Introduction

Navigating the complexities of tax debts can feel overwhelming. Many individuals wonder if tax forgiveness is a genuine option or just a myth. We understand that this uncertainty can weigh heavily on your mind.

There are programs like the Offer in Compromise and penalty abatement designed to help ease your financial burdens. Understanding these opportunities is essential, as they can provide a path to relief. However, it’s common to feel anxious about the potential for unexpected tax liabilities from forgiven debts.

How can you discern the legitimacy of tax forgiveness options? And how can you effectively navigate the application process to secure the relief you need? You're not alone in this journey, and we're here to help.

Define Tax Forgiveness and Its Implications

Tax forgiveness is tax forgiveness real, as it can be a beacon of hope for those grappling with tax debts. We understand that financial hardship can feel overwhelming, and programs like the Offer in Compromise (OIC) and penalty abatement are designed to help you find relief. These options allow individuals to settle their debts for less than what they owe, offering a crucial lifeline during tough times.

However, it’s important to remember that is tax forgiveness real isn’t a one-size-fits-all solution. While it can provide immediate relief, it may also lead to tax liabilities on the amounts forgiven, which could complicate your financial situation further. It’s common to feel uncertain about these implications.

As you explore your options, consider the various relief programs the IRS offers. Take the time to evaluate your eligibility and the potential consequences of participating in these programs. Remember, you’re not alone in this journey; we’re here to help you navigate these choices.

Looking ahead to 2026, as tax relief initiatives continue to evolve, understanding whether is tax forgiveness real will be essential. By staying informed, you can make empowered decisions that align with your financial goals.

