Overview

Navigating Georgia state tax payments can feel overwhelming, but we're here to help. This article serves as a comprehensive step-by-step guide, designed to address your concerns and make the process smoother. We understand that understanding essential tax types, deadlines, and payment methods is crucial for you.

You'll find clear instructions on how to navigate the Georgia Tax Center, along with helpful tips for troubleshooting common payment issues. Our goal is to empower you to manage your tax obligations confidently and efficiently. Remember, you are not alone in this journey; we are here to support you every step of the way.

Introduction

Navigating the complexities of state taxes can often feel like steering through a maze. We understand that in Georgia, various tax obligations await, and this can be overwhelming. This guide aims to demystify the process of Georgia state tax payments, offering you a clear path to understanding essential tax types, deadlines, and payment methods.

But what happens when unexpected issues arise during the payment process? It's common to feel anxious about these challenges. Explore our step-by-step approach that not only ensures timely payments but also equips you with solutions to common pitfalls. Remember, you are not alone in this journey; we’re here to help you tackle your tax responsibilities with confidence.

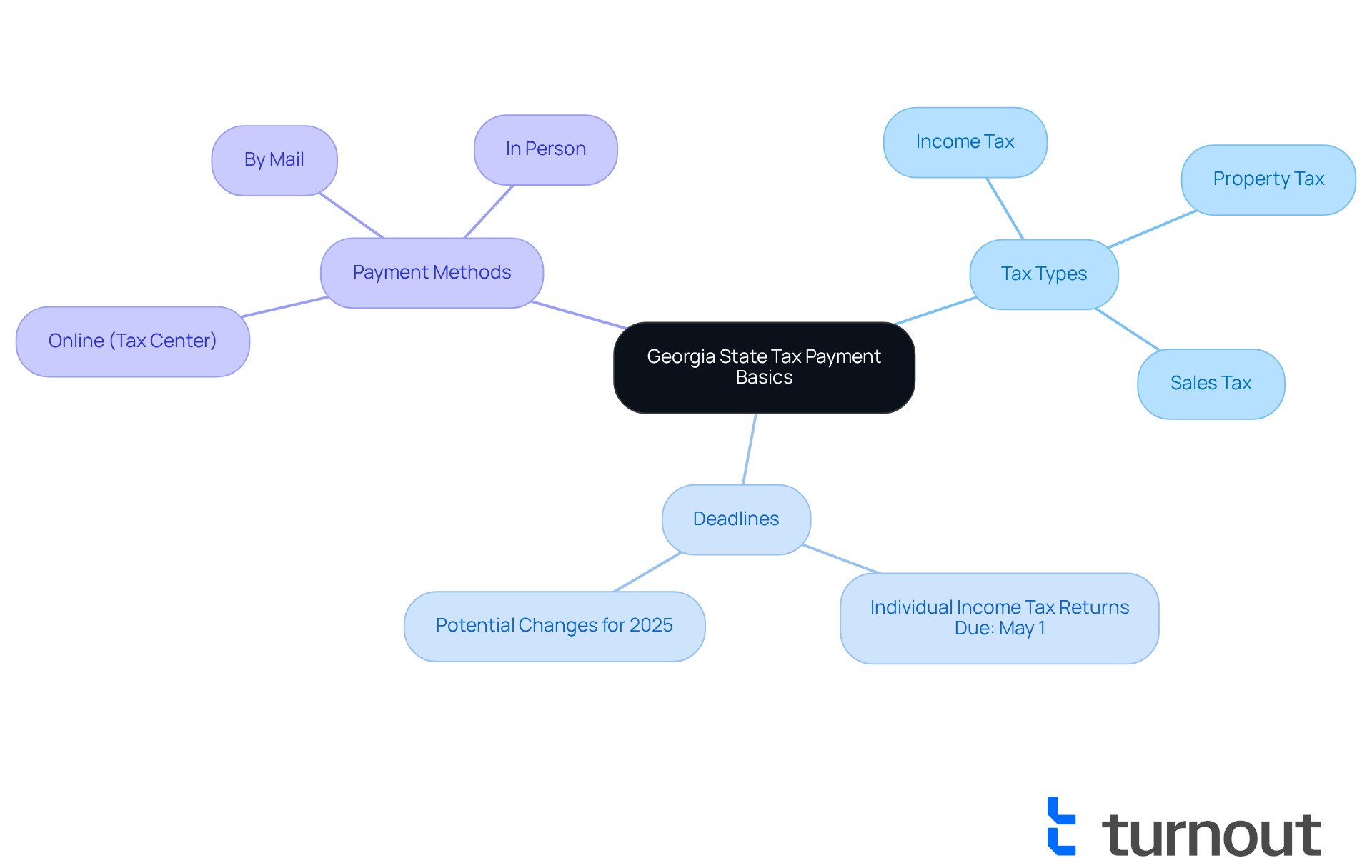

Understand Georgia State Tax Payment Basics

In the region, state levies can encompass personal income levies, corporate income levies, and various assessed obligations. We understand that navigating these responsibilities can feel overwhelming. Here are a few essentials to help you:

- Tax Types: It's important to familiarize yourself with the types of taxes you may owe, including income tax, property tax, and sales tax. Knowing what to expect can alleviate some of your concerns.

- Deadlines: Individual income tax returns are typically due by May 1 each year. For 2025, please ensure you are aware of any changes in deadlines or rates. We’re here to help you stay on top of these important dates.

- Payment Methods: Payments, such as Georgia state tax payment, can be made online through the Tax Center (GTC), by mail, or in person. Understanding these options will empower you to choose the most convenient method for your situation.

By grasping these basics, you will be better prepared to manage your Georgia state tax payment obligations effectively. Remember, you are not alone in this journey.

