Introduction

An Individual Taxpayer Identification Number (ITIN) is more than just a series of digits; it’s a lifeline for many taxpayers striving to meet their tax obligations. We understand that the IRS has warned of impending expirations affecting millions, making it crucial to grasp the importance of renewing your ITIN. This isn’t just about compliance; it’s about avoiding penalties that can weigh heavily on your shoulders.

But what if the renewal process feels overwhelming, filled with common pitfalls? It’s common to feel that way, and that’s why we’re here to help. This guide offers a clear, step-by-step approach to ensure a smooth ITIN renewal experience. Together, we can navigate these complexities with confidence, empowering you to take control of your tax situation.

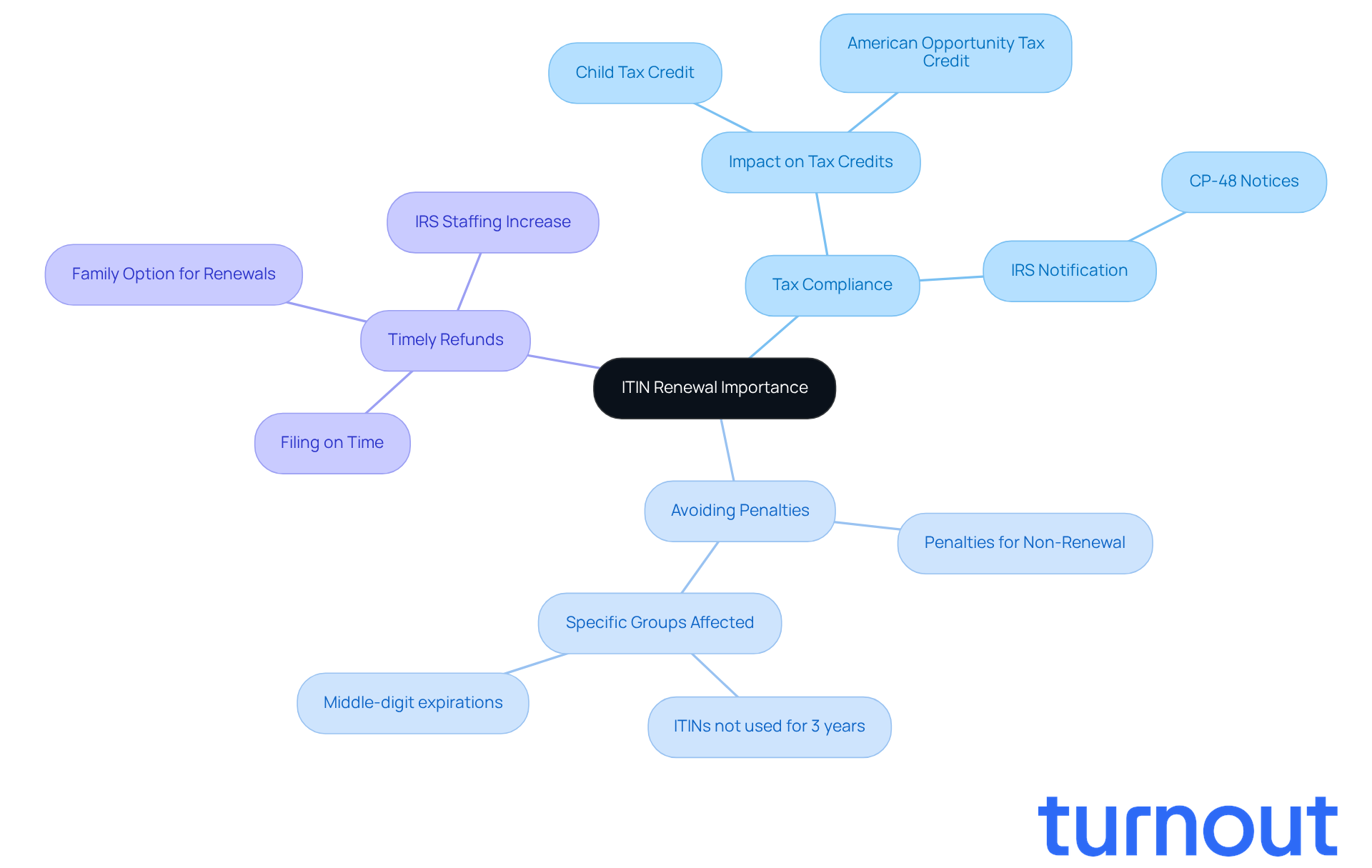

Understand ITIN Renewal and Its Importance

An Individual Taxpayer Identification Number (ITIN) is essential for those who need to file taxes but don’t have a Social Security Number (SSN). We understand that navigating tax requirements can be overwhelming, and renewing your ITIN is crucial for several reasons:

- Tax Compliance: An expired ITIN can lead to delays in processing your tax return. This may affect your eligibility for important tax credits like the Child Tax Credit and the American Opportunity Tax Credit. The IRS anticipates that up to two million ITINs will expire by the end of this year, urging taxpayers to understand how to renew my itin number promptly.

- Avoiding Penalties: If you don’t renew your identification number, you might face penalties or reduced refunds. The IRS requires that ITINs be renewed if they haven’t been used on a federal tax return for three consecutive years. Not all ITIN holders need to take action; only specific groups are affected.

- Timely Refunds: Renewing your identification number ensures that you can file your tax return on time and receive any refunds without unnecessary delays. The process for ITINs began earlier this year, in June, and the IRS has increased personnel to assist with reissuance requests. Plus, there’s a family option available for renewing multiple ITINs simultaneously.

Recognizing these aspects can help you understand how to renew my itin number before tax season. It’s common to feel anxious about potential delays in processing renewal requests during peak times, but we’re here to help you through this process.

