Introduction

Navigating the complexities of tax reporting can feel overwhelming, especially when it comes to Form 1098 and its crucial Box 7. This checkbox may seem simple, but it plays a vital role in determining whether the interest on a loan is eligible for deduction. This decision can significantly impact your financial situation. With recent changes from the IRS, understanding Box 7 is more important than ever. It not only helps ensure compliance but also opens the door to potential savings.

But what happens if this box is left unchecked? Or if the information reported doesn’t match your personal records? It’s common to feel uncertain in these situations. By exploring essential steps and troubleshooting common pitfalls, you can approach your tax returns with confidence and clarity. Remember, you’re not alone in this journey - we’re here to help you every step of the way.

Define Box 7 of Form 1098 and Its Importance

The 1098 box 7 plays a crucial role in tax reporting, and we understand how important it is for you to get it right. This box shows whether the property securing your loan matches your mailing address. When it’s checked, it confirms that the interest reported is linked to the property listed. This is vital for determining if you can deduct that interest on your tax returns. It’s not just a formality; it can significantly impact your tax situation.

If Box 7 is unchecked, don’t worry! You can still claim deductions if you provide the correct address in Box 8. Just make sure that the property is your primary residence or a second home. We know that navigating these details can feel overwhelming, but understanding them can help you optimize your potential tax benefits.

Recent changes to IRS regulations have made it even more important to report this information accurately. Many taxpayers have successfully claimed interest deductions by paying close attention to the 1098 box 7. In fact, a significant number of individuals benefit from these deductions each year, with the average refund for the 2025 filing season estimated at $3,453. Imagine what that could mean for you!

It’s also essential to remember that lenders must provide Form 1098 by January 31 of the year following the tax year. Each loan has a $600 limit for filing, so keep that in mind. Additionally, be aware of potential penalties for late filing of Form 1098, as these can add unnecessary stress to your tax reporting process.

The importance of the 1098 box 7 in tax reporting cannot be overstated. It’s a key factor in ensuring compliance with IRS regulations and optimizing your tax outcomes using the 1098 box 7. By grasping the nuances of this box, you can navigate the complexities of tax reporting with greater confidence and accuracy. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Identify Information Included in Box 7

The checkbox in 1098 box 7 on Form 1098 indicates whether the property securing the loan matches the borrower's mailing address. When this is verified, it reassures you that the loan interest reported in Box 1 pertains to the property listed. We understand that ensuring this information aligns with your records is crucial for accurate reporting.

