Introduction

Navigating the complexities of IRS penalties can feel like an uphill battle. We understand that unexpected life events can disrupt compliance, leaving you feeling overwhelmed. Fortunately, the IRS offers a pathway to relief through penalty abatement - a process that has already saved taxpayers billions.

However, many individuals remain unaware of their eligibility or the strategies that can significantly enhance their chances of success. It’s common to feel uncertain about where to turn for help. So, what steps can you take to ensure you don’t miss out on this crucial opportunity for financial relief?

We’re here to help you explore your options and find the support you need.

Understand the Importance of IRS Penalty Abatement

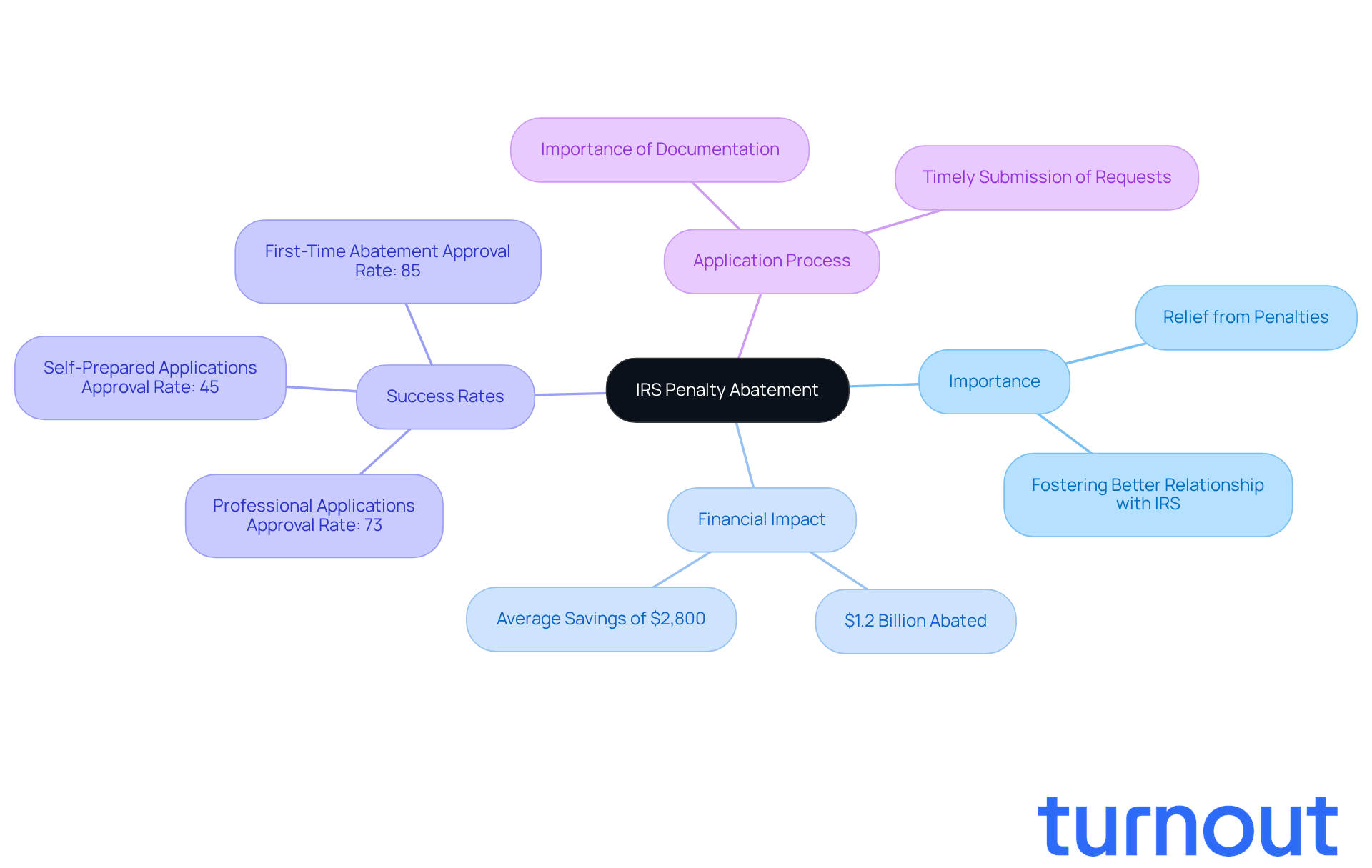

Facing fines from delayed filing or payment can be overwhelming. We understand that unexpected situations - like illness, natural disasters, or financial hardships - can make compliance difficult. Fortunately, the IRS penalty removal process is designed to help you contest unfair sanctions. By requesting a penalty removal, you can significantly lower or even eliminate those fees, easing your financial burden and fostering a healthier relationship with the tax system.

In fiscal year 2023, the IRS abated penalties totaling $1.2 billion, showcasing the program's effectiveness in providing relief. Successful applications often save individuals an average of $2,800, making this a financially wise choice. If you have a clean compliance record, the First-Time Penalty Abatement program offers penalty removal with an impressive approval rate of around 85%.

It's worth noting that the IRS approves 73% of professionally submitted abatement applications, compared to just 45% for self-prepared submissions. This highlights the advantages of seeking professional assistance. However, it's crucial to understand the eligibility criteria. Sadly, about 250,000 individuals with failure-to-file fines missed out on penalty removal, even though they qualified.

To maximize your chances of successful abatement, thorough documentation and timely submission of requests are essential. Remember, you are not alone in this journey. We're here to help you navigate these challenges and find the relief you deserve.

