Overview

Managing tax debts can feel overwhelming, but IRS installment payment plans offer a compassionate solution. These structured monthly payments allow individuals to manage their obligations while avoiding severe collection actions. We understand that financial stress can take a toll, and this option is designed to alleviate some of that burden.

In this article, we outline the eligibility criteria, application processes, and associated costs of these plans. By providing clear information, we aim to empower you to take control of your tax situation. Remember, you are not alone in this journey; many have found relief through these plans.

If you’re feeling uncertain about your options, we encourage you to explore how these payment plans can help you fulfill your tax obligations effectively. Taking the first step can lead to a brighter financial future. We're here to help you navigate this process with understanding and support.

Introduction

Navigating tax obligations can often feel like an uphill battle. We understand that facing mounting debts and looming deadlines is overwhelming. For many, the prospect of settling tax liabilities in full is daunting. This situation prompts the need for a more manageable solution.

IRS installment payment plans emerge as a lifeline. They allow individuals to break down their tax debts into affordable monthly payments while avoiding aggressive collection actions. However, with various options, eligibility criteria, and associated costs, one pressing question remains: how can taxpayers effectively leverage these plans to regain control over their financial futures?

You're not alone in this journey. Many find themselves in similar situations, seeking a path forward. Let’s explore how these plans can provide the relief you need.