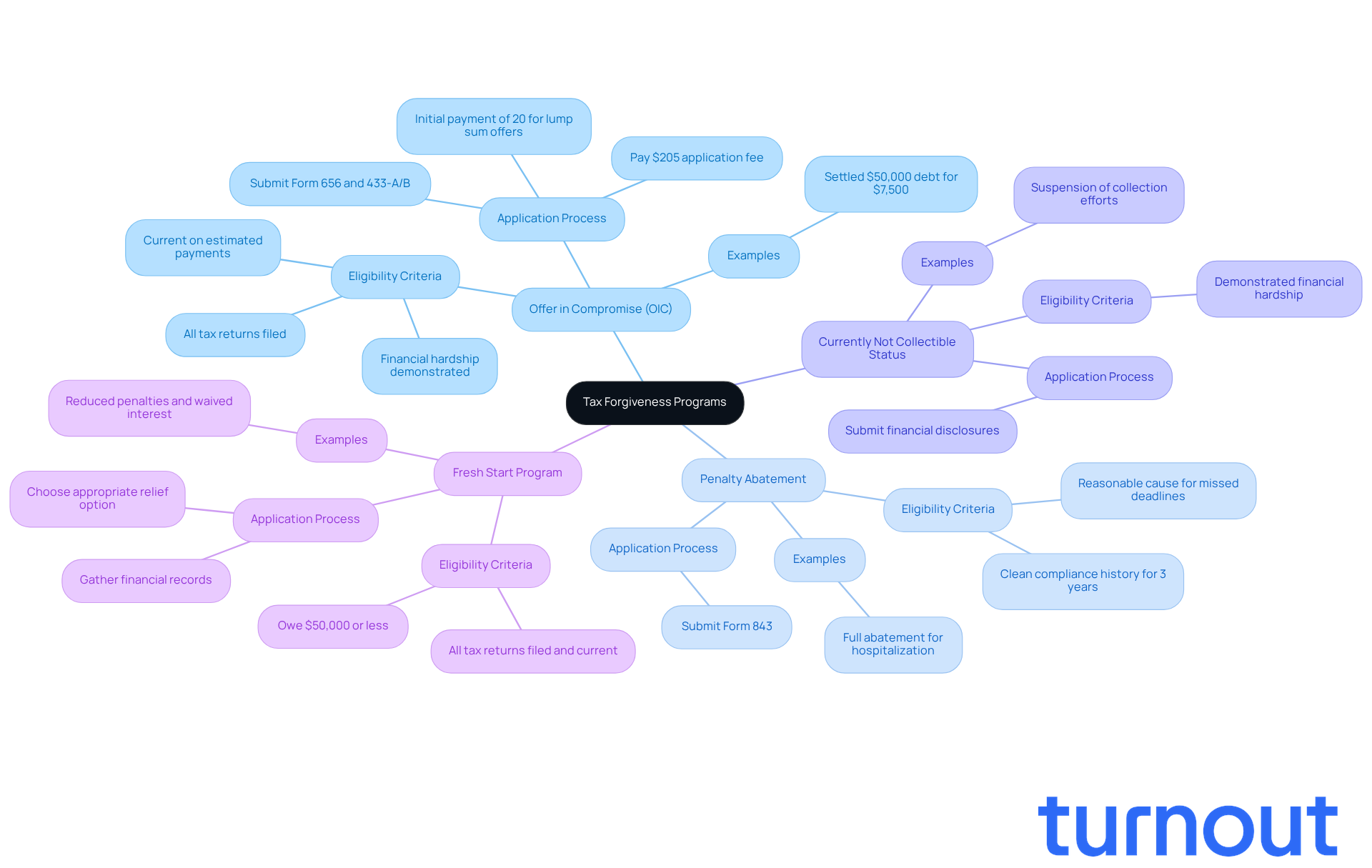

Identify Legitimate Tax Forgiveness Programs

Managing tax liabilities can feel overwhelming, and many people wonder, is tax forgiveness real, especially with the several legitimate programs designed to help you navigate these challenges. Here’s a look at some options that might provide the relief you need:

-

Offer in Compromise (OIC): If you’re facing financial hardship, this program allows you to settle your tax debts for less than what you owe. The IRS has a strict evaluation process, with acceptance rates hovering around 30-40%. To apply, you’ll need to submit detailed financial disclosures, including Forms 656 and 433-A/B, along with a $205 application fee-unless you qualify for the low-income exception.

-

Penalty Abatement: Have you missed deadlines due to unforeseen circumstances? You might qualify for penalty relief if you can show reasonable cause for your situation. Many individuals with a clean compliance history have successfully received full abatement of penalties. For example, someone who missed deadlines due to hospitalization found relief through this program, showcasing its potential for those genuinely struggling.

-

Currently Not Collectible Status: If you’re unable to pay your debts due to financial hardship, this status can temporarily suspend collection efforts. During this time, the IRS halts levies and garnishments, giving you space to stabilize your finances without the stress of immediate collection actions. Plus, if the 10-year statute of limitations runs out while you’re in this status, your tax debt may be forgiven.

-

Fresh Start Program: This initiative offers various relief options for individuals with lower income and tax debts, including streamlined installment agreements and OICs. The program has expanded to assist more individuals, especially in light of the financial challenges brought on by the COVID-19 pandemic.

We understand that navigating these options, especially the question of is tax forgiveness real, can be daunting. Researching these programs through official IRS resources or consulting with a tax professional can help ensure you’re pursuing legitimate options and maximizing your chances of success. Remember, you’re not alone in this journey, and there are people ready to help you find the relief you deserve.

