Overview

Mastering interest on IRS payment plans can feel overwhelming, but understanding the various repayment arrangements is the first step toward relief. This article explores different types of payment plans and their interest rates, offering practical strategies to help you manage or reduce accrued interest effectively.

We understand that making extra payments and negotiating with the IRS can seem daunting, yet these actions can significantly minimize your financial burden. By implementing these strategies, you can maintain compliance with your tax obligations while feeling more in control of your situation.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and find the best path forward. Together, we can work towards easing your financial stress and achieving peace of mind.

Introduction

Understanding tax obligations can feel overwhelming, especially when navigating the complexities of IRS payment plans. We recognize that these arrangements can provide a lifeline for individuals who are struggling to meet their tax commitments. However, the accompanying interest can add to the stress. By exploring effective strategies to manage or reduce this interest, you can gain valuable insights into alleviating your financial burdens. How can you take control of your repayment plans and minimize the impact of interest on your overall tax debt? We're here to help you find the answers.

Define IRS Payment Plans and Their Purpose

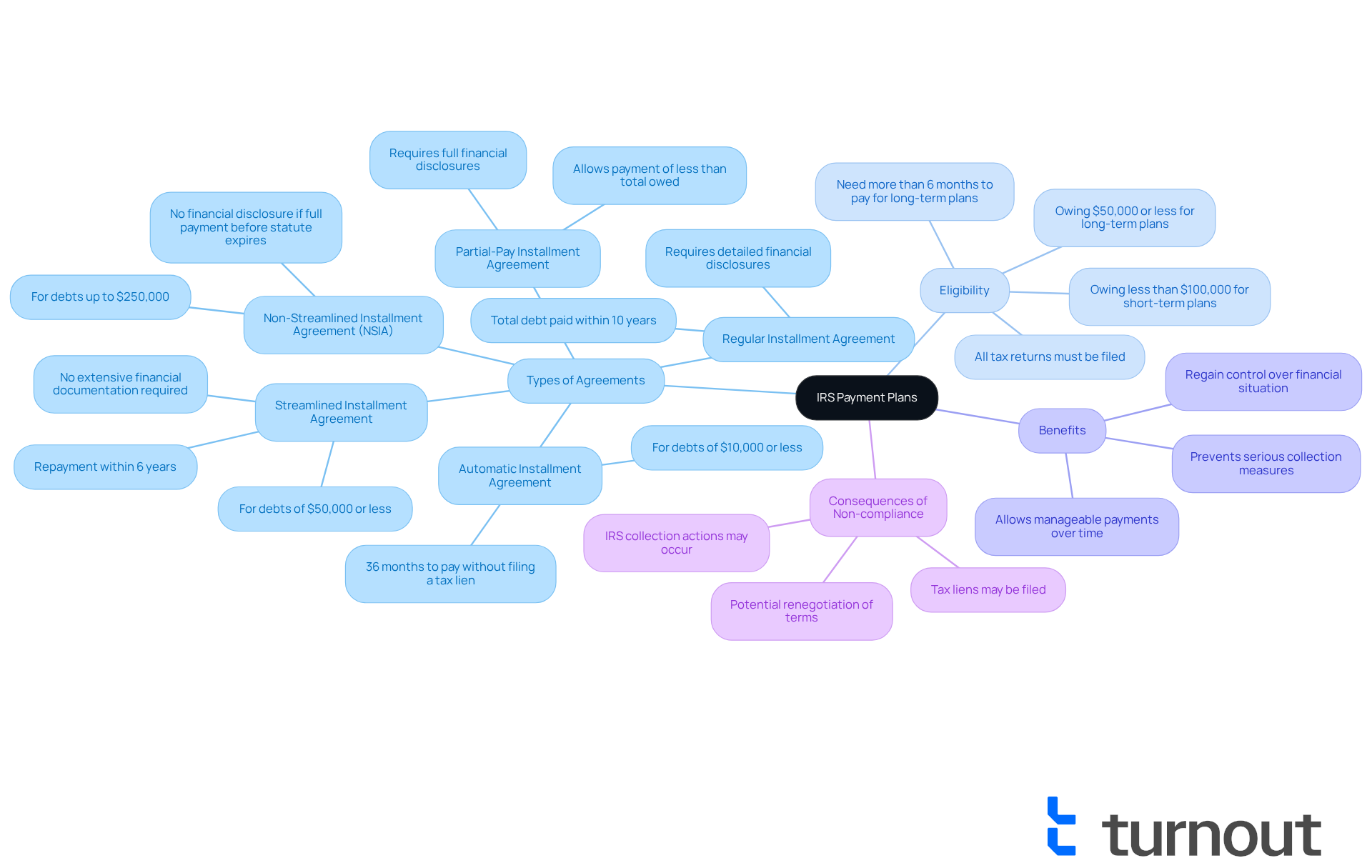

An IRS repayment arrangement, often referred to as an installment agreement, is a compassionate solution that allows individuals to gradually resolve their tax obligations, taking into account the interest on instead of facing them all at once. We understand that paying a tax bill in full by the due date can be overwhelming for many. Thankfully, these come in various lengths and conditions, offering both short-term options (up to 180 days) and long-term options (lasting up to 72 months or more).

By choosing a financing arrangement, you can prevent more serious collection measures, such as wage garnishments or bank levies, allowing you to manage your financial responsibilities in an organized way. It's reassuring to know that almost 37% of individuals are eligible for some type of financial arrangement, highlighting the availability of these supportive choices. In the last two years, nearly 3 million individuals have set up , underscoring a growing reliance on these structured methods to handle tax obligations effectively.

For instance, the Regular Installment Agreement requires detailed financial disclosures and ensures that the total debt is paid within ten years. Meanwhile, the allows for repayment within six years without the need for extensive financial documentation for those owing $50,000 or less. Additionally, the new (NSIA) permits individuals owing up to $250,000 to enter an agreement without financial disclosure if they can pay their full tax bill before the collection statute expires.

In 2021, the IRS collected nearly $13.7 billion through installment arrangements, demonstrating the efficiency and appeal of as financial options. It's also important to note the one-year rule, which allows you to claim actual expenses that exceed IRS standards for a limited time. Remember, failing to adhere to the conditions of a financial agreement can lead to renegotiation or IRS collection actions, making it crucial to make timely contributions.

These agreements not only facilitate compliance but also provide a pathway for you to regain control over your financial situation. You're not alone in this journey, and we're here to help you navigate these options with care.

