Overview

Are you feeling overwhelmed by financial difficulties? You’re not alone. Many taxpayers face challenges that make it hard to keep up with IRS collection efforts. The good news is that there’s a way to temporarily halt these efforts through IRS non-collectible status. This guide will walk you through the process, helping you understand how to achieve this relief.

To qualify for non-collectible status, you must meet specific eligibility criteria. It’s essential to gather thorough documentation that demonstrates your financial hardship. We understand that this can feel daunting, but taking these steps is crucial for your application’s success. Remember, clear communication with the IRS can make a significant difference.

You might encounter some common challenges during the application process. It’s normal to feel frustrated or confused at times. However, knowing what to expect can help ease your worries. Keep in mind that you are not alone in this journey; many have successfully navigated these waters before you.

Achieving non-collectible status can provide you with the breathing room you need. Imagine the relief of knowing that collection efforts are paused while you work on your financial situation. This status can be a vital step toward regaining control over your finances.

We’re here to help you through this process. If you have questions or need support, don’t hesitate to reach out. You deserve to find peace of mind, and taking action toward non-collectible status is a positive step forward.

Introduction

The IRS non-collectible status is a crucial lifeline for many taxpayers facing financial hardship. It allows individuals to temporarily halt collection efforts on their tax obligations. This designation not only eases the immediate pressures of wage garnishments and bank levies but also provides the breathing room needed to stabilize finances.

We understand that navigating the complexities of qualifying and applying for this status can feel overwhelming. The intricacies of IRS regulations and documentation requirements can be daunting. How can you ensure that you meet the eligibility criteria and successfully secure this vital relief?

You're not alone in this journey. Many have faced similar challenges, and there are steps you can take to find the support you need. Let's explore how you can take control of your situation and find the relief you deserve.

Understand IRS Currently Not Collectible Status

The IRS non collectible status is a vital classification that permits taxpayers to temporarily pause collection efforts on their tax obligations due to economic hardship. When your account is marked as IRS non collectible status, the IRS acknowledges that paying your tax obligations would impose undue financial strain. While the IRS non collectible status doesn’t erase your debt, it provides essential relief from immediate collection actions like wage garnishments, bank levies, and collection notices.

In 2025, approximately 10 million taxpayers find themselves in IRS non collectible status, which highlights the financial challenges many are experiencing. This condition can last anywhere from six months to two years, allowing individuals to focus on necessary living expenses without the burden of tax payments due to their IRS non collectible status. For instance, many taxpayers have successfully achieved IRS non collectible status by demonstrating that their monthly income is insufficient to cover essential living costs. This enables them to stabilize their finances and prioritize fundamental needs such as housing and healthcare.

One of the immediate benefits of CNC designation is the halt of IRS collection actions, which allows for an IRS non collectible status that can significantly reduce stress. As tax specialist J. David noted, "CNC classification could be your lifeline." It truly can help ease the pressure while you work to get back on your feet. This temporary relief allows individuals to create budgets, seek new employment, or explore options like an Offer in Compromise or payment plans if their financial situation improves, particularly in relation to their IRS non collectible status.

