Overview

Navigating the complexities of Form 433-A OIC can feel overwhelming, especially for those seeking an Offer in Compromise (OIC) with the IRS. This article aims to provide a comprehensive guide to help you master this essential form. It's crucial to complete the form accurately, including detailed financial information, as this significantly influences the IRS's decision on your OIC.

We understand that the submission process can be daunting. That's why we offer practical tips and highlight common pitfalls to avoid, ensuring you feel supported every step of the way. Remember, you are not alone in this journey, and with the right guidance, you can approach the IRS with confidence.

Take a moment to reflect on your situation. Are you feeling uncertain about how to present your financial details? By following our guide, you will gain the knowledge and tools needed to submit your OIC successfully. Together, we can navigate this process, making it less intimidating and more manageable.

In conclusion, we encourage you to take action. With careful preparation and our supportive insights, you can increase your chances of a favorable outcome. We're here to help you every step of the way.

Introduction

Navigating the complex landscape of tax debt can often feel overwhelming. We understand that submitting an Offer in Compromise (OIC) to the IRS may seem like an insurmountable challenge. Central to this process is Form 433-A OIC, a vital document that gives the IRS a comprehensive view of your financial situation. By mastering the completion of this form, you can significantly increase your chances of achieving a favorable outcome in your quest for tax relief.

However, it’s common to encounter pitfalls that could derail this process. What can you do to ensure that your submission stands out in a sea of applications? We're here to help you navigate these challenges with confidence.

