Introduction

Crafting a final notice letter can feel overwhelming, and we understand how crucial this task is in the debt collection process. With the right strategies, these letters can not only convey urgency but also foster a sense of collaboration between you and the recipient.

In this article, we’ll explore the essential components and best practices for writing effective final notice letters. We’ll delve into legal considerations and follow-up techniques that can enhance communication.

How can you ensure that your message resonates while also adhering to legal standards, ultimately leading to a successful resolution? You're not alone in this journey, and we're here to help.

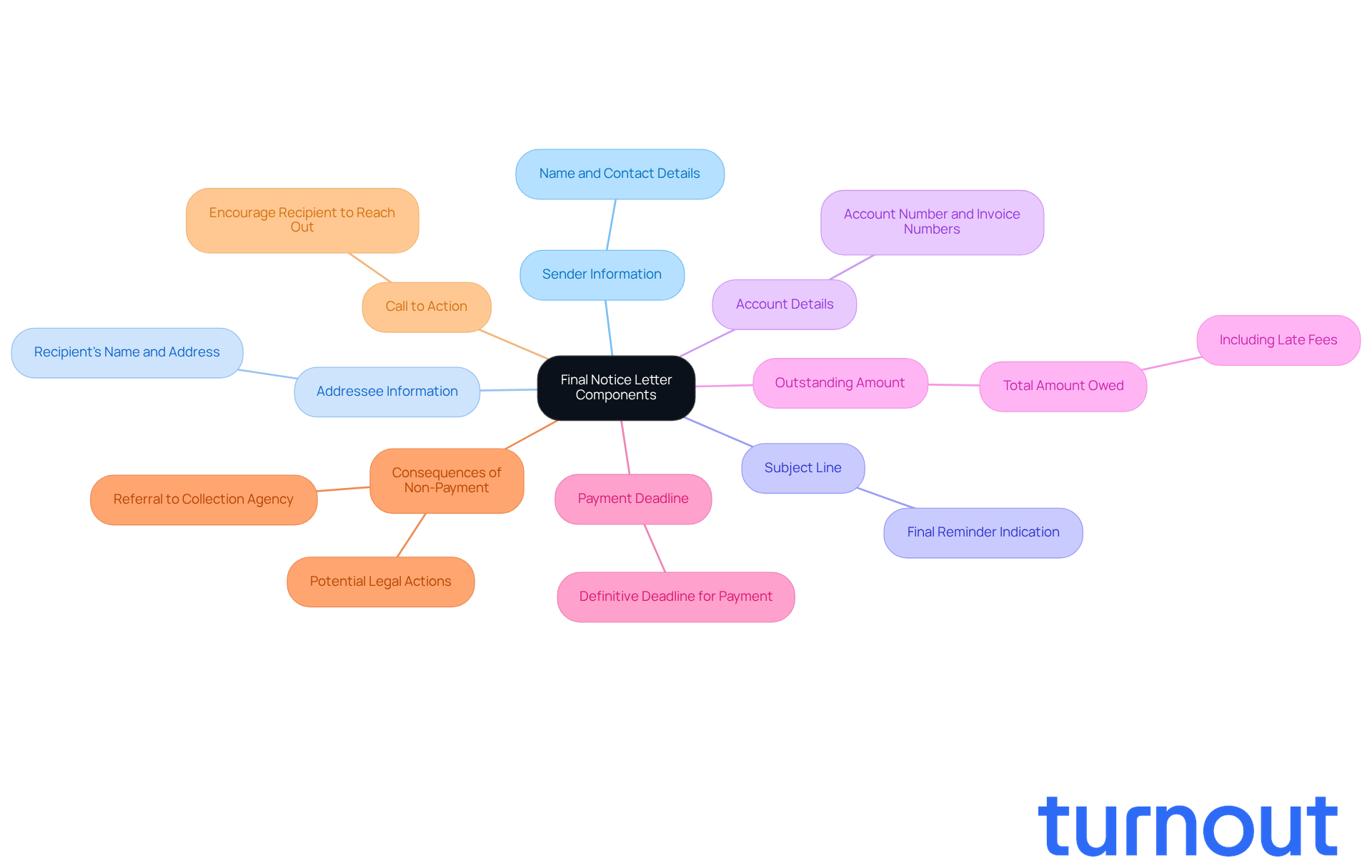

Identify Key Components of a Final Notice Letter

A final notice letter should include several key elements to ensure it resonates with the recipient:

- Sender Information: Clearly state your name and contact details. This establishes credibility and makes it easier for the recipient to reach out.

