Overview

If you're feeling overwhelmed by tax debts, you're not alone. IRS installment plans can be a lifeline, allowing you to pay off what you owe gradually. These plans offer both short-term and long-term options, tailored to the amount you owe, making it easier to manage your financial responsibilities.

Understanding the eligibility criteria and application methods is crucial. We know that navigating this process can be daunting, but we're here to help. The article outlines common issues that may arise, providing you with the knowledge to tackle them head-on. By familiarizing yourself with these plans, you can effectively manage your liabilities and avoid unnecessary penalties.

Remember, seeking assistance is a positive step forward. You deserve support in this journey, and knowing your options can make a significant difference. Take a moment to reflect on your situation—what would it mean for you to have a manageable payment plan in place? You're not alone in this; many have found relief through these options.

Introduction

Navigating tax liabilities can feel overwhelming, especially when you're dealing with significant debt. We understand that this journey can be daunting. Thankfully, the IRS provides various installment plans aimed at easing this burden, allowing you to pay off your debts in manageable increments.

This guide will walk you through the intricacies of these payment options. We want to empower you to understand your eligibility, the application processes, and the common hurdles you might face along the way. But what happens when unexpected challenges arise during this journey? How can you ensure compliance while alleviating your financial stress? You're not alone in this; we're here to help.