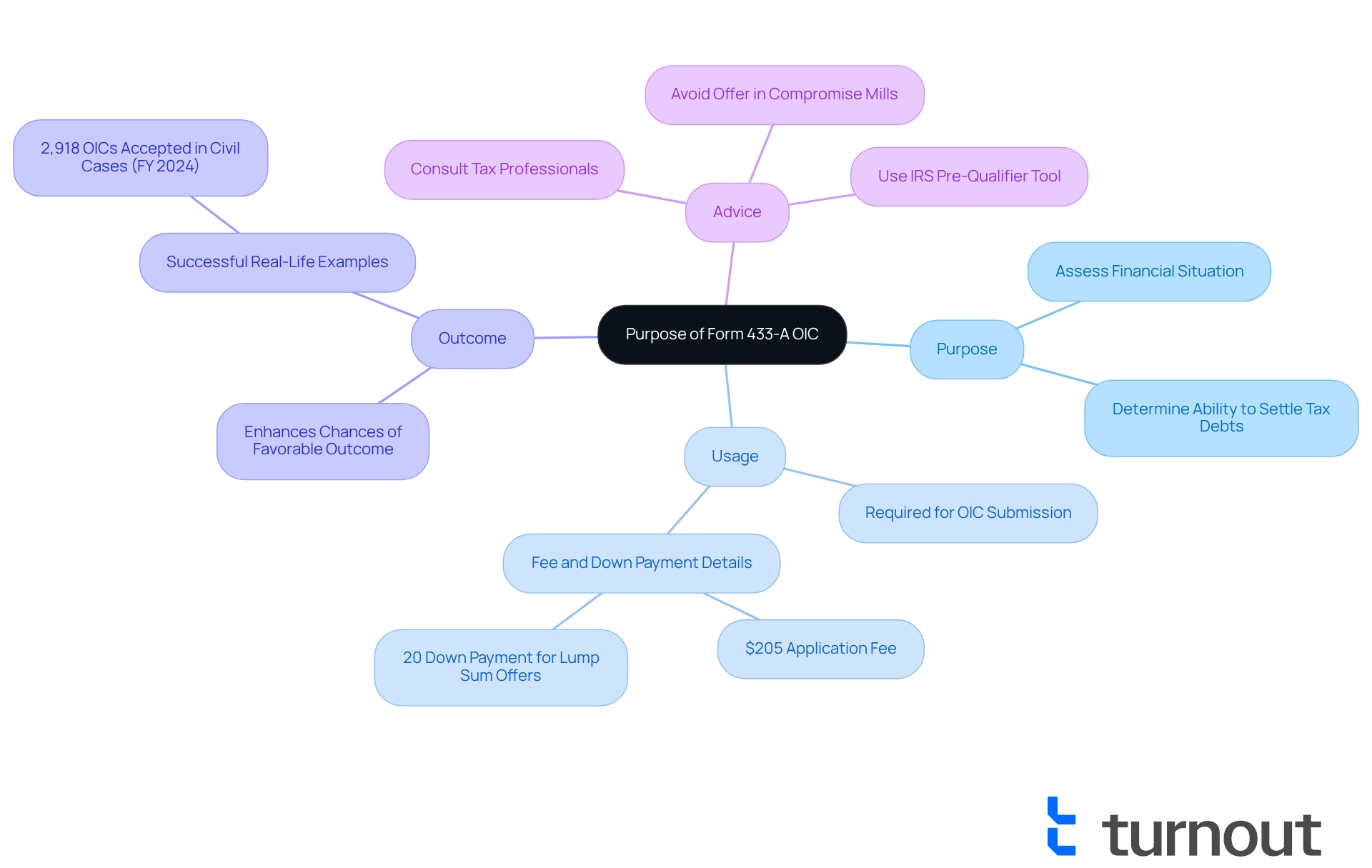

Understand the Purpose of Form 433-A OIC

, officially referred to as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is crucial for the 's assessment of your financial situation while you are pursuing an (OIC). This important document, form 433-a oic, provides a thorough overview of your income, expenses, assets, and liabilities, allowing the IRS to determine your ability to settle for less than the total amount owed.

The main goal of form 433-A OIC is to provide the IRS with a clear picture of your , which is crucial for assessing the reasonableness of your offer.

Usage:

Form 433-a OIC is required when submitting an OIC, as it supplies the that the IRS needs to make a well-informed decision. Additionally, a $205 fee is necessary for submitting an OIC, and if you are proposing a lump sum, a down payment of 20% of the offer is required.

Outcome:

By carefully completing the form 433-A OIC, you enhance your chances of a favorable outcome, as this form allows the IRS to evaluate whether your proposal aligns with your financial reality.

Real-life examples illustrate the effectiveness of 433-A OIC in securing . In fiscal year 2024, the IRS accepted 2,918 OICs in civil cases where the unpaid tax assessed was $50,000 or more, showcasing the potential for relief through this process. Moreover, tax professionals emphasize that a well-prepared form 433-a oic can significantly influence discussions with the IRS, providing clarity and validating your financial claims. They also advise caution against 'offer in compromise mills' that may mislead individuals about their qualifications, which could lead to substantial financial losses.

Understanding the importance of form 433-a oic not only prepares you for the submission process but also empowers you to navigate the complexities of with confidence. For additional support, consider using the IRS pre-qualifier tool to check your eligibility for an Offer in Compromise, and refer to the Offer in Compromise Booklet for comprehensive information on the process.

