Overview

Navigating tax relief can be daunting, especially when dealing with back taxes. This article offers a compassionate, step-by-step guide to completing Form 433-A, a crucial tool for those seeking assistance from the IRS. We understand that accurately reporting your financial information is vital, as it directly impacts your eligibility for relief options like installment agreements or offers in compromise.

Completing this form thoroughly can lead to better outcomes, providing you with the relief you deserve. Remember, you are not alone in this journey. Many have faced similar challenges, and with careful attention to detail, you can increase your chances of success.

Take a moment to reflect on your situation. Are you feeling overwhelmed by the process? It's common to feel this way, but rest assured that support is available. By following this guide, you can approach your application with confidence and clarity. We're here to help you every step of the way.

Introduction

Form 433-A serves as a vital lifeline for individuals facing the complexities of tax relief, especially for those with disabilities who are navigating financial challenges. We understand that this process can feel overwhelming, and this detailed guide aims to demystify the purpose of this essential document. Our step-by-step instructions are designed to empower you, helping you complete it effectively. Yet, it's common to encounter potential pitfalls along the way. How can you ensure accuracy and completeness to avoid delays or denials? We're here to help you through this journey.

Understand the Purpose of Form 433-A

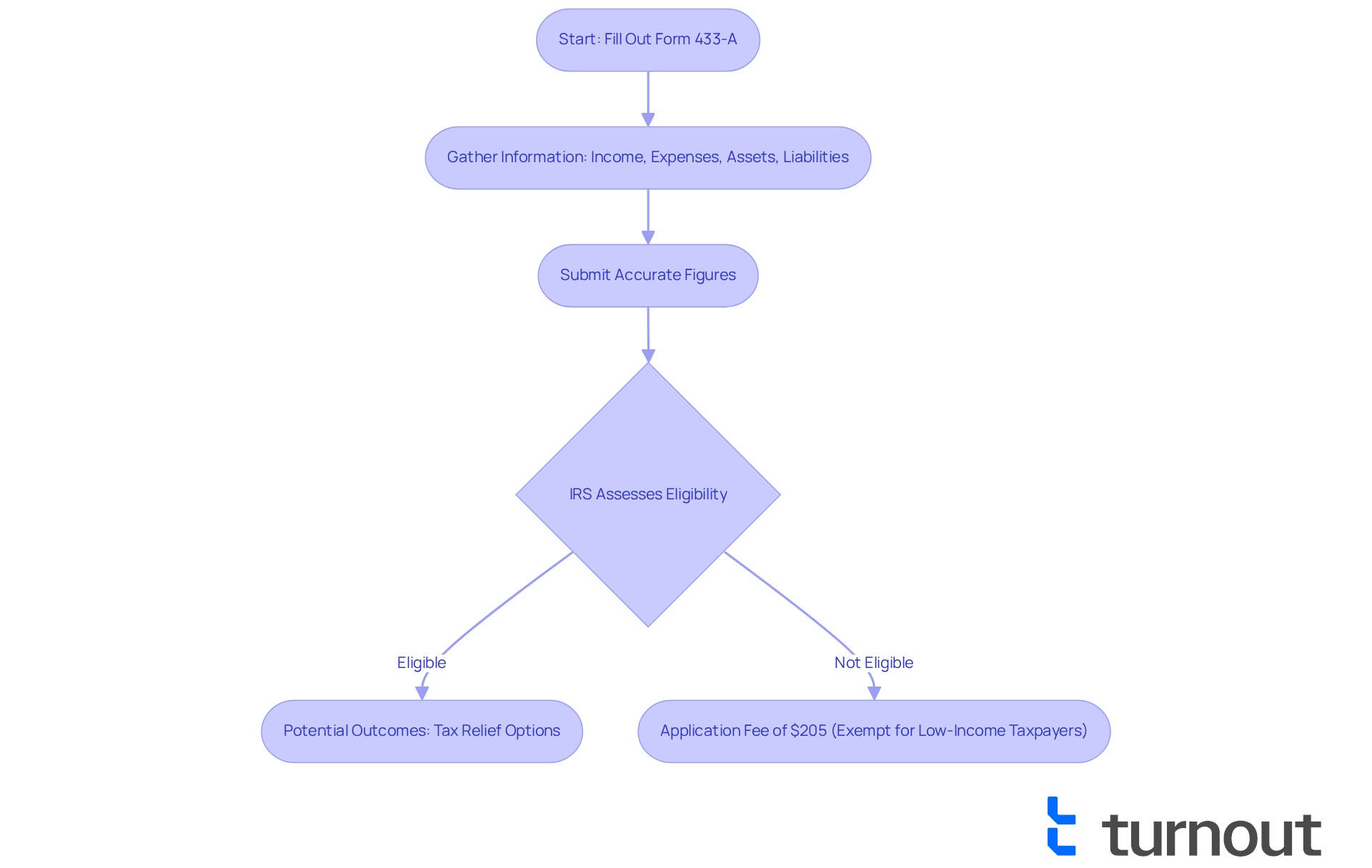