Explore Interest Rates on IRS Payment Plans

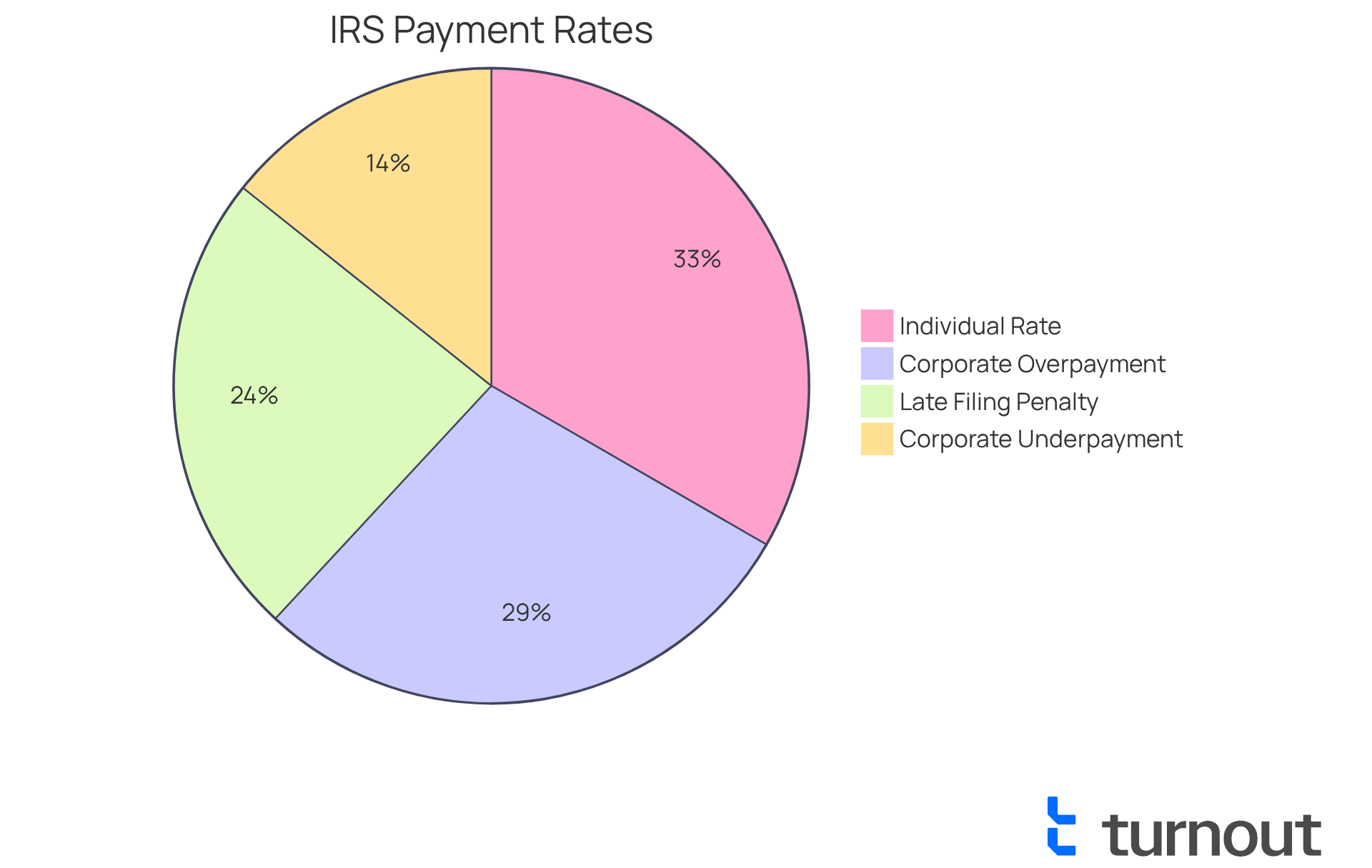

can feel overwhelming, but understanding it is essential for managing your finances. These and are based on the federal short-term rate plus 3%. Starting in 2025, individuals will see a rate established at 7% annually, compounded daily. This means that charges accumulate on any unpaid balance, which can raise the total amount owed over time. It's important to know that even while you're on a payment arrangement, the [interest on IRS payment plans](https://irs.gov/payments/quarterly-interest-rates) continues to accumulate until the balance is fully paid. By comprehending the interest on IRS payment plans, you can better determine your overall repayment sum and plan your finances accordingly.

For corporate entities, the overpayment rate is set at 6%, while the . Additionally, the late filing penalty typically amounts to 5 percent per month on any unpaid balance, highlighting the financial consequences of not addressing tax obligations promptly.

You have options for managing your tax debts through Short-Term and Long-Term Payment Plans. The allows up to 180 days to settle the full amount, while the enables monthly installments for up to 10 years. For instance, if you owe $10,000 and are on a repayment arrangement, you might accumulate roughly $1,000 in charges over a year if the balance remains unsettled. Understanding the interest on IRS payment plans is crucial for accurately calculating your total repayment obligations and effectively managing your finances.

Historically, have varied, reflecting changes in the federal short-term rate. For example, in 2024, the rate for non-corporate overpayments was 5.5%, while the rate for underpayments was 7%. These trends underscore the importance of staying informed about current rates, as they can impact your long-term financial strategies. Remember, you can sign up for IRS updates to receive the most recent interest rate details, ensuring you're prepared for any adjustments that may influence your repayment arrangements.

