Introduction

Navigating the complexities of tax obligations can feel overwhelming for employers. We understand that tackling the intricacies of Form 941, the Employer's Quarterly Federal Tax Return, is no small feat. This crucial document not only ensures compliance with federal tax laws but also plays a vital role in managing payroll accurately and planning finances effectively.

It's common to feel anxious about the potential penalties and the risk of misreporting. So, how can you confidently approach the filing process? This guide is here to help. We provide a step-by-step approach to mastering Form 941, equipping you with the knowledge and tools needed to avoid common pitfalls and ensure timely submissions. Remember, you are not alone in this journey.

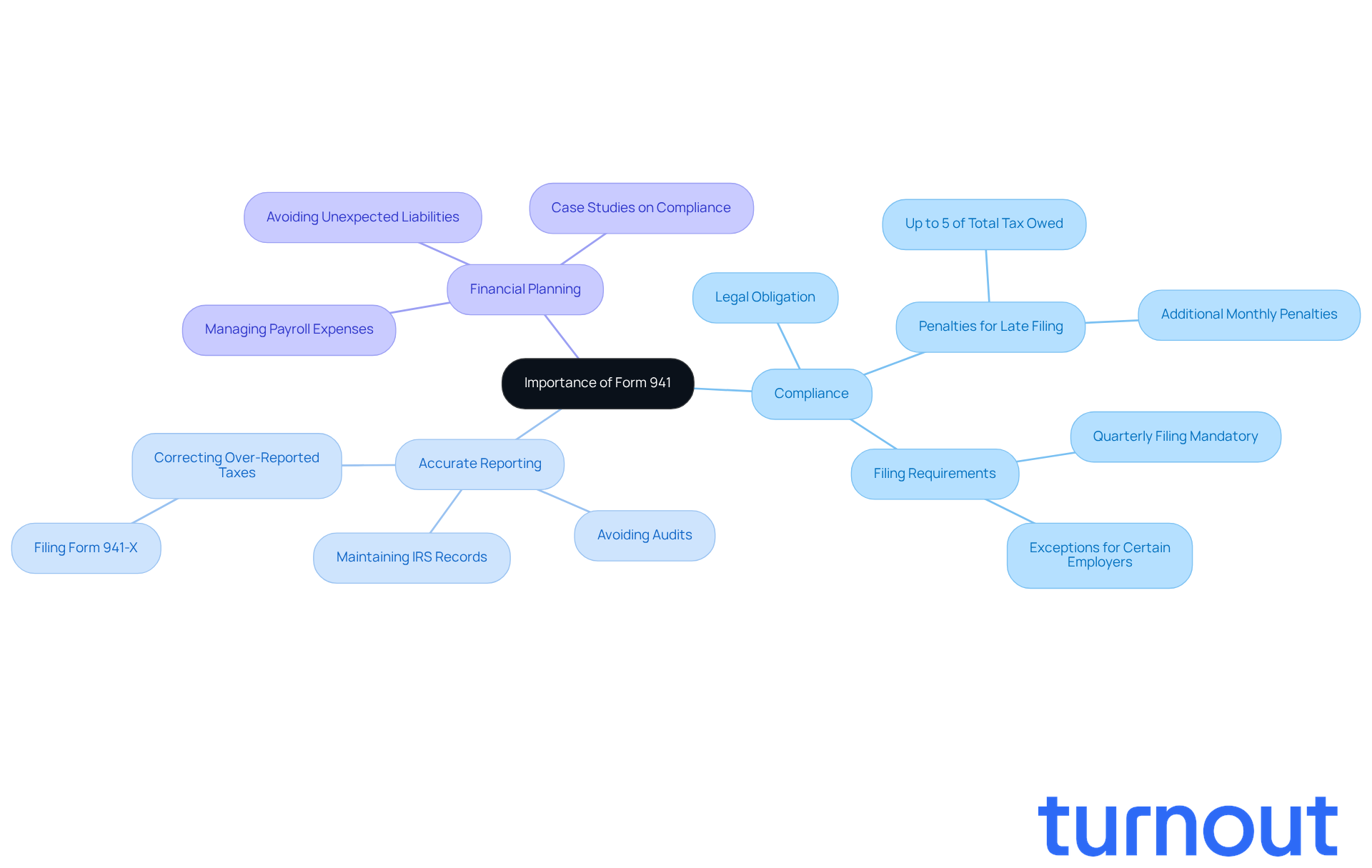

Understand Form 941 and Its Importance

The 941 tax payments, formally known as the Employer's Quarterly Federal Tax Return, are essential records that employers must submit to the IRS each quarter. This form reports federal income contributions, Social Security contributions, and Medicare contributions withheld from employees' wages, along with the employer's share of these contributions.

