Introduction

Facing an IRS levy can feel overwhelming. It’s a stark reminder of the government’s power to seize assets to settle unpaid tax debts. With millions of Americans likely to encounter this situation in the coming years, it’s crucial to understand what an IRS levy release entails. This guide is here to help you navigate the complexities of levy release, empowering you to reclaim your financial stability.

But what if the IRS takes too long to respond or your application gets rejected? It’s common to feel anxious in these situations. That’s why timely action and proper documentation are essential. By addressing these challenges head-on, you can overcome obstacles during this stressful time. Remember, you’re not alone in this journey - we’re here to help.

Understand the IRS Levy: Definition and Implications

An IRS seizure can feel overwhelming, as it represents a legal confiscation of your property to settle an outstanding tax debt. This action can take many forms, like wage garnishments, bank account seizures, or even the confiscation of physical assets. The consequences are profound, often leading to significant financial distress. For instance, if you’re facing wage garnishments, your ability to pay rent and cover essential living expenses may be severely compromised. In 2026, millions of Americans are expected to be impacted by IRS seizures, highlighting the urgency of understanding this issue.

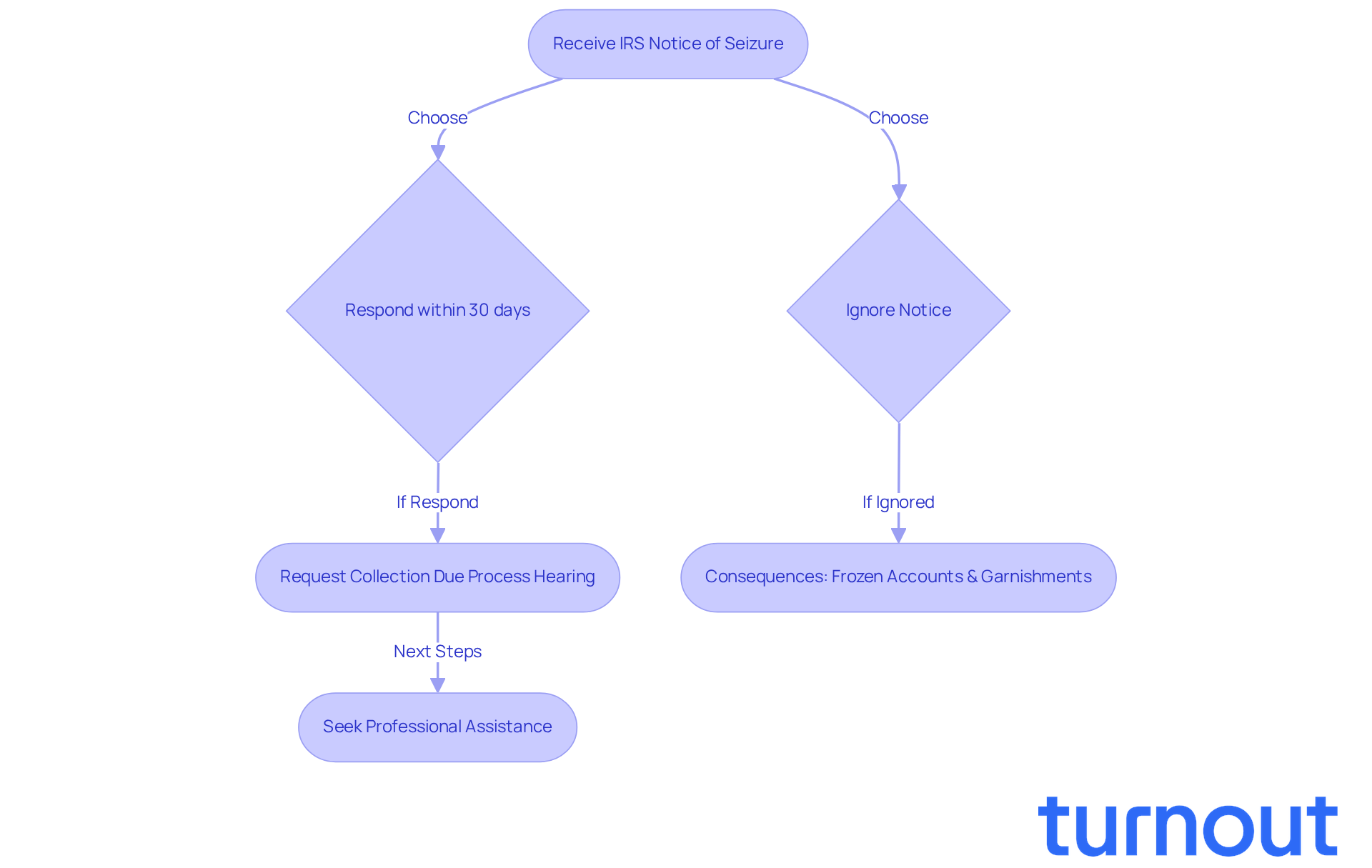

Receiving a notice of seizure is a critical moment; it signals that immediate action is required. Taxpayers typically have a limited timeframe to respond-usually 30 days after receiving a Final Notice of Intent to Collect. During this time, you can request a Collection Due Process (CDP) hearing to dispute the action. Ignoring this notice can lead to frozen bank accounts and ongoing garnishments, worsening your financial situation.

Real-life examples underscore the gravity of these situations. Take Steven L., for instance. He faced a $24,000 tax obligation and felt considerable anxiety about the risk of an IRS seizure. With professional assistance, he navigated the complexities of his tax situation, showing just how important it is to seek help promptly. Similarly, Brian M. owed $192,815 but managed to settle for just $500, demonstrating that effective intervention can lead to favorable outcomes.

Understanding the financial impact of an IRS levy release is vital for anyone facing tax difficulties. The stress and disruption caused by such actions can be overwhelming, but timely intervention, such as an IRS levy release, and professional guidance can help you regain control over your financial situation. Additionally, consider the Collection Appeals Program (CAP), which offers a quicker way to contest an inappropriate seizure. Taking prompt action can make a significant difference in resolving tax issues and preventing further financial hardship. Remember, you are not alone in this journey; we're here to help.