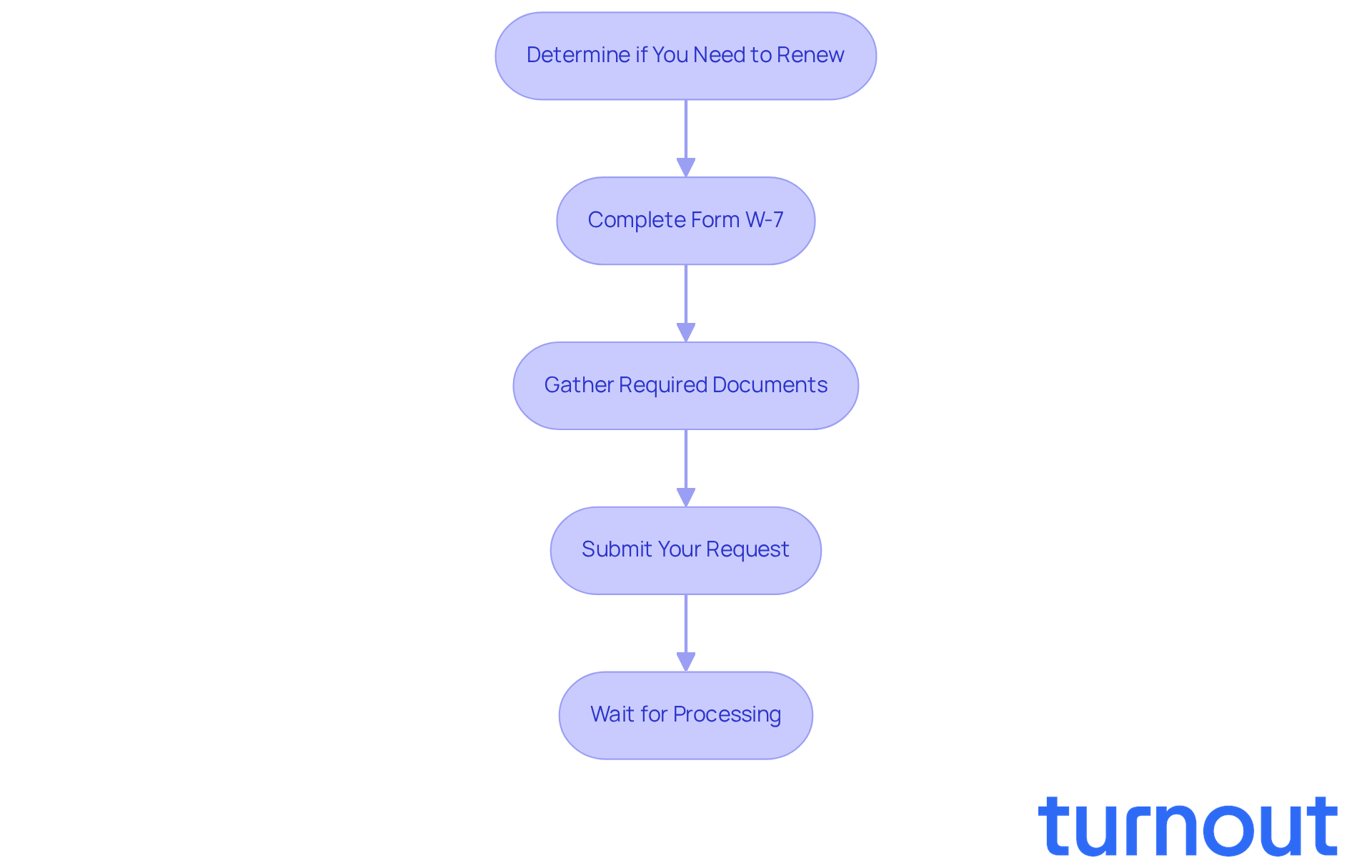

Follow the Step-by-Step Process to Renew Your ITIN

Renewing your ITIN can feel overwhelming, but we're here to guide you on how to renew my itin number. Follow these simple steps to ensure a smooth renewal process:

-

Determine if You Need to Renew: First, check if your tax identification number has expired or is about to. If you haven’t used your individual taxpayer identification number on a federal tax return for three consecutive years, it’s likely expired.

-

Complete Form W-7: Download and fill out Form W-7, making sure to mark the box for 'Renew an existing ITIN'. It’s important that all your information matches what you submitted before.

-

Gather Required Documents: You’ll need to provide:

- Proof of identity (like a passport or national ID card)

- Proof of foreign status (if applicable)

- Any additional documents specified in the Form W-7 instructions.

-

Submit Your Request: You can submit your request by mail or in person at an IRS Taxpayer Assistance Center. If you choose to mail it, don’t forget to include your completed Form W-7 along with the required documents.

-

Wait for Processing: Allow 7 to 11 weeks for the IRS to process your application. If you’re anxious to know the status, you can reach out to the IRS helpline for individual taxpayer identification numbers.

We understand that navigating this process can be challenging, but following these steps will teach you how to renew my itin number with confidence. Remember, you’re not alone in this journey!