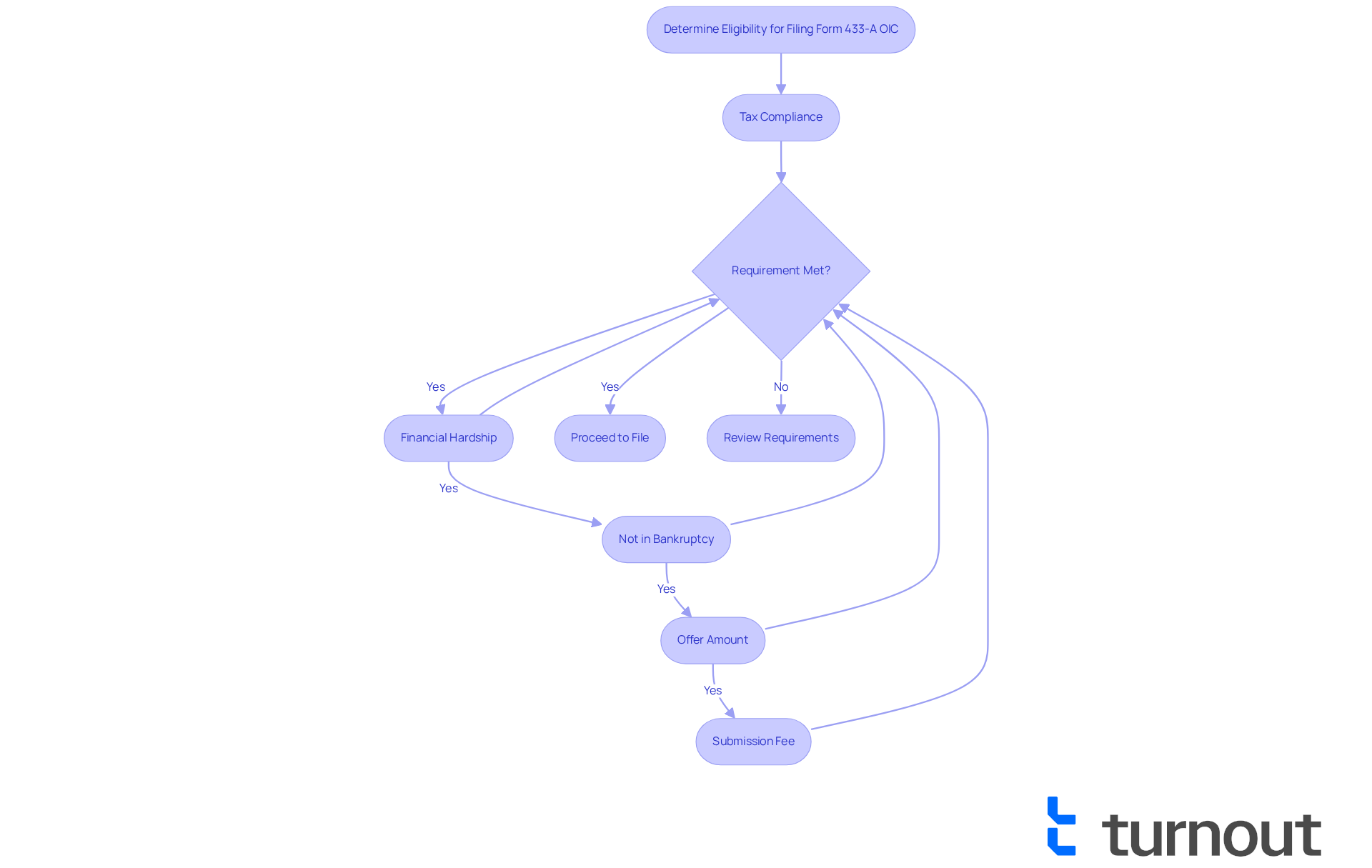

Determine Eligibility for Filing Form 433-A OIC

Before you file the form 433-a oic, it is essential to confirm your eligibility based on . We understand that navigating this process can be overwhelming, so let’s break down the key requirements together:

- : Make sure all required tax returns are filed and necessary estimated payments are made. This is a crucial step to show your commitment.

- : You must demonstrate an inability to pay your tax debt in full due to financial hardship. The IRS evaluates this on a case-by-case basis, recognizing that everyone's situation is unique.

- Not in Bankruptcy: You cannot be in an open bankruptcy proceeding. It's important to check your status here.

- : The proposed offer must be reasonable and reflective of your financial situation. This is where honesty about your circumstances plays a vital role.

- Submission Fee: Remember, there is a non-refundable submission fee of $205 associated with filing a Form 433-A OIC.

Steps to Determine Eligibility:

- Review your tax filing status to ensure all returns are submitted. Have you checked this yet?

- Assess your current financial situation to verify that you truly cannot pay your tax debt. It's okay to seek help if you're uncertain.

- Check your ; you must not have filed for bankruptcy in the past seven years. We understand that this can be a sensitive topic.

Furthermore, keep in mind that the IRS approves fewer than half of all Offer in Compromise requests. This makes it even more crucial to meet these criteria for a successful submission. If you're feeling unsure, it’s wise to seek advice from a qualified . They can help you navigate the complex requirements of the process and explore other payment options if relevant. Remember, applying too early can lead to rejection, and you are not alone in this journey.