Initiate the Levy Release Process: Key Steps to Follow

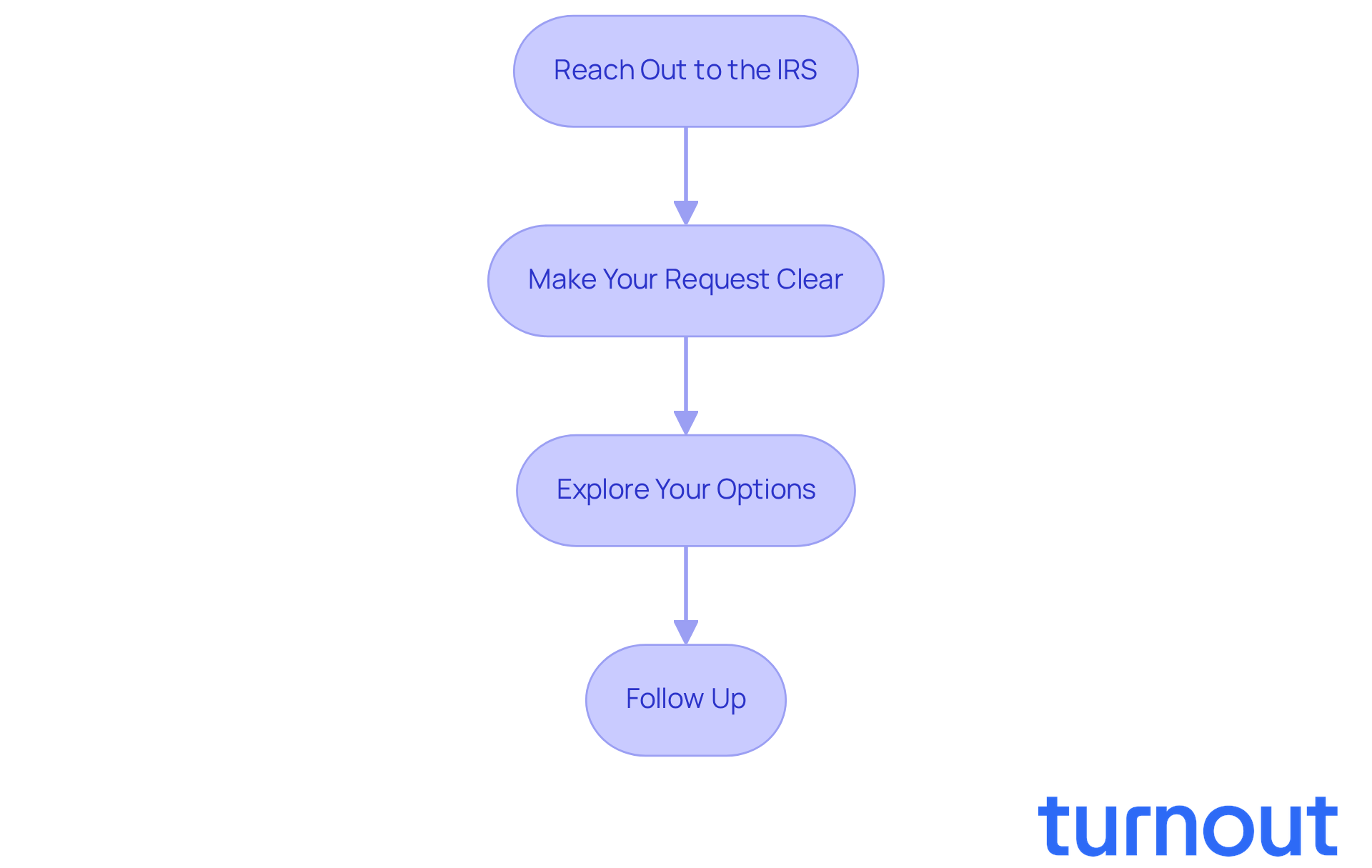

To start the levy release process, let’s walk through these important steps together:

-

Reach Out to the IRS: Call the number on your seizure notice. We understand that discussing your financial situation can be daunting, but it’s essential to express your desire to have the charge lifted.

-

Make Your Request Clear: When you speak with them, kindly state that you’re requesting a removal of the restriction. It’s okay to explain how this charge is affecting you or to mention if it was issued by mistake.

-

Explore Your Options: Ask about the different ways you might be able to get the release. You could demonstrate financial hardship or consider entering a payment agreement. The IRS may be willing to grant an IRS levy release if they see that the restriction is causing you undue hardship.

-

Follow Up: Keep track of your conversations with the IRS. If you don’t hear back in a timely manner, don’t hesitate to follow up. Remember, you’re not alone in this journey, and we’re here to help you navigate through it.

