Introduction

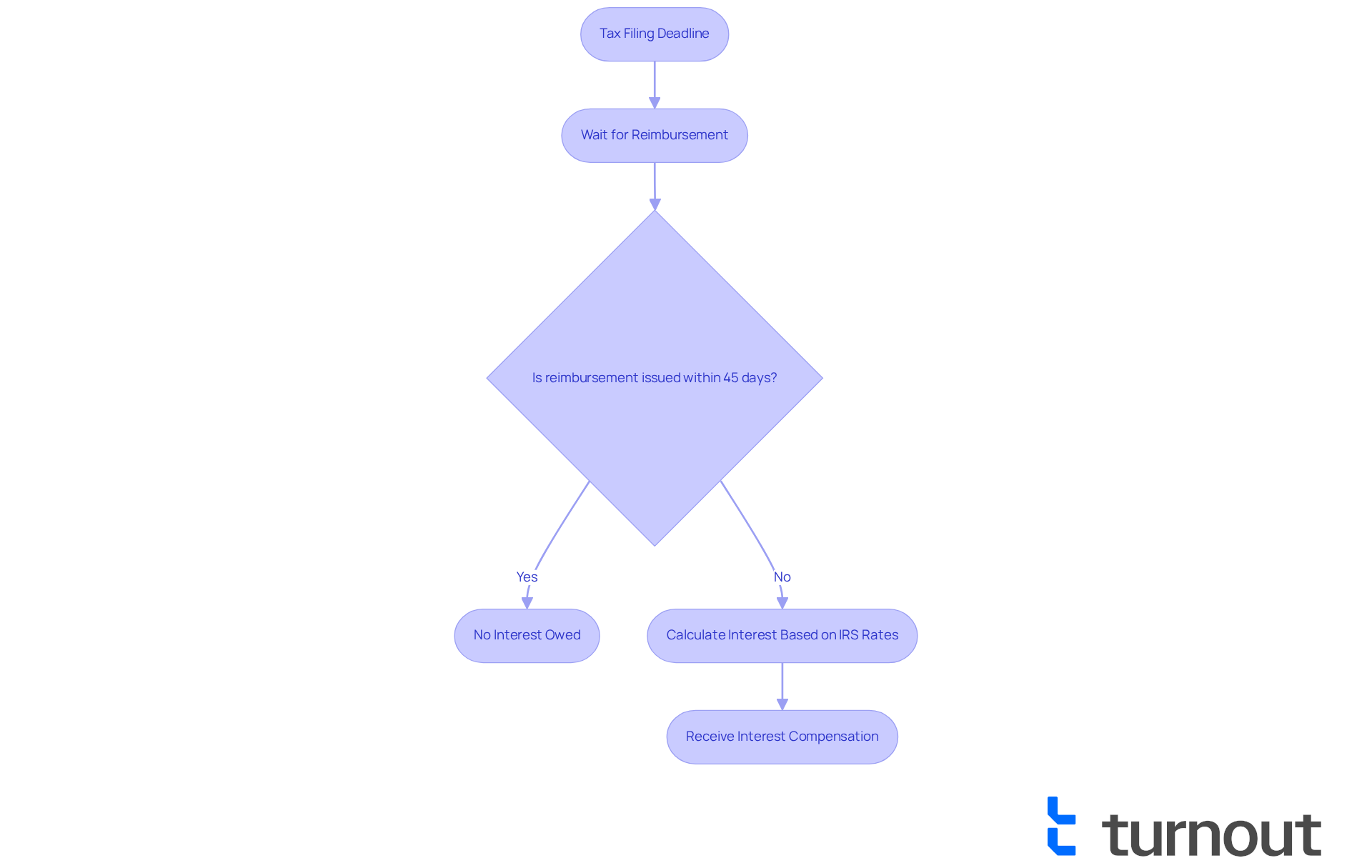

Navigating the complexities of IRS interest on refunds can feel overwhelming for many taxpayers. We understand that when the IRS doesn’t process a refund within 45 days, it can lead to frustration. However, this delay might also present a financial opportunity, as taxpayers may be entitled to interest that accumulates daily.

But how can you ensure you’re making the most of this situation? With various conditions and calculation methods involved, it’s common to feel uncertain. Discovering the answers to these questions could not only provide clarity but also empower you in your financial planning.

You are not alone in this journey. By understanding your rights and the potential benefits, you can turn a frustrating delay into a chance for financial gain. Let’s explore how you can navigate this process with confidence.

