Introduction

Navigating the complexities of VA disability benefits can feel overwhelming. We understand that many veterans are left wondering whether the financial support they receive is subject to taxation. This question is crucial for your financial planning and peace of mind.

In this article, we aim to demystify the tax status of VA disability income. Our goal is to provide you with essential insights and practical steps that will empower you to manage your benefits confidently. You deserve to avoid unnecessary tax liabilities and make informed decisions about your financial future.

How can you ensure that you fully understand your entitlements? We’re here to help you through this journey, offering guidance and support every step of the way.

Understand VA Disability Income and Tax Basics

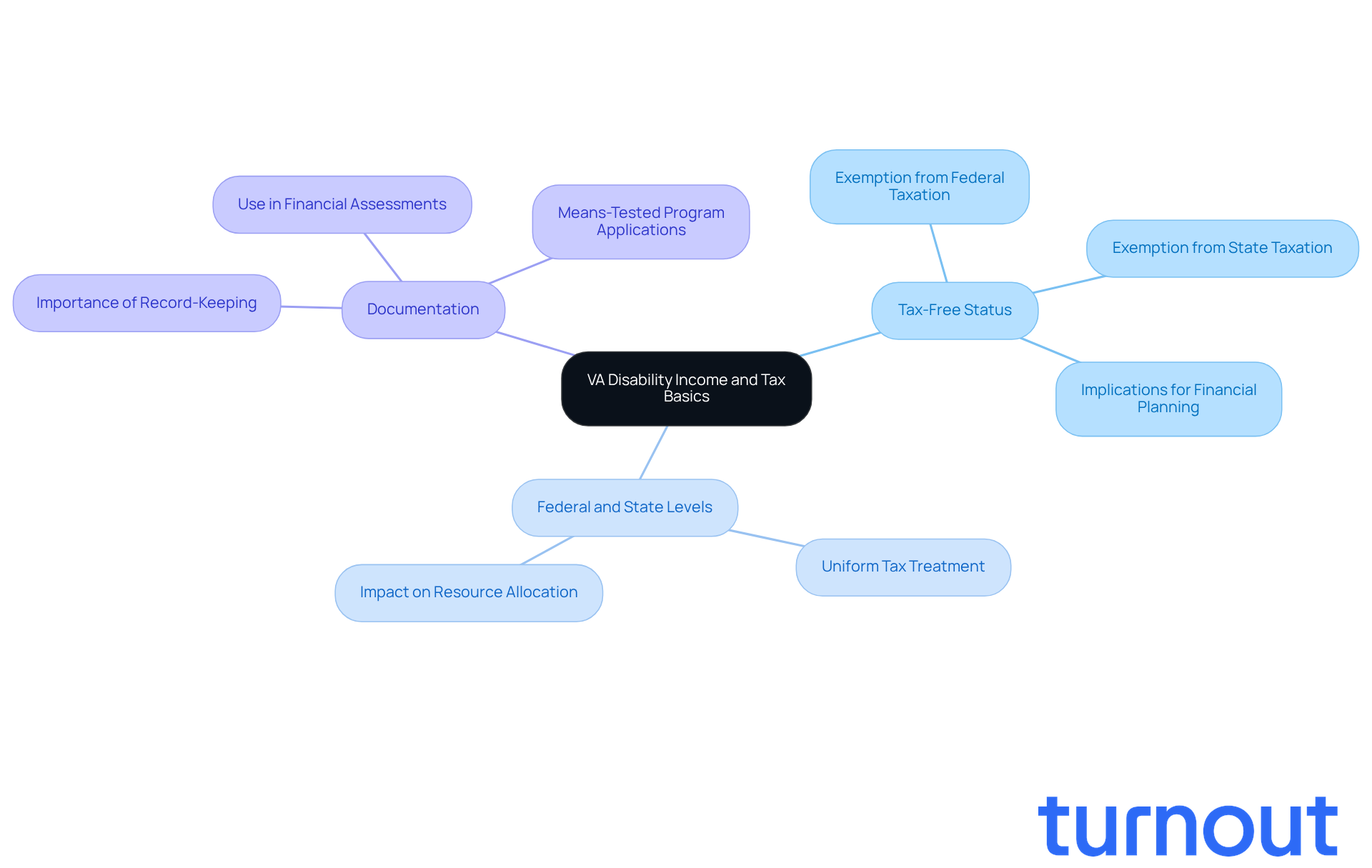

VA compensation for veterans with service-related impairments is a tax-exempt advantage, a crucial aspect that significantly impacts their financial planning. We understand that navigating these waters can be challenging, so let’s break down the essentials:

- Tax-Free Status: VA disability benefits are exempt from federal taxation. This means you don’t need to report these benefits as part of your gross income on tax returns, but it leads to the question: is VA disability income taxable? This exemption offers substantial financial relief, allowing you to focus on your recovery and well-being.

- Federal and State Levels: The tax-exempt status applies at both federal and state levels. This ensures you aren’t burdened by extra taxes on your disability income. Such uniformity simplifies your financial planning, helping you allocate your resources more effectively.

- Documentation: It’s wise to keep thorough records of your VA disability payments. These documents may be necessary for various financial assessments, including applications for loans or other benefits. Maintaining precise records can also help confirm your earnings when applying for means-tested programs.

Understanding these basics empowers you to manage your tax responsibilities with confidence, particularly when considering if VA disability income is taxable, alleviating worries about unexpected liabilities tied to your benefit earnings. With around 5 million veterans receiving tax-free VA disability assistance, the financial implications are significant. This support enables many to plan their futures without the stress of taxation on their primary income source.

We’re here to help you navigate these financial elements. Turnout offers access to tools and services that assist veterans, including help with SSD claims and tax debt relief. You are not alone in this journey; we ensure you comprehend your entitlements without the need for legal representation.

Identify Taxable and Non-Taxable VA Benefits

Managing your finances can feel overwhelming, especially when it comes to understanding VA benefits. We know that navigating this landscape is crucial for your peace of mind. Let’s break it down together:

