Introduction

Navigating tax payments can often feel overwhelming, especially when you’re faced with the complexities of IRS installment plans. We understand that managing financial obligations can be stressful, and knowing your options is crucial. This guide breaks down the different types of payment plans available to you and offers a step-by-step approach to applying online and managing these arrangements.

But what happens when unexpected financial challenges arise? It’s common to feel anxious in these situations. Exploring strategies to adapt and maintain compliance can be the key to successfully overcoming tax payment hurdles. Remember, you are not alone in this journey; we’re here to help you find the best path forward.

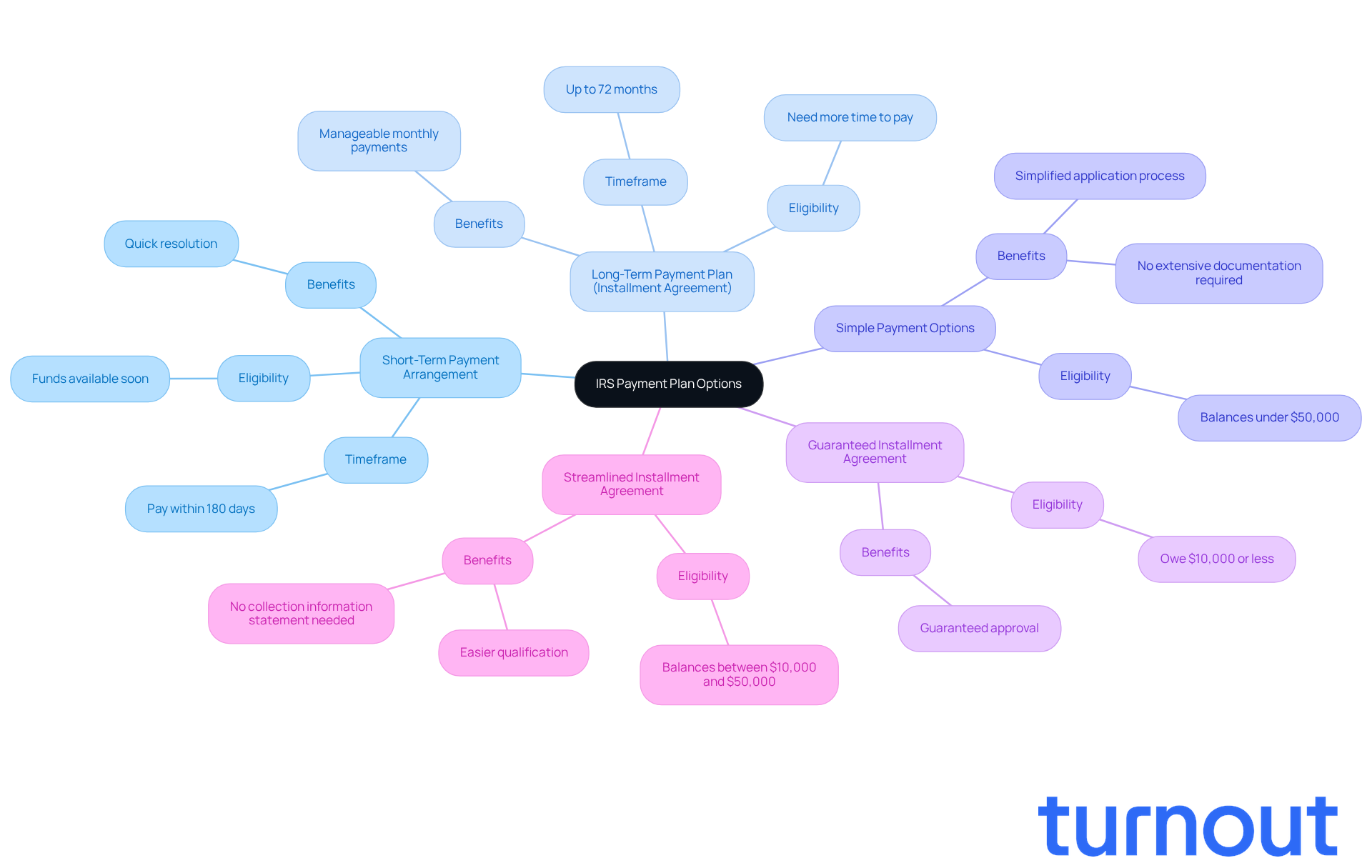

Understand IRS Payment Plan Options

Before you apply for an irs.gov payments installment, it’s important to understand the options that are available to you. We know that navigating tax payments can be stressful, and we’re here to help you find the best solution for your situation.

-

Short-Term Payment Arrangement: If you can pay your tax balance within 180 days, this arrangement might be right for you. It’s perfect for those who expect to have the funds available soon.

