Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when you're facing significant debts. We understand that this can be a daunting experience. IRS Form 433-A OIC is here to help - it serves as a vital lifeline for those looking to negotiate their tax liabilities through an Offer in Compromise.

In this article, we’ll walk you through the step-by-step process of mastering this essential form. You’ll gain the tools you need to:

- Understand eligibility criteria

- Avoid common pitfalls

- Ultimately secure a favorable resolution

It’s common to feel uncertain when the stakes are high, and the path to financial relief seems unclear. But remember, you are not alone in this journey.

Understand IRS Form 433-A OIC: Purpose and Importance

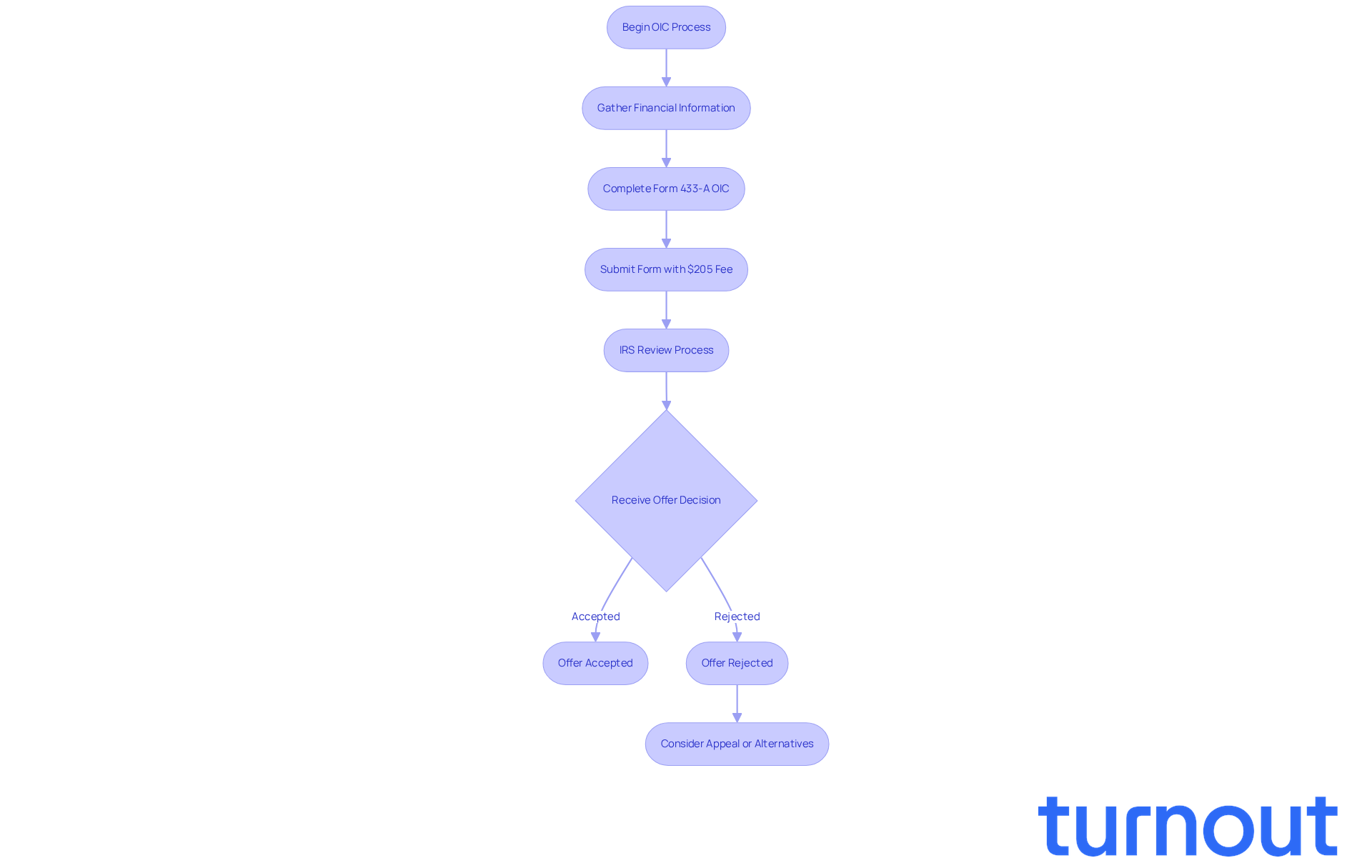

IRS Form 433 A OIC is a Collection Information Statement designed for individuals like you who are seeking to settle tax debts through an Offer in Compromise (OIC). This form gives the IRS a clear picture of your financial situation, including your income, expenses, assets, and liabilities. Understanding its purpose is crucial because it helps the IRS assess your ability to pay and determine if your offer is reasonable. By filling out this form accurately, you can make a strong case for why your tax debt should be settled for less than what you owe. This step is vital in your journey toward tax relief.

Real-world examples show how Form 433-A OIC can make a difference in resolving tax debt. Many taxpayers who report their financial situations honestly find that their offers are accepted, leading to significant reductions in their tax liabilities. The IRS dedicates over 6,000 hours each year to reviewing OICs, which highlights the complexity and importance of this process. Additionally, there is a $205 fee for submitting an Offer in Compromise, something important for you to consider.

Recent updates reflect the IRS's commitment to making the OIC process smoother. They are focusing on reducing processing delays and enhancing support for taxpayers. As the IRS states, "An offer in compromise allows you to settle your tax debt for less than the full amount you owe." Experts agree that the IRS Form 433 A OIC is more than just a bureaucratic requirement; it’s a powerful tool that can assist you in finding tax relief during tough times. By showing your financial reality through this form, you increase your chances of negotiating a favorable settlement, paving the way for a fresh start.

Furthermore, using the IRS pre-qualifier tool can help you assess your eligibility for an OIC, guiding you through this process. Remember, you’re not alone in this journey; we’re here to help.

