Introduction

Managing unpaid taxes can feel like navigating a minefield. We understand that as interest rates climb and penalties mount, it can be overwhelming. With the IRS charging a staggering 7% annually on underpayments, costs can escalate quickly, leaving many taxpayers feeling trapped.

This article explores effective strategies to manage and reduce tax interest. We’re here to offer practical solutions that empower you to take control of your financial obligations. How can you turn the tide and avoid the pitfalls of mounting charges while ensuring compliance with tax regulations?

You are not alone in this journey. Together, we can find a way forward.

Understand Tax Interest: Definition and Accumulation

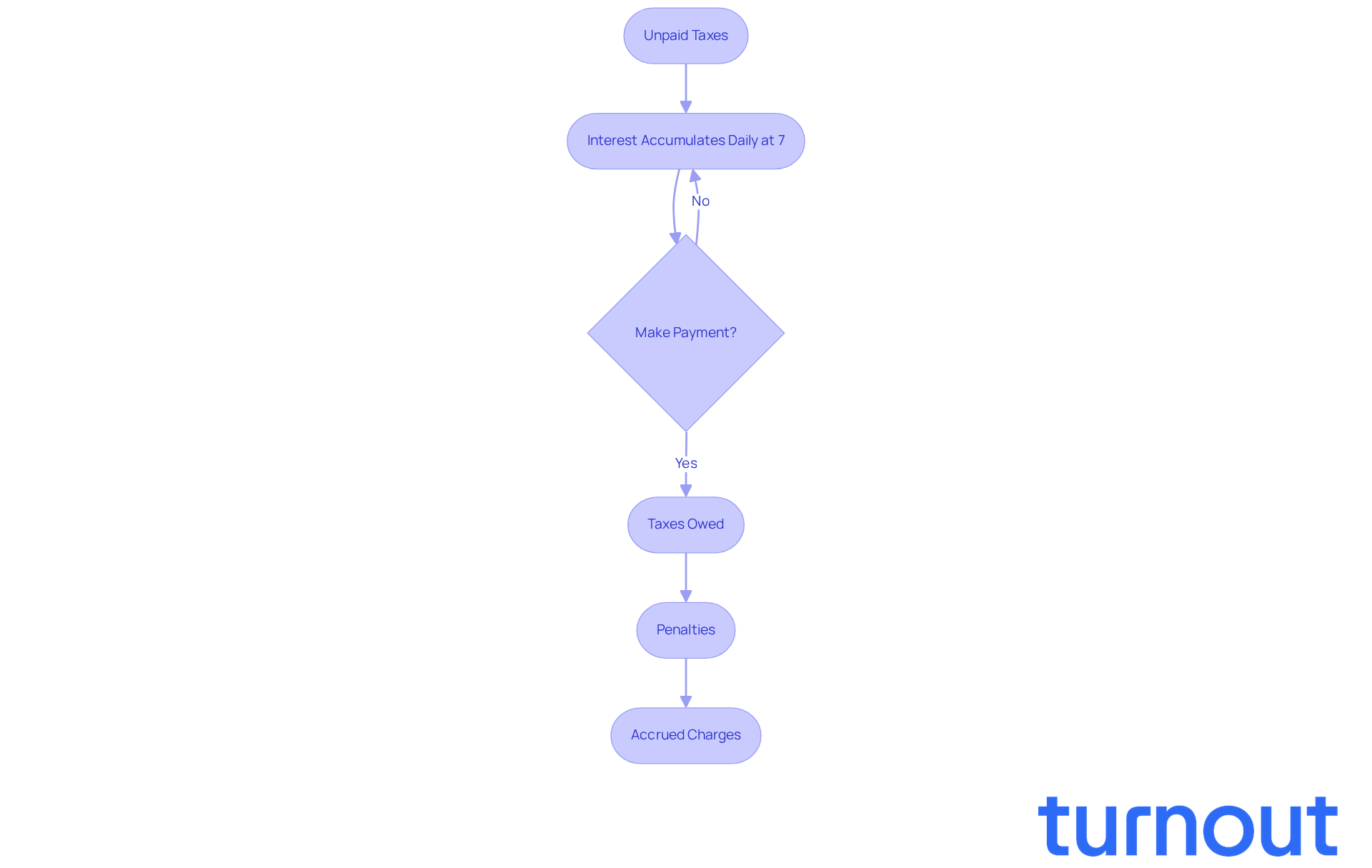

We understand that dealing with unpaid taxes can be overwhelming. The charges imposed by the IRS on these amounts, which include interest on taxes owed, add up daily from the due date until the debt is fully settled. As of February 2026, the IRS rate for underpayments stands at 7% annually, compounded daily. This rate is determined quarterly, typically based on the federal short-term rate plus a margin of 3%.

