Introduction

Understanding the nuances of W-4 allowances is essential for anyone wanting to optimize their tax withholding strategy. We know that claiming two allowances can significantly impact your take-home pay. However, it also raises important questions about your financial planning and potential tax liabilities.

As you navigate your unique financial situation - considering factors like dependents, marital status, and income fluctuations - you might wonder:

- Are you truly maximizing your tax benefits?

- Or could you be setting yourself up for unexpected surprises come tax season?

This guide offers a comprehensive look at how to effectively claim two allowances on the W-4 form. We're here to help you feel confident and informed in your decision-making process. You are not alone in this journey.

Understand W-4 Allowances and Their Impact on Tax Withholding

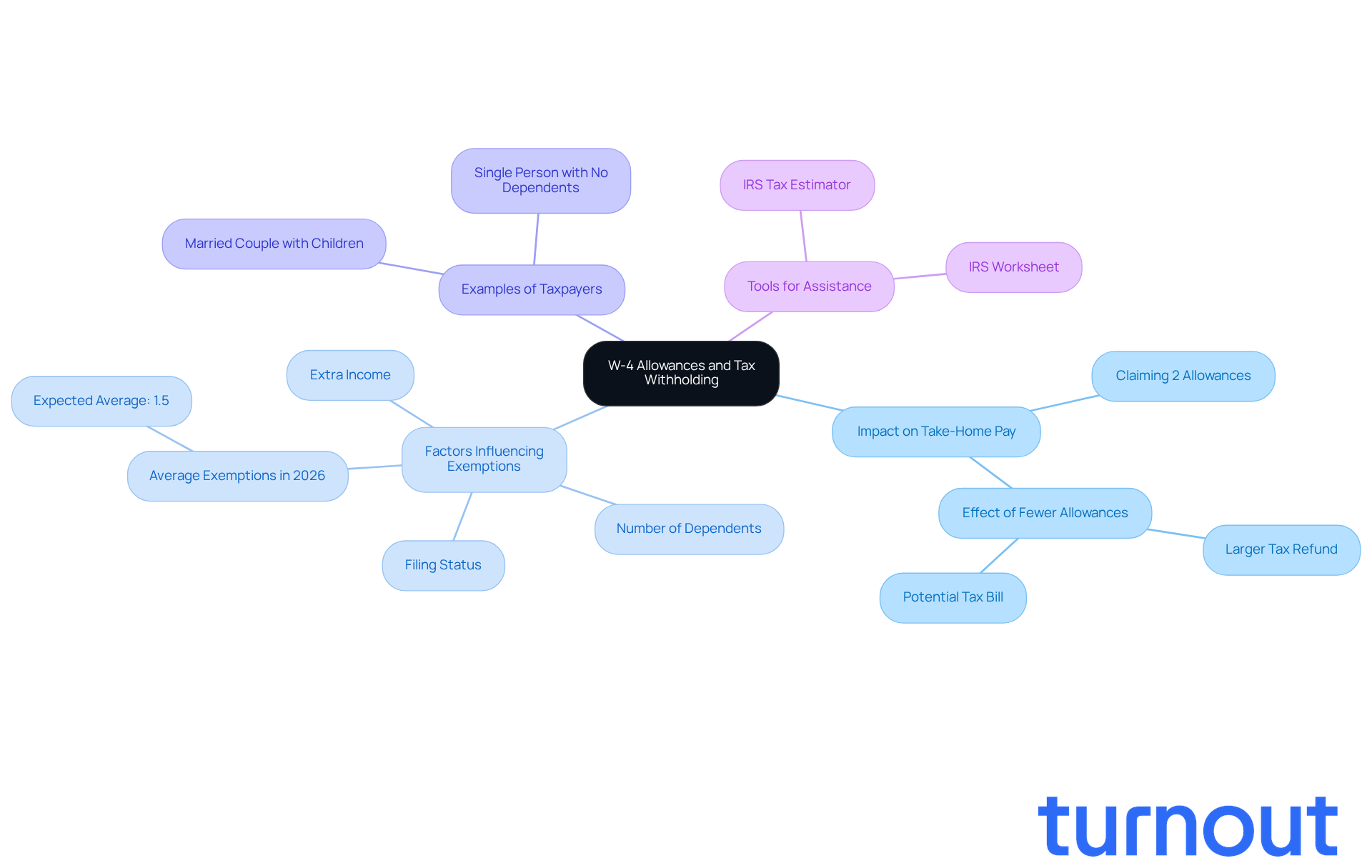

W-4 exemptions are essential for figuring out how much federal income tax gets withheld from your paycheck. We understand that navigating this can be tricky. Typically, claiming 2 allowances on W-4 means that the more deductions you declare, the less tax is withheld, which can lead to a boost in your take-home pay. But if you declare fewer deductions, you might see more tax retained, possibly resulting in a larger refund when tax season rolls around.

It's crucial to grasp your personal financial situation. Factors like your filing status, number of dependents, and any extra income directly influence how many exemptions you should declare. For instance, in 2026, the average number of exemptions claimed by taxpayers is expected to be around 1.5. This suggests a trend toward more cautious tax deduction strategies.

Consider a single person with no dependents who is claiming 2 allowances on W-4. This choice could increase their monthly take-home pay. On the flip side, a married couple with children might be claiming 2 allowances on W-4 to account for their dependents, optimizing their tax withholding. Notably, the 2026 W-4 form shows an increase in the amount for qualifying children under 17, rising from $2,000 to $2,200. This change can significantly impact the number of exemptions claimed.

Tax experts emphasize the importance of regularly reviewing your W-4 settings to reflect any changes in your financial situation. If your income fluctuates or you gain additional dependents, adjusting your allowances can help you avoid under-withholding, which might lead to unexpected tax bills. Plus, tools like the IRS Tax Estimator or IRS Worksheet can assist you in determining your deduction percentages accurately.

Ultimately, understanding these dynamics empowers you to make informed decisions about your tax withholding strategy. Remember, we're here to help you maximize your financial well-being throughout the year.