Determine Eligibility for Filing Form 433-A OIC

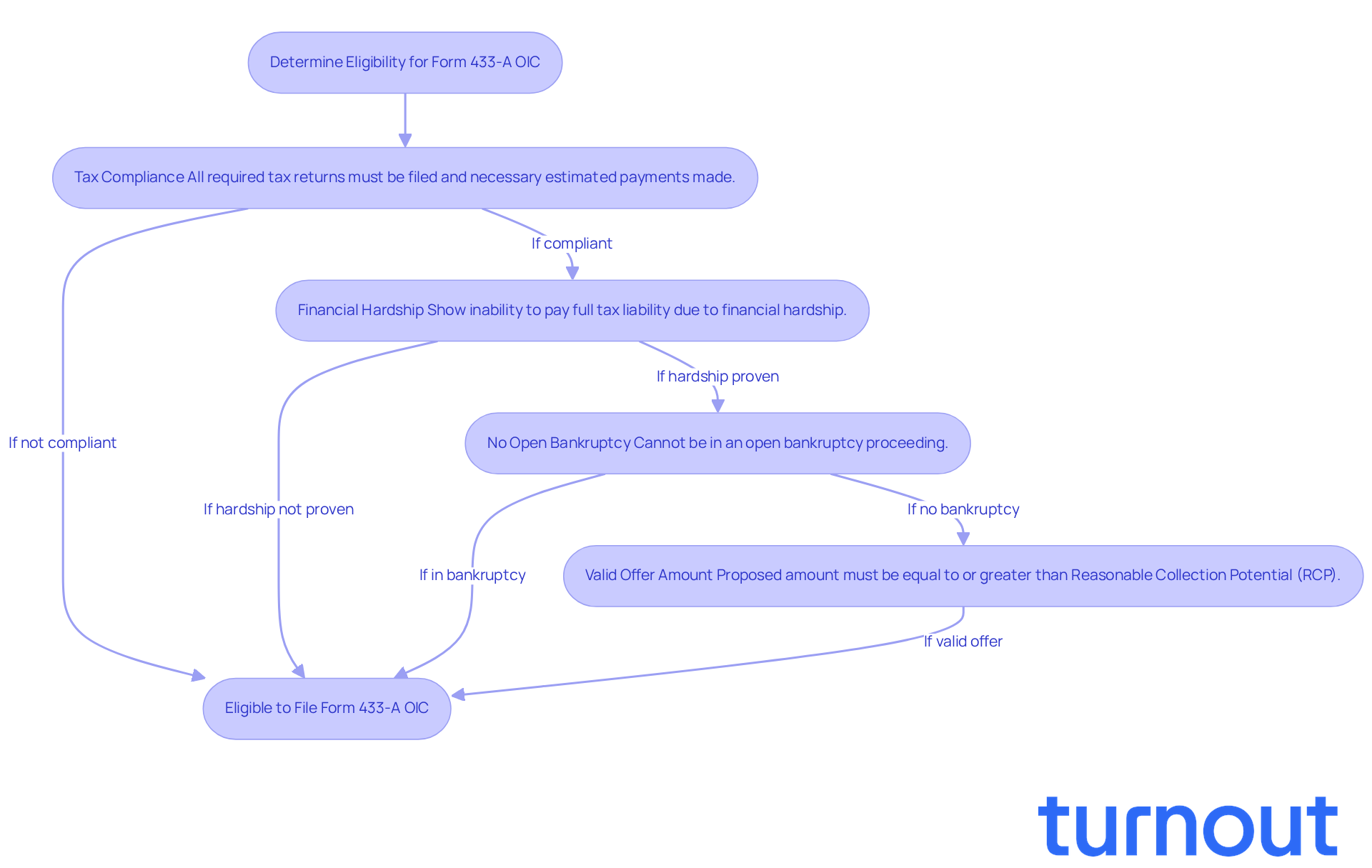

If you're considering filing the IRS form 433 A OIC, it's important to be aware that there are several criteria you need to meet. We understand that navigating tax issues can be overwhelming, but we're here to help you through it. Here’s what you need to keep in mind:

-

Tax Compliance: First and foremost, all required tax returns must be filed, and any necessary estimated payments should be made. The IRS won’t consider your request if you’re not compliant with your tax obligations.

-

Financial Hardship: You’ll need to show that you can’t pay your full tax liability due to financial hardship. This might include situations like unemployment, medical expenses, or other significant financial burdens that affect your ability to meet your tax obligations.

-

No Open Bankruptcy: It’s crucial to note that you cannot be in an open bankruptcy proceeding, as this will disqualify you from applying for an Offer in Compromise with the IRS form 433 A OIC.

-

Valid Offer Amount: The amount you propose must be equal to or greater than your Reasonable Collection Potential (RCP), which is the IRS's estimate of what they believe they can collect from you.

Understanding these criteria is essential. Did you know that approximately 30-40% of applicants meet the eligibility requirements for an Offer in Compromise? Additionally, there’s a non-refundable submission fee of $205 that you’ll need to pay when you present your offer. Providing thorough documentation of your financial hardship is crucial; without it, your application could be rejected.

By ensuring you meet these conditions before submitting, you can save yourself time and effort in this process. Remember, you’re not alone in this journey, and taking these steps can lead you toward relief.