- Addressee Information: Personalize the letter by including the recipient's name and address. This fosters a connection and shows you care.

- Subject Line: Use a clear subject line that indicates this is a final reminder. This helps the recipient recognize its importance right away.

- Account Details: Reference the account number and any relevant invoice numbers. This provides context and clarity, making it easier for the recipient to understand.

- Outstanding Amount: Clearly specify the total amount owed, including any late fees or penalties. This avoids confusion and ensures transparency.

- Payment Deadline: Set a definitive deadline for payment. This instills a sense of urgency and encourages prompt action.

- Consequences of Non-Payment: Outline potential repercussions for failing to pay, such as legal action or referral to a collection agency. This emphasizes the seriousness of the situation.

- Call to Action: Encourage the recipient to reach out to discuss payment options or resolve any disputes. This promotes proactive engagement and shows you’re willing to help.

Including these elements ensures that your message is thorough, understandable, and effective in eliciting a response. Remember, clear communication can significantly enhance collection rates without resorting to more costly methods. Automated email sequences can also reduce collection time by up to 10 days, improving efficiency in debt collection. Well-crafted final notice letters have been shown to boost debt recovery rates, making them an essential tool in the collection process.

We understand that navigating these situations can be challenging, but you are not alone in this journey. We're here to help.

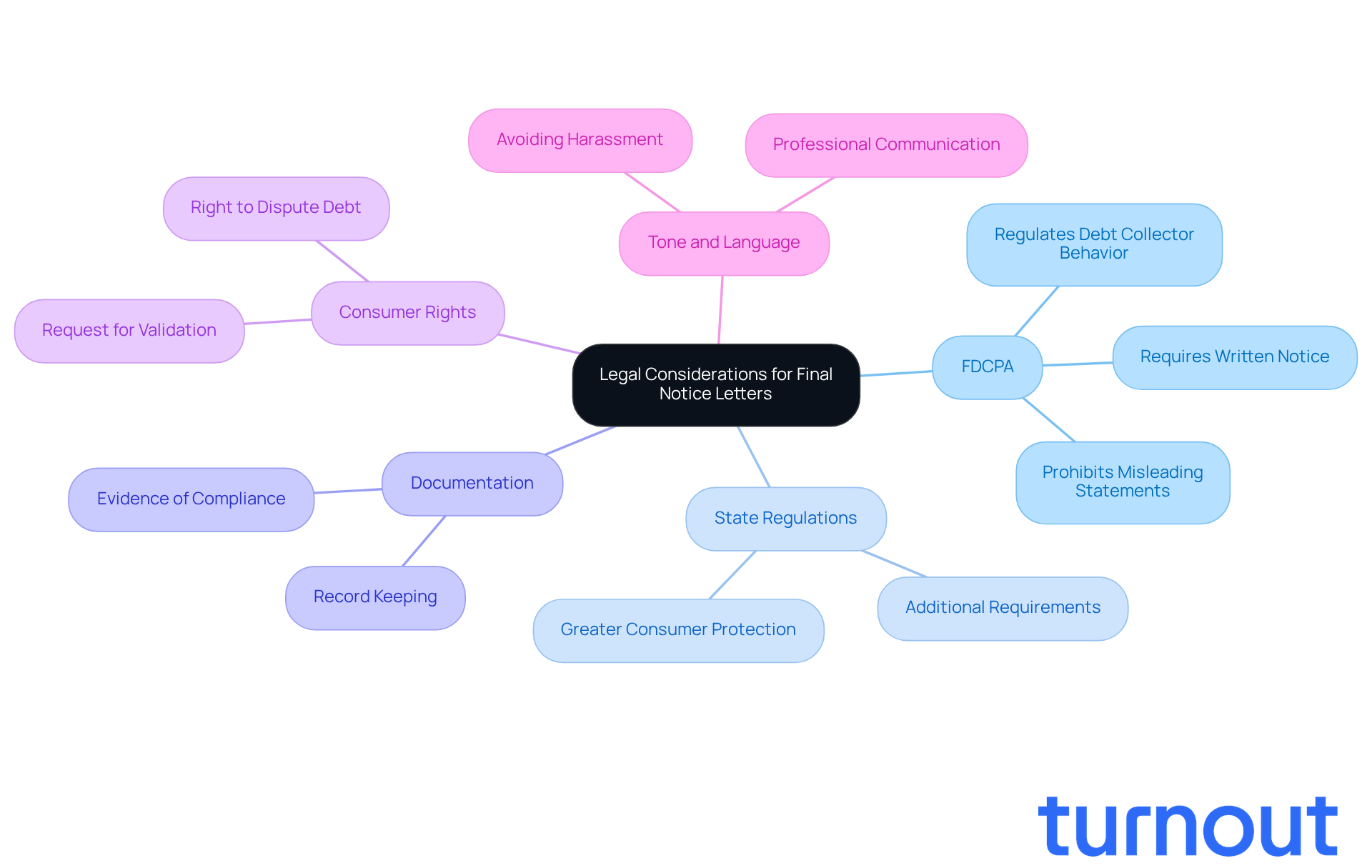

Understand Legal Considerations for Final Notice Letters

When drafting a final notice letter, it’s important to consider some key legal aspects that can make a difference in your communication:

-

Fair Debt Collection Practices Act (FDCPA): We understand that navigating debt collection can be overwhelming. It’s crucial to ensure your correspondence complies with the FDCPA, which regulates how debt collectors interact with consumers. This includes avoiding misleading statements and clearly identifying the debt.

-

State Regulations: It’s common to feel uncertain about state-specific laws. Be aware of any additional requirements that may apply to debt collection communications in your area.

-

Documentation: Keeping precise records of all communications sent to the debtor is essential. This includes duplicates of the final notice letter, which can serve as evidence of compliance if needed.

-

Consumer Rights: Remember to inform the recipient of their rights. This includes their right to dispute the debt and request validation, which can empower them in this challenging situation.

-

Tone and Language: Using professional and respectful language is vital. It helps avoid any perception of harassment or intimidation, which could lead to legal challenges.

By adhering to these legal factors, you can minimize risks and ensure that your final notice letter is both effective and compliant. We’re here to help you navigate this process with care and understanding.