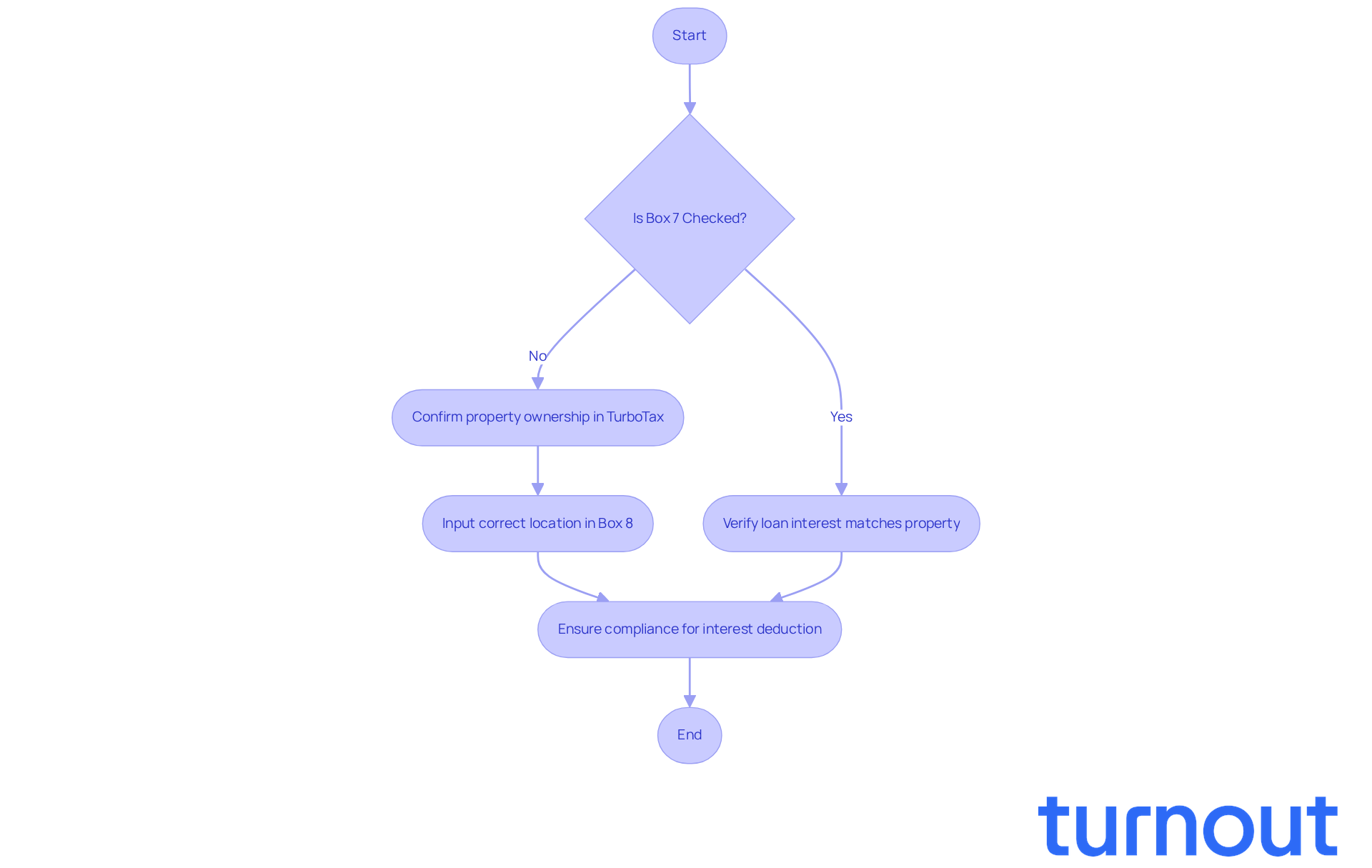

If Box 7 isn’t selected, TurboTax will prompt you to confirm if the loan is backed by a property you own. This step is vital for claiming your interest deduction. It’s common to feel confused, especially since there’s no physical checkbox for 1098 box 7 on the 1098 form. If multiple properties are involved, verifying which property is referenced can help prevent discrepancies.

For instance, if Box 7 is left unchecked, make sure to input the correct location in Box 8. This way, you can stay compliant and ensure you can claim the interest deduction on your loan. Addressing these details is essential, as mistakes can lead to complications during tax filing and even potential audits.

As tax expert KurtL1 wisely states, "You should enter in TurboTax exactly what is on the Form 1098." Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

Report Box 7 Information on Your Tax Return

To accurately report Box 7 information on your tax return, let’s walk through these essential steps together:

-

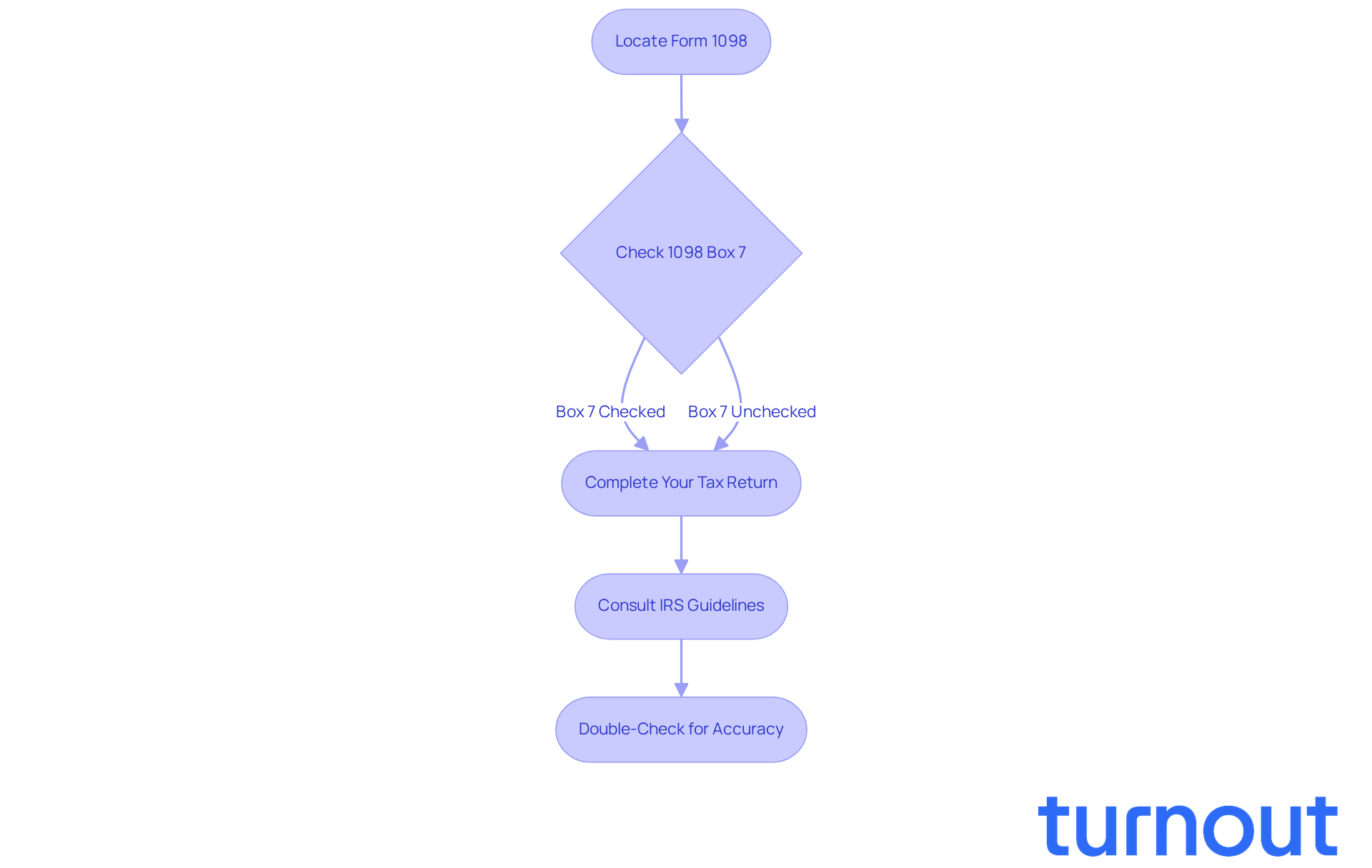

Locate Form 1098: Start by retrieving your Form 1098. This document, issued by your loan provider, details the interest you paid during the tax year. We understand that gathering paperwork can be overwhelming, but having this form is crucial.

-

Check 1098 box 7: Next, take a moment to see if the 1098 box 7 is checked. A checkmark here means the loan interest reported relates to the property mentioned on the form. It’s important that the mailing location matches the property securing the loan. If the 1098 box 7 is unchecked, don’t worry-just ensure there’s a location in Box 8 of the 1098, as this is essential for compliance.

-

Complete Your Tax Return: When you’re ready to prepare your tax return, include the interest amount from Box 1 of Form 1098. If 1098 box 7 is checked, ensure that the property address aligns with your records to support your claim. If you’re using TurboTax, be aware that it allows you to check or uncheck Box 7, which can sometimes lead to confusion due to wording referring to Box 8.

-

Consult IRS Guidelines: It’s always a good idea to refer to the IRS instructions for Form 1040 to ensure you’re reporting everything correctly. If you’re itemizing deductions, this may involve entering the interest on Schedule A. Remember, the maximum deductible mortgage loan amount is $750,000, which is important for determining your eligibility for deductions.

-

Double-Check for Accuracy: Before you submit your tax return, take a moment to meticulously review all information. Make sure it matches your Form 1098. It’s essential to enter the 1098 information exactly as received to avoid discrepancies that could lead to an IRS audit. Accurate reporting is crucial for compliance with IRS guidelines, and we’re here to help you through this process.

