Introduction

Navigating the complexities of tax deductions can feel overwhelming, especially for individuals facing disabilities. We understand that the financial burdens can be heavy, but knowing about the available benefits can truly lighten the load. This article explores essential strategies for maximizing disability tax deductions, offering insights into critical credits and resources that can enhance your financial support.

How can you effectively leverage these strategies? It’s important to ensure you receive the benefits you deserve while managing the intricacies of tax filing. Remember, you are not alone in this journey. We're here to help you find the support you need.

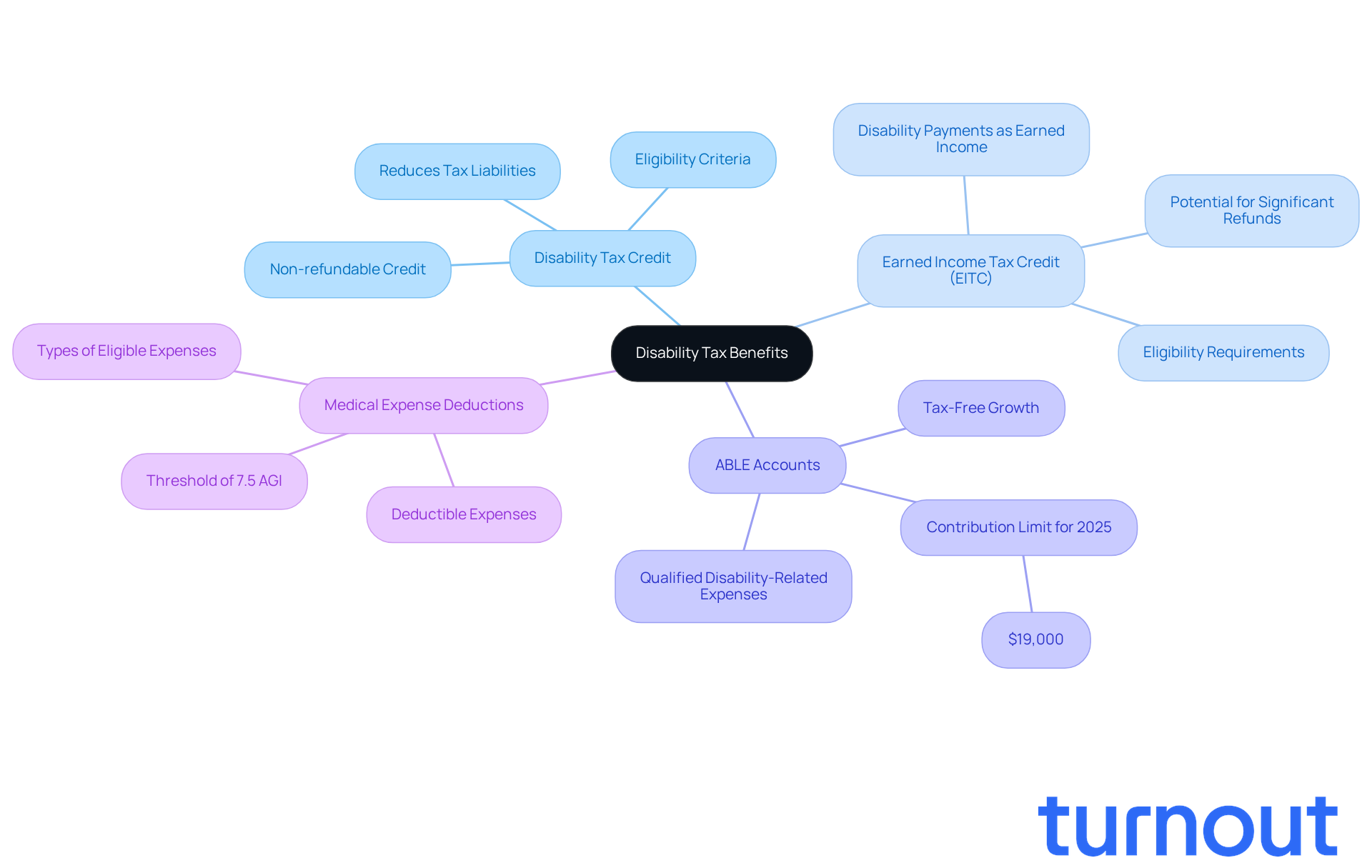

Understand Available Disability Tax Benefits

If you’re facing challenges due to impairments, it’s important to know that disability deductions on taxes are available to help ease your financial burden. Let’s explore some key benefits that can make a real difference:

- Disability Tax Credit: This non-refundable credit can significantly lower the amount of tax you owe if you have a qualifying disability. For 2025, it’s a vital tool for reducing tax liabilities and providing essential financial relief.

- Earned Income Tax Credit (EITC): Did you know that disability payments might qualify as earned income? This means you could claim the EITC, potentially leading to significant refunds that enhance your financial support during tough times.

- ABLE Accounts: Contributions to ABLE accounts grow tax-free and can be used for qualified disability-related expenses without affecting your eligibility for government benefits. In 2025, you can contribute up to $19,000, allowing you to save effectively for your needs.

- Medical Expense Deductions: You can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income. This includes costs related to health conditions, which can further alleviate financial strain.

Understanding the advantages of disability deductions on taxes is crucial for managing your tax responsibilities effectively. Remember, you’re not alone in this journey, and we’re here to help you navigate these options for the support you deserve.

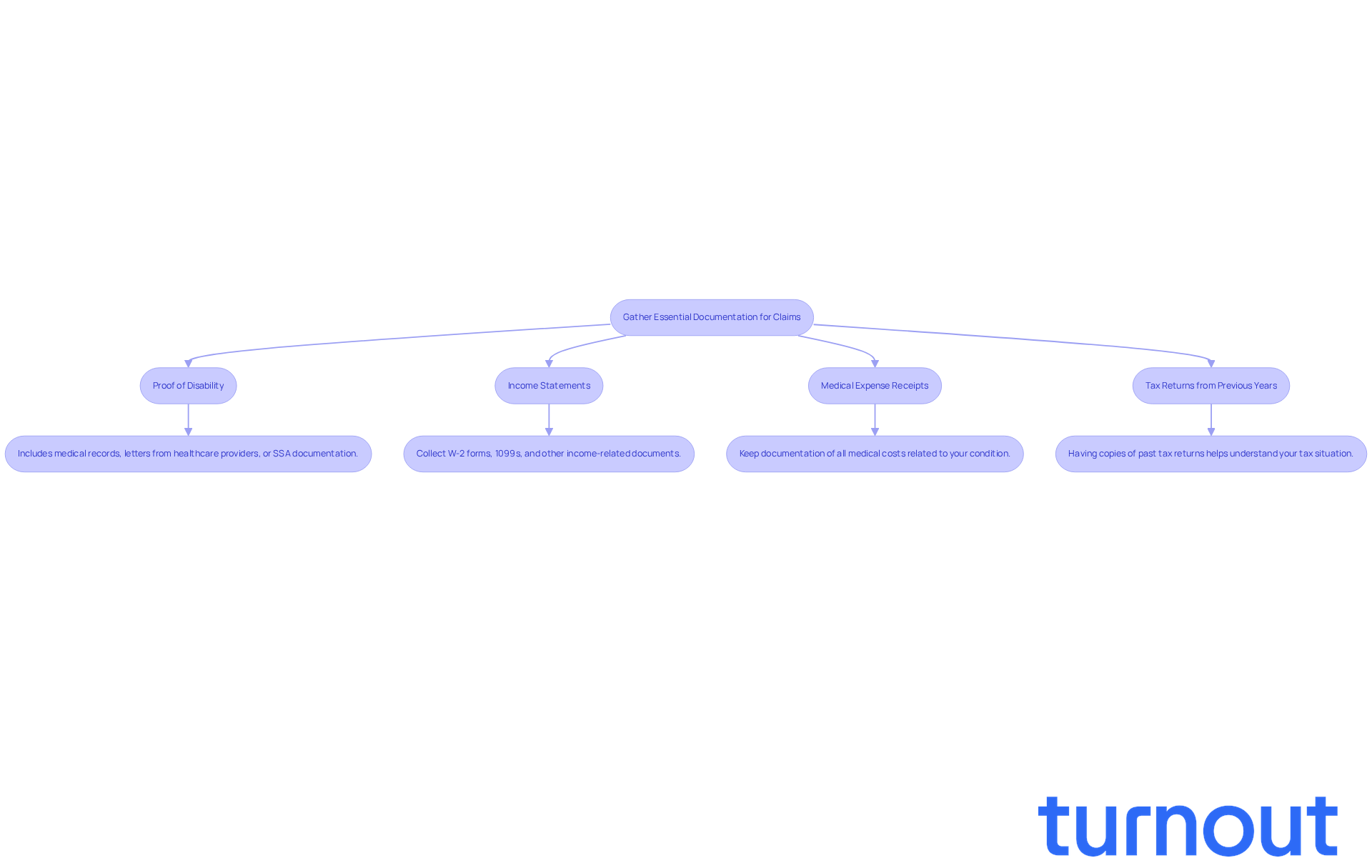

Gather Essential Documentation for Claims

Navigating disability deductions on taxes can feel overwhelming, but gathering the right documentation can make a significant difference. Here’s what you need to prepare:

- Proof of Disability: This includes medical records, letters from healthcare providers, or documentation from the Social Security Administration confirming your disability status. For instance, a personal affidavit detailing your daily struggles can really strengthen your claim by showing the real-life impact of your condition.