Define IRS Installment Payment Plans

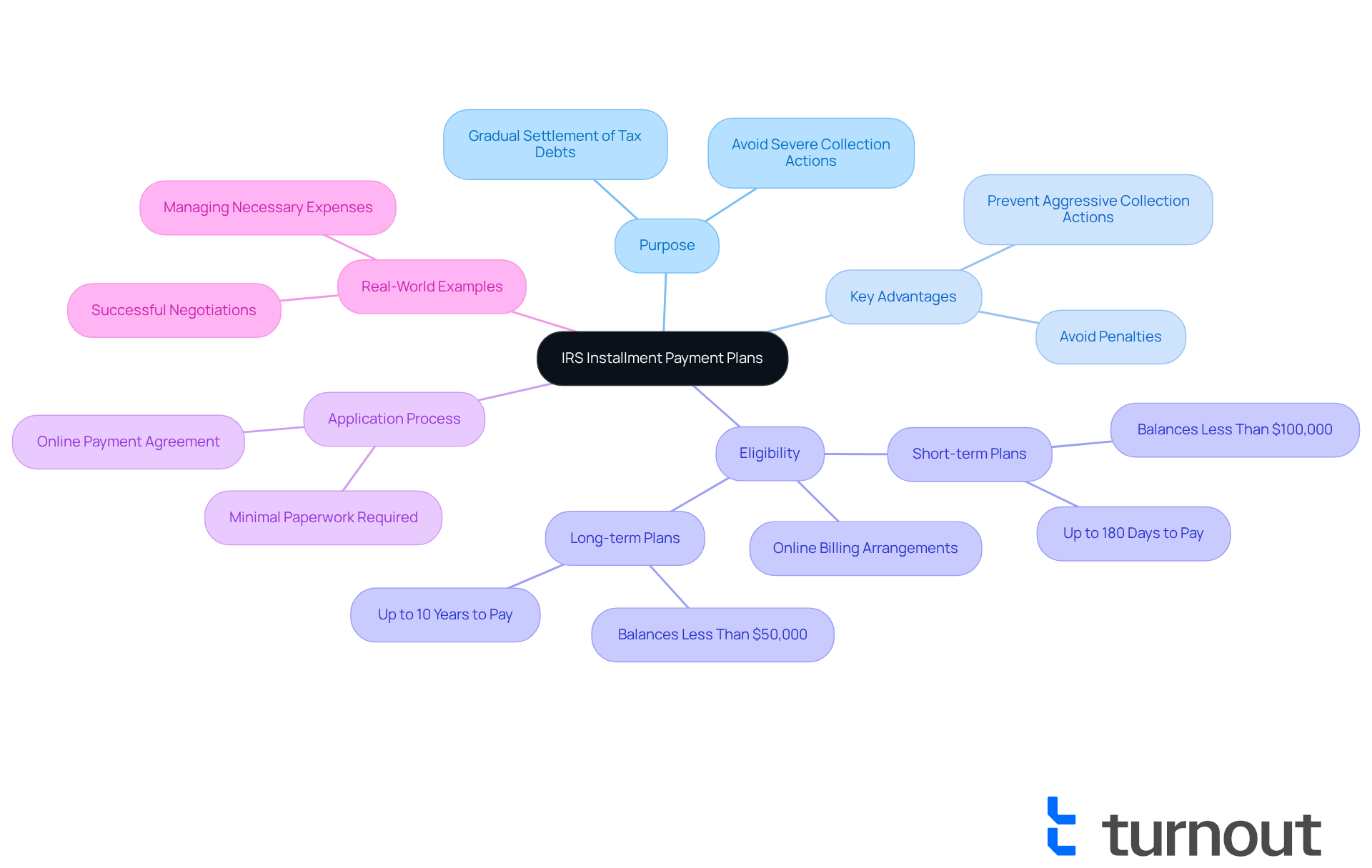

IRS installment payment plans, commonly referred to as installment payment IRS agreements, offer a compassionate solution for individuals seeking to gradually settle their tax debts through manageable monthly payments. We understand that many face challenges when unable to pay their tax liabilities in full by the due date. By entering into an installment agreement, you can avoid more severe collection actions, such as wage garnishments or bank levies, while still fulfilling your tax obligations. Typically, these plans can extend up to 72 months, depending on the amount owed and your financial situation. In 2025, millions of individuals are benefiting from these agreements, highlighting their growing importance in managing tax responsibilities.

The key advantages of IRS installment agreements include:

- The ability to avoid penalties associated with overdue amounts

- The prevention of aggressive collection actions

If you’ve made genuine efforts to comply with tax laws but faced unforeseen circumstances, you may qualify for penalty relief. Recent modifications to these agreements have made the application process more accessible for individuals who pay taxes. For example, short-term plans do not require financial documentation, and most individual filers can set up an online billing arrangement through IRS.gov with minimal paperwork.

The IRS emphasizes that 'the IRS is here to assist,' encouraging you to explore your options. If you cannot meet the criteria for an online settlement plan, consider an Offer in Compromise, which allows you to resolve your tax obligations for a lesser amount than the total due.

Real-world examples show the effectiveness of these agreements. Taxpayers who successfully negotiate an installment agreement can manage their necessary expenses while enjoying reduced penalties and interest rates during the agreement period. This approach alleviates immediate financial pressure and fosters a sense of control over your tax obligations.

Overall, installment payment IRS plans serve as an essential resource for individuals striving to manage their tax responsibilities efficiently. Remember, you can fulfill your obligations while preserving your financial stability. You're not alone in this journey; we're here to help.