Form 433-A, which is referred to as the Collection Information Statement, plays a vital role for individuals dealing with the burden of back taxes. We understand that this can be a challenging time, and form 433-a is designed to help the IRS assess your economic situation. It gathers detailed information about your income, expenses, assets, and liabilities, allowing the IRS to determine your eligibility for various tax relief options, such as installment agreements or offers in compromise.

In 2025, the application fee for an Offer in Compromise is $205. However, if you're a low-income taxpayer, you are exempt from this charge, which can be a significant relief during tough financial times. Recognizing this purpose highlights the importance of accuracy and completeness when filling out form 433-a, as it directly influences the IRS's decision regarding your tax relief request.

Tax professionals emphasize the importance of submitting precise figures instead of estimates. It's common to feel overwhelmed, but providing accurate information is critical for a successful application. For instance, the IRS may allow temporary delays in payments for individuals facing economic difficulties, assessed on a case-by-case basis.

Practical examples show that individuals who take the time to carefully complete form 433-a often achieve better outcomes in their discussions with the IRS. This underscores the crucial role of the form 433-a in securing financial assistance. Additionally, taxpayers can utilize the IRS Offer in Compromise Pre-Qualifier tool to check their eligibility for free. This resource is here to support you as you navigate this complex process. Remember, you are not alone in this journey, and we're here to help.

