Introduction

We understand that navigating state tax obligations can feel overwhelming for Georgia residents. With the complexities of varying tax rates and deadlines, it’s common to feel lost. This guide is here to help you master Georgia state tax payments, providing a clear, step-by-step approach that equips you with the knowledge to confidently manage your responsibilities.

However, it’s important to recognize that changing regulations and potential pitfalls can make this journey even more challenging. How can you ensure compliance and avoid costly mistakes? You are not alone in this journey, and we’re here to support you every step of the way.

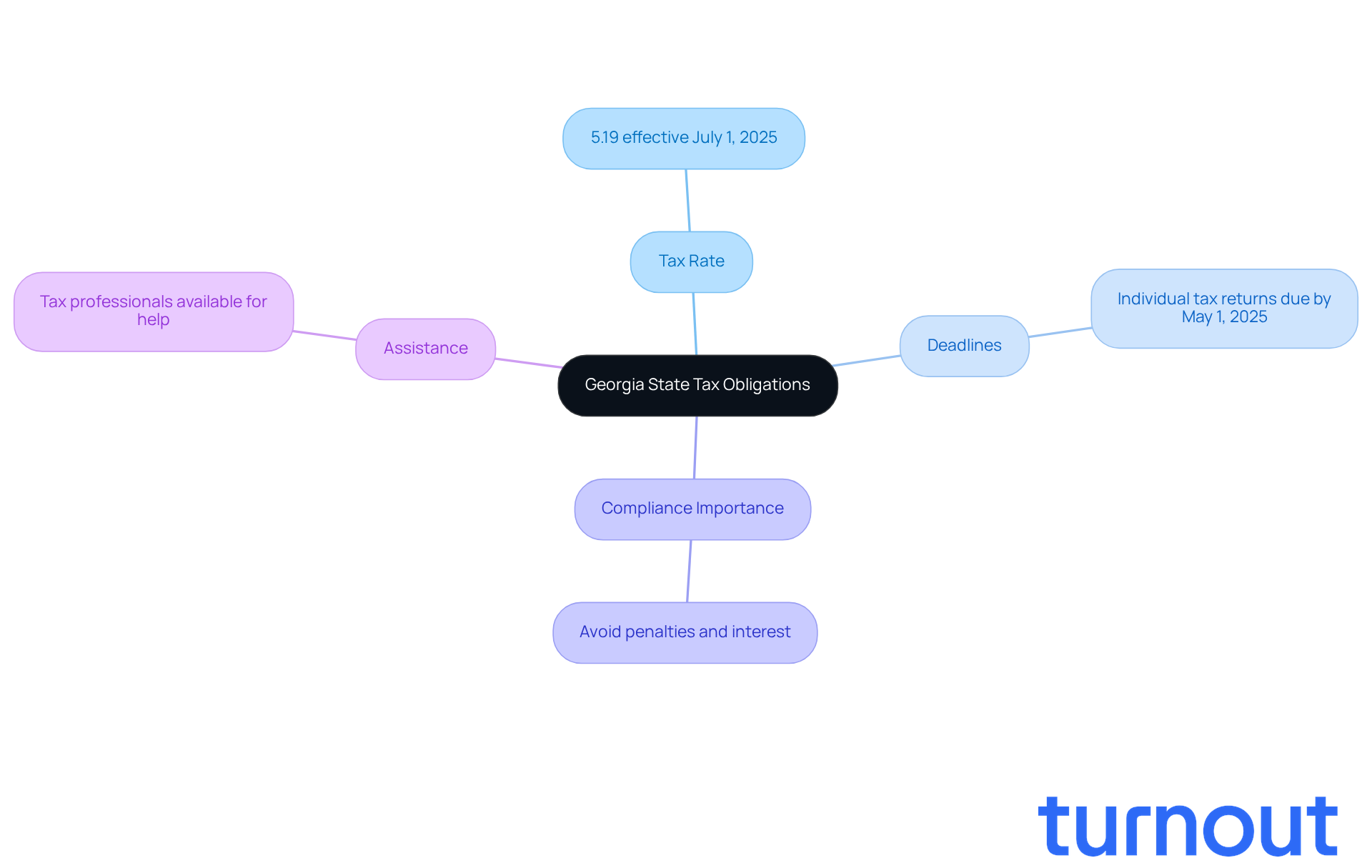

Understand Georgia State Tax Obligations

Managing your ga state tax payment can feel overwhelming, but understanding your obligations is the first step toward peace of mind. For the 2025 tax year, if you're a Georgia resident, it's important to know that you must make a ga state tax payment if your earnings exceed certain thresholds. The earnings tax rate is set at 5.19%, effective from July 1, 2025.