-

Long-Term Payment Plan (Installment Agreement): For those who need more time to pay off their balance, this option allows for monthly payments over an extended period, typically up to 72 months. It’s a manageable way to tackle your tax obligations.

-

Simple Payment Options: For information on setting up an irs.gov payments installment, please refer to the official guidelines. These options are designed for taxpayers with balances under $50,000. They simplify the application process and don’t require extensive documentation, making them more accessible.

-

Guaranteed Installment Agreement: If you owe $10,000 or less, you may qualify for this agreement, which guarantees approval as long as you meet certain conditions for irs.gov payments installment. It’s a reassuring option for many.

-

Streamlined Installment Agreement: For balances between $10,000 and $50,000, this option allows for easier qualification without needing a collection information statement. It’s designed to ease your burden.

Understanding these choices can empower you to decide which strategy best fits your financial circumstances. Remember, you’re not alone in this journey, and we’re here to support you every step of the way.

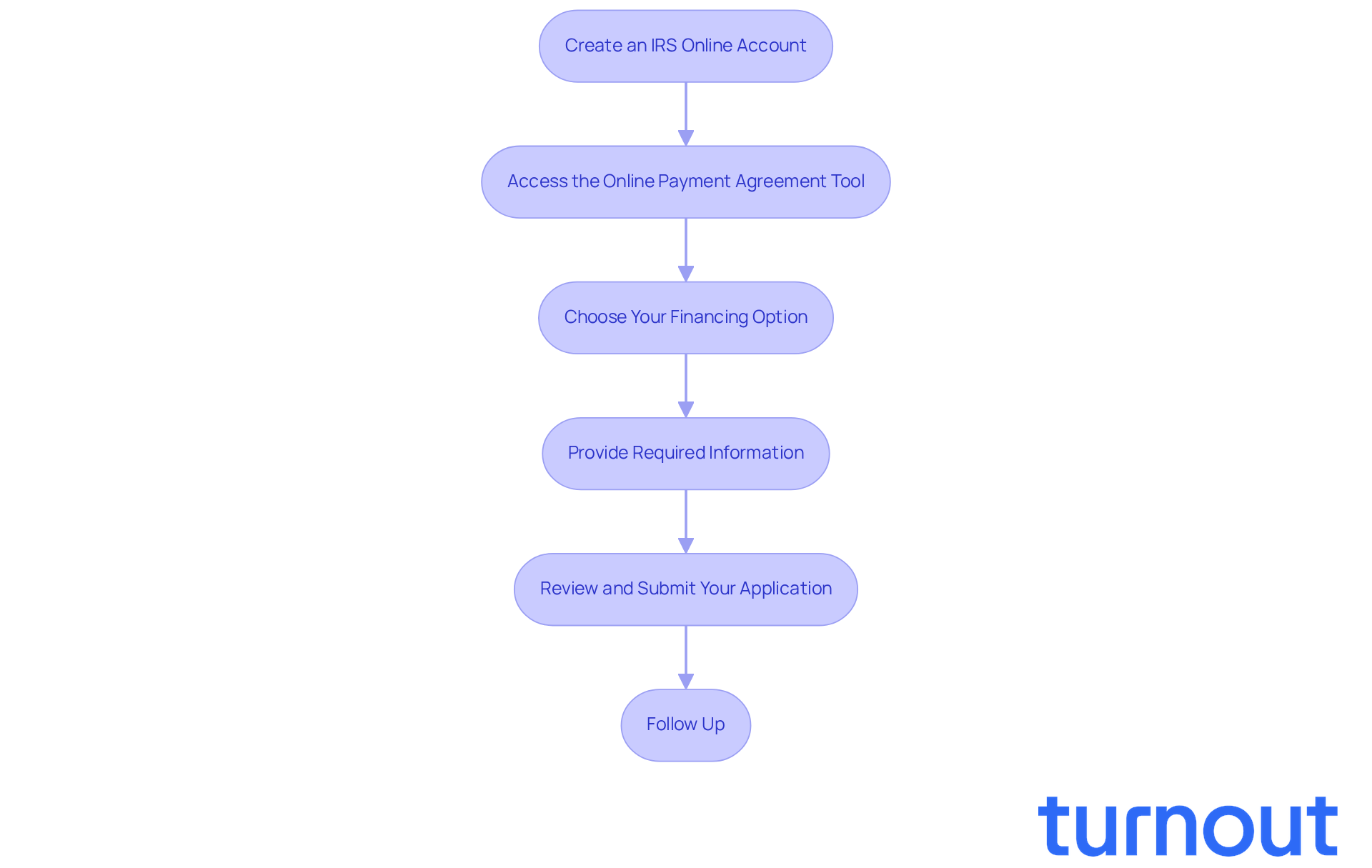

Apply for Your Installment Plan Online

Applying for an irs.gov payments installment plan online can feel overwhelming, but we are here to help you navigate the process. Just follow these simple steps:

-

Create an IRS Online Account: Start by visiting the IRS website to create an account if you don’t have one yet. This account will help you manage your financial arrangement and access your tax details easily. In 2025, many taxpayers found that having an online account made their transactions much simpler.