We understand that navigating tax obligations can feel overwhelming. That’s why it’s crucial to grasp the significance of Form 941 for several reasons:

- Compliance: Filing Form 941 is a legal obligation for most employers. Failing to file can lead to penalties, which can amount to 5% of the total amount owed, plus interest on any unpaid dues. Remember, even if you have no employees during a quarter, you still need to file unless you qualify for specific exceptions.

- Accurate Reporting: This form helps ensure that the IRS maintains accurate records of payroll tax liabilities. This is vital for you to uphold good standing with tax authorities. Inaccuracies can lead to audits and further complications, so meticulous record-keeping is essential.

- Financial Planning: Understanding document 941 allows you to manage payroll expenses and tax obligations effectively. This helps avoid unexpected liabilities at tax time. For instance, businesses that fail to file correctly may face significant financial repercussions, as seen in various compliance case studies where employers incurred substantial penalties for late submissions.

In essence, 941 tax payments are not just a bureaucratic requirement; they serve as a critical tool for managing payroll taxes and ensuring adherence to federal tax laws. We’re here to help you stay informed about IRS updates and compliance requirements for 2026, so you can navigate these obligations successfully. You are not alone in this journey.

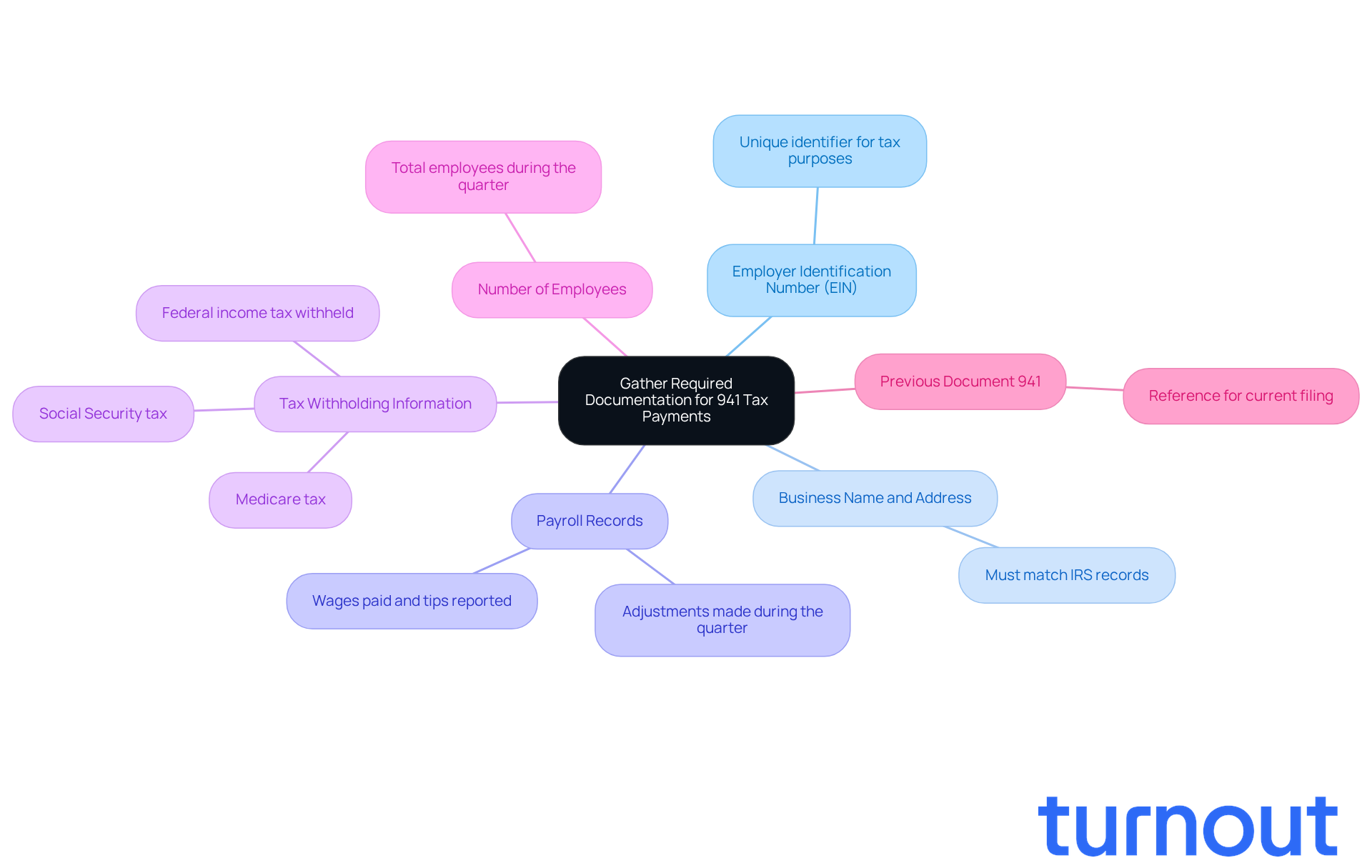

Gather Required Documentation and Information