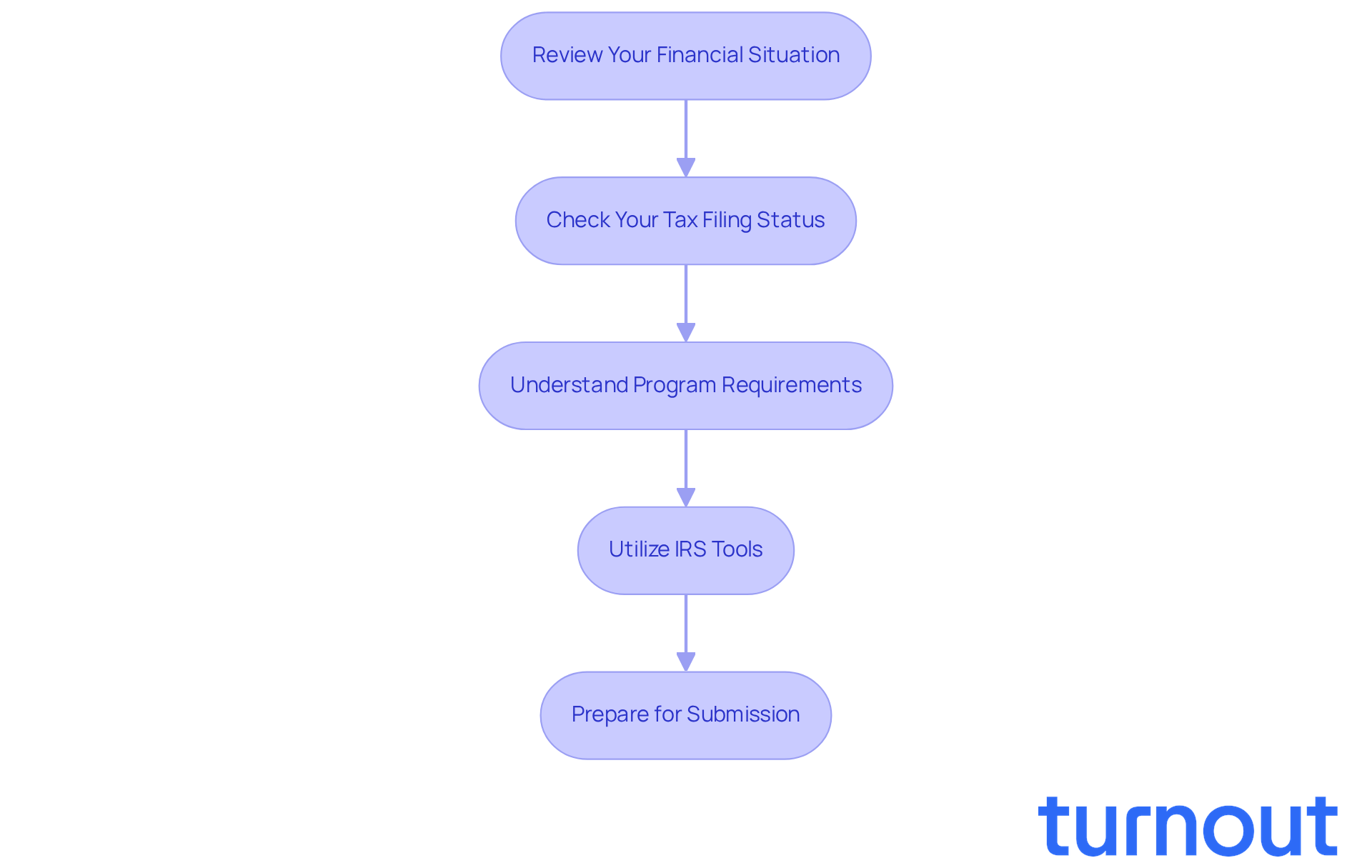

Assess Your Eligibility for Tax Forgiveness

To assess your eligibility for tax forgiveness, let’s walk through these essential steps together:

-

Review Your Financial Situation: Start by gathering all your important documents, like income statements, expense reports, and asset information. This will help you get a clear picture of your financial health and understand your ability to pay.

-

Check Your Tax Filing Status: Make sure all your required tax returns are filed. Many tax forgiveness programs, including the Offer in Compromise (OIC), require you to be up-to-date with your filing obligations. If you haven’t submitted all necessary returns, you might find your requests denied.

-

Understand Program Requirements: Take some time to familiarize yourself with the specific criteria for each program. For example, the OIC requires you to show that you can’t pay your full tax debt. Knowing these requirements will help you tailor your submission effectively.

-

Utilize IRS Tools: Don’t forget to use the IRS Offer in Compromise Pre-Qualifier tool. This resource can help you determine if you meet the basic eligibility criteria for the OIC, making your submission process smoother.

By carefully considering these factors, you can identify which tax forgiveness programs you might qualify for and prepare effectively for the submission process to see if tax forgiveness is real. Remember, timely action is crucial. Many taxpayers miss out on relief opportunities simply by delaying their responses to IRS notices. We’re here to help you navigate this journey.