When you make a payment, the IRS allocates it first to taxes owed, then to penalties, and finally to accrued charges. If you find yourself postponing payment, even for a brief moment, those growing charges can significantly increase the total amount due. It’s common to feel the pressure when you realize how quickly these costs can escalate.

Real-world situations show that many who delay resolving their tax obligations often face unexpectedly high financial burdens due to this daily compounding charge. Additionally, for individuals, the returns on overpayments are also set at 7% for the first quarter of 2026.

Understanding how tax charges accumulate is vital. It highlights the importance of making prompt payments to keep rising expenses at bay. Remember, interest on taxes owed continues to accrue on unpaid taxes, penalties, and interest until the balance is paid in full. You are not alone in this journey; we’re here to help you take action and find a resolution.

Identify Late Payment Penalties: Consequences of Delayed Filing

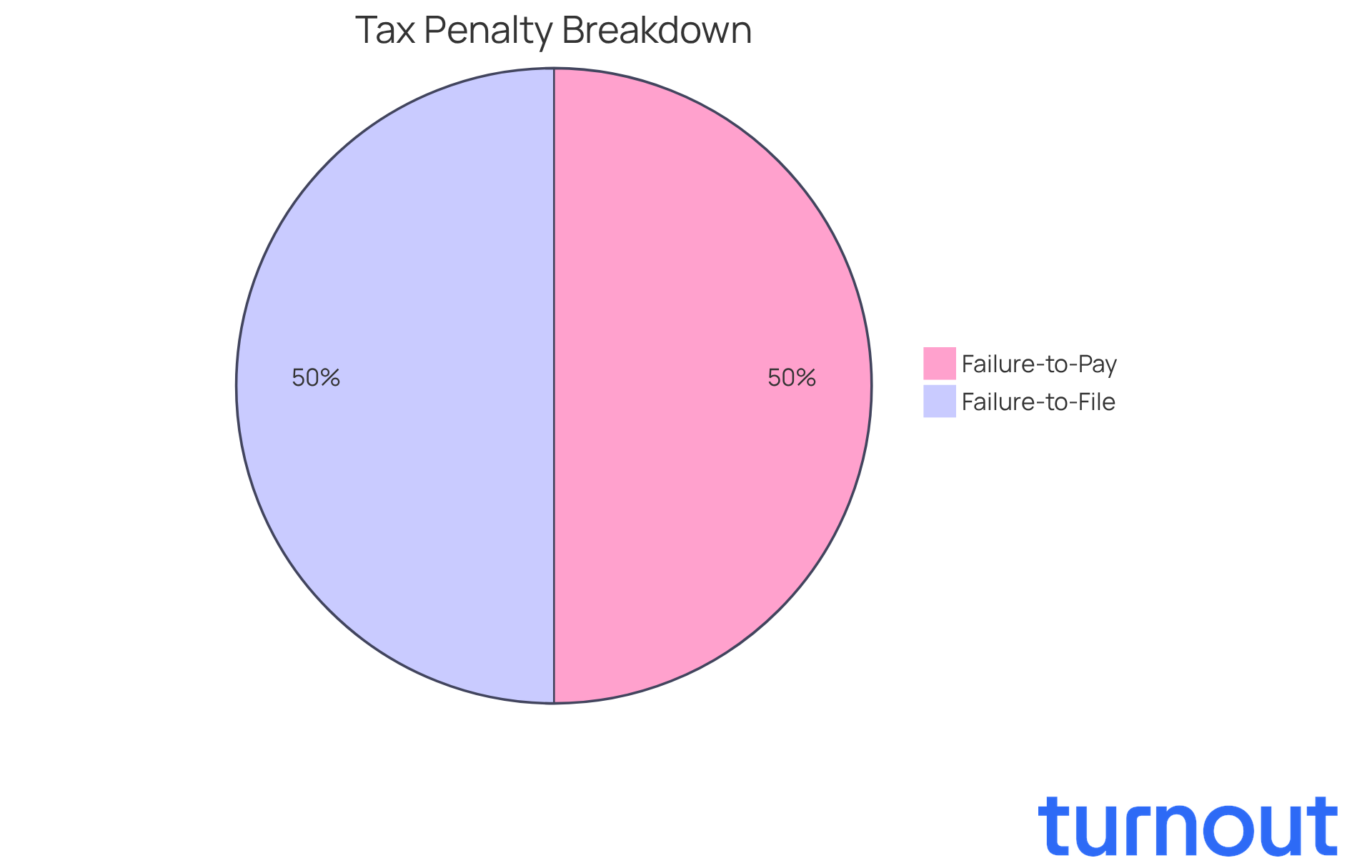

We understand that dealing with late payment penalties can be overwhelming. These penalties can significantly increase the amount of interest on taxes owed to the IRS, adding to your stress. The failure-to-pay penalty is typically 0.5% of the unpaid taxes for each month, or part of a month, that the tax remains unpaid, capping at 25% of the total unpaid amount.