Determine Eligibility for Payment Plans

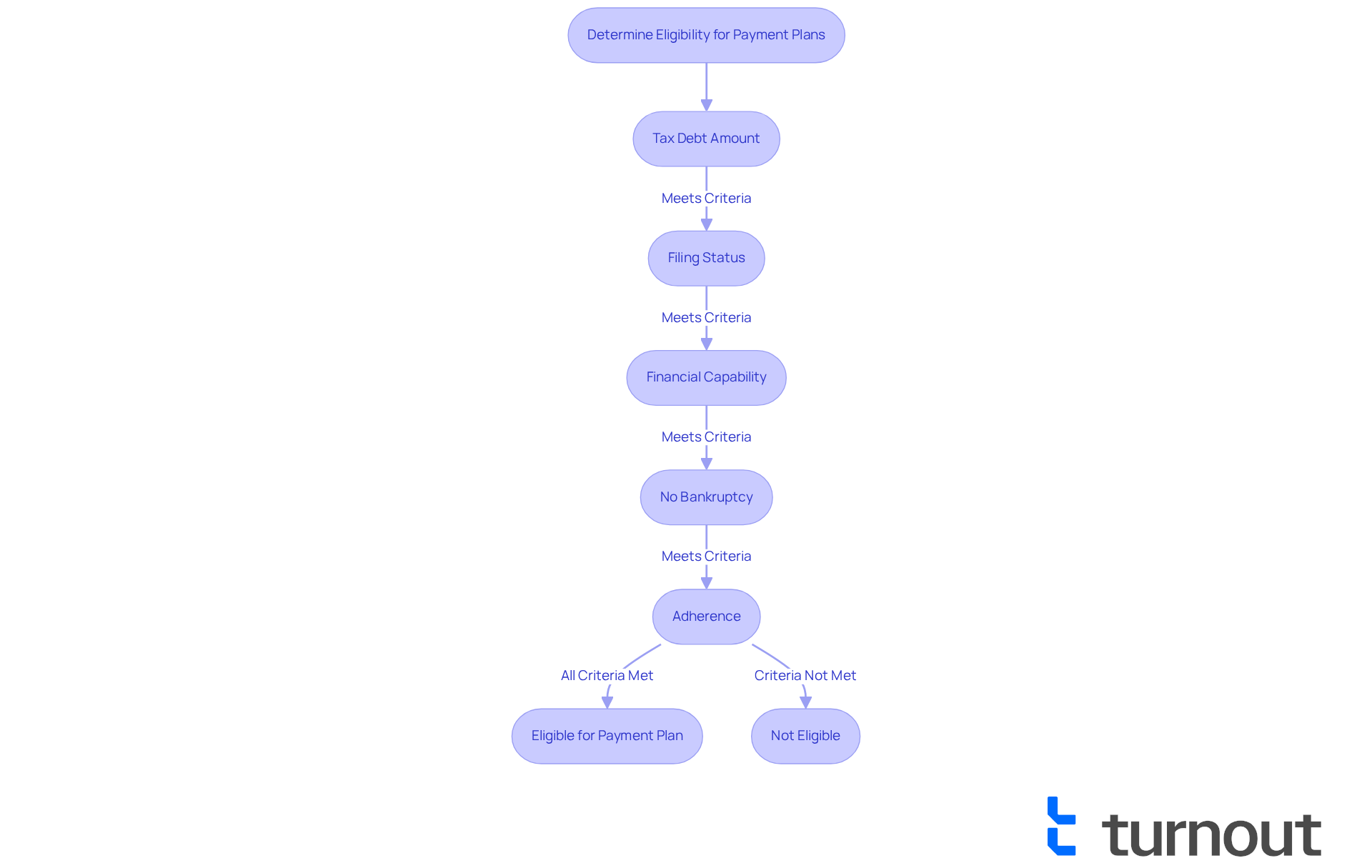

If you're feeling overwhelmed by tax debt, we want you to know that there are options available to help you find relief. To qualify for an IRS installment payment plan, there are specific criteria you need to meet:

- Tax Debt Amount: You must owe $50,000 or less in combined tax, penalties, and interest.

- Filing Status: All required tax returns must be filed.

- Financial Capability: You should demonstrate a capacity to make monthly installments.

- No Bankruptcy: You cannot be in an open bankruptcy proceeding.

- Adherence: You must conform to all tax responsibilities, including estimated tax contributions if applicable.

In 2025, the IRS has made the process simpler, allowing more individuals to qualify for financial arrangements. It's important to note that approximately 88% of individuals owe less than $25,000, which puts them in a favorable position for the most popular payment plan option, the Streamlined Installment Agreement (SLIA). This agreement lets individuals settle their tax obligations within 72 months or by the end of the collection statute of limitations, requiring minimal financial disclosures.

Many taxpayers with debts under $50,000 have successfully qualified for the installment payment IRS agreements. If you find yourself unable to pay your full tax balance, we encourage you to act swiftly by submitting your returns and making partial contributions. This can help reduce penalties and interest, making your journey a little easier. Remember, if your financial situation changes, you have the option to renegotiate your agreement for compensation.

Keep in mind that the IRS typically communicates with taxpayers through the mail, providing essential information regarding your financial agreements. By ensuring you meet these criteria, you can move forward with confidence in applying for a financial plan. You're not alone in this journey, and we're here to help you navigate through it.