Before you start filling out your paperwork for 941 tax payments, it’s essential to gather all the necessary documentation and information. We understand that this process can feel overwhelming, but having everything organized will make it much smoother. Here’s what you need:

- Employer Identification Number (EIN): This unique number identifies your business for tax purposes.

- Business Name and Address: Make sure the name and address match what the IRS has on file.

- Payroll Records: Collect records of wages paid, tips reported by employees, and any adjustments made during the quarter. Accurate payroll records are vital, as they directly impact your tax calculations.

- Tax Withholding Information: This includes the total federal income tax withheld, Social Security tax, and Medicare tax for the quarter. Documenting this information is critical for ensuring compliance and accuracy in your 941 tax payments filings.

- Number of Employees: Know how many employees you had during the quarter, as this affects your tax calculations.

- Previous Document 941: If applicable, have your last filed 941 ready for reference.

Having this information organized will help you avoid common mistakes and make completing 941 tax payments much easier. For instance, consider Dana, a taxpayer who sought help preparing her tax return for her babysitting business. Her meticulous documentation led to a smooth organization process, timely tax submissions, and no penalties. As tax experts often say, keeping precise records is crucial for successful tax submission.

By following these best practices, you can navigate the complexities of tax filing with confidence. Remember, you’re not alone in this journey; we’re here to help!

