Introduction

Navigating the complexities of tax debts can feel overwhelming, especially when financial hardships make it tough to meet obligations. We understand that this can be a daunting experience. Fortunately, the IRS offers a beacon of hope through the Currently Not Collectible (CNC) status. This option allows individuals to temporarily halt collection efforts due to economic strain, providing much-needed relief.

In this article, we’ll guide you through the step-by-step process for applying for IRS non-collectible status. We want to ensure you understand the eligibility criteria, necessary documentation, and submission methods. However, what happens if the IRS denies your application? How can you effectively demonstrate financial hardship? Exploring these questions will illuminate your path toward achieving the relief you deserve. Remember, you are not alone in this journey.

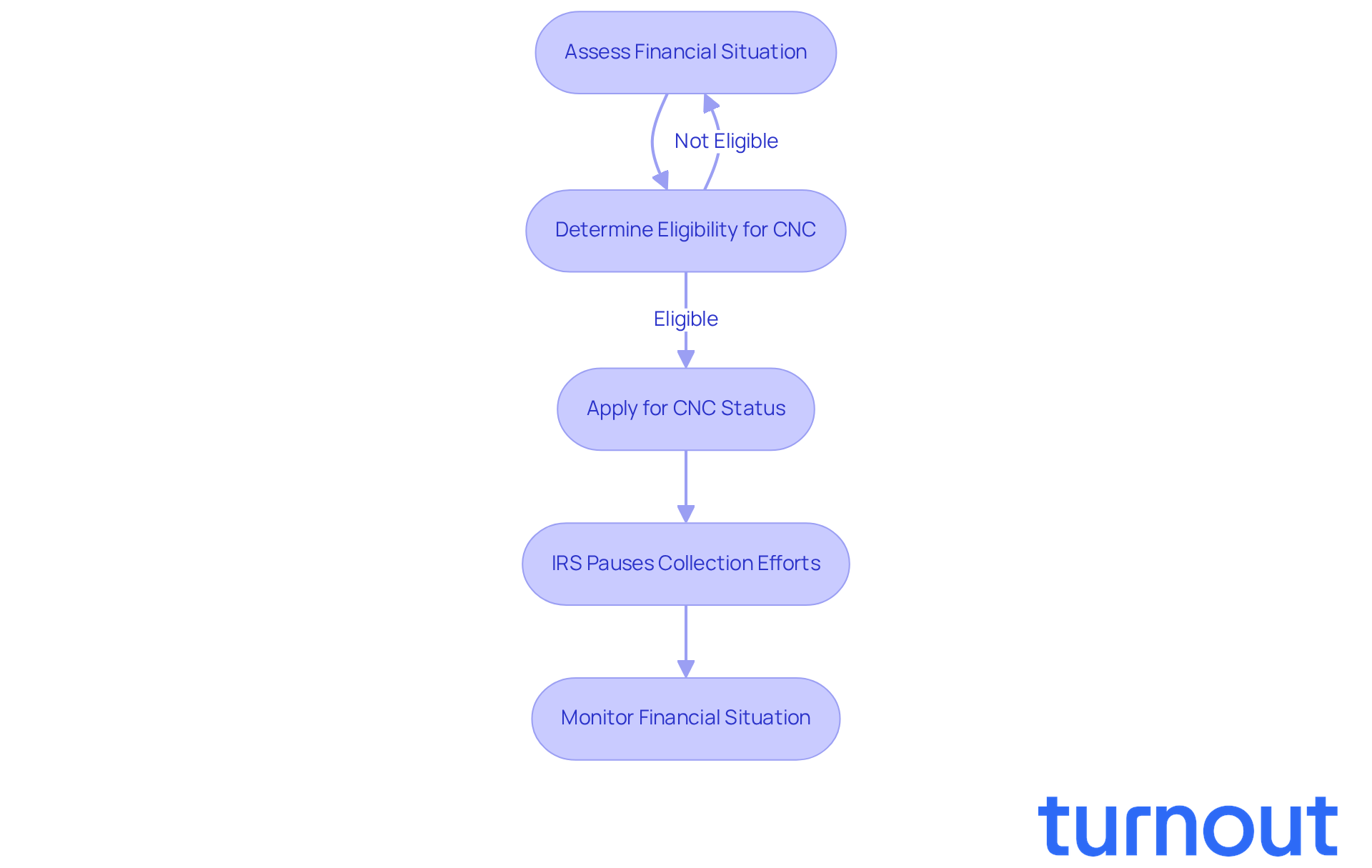

Understand Currently Not Collectible Status

If you're feeling overwhelmed by tax debts, you're not alone. The Currently Not Collectible (CNC) designation is a lifeline offered by the IRS for those seeking to understand how to apply for IRS non collectible status, allowing them to temporarily pause collection efforts due to economic hardship. When your financial situation makes it difficult to meet your tax obligations without sacrificing essential living expenses, you may qualify for this important relief.

This designation means that the IRS won’t pursue collection actions like wage garnishments or bank levies for a specified period. However, it’s crucial to understand that CNC designation doesn’t erase your tax debt; it simply pauses collection efforts until your financial situation improves. Recognizing this condition is the first step in understanding how to apply for IRS non collectible status, helping you assess whether you meet the necessary criteria for relief.

At Turnout, we’re here to help you navigate this complex process. We offer a range of tools and services, including personalized guidance and resources tailored to your needs. Our trained nonlawyer advocates and IRS-licensed enrolled agents are dedicated to assisting you in understanding how to apply for IRS non collectible status, all without the need for legal representation. Remember, you don’t have to face this journey alone.

