Introduction

Navigating the complexities of financial benefits can be particularly challenging for veterans. We understand that understanding the tax implications of VA compensation can feel overwhelming. These vital payments, designed to support former service members facing impairments, are often misunderstood regarding their tax status.

It's common to wonder whether these benefits are taxable. Clarifying the distinctions between taxable and non-taxable VA benefits is essential. What misconceptions might be hindering you from fully optimizing your financial support? How can you ensure compliance while maximizing your entitlements?

You're not alone in this journey. We're here to help you navigate these important questions.

Define VA Compensation and Its Purpose

VA benefits represent the monthly tax-exempt payments provided by the Department of Veterans Affairs (VA) to individuals facing impairments due to injuries or illnesses sustained during military service. We understand that navigating these challenges can be overwhelming, and this financial support aims to help former service members manage the economic impact of their impairments. It’s about ensuring you can maintain a living standard that reflects your invaluable contributions to our nation.

As of 2026, around 5 million former service members are receiving these vital supports, which play a crucial role in their financial stability. For instance, an individual with a complete impairment rating can receive significant monthly financial assistance, which can greatly help cover living expenses and medical costs. Plus, the anticipated 2.8% increase in VA disability payments for 2026 underscores the importance of these aids in your life.

Understanding VA assistance is essential for former service members to effectively manage their entitlements and ensure they receive the support they deserve. We’re here to help you navigate these complex financial systems. Turnout offers tools and services designed to assist former service members and disabled individuals with government-related processes. As one experienced advocate shared, "Understanding VA assistance is essential to accessing the resources that can change lives."

It’s also important to keep your information updated with the VA to avoid any delays in receiving your entitlements. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

