Introduction

Navigating the complexities of back tax debt can feel overwhelming. Many individuals find themselves trapped under the weight of unpaid obligations, and it’s common to feel anxious about what lies ahead. As financial strains mount, ignoring these debts can lead to serious consequences, like wage garnishments and legal actions.

But there’s hope. This article explores effective strategies for managing and resolving back tax debt. We’ll offer you practical solutions, such as installment agreements and the Offer in Compromise program.

Have you ever wondered what happens when individuals choose to remain inactive in the face of these challenges? Understanding the potential repercussions is crucial for anyone seeking financial relief and stability. Remember, you are not alone in this journey. We're here to help.

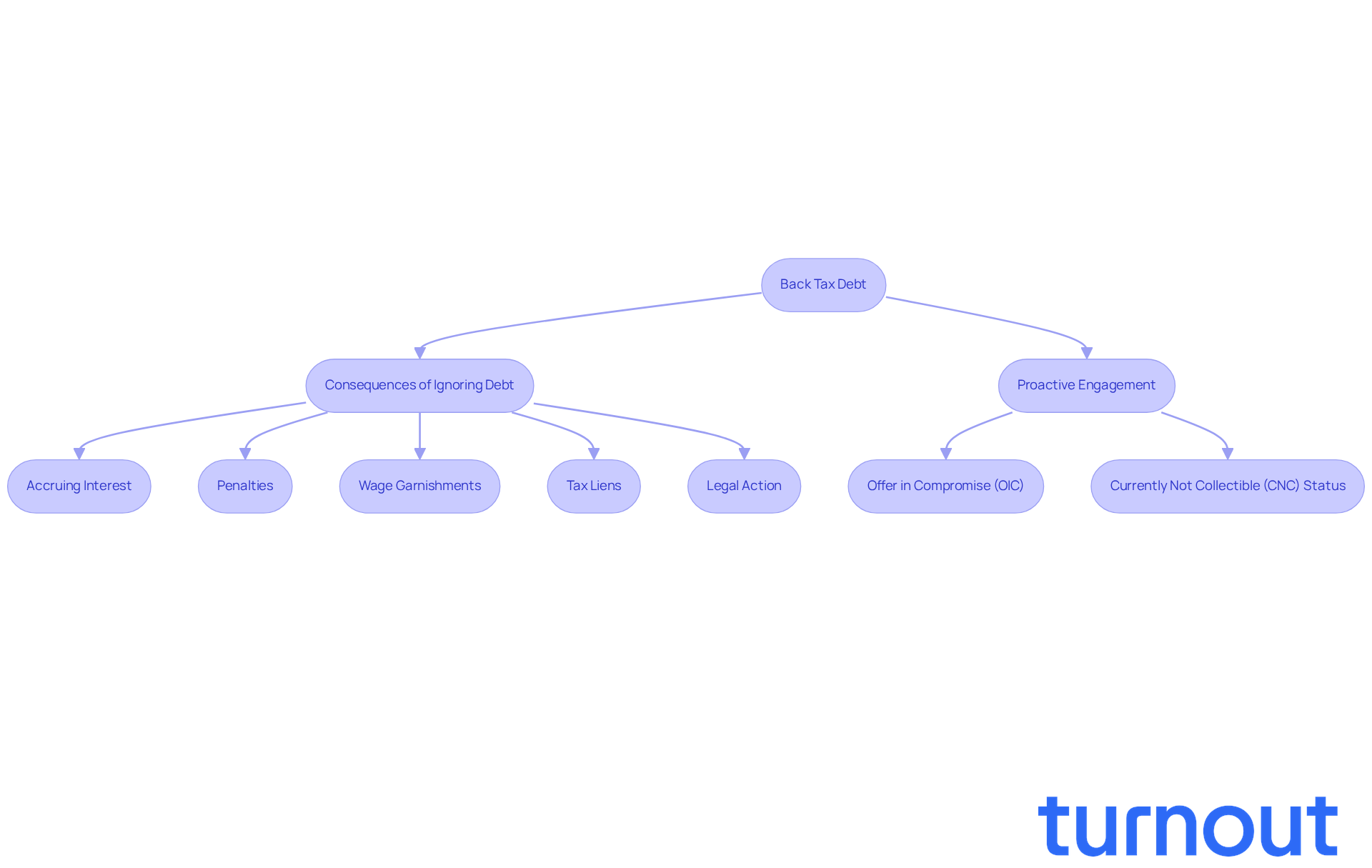

Define Back Tax Debt and Its Implications

The obligations associated with back tax debt can feel overwhelming. They refer to taxes that remain unpaid by their due date, creating a responsibility to the IRS or state tax authorities. This situation can escalate quickly due to accruing interest and penalties, significantly increasing the total amount owed.

In 2026, many American households are still feeling the weight of these obligations. Families often experience severe financial strain as a result. It’s common to feel anxious about what might happen if these obligations are ignored. The consequences can be dire, including wage garnishments, tax liens, and even legal action. For instance, if taxpayers don’t resolve their obligations, the IRS may issue a 'Final Notice of Intent to Levy,' allowing them to garnish wages or seize bank accounts.

Tax professionals emphasize that taking no action can lead to mounting penalties and interest, complicating the situation further. The failure-to-pay penalty can add up each month until the balance is resolved. Real-world examples illustrate the harsh realities faced by individuals burdened with back tax debt. This highlights the importance of proactive engagement with tax authorities.

In 2026, the IRS continues to offer various collection methods, such as the Offer in Compromise (OIC) and Currently Not Collectible (CNC) status. It’s crucial for individuals to address their tax obligations promptly. Remember, you are not alone in this journey. We’re here to help you navigate these challenges.