Qualify for First-Time Penalty Abatement

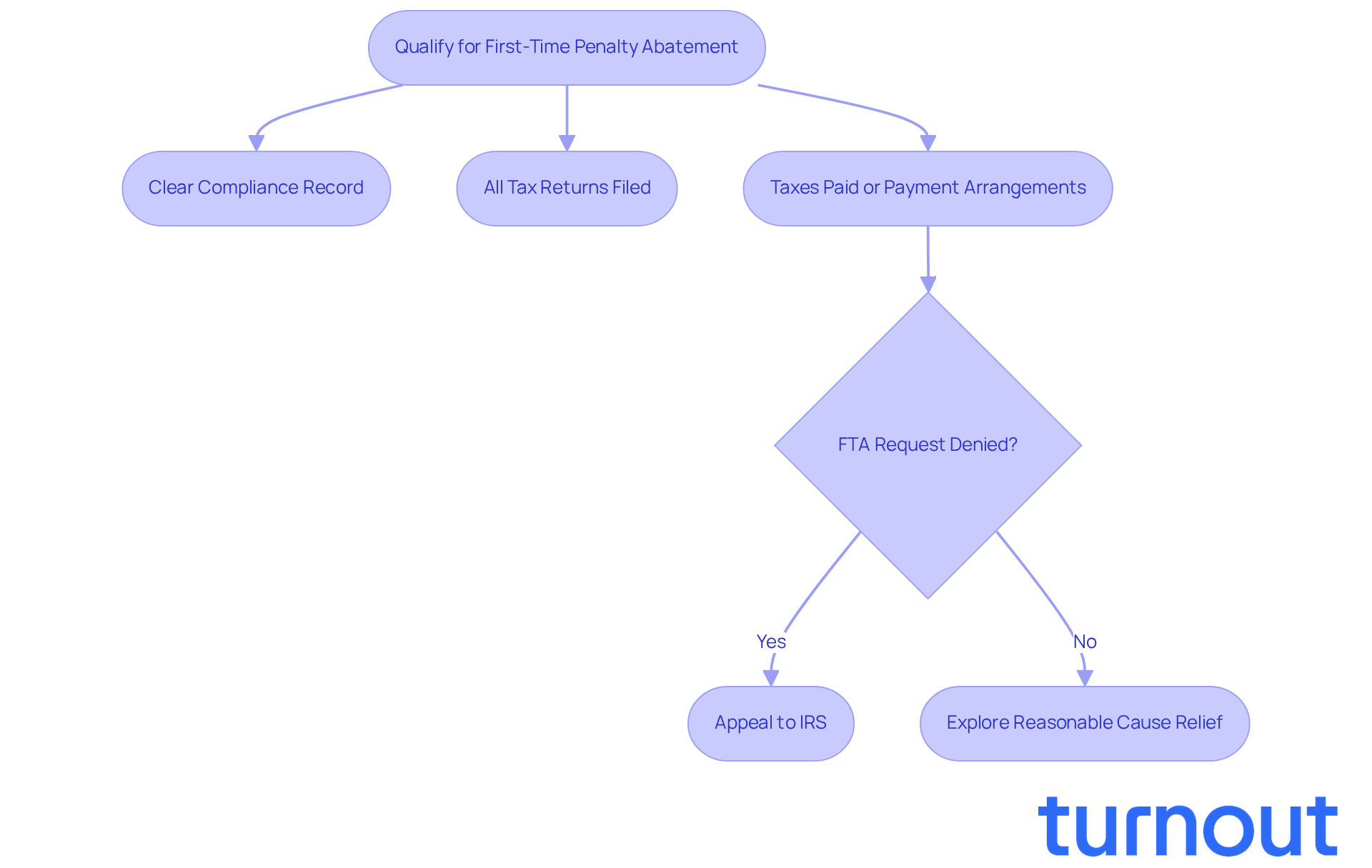

Are you feeling overwhelmed by tax fees? You're not alone. Many taxpayers struggle with the complexities of compliance and the fear of penalty removal challenges. But there’s hope! To qualify for first-time fee abatement (FTA), you just need to meet some specific IRS criteria.

First, it’s essential to have a clear compliance record over the past three years. This means no fines for the same type of tax return during that time. Additionally, make sure all required tax returns are filed, and any taxes owed are either paid or arrangements for payment are in place. You can seek penalty removal for charges associated with failure to file, failure to pay, or failure to deposit.

Starting in 2026, the eligibility criteria have been updated. Now, individuals must not have received another penalty in the last three years. This change reinforces the importance of maintaining a good compliance record. Did you know that around 2 million individuals qualify for FTA? Yet, only about 8% actively apply for it. This highlights a significant opportunity for those who may not be aware of their eligibility.

If your request for FTA is denied, don’t lose hope for penalty removal. You can appeal the decision to the IRS Independent Office of Appeals within 30 days of receiving the denial letter. For those who don’t qualify for FTA, reasonable cause relief options may still be available, especially for individuals facing significant hardships.

Understanding these qualifications and options is crucial. We’re here to help you assess your eligibility and seek the relief you deserve. Remember, you are not alone in this journey.

