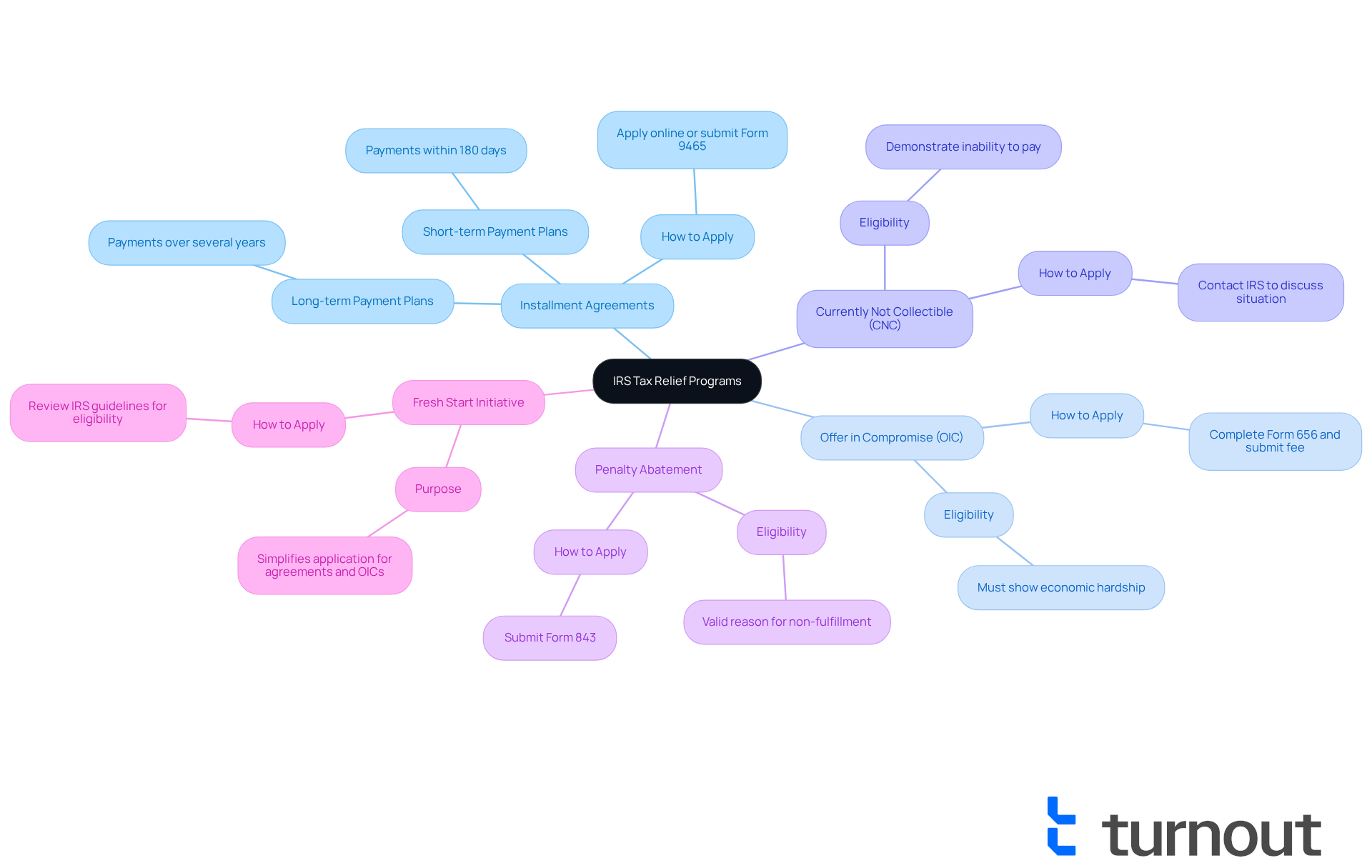

Explore IRS Tax Relief Programs

The IRS offers several programs designed to assist taxpayers seeking IRS tax debt relief when they feel overwhelmed by tax debt. Here’s a closer look at some of the most relevant options that can help you regain control:

-

Installment Agreements: You can apply for short-term or long-term payment plans. Short-term plans allow for payments within 180 days, while long-term plans can extend for several years.

- How to Apply: You can apply online through the IRS website or by submitting Form 9465.

-

Offer in Compromise (OIC): This program allows eligible taxpayers to settle their tax debts for less than the full amount owed. To qualify, you must show that paying your full tax obligation would cause economic hardship.

- How to Apply: Complete Form 656 and submit it along with the necessary fee and monetary documentation.

-

Currently Not Collectible (CNC): If you can demonstrate that you cannot pay your tax obligation without encountering economic hardship, you may qualify for CNC status, which halts collection efforts.