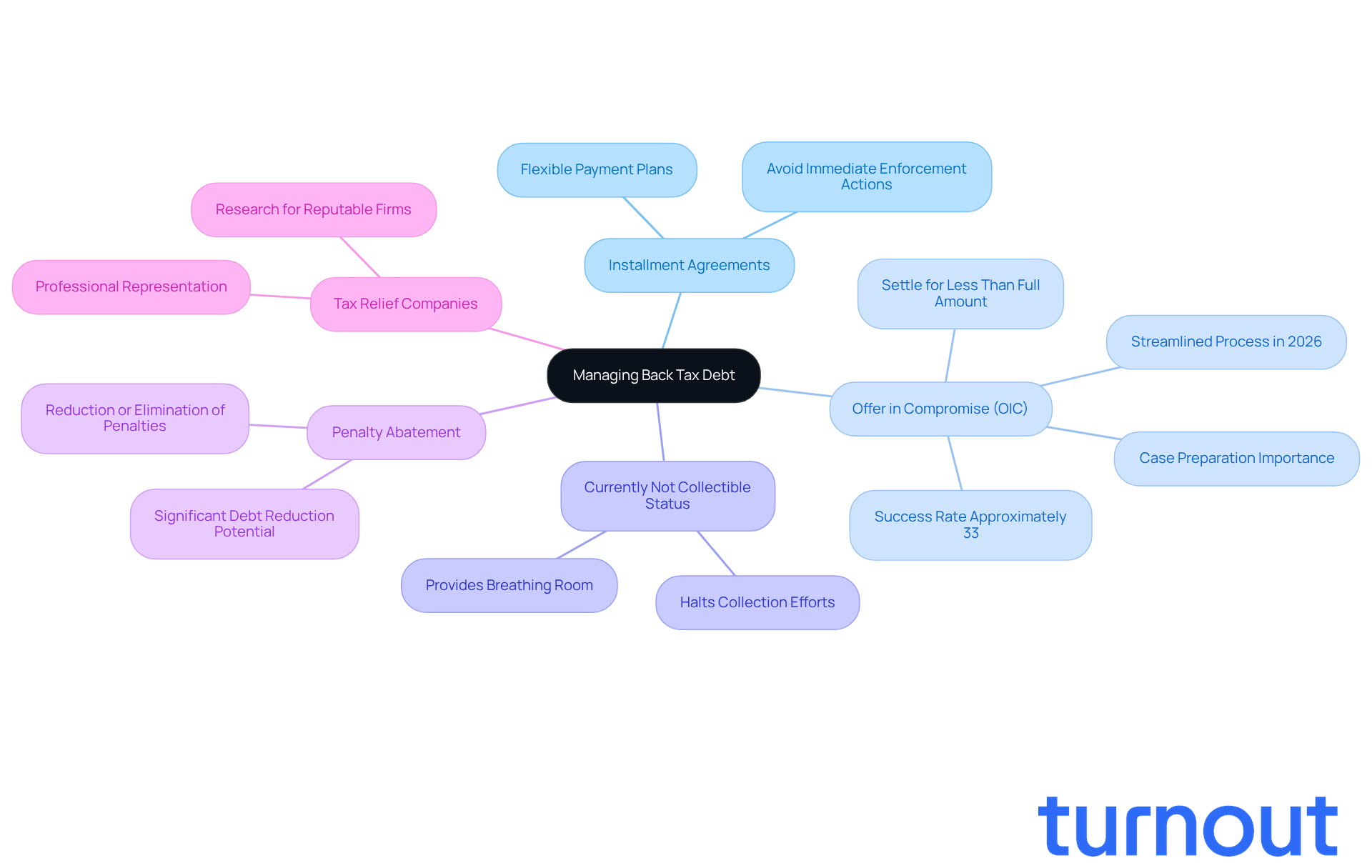

Explore Solutions for Managing Back Tax Debt

Managing back tax debt can seem overwhelming, yet there are effective solutions available to help you regain control of your financial situation.

-

Installment Agreements: We understand that facing tax obligations can be stressful. By creating a payment plan with the IRS, you can settle your debt in manageable monthly installments. This option offers flexibility and helps you avoid immediate enforcement actions, giving you peace of mind.

-

Offer in Compromise (OIC): If you're struggling financially, the OIC program might be a lifeline. It allows qualifying taxpayers to resolve their tax obligations for less than the full amount due, based on their economic situation. In 2026, the IRS streamlined the OIC process, increasing acceptance rates thanks to enhanced resources and support. Historically, about one in three OIC applications are accepted, highlighting the importance of proper case preparation. Many have successfully reduced their tax obligations significantly - like one taxpayer who lowered their debt from over $10,000 to just $500.

-

Currently Not Collectible (CNC) Status: If you're facing genuine financial hardship, you may qualify for CNC status, which temporarily halts collection efforts. This status can provide crucial breathing room, allowing you to stabilize your finances without the pressure of IRS enforcement.

-

Penalty Abatement: If you've missed payments for valid reasons, you can request a reduction or elimination of penalties. The IRS has programs that can significantly decrease your tax liabilities, sometimes by thousands of dollars, especially for first-time penalties.

-

Tax Relief Companies: While many firms offer assistance in negotiating with the IRS, it’s essential to do your research to find reputable companies. Professional representation can enhance your chances of successful negotiations and ensure you don’t miss out on potential relief opportunities.

As we move through 2026, the landscape of tax relief continues to evolve. It’s crucial to stay informed and proactive in managing your tax obligations. We understand that the psychological burden of accumulating financial obligations can make it harder to take action. Remember, you are not alone in this journey - immediate engagement can lead to positive change.