Understand How Interest Accumulates and Affects Repayment

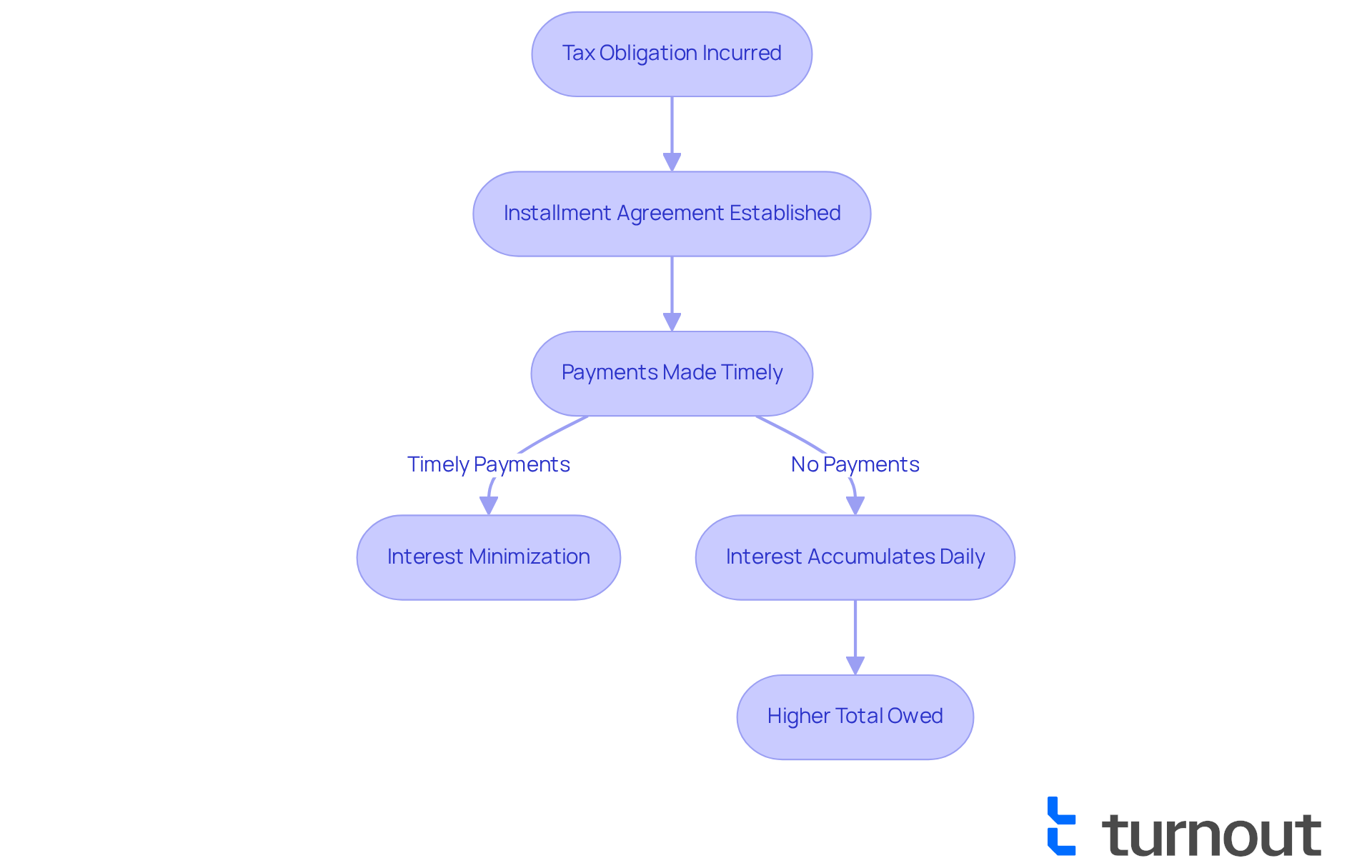

Understanding your tax obligations can be overwhelming, especially when it comes to . The is based on the outstanding balance of your tax obligation and compounds daily. This means that even slight delays in making payments can lead to significant increases in the total amount you owe due to interest on IRS payment plans. For instance, if you owe $10,000 and are in a , the charges alone could rise to about $700 over a year if no payments are made.

This to minimize financial charges, especially to avoid interest on IRS payment plans. Additionally, the IRS imposes fees on unpaid taxes from the due date until the obligation is fully settled, which can add to your financial stress. It’s common to feel anxious about these growing amounts, but understanding how daily compounding works can help you anticipate your overall obligations and plan your repayment strategies more effectively.

For example, a $5,000 tax obligation can balloon to over $6,700 in just six months due to interest and penalties. This underscores the necessity of . Remember, you are not alone in this journey. By staying informed and proactive, you can significantly reduce the overall financial burden of your tax obligations. We're here to help you and find a solution that works for you.