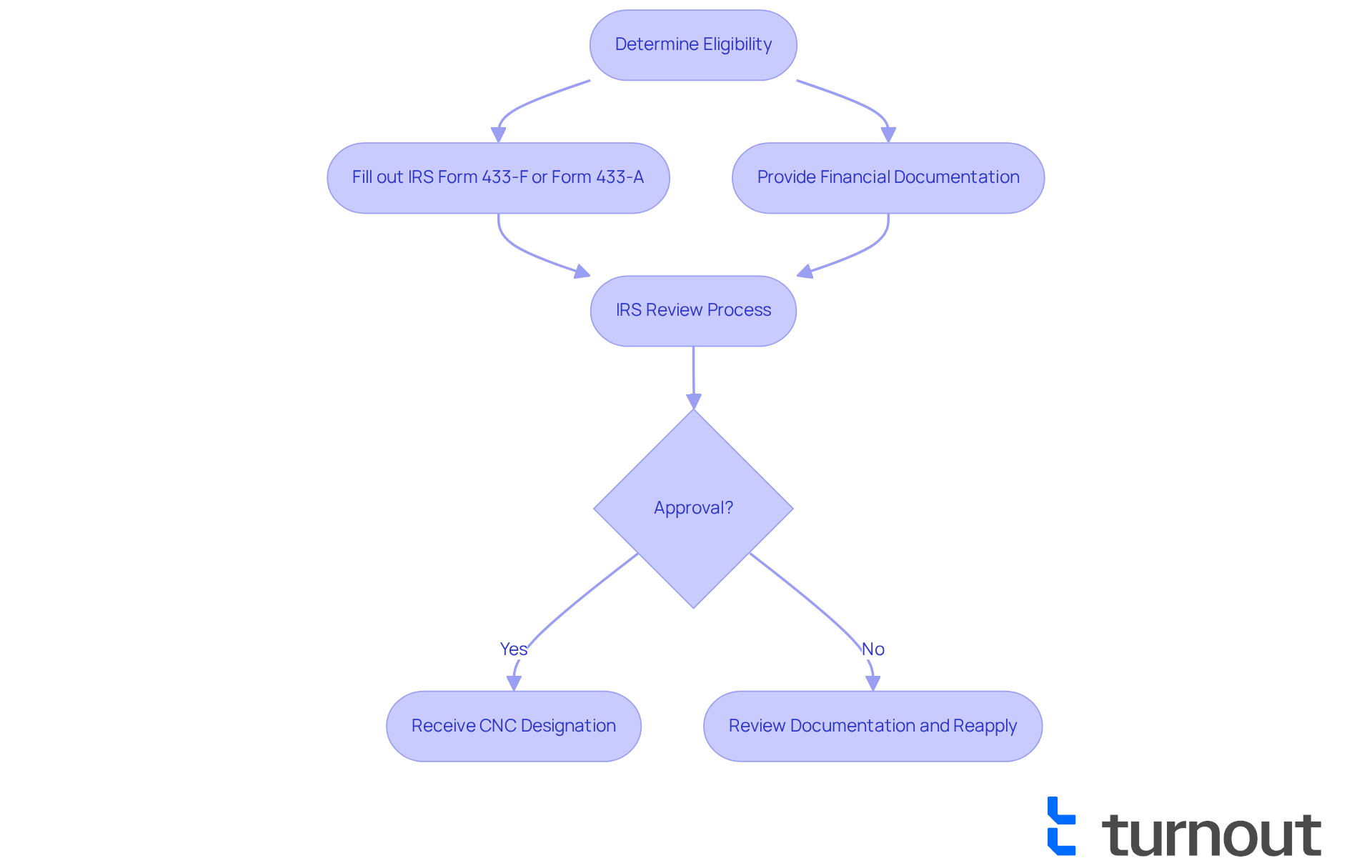

To request CNC classification, taxpayers need to fill out IRS Form 433-F or Form 433-A, providing detailed financial information, including income, expenses, and assets. To qualify for IRS non collectible status, it’s important that individuals haven’t made recent payments toward their tax debt and have filed all required tax returns. Clear documentation of your economic situation can strengthen your case for CNC classification, as the IRS frequently reviews these circumstances. While in IRS non collectible status, taxpayers can focus on their financial well-being and work toward settling their tax obligations without the fear of aggressive collection methods.

Keep in mind that approval for CNC designation can take from a few weeks to a couple of months. Unfortunately, individuals cannot apply for CNC designation online; they must reach out to the IRS by phone or mail. Additionally, while CNC designation doesn’t directly affect credit scores, a Notice of Federal Tax Lien can negatively impact credit if tax debt exceeds $10,000. Resources like the Taxpayer Advocate Service (TAS) and Low Income Taxpayer Clinics (LITCs) are available to help manage tax concerns and assist with applying for CNC designation. Remember, you’re not alone in this journey, and there are people ready to help.