Determine When to Claim Two Allowances Based on Your Situation

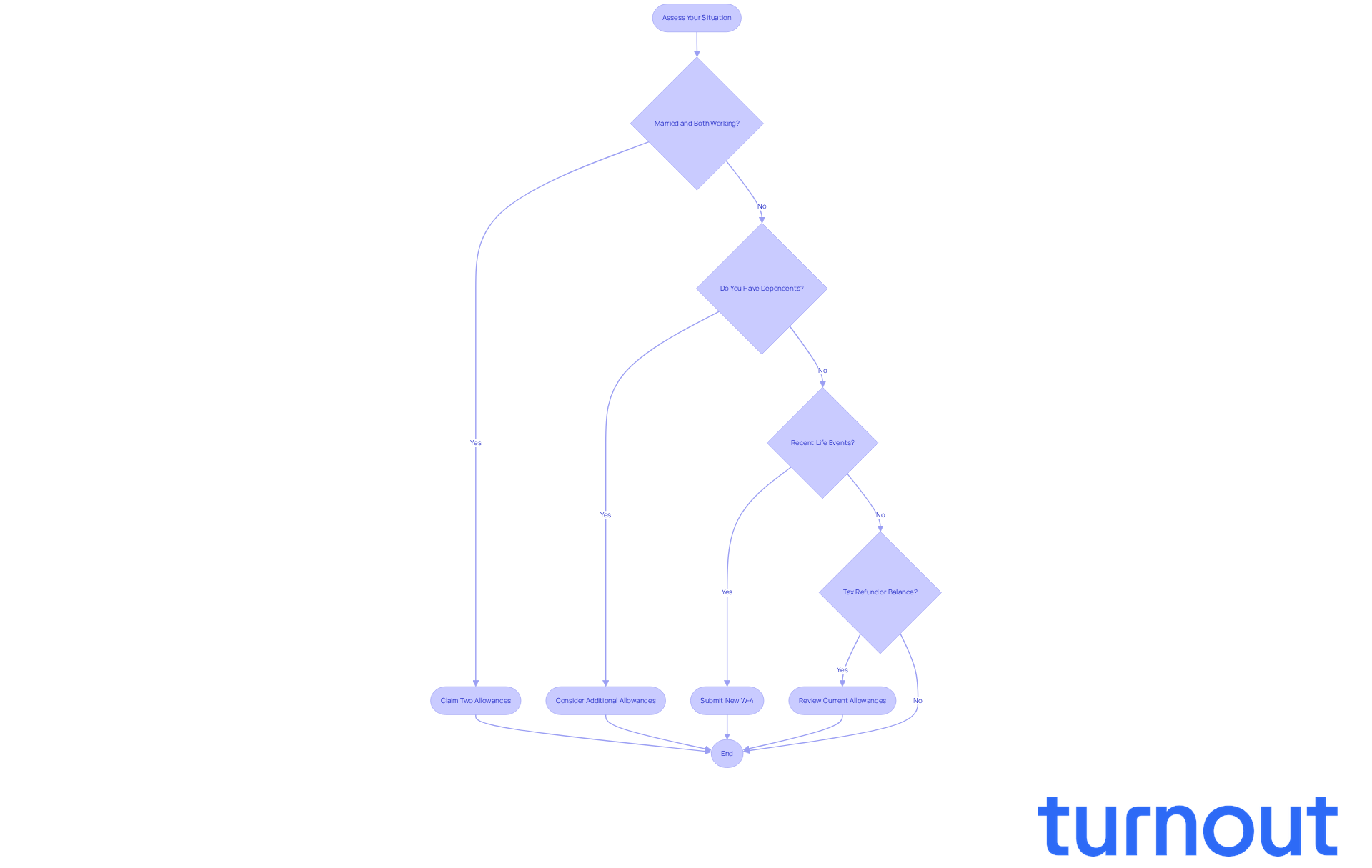

We understand that navigating your W-4 exemptions can feel overwhelming. To help you make the best decision, take a moment to assess your personal situation. If you’re married and both you and your partner are working, claiming two exemptions might be a smart move. Plus, if you have dependents, you could qualify for even more benefits.

Before you dive into the IRS deduction calculator, gather your paystubs from all jobs and your most recent tax return. This preparation will ensure you get an accurate assessment. For example, if you anticipate a significant tax refund or if your income varies, adjusting your exemptions can really help with cash flow management.

It’s also important to revisit your allowances after major life events - like getting married, having a baby, or starting a new job. These changes can impact your financial situation, and you want your deductions to reflect that. If your circumstances shift and you no longer qualify for an exemption, don’t forget to submit a new W-4 form.

Additionally, if you faced a large balance or received a considerable refund when filing your 2025 tax return, it might be time to review your deductions. Remember, if you’re claiming exemption from federal income tax deductions for 2026, you’ll need to submit a new Form W-4 by February 16, 2027, to avoid default deductions. We’re here to help you through this process, ensuring you’re not alone in your journey.