Identify Strategies to Manage or Reduce Interest on Payment Plans

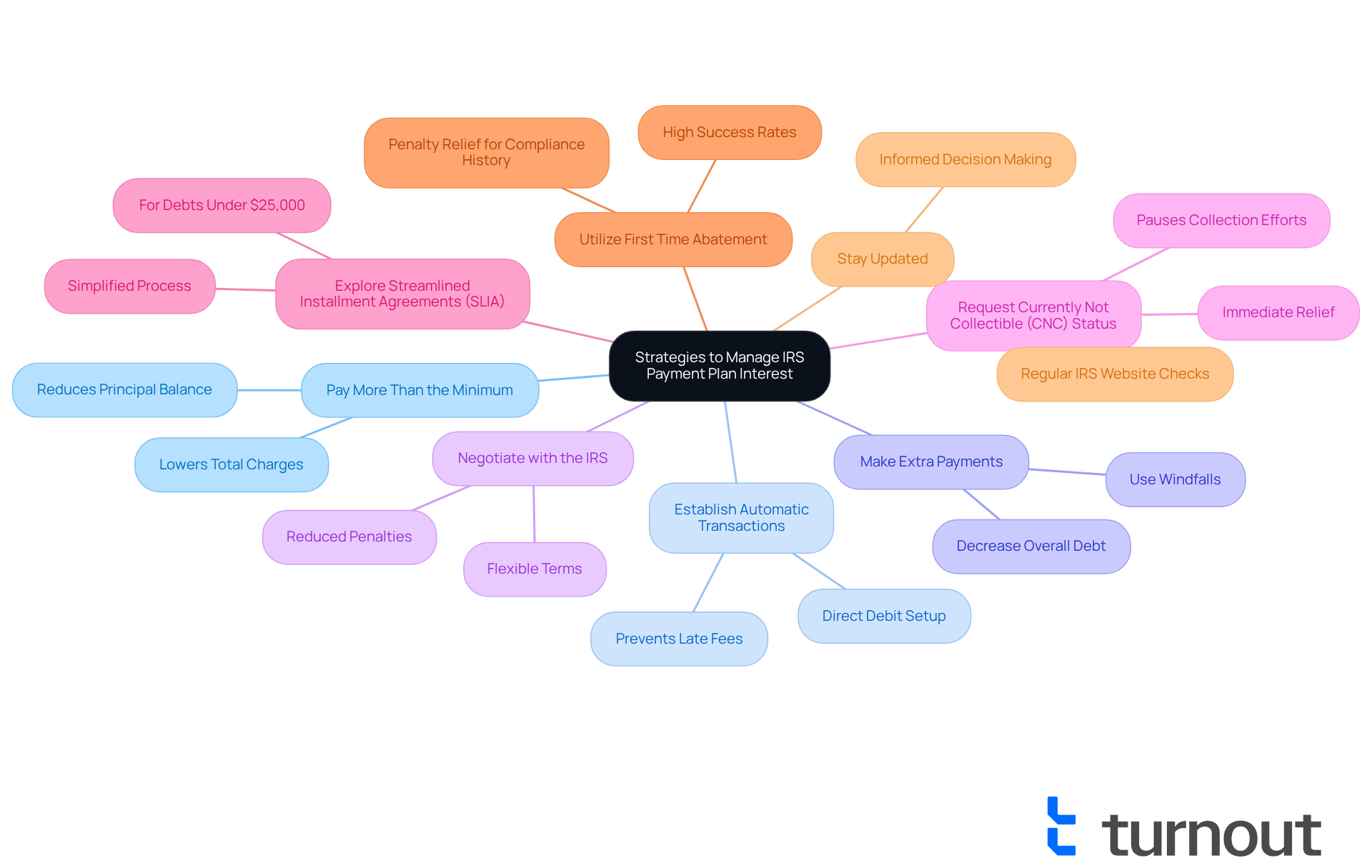

Managing or reducing interest on can feel overwhelming, but there are strategies that can help you navigate this challenge with confidence:

- : Whenever possible, consider paying more than the minimum monthly payment. This approach not only lowers your principal balance more quickly but also diminishes the total charges accumulated. By regularly paying above the minimum, you can significantly reduce your overall expenses over time, especially since penalties can increase by 25% or more to the initial tax bill.

- : Opting for direct debit can ensure that your dues are settled on time, preventing late fees and additional finance charges. This method simplifies the payment process and helps you stay compliant with your plan.