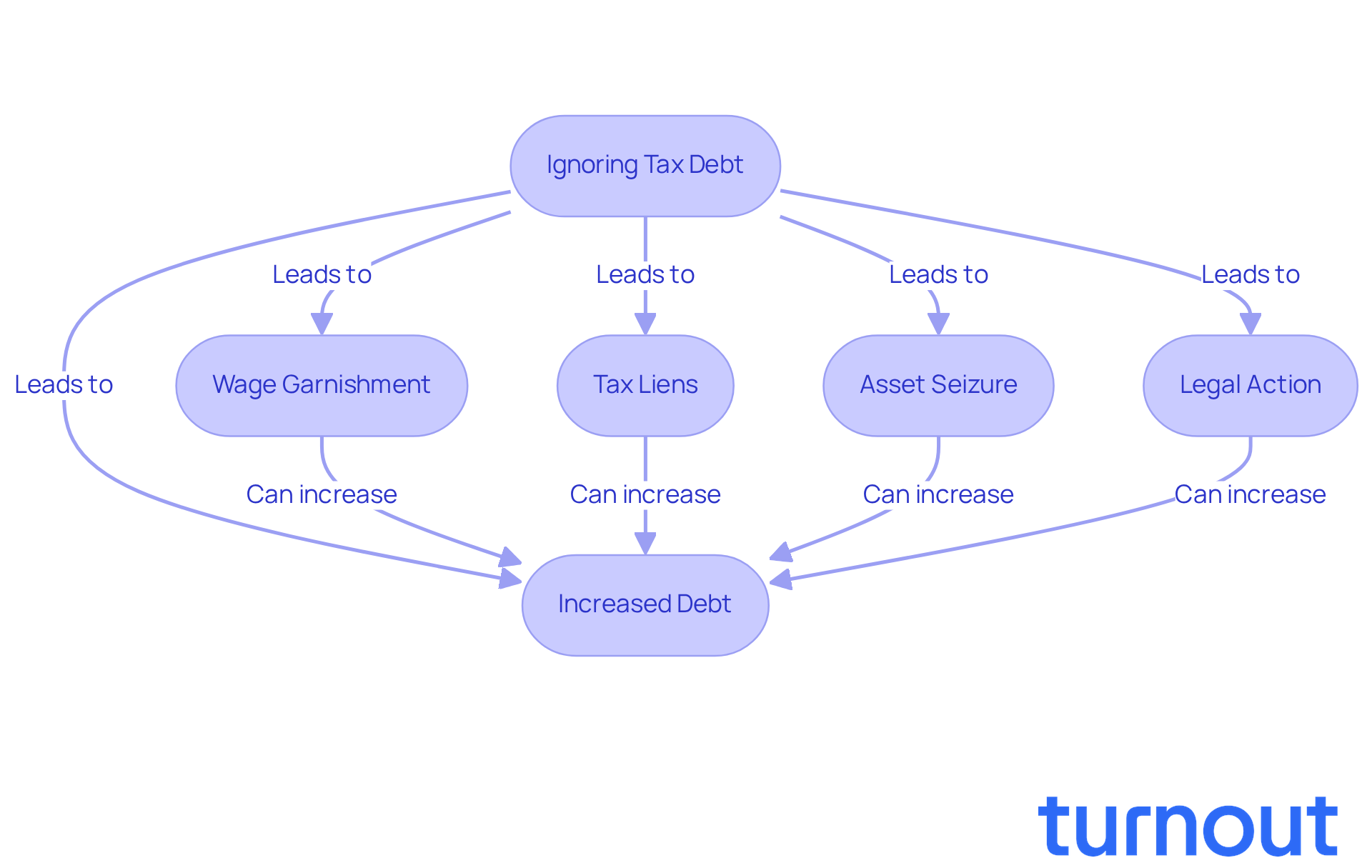

Understand the Consequences of Ignoring Tax Debt

Ignoring back tax debt can lead to serious consequences that may impact your financial stability and future. We understand that facing these issues can be overwhelming, but it’s important to be aware of what could happen if you don’t take action. Here are some key repercussions:

-

Wage Garnishment: The IRS has the legal authority to take a portion of your wages to cover tax debts. This means that a percentage of your paycheck could be withheld directly by your employer, which can complicate your financial situation and reduce your take-home pay.

-

Tax Liens: In 2026, the IRS plans to file thousands of tax liens against individuals who haven’t paid their debts. A tax lien is a legal claim against your property, which can hurt your credit score and make selling assets more difficult. It serves as a public record of your outstanding dues, making it harder to secure loans or mortgages.

-

Asset Seizure: The IRS can seize various assets, including bank accounts, vehicles, and real estate, to recover owed taxes. This action can disrupt your daily life and financial stability, as you may lose access to essential funds and property.

-

Legal Action: If you continue to ignore your tax obligations, it could escalate to legal proceedings. In extreme cases, failing to address back tax debt might even lead to criminal charges for tax evasion, resulting in significant fines or imprisonment.

-

Increased Debt: When you ignore tax obligations, interest and penalties can pile up, significantly increasing the total amount owed. For example, failure-to-pay penalties accumulate at 0.5% per month, which can quickly add up, making it harder to settle the obligation over time.