Complete the W-4 Form: Step-by-Step Instructions for Claiming Two Allowances

-

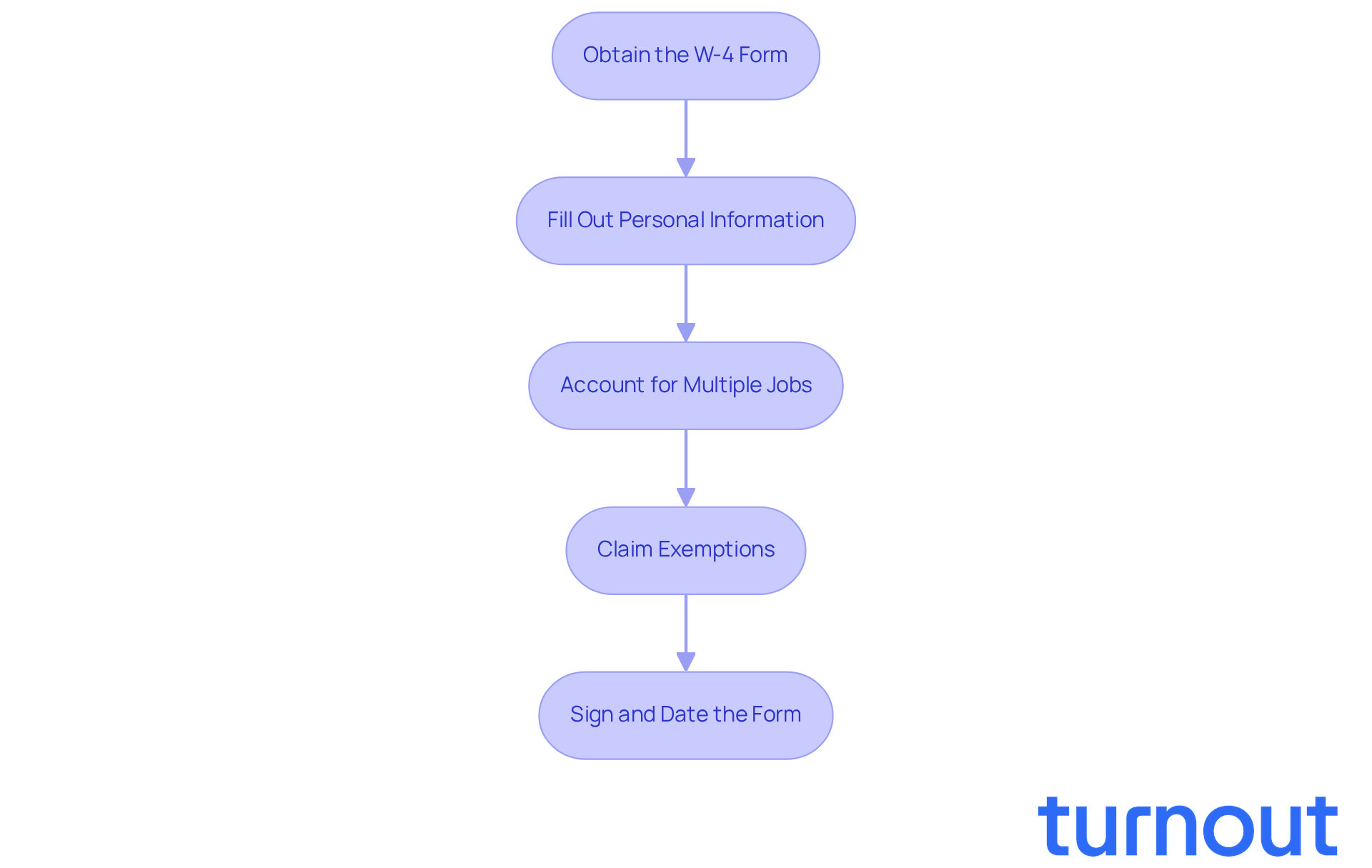

Obtain the W-4 Form: We understand that navigating tax forms can be overwhelming. Start by downloading the latest version of the W-4 form from the IRS website or simply ask your employer for one. This way, you’ll have the most current information at your fingertips.

-

Fill Out Personal Information: In Step 1, take a moment to accurately enter your name, address, Social Security number, and filing status (single, married, etc.). This information is crucial for your employer to process your deductions correctly, and we want to make sure you’re set up for success.

-

Account for Multiple Jobs: If you have more than one job or your spouse is working, don’t forget to complete Step 2. This step is vital for ensuring precise deductions and preventing under-deductions, which can lead to unexpected tax bills. It’s common to feel unsure about this, but we’re here to help you through it.

-

Claim Exemptions: In Step 3, indicate the number of exemptions you’re claiming. Claiming 2 allowances on W-4 can reduce your tax deductions, but it’s important to understand how this affects your total tax obligation. Many people mistakenly overestimate their allowances, which can lead to under-withholding and potential tax penalties. Remember, if you’re claiming exemption from federal income tax deductions, you must submit a new Form W-4 by February 16, 2027, to keep that status.

-

Sign and Date the Form: Finally, don’t forget to sign and date the form in Step 5 before submitting it to your employer. Keep a copy for your records. It’s a good idea to regularly review your W-4, especially after major life changes, to ensure it accurately reflects your current financial situation. Many taxpayers overlook this, which can lead to inaccurate deductions and stress during tax season. Also, if you’re 65 or older, you can account for an additional standard deduction amount of $6,000 on lines 3a and 3b of the worksheet. For those using older W-4 forms, the IRS provides a 'computational bridge' in Publication 15-T to help convert allowance-based data into modern deduction calculations.