Build a Compelling Case for Reasonable Cause

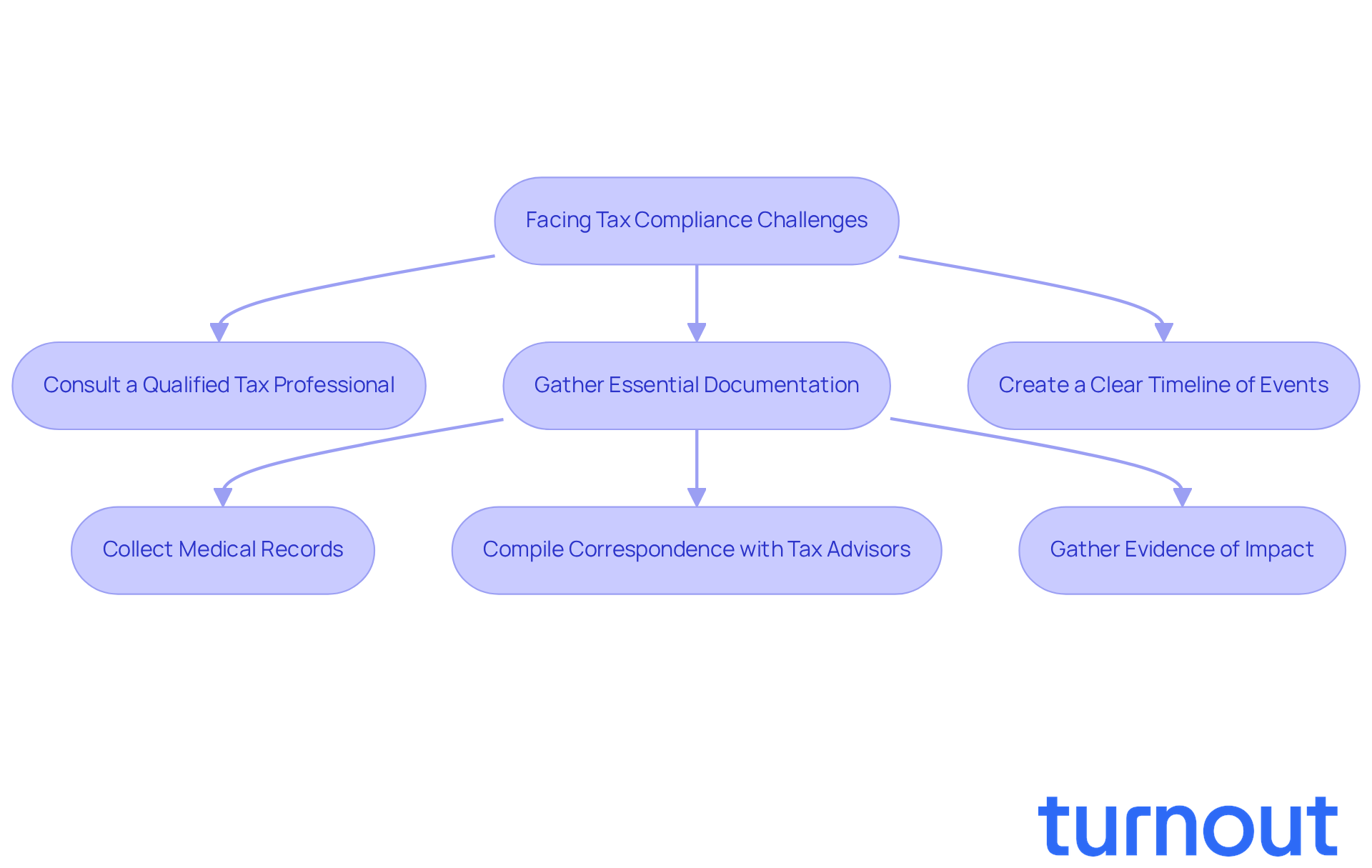

Navigating the complexities of tax compliance can be overwhelming, especially when unexpected circumstances arise. We understand that life can throw serious challenges your way, such as illness or natural disasters, which may hinder your ability to meet tax obligations. It's common to feel lost in these situations, but there is hope.

Mike Habib, EA, reminds us that "consulting a qualified tax professional can help you understand your specific situation and options." This guidance is invaluable as you explore your path forward. To strengthen your case for relief from fines, gather essential documentation. This includes:

- Medical records

- Correspondence with tax advisors

- Any evidence that illustrates how these circumstances impacted your compliance

Creating a clear timeline of events can also be beneficial. Recent changes from the IRS, such as the penalty removal by pausing automatic fine assessments, are set to assist around 1 million individuals starting in 2026. By presenting a well-documented case, you can significantly improve your chances of obtaining fee relief.

Remember, you are not alone in this journey. We're here to help you navigate these challenges with compassion and understanding.

