Overview

Navigating SSDI benefits can be overwhelming, and we understand that concerns about taxation may add to your stress. It's important to know that your benefits may be subject to taxation based on your overall income. Specifically, if half of your disability benefits, combined with other income, exceeds $25,000, some of those benefits may be taxed. This highlights the significance of understanding these thresholds for effective financial planning.

We’re here to help you make sense of it all. Knowing the limits can empower you to plan better for your future. Remember, you are not alone in this journey, and taking the time to understand these details can lead to more informed decisions. If you have any questions or need further assistance, please reach out—we're here for you.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can indeed feel overwhelming. Many individuals rely on this essential support system, and the question of whether SSDI benefits are taxable is significant. This uncertainty can heavily influence financial planning for countless recipients. With a patchwork of federal and state regulations, it’s crucial for beneficiaries to understand their tax obligations fully.

We understand that you may have concerns about how to manage these complexities effectively. How can you ensure that you maximize your benefits while minimizing potential liabilities? Rest assured, you are not alone in this journey. Together, we can explore the answers that will help you feel more secure and informed.

Define Social Security Disability Insurance (SSDI) and Its Purpose

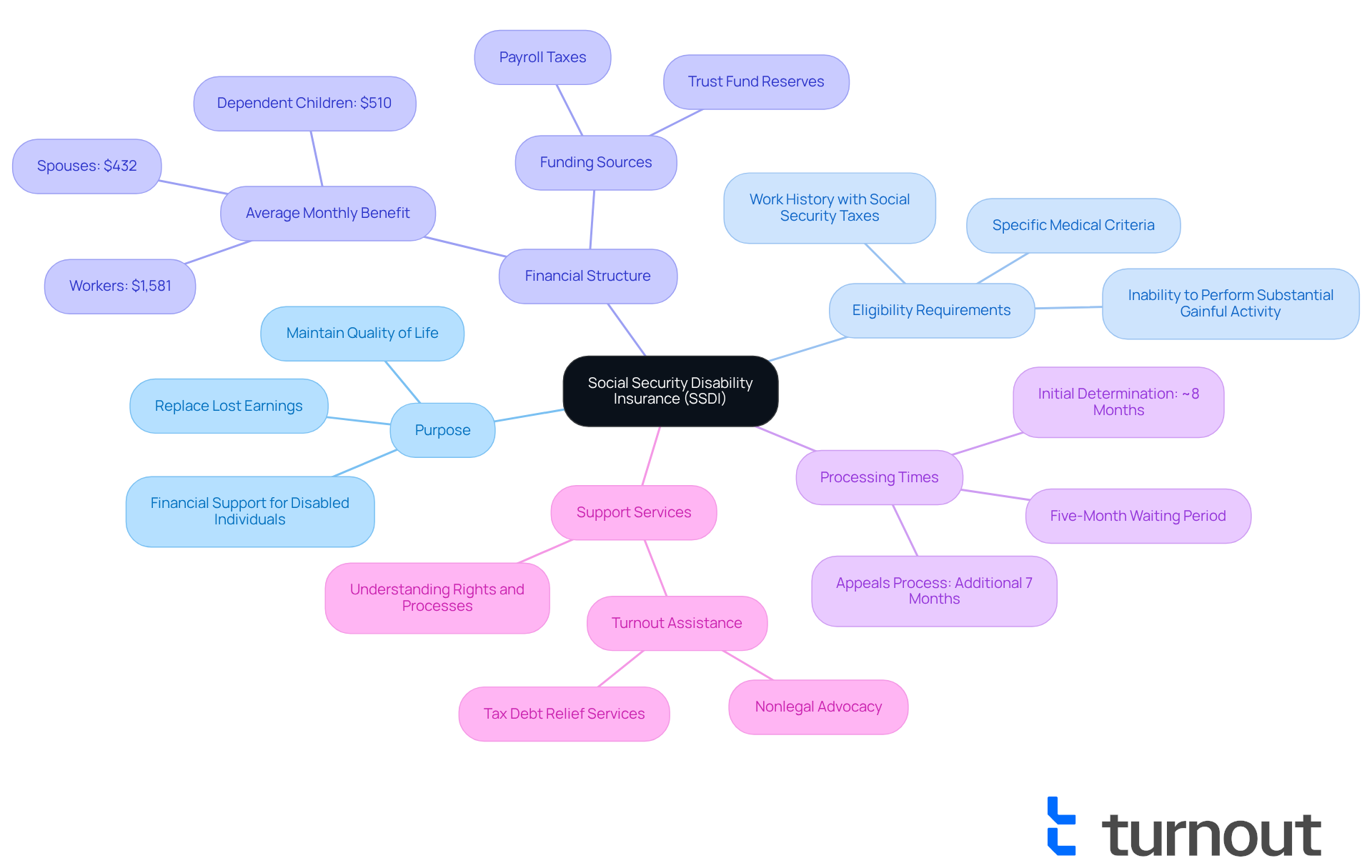

Social Security Disability Insurance is a federal initiative designed to provide financial support to individuals who are unable to work due to qualifying disabilities. We understand that navigating this process can be overwhelming, and it’s important to know that help is available. To qualify for disability benefits, applicants need a work history that includes paying Social Security taxes and must meet specific medical criteria set by the Social Security Administration (SSA). The primary goal of Social Security Disability Insurance is to replace lost earnings for those unable to work, helping them maintain a basic quality of life while facing health challenges.

As of January 2025, approximately 8.3 million people receive disability support payments, with the average monthly amount around $1,581. This program is vital for supporting disabled individuals, especially since many face significant economic hardships; nearly 25% of disabled beneficiaries aged 18 to 64 live below the official poverty line. Beyond cash benefits, the program also provides access to Medicare after 24 months of entitlement, further enhancing recipients' financial security.