Troubleshoot Common Issues with Box 7

Navigating the 1098 box 7 can be challenging, and it’s completely normal to encounter a few bumps along the way. Here are some essential troubleshooting steps to help you through:

-

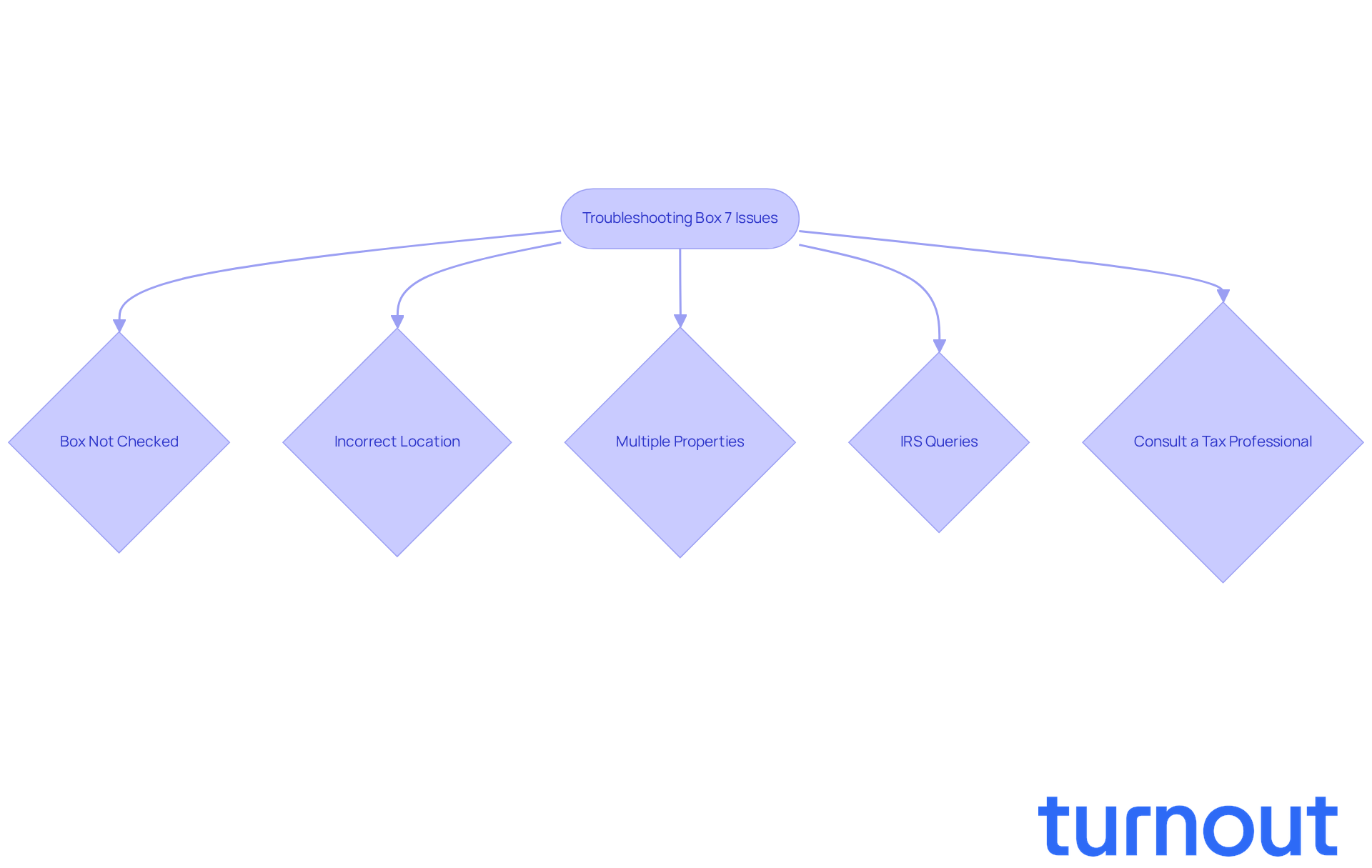

Box Not Checked: If you notice that the 1098 box 7 isn’t selected but your records align with the location, it’s crucial to check in with your lender. They might have reported the information incorrectly. Don’t hesitate to reach out for clarification - this can clear up any misunderstandings. Remember, as tax expert RudyS points out, if 1098 box 7 is left unchecked, it should remain that way in TurboTax. Make sure to remove any incorrect entries to avoid future issues.