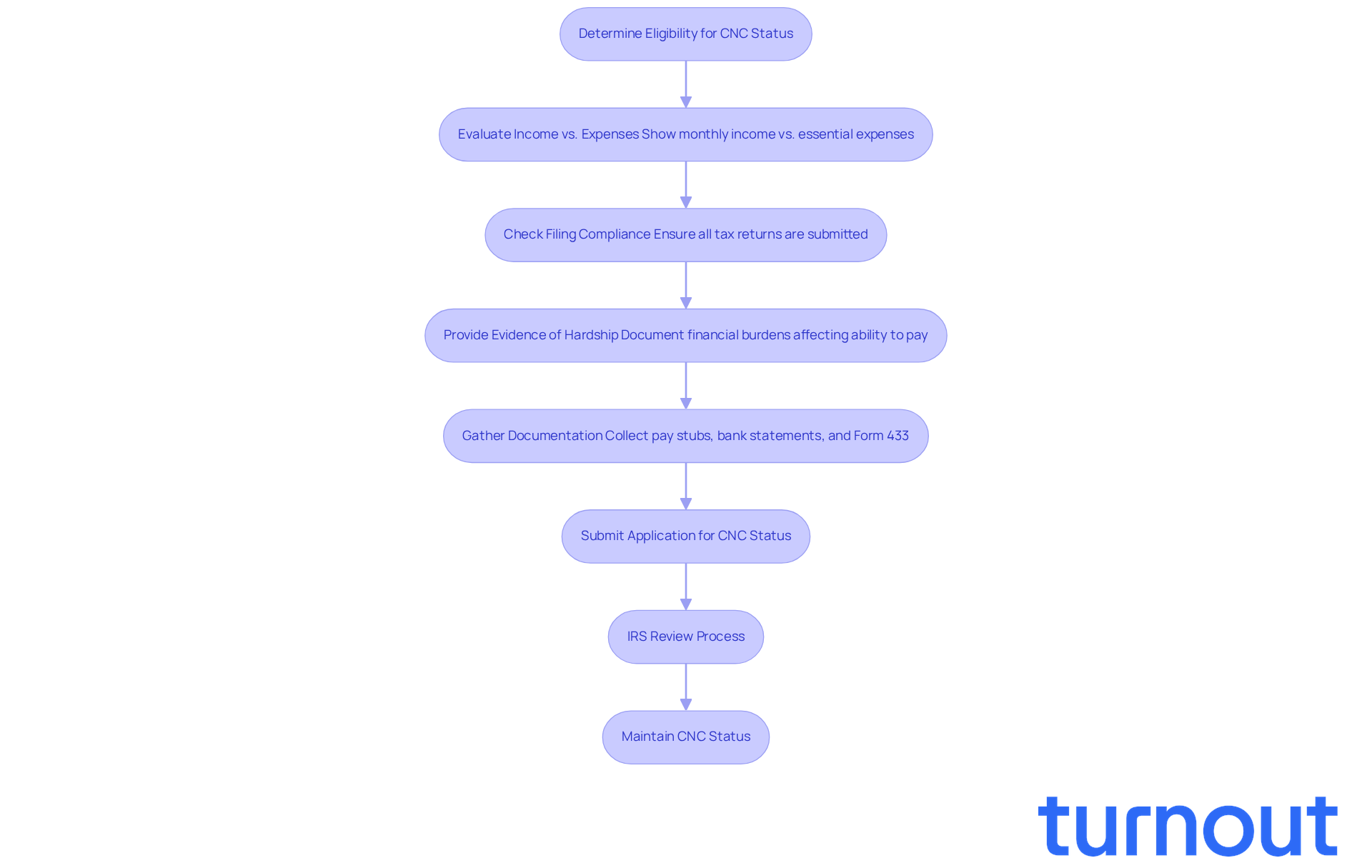

Determine Eligibility for CNC Status

If you're feeling overwhelmed by your financial situation, you're not alone. Many taxpayers find themselves in a tough spot, and learning how to apply for IRS non collectible status can be a crucial step toward relief. To qualify for CNC status, it's important to evaluate your financial circumstances against specific IRS criteria. Here are the key factors to consider:

-

Income vs. Expenses: You need to show that your monthly income isn’t enough to cover essential living expenses like rent or mortgage, utilities, food, and transportation. For example, if your disposable income is less than $25 a month, you might qualify for CNC classification.

-

Filing Compliance: It’s essential to have all required tax returns submitted. The IRS won’t grant CNC status if you have unfiled returns, so make sure you’re compliant. If you haven’t filed recent tax returns or are behind on estimated payments, your request for hardship may be denied.

-

Evidence of Hardship: You’ll need to provide proof that paying your tax debts would cause significant economic hardship. This could include documentation of unemployment, medical expenses, or other financial burdens that affect your ability to pay.

-

Gathering Documentation: Collecting supporting documents like pay stubs, bank statements, and bills is crucial. Be prepared to present a monetary statement (Form 433) that details your income and expenses.

We understand that navigating these requirements can feel daunting. The IRS reviews Currently Not Collectible accounts regularly, usually once a year, and may remove individuals from CNC status if their financial situation improves. By carefully assessing these criteria and preparing the necessary documentation, you can determine how to apply for IRS non collectible status before starting the application process. Remember, approximately 30 million taxpayers submit returns and owe taxes each year, and many may qualify for CNC designation in 2026. Understanding these requirements is essential, and we're here to help you through this journey.