Understanding if SSDI is taxed is crucial for beneficiaries, as it directly impacts their financial planning and tax obligations. The program is primarily funded through payroll taxes, and in 2024, total Social Security trust fund income reached $1.418 trillion, with $194 billion allocated to the Disability Insurance Trust Fund. This financial structure ensures that the program can continue offering essential support to millions of Americans facing disabilities.

However, we recognize that there can be significant processing delays at the SSA, which may lead to overpayments and affect beneficiaries. The average hold time on the phone for SSA is nearly 40 minutes, illustrating the bureaucratic hurdles applicants may face. Additionally, mortality rates among disability beneficiaries are notably higher, with many confronting serious health issues that underscore the need for prompt assistance.

It’s important to note that there is a five-month waiting period for disability support payments. Understanding this timeline can help prospective applicants set realistic expectations for receiving assistance. Successful Social Security Disability Insurance applications often hinge on thorough documentation and meeting strict eligibility requirements. For instance, in 2023, there were 523,834 awards to disabled workers, reflecting the program's ongoing commitment to assist those in need. Yet, the application process can be lengthy, with initial determinations taking nearly eight months and appeals extending the wait by an additional seven months.

Turnout simplifies access to these benefits by providing tools and services that help consumers navigate the complexities of disability claims. By employing skilled nonlegal advocates, Turnout offers assistance during the application process, ensuring individuals understand their rights and the essential steps to secure their entitlements. Importantly, Turnout is not a law firm and does not provide legal advice, which allows applicants to receive support without the need for legal representation. Furthermore, Turnout also offers services related to tax debt relief, helping individuals manage their financial challenges. This approach makes the process more accessible and less daunting, reminding applicants that they are not alone in this journey.

Identify When SSDI Benefits Are Taxable

Payments may become subject to tax if your overall earnings surpass certain limits set by the IRS. We understand that navigating these thresholds can be daunting. For individual taxpayers, if half of the disability benefits received, along with other revenue sources, exceeds $25,000, it raises the question of whether is ssdi taxed, as a portion of those benefits might be liable for federal taxes. Similarly, for married couples filing jointly, the threshold is set at $32,000. It's crucial to monitor your total income, as exceeding these limits can significantly impact your financial situation during tax season.