-

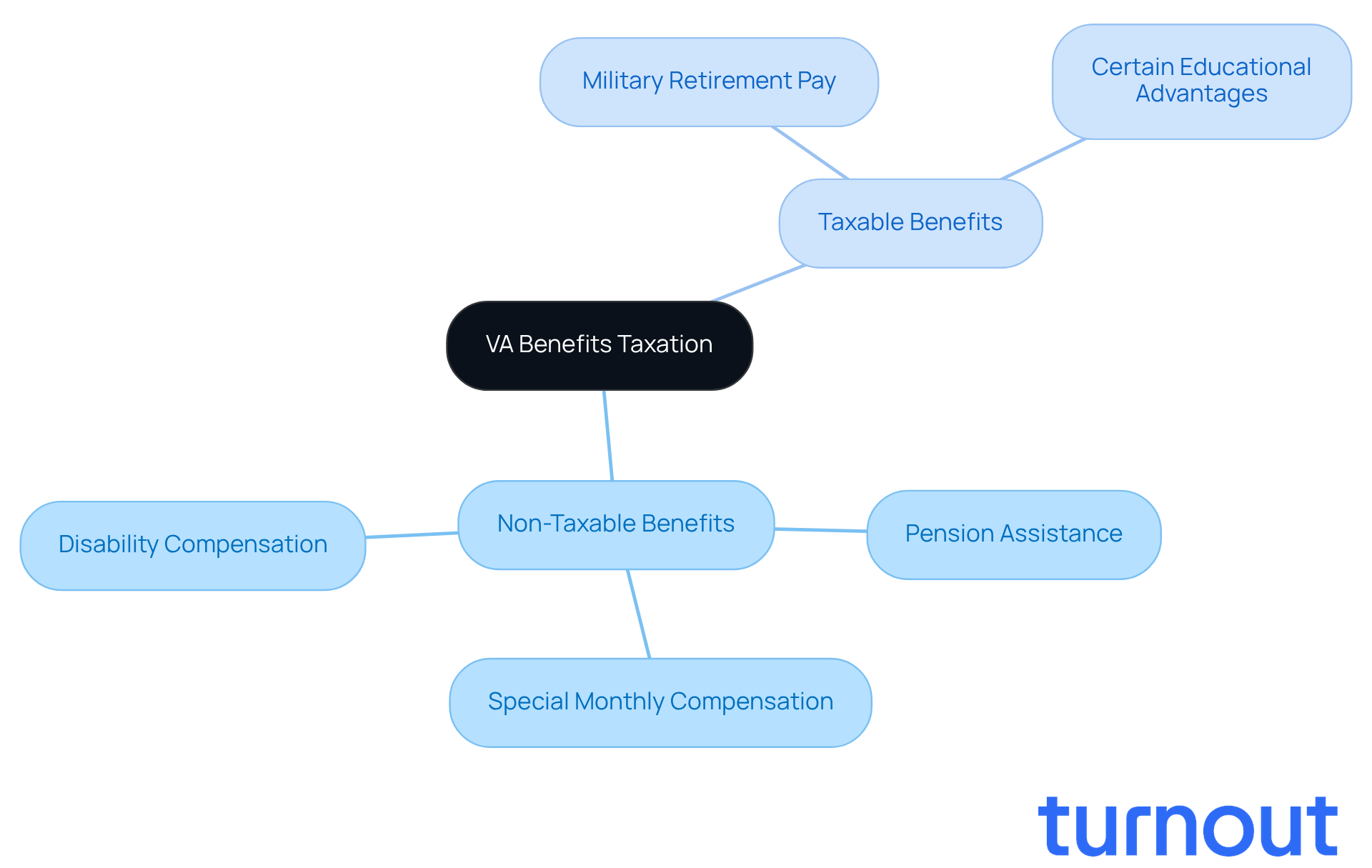

Non-Taxable Benefits: Most VA disability compensation payments are non-taxable. This includes:

- Disability compensation for service-connected conditions.

- Special Monthly Compensation (SMC) for severe impairments.

- Pension assistance for low-income veterans. It’s reassuring to know that most states confirm that VA disability income is non-taxable, reinforcing their non-taxable status.

-

Taxable Benefits: However, it is necessary to consider whether VA disability income is taxable. For instance:

- Military retirement pay, which is separate from VA disability compensation.

- Certain educational advantages that might be considered taxable earnings.

-

Consultation: If you’re unsure about specific benefits, it’s perfectly okay to seek help. We encourage you to consult with a tax professional or refer to IRS guidelines to clarify your tax obligations. As tax expert Brandon Wile wisely states, a common question is, "is VA disability income taxable?" since VA compensation for veterans is tax-free income. Don’t report it to the IRS. Don’t pay taxes on it. Remember, veterans receiving VA compensation do not need to report these amounts on their federal tax returns. This ensures you can maximize your assistance while avoiding potential pitfalls during tax season.

You are not alone in this journey, and we’re here to help you every step of the way.