Master the Request Process for IRS Penalty Abatement

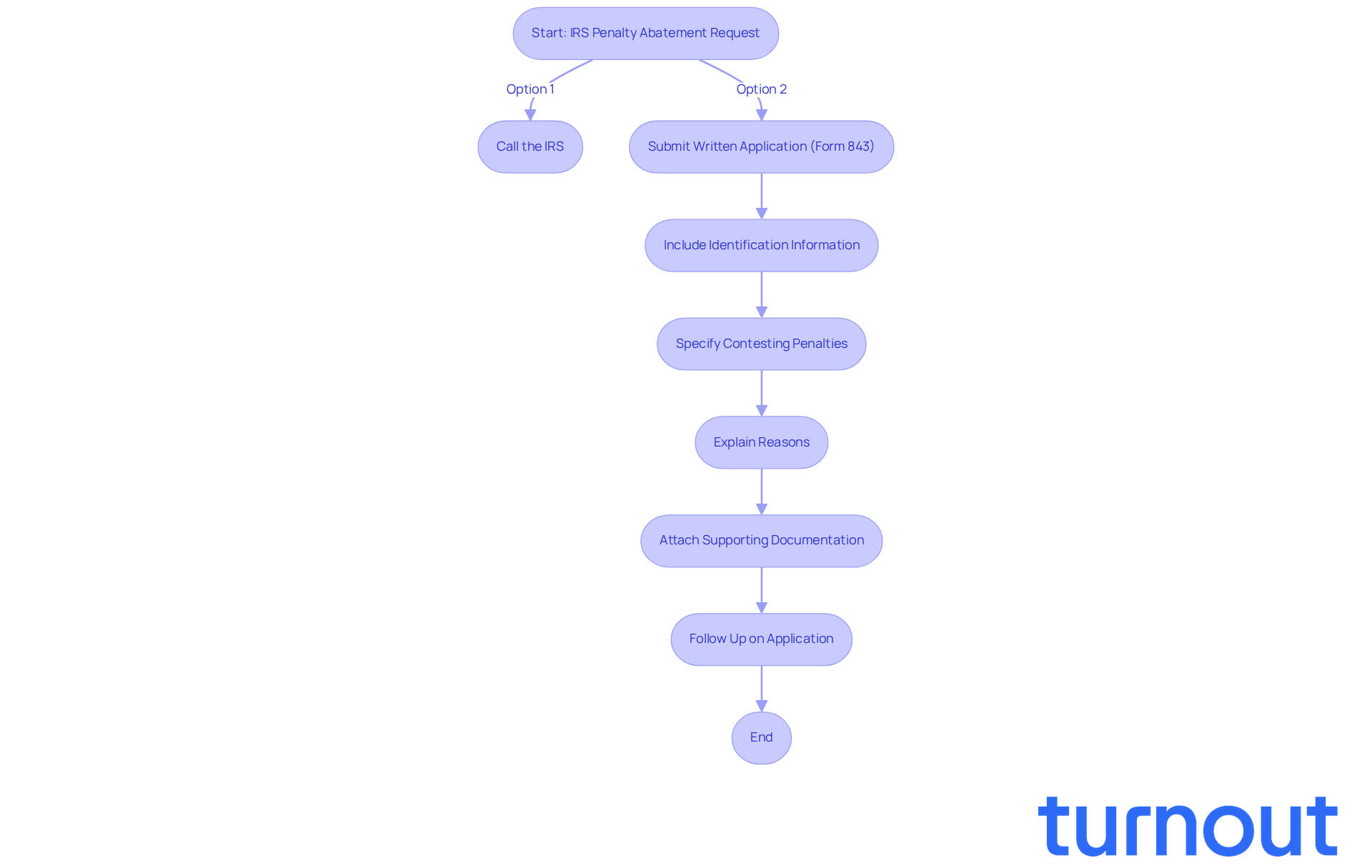

Starting an IRS abatement application can feel overwhelming, but you’re not alone in this journey. You have two options:

- You can either call the IRS directly

- Or submit a written application using Form 843, Claim for Refund and Request for Abatement.

If you choose the written route, it’s important to include comprehensive details. Make sure to provide your identification information, specify the penalties you’re contesting, and clearly explain your reasons for the inquiry.

Including supporting documentation can significantly strengthen your case. For instance, one client faced a tax obligation of $72,104.22 but managed to reduce it to just $2,507.00 through diligent advocacy. This example shows the potential benefits of a well-prepared appeal.

If you prefer to call, having relevant information on hand can make the conversation smoother. Be ready to explain your situation succinctly. We understand that navigating this process can be challenging, but knowing these nuances can lead to a more efficient resolution and may even expedite penalty removal.

Recent updates indicate that the IRS is working to streamline the abatement process. Typically, applications take about 2 to 3 months for an initial determination. We encourage you to follow up on your inquiries to ensure timely processing and to address any potential issues that may arise. Remember, we’re here to help you through this process.