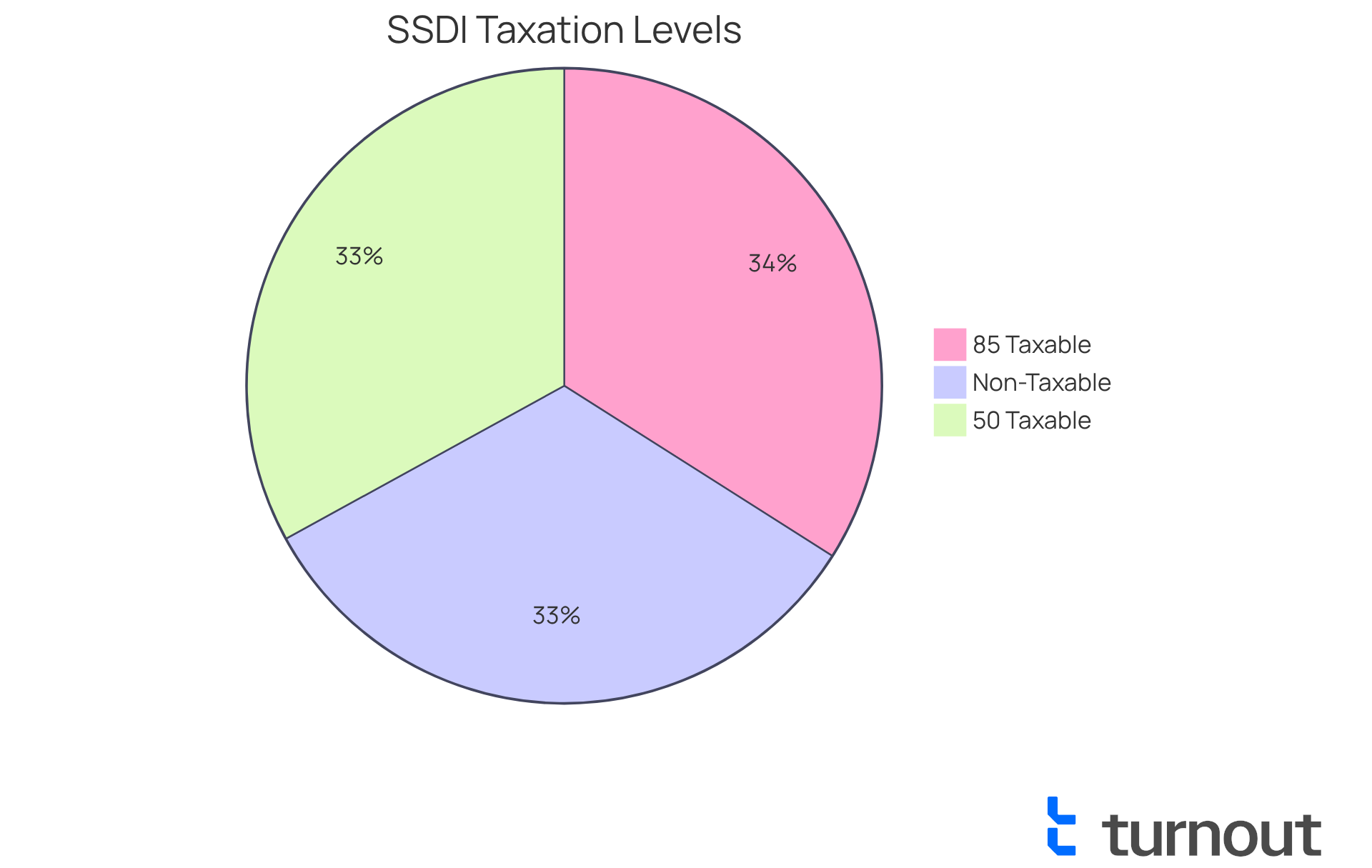

Consider this: individuals earning up to $2,083 each month or $25,000 per year will not have their disability benefits taxed. However, if your earnings fall between $2,084 and $2,833 each month, or $25,000 to $34,000 each year, 50% of your allowances will be taxed, leading to inquiries about how is ssdi taxed. For couples making more than $3,667 each month or $44,000 per year, the question of whether is ssdi taxed arises, as up to 85% of their disability payments may be subject to taxation.

It's important to note that approximately one-third of disability assistance recipients ultimately pay taxes on their payments, which leads to the question of how is ssdi taxed, often due to additional household earnings. Understanding these thresholds and implications is essential for effective tax planning. Remember, you are not alone in this journey. We're here to help you prepare for potential tax liabilities, ensuring you feel supported and informed every step of the way.

Differentiate Between Federal and State Tax Rules for SSDI

Navigating the taxation of Social Security Disability Insurance payments raises the question, is SSDI taxed, which can feel overwhelming. We understand that the differences between federal guidelines and state regulations can create confusion. While the federal government has established specific criteria for taxing disability benefits, it raises the question of how is SSDI taxed in individual states, leading to varying tax responsibilities for recipients.

Starting in 2025, nine states will impose taxes on disability support payments. These include:

- Colorado

- Connecticut

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

In contrast, states like California and New York provide a more supportive environment by not taxing disability assistance at all.