Complete Form 433-A OIC: Step-by-Step Instructions

-

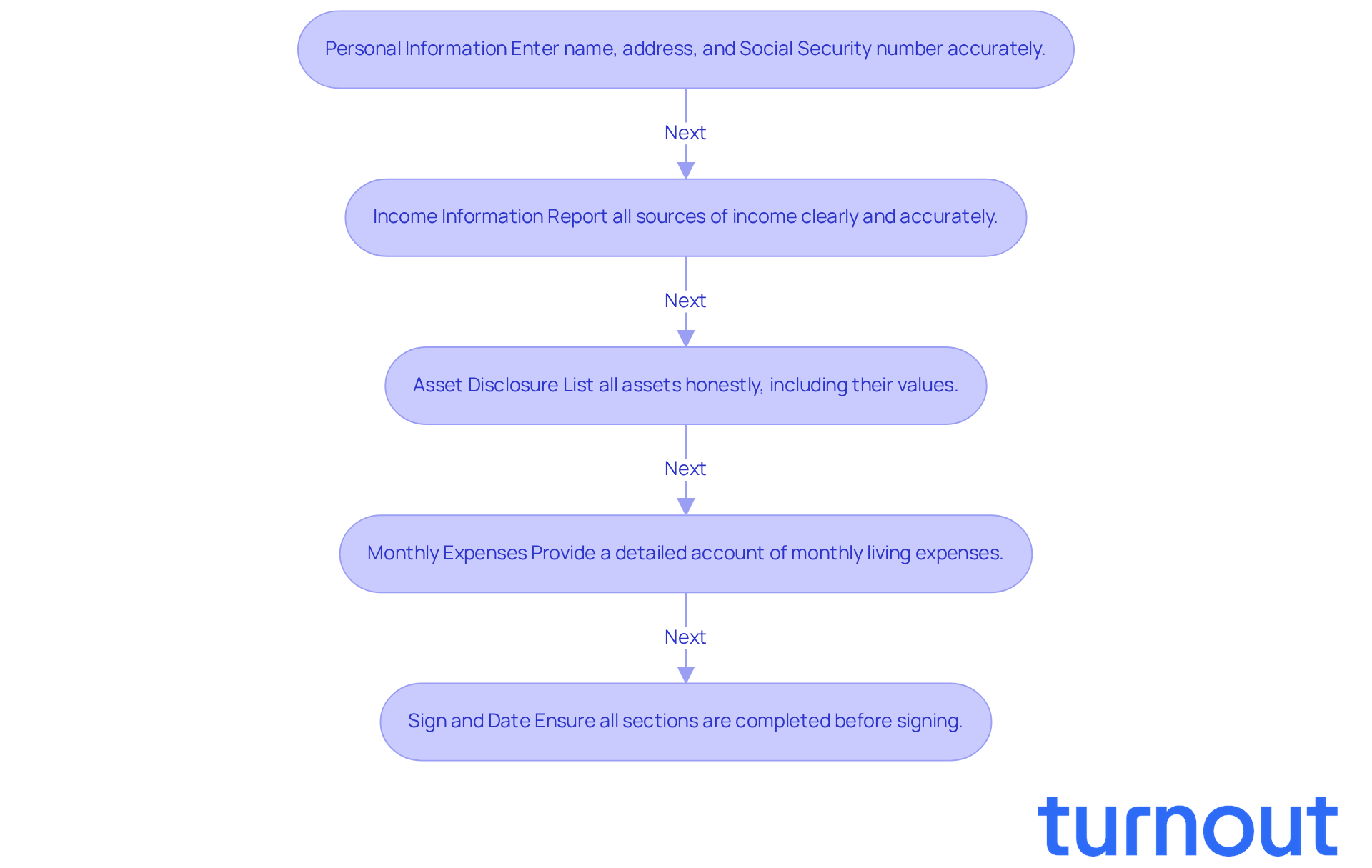

Personal Information: We understand that starting this process can feel overwhelming. Begin by accurately entering your name, address, and Social Security number. Precision is crucial here; any discrepancies can lead to processing delays. Remember, taking your time with this step can help prevent complications in your submission process.

-

Income Information: It’s important to clearly report all sources of income, including wages, self-employment earnings, and any additional income streams. Using exact figures instead of estimates ensures compliance with IRS requirements. If you’re unsure, Turnout's trained nonlawyer advocates are here to help you understand how to report your income accurately.

-

Asset Disclosure: Listing all your assets, such as bank accounts, real estate, vehicles, and investments, is essential. Being honest about the value of each asset is key, as the IRS will assess your financial situation based on this information. Turnout's method ensures that you’re well-informed about the implications of asset disclosure in your submissions.

-

Monthly Expenses: Providing a detailed account of your monthly living expenses, including housing, utilities, food, and transportation, is vital. This breakdown helps the IRS understand your financial obligations and overall situation. We encourage you to be thorough in this section to present a clear picture of your financial needs.

-

Sign and Date: Once you’ve completed the form, don’t forget to sign and date it. Ensure that all sections are fully completed to avoid unnecessary delays in processing your request. Turnout's support can assist you in reviewing your submission for completeness before it’s sent.

Completing the IRS form 433 A OIC can take time, but thorough preparation can significantly streamline the process. Successful submissions often depend on precise reporting of income and assets. Financial advisors emphasize the importance of honesty in these disclosures. For instance, many taxpayers have achieved significant reductions in their tax obligations through well-prepared OIC submissions, with some resolving debts of $82,000 for just $120. By following these steps and ensuring accuracy, you can enhance your chances of a favorable outcome. Remember, you’re not alone in this journey; we’re here to help.