Appeal a Denial to the IRS Independent Office of Appeals

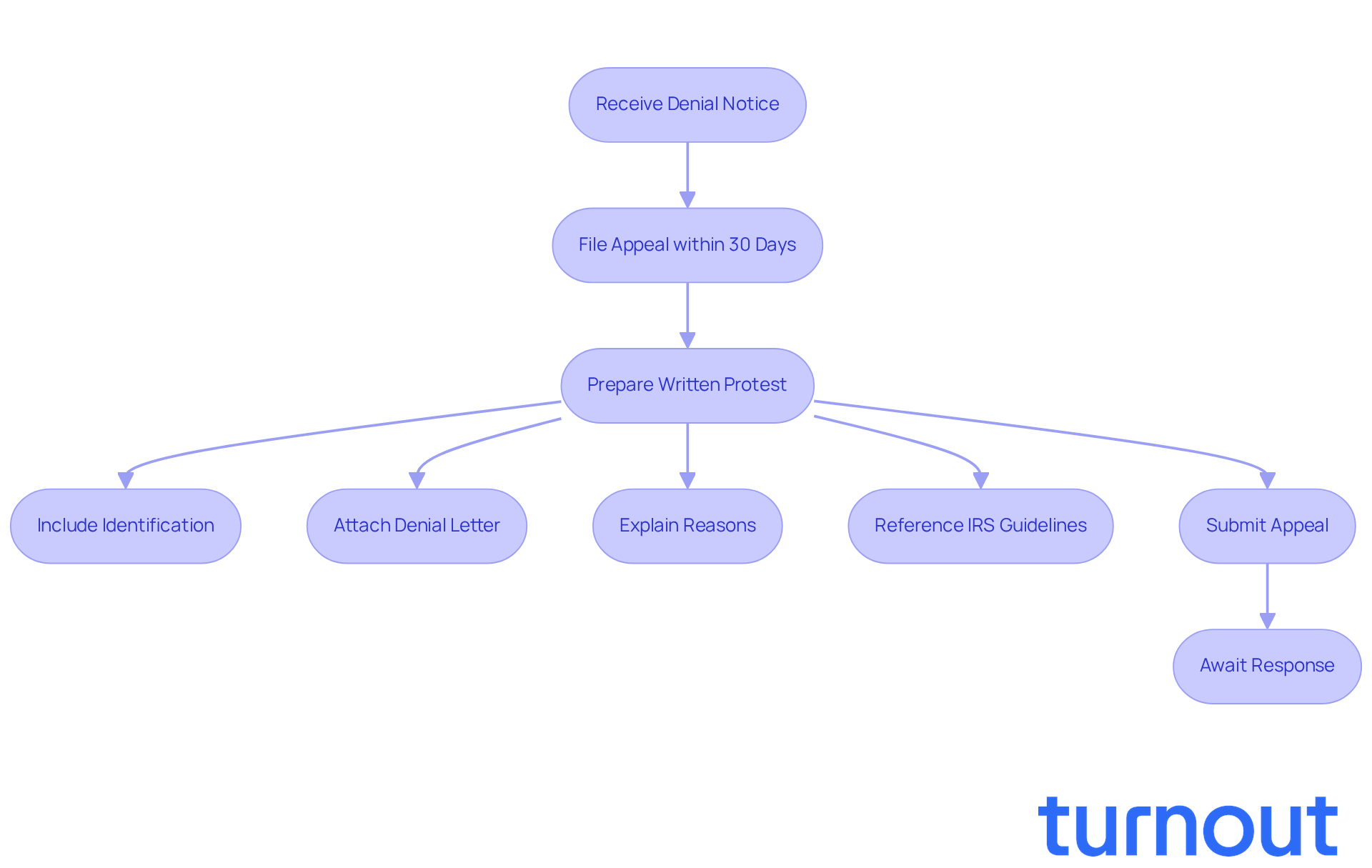

If your request for penalty removal has been denied, it’s important to know that you have the right to appeal this decision to the IRS Independent Office of Appeals. You’ll need to file your appeal within 30 days of receiving the denial notice. To get started, prepare a comprehensive written protest that includes your identification information, a copy of the denial letter, and a detailed explanation of why you believe the denial was incorrect. Remember to reference any relevant IRS guidelines or regulations that support your case.