For example, in Connecticut, individuals only face levies on disability benefits if their modified gross earnings exceed $75,000. This allows 75% of benefits to remain free from state taxes, which is a relief for lower-income retirees. However, in states like Nebraska, taxes apply to all retirement earnings, including Social Security Disability Insurance, so it is SSDI taxed, which can significantly impact beneficiaries' finances.

It's crucial for disability benefit recipients to consult their state's tax regulations or seek advice from a financial expert. Understanding the specific income limits and tax rates in their state can help ensure compliance with both federal and state tax regulations. This knowledge ultimately empowers recipients to optimize their benefits and minimize tax obligations.

Remember, you are not alone in this journey. Turnout offers various tools and services to assist individuals in navigating these complexities. With trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, we ensure that you receive the necessary support without the need for legal representation. We're here to help you every step of the way.

Explain How to Report SSDI Benefits on Your Tax Return

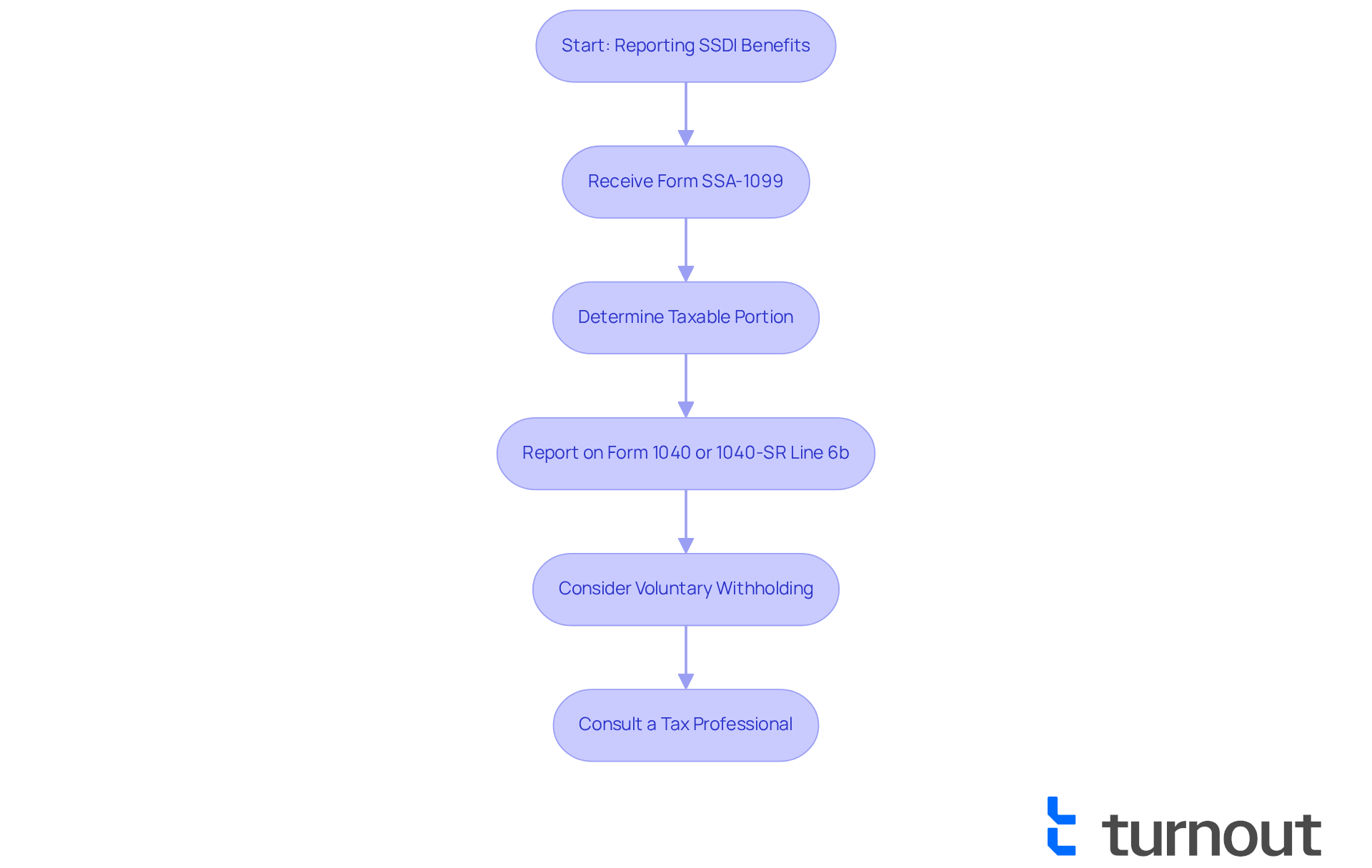

Navigating the reporting of Social Security Disability Insurance payments on your tax return can feel overwhelming, but we're here to help. To get started, you'll need to use Form SSA-1099, which the Social Security Administration provides each January. This important document outlines the total amount of disability assistance you received in the previous year.