Access Resources and Tools for Effective Tax Withholding Management

To effectively manage your tax withholding, we understand that it can feel overwhelming. But don’t worry; there are resources available to help you navigate this process with confidence:

-

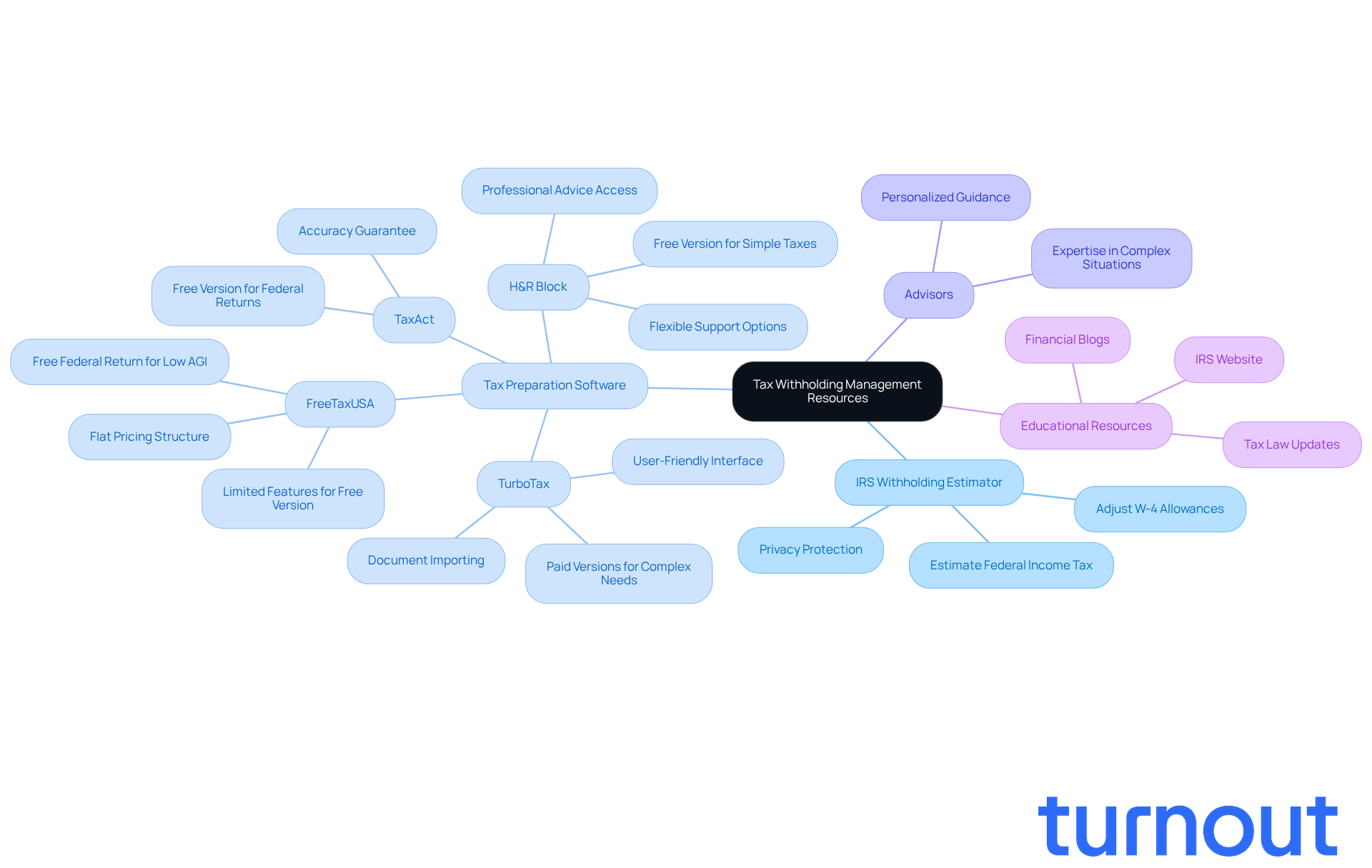

IRS Withholding Estimator: This handy online tool lets you estimate your federal income tax withholding based on your unique financial situation. By entering your income and deductions, you can adjust your W-4 allowances, which may include claiming 2 allowances on W-4, to better match your tax obligations. This way, you can avoid unexpected bills or penalties. Plus, your privacy is protected; the information you enter isn’t saved or recorded, keeping you safe from potential tax scams.