Avoid Common Mistakes When Filing Form 433-A OIC

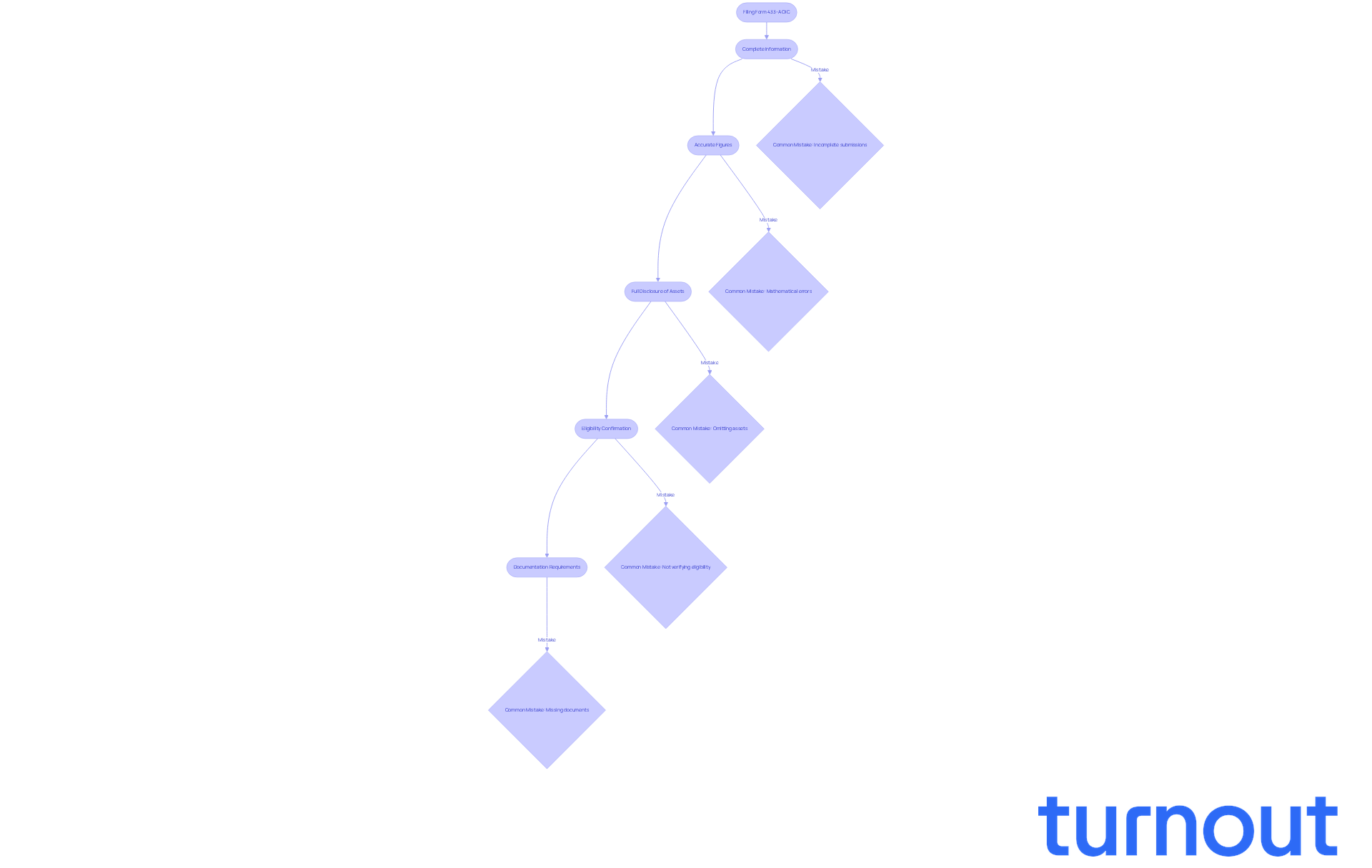

Maximizing your chances of a successful Offer in Compromise (OIC) request can feel overwhelming, but you’re not alone in this journey. It’s essential to steer clear of common pitfalls associated with the IRS Form 433 A OIC. Here are some key areas to focus on:

- Complete Information: Make sure every section of the form is filled out thoroughly. Incomplete submissions can lead to significant delays or outright denials. The IRS needs comprehensive data to assess your financial situation. Many rejections stem from incomplete or inaccurate submissions, so thoroughness is crucial.