We understand that keeping track of deadlines can be stressful. Individual tax returns, which include the ga state tax payment, are due by May 1, 2025, aligning with federal deadlines. Staying informed about any changes in tax laws or rates is crucial, as these can significantly impact your overall tax liability. Remember, noncompliance can lead to penalties, interest, and other legal consequences.

As tax professionals often remind us, understanding these requirements is vital for maintaining good standing with the state. You're not alone in this journey; we're here to help you navigate these complexities and avoid unnecessary complications. If you have any questions or need assistance, don't hesitate to reach out.

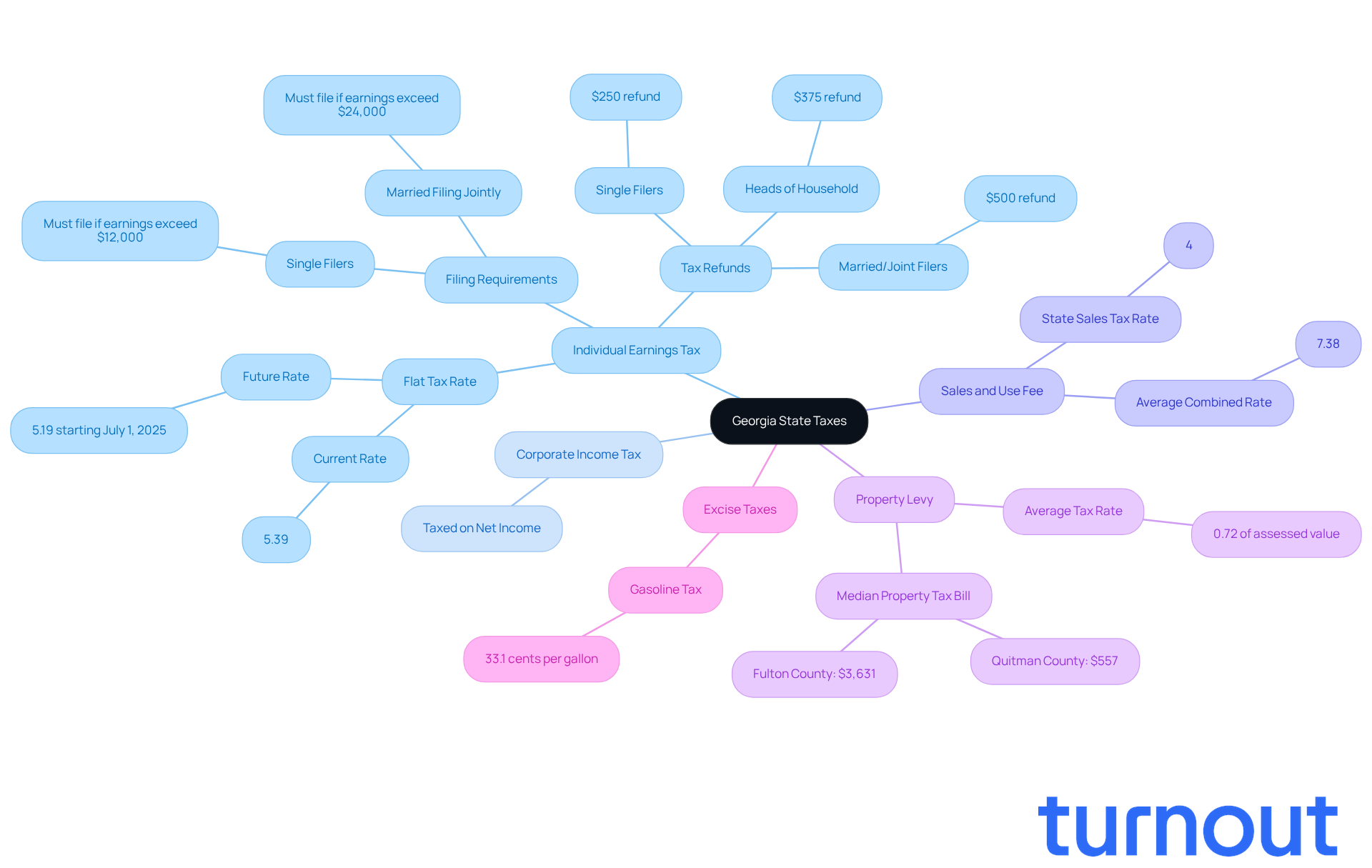

Identify Different Types of Georgia State Taxes

Navigating the various tax categories, such as the GA state tax payment, imposed by the state can feel overwhelming for both residents and businesses. We understand that grasping these categories is essential for determining your tax liabilities and ensuring compliance. Let’s take a closer look at the primary tax types that you might encounter:

