Introduction

Navigating the complexities of tax obligations can often feel like an uphill battle. We understand that managing IRS payment plans adds to this stress. These installment agreements serve as a crucial lifeline for individuals looking to ease their financial burdens by spreading out tax debts over time.

However, modifying an existing plan can introduce its own set of challenges and uncertainties. It’s common to feel overwhelmed by the process. How can you effectively navigate these changes while ensuring compliance and avoiding pitfalls?

This guide offers step-by-step insights into the IRS payment plan modification process. We’re here to empower you to take control of your financial responsibilities with confidence. You are not alone in this journey.

Understand IRS Payment Plans and Their Importance

Facing tax obligations can be overwhelming, but there’s a way to ease that burden. IRS payment plan changes, often known as installment agreements, allow you to settle your tax debts gradually rather than all at once. Understanding these options is essential for anyone navigating this challenging situation. Here’s what you need to know:

- Types of Payment Plans: The IRS provides various options, including short-term plans (up to 180 days) and long-term plans (up to 72 months or more). Each plan, such as the irs payment plan change, comes with its own eligibility requirements and terms, so it’s important to find the one that fits your needs.

- Advantages: By entering into a payment arrangement, you can prevent the IRS from taking collection actions, such as wage garnishments or bank levies. This can significantly ease your financial stress, allowing you to manage your expenses more effectively over time.

- Eligibility: Generally, to qualify for online settlement options, you need to have filed all necessary tax returns and owe less than $50,000. Understanding these criteria is crucial before you take the next step.

We understand that dealing with taxes can feel daunting, but you’re not alone in this journey. If you have questions or need assistance, remember that help is available.