Understand IRS Installment Plans

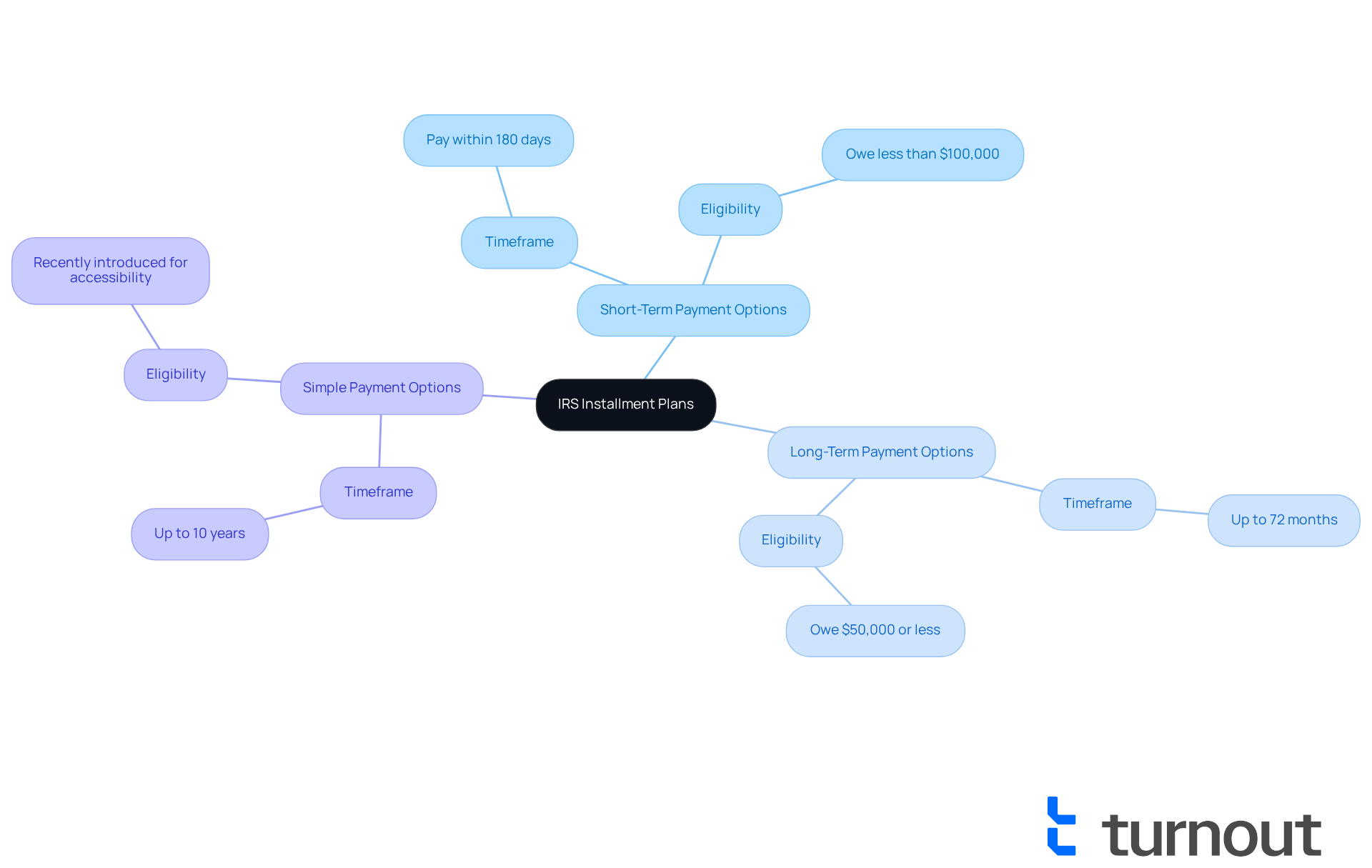

If you're feeling overwhelmed by your tax liabilities, you're not alone. The IRS offers installment plans, also known as payment agreements, that allow you to settle your tax debts gradually rather than all at once. This can be a lifeline for those who find it challenging to pay their tax bill by the due date. Let's explore the different types of installment plans available to you:

- Short-Term Payment Options: These are designed for those who can pay their tax balance within 180 days. If you owe less than $100,000, this option might be a good fit for you.

- Long-Term Payment Options: Often called installment agreements, these allow you to pay off your tax liability over a longer period, typically up to 72 months, for amounts of $50,000 or less.

- Simple Payment Options: Recently introduced, these options aim to be more accessible and easier to understand, allowing eligible taxpayers to make payments for up to 10 years.

By familiarizing yourself with these options, you can choose the plan that best fits your financial situation. This knowledge can help you avoid potential penalties or collection actions from the IRS. Remember, we're here to help you navigate this journey.

