Introduction

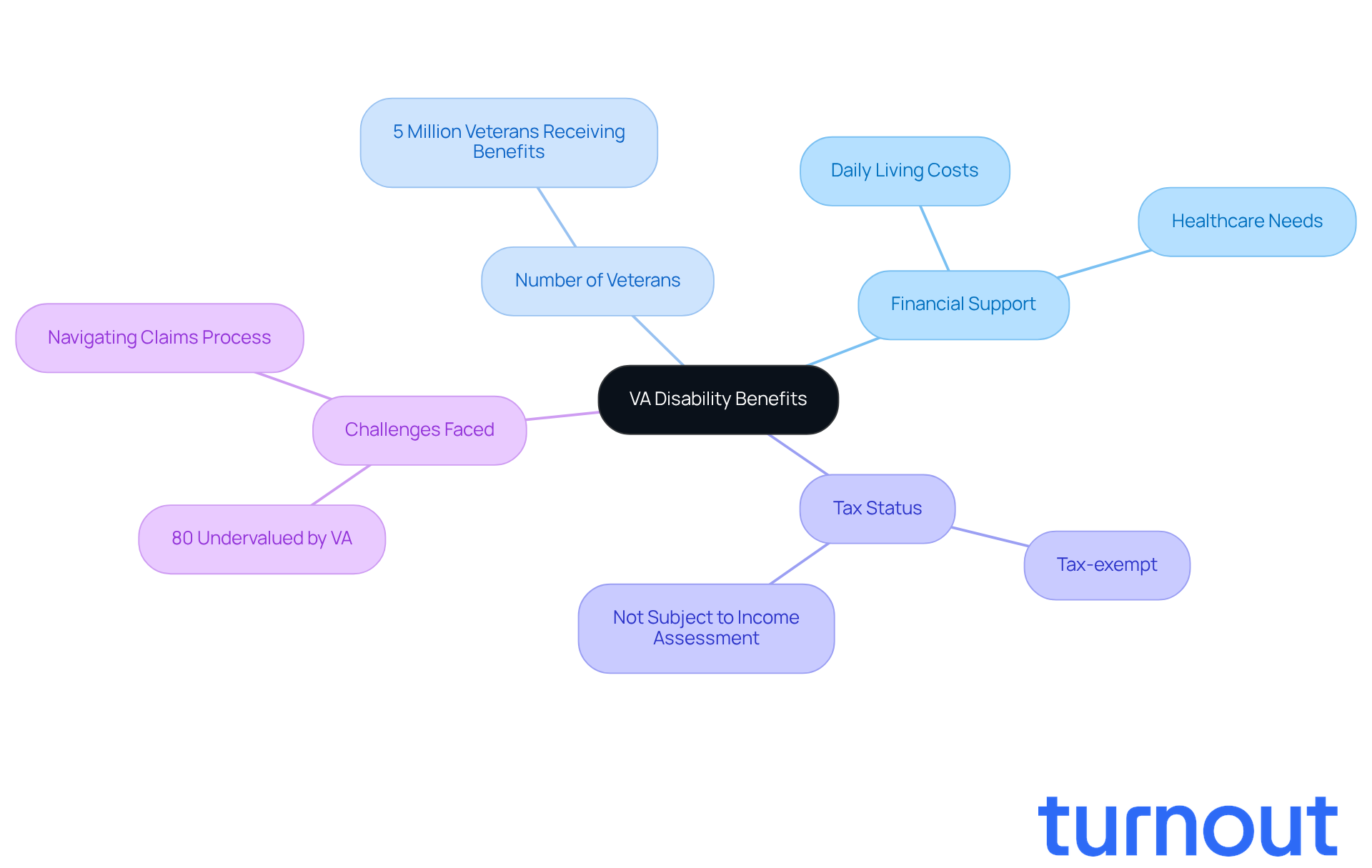

Navigating the financial landscape for veterans can feel overwhelming, especially when it comes to understanding VA disability benefits and their tax implications. With over 5 million veterans depending on these vital, tax-exempt payments for support, it’s crucial to comprehend how these benefits influence overall financial planning.

It’s common to feel confused about whether VA disability is considered taxable income. Many veterans find themselves asking:

- What are the real tax implications of these benefits?

- How can you ensure you’re maximizing your entitlements?

We’re here to help you through this journey. By addressing these questions and clarifying misconceptions, we can empower you to make informed decisions about your financial future.