Define IRS Interest on Refunds

When it comes to IRS compensation on reimbursements, it’s important to understand how the process works and how it can affect you. If your tax reimbursements are delayed beyond a certain timeframe, the Internal Revenue Service (IRS) may owe you compensation. Typically, if the IRS doesn’t issue a reimbursement within 45 days of the tax filing deadline, they are required to pay IRS interest on refund for the amount due to you.

The IRS interest on refund is calculated based on the rates set by the IRS, which are updated quarterly. The earnings accumulate daily, which means that the longer you wait for your reimbursement, the more IRS interest on refund you could potentially earn. For instance, the IRS disbursed $1.6 million in interest on reimbursements for Net Operating Loss (NOL) cases that weren’t processed in a timely manner. This highlights how delays can have a significant financial impact.

On average, it took 81 days to process reimbursements for certain cases, raising concerns about efficiency. The Treasury Inspector General for Tax Administration (TIGTA) found that 19% of NOL carryback tax abatements weren’t processed within the required 45 days. This can lead to considerable financial strain for taxpayers like you.

We understand that navigating these processes can be overwhelming. It’s common to feel frustrated when reimbursements are delayed, especially when you’re counting on that money. Remember, you’re not alone in this journey. If you’re facing challenges with your tax reimbursements, don’t hesitate to reach out for help. We’re here to support you.