Determine Your Eligibility for an Installment Plan

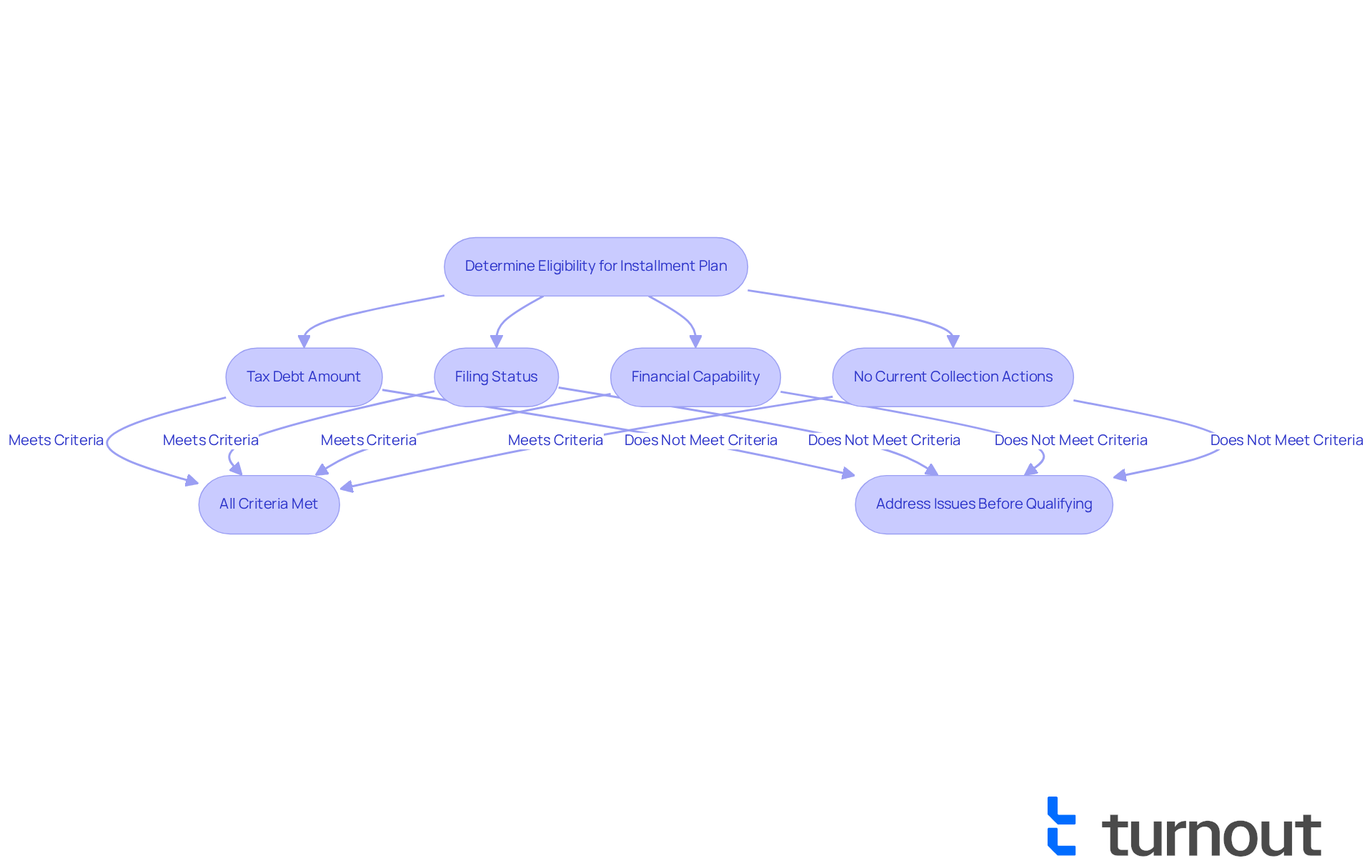

If you're feeling overwhelmed by tax debt, you're not alone. Many individuals find themselves in similar situations, and the good news is that there are options available to help you manage your financial obligations. To qualify for an IRS installment plan, there are specific criteria you need to meet:

- Tax Debt Amount: For a short-term arrangement, your total tax balance must be under $100,000. For a long-term plan, it should be $50,000 or less.

- Filing Status: It's essential that you have filed all required tax returns. If you have unfiled returns, the IRS won’t approve your installment agreement.

- Financial Capability: You should be able to make monthly contributions based on your financial situation. The IRS will evaluate your income and expenses to determine a fair amount to be paid.

- No Current Collection Actions: If the IRS has already started collection measures against you, such as levies or liens, you may need to address those matters before applying for a repayment arrangement.

More than 90% of individual taxpayers with a balance due qualify for a Simple Payment Plan, which simplifies the process significantly. For instance, consider a taxpayer who owed $45,000 and had submitted all required returns. They were able to establish a long-term arrangement, setting up automatic monthly transfers from their bank account. This not only simplified their transaction process but also lowered their user fees. It’s a great way to manage debt effectively without incurring additional penalties.

However, it’s important to remember that while you’re under a financial arrangement, interest and penalties will continue to accumulate until the balance is settled. By assessing these criteria, you can determine if you qualify for installment plans irs and prepare for the application process.

Additionally, if you’re a low-income taxpayer, you might be eligible for a waiver of the setup fee for extended repayment options, making this choice even more accessible. Remember, we’re here to help you navigate this journey, and you don’t have to face it alone.