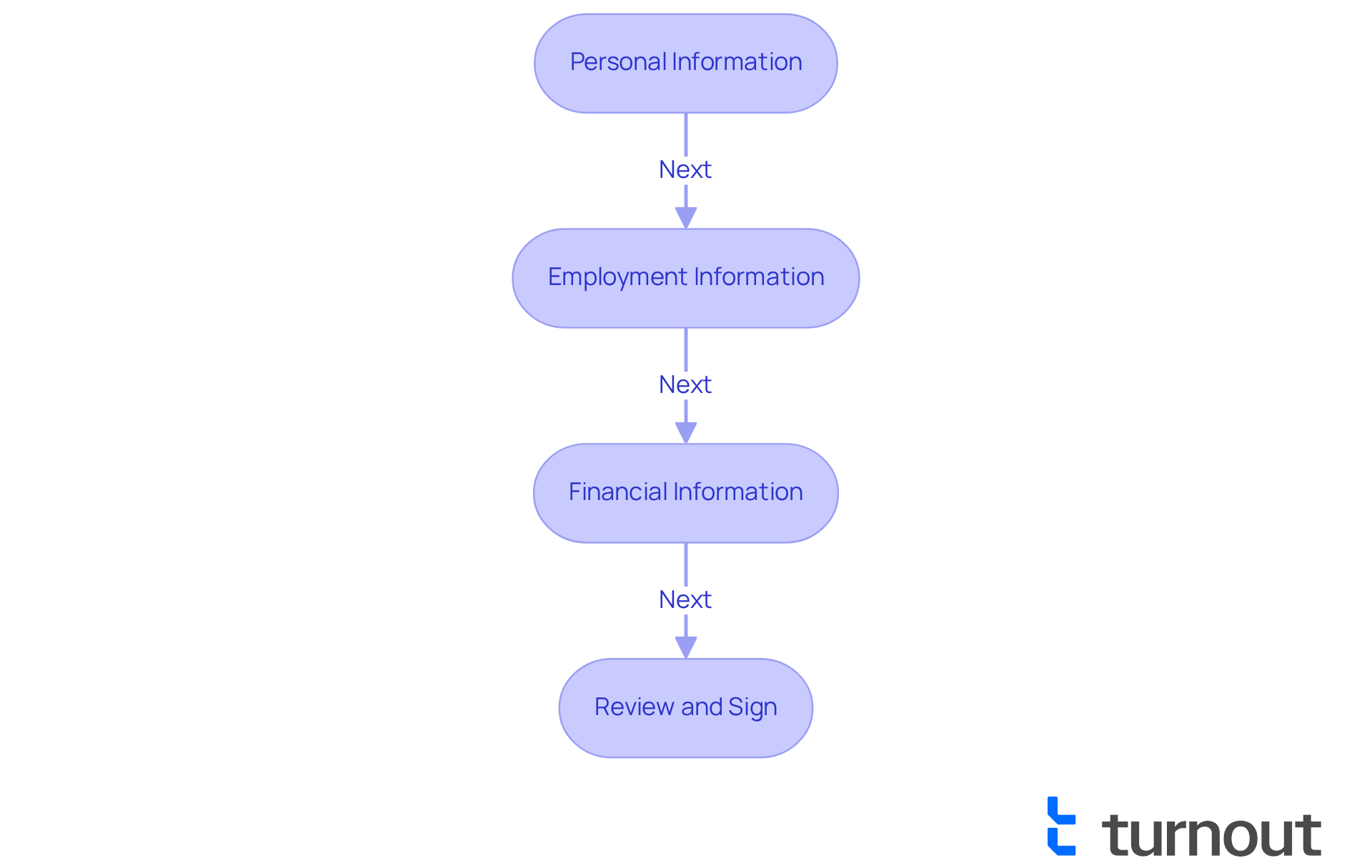

Complete Form 433-A OIC: Step-by-Step Instructions

Filling out the requires careful attention to detail across several sections that describe your . We understand that this process can feel overwhelming, so we’ve provided step-by-step instructions to help you ensure accuracy and completeness:

Step 1: Personal Information

- Please enter your full name, address, and Social Security number.

- If applicable, don’t forget to include your spouse's information as well.

Step 2: Employment Information

- Share details about your current employment, including your employer's name, address, and your income.

- For those who are self-employed, include relevant business information and your income details.

Step 3: Financial Information

- Assets: List all assets, such as bank accounts, real estate, and vehicles, specifying the market value of each.

- Income: Document all sources of income, including wages, self-employment income, and any additional earnings.

- Expenses: Detail your monthly expenses, covering housing, utilities, food, transportation, and any other necessary costs.

Step 4: Review and Sign

- Carefully double-check all entries for accuracy, ensuring that every required field is filled out completely.

- Remember to sign and date the form before submission.

Tips:

- Use precise figures when reporting income and expenses to avoid common errors, which can lead to .

- Retain copies of all documents submitted for your records, as this can be crucial if the later. The IRS may request verification after receiving the form.