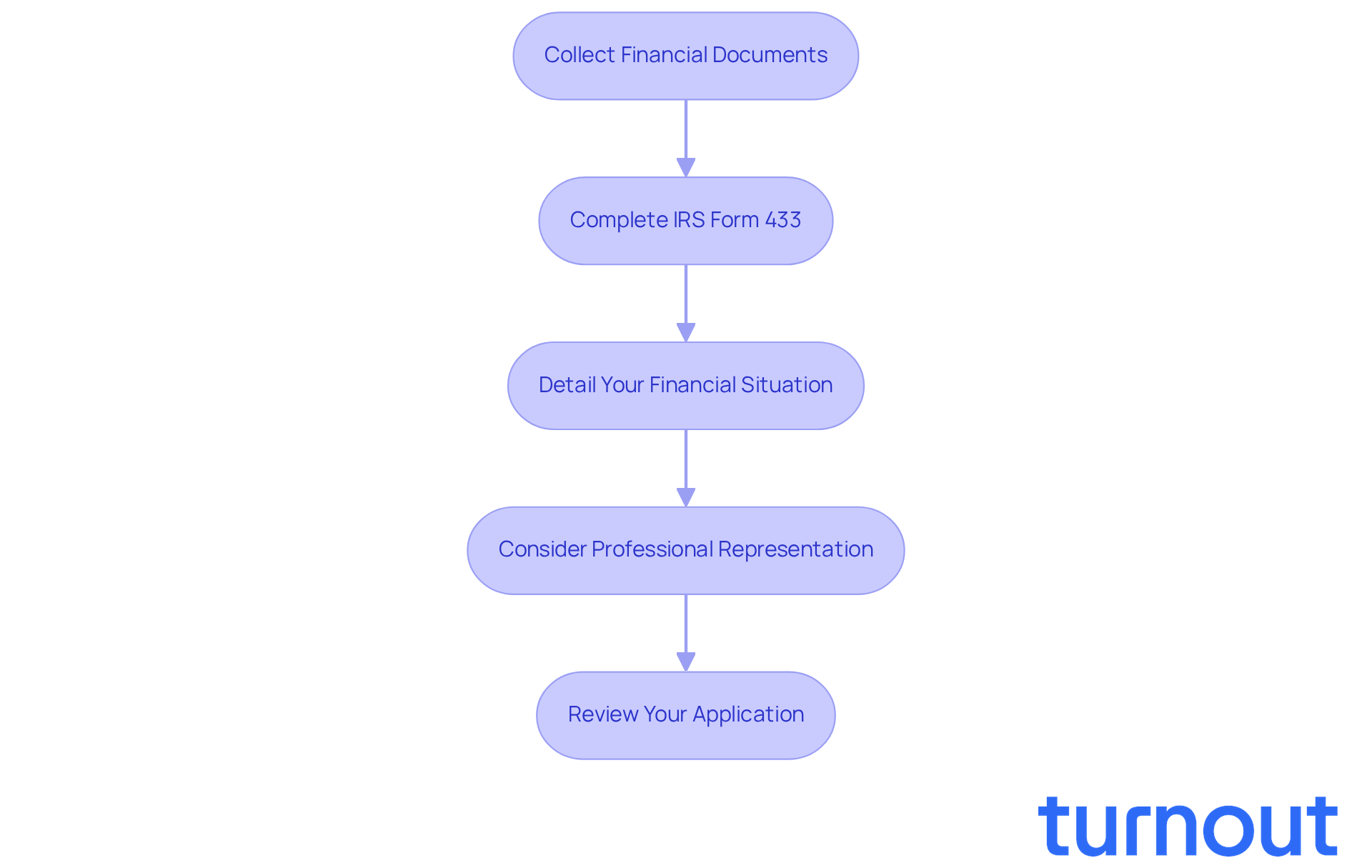

Gather Financial Information and Complete IRS Forms

If you're facing financial difficulties, requesting a Currently Not Collectible (CNC) designation can be a vital step. We understand that navigating this process can feel overwhelming, but we're here to help you through it. Here’s a simple guide to assist you:

-

Collect Financial Documents: Start by gathering essential documents that reflect your current financial situation. This includes:

- Recent pay stubs or proof of income

- Bank statements from the last few months

- Monthly bills for housing, utilities, and other essential expenses

- Documentation of debts or financial obligations

-

Complete IRS Form 433: Depending on your employment status, you’ll need to fill out one of the following forms:

- Form 433-F: For wage earners and self-employed individuals

- Form 433-A: For individuals with more complex financial situations

- Form 433-B: For businesses

-

Detail Your Financial Situation: It’s crucial to provide accurate information about your income, expenses, and assets on the form. Honesty and thoroughness are vital here. The IRS relies on this information to assess your eligibility for CNC classification. Remember, around 4 million to 5 million taxpayers are unable to pay their taxes, so if you find yourself in a similar situation, applying for CNC classification is urgent.

-

Consider Professional Representation: Engaging a tax professional, like an enrolled agent or CPA, can be incredibly beneficial. They can help ensure that your application is accurate and complete, which may improve your chances of approval. Just keep in mind that there might be indirect costs associated with hiring a professional for assistance.