Apply for Your IRS Installment Plan

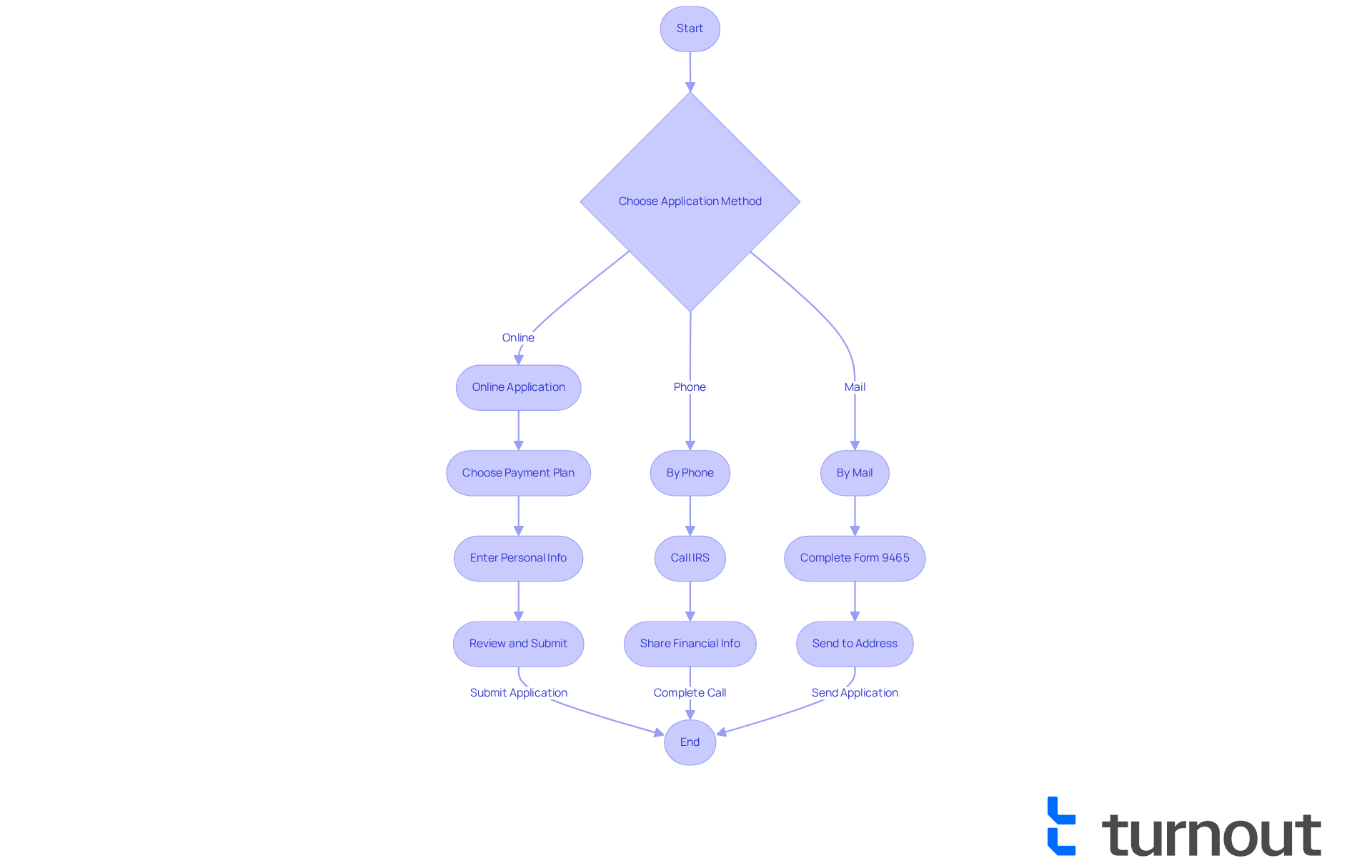

Applying for an IRS installment plan can feel overwhelming, but there are several convenient methods to help you through the process:

-

Online Application: The easiest way to get started is through the IRS Online Payment Agreement tool. If you don’t have an account yet, creating one is simple. Once you’re logged in, just follow these steps:

- Choose the type of payment plan you want to apply for.

- Enter your personal information, including your Social Security number and tax details.

- Review your application and submit it. You’ll receive immediate feedback on your approval status or any issues. Most taxpayers qualify for installment plans IRS and can use the Online Payment Agreement (OPA) for this.

-

By Phone: If you prefer speaking to someone, you can call the IRS at 800-829-1040. Just be prepared to share your financial information and tax details during the call to make the process smoother.

-

By Mail: For those who like to handle things on paper, complete Form 9465, Installment Agreement Request, and send it to the address listed in the form instructions. Don’t forget to include any required documentation to avoid delays.