-

Access the Online Payment Agreement Tool: Head over to the IRS Online Payment Agreement application page. This user-friendly tool is designed to guide you smoothly through the irs.gov payments installment application process. Tax professionals often note that using this tool can significantly ease the burden of managing your tax obligations.

-

Choose Your Financing Option: Think about whether a short-term financing arrangement or a long-term installment agreement works best for you. If your balance is under $100,000, you typically have these options available. Remember, settling your balance on time is crucial to avoid extra penalties and interest.

-

Provide Required Information: Fill out the necessary details, including your personal information, tax data, and the amount owed. If you prefer direct debit for irs.gov payments installment, be ready to provide your bank account information. Good news for low-income taxpayers: if you agree to make electronic debit transactions, you might have your user fees waived, making this option even more accessible.

-

Review and Submit Your Application: Take a moment to carefully review all the information you’ve entered. Once you’re sure everything is accurate, submit your application. You should receive immediate confirmation of your application status, which is essential for tracking your request.

-

Follow Up: After you submit, keep an eye on your email for any updates from the IRS about your application. If approved, you’ll receive details about your payment arrangement and schedule, helping you manage your tax responsibilities effectively. Remember, if you miss filing or paying your taxes on time, the IRS may impose penalties, so staying informed is key.

You’re not alone in this journey, and taking these steps can help you regain control over your tax situation.