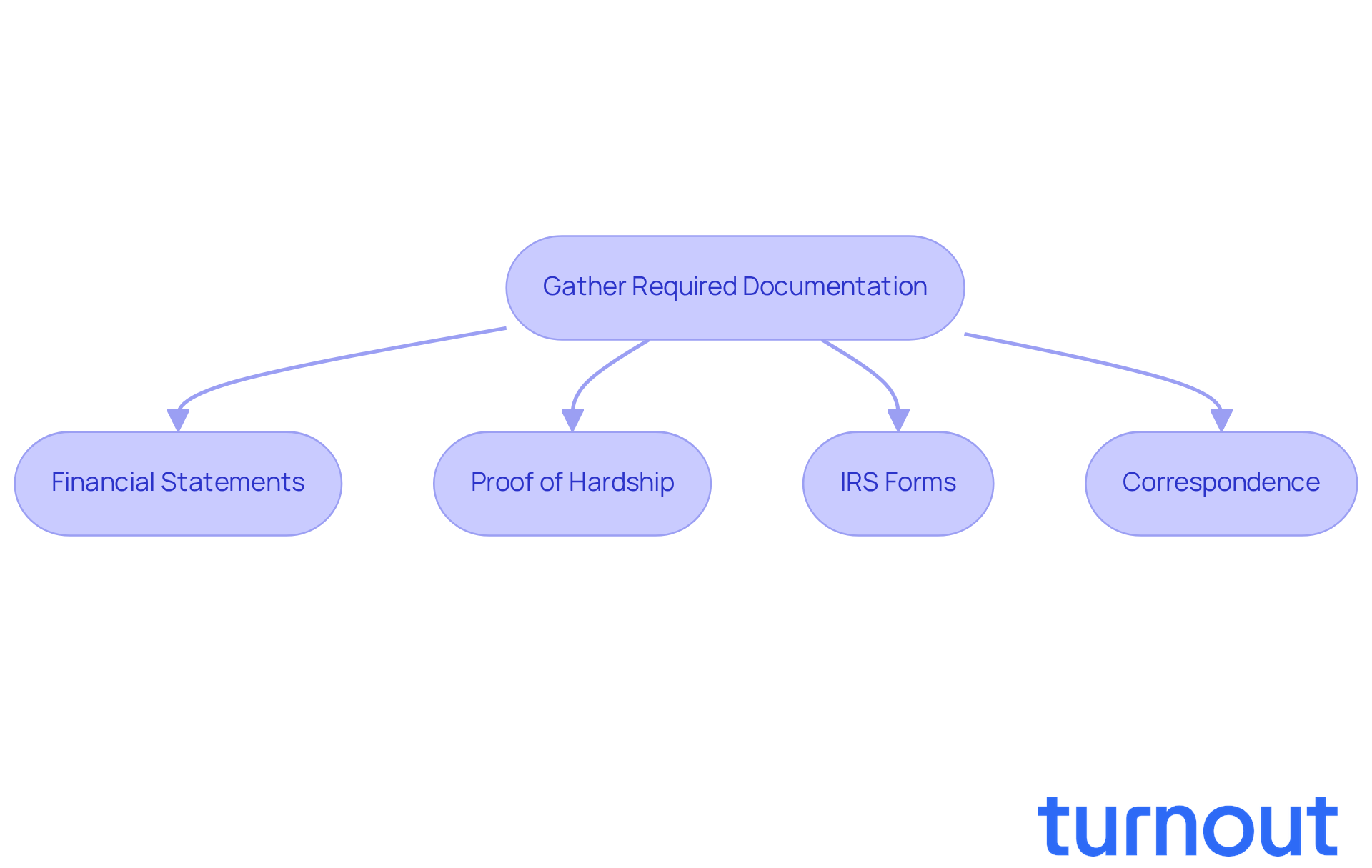

Gather Required Documentation: Essential Evidence for Your Case

If you're seeking an IRS levy release, we understand that gathering the right documentation can feel overwhelming. But don’t worry; we’re here to help you through this process. Here’s what you’ll need:

- Financial Statements: Start by preparing a detailed account of your income, expenses, assets, and liabilities. This may include pay stubs, bank statements, and bills.

- Proof of Hardship: If applicable, provide evidence that the levy is causing you economic difficulty. This could be documentation of missed payments, eviction notices, or medical bills.

- IRS Forms: Complete any necessary IRS forms, such as Form 433-A (Collection Information Statement). This form gives the IRS a comprehensive view of your financial situation.

- Correspondence: Keep copies of all correspondence with the IRS, including notices and any previous requests for relief.

We understand that this can be a challenging time, but taking these steps towards an IRS levy release can help you move forward. Remember, you are not alone in this journey.