Identify Who Needs to Complete Form 433-A

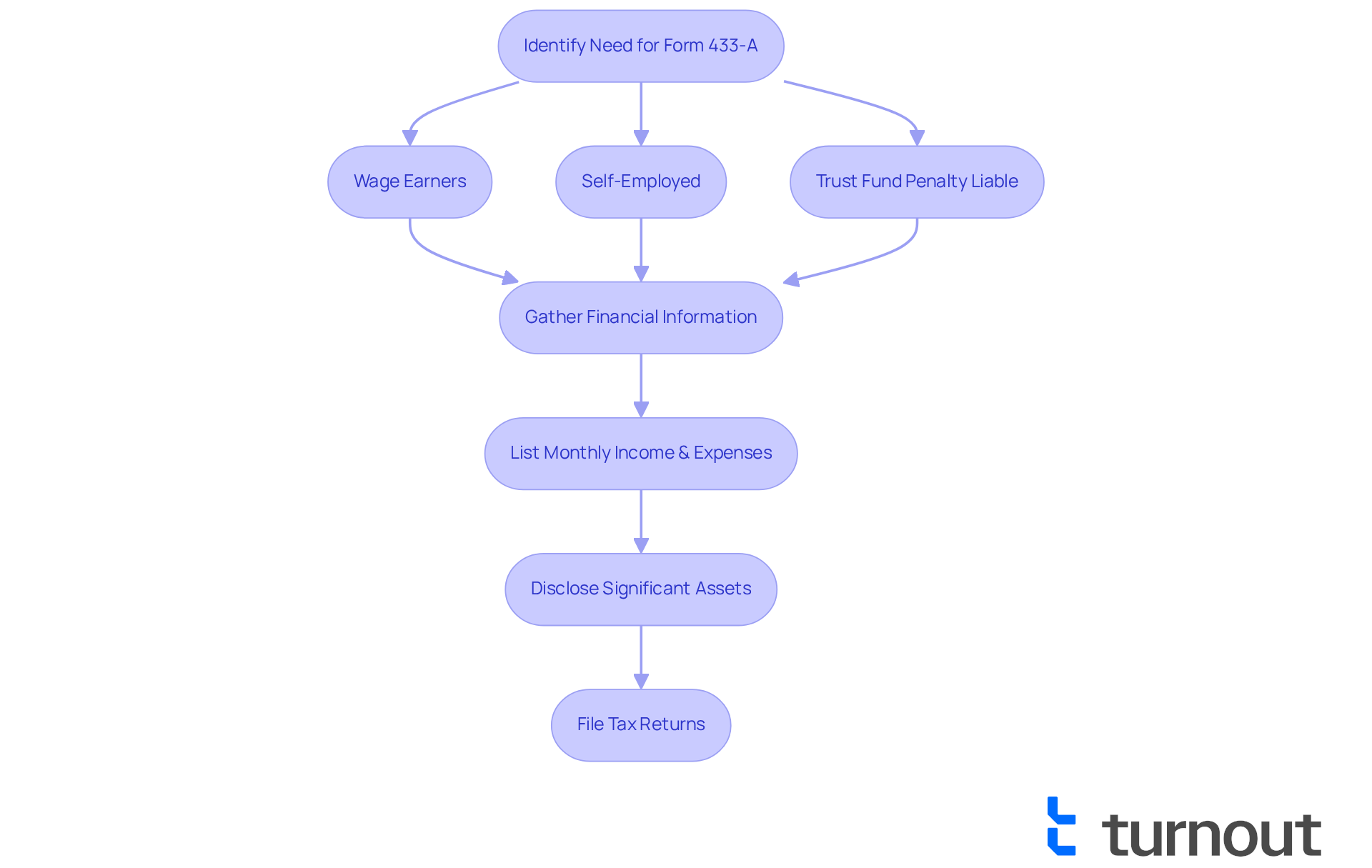

If you owe income taxes and are exploring relief options from the IRS, know that you are not alone in this journey. This document is crucial for wage earners, self-employed individuals, and those liable for Trust Fund Recovery Penalties. If you've received a notification from the IRS requesting this document or are considering a payment plan or settlement proposal, completing the necessary paperwork is essential. Understanding your obligation to fill out this form is the first step toward effectively navigating your tax relief options.

We understand that accurately completing the form 433-a is critical for taxpayers seeking to negotiate payment agreements. This form gathers essential information about your economic situation, including income, expenses, and assets. The IRS uses this information to evaluate your eligibility for various relief programs. Additionally, you will need to describe important business assets and their locations, and submit supporting documents like bank statements and pay stubs to illustrate your financial situation.

Many taxpayers applying for IRS installment agreements face financial hardships, including those with disabilities or significant medical expenses. Successfully submitting the required document has enabled numerous individuals to secure feasible payment arrangements, ultimately reducing their tax obligations.

To qualify for tax relief, it’s vital to meet specific criteria when completing the application. This includes:

- Providing detailed information about your monthly income and expenses.

- Disclosing any significant assets.

- Ensuring that all tax returns and estimated payments are filed before applying for an Offer in Compromise (OIC).

By diligently completing form 433-a, you show your willingness to cooperate with the IRS in resolving your tax obligations, paving the way for potential relief options. Remember, inaccuracies in the forms can lead to complications, delays, or legal repercussions, so it's imperative to ensure accuracy throughout the process.