Define VA Disability Benefits

VA compensation offers crucial financial support from the U.S. Department of Veterans Affairs (VA) to those with service-connected impairments. We understand that many former military personnel face challenges after sustaining injuries or illnesses during their service, impacting their ability to work and live independently. As of 2026, over 5 million veterans are receiving these essential benefits, which are tax-exempt and vary based on the severity of their impairments, rated from 0% to 100%.

This financial assistance is vital for many veterans, helping them manage daily living costs and healthcare needs. Brian Reese, a seasoned compensation specialist, emphasizes that "the VA support payments are not presently subject to income assessment," ensuring that veterans can rely on this assistance without the burden of taxation. However, it’s important to recognize that around 80% of former service members may be undervalued by the VA, potentially missing out on significant benefits.

Understanding the nature and tax status of VA assistance, particularly whether VA disability is taxable income, is essential for those navigating their financial futures. We’re here to help! Turnout simplifies access to these benefits by providing tools and services that assist veterans in understanding their rights and navigating the complexities of government processes. You are not alone in this journey; we ensure you receive the support you deserve.

Examine Tax Implications of VA Disability Benefits

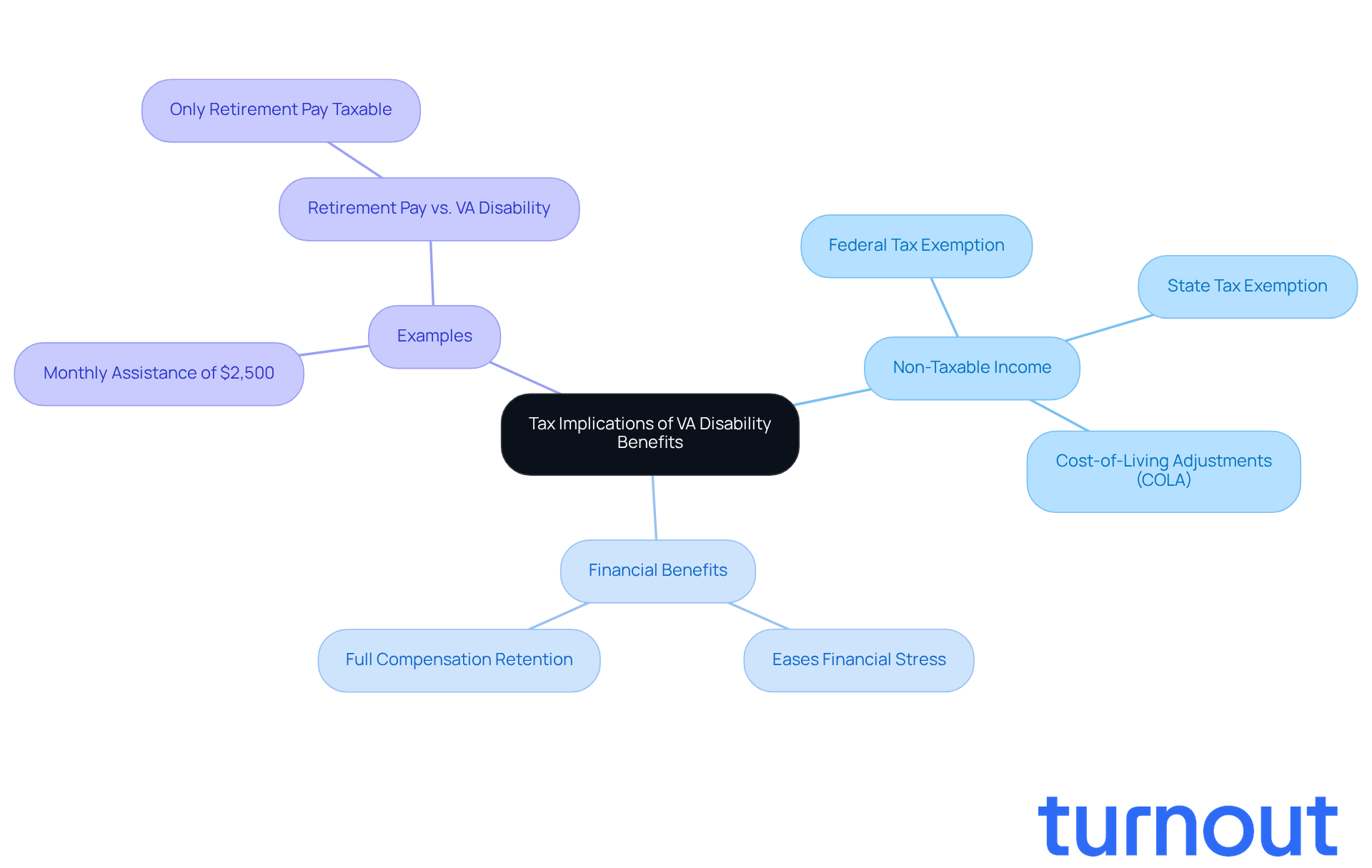

VA benefits are considered non-taxable income at both the federal and state levels. This means that service members don’t have to report these benefits on their tax returns. We understand that financial burdens can be overwhelming, and this exemption allows former service members to keep the full amount of their compensation, significantly easing their financial stress.

According to IRS guidelines, disability compensation from the VA is explicitly exempt from income tax. This is especially beneficial for those who rely on these payments for their livelihood. Additionally, any cost-of-living adjustments (COLA) to these allowances are also tax-free. This contributes to the overall financial stability of former military personnel.

Statistics show that many former service members do not declare their VA assistance, even though it raises the question of whether VA disability is taxable income. It’s crucial to grasp these tax implications to avoid confusion and ensure accurate financial planning. For instance, if a service member receives $2,500 monthly in VA assistance, they don’t need to declare this amount on their federal tax return. This allows them to fully benefit from the support they have earned.

Remember, you are not alone in this journey. We’re here to help you navigate these benefits and ensure you make the most of what you’ve earned.