Tax attorneys emphasize the importance of addressing tax issues promptly. As the IRS states, "If you don't pay your tax bill in full by Tax Day, the IRS will charge interest on the outstanding amount." Proactive engagement with the IRS can help prevent the escalation of enforcement actions like wage garnishments and tax liens. Remember, staying informed about IRS updates and understanding the consequences of tax obligations is essential for preserving your economic well-being. You're not alone in this journey; we're here to help.

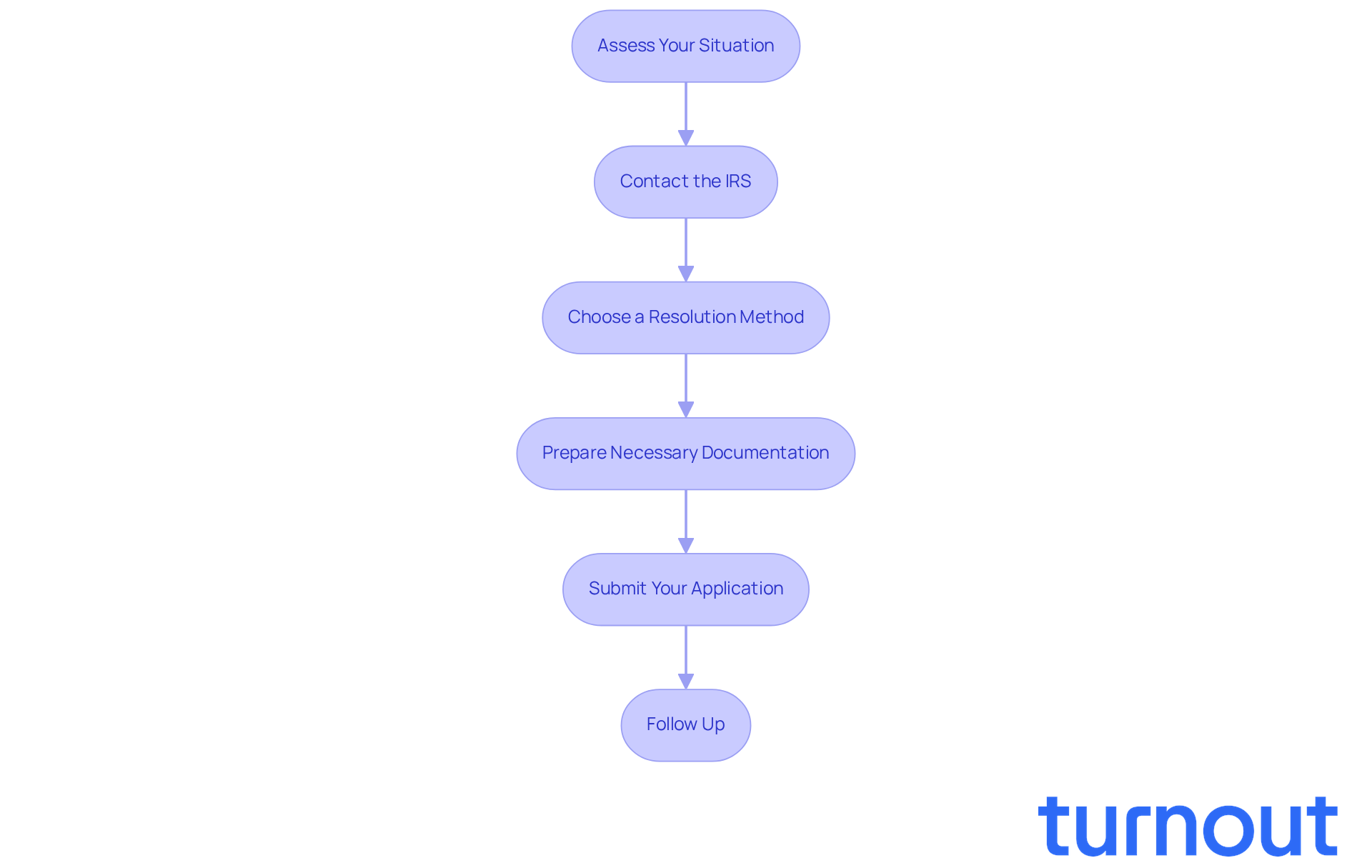

Implement Step-by-Step Strategies for Resolution

Addressing back tax debt can feel overwhelming, but you’re not alone in this journey. Here’s a step-by-step guide to help you navigate through it with confidence:

-

Assess Your Situation: Start by gathering all your financial documents, like tax returns and IRS notices. Understanding your financial landscape is crucial; it sets the stage for your next steps.