Determine Eligibility for CNC Status

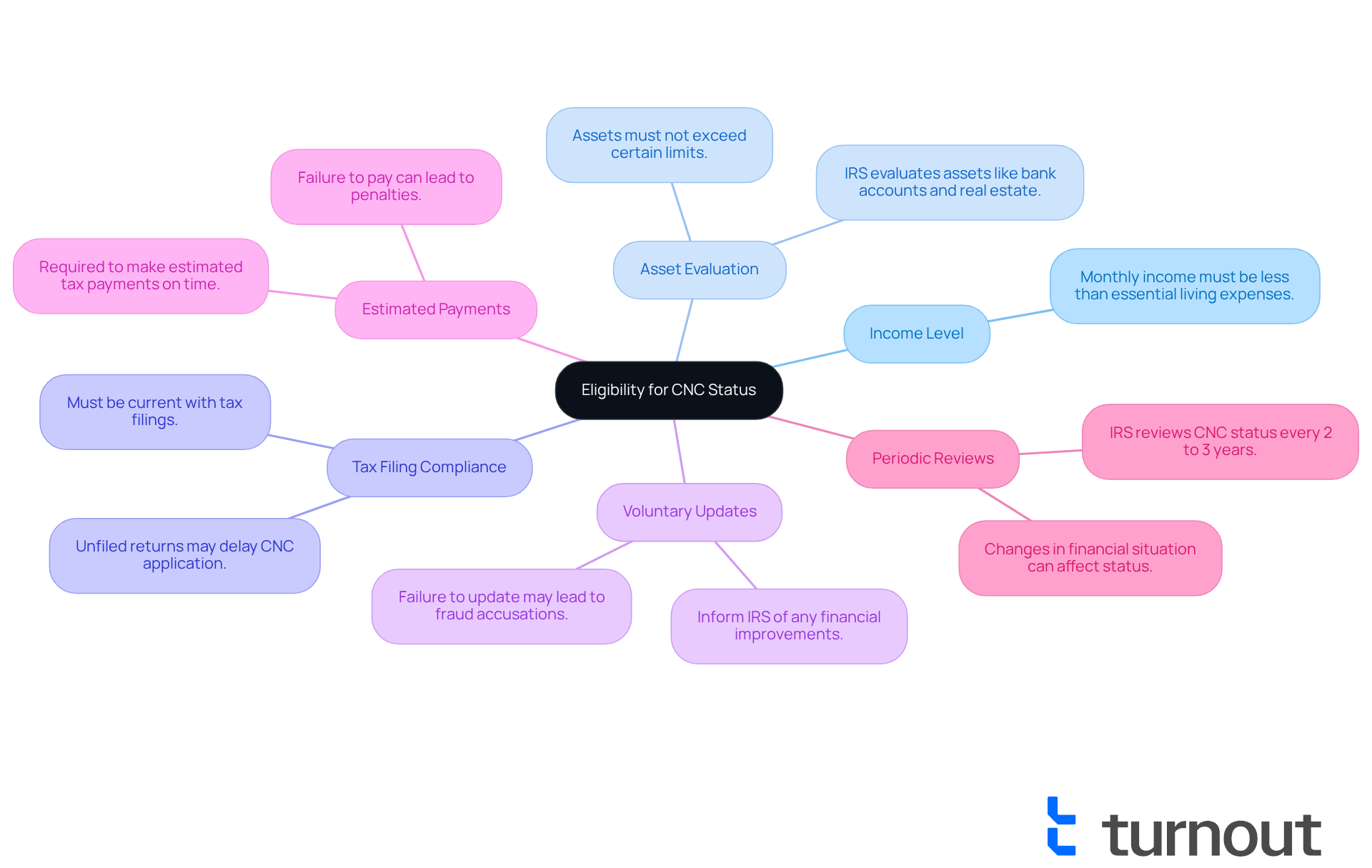

If you're facing financial difficulties, you might be wondering about the IRS non collectible status designation. This option is available for those who can demonstrate that they qualify for IRS non collectible status because settling their tax obligations would lead to significant economic hardship. We understand that navigating these waters can be overwhelming, so let’s break down the key eligibility criteria together:

- Income Level: Your monthly income should be less than your essential living expenses. This includes costs for housing, utilities, food, transportation, and healthcare.