- Income Statements: Collect W-2 forms, 1099s, and any other income-related documents to accurately report your earnings. This is essential, as verifying your income helps illustrate how your condition affects your financial situation. It’s important to note that around 51 million working adults lack coverage for disabilities beyond Social Security, making it crucial to understand the available tax advantages.

- Medical Expense Receipts: Keep thorough documentation of all medical costs related to your condition. Disability deductions on taxes can often be claimed for these expenses, which helps provide significant tax relief. For example, if you itemize your taxes, you may benefit from disability deductions on taxes for medical costs that exceed 7.5% of your adjusted gross income (AGI).

- Tax Returns from Previous Years: Having copies of past tax returns can help you understand your tax situation and ensure that all relevant information is included in your current claim. This historical context can be beneficial, especially when demonstrating consistent disability-related expenses.

Additionally, individuals with disabilities may qualify for the Earned Income Tax Credit (EITC) or the Tax Credit for the Elderly or Disabled, which can further ease financial burdens. We understand that this process can be complex, but organizations like Turnout provide access to tools and services that help consumers navigate these financial systems. They offer assistance with SSD claims and tax debt relief through trained nonlawyer advocates and IRS-licensed enrolled agents.

By organizing these documents in advance, you can streamline the filing process and enhance your chances of a successful claim. Many individuals who take the time to prepare their documentation see a higher success rate in obtaining the benefits they deserve. Remember, having the correct documentation is essential to ensuring you receive the advantages you are entitled to. You are not alone in this journey; we’re here to help.