-

Individual Earnings Tax: The state has a flat tax rate that’s set to decrease from 5.39% to 5.19% starting July 1, 2025. This tax applies to personal earnings, and it’s important to know that single filers must file if their earnings exceed $12,000, while married couples filing jointly need to file if their earnings surpass $24,000. A comforting aspect is that Social Security benefits aren’t taxed, which can be a relief for disabled individuals seeking assistance. Plus, qualifying taxpayers who filed in 2023 and 2024 will receive a one-time tax refund based on their filing status: $250 for single filers, $375 for heads of household, and $500 for married/joint filers.

-

Corporate Income Tax: If you’re running a corporation in Georgia, it’s taxed on its net income, which contributes to the state’s revenue.

-

Sales and Use Fee: A state sales charge of 4% is applied to most goods and services. Local jurisdictions can add their own levies, leading to an average combined sales rate of about 7.38%.

-

Property Levy: Property owners face fees based on the assessed value of their properties, with rates varying significantly by county. Typically, the property tax rate in the state is 0.72% of a home's assessed value. In 2022, the median property tax bill ranged from $557 in Quitman County to $3,631 in Fulton County, highlighting the disparities in property tax burdens across different regions.

-

Excise Taxes: These specific taxes apply to certain goods, like fuel. For instance, the state imposes an excise tax of 33.1 cents per gallon on gasoline.

By familiarizing yourself with these tax categories, you can better manage your financial obligations and avoid potential pitfalls related to GA state tax payment. Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