If you miss the deadline to file your return, you may face a failure-to-file penalty of 5% of the unpaid tax for each month the return is late, also capped at 25%. These penalties can accumulate quickly, along with interest on taxes owed, making it crucial to file and pay on time.

But don’t worry; you’re not alone in this journey. There are alternatives available, such as payment plans, that can help you manage these costs. Remember, taking action now can ease your burden and help you regain control.

Implement Strategies to Manage and Reduce Tax Interest

Managing interest on taxes owed can feel overwhelming, but there are several strategies you can use to alleviate the burden.

-

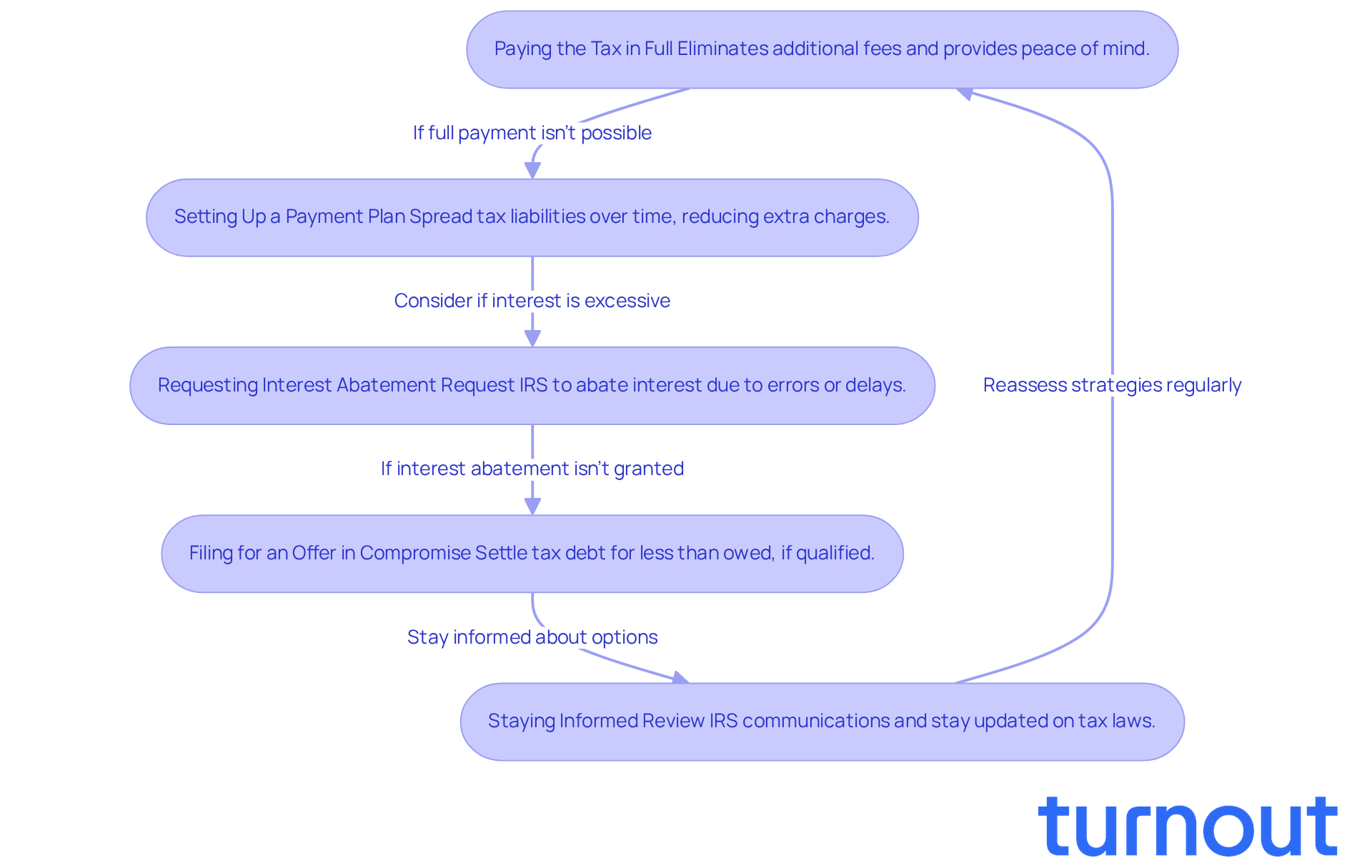

Paying the Tax in Full: The most straightforward way to halt the growth of charges is to pay your tax bill in full by the due date. This approach eliminates any additional fees, providing you peace of mind about the interest on taxes owed.