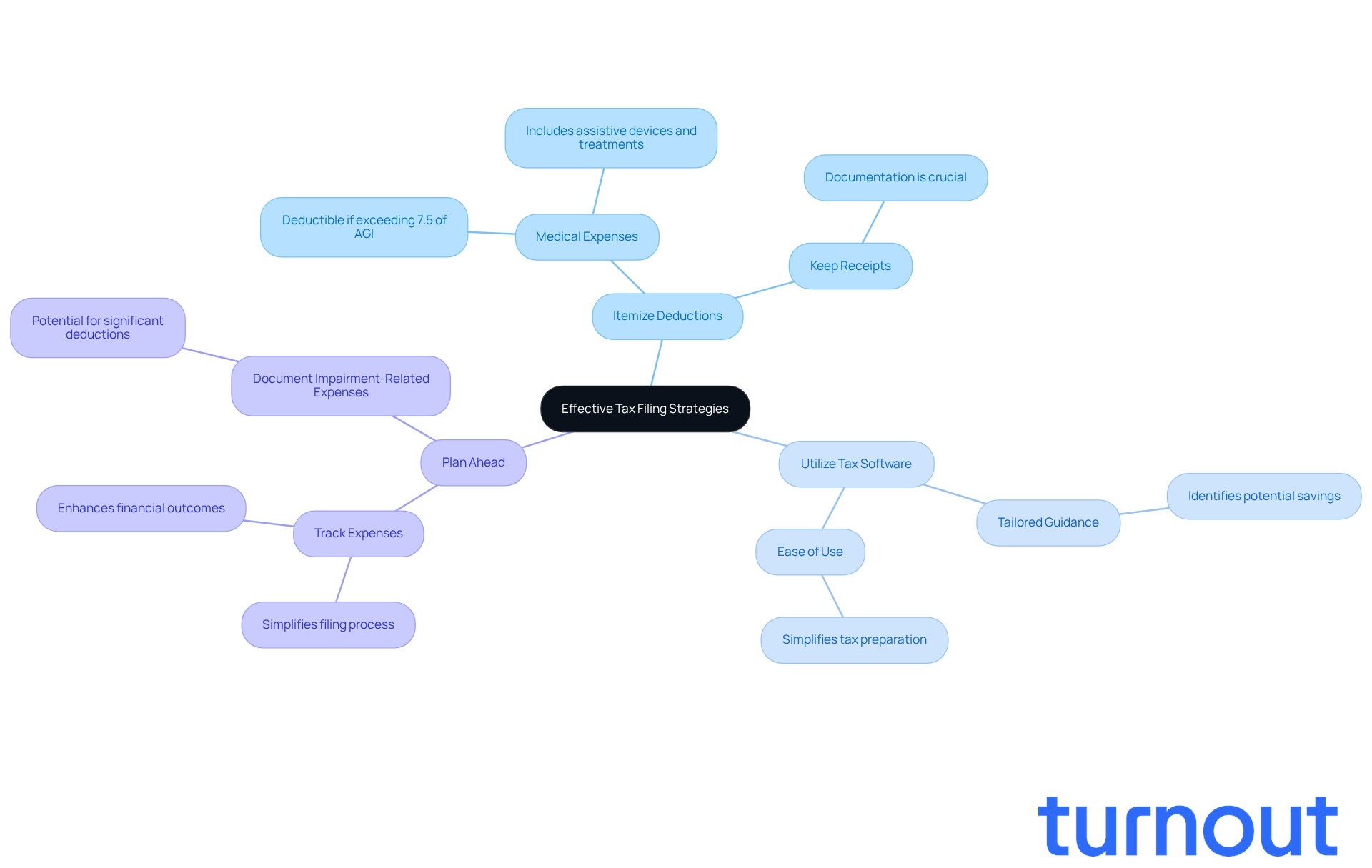

Implement Effective Tax Filing Strategies

To maximize your tax benefits, consider these supportive strategies:

-

Itemize Deductions: If your medical expenses and other deductions exceed the standard deduction, itemizing can lead to greater tax savings. Did you know that medical expenses surpassing 7.5% of your adjusted gross income (AGI) can be deducted? This includes costs for assistive devices and necessary medical treatments. Keeping all relevant receipts and documentation is crucial for this process, and we’re here to help you navigate it.

-

Utilize Tax Software: We understand that tax preparation can be overwhelming. That’s why leveraging tax software designed to assist individuals can make a difference. Many programs offer tailored guidance on available credits and deductions, helping you identify potential savings with ease.

Engaging a tax professional who specializes in disability deductions on taxes can provide personalized advice. They ensure that all eligible entitlements are claimed. At Turnout, our IRS-licensed enrolled agents are ready to assist you in understanding your tax responsibilities and optimizing your advantages without the need for legal representation.