Apply for an IRS Installment Payment Plan

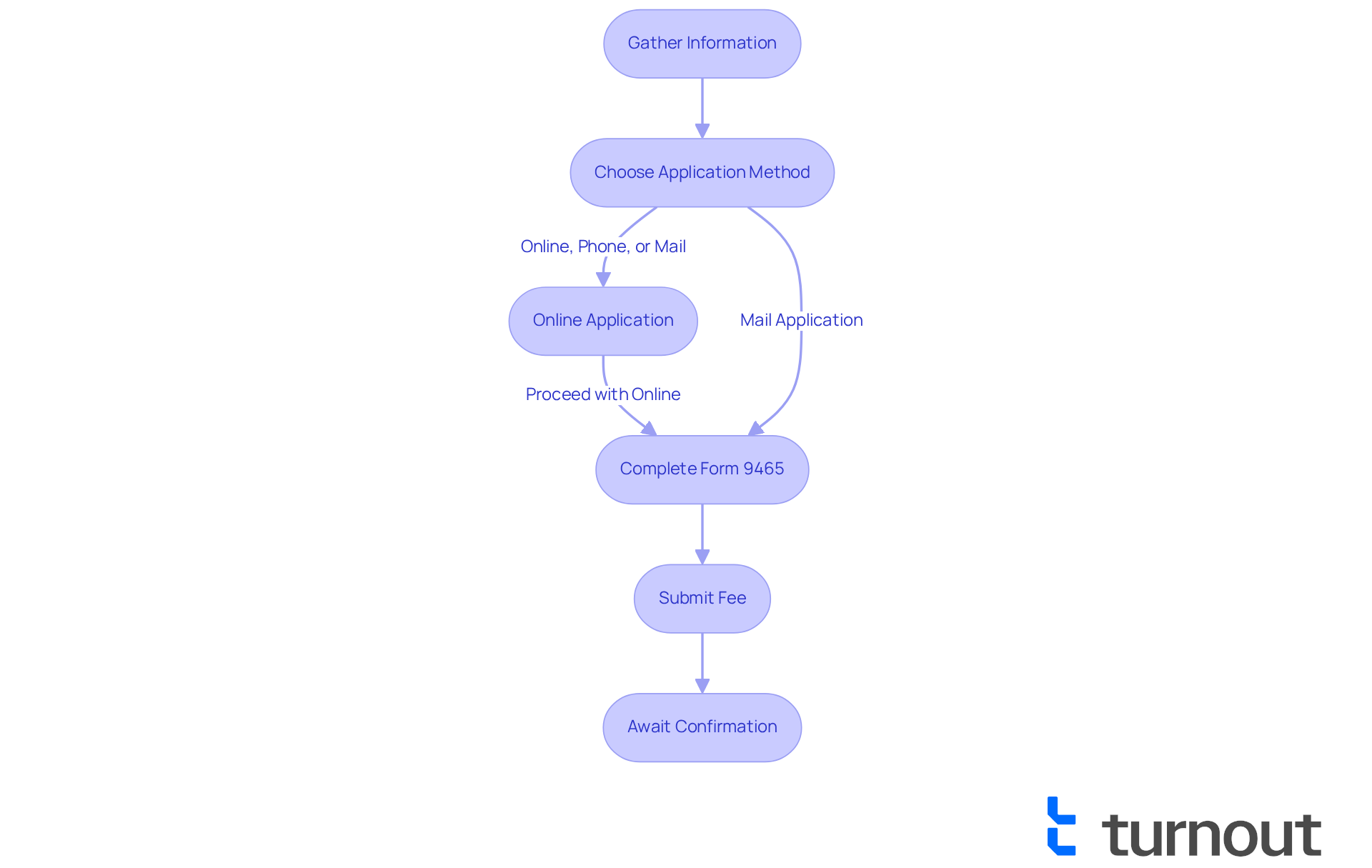

Applying for an instalment payment IRS plan can feel overwhelming, but we're here to guide you through the process step by step. Here’s how to get started:

- Gather Information: Begin by collecting your financial details, including your total tax debt, income, and expenses. We understand that this can be a challenging task, but having this information ready will help you move forward.