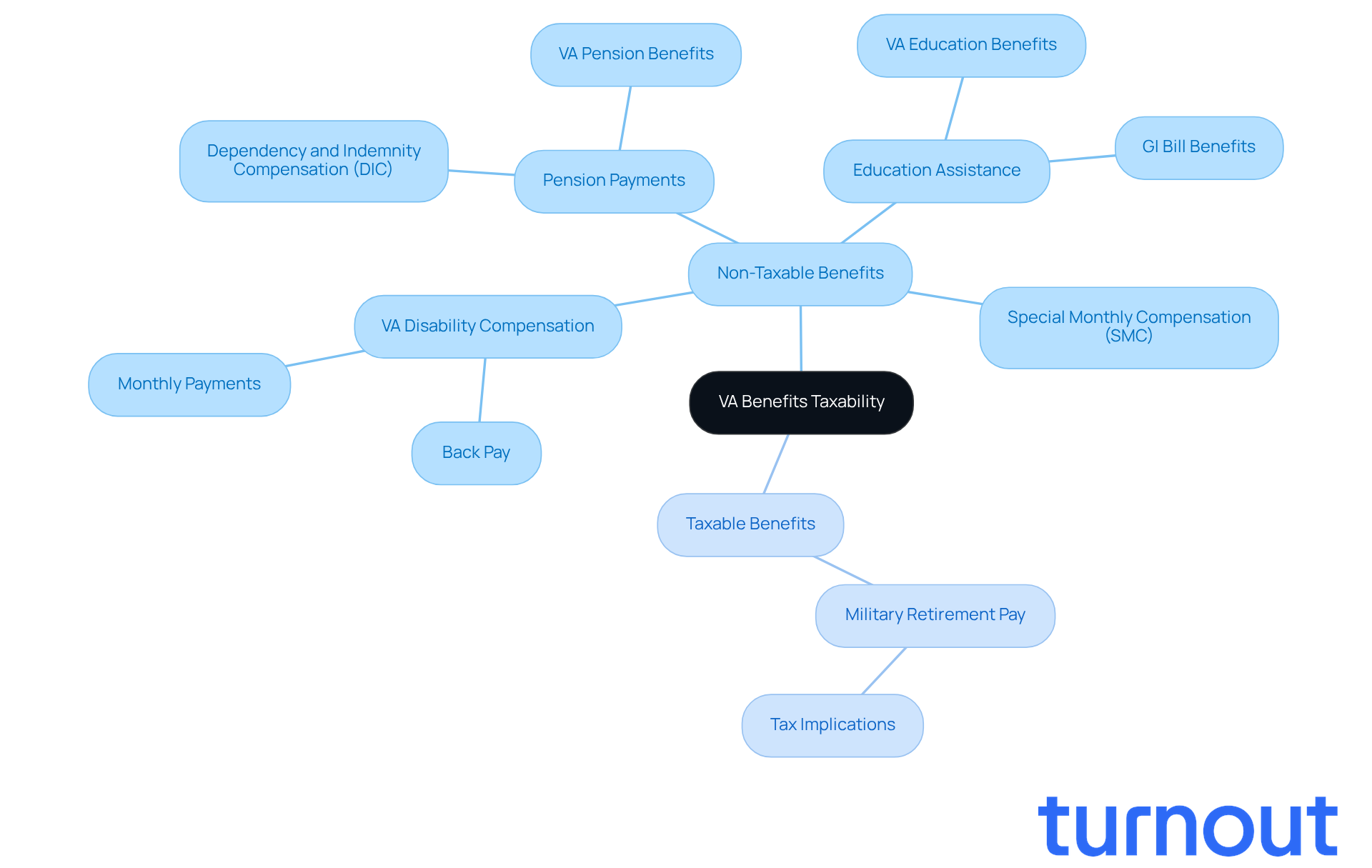

Identify Taxable and Non-Taxable VA Benefits

Many veterans face challenges when it comes to understanding their financial benefits. It’s important to understand whether VA compensation is taxable, given that most VA advantages, including impairment payments, are non-taxable. This means you don’t need to report these benefits as income on your federal tax returns. Specifically, the question of whether VA compensation is taxable arises, but VA disability compensation, pension payments, and education assistance are exempt from taxation.

However, some benefits, like military retirement pay, may be taxable. We understand that navigating these categories can be confusing. It’s essential for former service members to distinguish between them to ensure compliance with tax regulations and to maximize their financial rewards.

At Turnout, we’re committed to making access to these resources easier for you. We offer support to service members as they maneuver through the complexities of financial aid. You deserve to comprehend the implications of your entitlements without the added stress of needing legal counsel. Remember, you are not alone in this journey; we’re here to help.