Identify Conditions for IRS Interest Payments

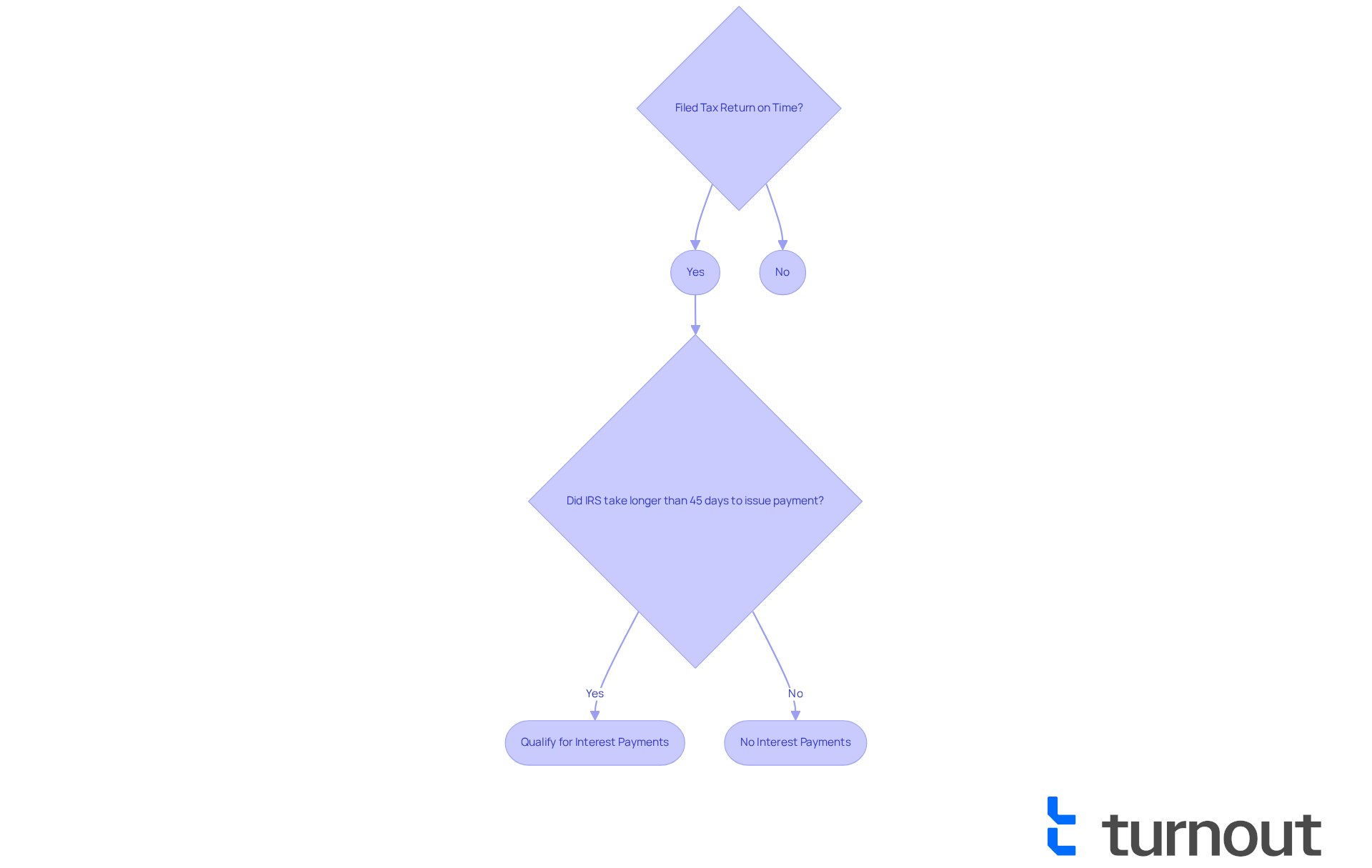

We understand that navigating tax matters can be overwhelming, especially when it comes to reimbursements from the IRS. To qualify for interest payments on these reimbursements, there are a few important conditions to keep in mind:

- You must have filed your tax return on time.

- The IRS needs to take longer than 45 days to issue your payment after the tax filing deadline or the date you submitted your return, whichever is later.

- The repayment cannot be offset against any outstanding tax liabilities.