Troubleshoot Common Issues: Overcoming Obstacles in the Release Process

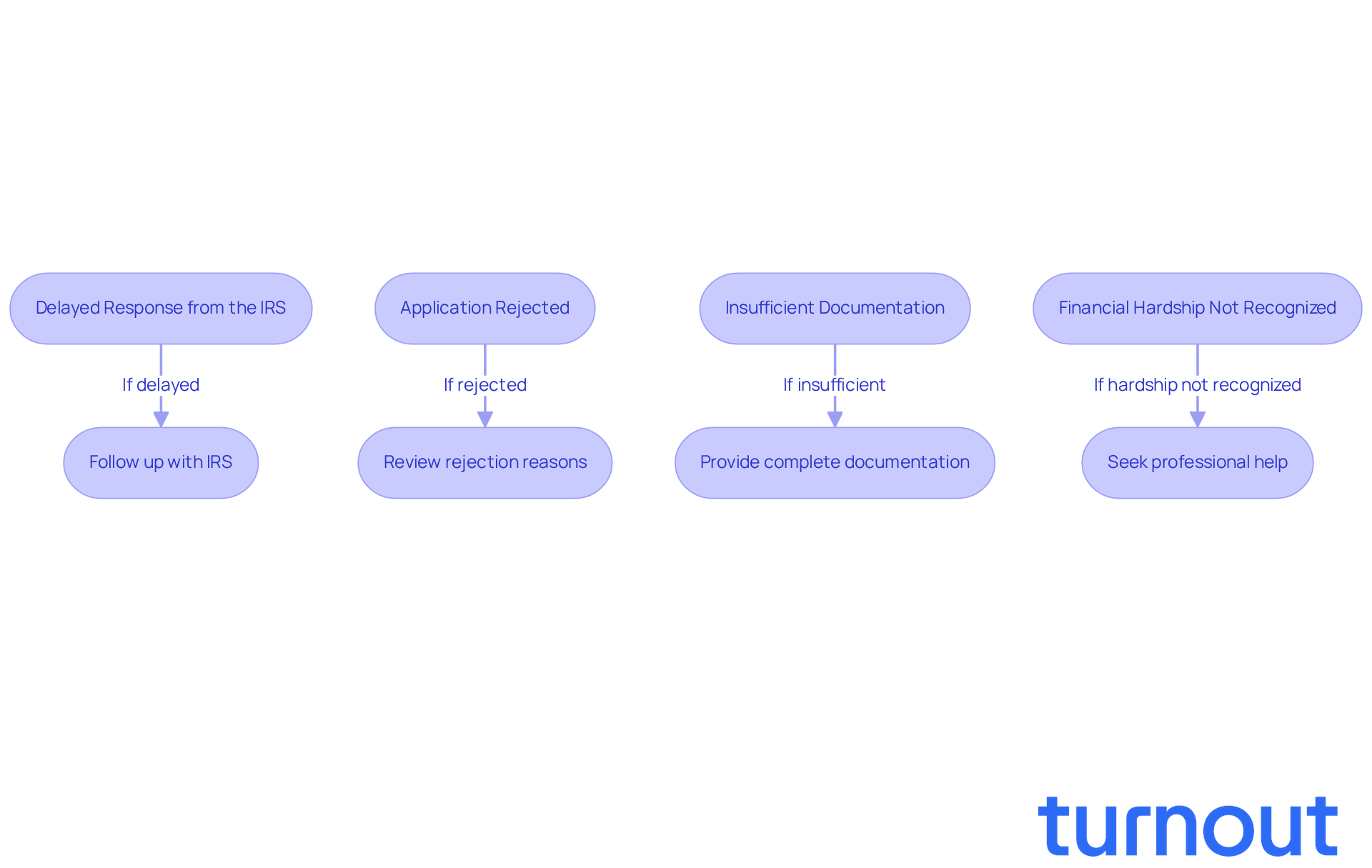

Navigating financial obligations can be tough, and you might face some common hurdles along the way. Here’s how to tackle them with confidence:

-

Delayed Response from the IRS: It’s frustrating when you don’t hear back in a timely manner. If that happens, don’t hesitate to follow up with the IRS. Keep a record of all your communications and stay persistent. Remember, delays are common. In 2024, over 1.8 million seizure actions were issued, which shows just how many cases the IRS is handling. This can lead to response delays. Additionally, there have been acknowledged systemic failures in notifying taxpayers about their Collection Due Process (CDP) rights, which may also contribute to these delays.