- Be aware that the application fee for an is $205, although low-income taxpayers are exempt from this fee.

- The IRS intends to handle 433-A requests within 30 days, but actual processing durations may differ.

- As Timothy S. Hart emphasizes, " are key as you work through form 433-A OIC - the IRS will check your supporting documents in great detail to ensure that you have disclosed everything."

By following these steps and maintaining accuracy, you can enhance your chances of a successful submission for an [Offer in Compromise](https://irs.gov/newsroom/an-offer-in-compromise-can-help-certain-taxpayers-resolve-tax-debt). Remember, we’re here to help, and you are not alone in this journey.

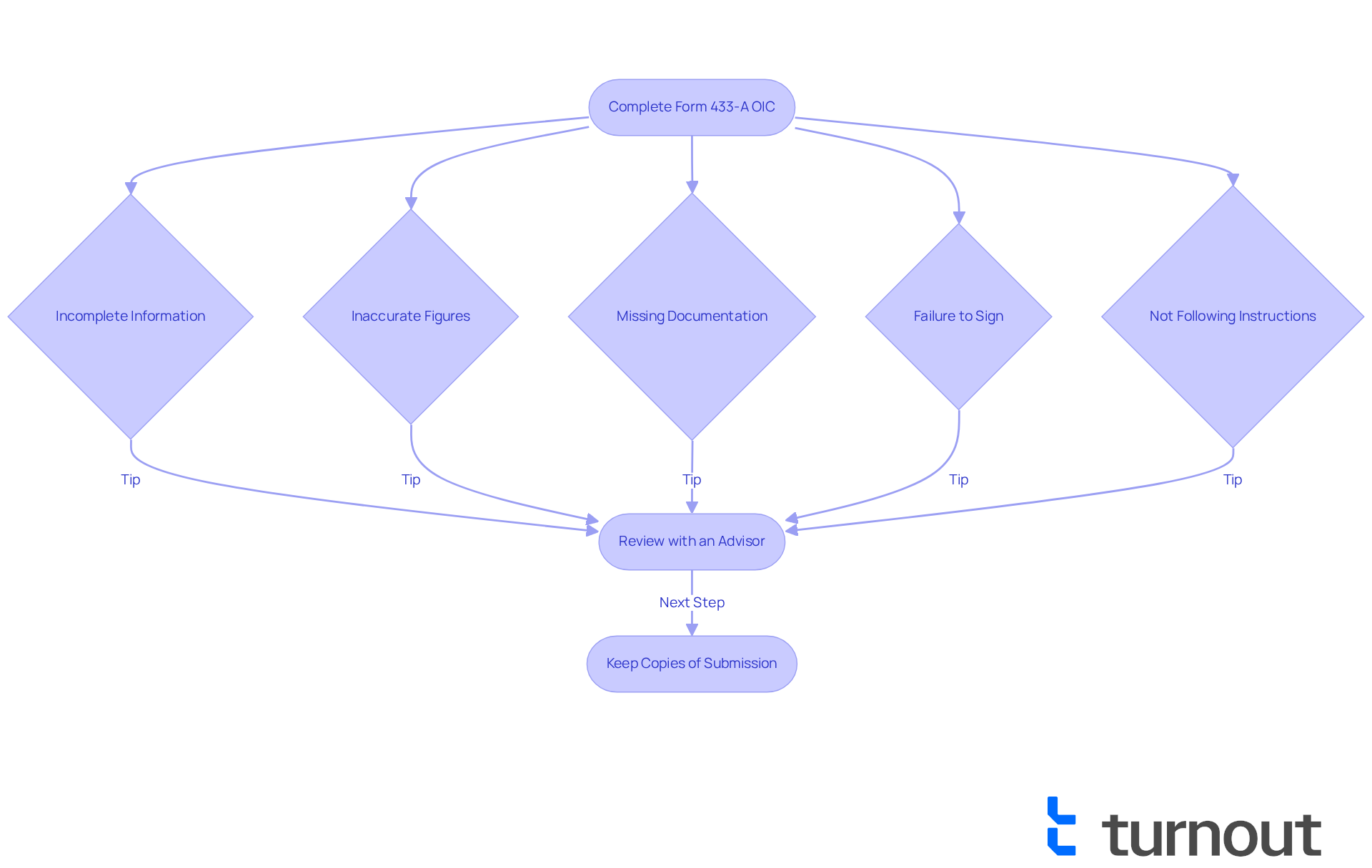

Avoid Common Mistakes When Completing Form 433-A OIC

When filling out the form 433-a oic, we understand that steering clear of typical errors is vital for the success of your submission. Here are some :

- Incomplete Information: It’s important to . The that lack necessary details, which can be frustrating.