- Asset Evaluation: The IRS will take a close look at your assets, such as bank accounts, real estate, and other valuables. If your assets exceed certain limits, you may not qualify for the IRS non collectible status.

- Tax Filing Compliance: It’s important to be current with your tax filings. If you have any unfiled returns, the IRS may ask you to file them before they consider your CNC application.

- Voluntary Updates: Remember, it’s crucial to inform the IRS if your financial situation improves. Failing to do so could lead to serious consequences, including accusations of fraud.

- Estimated Payments: Even while in IRS non collectible status, you are still required to make estimated tax payments and federal tax deposits on time to avoid further penalties.

- Periodic Reviews: The IRS reviews accounts to determine if the IRS non collectible status should be maintained every 2 to 3 years based on any changes in your financial situation.

Gathering the right documentation is essential to support your case. This includes pay stubs, bank statements, vehicle titles, home value estimates, and detailed expense reports. These documents will help illustrate your economic hardship and make the application process smoother.

We’re here to help you through this journey. Remember, you’re not alone in this. If you have any questions or need assistance, don’t hesitate to reach out.

Follow the Application Process for CNC Status

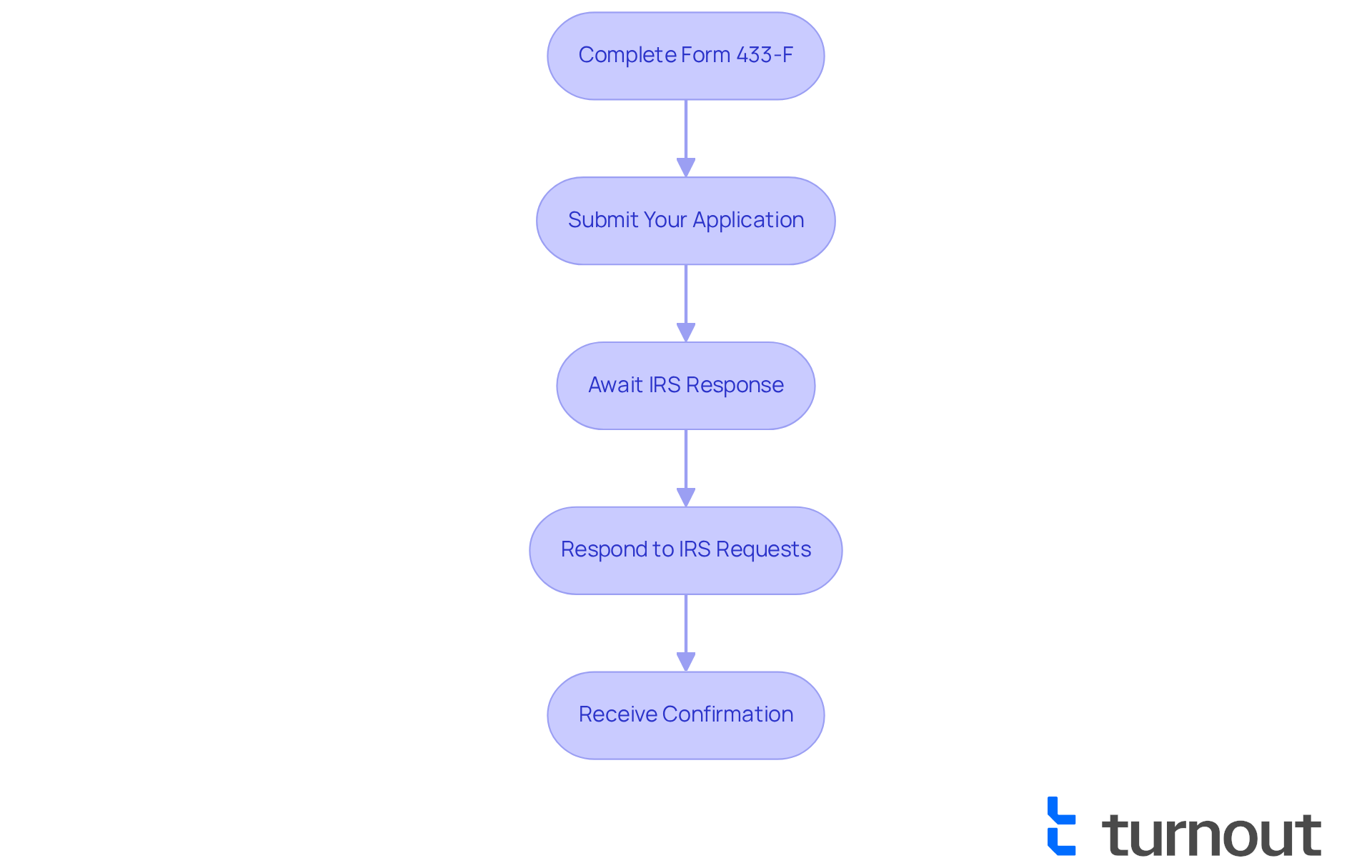

Navigating the process of applying for IRS non collectible status can feel overwhelming, but you’re not alone. We understand that financial hardships can weigh heavily on your mind. Here’s a step-by-step guide to help you through this journey with compassion and clarity.

-

Complete Form 433-F: This form is crucial for giving the IRS a clear picture of your financial situation. You can easily download it from the IRS website. Make sure to report all your income and expenses accurately to reflect your current economic hardship.