Outline Eligibility and Documentation Requirements

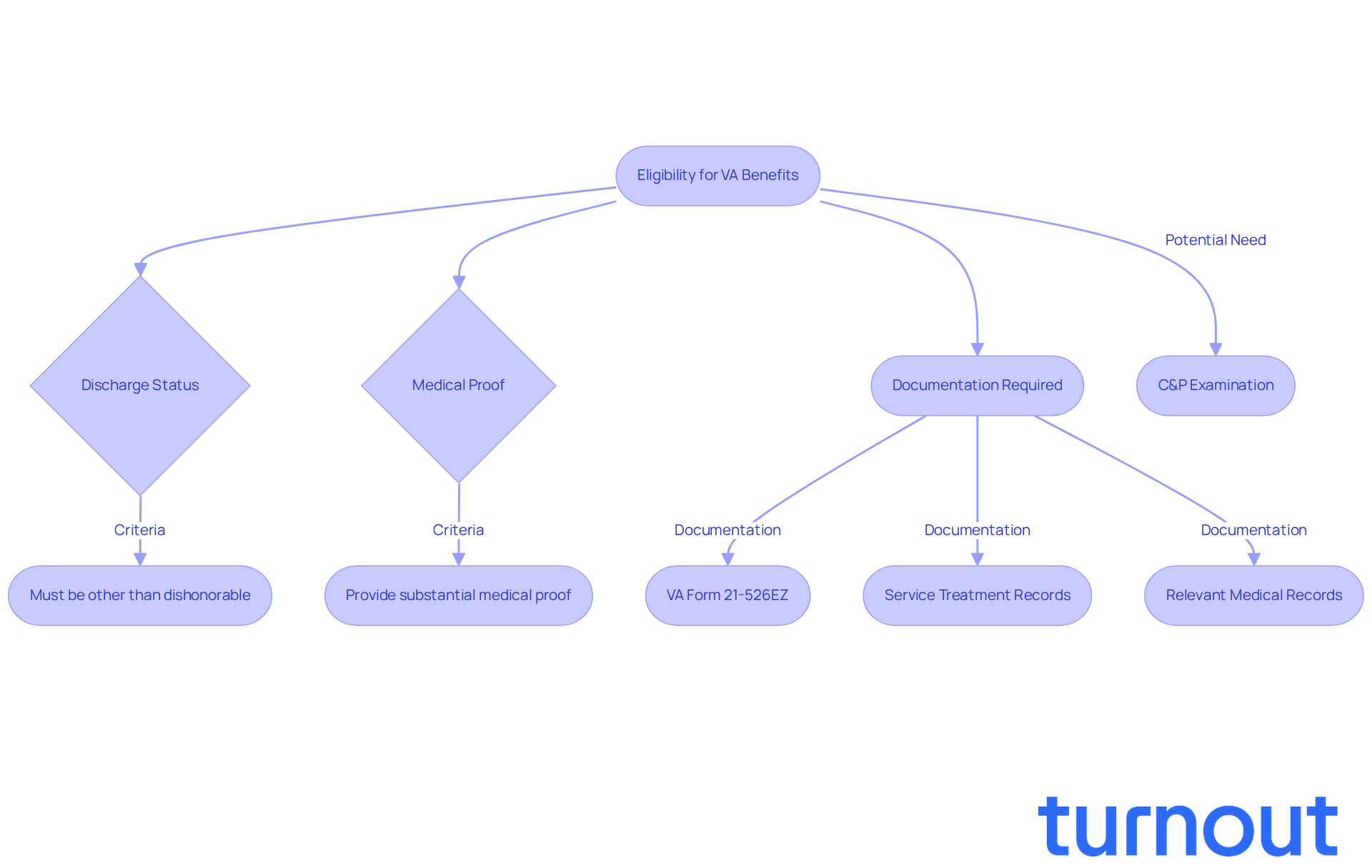

Navigating the VA benefits process can feel overwhelming, and we understand that many servicemen and women face challenges in proving their service-related impairments. To qualify for these vital benefits, it’s essential to show that your condition was incurred or worsened during active military duty.

Eligibility criteria include:

- Having a discharge status other than dishonorable

- Providing substantial medical proof of your condition

This documentation typically involves:

- A completed VA Form 21-526EZ

- Service treatment records

- Any relevant medical records that support your claim

You may also need to undergo a Compensation & Pension (C&P) examination to assess the severity of your condition. We’re here to help you grasp these requirements, ensuring your application is thorough and precise, which can significantly enhance your chances of approval.

Recent statistics show that the overall accuracy of claims processing has improved to 93.5%. In fiscal year 2025, the VA processed 3 million claims, highlighting the importance of meticulous documentation in achieving successful outcomes. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Clarify Common Misconceptions About VA Benefits and Taxes