- Make Extra Payments: If you receive a windfall, such as a tax refund or bonus, consider applying it to your tax debt. This can greatly lower the principal and the amount that accumulates. Many taxpayers who have used this strategy report a noticeable decrease in their overall debt burden.

- : In certain situations, you may be able to negotiate reduced penalties or interest rates, especially if you can demonstrate financial difficulties. The IRS allows for renegotiation of terms if your circumstances change, providing flexibility for those facing unforeseen obstacles.

- Request Currently Not Collectible (CNC) Status: If paying your tax debt would hinder your ability to cover essential living costs, you can request CNC status. This option pauses collection efforts, offering immediate relief while giving you time to improve your financial situation.

- (SLIAs): For individuals with debts under $25,000, SLIAs are a substantial part of IRS settlement options. These agreements simplify the process and can help you manage your debts more effectively.

- : If you have a clean compliance history, you may qualify for penalty relief under the First Time Abatement program. This can be a straightforward way to reduce your overall tax debt without affecting the underlying obligation.

- Stay Updated: Regularly visit the IRS website for news on rates and installment choices. Being informed can empower you to make timely decisions regarding your tax obligations. Understanding the current rate, usually the federal short-term rate plus 3%, can assist in shaping your strategy effectively.

By implementing these strategies, you can take control of your IRS payment plans and minimize the financial burden associated with interest on IRS payment plans. Remember, nearly 3 million taxpayers set up IRS installment agreements in the past two years, demonstrating the effectiveness of these approaches in alleviating tax debt stress. You're not alone in this journey, and we're here to help you every step of the way.

Conclusion

Understanding IRS payment plans is essential for anyone grappling with tax obligations. These arrangements offer a structured way to manage debts, allowing you to pay off your taxes over time while navigating the complexities of interest accumulation. By utilizing these plans, you can avoid severe collection actions and regain control over your finances. It’s important to explore the options available to you.

This article elaborates on the various types of IRS payment plans, highlighting the distinctions between short-term and long-term agreements. It also emphasizes the significance of understanding how interest rates are determined and how they accumulate, which can significantly affect your total repayment amount. Strategies for managing or reducing interest, such as:

- Making extra payments

- Negotiating with the IRS

empower you to tackle your tax debts effectively.

Ultimately, taking proactive steps in managing IRS payment plans is vital for minimizing financial stress. By staying informed about current interest rates and exploring available strategies, you can alleviate the burden of tax obligations. We understand that this journey may feel daunting, but with the right knowledge and resources, you are not alone in navigating these challenges. Together, we can work towards achieving financial relief.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment agreements, are arrangements that allow individuals to gradually resolve their tax obligations instead of paying the full amount at once.

Why are IRS payment plans beneficial?

They provide a compassionate solution for individuals who may find it overwhelming to pay their tax bill in full by the due date. Payment plans help prevent serious collection measures like wage garnishments or bank levies.

What types of IRS payment plans are available?

There are various payment plan options, including short-term options (up to 180 days) and long-term options (lasting up to 72 months or more). Specific plans include the Regular Installment Agreement and the Streamlined Installment Agreement.

What is the Regular Installment Agreement?

The Regular Installment Agreement requires detailed financial disclosures and ensures that the total debt is paid within ten years.

What is the Streamlined Installment Agreement?

The Streamlined Installment Agreement allows repayment within six years without extensive financial documentation for individuals owing $50,000 or less.

What is the Non-Streamlined Installment Agreement (NSIA)?

The NSIA permits individuals owing up to $250,000 to enter an agreement without financial disclosure if they can pay their full tax bill before the collection statute expires.

How much did the IRS collect through installment arrangements in 2021?

In 2021, the IRS collected nearly $13.7 billion through installment arrangements, highlighting the efficiency of these financial options.

What happens if I fail to adhere to the conditions of an IRS payment plan?

Failing to adhere to the conditions can lead to renegotiation of the agreement or IRS collection actions, making it crucial to make timely contributions.

Who is eligible for IRS payment plans?

Almost 37% of individuals are eligible for some type of financial arrangement with the IRS, as evidenced by nearly 3 million individuals setting up installment plans in the last two years.

How do IRS payment plans help individuals regain control over their financial situation?

These agreements facilitate compliance with tax obligations and provide a structured pathway for individuals to manage their financial responsibilities effectively.