-

Contact the IRS: Don’t hesitate to reach out to the IRS. We understand that this can be intimidating, but it’s important to explore your options. Responding quickly to IRS notices can prevent collections, and the IRS has resources to guide you through the process.

-

Choose a Resolution Method: After assessing your situation, decide on a resolution method that suits you. You might consider an installment agreement or an Offer in Compromise (OIC), which allows qualifying taxpayers to settle their tax debt for less than what they owe. If you’re facing financial hardship, applying for Currently Not Collectible (CNC) status can pause IRS collection efforts, giving you some breathing room.

-

Prepare Necessary Documentation: Gather and organize all the documents you’ll need to support your chosen resolution method. This includes forms like IRS Form 433-A for OIC applications. Accuracy and completeness are key to ensuring a smooth process.

-

Submit Your Application: Follow the IRS guidelines carefully when submitting your application. Make sure all forms are filled out correctly to avoid delays. Remember, the IRS usually takes 6 to 12 months to process OIC applications, with a 33 percent acceptance rate, so timely submission is essential.

-

Follow Up: Stay in touch with the IRS to keep track of your application’s status. Respond promptly to any requests for additional information. Keeping an eye on your application can help prevent unnecessary delays and keep you informed throughout the process.

By following these steps, you can address the complexities of back tax debt more clearly and confidently. Remember, we’re here to help you every step of the way.

Conclusion

Addressing back tax debt is a critical issue that deserves your immediate attention. We understand that this situation can feel overwhelming, but taking proactive steps can significantly ease your financial stress. By recognizing the importance of engaging with tax authorities, you can navigate your obligations more effectively and find solutions that fit your unique circumstances.

Throughout this article, we’ve explored various strategies, such as:

- Installment agreements

- Offer in Compromise (OIC)

- Currently Not Collectible (CNC) status

- Penalty abatement

Each option offers unique benefits that can help you manage your debt and lighten your financial burden. It’s common to feel anxious about the severe repercussions of ignoring tax debt-like wage garnishment, tax liens, and asset seizure. This highlights the urgency of addressing these obligations promptly.

Remember, you don’t have to face this journey alone. By taking informed steps-like assessing your financial situation, reaching out to the IRS, and choosing the right resolution method-you can regain control over your finances. Embracing these strategies is essential for achieving tax relief and protecting your financial future. The time to act is now; proactive engagement can lead to positive outcomes and a renewed sense of financial stability. We're here to help you every step of the way.

Frequently Asked Questions

What is back tax debt?

Back tax debt refers to taxes that remain unpaid by their due date, creating a responsibility to the IRS or state tax authorities.

What are the implications of having back tax debt?

The implications include accruing interest and penalties, which can significantly increase the total amount owed. Additionally, it can lead to severe financial strain for families and potential consequences such as wage garnishments, tax liens, and legal action.

What can happen if back tax debt obligations are ignored?

Ignoring back tax debt can result in dire consequences, including the IRS issuing a 'Final Notice of Intent to Levy,' which allows them to garnish wages or seize bank accounts.

What penalties can accumulate for unpaid taxes?

The failure-to-pay penalty can add up each month until the balance is resolved, leading to mounting penalties and interest.

What collection methods does the IRS offer for back tax debt?

The IRS offers various collection methods, including the Offer in Compromise (OIC) and Currently Not Collectible (CNC) status.

Why is it important to address tax obligations promptly?

Addressing tax obligations promptly is crucial to avoid escalating penalties and interest, and to prevent severe financial consequences such as wage garnishments and legal actions.