-

Review Your Application: Before you submit, take a moment to meticulously check all information for accuracy and completeness. This step is crucial to prevent processing delays. Ignoring IRS notices or having inaccuracies can lead to complications, including audits.

By carefully collecting your financial information and completing the necessary forms, you can significantly enhance your chances of successfully acquiring CNC designation. Remember, the IRS evaluates financial situations each year, so keeping precise records is essential for your continued eligibility. You're not alone in this journey, and taking these steps can lead you toward relief.

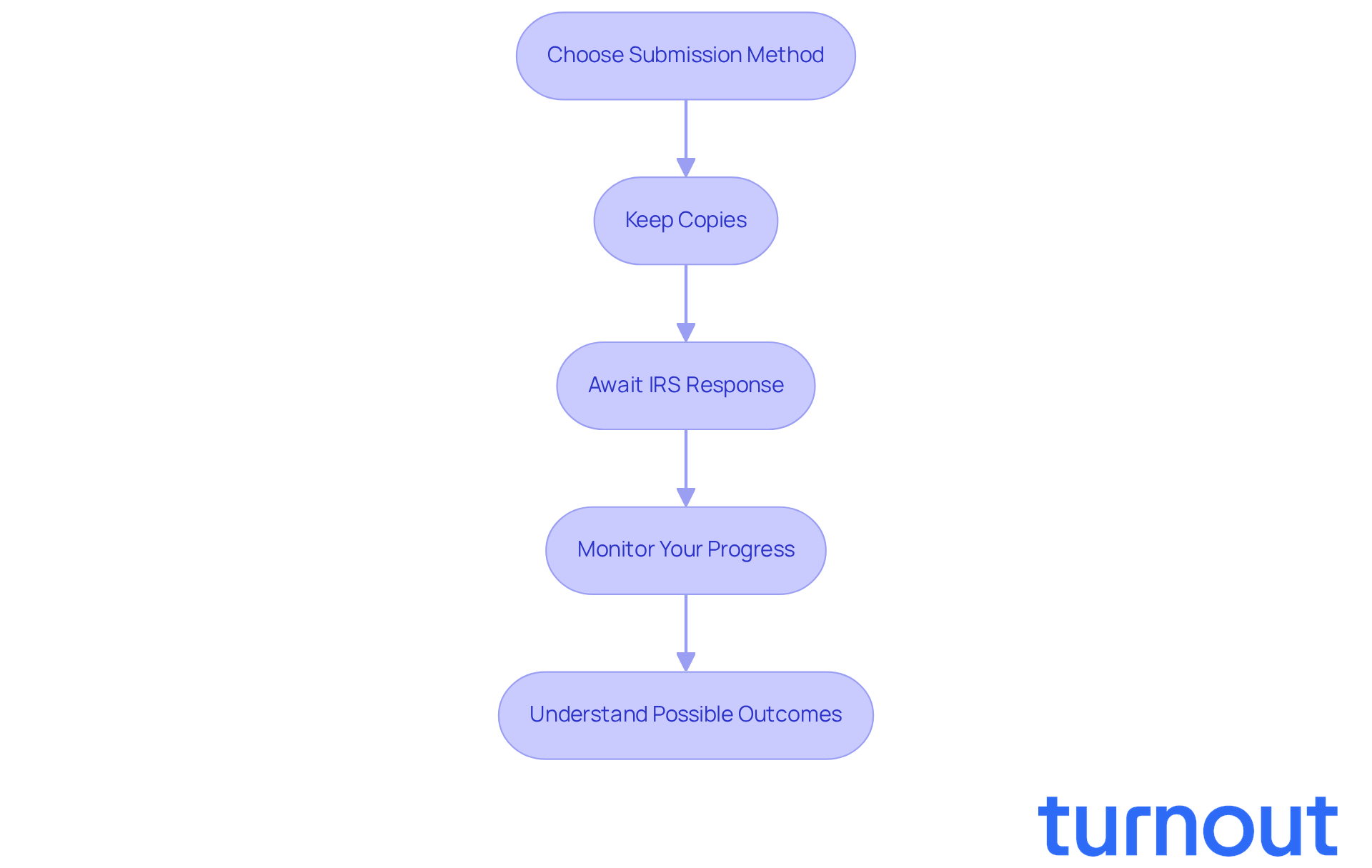

Submit Your CNC Application and Understand Next Steps

Once you’ve gathered your financial information and completed the necessary IRS forms, it’s time to understand how to apply for IRS non collectible status. We understand that this can feel overwhelming, but following these steps can help you navigate the process with confidence:

-

Choose Your Submission Method: You can submit your CNC application either by mail or by phone. If you decide to mail your application, send it to the address specified on the IRS form. Prefer to call? Reach out to the IRS at 800-829-1040.

-

Keep Copies: It’s wise to make copies of all documents and forms you submit. This way, you’ll have them handy if you need to reference them later.

-

Await IRS Response: After you submit your application, the IRS will review it. This process can take several weeks-typically between 60 to 90 days-but response times can vary. During this time, it’s common for them to contact you for additional information or clarification.

-

Monitor Your Progress: You can check the status of your application by calling the IRS or checking online if that’s an option. Just be ready to provide your personal information for verification.

-

Understand Possible Outcomes: If your application is approved, the IRS will place your account in CNC status, pausing collection efforts. However, it’s important to remember that penalties and interest will continue to accrue on your outstanding balance until the debt is fully resolved. If your application is denied, you’ll receive a notice explaining the reasons, and you may have the option to appeal the decision.

By following these steps, you can successfully submit your CNC application and understand how to apply for IRS non collectible status along the way. Remember, being classified as currently not collectible means the IRS recognizes that you can’t afford to pay the debt right now, giving you some much-needed relief from collection actions. You’re not alone in this journey, and we’re here to help.

Conclusion

Understanding how to apply for IRS non-collectible status is a crucial step for those of you facing financial hardships. This designation offers temporary relief from collection actions, allowing you to focus on your essential living expenses without the constant worry of tax debt. By recognizing the eligibility criteria and following the outlined steps, you can navigate this process effectively and find the respite you truly need.

We understand that assessing your financial situation against IRS criteria can feel overwhelming. Gathering the necessary documentation and accurately completing the required forms are vital steps in this journey. Each part of the process, from determining eligibility to submitting your application, plays a significant role in securing CNC status. This guidance is here to empower you to take control of your financial circumstances and seek the relief you deserve.

In conclusion, applying for IRS non-collectible status isn’t just a bureaucratic task; it’s a vital opportunity for those in economic distress to regain their footing. By taking proactive steps and utilizing available resources, you can pause collection efforts and work towards a more stable financial future. It’s common to feel daunted by this journey, but remember, it’s a necessary pathway toward achieving peace of mind and financial recovery. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is Currently Not Collectible (CNC) status?

Currently Not Collectible (CNC) status is a designation by the IRS that allows individuals experiencing economic hardship to temporarily pause collection efforts on their tax debts.

Who qualifies for CNC status?

Individuals who find it difficult to meet their tax obligations without sacrificing essential living expenses may qualify for CNC status.

What does CNC status mean for my tax collection efforts?

When you are designated as CNC, the IRS will not pursue collection actions such as wage garnishments or bank levies for a specified period. However, it does not erase your tax debt.

How can I apply for CNC status?

To apply for CNC status, you need to assess your financial situation and determine if you meet the necessary criteria for relief. Assistance is available through resources and guidance from organizations like Turnout.

What services does Turnout provide regarding CNC status?

Turnout offers personalized guidance and resources to help individuals understand how to apply for IRS non collectible status, with support from trained nonlawyer advocates and IRS-licensed enrolled agents.

Do I need legal representation to apply for CNC status?

No, you do not need legal representation to apply for CNC status; assistance can be provided by nonlawyer advocates and enrolled agents.

What should I do if I feel overwhelmed by tax debts?

If you feel overwhelmed by tax debts, consider exploring CNC status as a potential relief option and seek assistance from resources like Turnout to navigate the process.