If you meet these conditions, you can rest assured that the IRS interest on refund will begin accumulating on your reimbursement amount starting from the 46th day after the filing deadline.

It's common to feel uncertain about these processes, but knowing your rights can empower you. Remember, we're here to help you through this journey.

Calculate IRS Interest on Refunds

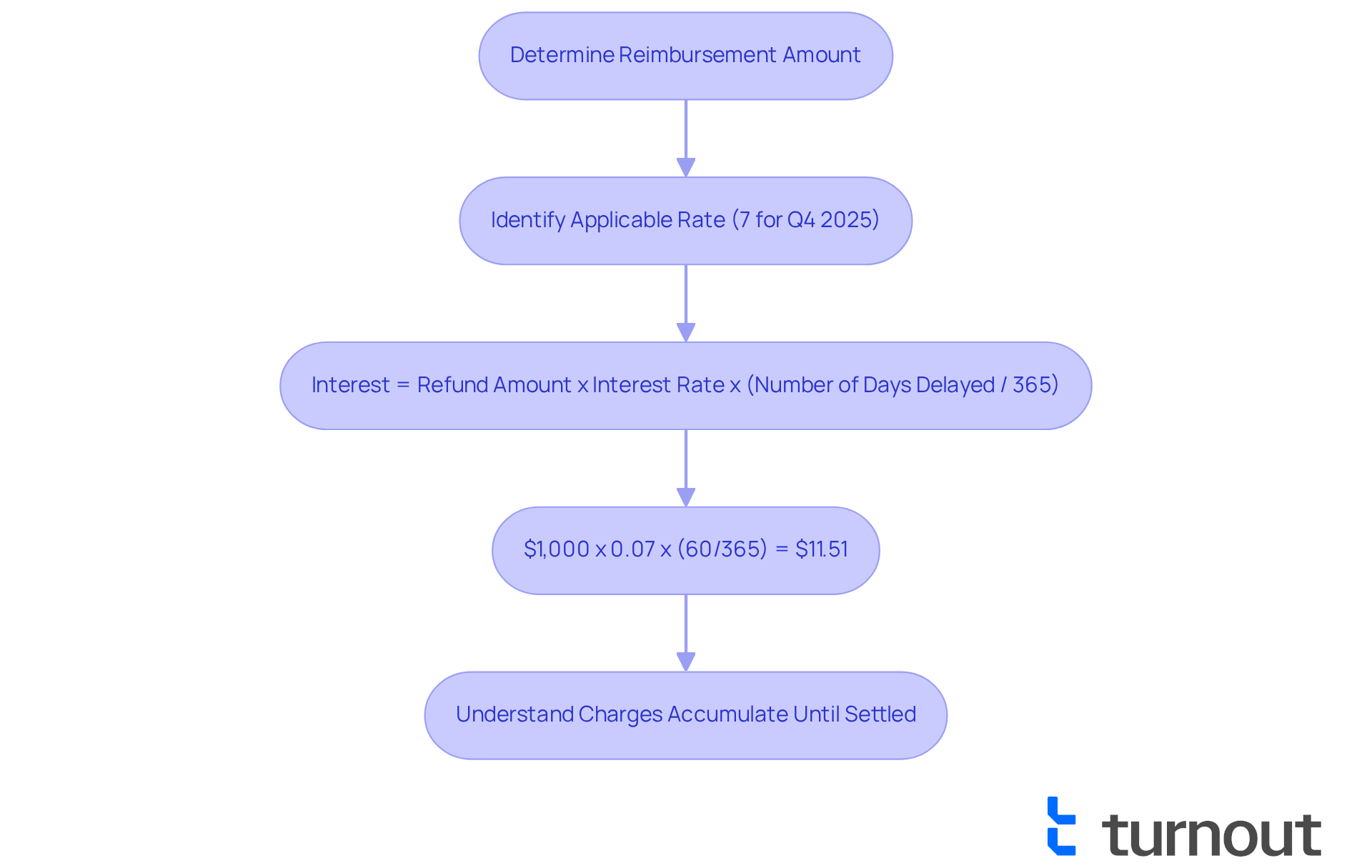

Navigating the IRS interest on refund related to reimbursements can feel overwhelming, but we're here to help you through it. To determine what you might earn, follow these simple steps:

- Determine the amount of your reimbursement.

- Identify the applicable rate. The IRS sets this quarterly, and for the fourth quarter of 2025, it’s currently 7%.

- Use this formula: Interest = Refund Amount x Interest Rate x (Number of Days Delayed / 365).

For example, if your reimbursement is $1,000 and it was delayed by 60 days, the calculation would look like this: $1,000 x 0.07 x (60/365) = $11.51. So, you would earn approximately $11.51 on your delayed payment.

It’s important to recognize that the IRS typically does not reduce charges. These charges continue to accumulate until everything is settled. If your reimbursement isn’t processed within 45 days of the tax deadline, you are entitled to IRS interest on refund for each extra day it’s overdue, compounding daily.

We understand that dealing with these financial matters can be stressful. Remember, you are not alone in this journey, and taking these steps can help you feel more in control.

Explore Implications of IRS Interest on Taxpayers

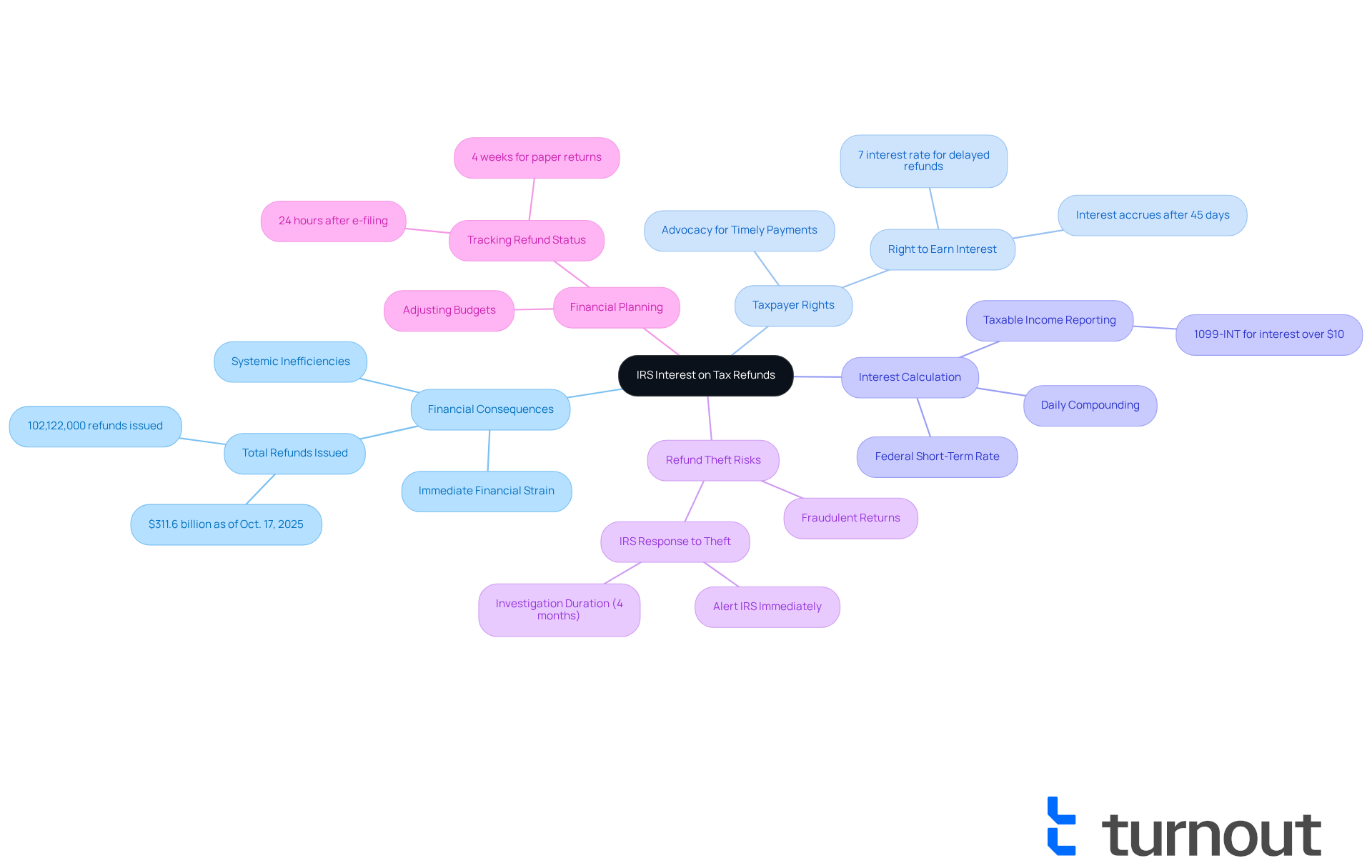

The financial consequences of IRS charges on postponed returns can be quite significant for taxpayers. We understand that when reimbursements are delayed, it creates immediate financial strain and highlights systemic inefficiencies within the tax administration. Taxpayers have the right to earn IRS interest on refund for their delayed returns. While this may seem modest, it can provide some much-needed financial assistance.

For instance, if a reimbursement isn’t issued within 45 days of the tax deadline, the IRS interest on refund is paid at the prevailing overpayment rate, which is currently set at 7% for the fourth quarter of 2025. This charge is calculated based on the federal short-term rate and compounds daily, offering a small buffer against the inconvenience of waiting for funds.

Understanding these implications empowers you to advocate for your rights, ensuring you receive timely payments. This knowledge is essential for efficient financial planning. You may need to adjust your budget based on expected reimbursement timelines. As the IRS processes millions of returns, with over 102 million reimbursements issued as of mid-October 2025, being informed about the status of your reimbursements and the possibility of IRS interest on refund can help you navigate your financial situation more effectively.

Additionally, it’s important to be aware of the risks of refund theft. Fraudulent returns can complicate the refund process and delay payments. Ultimately, being aware of these factors can lead to better financial decision-making and preparedness for future tax seasons. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding IRS interest on refunds is crucial for taxpayers navigating the complexities of delayed reimbursements. We understand that waiting for your refund can be frustrating, and this financial mechanism not only compensates you for that wait but also underscores the importance of being informed about your rights and the processes involved. By recognizing how interest accumulates and the conditions under which it applies, you can better manage your expectations and financial planning.

Throughout this article, we’ve discussed key points that matter to you. We covered the specific conditions that must be met to qualify for IRS interest on refunds, the calculation methods to determine potential earnings, and the broader implications of these interest payments on your financial well-being. The statistics regarding processing delays highlight the systemic challenges faced by the IRS, reminding us all of the importance of staying proactive in understanding our rights.

Ultimately, being well-informed about IRS interest on refunds can empower you to advocate for yourself and ease the financial strain caused by delays. As the tax landscape continues to evolve, staying updated on current rates and conditions will not only enhance your financial decision-making but also prepare you for future interactions with the IRS. Engaging with this knowledge is a vital step in ensuring your financial stability and maximizing the benefits of tax reimbursements. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is IRS interest on refunds?

IRS interest on refunds is compensation that the Internal Revenue Service (IRS) owes you if your tax reimbursements are delayed beyond a certain timeframe, specifically if they are not issued within 45 days of the tax filing deadline.

How is the IRS interest on refunds calculated?

The IRS interest on refunds is calculated based on rates set by the IRS, which are updated quarterly. The interest accumulates daily, meaning the longer you wait for your reimbursement, the more interest you could potentially earn.

What happens if my refund is delayed?

If your tax refund is delayed beyond 45 days after the tax filing deadline, the IRS is required to pay you interest on the amount due.

How significant can the IRS interest on refunds be?

The IRS has disbursed substantial amounts in interest on refunds, such as $1.6 million for Net Operating Loss (NOL) cases that were not processed timely, indicating that delays can have a significant financial impact.

What are the average processing times for tax reimbursements?

On average, it took 81 days to process reimbursements for certain cases, which raises concerns about efficiency in the IRS's processing of refunds.

What did the Treasury Inspector General for Tax Administration (TIGTA) find regarding refund processing?

TIGTA found that 19% of Net Operating Loss (NOL) carryback tax abatements were not processed within the required 45 days, which can lead to financial strain for taxpayers.

What should I do if I'm facing challenges with my tax reimbursements?

If you are experiencing difficulties with your tax reimbursements, it is advisable to reach out for help and support, as navigating these processes can be overwhelming.