-

Submit Your Application: Along with your completed Form 433-F, include supporting documents that back up your claim of financial hardship. This might include recent pay stubs, bank statements, and a detailed list of your monthly expenses. Remember, this documentation is vital in showing your genuine need for assistance.

-

Await IRS Response: After you submit your application, the IRS will take some time to review it—typically several weeks. During this waiting period, it’s important to refrain from making any payments on your tax debt, as this could impact your IRS non collectible status. Keep in mind that while you’re in IRS non collectible status, interest and penalties on your tax debt will continue to accumulate.

-

Respond to IRS Requests: If the IRS reaches out for more information or clarification, don’t worry. Being prepared to respond promptly can help prevent delays in processing your application. We know it can be stressful, but timely communication is key.

-

Receive Confirmation: Once your application is approved, you’ll receive a notice confirming your IRS non collectible status. Hold onto this documentation for your records, as you may need it in the future. Remember, CNC classification is temporary and will be reviewed periodically by the IRS to see if you still qualify for IRS non collectible status based on your financial situation. If things change, you can always reapply for the IRS non collectible status.

By following these steps, you can navigate the application process more smoothly and increase your chances of achieving CNC designation. The IRS non collectible status can provide significant relief from tax collection efforts, enabling you to focus on rebuilding your financial stability. Remember, we’re here to help you every step of the way.