-

Incorrect Location: If the details in 1098 box 7 don’t match your records, verify this with your lender. Correcting discrepancies before filing your tax return can save you from complications later on. One user shared their concern when their lender didn’t check the 1098 box 7, which made them worry about their eligibility for capital gains exclusion when selling their home.

-

Multiple Properties: For those of you who own multiple properties, it’s vital to use the correct Form 1098 that corresponds to the property you’re reporting. Each property may have its own distinct Form 1098, and using the wrong one can lead to errors that complicate your tax situation.

-

IRS Queries: If you receive a notice from the IRS regarding your Form 1098, respond promptly. Providing the necessary documentation can help clarify any issues. Timely communication is key to resolving potential problems. Keep in mind that the IRS recommends retaining tax records for at least three years before disposal - this can be crucial if discrepancies arise.

-

Consult a tax professional if you’re feeling uncertain about how to tackle issues related to 1098 box 7. Their expertise can offer personalized guidance tailored to your specific situation, ensuring compliance and accuracy in your tax reporting. As one satisfied user noted, having access to knowledgeable professionals can significantly enhance your understanding and resolution of tax-related concerns.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges with confidence.

Conclusion

Understanding the nuances of Box 7 on Form 1098 is crucial for anyone looking to optimize their tax reporting. We know that navigating tax forms can be overwhelming, but this critical component not only verifies the connection between your loan interest and the property listed, it also plays a significant role in determining your eligibility for deductions. By ensuring that this box is accurately checked or unchecked, you can approach tax compliance with greater confidence.

Throughout this article, we’ve shared key insights about Box 7, including its implications for interest deductions and the importance of aligning this information with your records. The steps outlined for accurately reporting Box 7 on your tax return emphasize the need for meticulous attention to detail, especially with recent IRS regulations. It’s common to feel uncertain about these requirements, but troubleshooting common issues related to Box 7 can provide practical guidance to help you avoid potential pitfalls in tax reporting.

Ultimately, mastering the intricacies of Box 7 isn’t just about compliance; it’s about empowering yourself to make informed financial decisions. As the tax landscape continues to evolve, staying informed and proactive can lead to significant benefits, including maximizing your tax refund. Embrace this opportunity to enhance your understanding of tax reporting. Remember, you’re not alone in this journey-consider seeking professional guidance if uncertainties arise. This proactive approach can pave the way for a smoother tax season and greater financial peace of mind.

Frequently Asked Questions

What is Box 7 of Form 1098?

Box 7 of Form 1098 indicates whether the property securing your loan matches your mailing address. It confirms that the interest reported is linked to the property listed.

Why is Box 7 important for tax reporting?

Box 7 is important because it helps determine if you can deduct the interest on your tax returns. If it is checked, it confirms the connection between the interest and the property, which is vital for tax deductions.

What if Box 7 is unchecked?

If Box 7 is unchecked, you can still claim deductions by providing the correct address in Box 8, as long as the property is your primary residence or a second home.

How can recent IRS regulation changes affect Box 7 reporting?

Recent changes to IRS regulations have made it more important to report the information in Box 7 accurately, as it can significantly impact your ability to claim interest deductions.

What is the estimated average refund for taxpayers filing in the 2025 season?

The estimated average refund for the 2025 filing season is $3,453, which many individuals benefit from by claiming interest deductions linked to Box 7.

When must lenders provide Form 1098?

Lenders must provide Form 1098 by January 31 of the year following the tax year.

Is there a limit for filing Form 1098 for each loan?

Yes, there is a $600 limit for filing Form 1098 for each loan.

What are the potential consequences of late filing of Form 1098?

Late filing of Form 1098 can result in penalties, adding stress to the tax reporting process.