- Choose Application Method: You have options! You can apply online, by phone, or by mail. The online method is often the quickest and most efficient, making it a great choice for many.

- Online Application: Visit the IRS Online Payment Agreement tool. If you don’t have an account yet, creating an IRS Online Account is simple and will allow you to proceed with your application.

- Complete Form 9465: If you prefer to apply by mail, fill out Form 9465, Installment Agreement Request, and send it to the IRS. This form is straightforward, and we’re here to help if you have questions.

- Submit Fee: If applicable, make sure to submit the required setup charge. This fee varies based on your income level and transaction method, so it’s good to check beforehand.

- Await Confirmation: After you submit your application, you’ll receive a notification about the approval of your financing plan. It’s common to feel anxious during this waiting period, but rest assured that the IRS has streamlined this process.

The IRS has simplified the online application procedure, enabling most individual filers to qualify for a financial plan swiftly. In FY 2024, the IRS handled over 2 billion electronic assistance transactions, indicating a significant rise in efficiency. You can expect to receive immediate notification of your application status, making it easier to manage your tax liabilities.

For those who successfully navigate this process, the installment payment IRS collected more than $16 billion through installment agreements in the last fiscal year. This showcases how effective these plans can be in helping individuals resolve their tax debts. Additionally, if your total balance due is less than $100,000, short-term financing options are available, providing an extra 180 days to settle your account.

The IRS indicates that "most individual filers qualify for a financial arrangement," emphasizing the ease of the online application process. However, it’s important to be aware that penalties for late payments may apply, such as the failure-to-pay penalty of typically 0.5% per month. To avoid these penalties, the IRS recommends filing and paying as much as possible by the due date. Remember, you are not alone in this journey, and we're here to help you navigate through it.

Explore Types of Installment Agreements

Managing tax obligations can be overwhelming, but there are several types of IRS installment agreements designed to help you navigate this journey effectively:

-

Streamlined Installment Agreement: If you owe $50,000 or less, this option allows for repayment within 72 months and requires minimal documentation. Many individuals find this option appealing, as it accounts for nearly 70% of all IRS payment plans. With 88% of personal filers owing less than $25,000, this agreement is crucial for simplifying the repayment process and easing the burden of paperwork.

-

Non-Streamlined Installment Agreement: For those facing tax debts exceeding $50,000, this option requires more detailed financial information and may involve a longer approval process. We understand that this can feel daunting, and it’s important to be prepared for a thorough review of your financial situation.

-

Guaranteed Installment Agreement: If you owe $10,000 or less and meet specific criteria, this agreement can be a straightforward solution. Once the conditions are satisfied, it’s automatically approved, providing a clear path to managing your tax liabilities.

-

Partial Payment Installment Agreement: This choice allows you to pay less than the total amount owed, with the possibility of having the remaining balance forgiven after a specified period. This can be a valuable option for those experiencing significant financial challenges.

Each type of agreement has unique requirements and benefits, making it essential to select the one that aligns best with your financial situation, particularly regarding installment payment IRS. Remember, streamlined agreements are particularly beneficial for the 88% of individual filers who owe less than $25,000. They simplify the repayment process and reduce the stress of extensive documentation. Additionally, setting up a streamlined installment payment IRS agreement before the IRS files a tax lien is crucial to avoid complications.

On the other hand, if you have larger debts, non-streamlined agreements may be more suitable, despite the additional requirements. It’s also vital to keep in mind that IRS penalties and interest are never deductible for individuals, which is an important financial consideration. You are not alone in this journey; we’re here to help you find the best solution for your needs.