Gather Required Documentation for Tax Assessment

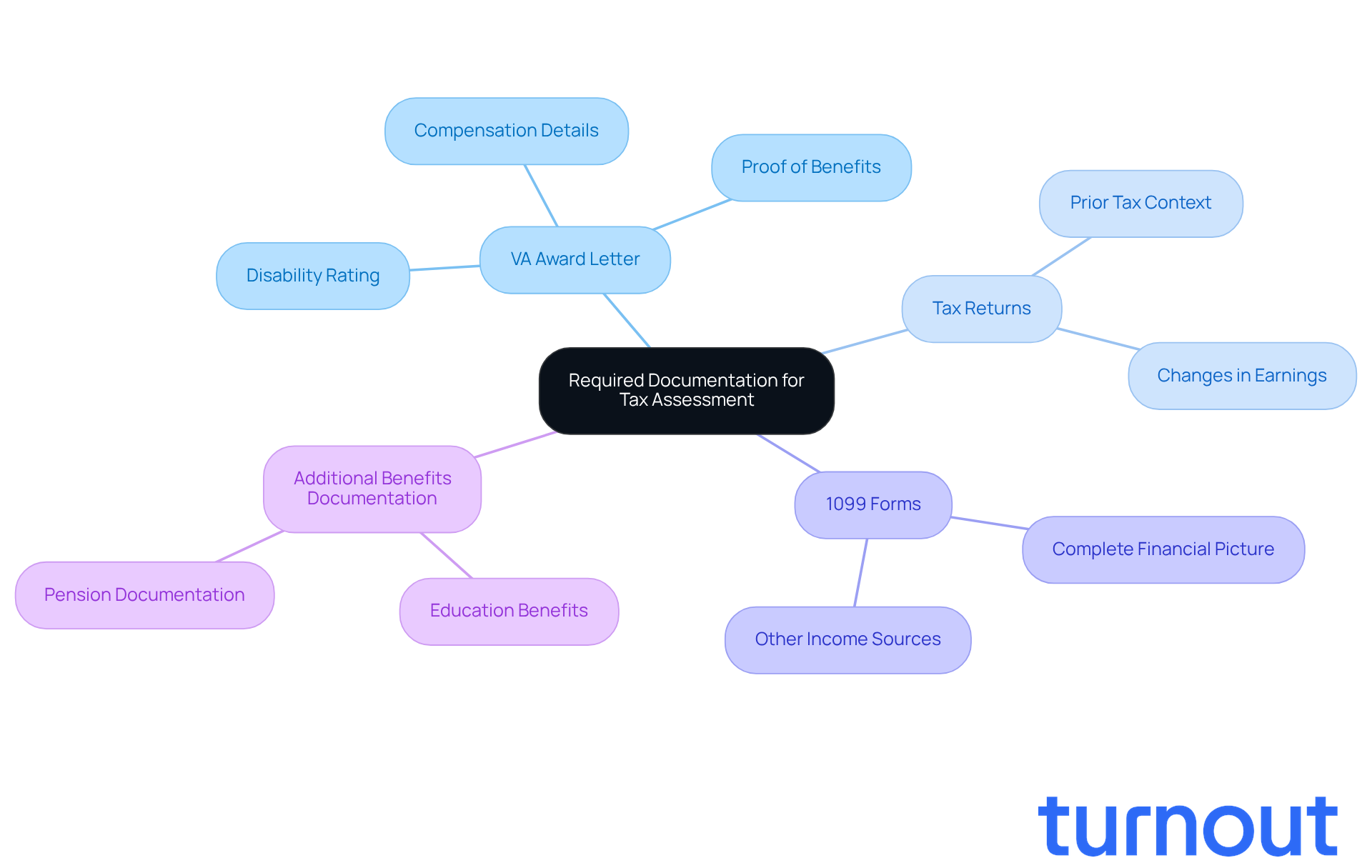

To accurately report your VA disability income and ensure compliance with tax regulations, it’s important to gather the right documentation. We understand that this process can feel overwhelming, but having everything in order can make a significant difference.

-

VA Award Letter: This essential document outlines your disability rating and the compensation you receive. It serves as official proof of your benefits. For many veterans, this letter is crucial for tax assessment and raises the question of whether VA disability income is taxable, confirming eligibility for various tax exemptions and credits.

-

Tax Returns: Keeping copies of your prior tax returns is a good practice. They provide context for your current financial status and can help identify any changes in earnings or benefits.

-

1099 Forms: If you have them, collect any 1099 forms that report other income sources. This ensures you have a complete financial picture, which is vital for accurate tax reporting.