- How to Apply: Reach out to the IRS directly to discuss your monetary situation and request CNC status.

-

Penalty Abatement: If you have a valid reason for not fulfilling your tax obligations, you may request a reduction of penalties.

- How to Apply: Submit Form 843 to request abatement of penalties.

-

Fresh Start Initiative: This initiative simplifies the process for taxpayers to apply for installment agreements and OICs, making it easier to regain financial footing.

- How to Apply: Review the IRS guidelines on the Fresh Start Initiative to determine eligibility and application procedures.

By understanding these programs related to IRS tax debt relief, you can better navigate your options. Remember, you are not alone in this journey, and taking proactive steps toward resolving your tax debt can lead to a brighter financial future.

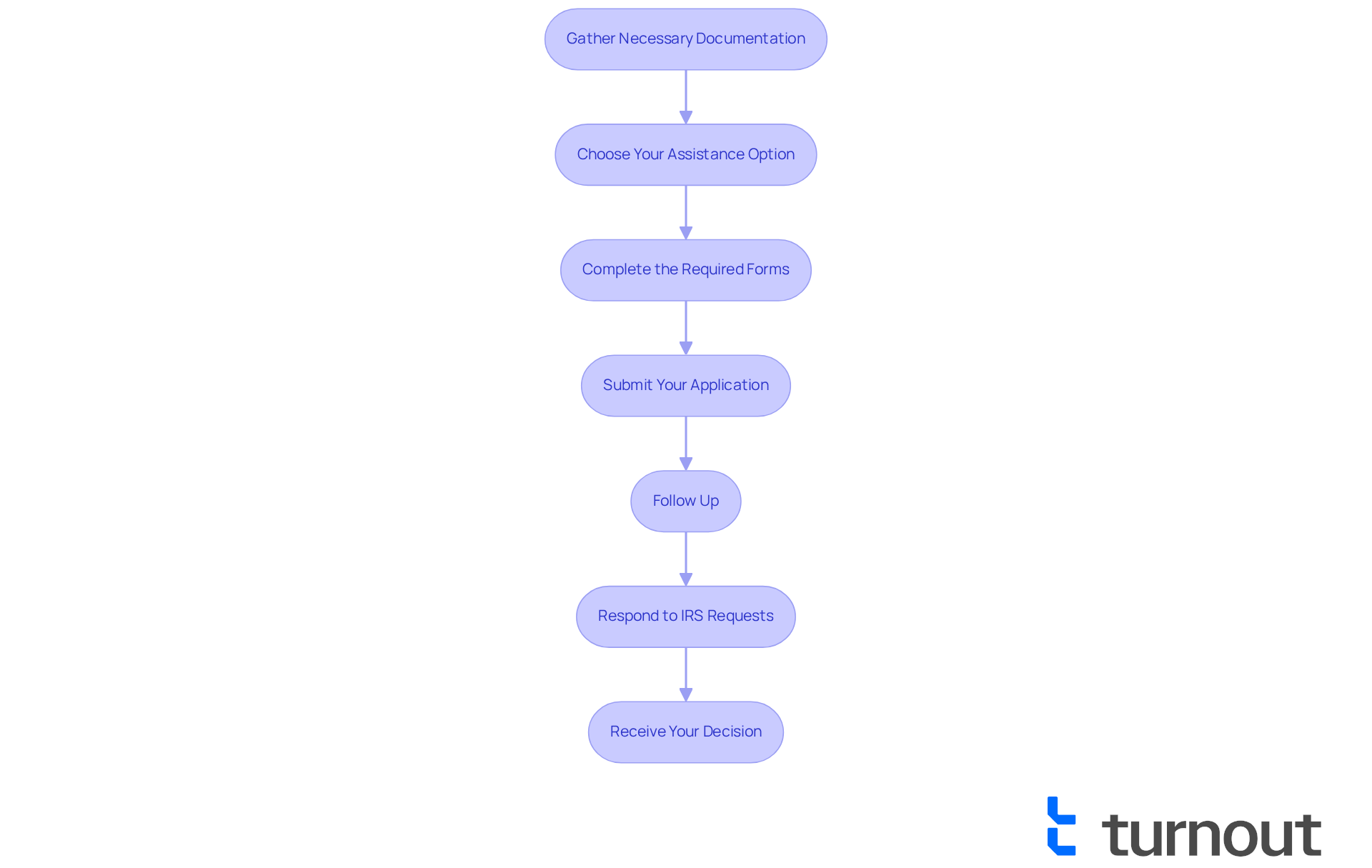

Apply for Tax Debt Relief: Step-by-Step Process

Applying for IRS tax debt relief can feel overwhelming, but breaking it down into clear steps can make the process much easier. We understand that navigating these waters can be challenging, so here’s how to apply for the most common relief options:

-

Gather Necessary Documentation: Before applying, take a moment to collect all relevant financial documents, including income statements, tax returns, and any notices from the IRS. This step is crucial to ensure you have everything you need.