Understand Costs and Fees of Payment Plans

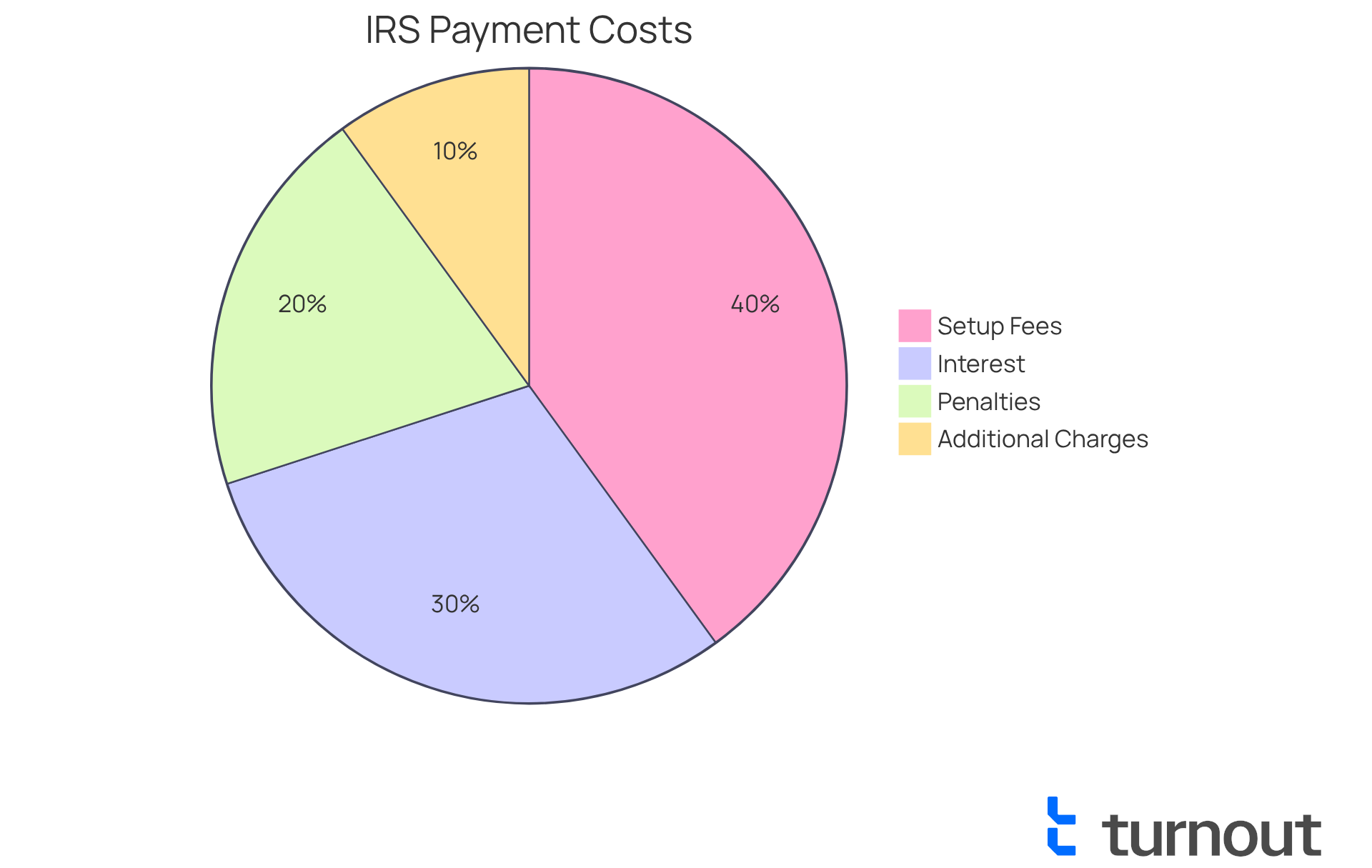

When entering into an IRS instalment payment plan, we understand that navigating costs and fees can feel overwhelming. Here’s what you should be aware of:

-

Setup Fees:

- If you apply online with direct debit, the setup fee is $22.

- For online applications without direct debit, it’s $69.

- If you choose to apply by phone or mail, expect fees ranging from $107 to $178, depending on your payment method.

- Individuals with low income may qualify for reduced fees, which can be as low as $43.

-

Interest and Penalties: It’s important to know that interest accrues on the unpaid balance at a rate of 7% per year, compounded daily. Additionally, a failure-to-pay penalty of 0.5% per month may apply until your debt is fully paid.

-

Fee Adjustments: Should you need to alter your fee plan, please be aware that extra charges may apply.