-

Setting Up a Payment Plan: If paying in full isn’t an option, consider establishing an IRS installment agreement. This allows you to spread your tax liabilities over time, significantly reducing extra charges. In fact, over 90% of individual filers qualify for a Simple Payment Plan, which offers manageable payments for assessed taxes, penalties, and charges up to $50,000. While setting up a payment plan is generally easy, be aware of potential fees, including interest on taxes owed, such as a $22 charge for online applications or $107 for phone or mail applications.

-

Requesting Interest Abatement: You might be able to request the IRS to abate interest charges if they accrued due to IRS errors or delays. This can provide substantial relief from unexpected financial burdens, helping you regain control.

-

Filing for an Offer in Compromise: This option lets you settle your tax debt for less than what you owe, potentially lightening your financial load. In FY 2024, the IRS accepted 7,199 offers out of 33,591 proposed, showing that successful negotiations are possible for those who qualify. As Jim Buttonow notes, the new payment plan allows individuals who owe up to $250,000 to pay under more favorable terms, making it more attainable for many.

-

Staying Informed: Regularly reviewing IRS communications and staying updated on tax law changes can help you avoid unnecessary penalties and interest. Understanding the IRS's decision-making criteria can clarify the best relief options available, ensuring you’re well-prepared to manage the interest on taxes owed effectively. Remember, the IRS has a 10-year statute of limitations for collecting federal tax debt, so addressing your tax obligations promptly is crucial.

You're not alone in this journey, and we're here to help you navigate these challenges.

Communicate Proactively with Tax Authorities: Best Practices

Effective communication with tax authorities can truly make a difference in managing interest on taxes owed related to tax debts. We understand that navigating this process can be overwhelming, but there are some supportive practices you can follow:

-

Be Prompt and Clear: Respond to IRS notices and requests for information as soon as you can. Providing clear and concise information helps avoid delays and keeps the process moving smoothly.

-

Document Everything: Keeping detailed records of all communications with the IRS is crucial. Note down dates, times, and the names of representatives you speak with. This documentation can be invaluable if disputes arise, giving you peace of mind.

-

Utilize Available Resources: Don’t hesitate to take advantage of IRS resources, like the Taxpayer Advocate Service. They can offer assistance in resolving issues related to interest on taxes owed, ensuring you’re not alone in this journey.

-

Seek Professional Help: If things start to feel overwhelming, consider consulting a tax professional or advocate. They can navigate the complexities of tax communication on your behalf, allowing you to focus on what matters most.

-

Stay Informed: Regularly check the IRS website for updates on policies and procedures that may affect your tax situation. Staying informed means you’re always equipped with the latest information, which can alleviate some stress.

Remember, you’re not alone in this. We’re here to help you through every step.

Conclusion

Managing interest on taxes owed can feel overwhelming, but it’s a crucial part of maintaining your financial health. We understand that navigating tax obligations can be stressful, and knowing how tax interest accumulates, along with the penalties for late payments, is essential. By taking timely action, you can prevent escalating costs and regain control over your financial situation.

This article highlights several effective strategies to help you manage and reduce tax interest:

- Consider paying your taxes in full when possible.

- Set up payment plans.

- Request interest abatement.

- Explore offers in compromise.

Remember, keeping open lines of communication with tax authorities can significantly ease the stress associated with your obligations. Documenting your interactions and utilizing available resources will equip you to navigate these complexities with confidence.

Ultimately, taking charge of your tax responsibilities through informed decisions and strategic actions is vital. By implementing these best practices, you can alleviate the burden of tax interest and penalties, paving the way for a more secure financial future. Whether it’s through timely payments or proactive communication, remember that the path to managing tax interest begins with taking that first step. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is tax interest and how does it accumulate?

Tax interest refers to the charges imposed by the IRS on unpaid taxes, which accumulate daily from the due date until the debt is fully settled.

What is the current IRS interest rate for underpayments?

As of February 2026, the IRS interest rate for underpayments is 7% annually, compounded daily. This rate is determined quarterly based on the federal short-term rate plus a margin of 3%.

How does the IRS allocate payments made towards tax obligations?

When a payment is made, the IRS first allocates it to taxes owed, then to penalties, and finally to accrued charges.

What happens if I delay my tax payments?

Delaying tax payments, even briefly, can lead to significantly increased total amounts due due to daily compounding charges.

What are the implications of overpayments on tax returns?

For individuals, the returns on overpayments are also set at 7% for the first quarter of 2026.

Why is it important to understand how tax charges accumulate?

Understanding how tax charges accumulate emphasizes the importance of making prompt payments to avoid rising expenses from interest, penalties, and unpaid taxes.

What should I do if I am struggling with unpaid taxes?

If you are struggling with unpaid taxes, it’s important to take action and seek help to find a resolution. You are not alone in this journey.