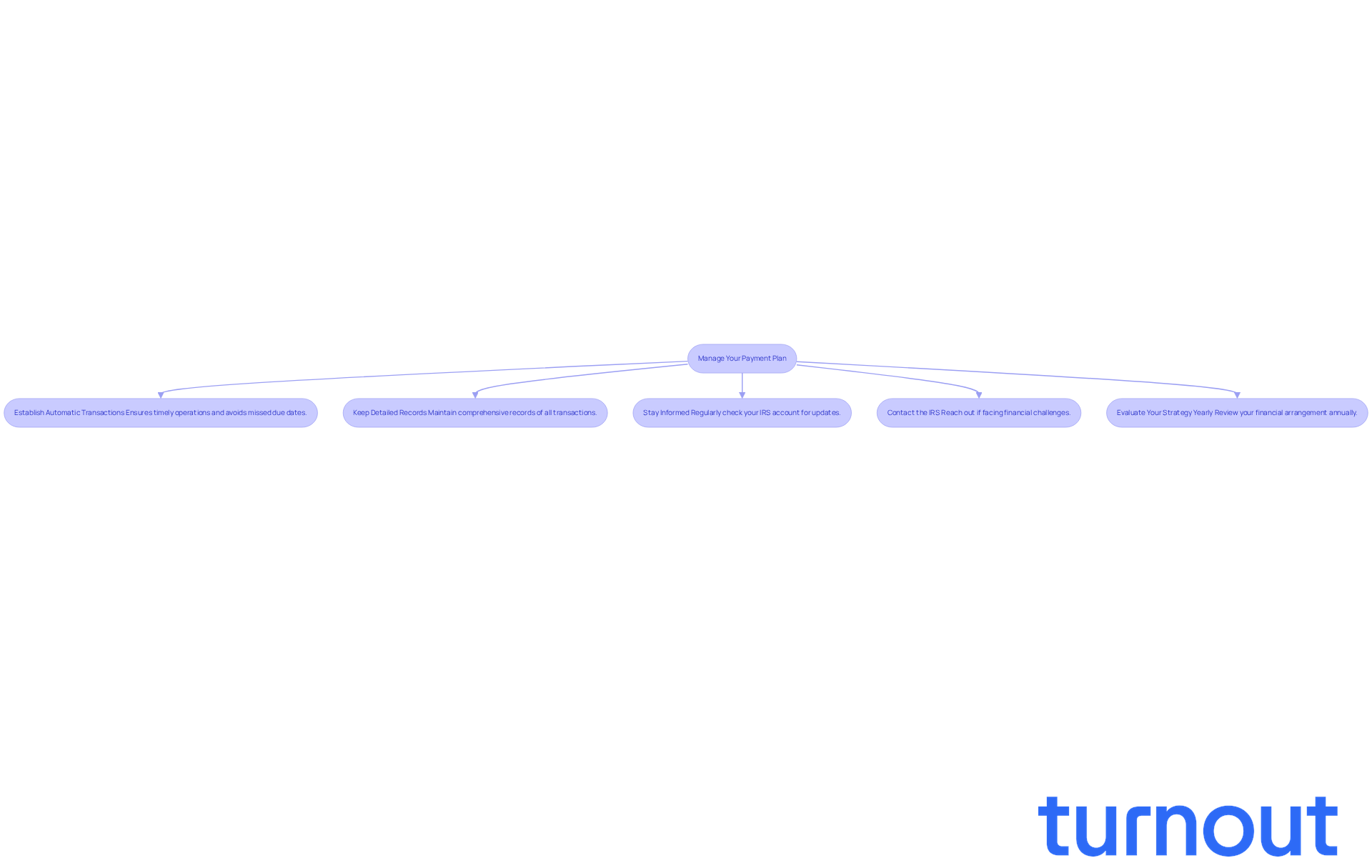

Manage Your Payment Plan Effectively

Once your installment plan is set up, effective management becomes essential to avoid complications. We understand that navigating this process can be challenging, but there are strategies that can help you feel more in control:

-

Establish Automatic Transactions: Signing up for automatic transactions ensures timely operations and helps you avoid missing due dates. This proactive step can significantly reduce the risk of penalties and interest, which can add up quickly. Did you know that many taxpayers miss IRS due dates? This highlights just how important it is to stay on top of your contributions.

-

Keep Detailed Records: Maintaining comprehensive records of all transactions, including dates and amounts, is crucial. This documentation not only helps you monitor your progress but also serves as evidence of transactions if needed.

-

Stay Informed: Regularly checking your IRS account allows you to monitor your balance and transaction history. Staying informed about your strategy helps you catch any changes that may impact your obligations. The Online Payment Agreement tool can make this process easier, letting you view your current financial arrangement details effortlessly.

-

Contact the IRS: If you face financial challenges that might affect your ability to meet your obligations, don’t hesitate to reach out to the IRS. They may offer alternatives to adjust your financial arrangement, helping you stay compliant without unnecessary stress. Remember, proactive communication with the IRS can prevent complications.

-

Evaluate Your Strategy Yearly: At least once a year, take the time to review your financial arrangement. This ensures it aligns with your current economic circumstances. If your situation changes, modifying your strategy can help you manage your obligations more effectively. Keep in mind that penalties and interest continue to accumulate on outstanding balances, so staying on top of your dues is vital.

By implementing these strategies, you can navigate your IRS.gov payments installment plan with confidence and efficiently work towards resolving your tax obligations. Remember, you’re not alone in this journey. Real-world examples of taxpayers successfully setting up automatic payments can inspire you to follow these strategies.

Conclusion

Navigating the complexities of IRS payment plans can feel overwhelming, and we understand that. But knowing your options can truly empower you to manage your obligations with confidence. By exploring various installment plans - like short-term arrangements and long-term agreements - you can find the solution that best fits your financial situation. This guide is here to help you tackle your tax responsibilities effectively.

We’ll discuss key points, including the different types of payment plans, the step-by-step process for applying online, and essential management strategies once your plan is in place. From creating an IRS online account to setting up automatic transactions, each step is designed to simplify the process and ease your stress. Staying informed and proactive can significantly reduce the risk of penalties and interest, allowing you to regain control over your financial situation.

Ultimately, taking charge of your IRS payment obligations isn’t just about compliance; it’s about fostering financial stability and peace of mind. By utilizing the insights and strategies outlined in this guide, you can navigate your IRS.gov payments installment plans with ease. Embracing these steps can lead to a more manageable tax experience and pave the way for a brighter financial future. Remember, you are not alone in this journey - we're here to help!

Frequently Asked Questions

What are the main IRS payment plan options available?

The main IRS payment plan options include Short-Term Payment Arrangement, Long-Term Payment Plan (Installment Agreement), Simple Payment Options, Guaranteed Installment Agreement, and Streamlined Installment Agreement.

What is a Short-Term Payment Arrangement?

A Short-Term Payment Arrangement is suitable for those who can pay their tax balance within 180 days. It is ideal for individuals who expect to have the necessary funds available soon.

What is a Long-Term Payment Plan (Installment Agreement)?

A Long-Term Payment Plan allows taxpayers to make monthly payments over an extended period, typically up to 72 months, for those who need more time to pay off their tax balance.

What are Simple Payment Options?

Simple Payment Options are designed for taxpayers with balances under $50,000 and simplify the application process without requiring extensive documentation.

What is a Guaranteed Installment Agreement?

A Guaranteed Installment Agreement is available for individuals who owe $10,000 or less. It guarantees approval as long as certain conditions are met for the payment installment.

What is a Streamlined Installment Agreement?

A Streamlined Installment Agreement is for balances between $10,000 and $50,000 and allows for easier qualification without the need for a collection information statement.

How can understanding these payment options help taxpayers?

Understanding these payment options can empower taxpayers to choose the strategy that best fits their financial circumstances, providing reassurance and support in managing tax obligations.