Follow Step-by-Step Instructions to Complete Each Section

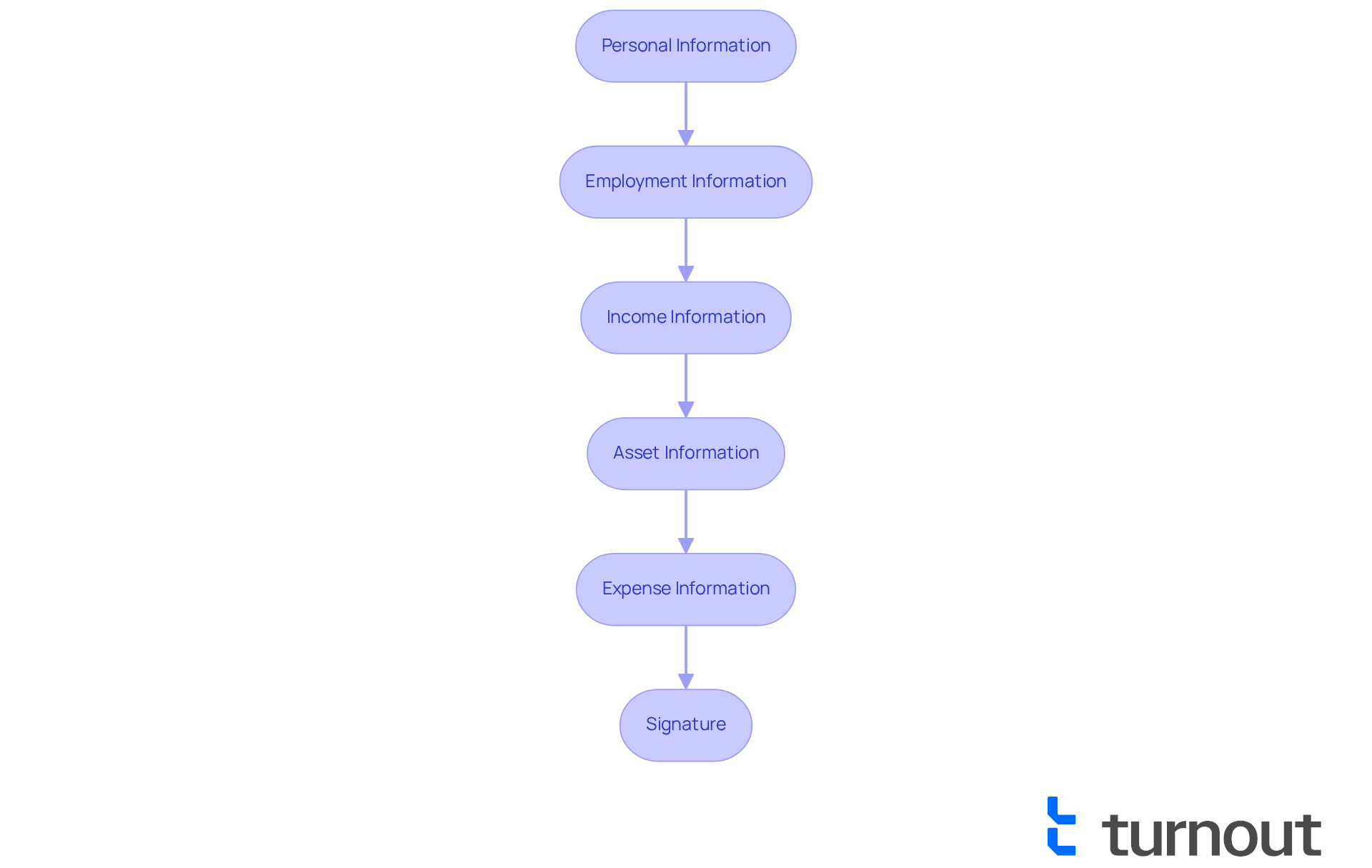

We understand that completing Form 433-A accurately can feel overwhelming. Follow these detailed steps for each section to ease your process:

- Personal Information: Start by entering your full name, Social Security number, and contact details. If applicable, include your spouse's information to provide a complete picture of your situation.

- Employment Information: Share comprehensive details about your current employment, including your employer's name, address, and job title. If you are self-employed, include your business name and type of business, and ensure you complete Section 6 with details about your business operations.

- Income Information: List all sources of income, such as wages, Social Security benefits, and any additional income streams. This information should be comprehensive and precise to represent your economic situation accurately.

- Asset Information: Detail your assets, including bank accounts, real estate, vehicles, and other significant possessions. Be sure to include their estimated values and detailed account and balance information to give the IRS a clear understanding of your economic status.

- Expense Information: Outline your monthly expenses, including housing, utilities, food, and transportation. This breakdown will assist the IRS in evaluating your monetary responsibilities and capacity to pay.

- Signature: Remember to sign and date the form. An unsigned form may lead to rejection, delaying your application.