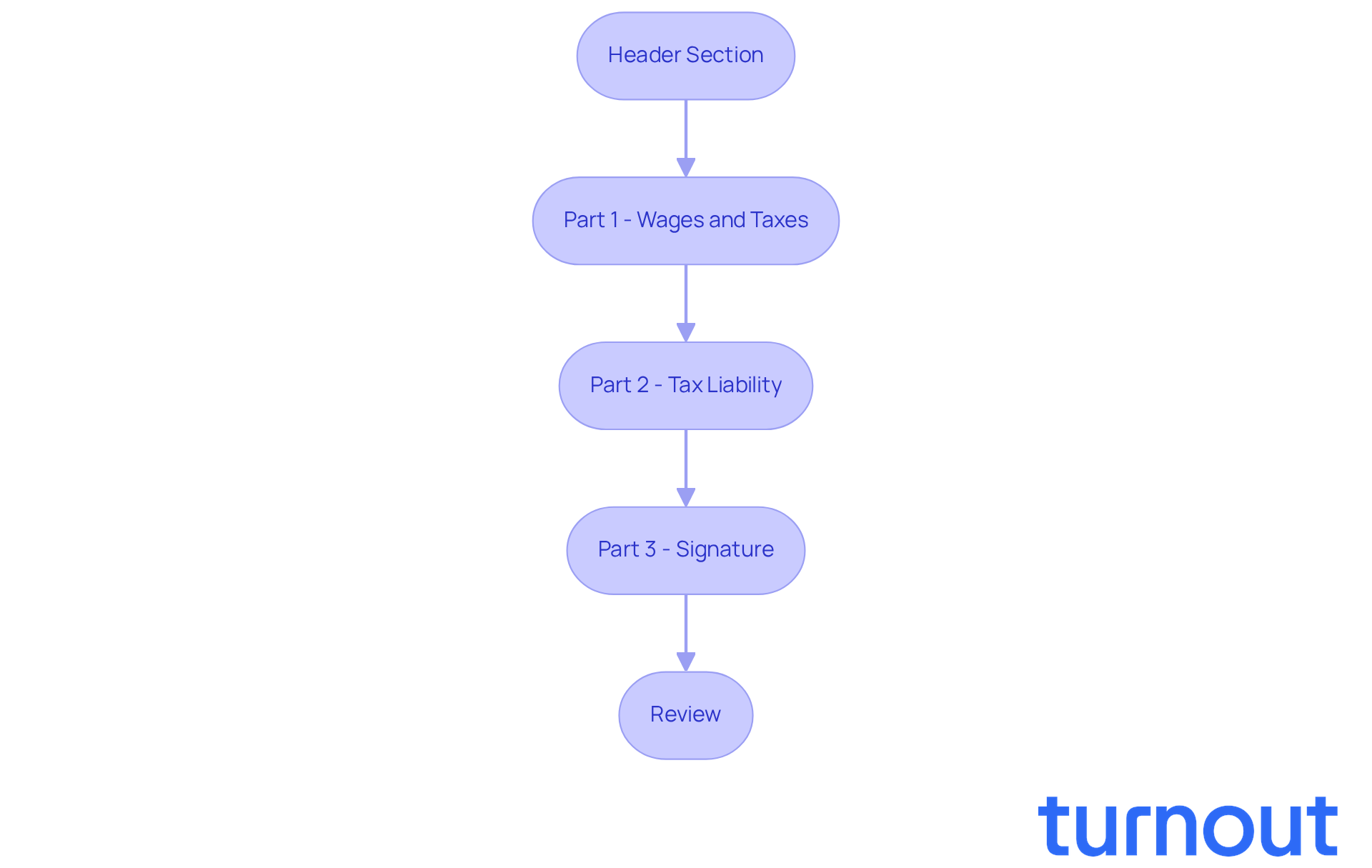

Complete Form 941 Accurately

Completing Form 941 can feel overwhelming, but we're here to help you navigate it with ease. Just follow these steps to ensure everything is accurate:

-

Header Section: Start by entering your Employer Identification Number (EIN), business name, and address. It’s crucial that these details match IRS records to avoid any discrepancies that could cause stress later on.

-

Part 1 - Wages and Taxes: Here, report the total number of employees and the total wages paid during the quarter. Make sure to calculate the federal income tax withheld, Social Security tax, and Medicare tax accurately. This will help you stay compliant and avoid any unnecessary worries.

-

Part 2 - Tax Liability: Specify your tax liability for the quarter, along with any necessary adjustments. This section is vital for determining your total tax due and helps you steer clear of underpayment penalties.

-

Part 3 - Signature: Don’t forget to have an authorized individual sign the form. This step is essential for validating the information provided and ensuring accountability, giving you peace of mind.

-

Review: Take a moment to conduct a thorough review of all entries for accuracy, especially calculations and employee counts. It’s common to misreport wages or tax withholdings, which can lead to significant penalties. In fact, studies show that about 30% of businesses face issues due to inaccuracies in their 941 tax payments, as noted by tax professionals.

As you prepare for the 2026 filing season, remember that the IRS encourages you to ensure all information is accurate and complete. By meticulously following these steps, you can enhance the accuracy of your 941 document, minimizing the risk of errors and the stress that comes with associated penalties. You're not alone in this journey; with careful attention, you can tackle this task confidently.