- Accurate Figures: Take a moment to double-check all numerical entries for accuracy. Simple mathematical errors can lead to rejection, so meticulous verification is essential. Even minor mistakes can significantly affect your submission.

- Full Disclosure of Assets: It’s important to report all assets diligently. Excluding any asset may be seen as an effort to deceive the IRS, which can jeopardize your request. The IRS takes such omissions seriously, and it could lead to immediate denial.

- Eligibility Confirmation: Before you submit your request, verify that you meet all eligibility criteria for an OIC. Failing to do so can lead to immediate denial, wasting your time and effort. Remember, the IRS expects taxpayers to file taxes regularly for at least five years after the acceptance of the irs form 433 a oic, which is crucial for maintaining the agreement.

- Documentation Requirements: Don’t forget to include all necessary supporting documents with your submission, such as proof of income, expenses, and asset valuations. Properly preparing your application with complete documentation significantly enhances your chances of approval.

By following these guidelines, you can improve your likelihood of a favorable outcome and navigate the complexities of tax relief more effectively. We understand that this process can be daunting, and consulting with a tax professional can provide valuable insights and help you avoid common mistakes that lead to rejection. Remember, we’re here to help you every step of the way.

Conclusion

Mastering IRS Form 433-A OIC is crucial for anyone looking to ease their tax burdens through an Offer in Compromise. This form is more than just paperwork; it’s a vital tool that gives the IRS a clear picture of your financial situation. By understanding its significance, you can navigate the complexities of tax relief and boost your chances of a positive outcome.

We understand that the process can feel overwhelming. Throughout this article, we’ve shared key insights about the eligibility criteria for filing Form 433-A OIC, the step-by-step process for completing it, and common pitfalls to avoid. It’s essential to be thorough and accurate. Meeting the eligibility requirements and providing complete documentation are critical for your application’s success. Real-world examples have shown how careful preparation can lead to significant reductions in tax liabilities, highlighting the relief this form can offer.

Ultimately, taking proactive steps to understand and complete IRS Form 433-A OIC can open doors to a fresh financial start. We encourage you to utilize available resources, like the IRS pre-qualifier tool and professional guidance, to ensure your application is well-prepared and submitted correctly. By doing so, you not only enhance your chances of acceptance but also embark on a journey toward financial stability and peace of mind. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is IRS Form 433-A OIC?

IRS Form 433-A OIC is a Collection Information Statement designed for individuals seeking to settle tax debts through an Offer in Compromise (OIC). It provides the IRS with a clear picture of your financial situation, including income, expenses, assets, and liabilities.

Why is understanding Form 433-A OIC important?

Understanding Form 433-A OIC is crucial because it helps the IRS assess your ability to pay and determine if your offer to settle tax debt is reasonable. Accurately filling out this form strengthens your case for reducing your tax liability.

How can Form 433-A OIC affect tax debt resolution?

Many taxpayers who honestly report their financial situations using Form 433-A OIC find that their offers are accepted, leading to significant reductions in their tax liabilities.

What is the fee associated with submitting an Offer in Compromise?

There is a $205 fee for submitting an Offer in Compromise, which is an important consideration for individuals looking to settle their tax debts.

What recent updates have been made to the OIC process by the IRS?

Recent updates reflect the IRS's commitment to making the OIC process smoother by reducing processing delays and enhancing support for taxpayers.

How does the IRS define an Offer in Compromise?

The IRS states that 'an offer in compromise allows you to settle your tax debt for less than the full amount you owe.'

What tools can assist in assessing eligibility for an OIC?

The IRS pre-qualifier tool can help you assess your eligibility for an Offer in Compromise, guiding you through the process.

How can Form 433-A OIC be seen as a tool for tax relief?

Experts agree that Form 433-A OIC is more than just a bureaucratic requirement; it is a powerful tool that can assist you in negotiating a favorable settlement and finding tax relief during tough times.