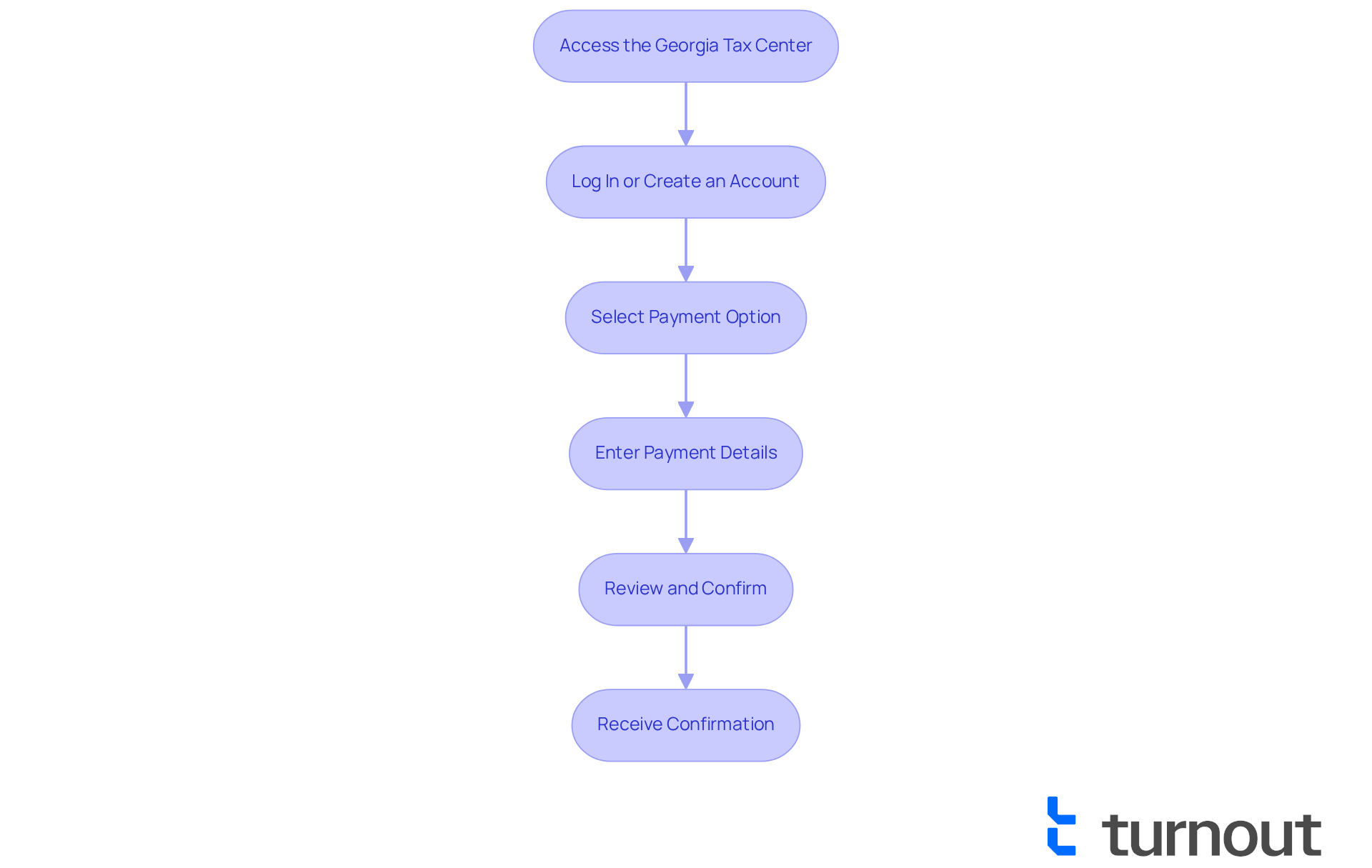

Follow the Step-by-Step Payment Process

Making a Georgia state tax payment may seem overwhelming, but we're here to guide you through the process. Follow these simple steps to ensure your transaction is handled smoothly:

- Access the Georgia Tax Center: Start by visiting the Georgia Tax Center. This is your gateway to managing your tax payments.

- Log In or Create an Account: If you already have an account, simply log in. If you’re new, take a moment to create an account by providing the necessary information. It’s a simple process that sets you up for success.

- Select Payment Option: Choose the type of transaction you wish to make, whether it’s individual income tax, estimated tax, or another option. Knowing what you need helps streamline the process.

- Enter Payment Details: Fill in the required details, including the amount you wish to pay and your bank information if you’re opting for electronic payment. Take your time to ensure accuracy here.

- Review and Confirm: Before you submit, double-check all entered information. It’s common to feel a bit anxious at this stage, but reviewing your details ensures everything is correct.

- Receive Confirmation: After submitting, make sure you receive a confirmation number or receipt. This is essential for keeping track of your transaction and provides peace of mind.

By following these steps, you can feel confident that your transaction will be processed efficiently and on time. Remember, you're not alone in this journey—many people navigate tax payments, and we're here to help you every step of the way.