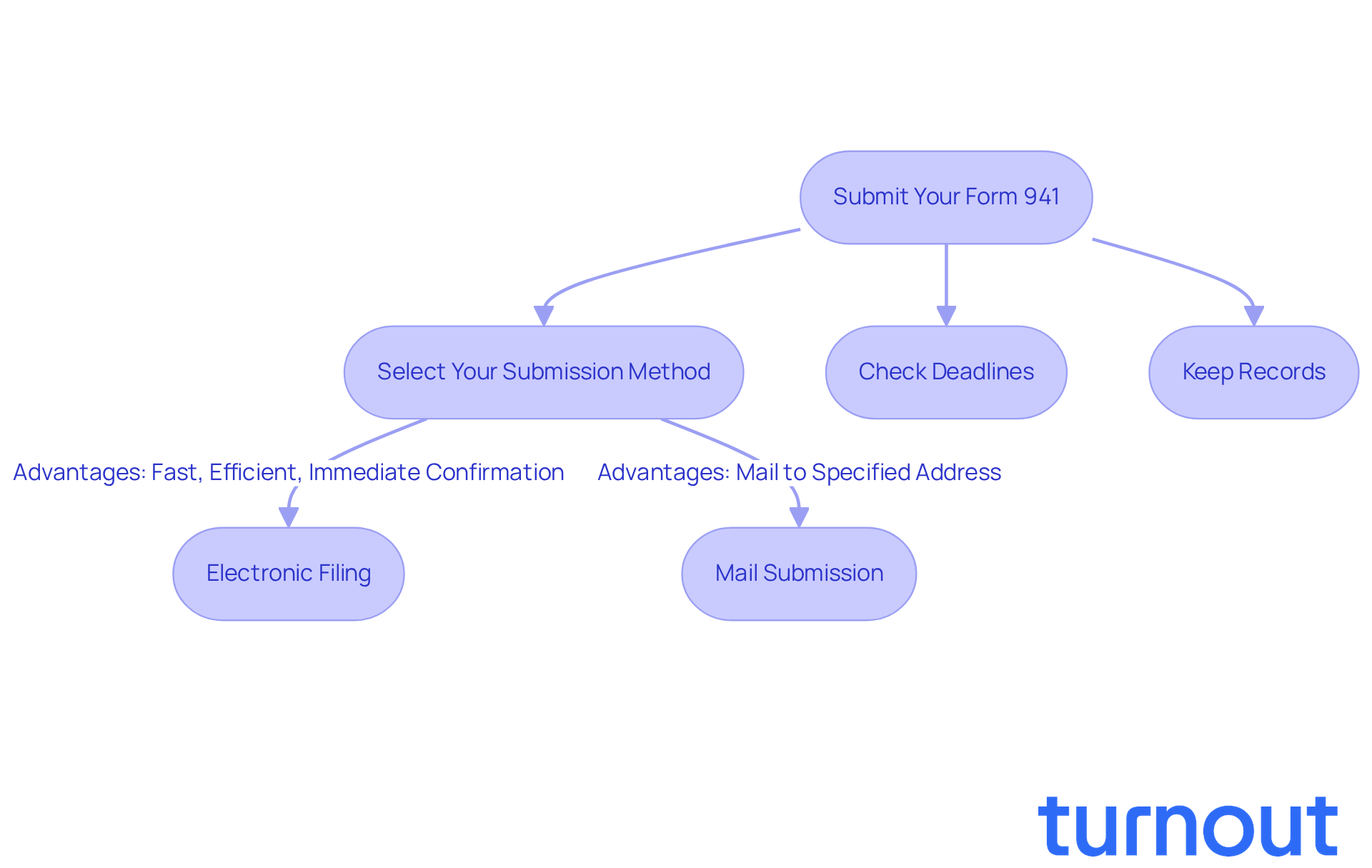

Submit Your Form 941

Once you’ve completed your 941, it’s time to submit it. We understand that this can feel overwhelming, but we’re here to help you through it. Here’s how to make the process smoother:

-

Select Your Submission Method: You have two options for submitting your 941: electronically or by mail. The IRS strongly encourages electronic filing because it’s faster and more efficient. Most taxpayers find this method to be the easiest.

- Electronic Filing: By using IRS-approved software to e-file, you’ll receive immediate confirmation of receipt. This method significantly reduces the chances of errors thanks to built-in validation checks, making it a preferred choice for many.

- Mail Submission: If you decide to send your document by mail, please ensure you direct it to the address specified in the 941 instructions based on your location.

-

Check Deadlines: It’s crucial to submit your 941 by the last day of the month following the end of the quarter. For example, if you’re filing for the first quarter (January to March), the deadline is April 30, 2026. Missing this deadline can lead to penalties, so please stay vigilant.

-

Keep Records: After you submit, be sure to keep a copy of your 941 along with any confirmation of electronic submission. This documentation is essential for your records and can be invaluable in case of discrepancies or audits. Also, remember to have the form signed by an authorized person, including their printed name, title, and contact information.