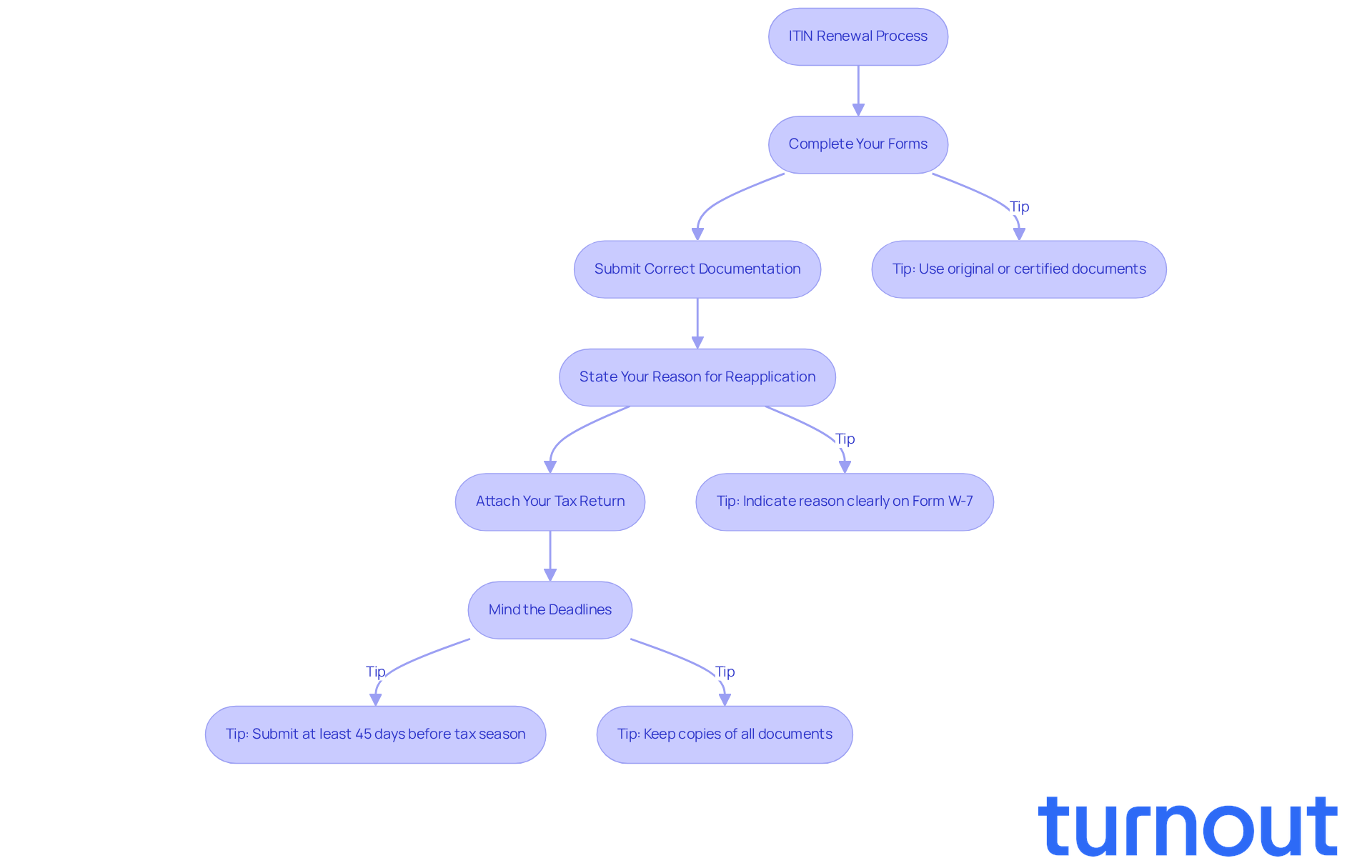

Avoid Common Mistakes During ITIN Renewal

Understanding how to renew my ITIN number can feel overwhelming, but we're here to help you navigate the process smoothly. To avoid common mistakes that could lead to delays or rejections, keep these important points in mind:

- Complete Your Forms: Make sure every section of Form W-7 is filled out completely. Leaving any fields blank can significantly slow down processing time, as the IRS requires all information to be provided.

- Submit Correct Documentation: Only original or certified copies of the required documents should be submitted. Using expired IDs or documents not recognized as acceptable can lead to denial. The IRS accepts 13 types of identification documents, including passports and military IDs, so ensure yours are current and valid.

- State Your Reason for Reapplication: Clearly indicate the reason for your ITIN reapplication on the form. Failing to do so can create confusion and lead to unnecessary delays in processing.