-

Tax Preparation Software: Applications like TurboTax and H&R Block can be incredibly helpful in calculating your deductions and providing insights into your overall tax situation. Did you know that 44% of tax filers prefer using commercial tax-prep software? It’s popular for a reason! H&R Block is especially recommended for more complicated tax situations, offering access to professional advice and flexible support options.

-

Advisors: Consulting with a financial advisor can offer you personalized guidance tailored to your specific circumstances, especially if your financial situation is complex. Their expertise can help you navigate the intricacies of tax deductions, ensuring you make informed decisions. As one financial consultant mentioned, using the IRS Estimator can significantly aid in adjusting your deductions to align with your financial goals.

-

Educational Resources: Websites like the IRS and various financial blogs provide valuable articles and guides on tax deductions. Staying informed about changes in tax laws and best practices can empower you to manage your deductions effectively. The IRS emphasizes that early preparation is key to avoiding surprises during tax season, so reviewing your deductions early in the year is crucial.

By utilizing these resources, you can enhance your understanding of tax withholding and make informed decisions that align with your financial goals. Remember, you’re not alone in this journey; we’re here to help!

Conclusion

Claiming two allowances on your W-4 form can truly impact your tax withholding strategy and overall financial well-being. We understand that navigating this process can feel overwhelming, but empowering yourself with knowledge can help you optimize your take-home pay while fulfilling your tax obligations. By managing your allowances effectively, you can tailor your tax withholdings to fit your unique financial situation, whether you’re single, married, or have dependents.

Throughout this guide, we’ve shared important insights about assessing your individual circumstances when deciding how many allowances to claim. Factors like your filing status, number of dependents, and any changes in your income are crucial in determining the right allowances for you. Tools such as the IRS Withholding Estimator and tax preparation software can be invaluable in making informed decisions. Regularly reviewing your W-4 can also help you avoid unexpected tax bills.

Ultimately, staying proactive about your tax withholding management is essential. By leveraging the resources available and understanding the implications of your W-4 allowances, you can enhance your financial well-being throughout the year. Taking the time to evaluate and adjust your allowances not only minimizes the risk of under-withholding but also positions you for greater financial success. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What are W-4 allowances and why are they important?

W-4 allowances are used to determine how much federal income tax is withheld from your paycheck. They are crucial for managing your tax withholding and can affect your take-home pay.

How do claiming more or fewer allowances on the W-4 affect my paycheck?

Claiming more allowances typically results in less tax being withheld, which can increase your take-home pay. Conversely, claiming fewer allowances may lead to more tax being withheld, potentially resulting in a larger refund at tax time.

What factors should I consider when deciding how many allowances to claim?

You should consider your personal financial situation, including your filing status, number of dependents, and any additional income, as these factors influence the number of exemptions you should declare.

What is the average number of exemptions claimed by taxpayers expected to be in 2026?

The average number of exemptions claimed by taxpayers is expected to be around 1.5 in 2026, indicating a trend towards more cautious tax deduction strategies.

How might a single person with no dependents benefit from claiming 2 allowances?

A single person with no dependents claiming 2 allowances may see an increase in their monthly take-home pay due to less tax being withheld.

How do married couples with children typically approach W-4 allowances?

Married couples with children might claim 2 allowances on their W-4 to account for their dependents, optimizing their tax withholding based on their family situation.

What significant change regarding qualifying children under 17 is noted for the 2026 W-4 form?

The amount for qualifying children under 17 is expected to rise from $2,000 to $2,200 in 2026, which can significantly impact the number of exemptions claimed.

Why is it important to regularly review your W-4 settings?

Regularly reviewing your W-4 settings is important to reflect any changes in your financial situation, such as income fluctuations or gaining additional dependents, to avoid under-withholding and unexpected tax bills.

What tools can assist me in determining my W-4 allowances accurately?

Tools like the IRS Tax Estimator or the IRS Worksheet can help you accurately determine your deduction percentages and make informed decisions about your tax withholding strategy.