-

Financial Hardship Options: If you’re facing financial hardship, you can request a temporary delay in the collection process from the IRS. While this may postpone collection efforts, keep in mind that interest and penalties will continue to accumulate.

-

Prompt Alert: After completing the online application, you will receive a prompt alert regarding your plan approval, simplifying the process and easing your mind.

-

Alternative Options: If you do not qualify for an online installment plan, consider exploring the Offer in Compromise. This option allows some individuals to resolve their tax obligations for less than what is owed.

-

Penalty Relief: If you’ve made efforts to comply with tax laws but encountered uncontrollable circumstances, you may qualify for penalty relief.

-

Scam Awareness: We want to ensure your safety. Be wary of scams; the IRS will not reach out to you through phone, text, or social media for urgent financial requests.

Understanding these costs and options will empower you to manage your budget effectively while ensuring you can meet your tax obligations through instalment payment IRS. For instance, taxpayers who utilize direct debit not only benefit from lower setup fees but also reduce the risk of defaulting on payments. Future refunds will be applied to any outstanding tax debt until it is fully settled. Remember, staying informed about these fees and penalties is crucial to avoid unexpected financial burdens. You are not alone in this journey; we’re here to help.

Conclusion

Navigating tax obligations can feel overwhelming, but IRS installment payment plans provide a compassionate solution for those looking to manage their debts effectively. These agreements allow you to settle your tax liabilities through manageable monthly payments, offering a vital lifeline if you’re unable to pay your taxes in full. By understanding the eligibility criteria, application process, and associated costs, you can take charge of your financial situation and work towards fulfilling your tax responsibilities without the weight of excessive stress.

Throughout this article, we've highlighted the significant benefits of installment agreements, such as the ability to avoid severe collection actions and penalties. The streamlined application process, especially for those owing less than $50,000, showcases the IRS's commitment to supporting taxpayers like you. Moreover, various types of agreements are available to cater to different financial situations, ensuring that there’s an option for nearly everyone. By focusing on understanding costs and fees, you are empowered to make informed choices, reducing the risk of unexpected financial burdens.

Ultimately, the importance of IRS installment payment plans cannot be overstated. They not only provide a structured way to manage tax debts but also foster financial stability and peace of mind. If you’re grappling with tax liabilities, exploring these options is a crucial step towards regaining control over your financial future. Remember, you are not alone in this journey—the IRS is here to help. Taking proactive measures can lead to a more manageable and less stressful tax experience.

Frequently Asked Questions

What are IRS installment payment plans?

IRS installment payment plans, also known as installment payment IRS agreements, allow individuals to gradually settle their tax debts through manageable monthly payments, helping them avoid severe collection actions like wage garnishments or bank levies.

What are the benefits of entering into an IRS installment agreement?

The key benefits include avoiding penalties for overdue amounts, preventing aggressive collection actions, and reducing financial pressure while managing necessary expenses.

What are the eligibility requirements for an IRS installment payment plan?

To qualify, you must owe $50,000 or less in combined tax, penalties, and interest, have all required tax returns filed, demonstrate the ability to make monthly payments, not be in an open bankruptcy proceeding, and adhere to all tax responsibilities.

What is the Streamlined Installment Agreement (SLIA)?

The Streamlined Installment Agreement allows individuals who owe less than $50,000 to settle their tax obligations within 72 months or by the end of the collection statute of limitations, requiring minimal financial disclosures.

How has the IRS made the process of applying for installment payment plans easier?

Recent modifications have simplified the application process, allowing many individuals to set up online billing arrangements with minimal paperwork, especially for short-term plans that do not require financial documentation.

What should I do if I cannot meet the criteria for an online settlement plan?

If you cannot qualify for an online settlement plan, you may consider an Offer in Compromise, which allows you to resolve your tax obligations for less than the total amount due.

How can I manage my tax obligations effectively while on an installment plan?

By successfully negotiating an installment agreement, you can manage necessary expenses while benefiting from reduced penalties and interest rates during the agreement period, alleviating immediate financial pressure.

How does the IRS communicate with taxpayers regarding installment payment plans?

The IRS typically communicates with taxpayers through mail, providing essential information about their financial agreements and obligations.