-

Additional Benefits Documentation: If you receive other VA benefits, such as education or pension, gather related documentation. This can include letters or statements outlining the benefits received, which may also impact your tax responsibilities.

Organizing these documents ahead of time can streamline the tax filing process and help avoid potential issues, including questions about whether VA disability income is taxable. For instance, if you’ve recently increased your disability rating, you might need to file an amended return to claim a federal tax refund based on the new rating. Having your VA award letter easily accessible can simplify this process, ensuring compliance and maximizing your potential benefits.

We’re here to assist you in navigating these processes. Our trained nonlawyer advocates and IRS-licensed enrolled agents provide expert guidance without the need for legal representation. You are not alone in this journey; we guarantee you have the support you need to utilize your benefits effectively.

Take Action: Reporting Taxable VA Disability Income

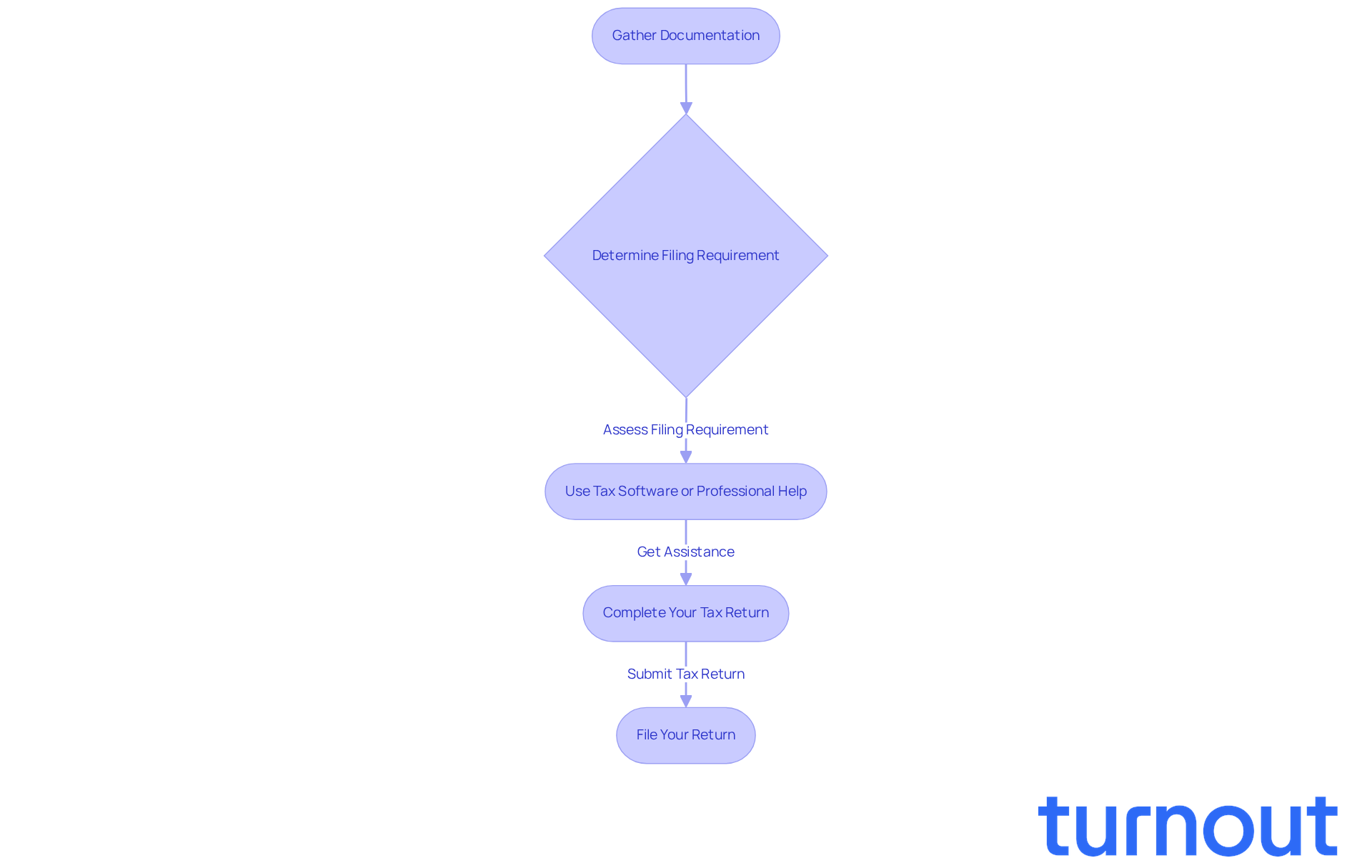

Gathering your documentation is the first step in determining if VA disability income is taxable. We understand that navigating taxes can be overwhelming, but you’re not alone in this journey. Here’s how to approach it with confidence:

-

Determine Your Filing Requirement: If your only income comes from VA disability benefits, you might not need to file a federal tax return. However, if you have other sources of income, it’s important to assess your filing requirements based on IRS guidelines, including whether VA disability income is taxable. Remember, it’s common to feel uncertain about this.

-

Use Tax Software or Professional Help: Consider using tax preparation software or consulting a tax professional. This can help ensure accurate reporting. Many software programs even have specific sections designed for veterans, making the process smoother.

-

Complete Your Tax Return: When filling out your tax return, make sure to determine if VA disability income is taxable and exclude your VA disability compensation from taxable earnings. It’s crucial to report any other taxable earnings accurately. We’re here to help you through this.

-

File Your Return: Don’t forget to submit your tax return by the deadline. Keeping copies of all documents for your records is a good practice.

By following these steps, you can confidently report your income and ensure compliance with tax regulations. Remember, you’re taking an important step, and we’re here to support you every step of the way.

Conclusion