- Inaccurate Figures: is essential. Simple mathematical mistakes can lead to the denial of your submission, and we want to help you avoid that.

- : Remember to to support your financial claims, such as pay stubs, bank statements, and expense receipts. Missing documents can significantly weaken your case, and we want you to present the strongest application possible.

- Failure to Sign: Don’t forget to . An unsigned form will be deemed invalid, halting your progress, which can be discouraging.

- Not Following Instructions: Carefully reading the instructions provided with the form is crucial. Each section has specific requirements that must be adhered to, and we’re here to guide you through it.

Final Tips:

- Review your completed form with a to catch any potential errors. This extra step can provide peace of mind.

- Keep a copy of your submission and any correspondence with the IRS for your records. It’s always helpful to have this information on hand.

- Verify your eligibility before applying for an to ensure you meet all necessary criteria. Knowing you’re on the right path can be reassuring.

By being meticulous in your preparation and documentation of form 433-a oic, you can enhance your chances of a successful Offer in Compromise application. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Mastering Form 433-A OIC is essential for anyone seeking to negotiate tax debts through an Offer in Compromise. This form plays a pivotal role in presenting a comprehensive view of your financial situation to the IRS, influencing the decision on whether a tax settlement can be reached. We understand that navigating this process can feel overwhelming. However, grasping its purpose and the steps required for completion not only simplifies the journey but also enhances the likelihood of a successful outcome.

Throughout this guide, we have thoroughly discussed key aspects such as:

- Determining eligibility

- Accurately completing the form

- Avoiding common pitfalls

It is vital to provide complete and accurate information, along with necessary supporting documentation. Real-life examples and expert advice illustrate the potential for relief through a well-prepared application, reinforcing that you are not alone in this journey.

Navigating tax debt relief can indeed be daunting. Yet, with the right knowledge and preparation, achieving a favorable resolution is possible. We encourage you to leverage available resources, such as the IRS pre-qualifier tool and professional advice, ensuring you feel well-equipped for the journey ahead. Taking these proactive steps empowers you and highlights the significance of diligence in submitting Form 433-A OIC. Remember, you have the support and tools needed to move forward confidently.

Frequently Asked Questions

What is Form 433-A OIC?

Form 433-A OIC, or the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document required by the IRS to assess your financial situation while pursuing an Offer in Compromise (OIC). It provides a detailed overview of your income, expenses, assets, and liabilities.

What is the purpose of Form 433-A OIC?

The purpose of Form 433-A OIC is to give the IRS a clear picture of your financial status, which is essential for evaluating the reasonableness of your offer to settle tax debts for less than the total amount owed.

When is Form 433-A OIC required?

Form 433-A OIC is required when submitting an Offer in Compromise (OIC) to the IRS, as it supplies the necessary financial information for their decision-making process.

Is there a fee associated with submitting Form 433-A OIC?

Yes, there is a $205 fee required for submitting an Offer in Compromise, and if you are proposing a lump sum, a down payment of 20% of the offer is also required.

How can completing Form 433-A OIC affect my chances of acceptance?

Carefully completing Form 433-A OIC enhances your chances of a favorable outcome by allowing the IRS to evaluate whether your proposal aligns with your financial reality.

What examples demonstrate the effectiveness of Form 433-A OIC?

In fiscal year 2024, the IRS accepted 2,918 OICs in civil cases where the unpaid tax assessed was $50,000 or more, showcasing the potential for relief through this process.

What advice do tax professionals give regarding Form 433-A OIC?

Tax professionals emphasize that a well-prepared Form 433-A OIC can significantly influence discussions with the IRS, providing clarity and validating your financial claims. They also warn against 'offer in compromise mills' that may mislead individuals about their qualifications.

How can I prepare for the submission process of Form 433-A OIC?

Understanding the importance of Form 433-A OIC prepares you for the submission process. Additionally, you can use the IRS pre-qualifier tool to check your eligibility for an Offer in Compromise and refer to the Offer in Compromise Booklet for comprehensive information on the process.