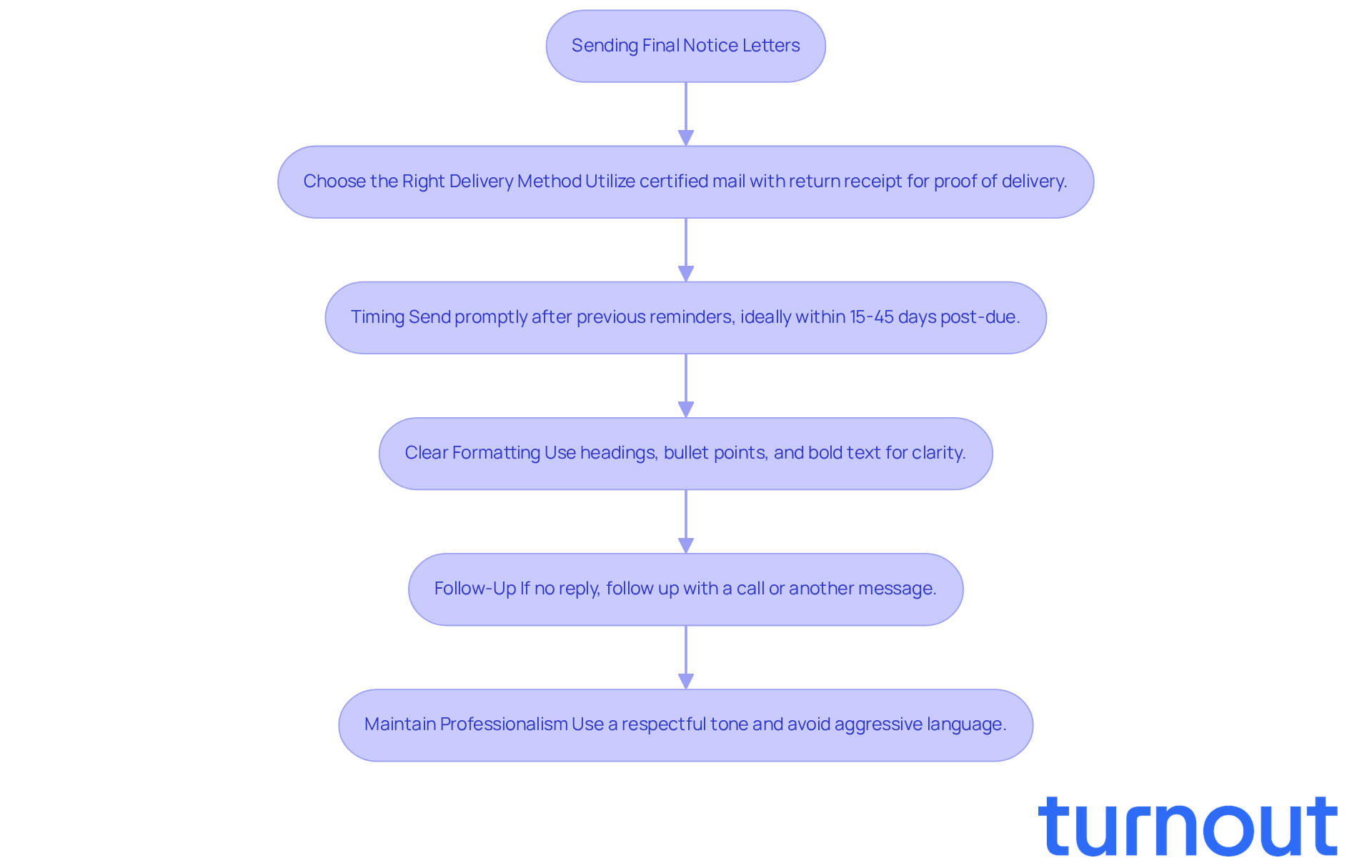

Implement Best Practices for Sending Final Notice Letters

To maximize the effectiveness of your final notice letters, we understand that it’s important to consider a few key strategies:

-

Choose the Right Delivery Method: We recommend utilizing certified mail with a return receipt. This method provides undeniable proof of delivery, ensuring that the receiver cannot dispute receipt of the letter. Research shows that using certified mail can increase response rates by 10-20%. It’s a valuable tool in your collection strategy.

-

Timing: Dispatch your final notice letter promptly after previous reminders. It’s common to feel urgency in these situations, so aim to send it within a few days of the last communication. Letters sent 15-45 days post-due have been shown to collect twice as much as those sent after 90 days. Timely communication is crucial.

-

Clear Formatting: Use clear headings, bullet points, and bold text to highlight critical information. This approach makes it easier for the recipient to grasp key points at a glance, increasing the likelihood of a timely response.

-

Follow-Up: If there’s no reply within the specified timeframe, consider following up with a phone call or another message. This reinforces the urgency of the situation and shows your commitment to resolving the matter. As Sonia Dorais notes, the primary goal of a debt collection message is to prompt the debtor to settle their debt without further escalation.