By following these steps, you can ensure that your 941 document is submitted correctly and on time. You’re not alone in this journey, and taking these actions will help reduce the chance of any issues.

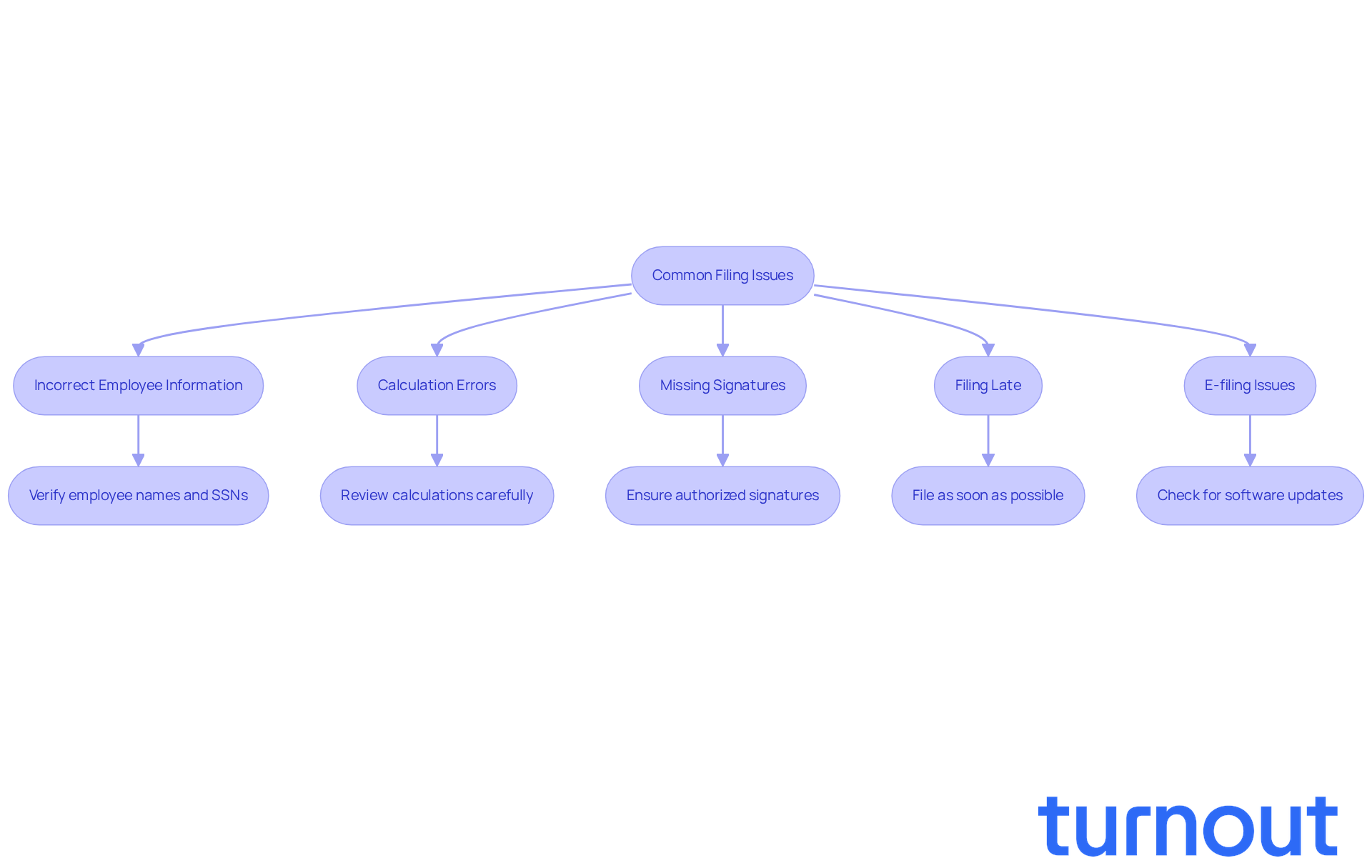

Troubleshoot Common Filing Issues

Even with careful preparation, we understand that challenges can emerge when submitting 941 paperwork. Here are some common issues you might face, along with effective troubleshooting strategies:

-

Incorrect Employee Information: It’s crucial to verify that all employee names and Social Security numbers are correct. Mismatches can lead to significant processing delays. In fact, studies show that about 30% of forms are rejected due to such inaccuracies.