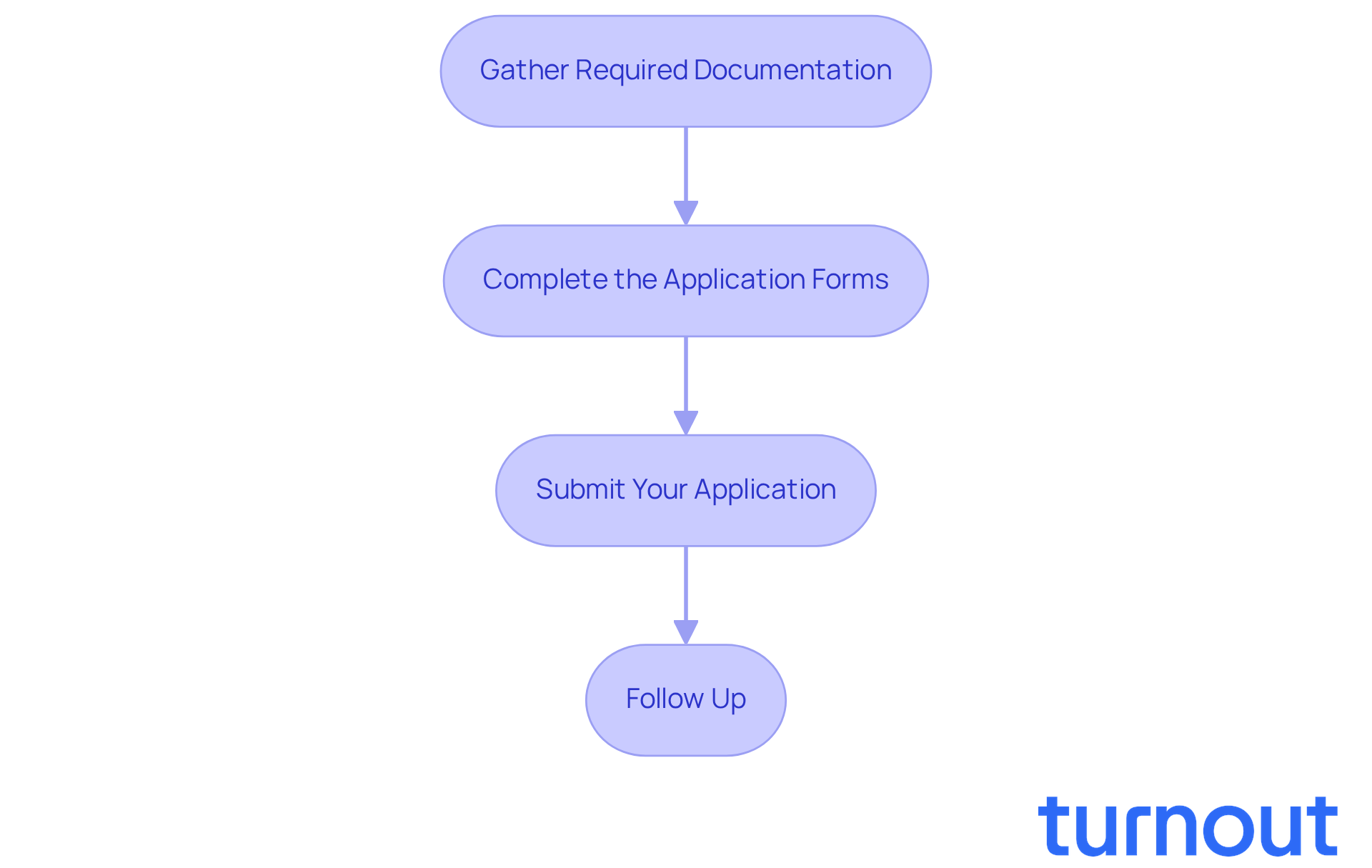

Navigate the Application Process for Tax Forgiveness

Navigating the application process for tax forgiveness can feel overwhelming, but you’re not alone. By following these steps, you can make the journey smoother and increase your chances of success:

-

Gather Required Documentation: Start by compiling essential financial documents, like income statements, tax returns, and proof of expenses. Precise documentation is crucial, as the IRS requires thorough financial disclosure. Don’t forget to include supporting evidence, such as medical records or disaster declarations, which can strengthen your case.

-

Complete the Application Forms: If you’re considering an Offer in Compromise (OIC), fill out Form 656 and either Form 433-A or 433-B, depending on your situation. Make sure all information is accurate and comprehensive to avoid delays or refusals. Many requests are rejected due to incomplete details. Consulting a tax professional can help ensure your forms are filled out correctly, boosting your chances of approval.

-

Submit Your Application: Once your forms are complete, send them along with any required fees to the appropriate IRS address. Keep copies of all submitted documents for your records; this will help you track your status. If you owe less than $50,000, you may have additional options for tax debt relief.