-

Choose Your Assistance Option: Reflect on which assistance option suits your situation best—whether it’s an installment agreement, Offer in Compromise (OIC), Currently Not Collectible (CNC), or penalty abatement. Each option has its own benefits.

-

Complete the Required Forms:

- For Installment Agreements, fill out Form 9465.

- For OIC, complete Form 656 and either Form 433-A (OIC) or 433-B (OIC) for businesses.

- For Penalty Abatement, use Form 843.

-

Submit Your Application: Once your forms are ready, send them to the IRS. For online applications, use the IRS website; for paper submissions, mail them to the address specified in the form instructions. Remember, this is a significant step toward obtaining IRS tax debt relief.

-

Follow Up: After submission, it’s important to monitor the status of your application. You can check your IRS account online or contact the IRS directly for updates. We know it can feel like a waiting game, but staying informed is key.

-

Respond to IRS Requests: Be prepared to provide additional information if the IRS requests it. Prompt responses can help expedite the process, and we’re here to support you through this.

-

Receive Your Decision: Once the IRS processes your application, you will receive a decision. If approved, follow any further instructions given to complete your assistance.

Turnout is here to assist you throughout this process. While we are not a law firm and do not provide legal representation, our trained nonlawyer advocates and IRS-licensed enrolled agents are qualified to support you in navigating these complex financial systems. By adhering to these steps and utilizing our services, you can maneuver through the application process more efficiently and enhance your likelihood of acquiring the assistance you require. Remember, you are not alone in this journey.