No matter which method you choose, having all your information ready will help ensure a smooth application process. The IRS has made the online application straightforward, allowing for quick approvals—often within minutes for those who qualify. Plus, the IRS Online Payment Agreement tool is available Monday to Friday from 6 a.m. to 12:30 a.m. Eastern time, and on weekends, giving you the flexibility to manage your application when it suits you best.

For extended financing options, there’s a setup charge of $22, which is waived for low-income applicants. You can also modify, suspend, or terminate payments if your financial situation changes. After you apply, the IRS will send a formal approval or denial letter to your mailing address, so you’ll know exactly where you stand. Remember, you’re not alone in this journey, and we’re here to help you navigate it.

Troubleshoot Common Issues with Your Installment Plan

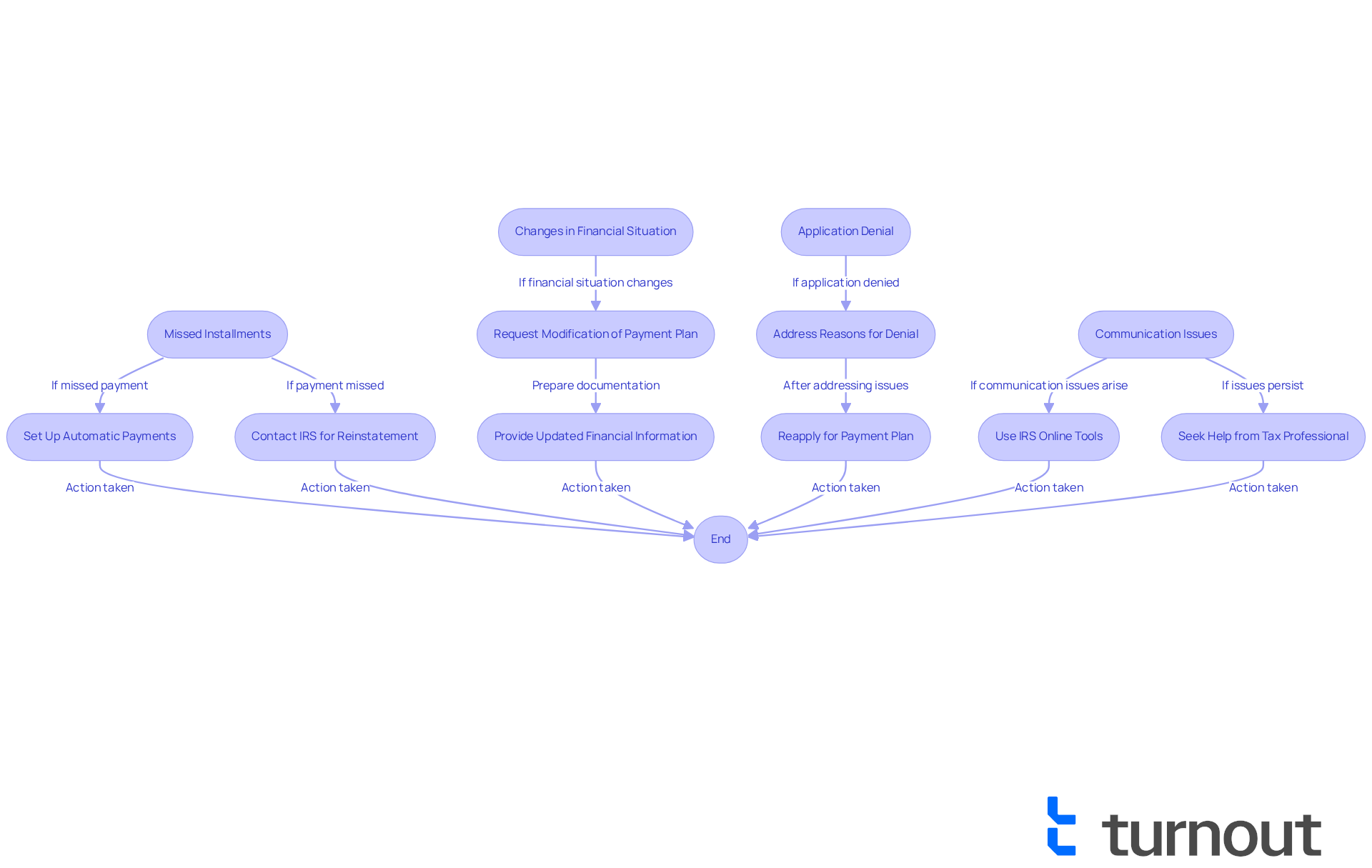

Even after successfully applying for installment plans IRS, you might still face some challenges. We understand that navigating these issues can be stressful, but we’re here to help. Here are some common problems and how to address them:

-

Missed Installments: If you miss a payment, the IRS may terminate your installment agreement. To avoid this, consider setting up automatic payments to prevent late fees. If you do miss a due amount, don’t hesitate to contact the IRS right away to discuss your options for reinstatement. Remember, you typically have a 30-day window to fix the situation before termination occurs.

-

Changes in Financial Situation: Life can be unpredictable, and if your financial circumstances change, it’s important to reach out to the IRS to request a modification of your payment plan. Be ready to provide updated financial information, as this helps the IRS understand your new situation. Many taxpayers—over 4 million—adjust their strategies due to financial changes, highlighting the importance of proactive communication.

-

Application Denial: If your application is denied, the IRS will explain why. Common reasons include owing too much tax, not filing all required returns, or providing incomplete financial information. Address these issues promptly and reapply if needed. Understanding the reasons for denial can significantly improve your chances of approval when you reapply.

-

Communication Issues: If you’re having trouble communicating with the IRS, consider using their online tools or seeking help from a tax professional. Keeping detailed records of all correspondence can clarify misunderstandings and make interactions smoother.

By staying proactive and informed, you can effectively navigate these challenges and maintain your installment plans IRS. Remember, timely action is essential to avoid penalties and ensure compliance with IRS requirements. You are not alone in this journey—take the first step today!

Conclusion

Navigating IRS installment plans can feel overwhelming, especially when faced with significant tax liabilities. We understand that managing these debts is no small feat. These payment agreements offer a structured way to tackle tax obligations gradually, rather than all at once. By familiarizing yourself with the different types of installment plans and their eligibility requirements, you can position yourself to take advantage of these options, ultimately easing your financial stress.

This article provides essential insights into IRS installment plans, including both short-term and long-term payment options, eligibility criteria, and practical steps for applying. Remember, it’s crucial to have all your tax returns filed, understand your financial capabilities, and maintain open communication with the IRS to address any potential issues. With over 90% of taxpayers qualifying for a Simple Payment Plan, these arrangements are designed to offer accessible solutions tailored to your unique financial situation.

Taking proactive steps toward managing your tax debt through IRS installment plans can lead to a more stable financial future. Staying informed about the application process, eligibility criteria, and common challenges is vital. If you’re struggling with tax liabilities, exploring these options not only fosters compliance but also empowers you to regain control over your financial health. Taking action today can pave the way for a brighter tomorrow, ensuring that your tax obligations don’t become an insurmountable burden.

Frequently Asked Questions

What are IRS installment plans?

IRS installment plans, also known as payment agreements, allow taxpayers to settle their tax debts gradually rather than paying the full amount at once.

Who can benefit from IRS installment plans?

Taxpayers who feel overwhelmed by their tax liabilities and find it challenging to pay their tax bill by the due date can benefit from these plans.

What are the short-term payment options available?

Short-term payment options are designed for those who can pay their tax balance within 180 days and are suitable for individuals who owe less than $100,000.

What are long-term payment options?

Long-term payment options, often referred to as installment agreements, allow taxpayers to pay off their tax liability over a longer period, typically up to 72 months, for amounts of $50,000 or less.

What are the simple payment options introduced by the IRS?

Simple payment options are a recently introduced choice that aims to be more accessible and easier to understand, allowing eligible taxpayers to make payments for up to 10 years.

How can understanding these options help taxpayers?

Familiarizing oneself with these installment plan options can help taxpayers choose the plan that best fits their financial situation and avoid potential penalties or collection actions from the IRS.