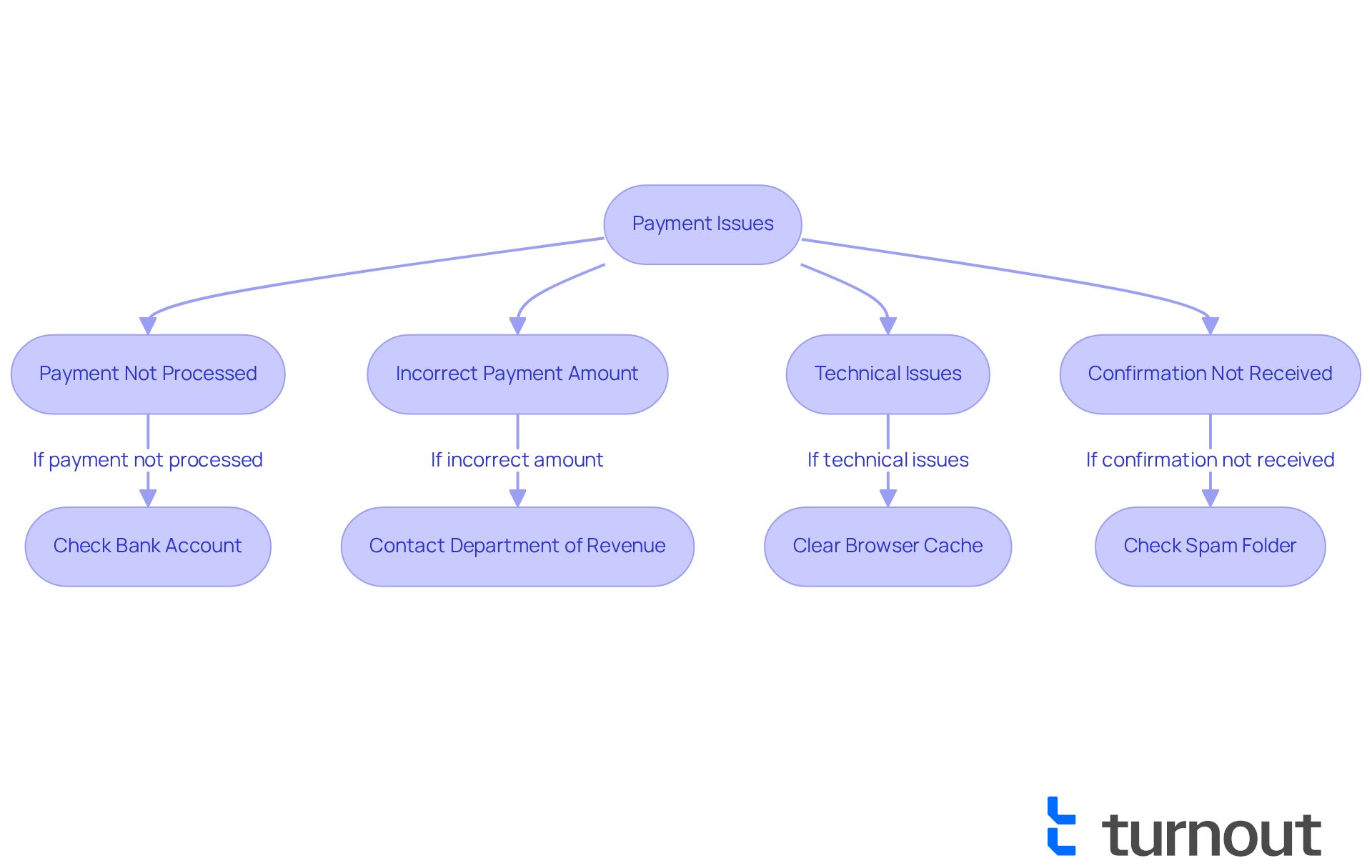

Troubleshoot Common Payment Issues

If you encounter issues while making your Georgia state tax payment, we recognize how frustrating that situation can be. Here are some troubleshooting tips to help you navigate the process with greater confidence:

- Payment Not Processed: If your payment does not appear to have been processed, please check your bank account for pending transactions. If no deduction has occurred, we encourage you to revisit the Tax Center to confirm your submission.

- Incorrect Payment Amount: It’s common to input the wrong amount. If you notice this, reach out to the Department of Revenue promptly. They are here to assist you in correcting the situation and modifying your fee.

- Technical Issues: If you encounter technical difficulties with the state tax center website, try clearing your browser cache or using a different browser. If problems persist, don’t hesitate to contact their support for assistance.

- Confirmation of Transaction Not Received: If you did not receive a confirmation after submitting your transaction, please check your spam folder for emails from the Georgia Department of Revenue. If you still cannot find it, reach out to their customer service for verification.

By being aware of these common issues and their solutions, remember that you are not alone in your Georgia state tax payment journey. We’re here to help you through it.

Conclusion

Understanding and managing Georgia state tax payments can feel overwhelming, but you are not alone in this journey. With the right knowledge and guidance, it becomes much more manageable. This article has provided a comprehensive overview of the essential components involved in making tax payments in Georgia, empowering you to navigate your obligations with confidence.

We understand that familiarizing yourself with the various types of taxes, adhering to deadlines, and selecting the appropriate payment methods can be challenging. That’s why we outlined a step-by-step guide to streamline the payment process, ensuring you can complete your transactions efficiently. If you encounter any issues, remember that troubleshooting tips were shared to help you address common problems, reinforcing that support is available whenever challenges arise.

Ultimately, mastering Georgia state tax payments is crucial for maintaining compliance and peace of mind. By taking proactive steps and utilizing the resources available, you can alleviate stress and ensure that your tax obligations are met in a timely manner. Embracing this knowledge not only simplifies your tax payment experience but also fosters a sense of empowerment in managing your financial responsibilities.

Frequently Asked Questions

What types of taxes are applicable in Georgia?

In Georgia, the applicable taxes include personal income tax, corporate income tax, property tax, and sales tax.

When are individual income tax returns due in Georgia?

Individual income tax returns in Georgia are typically due by May 1 each year.

What payment methods are available for Georgia state tax payments?

Georgia state tax payments can be made online through the Georgia Tax Center (GTC), by mail, or in person.

How can understanding tax types and deadlines help me?

Familiarizing yourself with the types of taxes you may owe and the deadlines can alleviate concerns and help you manage your tax obligations more effectively.