-

Application Rejected: If your tax release application gets rejected, take a moment to carefully review the reasons provided by the IRS. You have the right to appeal this decision by filing Form 12153 for a Collection Due Process (CDP) hearing. In 2026, a significant number of IRS levy release applications were denied, with reports indicating that 10,095 taxpayer rights violations occurred due to late submissions of CDP levy hearing applications. Understanding the appeal process is essential in these situations, and you’re not alone in this.

-

Insufficient Documentation: If the IRS asks for more documentation, respond quickly with the necessary information. Make sure all your documents are complete and accurate to avoid any further delays. Many taxpayers face challenges due to incomplete submissions, which can prolong the IRS levy release. You deserve to have your case handled smoothly.

-

Financial Hardship Not Recognized: If the IRS doesn’t recognize your financial hardship, consider providing more detailed evidence. Seeking help from a tax professional or advocate can make a big difference. They can help you navigate the complexities of IRS communications and requirements. Many taxpayers have successfully improved their situations by leveraging expert guidance during the appeal process. Remember, you’re not alone in this journey, and there are people ready to help you.

Conclusion

Understanding the IRS levy release process is crucial for anyone facing tax-related challenges. We know that dealing with IRS seizures can lead to severe financial distress, and it’s important to take timely action. This guide outlines the steps necessary for:

- Initiating a levy release

- Gathering essential documentation

- Troubleshooting common issues

By following these steps, you can regain control over your financial situation and work towards a resolution.

It’s vital to respond promptly to IRS notices. Proper documentation is necessary, and seeking professional assistance can make a significant difference. Real-life examples, like those of Steven L. and Brian M., show that with the right approach and support, favorable outcomes are possible even in daunting circumstances. We understand that hurdles, such as delayed responses or insufficient documentation, can be frustrating. But don’t worry; this guide provides practical solutions to navigate these challenges effectively.

You don’t have to face the journey towards an IRS levy release alone. By taking proactive steps, remaining persistent, and leveraging available resources, you can overcome the obstacles associated with IRS seizures. Remember, you are not alone in this journey. This guide serves as a vital tool, empowering you to take control of your financial future and avoid the repercussions of unresolved tax issues. Together, we can work towards a brighter financial path.

Frequently Asked Questions

What is an IRS levy?

An IRS levy is a legal confiscation of your property to settle an outstanding tax debt, which can take forms such as wage garnishments, bank account seizures, or confiscation of physical assets.

What are the implications of an IRS levy?

The implications of an IRS levy can include significant financial distress, as it may compromise your ability to pay rent and cover essential living expenses.

How many Americans are expected to be affected by IRS seizures in 2026?

In 2026, millions of Americans are expected to be impacted by IRS seizures, highlighting the urgency of understanding this issue.

What should I do if I receive a notice of seizure from the IRS?

If you receive a notice of seizure, it is crucial to take immediate action, as you typically have a limited timeframe of 30 days to respond and can request a Collection Due Process (CDP) hearing to dispute the action.

What happens if I ignore the notice of seizure?

Ignoring the notice of seizure can lead to frozen bank accounts and ongoing garnishments, which can worsen your financial situation.

Can you provide an example of someone who successfully managed an IRS seizure?

Yes, for example, Steven L. faced a $24,000 tax obligation and, with professional assistance, was able to navigate his tax situation. Another example is Brian M., who owed $192,815 but managed to settle for just $500.

How can I regain control over my financial situation after an IRS levy?

Timely intervention, such as obtaining an IRS levy release and seeking professional guidance, can help you regain control over your financial situation.

What is the Collection Appeals Program (CAP)?

The Collection Appeals Program (CAP) offers a quicker way to contest an inappropriate seizure by the IRS.

What is the importance of seeking help when facing an IRS levy?

Seeking help promptly is important, as it can lead to favorable outcomes and help prevent further financial hardship caused by tax issues.