- Attach Your Tax Return: If applicable, don’t forget to attach your current year’s tax return to your submission. This is essential for the IRS to process your application correctly, especially if you have a filing requirement.

- Mind the Deadlines: Submit your request for renewal well ahead of tax season to prevent processing delays. The IRS recommends submitting your application at least 45 days before you plan to file your taxes to ensure timely processing. Given that the IRS estimates processing times can take about 7 weeks, early submission is vital.

We understand that this process can be daunting, especially with the IRS sending letters to over 1 million taxpayers with expiring ITINs. By being diligent and avoiding these pitfalls, you can help ensure that you understand how to renew my itin number smoothly and efficiently. Remember, you are not alone in this journey, and taking these steps can make a significant difference.

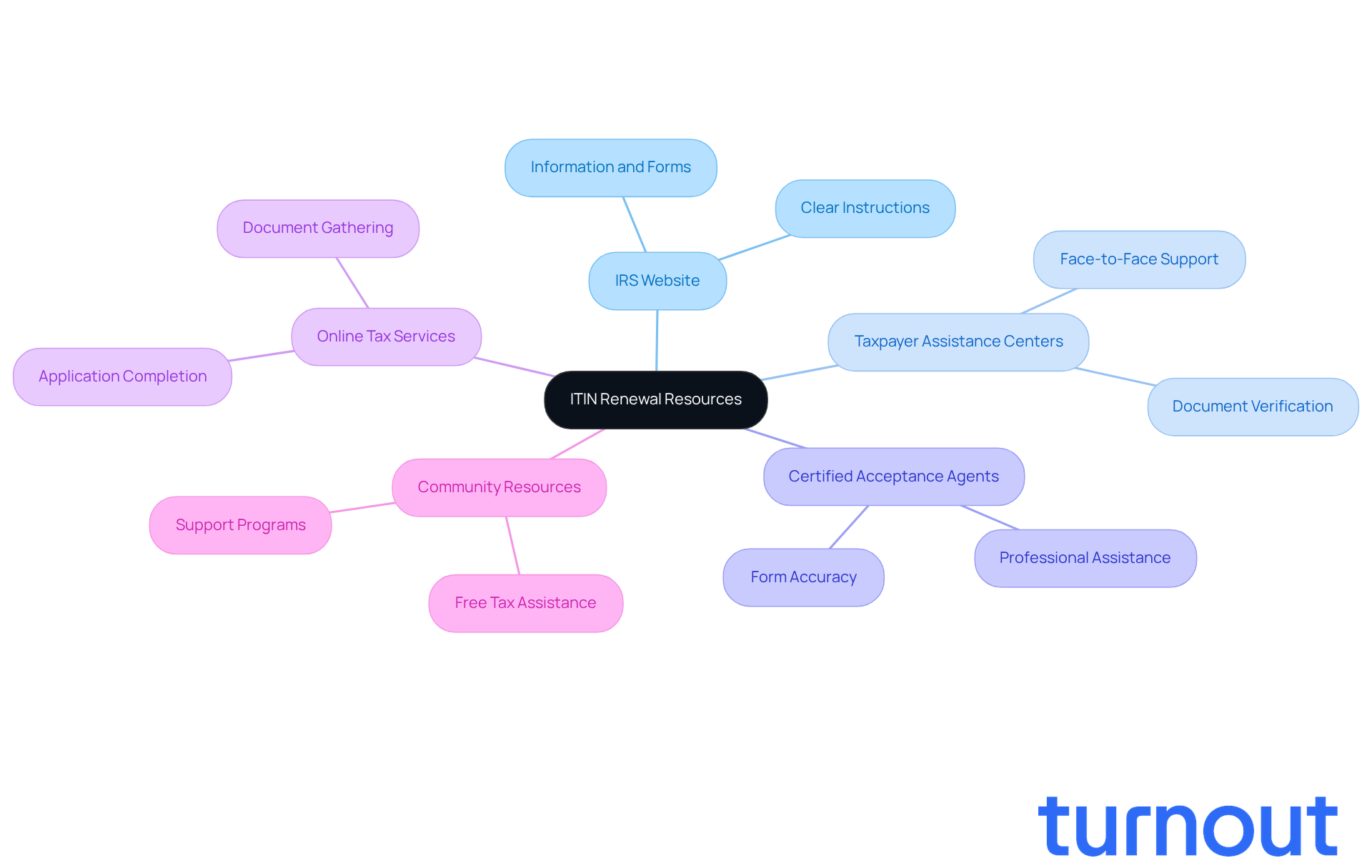

Utilize Resources and Tools for a Smooth Renewal Experience

Understanding how to renew my ITIN number can feel overwhelming, but you’re not alone in this journey. To make the process smoother, consider these helpful resources:

- IRS Website: The IRS offers a wealth of information on ITIN renewal, complete with downloadable forms and clear instructions. You can find everything you need by visiting the IRS TIN page.

- Taxpayer Assistance Centers: If you prefer face-to-face support, look for a nearby IRS Taxpayer Assistance Center. They’re there to help you verify your documents and guide you through the renewal process.

- Certified Acceptance Agents (CAAs): These knowledgeable professionals can assist you with your ITIN process and reissue. Authorized by the IRS, they ensure your forms are filled out correctly.

- Online Tax Services: Many online tax preparation services are available to help with ITIN reissue. They can assist you in gathering the necessary documents and completing your application accurately.

- Community Resources: Local organizations often provide free tax assistance and can help with updating your tax identification number. Seek out community programs that offer support for those needing help with tax-related issues.

Utilizing these resources can make how to renew my itin number not only more efficient but also less stressful. Remember, we’re here to help you every step of the way.

Conclusion