- Plan Ahead: It’s common to feel stressed about taxes, but considering your situation throughout the year can ease that burden. Keeping track of expenses and potential deductions simplifies the filing process and enhances your financial outcomes. Documenting impairment-related work expenses can result in significant disability deductions on taxes, making proactive planning essential.

By implementing these strategies, you can navigate the tax filing process more effectively. Remember, you’re not alone in this journey. With Turnout's expertise in government benefits and financial assistance, you can enhance your financial support.

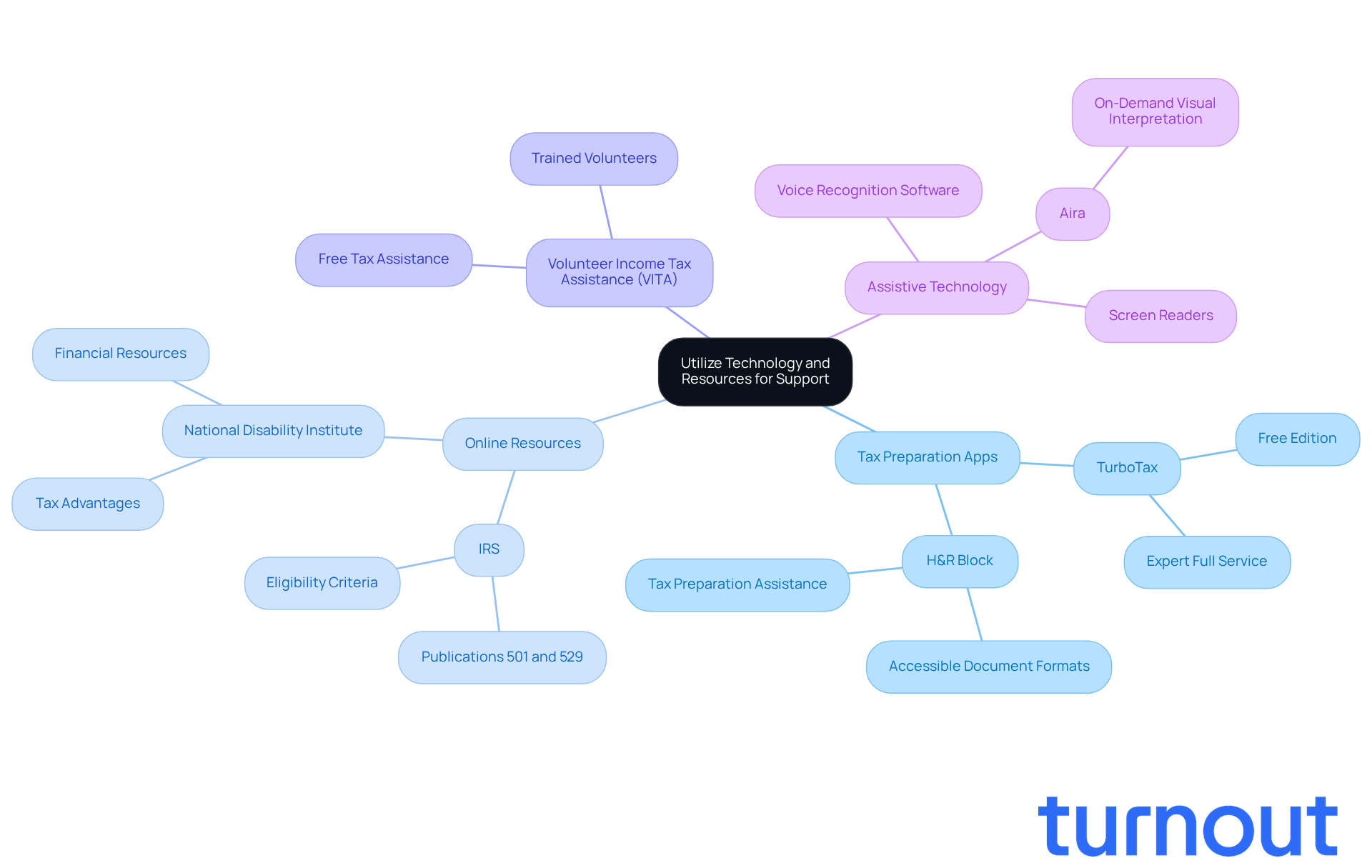

Utilize Technology and Resources for Support

Integrating technology can truly enhance the tax filing experience for individuals with impairments, particularly in facilitating disability deductions on taxes. We understand that navigating taxes can be overwhelming, but there are valuable resources available to help you.