-

Maintain Professionalism: Always uphold a professional and respectful tone, regardless of the circumstances. This promotes a positive relationship and encourages collaboration. Avoid aggressive language or failing to clearly state the debt details, as these can alienate the debtor and hinder the collection process.

By adopting these optimal strategies, you can greatly boost the efficiency of your concluding correspondence. Remember, you’re not alone in this journey, and we’re here to help you increase the likelihood of obtaining a prompt reply.

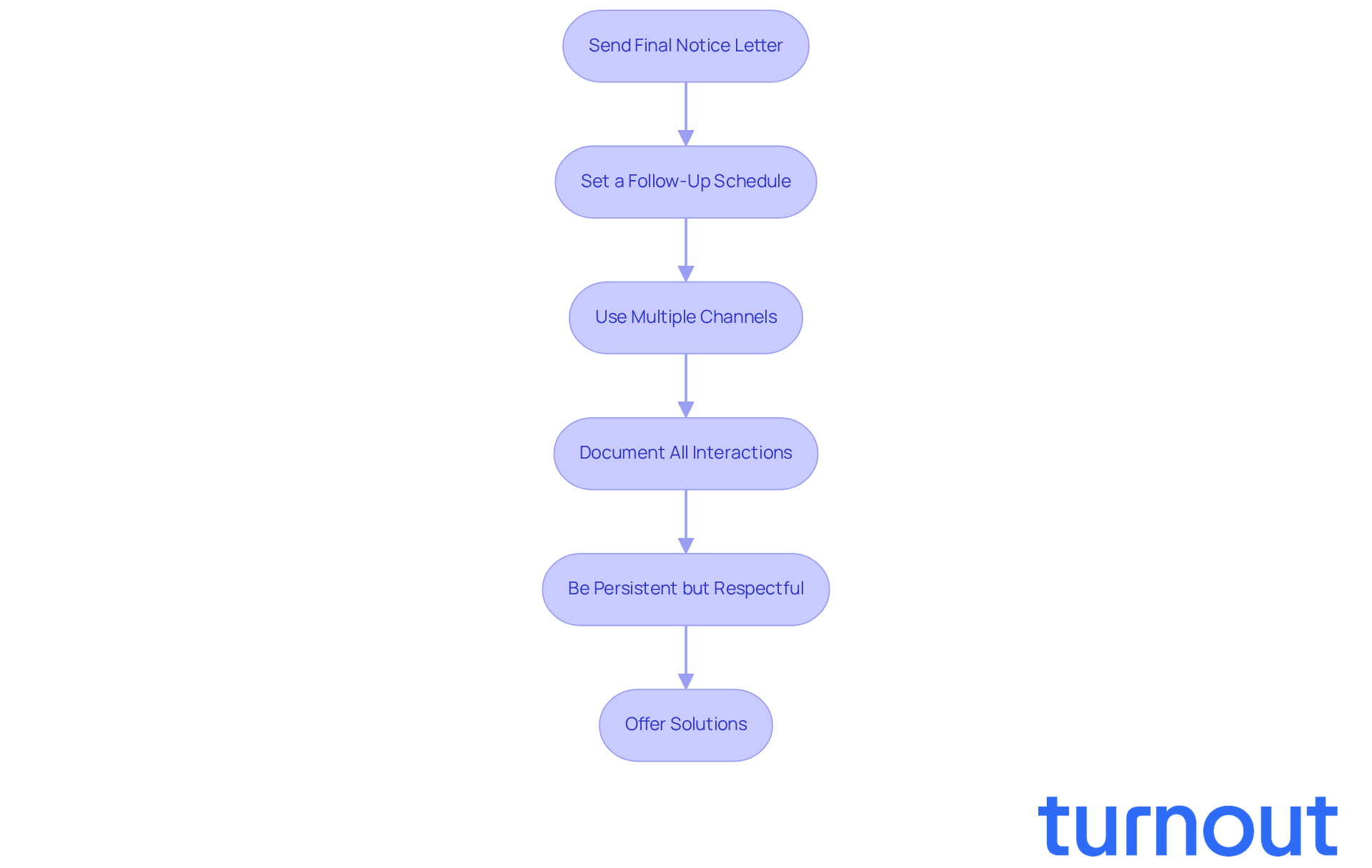

Follow Up Effectively After Sending a Final Notice Letter

After sending your last letter, it’s important to follow up to ensure the individual takes action. We understand that this can feel daunting, but here are some effective strategies to help you navigate this process:

- Set a follow-up schedule: Plan to follow up within a week of sending the final notice letter. This keeps the matter fresh in the receiver's mind and shows your commitment to resolving the issue.