-

Follow Up: After submission, actively monitor the status of your request. The IRS may ask for more information, so be ready to respond promptly. Quick communication can significantly influence the outcome of your submission. Remember, neglecting to file or delaying action on tax debt can lead to increasing penalties and interest. It’s essential to stay compliant with all tax filings and payments while your request is under review.

By following these steps, you can effectively navigate the process and enhance your chances of determining if tax forgiveness is real. As tax attorney Darrin T. Mish wisely advises, 'Understanding if tax forgiveness is real empowers you to seek real solutions and avoid the traps of hype and misinformation.' We're here to help you every step of the way.

Avoid Common Mistakes in Tax Forgiveness Applications

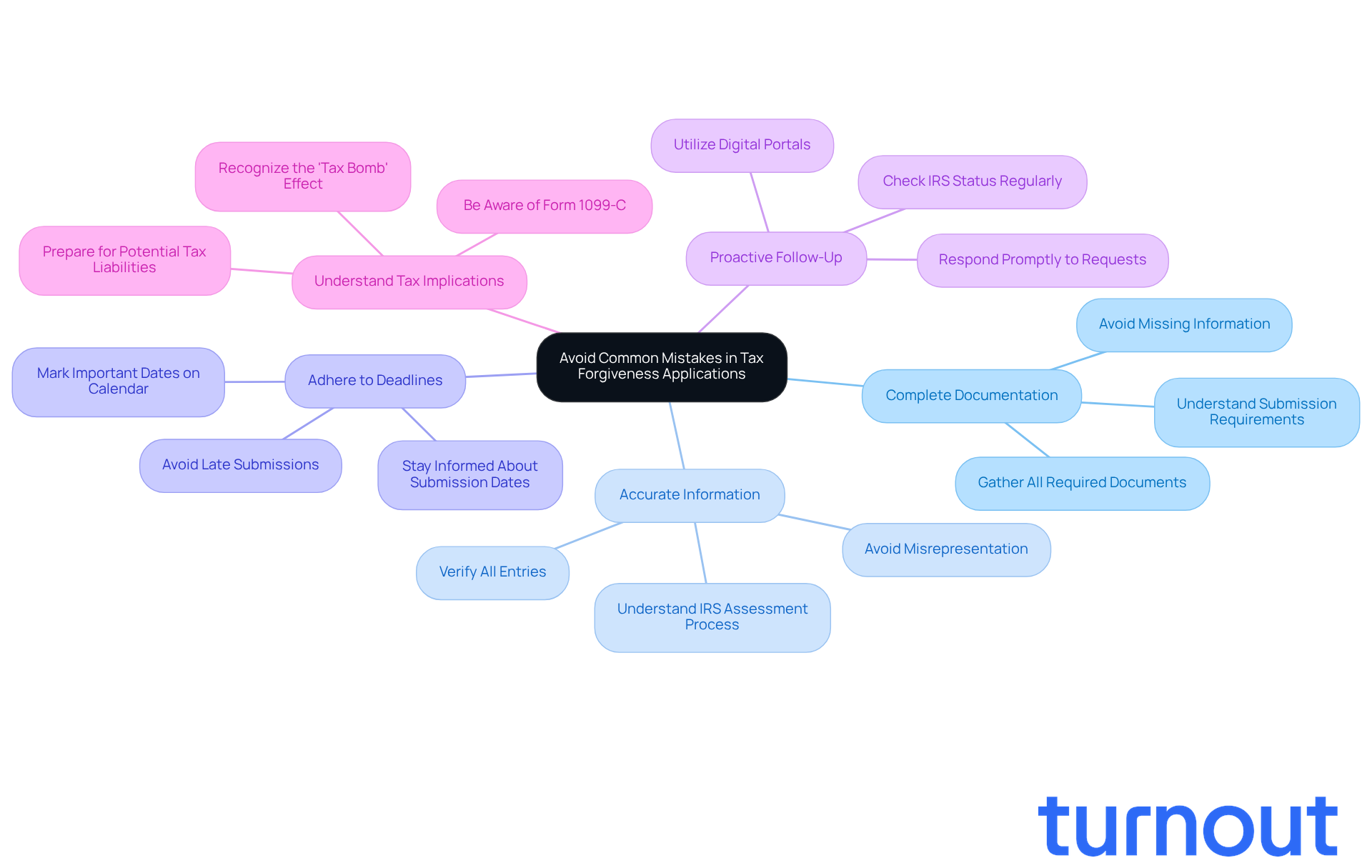

To enhance your chances of success in tax forgiveness applications, consider these essential tips:

-

Complete Documentation: We understand that gathering all required documents can feel overwhelming. However, ensuring that everything is included with your submission is crucial. Missing information can lead to significant delays or outright denials. Remember, many applications are rejected due to incomplete submissions.