Renewing your Individual Taxpayer Identification Number (ITIN) is essential for staying compliant with tax regulations and accessing valuable tax credits. We understand that the process can feel overwhelming, but it’s crucial for those who depend on their ITIN for filing taxes. By grasping the steps involved - from recognizing the need for renewal to submitting the required documentation - you can make this experience much smoother.

Timely renewal is key to avoiding penalties and delays in receiving your tax refunds. Our step-by-step guide walks you through the necessary actions, like:

- Completing Form W-7

- Gathering the required documents

- Ensuring your application is submitted correctly

It’s also important to steer clear of common pitfalls that could complicate the renewal process, such as submitting incomplete forms or incorrect documentation.

Being proactive about your ITIN renewal not only helps you meet your tax obligations but also empowers you to take charge of your financial future. Remember, you’re not alone in this journey. Utilizing resources like the IRS website and local assistance programs can make this process even easier. By following the outlined steps and seeking support when needed, you can ensure a smooth renewal experience, paving the way for continued compliance and access to essential tax benefits.

Frequently Asked Questions

What is an Individual Taxpayer Identification Number (ITIN)?

An ITIN is a tax processing number issued by the IRS for individuals who need to file taxes but do not have a Social Security Number (SSN).

Why is renewing an ITIN important?

Renewing an ITIN is important for tax compliance, avoiding penalties, and ensuring timely refunds. An expired ITIN can delay tax return processing and affect eligibility for tax credits.

What happens if I don’t renew my ITIN?

If you don’t renew your ITIN, you may face penalties, reduced refunds, and delays in processing your tax return. The IRS requires renewal for ITINs not used on a federal tax return for three consecutive years.

How many ITINs are expected to expire this year?

The IRS anticipates that up to two million ITINs will expire by the end of this year.

When did the ITIN renewal process begin?

The ITIN renewal process began in June of this year.

Is there an option to renew multiple ITINs at once?

Yes, there is a family option available for renewing multiple ITINs simultaneously.

What should I do if I feel anxious about potential delays in my ITIN renewal?

It's common to feel anxious about delays, especially during peak times, but seeking assistance can help you navigate the renewal process more smoothly.