Initiate Your IRS Payment Plan Change Request

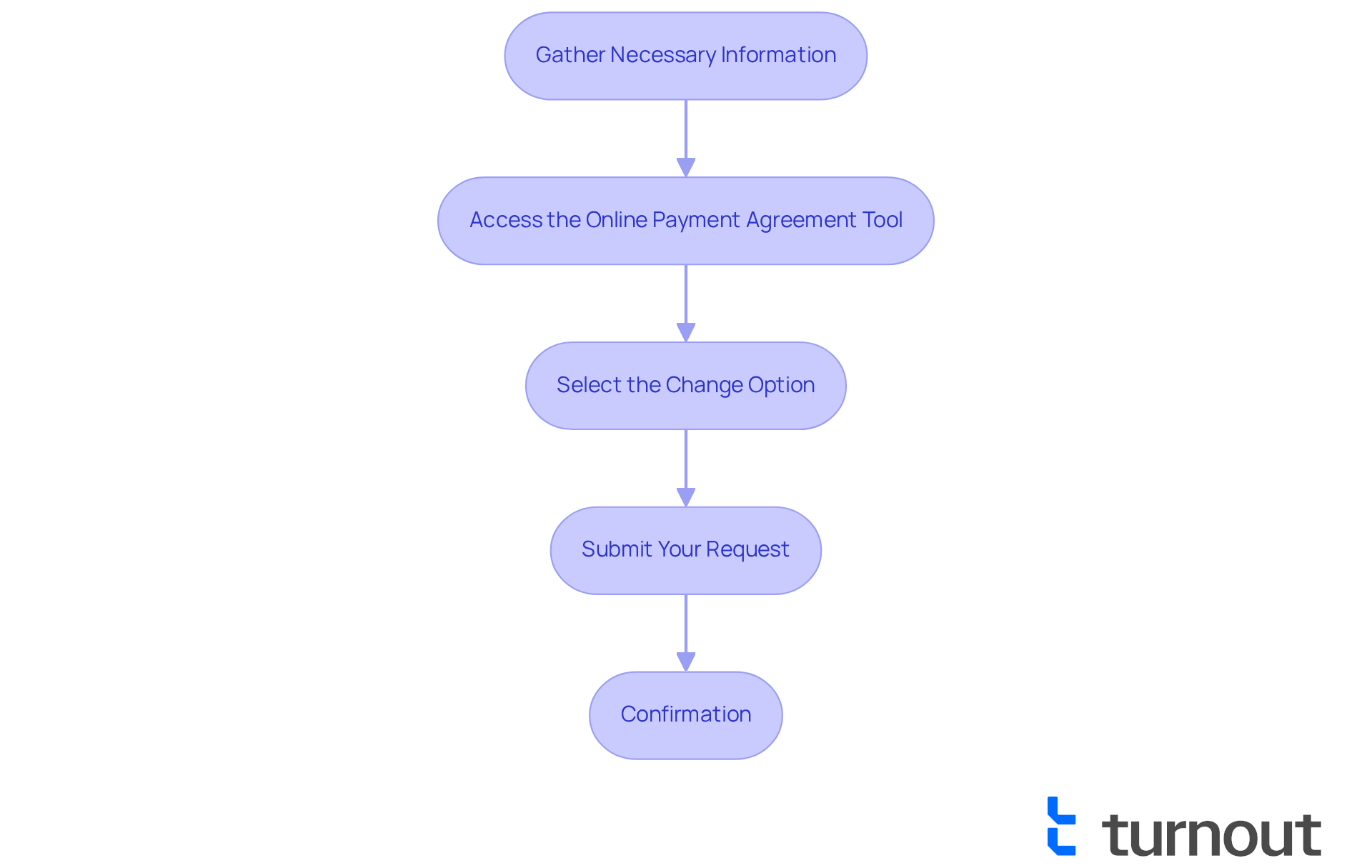

Changing your IRS payment plan can feel overwhelming, but we're here to help you navigate the process. Follow these simple steps to make the process smoother:

-

Gather Necessary Information: Before you start, take a moment to collect your IRS account details. This includes your taxpayer identification number and information about your current financial arrangement. We understand that having everything ready can ease your mind.

-

Access the Online Payment Agreement Tool: Head over to the IRS website and log into the Online Payment Agreement tool. This is the most efficient way to request an IRS payment plan change, which can save you time and reduce stress.

-

Select the Change Option: Once you're logged in, look for the option to modify your current financial arrangement. You can adjust your monthly payment amount, change your due date, or even add new tax debts. It’s common to feel uncertain about the IRS payment plan change, but know that you have options.

-

Submit Your Request: After making the necessary adjustments, go ahead and submit your request. Just a heads up - there might be a $10 fee for online modifications, but don’t worry; this can be reimbursed under certain conditions.

-

Confirmation: After you submit, you should receive a confirmation of your request. Keep this for your records; it’s important to have it handy.

Remember, you’re not alone in this journey. If you have any questions or need further assistance, don’t hesitate to reach out. We're here to support you every step of the way.

Manage Challenges During Your Payment Plan Modification

Navigating the IRS payment plan change can be challenging, and we understand that. Here’s how to manage those hurdles with care:

-

Technical Issues: If you run into problems with the Online Payment Agreement tool, don’t worry! Try clearing your browser cache or switching to a different browser. If the issues persist, reaching out to the IRS directly can be a helpful step. Remember, you’re not alone in this; 88% of individual taxpayers owe less than $25,000 to the IRS, which shows how common these technical issues can be.

-

Financial Documentation: If you’re looking to request a reduced amount, be ready to provide documentation of your financial situation. This might include recent pay stubs, bank statements, or proof of expenses. Having these documents handy can make the process smoother.

-

Communication Delays: Changing your arrangement by phone or mail can take longer than expected. It’s common to feel anxious about the IRS payment plan change, but always follow up to ensure that your request has been processed. As Jim Buttonow, Senior Vice President for Post-Filing Tax Services at Jackson Hewitt, wisely points out, "The good news is that individual taxpayers who owe up to $250,000 now have a simpler route to an IRS installment arrangement."

-

Default Risks: Missing a contribution during the modification process can lead to your plan going into default. To avoid this, stay proactive by keeping an eye on your billing schedule and communicating with the IRS if you anticipate any challenges.