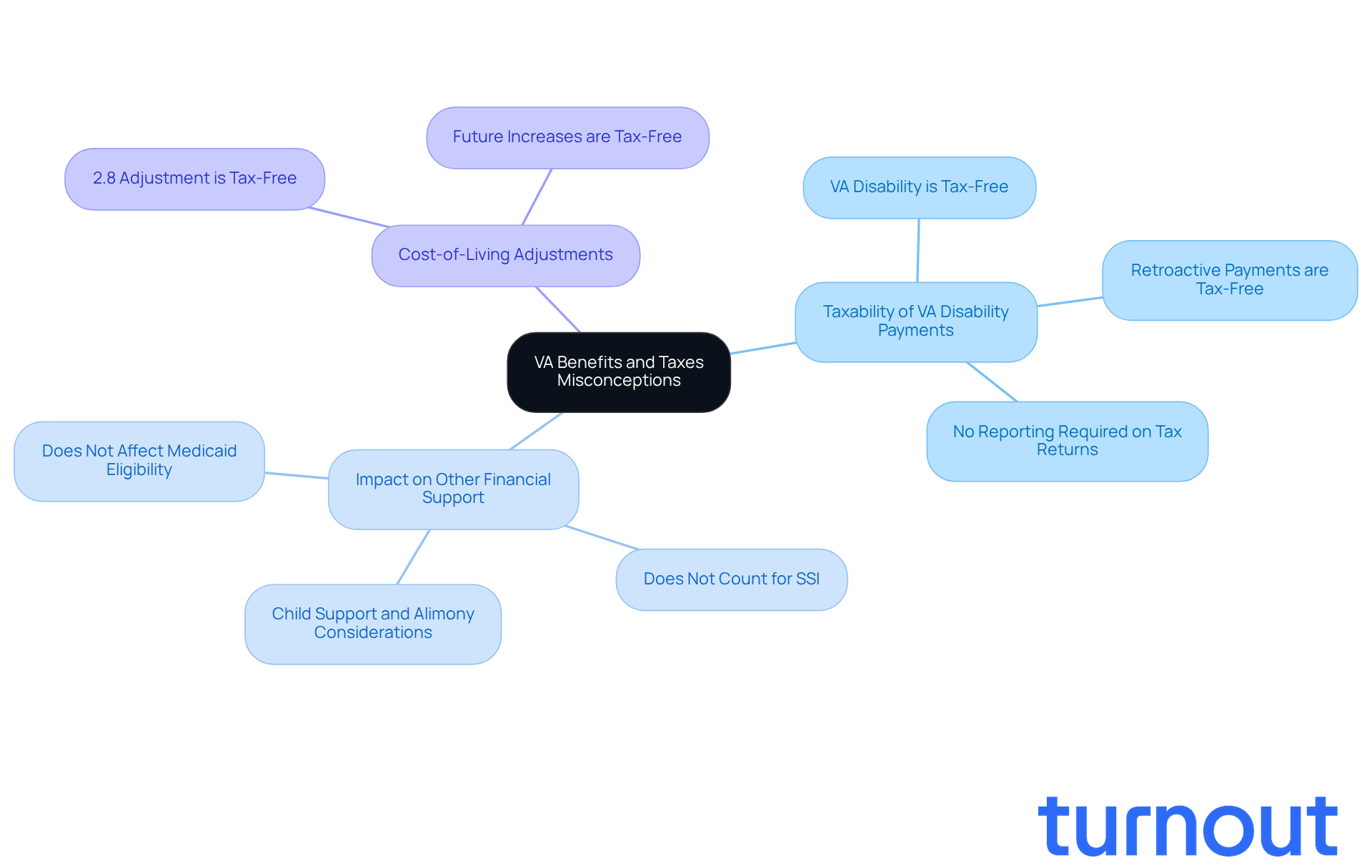

It's common to feel uncertain about whether VA assistance payments are considered VA disability taxable income and their tax implications. Many veterans mistakenly believe that the question of whether VA disability is taxable income is relevant, but the truth is, these benefits are exempt from federal income tax. This means you don’t need to report them as income on your tax returns. Financial expert Brandon Wile reassures us, "the federal and state governments do not tax VA compensation under any circumstances."

Another concern is whether receiving VA assistance affects eligibility for other financial support or tax credits. Rest assured, VA disability payments do not count as income when determining eligibility for programs like Medicaid or Supplemental Security Income (SSI). Some former service members worry about taxes on cost-of-living adjustments to their benefits, but that’s a misconception too. Wile emphasizes, "retroactive payments are tax-free," which clarifies the financial implications for you.

Understanding these misconceptions is crucial for navigating your financial landscape confidently. For instance, if you rely solely on VA disability benefits, you may not need to file a tax return because it is VA disability taxable income. This allows you to focus on your health and well-being without the burden of tax concerns. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Conclusion

VA disability benefits are a crucial lifeline for millions of veterans, offering essential financial support that remains untaxed. It’s important for veterans to know that these benefits are exempt from both federal and state income tax. This understanding can make a significant difference for those who depend on this assistance for daily living expenses and healthcare needs. By clarifying the tax implications surrounding VA disability, veterans can navigate their financial futures with greater confidence.