VA disability income is a crucial financial lifeline for veterans, providing essential support without the worry of taxation. We understand that navigating these benefits can feel overwhelming, but grasping the nuances is key to effective financial planning and peace of mind. The tax-exempt status of VA disability compensation not only eases potential financial strain but also allows veterans to focus on their recovery and future without the looming concern of tax liabilities.

Throughout this discussion, we highlighted important points, such as:

- The difference between taxable and non-taxable benefits

- The necessity of keeping thorough documentation

- The steps needed for accurate tax reporting

It’s reassuring to know that most VA disability compensation is non-taxable, enabling veterans to maximize their financial assistance while steering clear of unnecessary complications during tax season. Seeking professional advice and utilizing available resources can further enhance understanding and compliance with tax regulations.

Ultimately, understanding the tax implications of VA disability income is vital. By staying informed and organized, veterans can confidently navigate their financial landscape, ensuring they receive the full benefits they deserve. Remember, taking proactive steps-whether it’s gathering necessary documentation or consulting with tax professionals-can secure your financial well-being and peace of mind. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

Are VA disability benefits taxable?

No, VA disability benefits are exempt from federal taxation, meaning you do not need to report these benefits as part of your gross income on tax returns.

Does the tax-exempt status of VA disability benefits apply at both federal and state levels?

Yes, the tax-exempt status applies at both federal and state levels, ensuring that veterans are not burdened by additional taxes on their disability income.

Why is it important to keep records of VA disability payments?

Keeping thorough records of VA disability payments is important for various financial assessments, including applications for loans or other benefits, and can help confirm your earnings when applying for means-tested programs.

How many veterans receive tax-free VA disability assistance?

Approximately 5 million veterans receive tax-free VA disability assistance, highlighting the significant financial implications of this support.

What resources are available to help veterans navigate financial elements related to VA disability?

Turnout offers access to tools and services that assist veterans, including help with SSD claims and tax debt relief, ensuring veterans understand their entitlements without the need for legal representation.