- Tax Preparation Apps: Consider user-friendly applications like TurboTax and H&R Block. They offer tailored guidance specifically designed for individuals with disabilities. Did you know that around 37% of taxpayers qualify for the TurboTax Free Edition? These platforms are accessible and aim to simplify the tax preparation process, ensuring you can easily find your way through the options.

- Online Resources: Websites such as the IRS and the National Disability Institute provide extensive information on tax advantages, eligibility criteria, and filing tips. These resources are essential for understanding the various deductions and credits available to you, including disability deductions on taxes, as detailed in IRS Publications 501 and 529, which explain specific benefits and deductions.

- Volunteer Income Tax Assistance (VITA): This program offers free tax assistance to individuals with impairments and low-income taxpayers. VITA volunteers are trained to help with tax preparation, ensuring that all eligible credits are claimed, which can lead to significant savings. The National Disability Institute also provides resources for complimentary tax preparation services aimed at those facing challenges.

- Assistive Technology: Tools like screen readers, voice recognition software, and services such as Aira, which offers on-demand visual interpretation, can greatly assist individuals with disabilities in completing their tax forms. These technologies enhance accessibility, making it easier to manage financial documents and navigate the tax filing process.

By leveraging these technological resources, you can approach tax filing with greater ease and confidence. Remember, you are not alone in this journey, and we're here to help you maximize your potential benefits.

Conclusion

Navigating the complexities of disability tax deductions can feel overwhelming, especially for those facing financial challenges due to impairments. We understand that this journey is not easy, but by grasping the available benefits and implementing thoughtful filing practices, you can significantly lighten your tax burdens and improve your financial well-being. This article has shared essential strategies, from recognizing key tax credits to gathering necessary documentation, all aimed at helping you optimize the benefits available for individuals with disabilities.

Key points we've discussed include:

- The importance of the Disability Tax Credit

- The potential of the Earned Income Tax Credit

- The advantages of ABLE accounts and medical expense deductions

It's crucial to have proper documentation and effective tax filing strategies, such as itemizing deductions and utilizing technology for support. Each of these elements plays a vital role in ensuring that you can claim the full extent of your entitled benefits.

Ultimately, you don’t have to navigate the journey to mastering disability tax deductions alone. With the right resources, including tax preparation apps and support from organizations like Turnout, you can confidently find your way through the tax landscape. Embracing these strategies not only empowers you to maximize your financial support but also highlights the importance of awareness and preparation in securing the benefits you deserve. Remember, we're here to help, and you are not alone in this journey.

Frequently Asked Questions

What are the main disability tax benefits available?

The main disability tax benefits include the Disability Tax Credit, Earned Income Tax Credit (EITC), ABLE Accounts, and Medical Expense Deductions.

What is the Disability Tax Credit?

The Disability Tax Credit is a non-refundable credit that can significantly lower the amount of tax you owe if you have a qualifying disability, providing essential financial relief.

How can disability payments affect the Earned Income Tax Credit (EITC)?

Disability payments may qualify as earned income, allowing you to claim the EITC, which could lead to significant refunds and enhanced financial support.

What are ABLE Accounts and how do they work?

ABLE Accounts allow contributions that grow tax-free and can be used for qualified disability-related expenses without affecting eligibility for government benefits. In 2025, you can contribute up to $19,000 to these accounts.

How can I deduct medical expenses related to disabilities?

You can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income, which includes costs related to health conditions, helping to alleviate financial strain.

Why is it important to understand disability tax deductions?

Understanding disability tax deductions is crucial for effectively managing your tax responsibilities and easing your financial burden related to disabilities.