By meticulously following these steps, you can ensure that your form 433-a is completed accurately, which is essential for a successful tax relief application. We know that common mistakes include omitting details about income sources or failing to provide accurate asset valuations, which can hinder your chances of approval. Taxpayers who offer detailed economic disclosures often experience improved results in their relief requests. Keith Jones emphasizes, "Whether you're filing for yourself or your business, my expertise will ensure that the form is completed properly, helping you avoid mistakes that could delay your case or lead to further complications with the IRS."

Ensuring that all sections are filled out correctly not only streamlines the process but also enhances your eligibility for programs like the Offer in Compromise or Installment Agreements. If your tax obligation exceeds $50,000 or cannot be settled within 72 months, consider the implications of the 433-H document. Explore options like Currently Not Collectible (CNC) status if you're experiencing financial hardship. Remember, you are not alone in this journey; we’re here to help.

Troubleshoot Common Issues and Questions

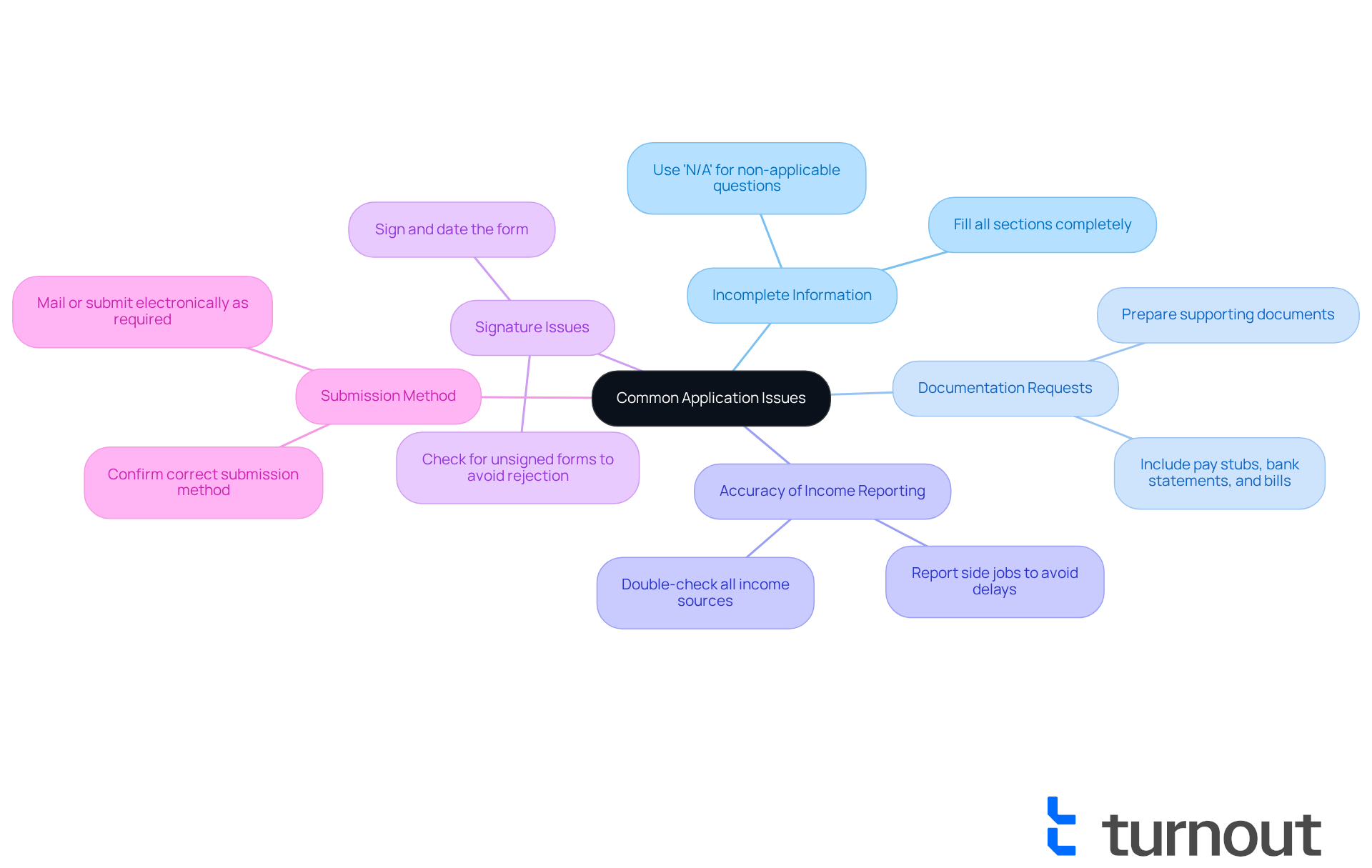

While filling out the application, we understand that you may encounter several common challenges. Here are some supportive tips to help you navigate the process:

- Incomplete Information: It's essential to ensure that all sections are filled out completely. If a question doesn’t apply to you, simply write 'N/A' instead of leaving it blank. Incomplete entries can significantly delay processing your application, and we want to help you avoid that.

- Documentation Requests: Be prepared to provide supporting documentation for the information you report. This may include pay stubs, bank statements, and bills. The IRS may request verification of your financial details, so having these documents ready can help expedite your application.

- Accuracy of Income Reporting: Double-check that all income sources are reported accurately. Missing income can lead to delays or even denials of your relief request. For instance, failing to report a side job could jeopardize your chances of receiving assistance. As J. David Tax Law states, "It is crucial to provide accurate information," since inaccuracies can lead to penalties or serious consequences.

- Signature Issues: Remember to sign and date the form. An unsigned form will be rejected, causing unnecessary delays in processing your request. We want to ensure you don’t face any setbacks.

- Submission Method: Confirm the correct submission method for your form. Depending on your situation, you may need to mail it to a specific IRS address or submit it electronically. Incorrect submission methods can lead to further complications, and we're here to guide you through it.

By recognizing these common challenges and preparing for them, you can simplify the process of completing and submitting your application, enhancing your likelihood of a positive outcome. After submission, the IRS will review your form 433-a to assess your financial situation and determine eligibility for relief options. Remember, you are not alone in this journey, and we are here to help you every step of the way.

Conclusion

Mastering Form 433-A is vital for individuals seeking tax relief, especially for those with disabilities who may be experiencing financial hardships. This guide highlights the significance of this form as a means for the IRS to evaluate economic situations and determine eligibility for various relief options. By grasping the purpose and detailed steps involved in completing this form, taxpayers can navigate the complexities of their financial obligations with greater confidence.

We understand that filling out this form can be daunting. Key insights shared throughout the article emphasize the necessity of providing accurate and complete information, the importance of supporting documentation, and the common challenges faced when completing the form. Remember, meticulous attention to detail can lead to improved outcomes in negotiations with the IRS. Additionally, resources like the IRS Offer in Compromise Pre-Qualifier tool are valuable aids in this process.

Ultimately, successfully completing Form 433-A can open the door to much-needed financial relief. It is crucial for individuals to take proactive steps in managing their tax obligations, ensuring they do not feel overwhelmed by the process. By approaching the completion of this form with diligence and care, you can unlock potential relief opportunities and regain control over your financial future. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Form 433-A?

Form 433-A, known as the Collection Information Statement, is used by individuals dealing with back taxes to provide the IRS with detailed information about their economic situation, including income, expenses, assets, and liabilities.

What is the purpose of Form 433-A?

The purpose of Form 433-A is to help the IRS assess an individual's financial situation to determine their eligibility for tax relief options, such as installment agreements or offers in compromise.

What is the application fee for an Offer in Compromise in 2025?

The application fee for an Offer in Compromise in 2025 is $205. However, low-income taxpayers are exempt from this fee.

Why is accuracy important when filling out Form 433-A?

Accuracy is crucial when filling out Form 433-A because the information provided directly influences the IRS's decision regarding tax relief requests. Submitting precise figures instead of estimates can lead to better outcomes.

Can individuals facing economic difficulties request temporary delays in payments?

Yes, individuals facing economic difficulties may request temporary delays in payments, which are assessed by the IRS on a case-by-case basis.

How can taxpayers check their eligibility for an Offer in Compromise?

Taxpayers can use the IRS Offer in Compromise Pre-Qualifier tool to check their eligibility for free.

What support is available for individuals navigating the tax relief process?

Individuals can seek support from tax professionals and utilize resources like the IRS Offer in Compromise Pre-Qualifier tool to help them navigate the complex process of seeking tax relief.