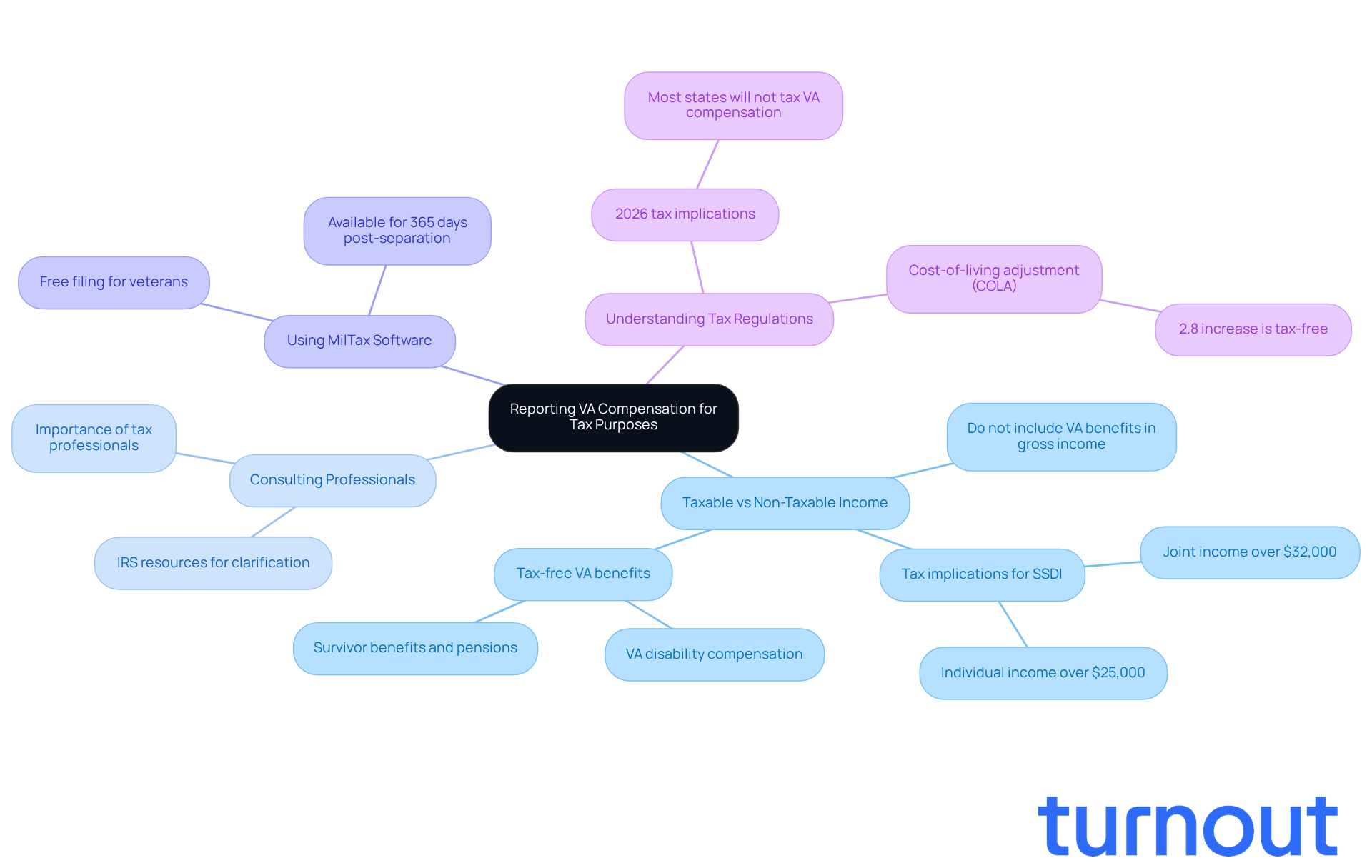

Guide on Reporting VA Compensation for Tax Purposes

Filing taxes can be a daunting task, especially for former service members. It's important to understand whether VA compensation is taxable and that it should not be included as part of your gross income. Instead, focus on reporting other sources of income that may be taxable. If you receive both taxable income and non-taxable VA benefits, make sure to report only the taxable income on your tax return.

We understand that tax regulations can be confusing. That's why it's advisable to consult with a tax professional or utilize IRS resources to clarify any uncertainties regarding reporting requirements. Additionally, you can take advantage of MilTax software to file your federal and state returns at no cost for up to 365 days after military separation or retirement.

Tax experts frequently highlight that the question of whether VA compensation is taxable is important, as these benefits should not be declared on your tax filings due to their exclusion from taxation. Remember, the 2.8% cost-of-living adjustment (COLA) increase for VA assistance raises the question of whether VA compensation is taxable. In 2026, the question of whether VA compensation is taxable will not apply in most states. This understanding can greatly simplify your tax filing process, allowing you to concentrate on your qualified entitlements without worrying about tax consequences.

You're not alone in this journey. We're here to help you navigate these complexities with confidence.

Clarify Common Misconceptions About VA Benefits and Taxes

Many veterans are concerned about whether VA compensation is taxable. It’s a common misunderstanding. The truth is, the question of whether VA compensation is taxable arises, but it is completely tax-free. This means you don’t need to report it as income. Knowing this can ease your mind and help you focus on what truly matters.

It’s also understandable to think that receiving VA support might affect your eligibility for other financial assistance programs. However, VA assistance is usually excluded from income calculations for these programs. This allows you to access multiple forms of support without jeopardizing your entitlements.

Understanding these points is crucial for optimizing your benefits and knowing whether VA compensation is taxable to avoid unnecessary financial strain. For example, if you’re receiving disability compensation, you can confidently apply for state assistance programs. Your VA benefits won’t count against you.

We’re here to help you navigate these complexities. With the support of trained nonlawyer advocates from Turnout, who specialize in SSD claims and tax debt relief, you can make informed decisions about your financial future. You are not alone in this journey. Together, we can ensure you fully leverage the support available to you.

Conclusion

Understanding the complexities of VA compensation and its tax implications is crucial for our former service members. These benefits are essential for financial stability, providing necessary support without the weight of taxation. Knowing that VA compensation is generally non-taxable allows veterans to focus on using these resources effectively, rather than worrying about tax consequences.

We recognize that navigating these waters can be challenging. This article has highlighted key points, such as:

- The difference between taxable and non-taxable benefits

- The importance of accurate reporting during tax season

- Clarifying common misconceptions

By understanding that VA compensation doesn’t need to be reported as income, veterans can confidently manage their financial landscape and access additional assistance programs without risking their benefits.

Ultimately, empowering veterans with knowledge about their rights and benefits is vital. We encourage seeking guidance from professionals or utilizing available resources to ensure that all entitlements are maximized. Remember, you are not alone in this journey. By staying informed and proactive, former service members can secure their financial futures and continue to thrive after their service to our nation.

Frequently Asked Questions

What is VA compensation?

VA compensation refers to the monthly tax-exempt payments provided by the Department of Veterans Affairs to individuals facing impairments due to injuries or illnesses sustained during military service.

What is the purpose of VA compensation?

The purpose of VA compensation is to help former service members manage the economic impact of their impairments and maintain a living standard that reflects their contributions to the nation.

How many former service members receive VA compensation?

As of 2026, around 5 million former service members are receiving VA compensation.

What kind of financial assistance can individuals with complete impairment ratings expect?

Individuals with complete impairment ratings can receive significant monthly financial assistance to help cover living expenses and medical costs.

Is there an expected increase in VA disability payments for 2026?

Yes, there is an anticipated 2.8% increase in VA disability payments for 2026.

Why is it important for former service members to understand VA assistance?

Understanding VA assistance is essential for former service members to effectively manage their entitlements and ensure they receive the support they deserve.

How can individuals get help with navigating VA processes?

Turnout offers tools and services designed to assist former service members and disabled individuals with government-related processes.

What should former service members do to avoid delays in receiving their entitlements?

It is important to keep your information updated with the VA to avoid any delays in receiving your entitlements.