Troubleshoot Common Issues in the CNC Application

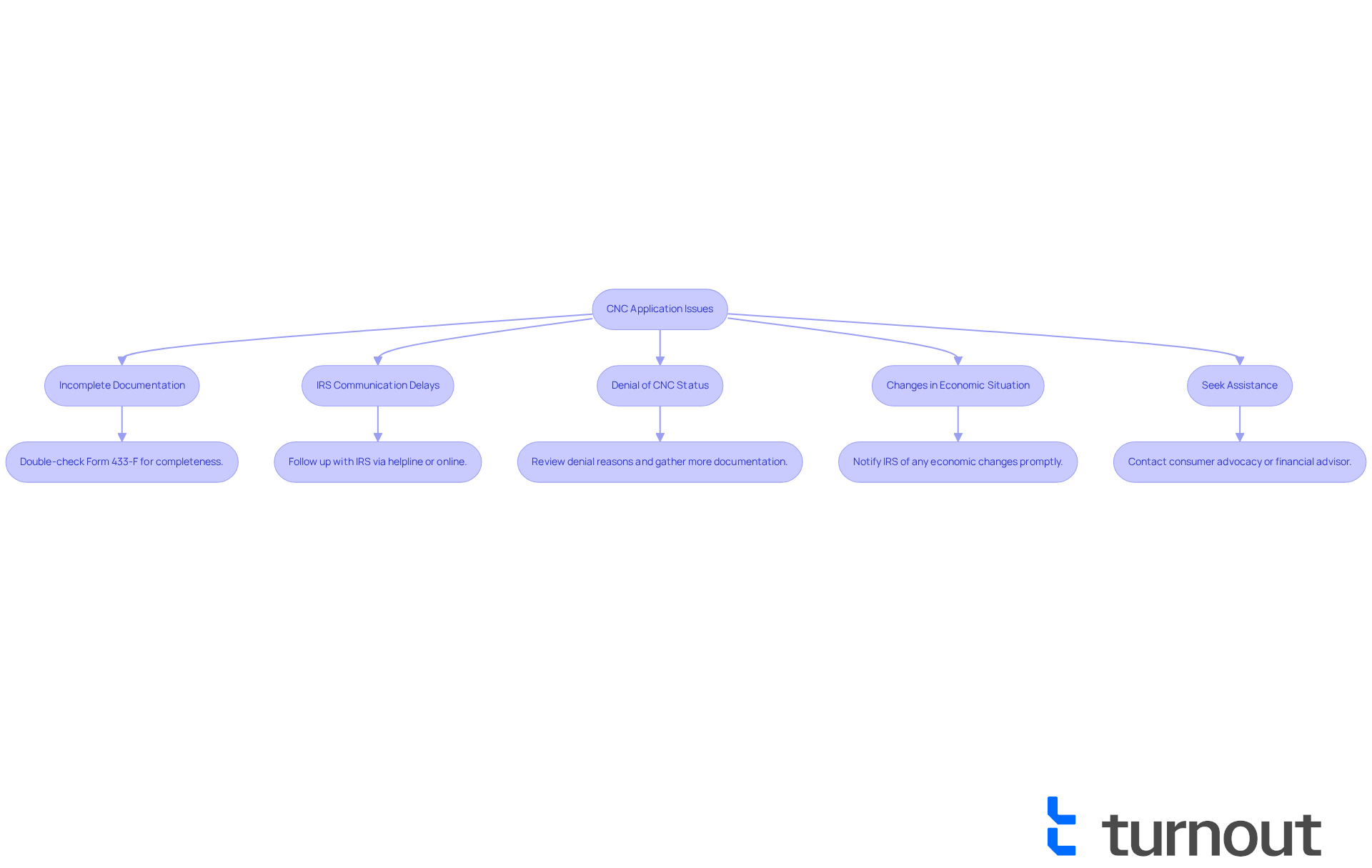

Applying for IRS non-collectible status can feel overwhelming, and you’re not alone in facing challenges along the way. Here’s how to navigate some common issues with care and support:

-

Incomplete Documentation: It’s crucial to submit all required documents with your application. Missing information can lead to frustrating delays or even denials. Take a moment to double-check your Form 433-F for completeness. Precise completion of these monetary forms is essential for the IRS to accurately evaluate your economic situation.

-

IRS Communication Delays: If you haven’t heard back from the IRS in a while, it’s perfectly okay to follow up. You can call the IRS helpline or check your application status online. We understand that waiting can be stressful, but staying proactive is key. Remember, the IRS can take time to review applications, and delays are not uncommon.