-

Accurate Information: It's common to feel anxious about accuracy. Carefully verify all entries to avoid misrepresenting your income or expenses. The IRS thoroughly assesses financial disclosures, and only about 21% of Offer in Compromise submissions are approved. Taking the time to double-check can make a big difference.

-

Adhere to Deadlines: Staying informed about submission deadlines is vital. We know how easy it is to lose track of time, but submitting your forms punctually can help you avoid complications. Late submissions often result in automatic denials, so mark those dates on your calendar!

-

Proactive Follow-Up: After submitting your request, it’s a good idea to check in with the IRS regularly. We encourage you to take advantage of their digital portals to monitor your status. If they request additional information, respond promptly to prevent unnecessary delays. You're not alone in this process; staying engaged can help.

-

Understand Tax Implications: Be aware that receiving a Form 1099-C after tax debt forgiveness means the canceled debt may be considered taxable income. This could lead to what some call a 'tax bomb.' Understanding this can help you prepare for any surprises.

By being vigilant about these common mistakes and understanding the current landscape, including the challenges posed by staffing reductions at the IRS, you can streamline your application process. Remember, you are not alone in this journey, and with the right approach, you can significantly improve your chances of understanding if tax forgiveness is real.

Conclusion

Tax forgiveness can truly be a lifeline for those grappling with overwhelming tax debts, offering a way to find financial relief through various programs. It’s important to recognize that while these options can help settle debts for less than what you owe, understanding the implications - like potential tax liabilities from forgiven amounts - is crucial.

In this article, we’ve highlighted key programs such as the Offer in Compromise (OIC), penalty abatement, and the Fresh Start Program. Each of these avenues provides a legitimate path to tax relief, but they come with specific eligibility criteria and application processes. Thorough preparation and accurate documentation are essential. Remember, avoiding common pitfalls like incomplete submissions and missed deadlines can significantly boost your chances of a successful application.

Navigating the complexities of tax forgiveness can feel daunting, but staying informed and proactive is key. As financial landscapes change, understanding the nuances of tax relief options empowers you to make informed decisions. Whether you consult with tax professionals or utilize IRS resources, taking those first steps toward financial recovery can lead to meaningful relief and a brighter financial future.

We understand that this journey can be overwhelming, but you are not alone. We're here to help you explore these options and find the support you need.

Frequently Asked Questions

What is tax forgiveness?

Tax forgiveness refers to programs designed to help individuals settle their tax debts for less than what they owe, providing relief during financial hardship. Examples include the Offer in Compromise (OIC) and penalty abatement.

Are there any implications of tax forgiveness?

Yes, while tax forgiveness can provide immediate relief, it may also lead to tax liabilities on the amounts forgiven, which could complicate your financial situation further.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program that allows individuals facing financial hardship to settle their tax debts for less than the total amount owed. The IRS has a strict evaluation process for this program, with acceptance rates around 30-40%.

How can I apply for the Offer in Compromise (OIC)?

To apply for the OIC, you need to submit detailed financial disclosures using Forms 656 and 433-A/B, along with a $205 application fee, unless you qualify for the low-income exception.

What is penalty abatement?

Penalty abatement is a program that provides relief from penalties for individuals who can demonstrate reasonable cause for missing deadlines. Those with a clean compliance history may successfully receive full abatement of penalties.

What does Currently Not Collectible status mean?

Currently Not Collectible status is a temporary status that suspends IRS collection efforts for individuals unable to pay their debts due to financial hardship. During this time, the IRS halts levies and garnishments.

What is the Fresh Start Program?

The Fresh Start Program offers various relief options for individuals with lower income and tax debts, including streamlined installment agreements and OICs. It has expanded to assist more individuals, particularly due to financial challenges from the COVID-19 pandemic.

How can I ensure I’m pursuing legitimate tax forgiveness options?

Researching tax forgiveness programs through official IRS resources or consulting with a tax professional can help ensure you are pursuing legitimate options and maximizing your chances of success.