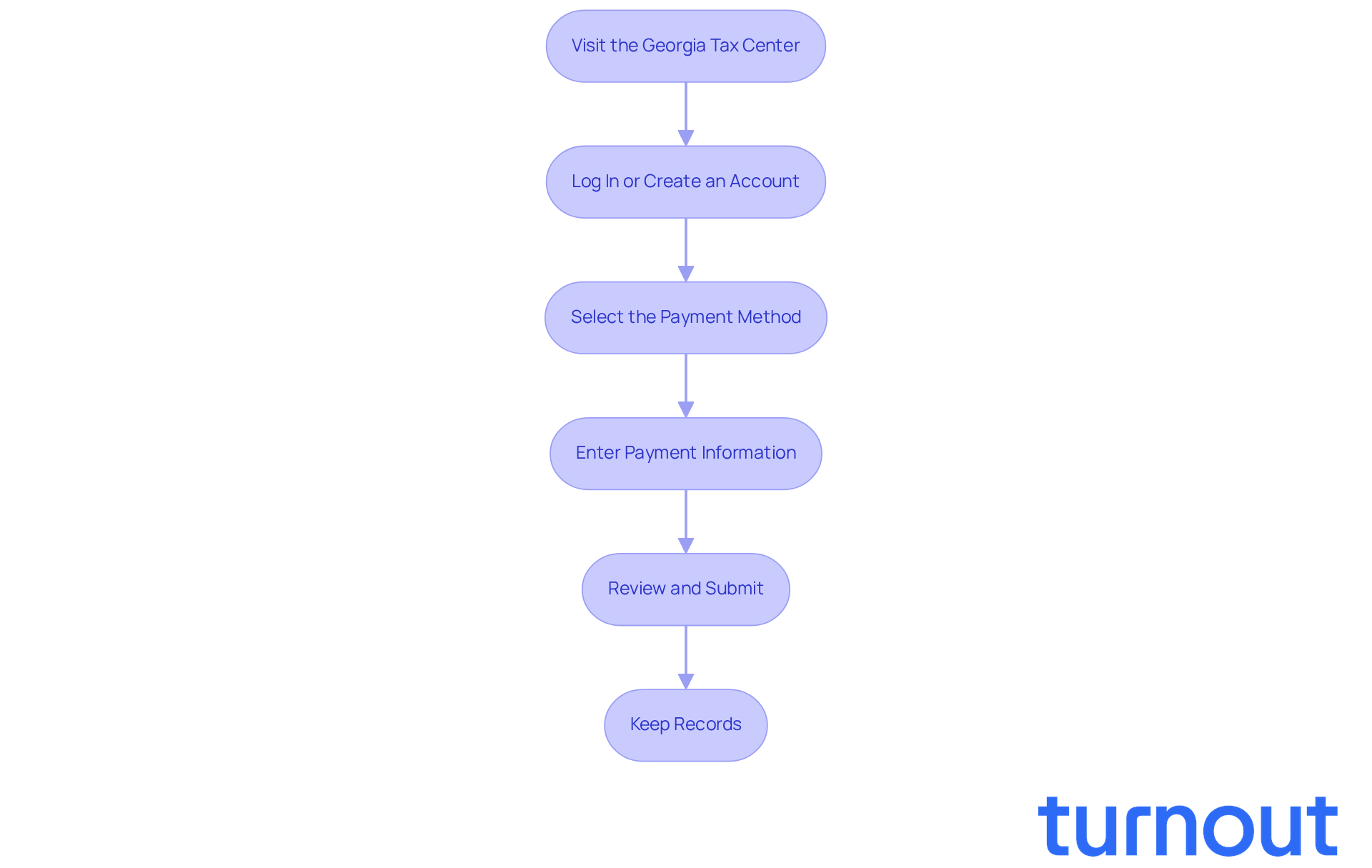

Make Your Georgia State Tax Payment

Making your ga state tax payment can feel overwhelming, but we're here to help you through it. Follow these simple steps to ensure a smooth experience:

-

Visit the Georgia Tax Center: Start by heading over to the Georgia Tax Center. This is your gateway to the online transaction portal.

-

Log In or Create an Account: If you already have an account, just log in. If you’re new, don’t worry! Creating an account is easy-just provide the necessary information.

-

Select the Payment Method: Choose the type of tax contribution you’re making, whether it’s individual income tax or corporate tax. We understand that making these decisions can be tricky, but take your time to select the right option.

-

Enter Payment Information: Now, input the details needed for your payment. This includes the amount you wish to pay and your bank account information if you’re paying electronically. Just a heads up: credit card transactions come with a convenience fee of 2.31%, with a minimum charge of $1.00.

-

Review and Submit: Before you hit submit, double-check all the information you’ve entered. Accuracy is key! Once you’re sure everything is correct, go ahead and submit your fee. You’ll receive a confirmation of your transaction, which is always a relief.

-

Keep Records: Finally, don’t forget to save any confirmation emails or receipts. These documents are important for future reference or in case any disputes arise. Remember, you’re not alone in this journey; keeping good records can make things easier down the line.

We understand that navigating the ga state tax payment process can be stressful, but following these steps can help ease your worries. If you have any questions or need further assistance, please reach out. We're here for you!