In 2025, the IRS implemented an IRS payment plan change by introducing new Simple Payment Plans, making it easier for individuals to manage their obligations. Understanding how to handle potential technical issues is essential for a smooth experience. Remember, we’re here to help you through this journey.

Utilize Resources and Tools for Effective Payment Plan Management

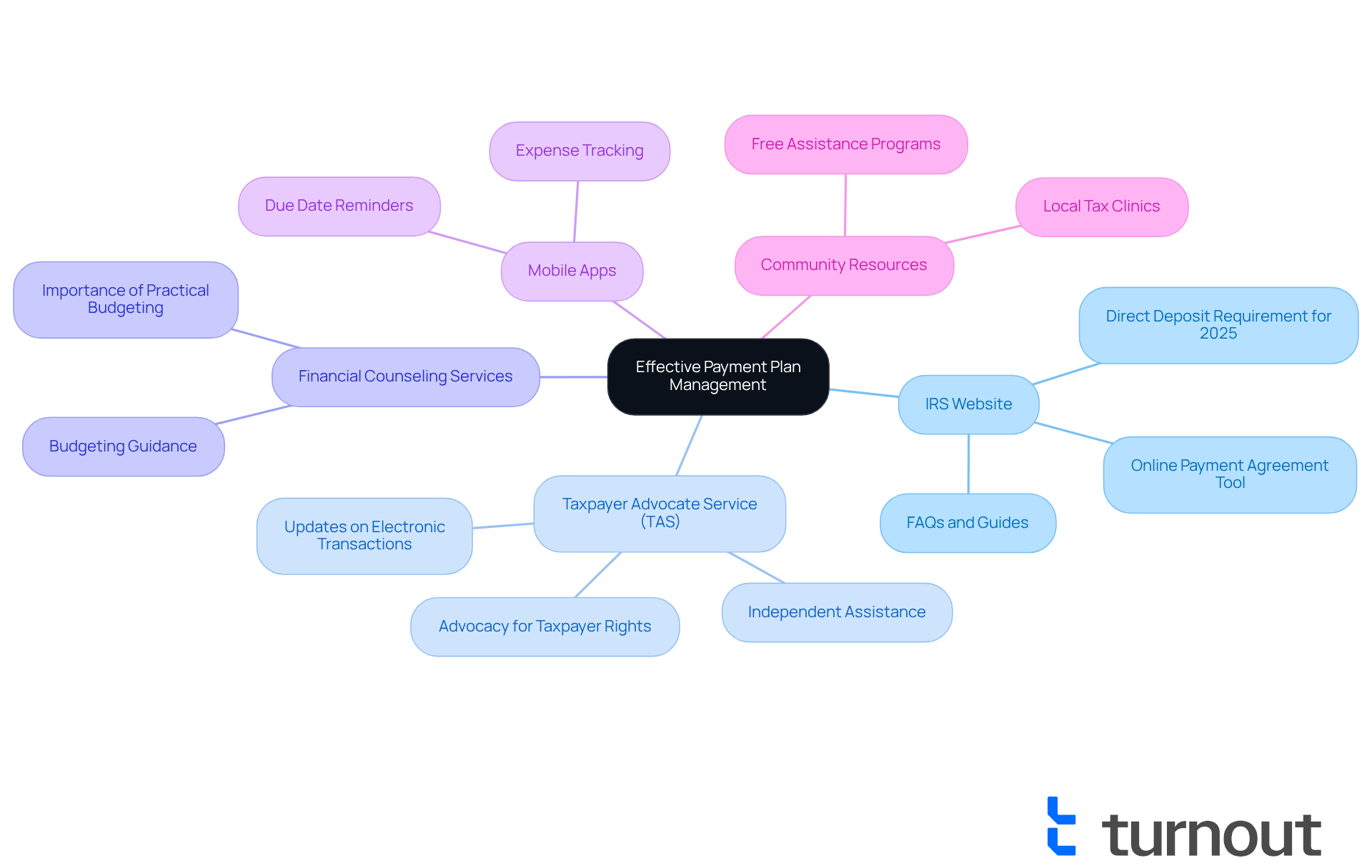

Managing your IRS payment plan change can feel overwhelming, but you’re not alone in this journey. Here are some resources that can help you navigate the process with greater ease:

-

IRS Website: The IRS website is a crucial resource, offering a wealth of information. You’ll find FAQs, detailed guides on payment plans, and access to the Online Payment Agreement tool, which simplifies setting up and managing your payment plan. Remember, starting with the 2025 tax returns, you’ll need to provide direct deposit information to avoid delays in your refunds.

-

Taxpayer Advocate Service (TAS): This independent entity within the IRS is dedicated to helping individuals like you with tax-related issues. TAS can assist you in addressing concerns about your billing plan and advocate on your behalf if challenges arise. As the IRS moves toward electronic transactions by 2027, TAS is also providing updates and guidance to ensure you know your rights and options. As the National Taxpayer Advocate wisely stated, "Taxpayers should be aware that without direct deposit information or an approved exception, the IRS will hold their refund for six weeks before issuing it via a paper check."

-

Financial Counseling Services: Non-profit organizations offer valuable financial guidance that can help you budget for your IRS obligations and improve your overall financial health. Financial advisers emphasize the importance of creating a practical budget to manage tax responsibilities effectively, allowing you to meet your deadlines without unnecessary stress. One financial counselor shared, "Creating a budget is essential for managing tax obligations and avoiding penalties."

-

Mobile Apps: There are various mobile applications available to help you track your expenses and remind you of due dates. These tools can enhance your organization skills and ensure you meet your obligations on time, reducing the risk of penalties.

-

Community Resources: Local tax clinics and community organizations often provide free assistance with tax-related inquiries and financial planning. These resources can be invaluable, especially if you feel overwhelmed by the complexities of the tax system. It’s important to note that unbanked individuals may face challenges accessing electronic transaction methods, as highlighted by the IRS's transition strategy.

By leveraging these resources, you can confidently and clearly approach the IRS payment plan change. Remember, you’re not alone in this process, and there are many ways to ensure you stay on track and avoid potential pitfalls.

Conclusion

Navigating the complexities of IRS payment plans can feel overwhelming, especially when facing tax obligations. We understand that understanding the various types of payment plans, their advantages, and eligibility criteria is crucial for managing your financial responsibilities effectively. This guide has aimed to provide essential insights into initiating and modifying an IRS payment plan, empowering you to take control of your financial situation.

Key points discussed include:

- The importance of gathering necessary information

- Utilizing the Online Payment Agreement tool

- Managing potential challenges like technical issues and communication delays

By being proactive and informed, you can successfully navigate the modification process, ensuring compliance and avoiding default risks. Remember, resources like the IRS website, Taxpayer Advocate Service, and financial counseling can significantly enhance your ability to manage tax obligations.

Ultimately, understanding and effectively managing IRS payment plans not only alleviates financial stress but also empowers you to take charge of your tax situation. By utilizing the tools and resources available, you can confidently approach your obligations and ensure a smoother financial journey. Taking that first step toward modifying an IRS payment plan can lead to greater peace of mind and a more secure financial future. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment agreements, allow taxpayers to settle their tax debts gradually rather than in a lump sum.

What types of payment plans does the IRS offer?

The IRS offers various options, including short-term plans (up to 180 days) and long-term plans (up to 72 months or more).

What are the advantages of entering into an IRS payment plan?

Entering into a payment arrangement can prevent the IRS from taking collection actions, such as wage garnishments or bank levies, which can help ease financial stress.

What are the eligibility requirements for IRS payment plans?

To qualify for online settlement options, you generally need to have filed all necessary tax returns and owe less than $50,000.

Why is it important to understand IRS payment plans?

Understanding IRS payment plans is essential for anyone facing tax obligations, as it helps in choosing the right option to manage tax debts effectively.