- Use Multiple Channels: Consider reaching out via phone, email, or even a personal visit if appropriate. Different channels can connect with the individual more effectively.

- Document All Interactions: Keep detailed records of all follow-up communications, including dates, times, and the content of discussions. This documentation can be crucial if further action is needed.

- Be Persistent but Respectful: While it’s important to be persistent in your follow-up efforts, always maintain a respectful tone. This encourages cooperation and reduces the likelihood of conflict.

- Offer Solutions: During follow-ups, be ready to discuss payment plans or other solutions that may help the recipient resolve their debt. This shows that you’re willing to work with them rather than simply demanding payment.

By following these strategies, you can enhance the effectiveness of your final notice letter and increase the likelihood of a positive outcome. Remember, you’re not alone in this journey; we’re here to help.

Conclusion

Crafting an effective final notice letter is essential for meaningful communication in debt collection. We understand that this process can be daunting, but by grasping the key components, legal considerations, and best practices, you can significantly enhance your chances of receiving a timely response. Clarity, professionalism, and a respectful tone are vital; they ensure your message resonates with the recipient while adhering to relevant regulations.

It's important to include specific elements in your letter, such as:

- Sender and recipient information

- Clear subject lines

- Detailed account information

Remember, following the Fair Debt Collection Practices Act and state regulations is crucial. By using effective delivery methods like certified mail and scheduling follow-ups, you can greatly increase the likelihood of a positive outcome.

Ultimately, mastering the strategies for final notice letters fosters effective communication and helps maintain a professional relationship with the recipient. Embracing these practices not only boosts collection rates but also empowers you to navigate the complexities of debt recovery with confidence. You are not alone in this journey; adopting these approaches can transform a challenging task into a manageable process, leading to greater success in achieving timely payments.

Frequently Asked Questions

What are the key components that should be included in a final notice letter?

A final notice letter should include the following key components: sender information, addressee information, a clear subject line, account details, outstanding amount, payment deadline, consequences of non-payment, and a call to action.

Why is sender information important in a final notice letter?

Sender information establishes credibility and makes it easier for the recipient to reach out for clarification or assistance.

How can personalizing the addressee information benefit the final notice letter?

Personalizing the addressee information by including the recipient's name and address fosters a connection and shows that you care about their situation.

What should the subject line of a final notice letter indicate?

The subject line should clearly indicate that the letter is a final reminder, helping the recipient recognize its importance right away.

Why is it important to include account details in the letter?

Including account details, such as the account number and relevant invoice numbers, provides context and clarity, making it easier for the recipient to understand the situation.

How should the outstanding amount be presented in the final notice letter?

The outstanding amount should be clearly specified, including any late fees or penalties, to avoid confusion and ensure transparency.

What is the significance of setting a payment deadline in the letter?

Setting a definitive payment deadline instills a sense of urgency and encourages prompt action from the recipient.

What consequences should be outlined for non-payment in the letter?

The letter should outline potential repercussions for failing to pay, such as legal action or referral to a collection agency, emphasizing the seriousness of the situation.

What is a call to action in a final notice letter?

A call to action encourages the recipient to reach out to discuss payment options or resolve any disputes, promoting proactive engagement.

How can well-crafted final notice letters impact debt recovery rates?

Well-crafted final notice letters can boost debt recovery rates and improve efficiency in the collection process, as they enhance communication and understanding between the sender and recipient.