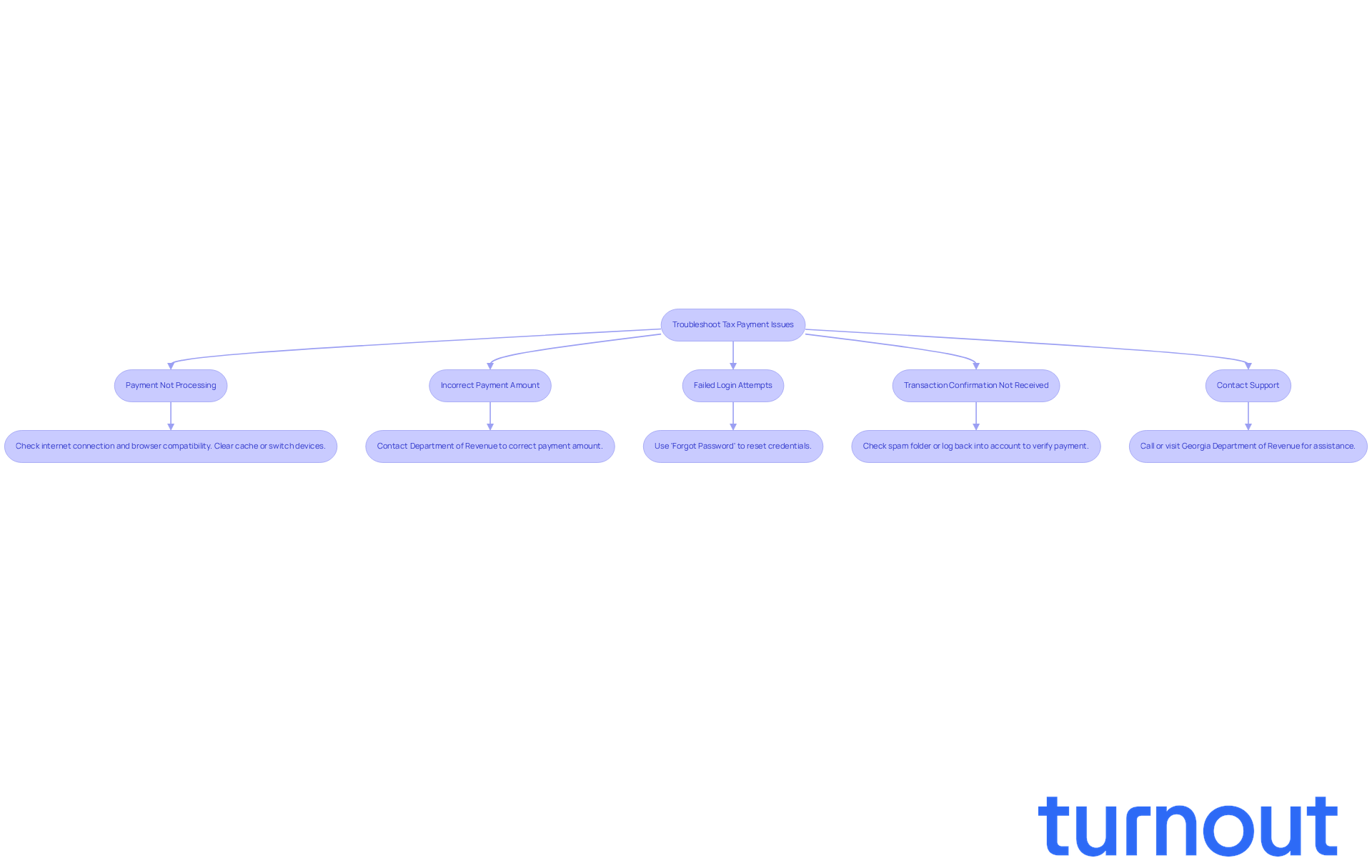

Troubleshoot Common Tax Payment Issues

If you’re facing challenges while making your GA state tax payment, we’re here to help. It’s completely normal to encounter a few bumps along the way, and we want to guide you through some troubleshooting steps that can ease your experience:

-

Payment Not Processing: We understand how frustrating it can be when your payment doesn’t go through. First, check that your internet connection is stable and that you’re using a compatible browser. If the issue continues, try clearing your browser’s cache or switching to a different device.

-

Incorrect Payment Amount: Double-check the amount you entered. If you realize there’s an error after submitting, don’t worry! Just contact the state Department of Revenue promptly to correct the situation related to your GA state tax payment. They’re there to assist you.

-

Failed Login Attempts: If you’re having trouble logging into your Georgia Tax Center account, it’s common to forget passwords. Use the 'Forgot Password' feature to reset your credentials, and make sure you’re entering the correct information.

-

Transaction Confirmation Not Received: Not receiving a confirmation email after completing a transaction can be concerning. Check your spam folder first. If it’s not there, log back into your account to verify if your payment was processed. You deserve peace of mind.

-

Contact Support: If you still have unresolved issues, please reach out to the Georgia Department of Revenue. You can call their customer service number or visit their website for assistance. Remember, you’re not alone in this journey.

Conclusion

Understanding Georgia's state tax payment process is essential for both residents and businesses. We know that navigating tax obligations can feel overwhelming, but familiarizing yourself with deadlines and payment methods can help you manage your responsibilities with confidence. Staying informed about tax laws is crucial; it ensures compliance and helps you recognize the various types of taxes applicable in Georgia.

Key insights include the specifics of individual earnings tax, corporate income tax, and other tax categories you may encounter. Our step-by-step guide to making a Georgia state tax payment, along with troubleshooting common issues, offers practical support for taxpayers. By following these guidelines, you can streamline your tax payment process and reduce stress.

Ultimately, being proactive about your Georgia state tax obligations not only aids in compliance but also fosters your financial well-being. Remember, you are not alone in this journey. It's essential to stay informed, seek assistance when needed, and keep accurate records. Taking these steps can lead to a smoother tax experience and peace of mind, ensuring that you meet your obligations without unnecessary complications.

Frequently Asked Questions

What are the Georgia state tax obligations for residents in 2025?

Georgia residents must make a state tax payment if their earnings exceed certain thresholds for the 2025 tax year.

What is the tax rate for Georgia state tax in 2025?

The earnings tax rate is set at 5.19%, effective from July 1, 2025.

When are individual tax returns due for Georgia residents in 2025?

Individual tax returns, which include the Georgia state tax payment, are due by May 1, 2025, aligning with federal deadlines.

Why is it important to stay informed about tax laws and rates?

Staying informed about changes in tax laws or rates is crucial because these can significantly impact your overall tax liability.

What are the consequences of noncompliance with Georgia state tax obligations?

Noncompliance can lead to penalties, interest, and other legal consequences.

How can I get assistance with my Georgia state tax obligations?

If you have questions or need assistance, you can reach out for help in navigating the complexities of Georgia state tax requirements.