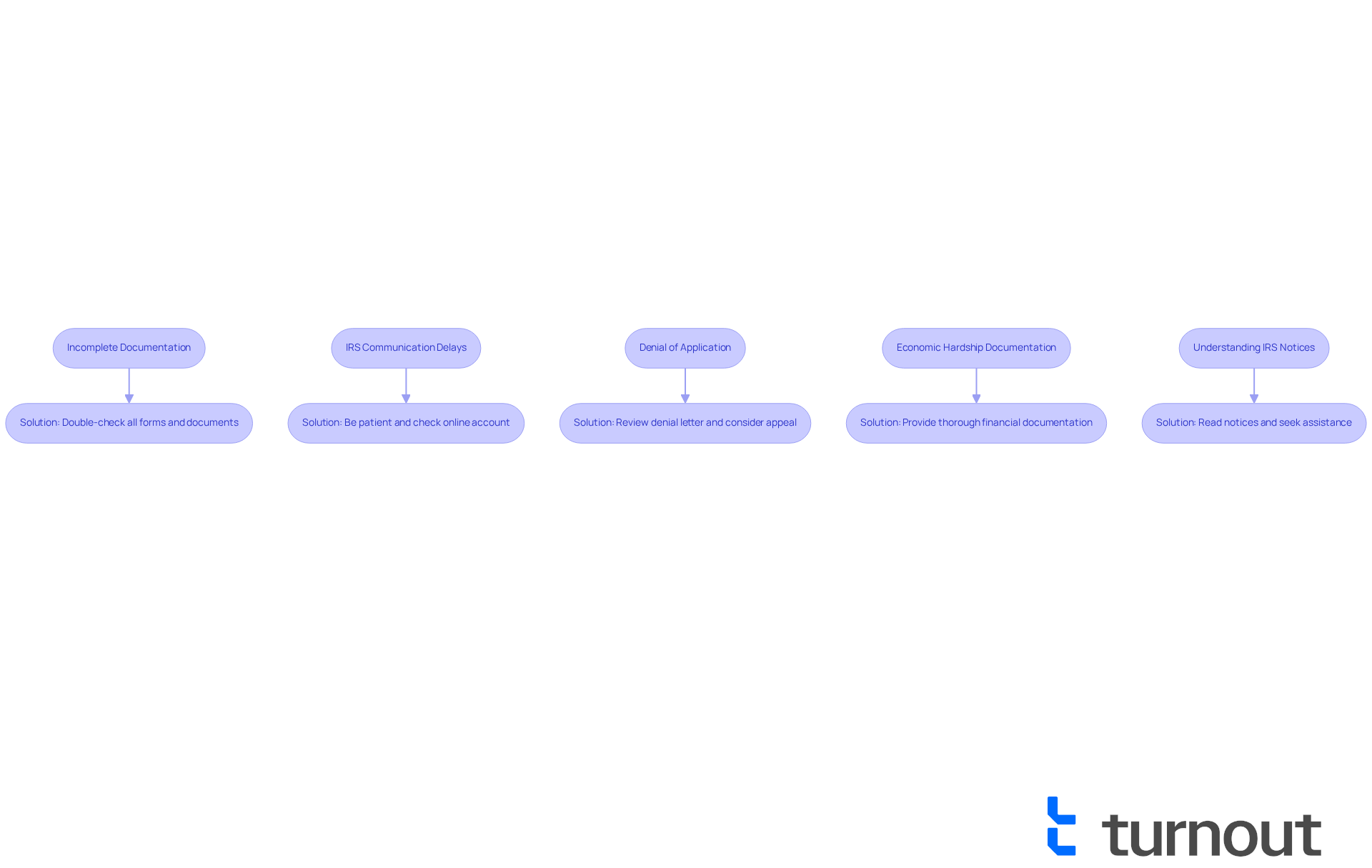

Troubleshoot Common Tax Relief Challenges

While applying for IRS tax debt relief can be straightforward, we understand that many individuals encounter challenges along the way. Here are some common issues you might face and how to troubleshoot them:

-

Incomplete Documentation: It’s common for applications to experience delays due to missing or incomplete documentation.

- Solution: Please double-check all forms and ensure you have attached all required documents before submission. This small step can make a big difference.

-

IRS Communication Delays: Sometimes, the IRS may take longer than expected to respond to applications, which can be frustrating.

- Solution: Be patient, but also proactive. Check your IRS online account for updates, and consider calling the IRS if you haven’t received a response within a reasonable timeframe. Remember, you’re not alone in this.

-

Denial of Application: If your application is denied, it can feel disheartening, but there is hope.

- Solution: Review the denial letter carefully to understand the reasons. You can appeal the decision or reapply with additional information that addresses the concerns raised. This is a chance to clarify your situation.

-

Economic Hardship Documentation: Demonstrating economic hardship can be challenging, especially for Offer in Compromise (OIC) applications.

- Solution: Provide thorough documentation of your financial situation, including income, expenses, and any extenuating circumstances that impact your ability to pay. This transparency can help your case.

-

Understanding IRS Notices: IRS notices can be confusing and may lead to misunderstandings about your obligations.

- Solution: Take the time to read and understand any notices you receive. If needed, seek assistance from a knowledgeable advocate, such as those provided by Turnout, to clarify your situation. You deserve support in navigating this.

By anticipating these challenges and knowing how to address them, you can navigate the IRS tax debt relief process more effectively. Remember, you are not alone in this journey, and we’re here to help you increase your chances of success.

Conclusion

Navigating the complexities of IRS tax debt relief can feel overwhelming, but understanding the available options is the first step toward regaining your financial control. This guide outlines essential relief options, such as:

- Installment agreements

- Offers in compromise

- Currently not collectible status

Our goal is to empower you to take proactive measures against your tax obligations.

We understand that gathering necessary documentation and choosing the right relief option can seem daunting. However, by following a structured application process, you can enhance your chances of successfully obtaining relief. Each option serves a unique purpose and caters to different financial situations. Knowing how to leverage these tools is crucial for achieving lasting financial stability.

Addressing IRS tax debt is not just about resolving current obligations; it’s about paving the way for a more secure financial future. Taking the time to explore available programs, understanding the application process, and seeking assistance when needed can lead to significant relief. Remember, you are not alone in this journey. For those facing tax debt, now is the time to take action and explore the various avenues available for achieving peace of mind and financial freedom.

Frequently Asked Questions

What are the main options for IRS tax debt relief?

The main options for IRS tax debt relief include Installment Agreements, Offer in Compromise (OIC), Currently Not Collectible (CNC) status, Penalty Abatement, and the Fresh Start Program.

What is an Installment Agreement?

An Installment Agreement allows you to pay your tax debt in manageable monthly payments if you cannot pay your tax bill in full.

What does the Offer in Compromise (OIC) program do?

The Offer in Compromise (OIC) program enables you to settle your tax debt for less than the total amount owed, which is beneficial for those facing economic difficulties.

What is Currently Not Collectible (CNC) status?

Currently Not Collectible (CNC) status is granted if you can demonstrate that paying your tax obligation would cause significant economic hardship. This status temporarily suspends collection efforts.

How can Penalty Abatement help with tax debt?

Penalty Abatement may assist you if you can show reasonable cause for failing to meet your tax obligations, potentially reducing your overall burden.

What is the Fresh Start Program?

The Fresh Start Program offers various relief options, including streamlined installment agreements and OICs, aimed at helping individuals restore their economic stability.

Why is it important to understand these tax debt relief options?

Understanding these options is the first step toward effectively achieving IRS tax debt relief and can lead to a more manageable economic future.