-

Denial of CNC Status: If your application is denied, take a deep breath and carefully review the reasons provided by the IRS. You have the right to contest the decision by submitting more documentation or clarifying your economic situation. Understanding the specific reasons for denial can help you address any gaps in your application for IRS non-collectible status, and we’re here to support you through this process.

-

Changes in Economic Situation: Life can change unexpectedly. If your economic circumstances shift after applying, it’s important to notify the IRS promptly. This can influence your CNC standing and may require you to reapply for IRS non-collectible status. The IRS periodically reviews accounts, and significant changes in income or assets could impact your eligibility.

-

Seek Assistance: If the process feels too much to handle, consider reaching out to a consumer advocacy organization or a financial advisor who specializes in tax issues. Expert guidance can simplify the process and improve your chances of a successful application. Remember, the IRS's criteria for CNC classification can change, so staying informed and seeking help when needed is vital.

While in IRS non-collectible status, remember that the IRS still charges monthly late payment penalties and interest on your account. To qualify for assistance from Low Income Taxpayer Clinics (LITCs), the amount in dispute with the IRS must usually be less than $50,000. Gathering comprehensive financial information is essential to effectively demonstrate your hardship.

We’re here to help you through this journey, and you don’t have to face it alone.

Conclusion

Achieving IRS non-collectible status can be a vital step for taxpayers grappling with financial challenges. This designation offers temporary relief from tax collection efforts, acknowledging the economic hardships many endure. It allows individuals to focus on essential living expenses without the immediate pressure of tax obligations. By understanding the process and requirements, you can navigate your way toward this important status, providing a much-needed lifeline during tough times.

Throughout this article, we’ve shared key insights about eligibility criteria, the application process, and common issues that may arise when seeking IRS non-collectible status. From demonstrating that your monthly income falls below necessary living expenses to submitting accurate documentation, each step is crucial for approval. Moreover, timely communication with the IRS and utilizing resources like the Taxpayer Advocate Service and Low Income Taxpayer Clinics can make a significant difference.

Ultimately, navigating the complexities of IRS non-collectible status isn’t just about managing tax obligations; it’s about reclaiming your financial stability and peace of mind. If you’re facing economic hardship, we encourage you to take proactive steps. Gather the necessary documentation and seek assistance when needed. By doing so, you empower yourself to overcome financial challenges and work toward a more secure future. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is IRS non collectible status?

IRS non collectible status is a classification that allows taxpayers to temporarily pause collection efforts on their tax obligations due to economic hardship. It acknowledges that paying taxes would impose undue financial strain.

What are the benefits of being in IRS non collectible status?

The primary benefit is the halt of IRS collection actions, such as wage garnishments and bank levies, providing relief from immediate financial pressure. This status allows individuals to focus on essential living expenses.

How long can IRS non collectible status last?

IRS non collectible status can last anywhere from six months to two years, depending on the individual's financial situation.

How can taxpayers qualify for IRS non collectible status?

Taxpayers can qualify by demonstrating that their monthly income is insufficient to cover essential living costs, not making recent payments toward their tax debt, and having filed all required tax returns.

What forms do taxpayers need to fill out to request CNC classification?

Taxpayers need to fill out IRS Form 433-F or Form 433-A, providing detailed financial information such as income, expenses, and assets.

How long does it take to get approval for CNC designation?

Approval for CNC designation can take from a few weeks to a couple of months.

Can taxpayers apply for CNC designation online?

No, individuals cannot apply for CNC designation online; they must contact the IRS by phone or mail.

Does IRS non collectible status affect credit scores?

While CNC designation itself does not directly affect credit scores, a Notice of Federal Tax Lien can negatively impact credit if the tax debt exceeds $10,000.

What resources are available for taxpayers seeking help with tax concerns?

Resources such as the Taxpayer Advocate Service (TAS) and Low Income Taxpayer Clinics (LITCs) are available to assist with managing tax issues and applying for CNC designation.