Throughout this article, we’ve highlighted key insights, such as the importance of accurate documentation when applying for VA benefits and the common misconceptions about their tax status. Many veterans may not realize that these benefits do not affect their eligibility for other forms of financial assistance. It’s common to feel overwhelmed by the complexities of these issues, but being informed can empower you.

Ultimately, it’s essential for veterans to understand their rights and the benefits available to them. By dispelling myths and providing clear guidance on the application process, veterans can ensure they receive the full support they deserve. Remember, you are not alone in this journey. We’re here to help you navigate these waters. Empowering veterans with this knowledge not only enhances their financial well-being but also reinforces our commitment to honoring your service.

Frequently Asked Questions

What are VA Disability Benefits?

VA Disability Benefits, or VA compensation, are financial support provided by the U.S. Department of Veterans Affairs to veterans with service-connected impairments, helping them manage daily living costs and healthcare needs.

Who is eligible for VA Disability Benefits?

The benefits are available to veterans who have sustained injuries or illnesses during their military service that impact their ability to work and live independently.

How many veterans are currently receiving VA Disability Benefits?

As of 2026, over 5 million veterans are receiving these essential benefits.

Are VA Disability Benefits taxable?

No, VA Disability Benefits are tax-exempt and are not subject to income assessment, allowing veterans to rely on this assistance without the burden of taxation.

How are VA Disability Benefits determined?

The benefits vary based on the severity of the veteran's impairments, which are rated from 0% to 100%.

What is the significance of the 80% statistic mentioned in the article?

Approximately 80% of former service members may be undervalued by the VA, meaning they could be missing out on significant benefits that they are entitled to receive.

How can veterans access help in navigating VA Disability Benefits?

Organizations like Turnout provide tools and services to assist veterans in understanding their rights and navigating the complexities of the government processes related to VA benefits.