We understand that navigating this process can be overwhelming. Recent updates to the IRS Independent Office of Appeals process in 2026 highlight the importance of thorough documentation and clear communication. Taxpayers are encouraged to provide a consistent timeline of events and any supporting evidence that shows their compliance efforts. Plus, the IRS has made it easier to connect through video conferences, giving you a more flexible way to present your appeal.

Did you know that success rates for IRS fee reduction appeals show that over 50% of first-time abatement requests are approved each year? Taxpayers who effectively articulate their arguments and present compelling evidence often achieve penalty removal or a reduction in their penalties. It’s crucial to remember that the IRS places the burden of proof on you, meaning you must demonstrate why you deserve relief. By following the proper procedures and crafting a persuasive appeal, you can turn initial denials into successful resolutions, paving the way for financial relief.

However, it’s common to feel anxious about this process. Be cautious of common pitfalls, like overlooking important details in your appeal, as these can hinder your chances of success. You are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Navigating the complexities of IRS penalty removal can feel overwhelming, but it’s a journey that can lead to significant relief and a healthier relationship with the tax system. We understand that the penalties imposed by the IRS can be daunting, but knowing about abatement options empowers you to seek the relief you deserve. By exploring the strategies we've discussed, you can stand up against unfair sanctions and work towards eliminating those burdensome fees.

Throughout this article, we’ve shared valuable insights into the eligibility criteria for the First-Time Penalty Abatement program, the importance of thorough documentation, and the appeal process for denied requests. The statistics show a clear difference in success rates between self-prepared and professionally submitted applications, highlighting the benefits of seeking expert assistance. With recent updates to IRS processes, including more efficient appeals, you now have more tools at your disposal to advocate for yourself.

The path to IRS penalty abatement requires diligence, patience, and the right guidance. By taking proactive steps - whether it’s understanding your eligibility, gathering compelling evidence, or seeking professional help - you can reclaim your financial stability and peace of mind. Remember, the significance of IRS penalty abatement is profound; it not only offers a chance for financial relief but also reinforces the idea that compliance is achievable, even in tough times.

You are not alone in this journey. We’re here to help you navigate these challenges and find the support you need.

Frequently Asked Questions

What is IRS penalty abatement?

IRS penalty abatement is a process that allows taxpayers to contest and potentially remove penalties imposed for delayed filing or payment due to unexpected circumstances, such as illness or financial hardships.

How much money did the IRS abate in penalties in fiscal year 2023?

In fiscal year 2023, the IRS abated penalties totaling $1.2 billion.

What is the average savings for individuals who successfully apply for penalty abatement?

Successful applications for penalty abatement often save individuals an average of $2,800.

What is the First-Time Penalty Abatement program?

The First-Time Penalty Abatement program allows individuals with a clean compliance record to request penalty removal, with an impressive approval rate of around 85%.

How does professional assistance impact the success rate of abatement applications?

The IRS approves 73% of professionally submitted abatement applications, compared to just 45% for self-prepared submissions, highlighting the advantages of seeking professional help.

What are the eligibility criteria for First-Time Penalty Abatement?

To qualify for First-Time Penalty Abatement, individuals must have a clear compliance record over the past three years, with no fines for the same type of tax return, all required tax returns filed, and taxes owed either paid or arrangements for payment in place.

What changes were made to the eligibility criteria starting in 2026?

Starting in 2026, individuals must not have received another penalty in the last three years to qualify for First-Time Penalty Abatement.

What should I do if my First-Time Penalty Abatement request is denied?

If your request for First-Time Penalty Abatement is denied, you can appeal the decision to the IRS Independent Office of Appeals within 30 days of receiving the denial letter.

Are there options for those who do not qualify for First-Time Penalty Abatement?

Yes, individuals who do not qualify for First-Time Penalty Abatement may still have access to reasonable cause relief options, particularly if they are facing significant hardships.

How can I maximize my chances of successful penalty abatement?

To maximize your chances of successful penalty abatement, it is essential to provide thorough documentation and submit your requests in a timely manner.