-

Calculation Errors: We know how easy it is to make mistakes. Carefully review all calculations, especially for wages and tax withholdings. Using a calculator or spreadsheet can help ensure your totals are accurate and prevent costly errors. As tax consultant Jane Doe wisely points out, "Accurate calculations are crucial; even small errors can lead to significant penalties."

-

Missing Signatures: Don’t forget to confirm that the form is signed by an authorized individual. An unsigned form will be rejected, causing unnecessary delays in processing.

-

Filing Late: If you miss the deadline, file as soon as possible to mitigate penalties. Consider using Form 941-X to correct any mistakes from earlier submissions. The IRS emphasizes the importance of prompt corrections. Remember, "Timely submission is essential to avoid penalties and ensure compliance."

-

E-filing Issues: If you encounter difficulties while e-filing, check for software updates or consult the IRS website for known issues and troubleshooting solutions.

By understanding these common challenges and their solutions, you can navigate the submission process more effectively and avoid unnecessary complications. For instance, one small business owner successfully resolved employee information errors by implementing a double-check system, significantly reducing their filing issues. This practical approach can serve as a model for others facing similar challenges. Remember, you are not alone in this journey; we're here to help!

Conclusion

Mastering the 941 tax payments filing process is crucial for employers who want to stay compliant and avoid penalties. We understand that navigating these requirements can feel overwhelming. However, grasping the significance of Form 941 not only meets a legal obligation but also plays a vital role in accurate payroll reporting and financial planning. By recognizing the importance of this form, you can approach your tax responsibilities with greater confidence and clarity.

This article provides a step-by-step approach to successfully filing Form 941. Key points include:

- Gathering necessary documentation

- Accurately completing the form

- Submitting it on time

Remember, meticulous record-keeping and attention to detail are essential, as inaccuracies can lead to significant penalties. It’s common to encounter filing issues, but troubleshooting these challenges is vital for ensuring a smooth submission process, helping you avoid unnecessary complications.

Ultimately, taking the time to understand and master the 941 tax payments process can lead to a more efficient and stress-free experience. We encourage you to stay informed about IRS updates and compliance requirements for 2026. By doing so, you can fulfill your obligations accurately and on time. Implementing the strategies discussed not only minimizes the risk of errors but also reinforces your commitment to responsible financial management. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Form 941 and why is it important?

Form 941, known as the Employer's Quarterly Federal Tax Return, is a crucial document that employers must submit to the IRS each quarter. It reports federal income contributions, Social Security contributions, and Medicare contributions withheld from employees' wages, as well as the employer's share of these contributions. Filing this form is a legal obligation for most employers, and it plays a vital role in ensuring compliance with federal tax laws.

What are the consequences of failing to file Form 941?

Failing to file Form 941 can lead to penalties amounting to 5% of the total amount owed, in addition to interest on any unpaid dues. Employers are required to file even if they have no employees during a quarter unless they qualify for specific exceptions.

How does Form 941 help with accurate reporting?

Form 941 helps maintain accurate records of payroll tax liabilities with the IRS. Accurate reporting is essential for upholding good standing with tax authorities, as inaccuracies can lead to audits and further complications.

How can understanding Form 941 aid in financial planning?

Understanding Form 941 allows employers to effectively manage payroll expenses and tax obligations, helping to avoid unexpected liabilities at tax time. Incorrect filing can result in significant financial repercussions, including penalties for late submissions.

What documentation is required to fill out Form 941?

To fill out Form 941, you need to gather the following documentation: - Employer Identification Number (EIN) - Business Name and Address - Payroll Records (wages paid, tips reported, adjustments) - Tax Withholding Information (federal income tax, Social Security tax, Medicare tax) - Number of Employees during the quarter - Previous Document 941 (if applicable)

Why is it important to keep accurate payroll records?

Accurate payroll records are vital as they directly impact tax calculations and compliance. Maintaining precise records helps avoid common mistakes and ensures timely tax submissions without penalties.

How can organizing information help in the tax filing process?

Organizing necessary information and documentation can make the process of completing Form 941 much smoother, helping to avoid common mistakes and ensuring accurate and timely submissions.