When you're finalizing your tax return, remember to report the taxable portion of your SSDI payments on line 6b of Form 1040 or Form 1040-SR. It's common to wonder if SSDI is taxed, as this depends on specific income thresholds. For instance, if your total earnings exceed $34,000, you might find that up to 85% of your benefits could be subject to taxation.

It's crucial to keep a copy of your SSA-1099 for your records. Additionally, you have the option to voluntarily withhold funds from your disability payments using IRS Form W-4V, which can be a proactive way to manage your financial responsibilities. As tax professional Christine Scott wisely points out, "If your client has any tax liability in the year they receive benefits, it is especially crucial to consult a tax professional to figure out how to reduce taxes owed."

You are not alone in this journey; resources like the IRS Taxpayer Advocate Service and Volunteer Income Tax Assistance (VITA) programs are available to assist you with any tax-related questions. If Social Security Disability Insurance is your household's only source of income, you may wonder if SSDI is taxed; it's unlikely to be taxed, even if it totals $81,000. Also, if you receive auxiliary payments based on a wage earner’s record, keep in mind that these are considered income and may require separate tax reporting.

Understanding how Workers' Compensation might affect your SSDI benefits is also important, as it can influence your overall tax situation. Therefore, consulting a knowledgeable tax professional can provide clarity and peace of mind regarding the reporting of your benefits.

Conclusion

Understanding the nuances of Social Security Disability Insurance (SSDI) is essential for beneficiaries to effectively manage their financial situation and tax obligations. This program serves as a crucial lifeline for millions who are unable to work due to disabilities, providing necessary support to maintain a basic standard of living. We understand that navigating these complexities can be overwhelming, but recognizing how SSDI benefits may be taxed and the specific reporting requirements can empower you to make informed decisions regarding your finances.

Throughout this article, we have highlighted key aspects of SSDI, including its purpose, eligibility criteria, and the potential tax implications based on income levels. While SSDI benefits are primarily non-taxable for many individuals, those with additional income may face tax liabilities. It's common to feel confused about the differences between federal and state tax rules, but understanding local regulations is vital to optimize your benefits and minimize taxes.

Ultimately, navigating the complexities of SSDI and its taxation requires awareness and proactive planning. We encourage you to seek assistance from resources such as tax professionals or advocacy services. Remember, you are not alone in this journey; by staying informed and prepared, you can better manage your financial challenges and focus on your well-being during difficult times.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance (SSDI) is a federal program designed to provide financial support to individuals who are unable to work due to qualifying disabilities.

Who qualifies for SSDI benefits?

To qualify for SSDI benefits, applicants must have a work history that includes paying Social Security taxes and must meet specific medical criteria set by the Social Security Administration (SSA).

What is the primary goal of SSDI?

The primary goal of SSDI is to replace lost earnings for individuals unable to work, helping them maintain a basic quality of life while facing health challenges.

How many people receive SSDI benefits, and what is the average monthly payment?

As of January 2025, approximately 8.3 million people receive SSDI benefits, with the average monthly payment around $1,581.

What additional support does SSDI provide beyond cash benefits?

In addition to cash benefits, SSDI provides access to Medicare after 24 months of entitlement, enhancing recipients' financial security.

Are SSDI benefits taxed?

Understanding whether SSDI benefits are taxed is crucial for beneficiaries, as it impacts their financial planning and tax obligations.

How is the SSDI program funded?

The SSDI program is primarily funded through payroll taxes. In 2024, the total Social Security trust fund income reached $1.418 trillion, with $194 billion allocated to the Disability Insurance Trust Fund.

What are some challenges faced by SSDI applicants?

Applicants may face significant processing delays at the SSA, leading to overpayments and long hold times on the phone, which average nearly 40 minutes. Additionally, mortality rates among disability beneficiaries are notably higher.

Is there a waiting period for SSDI benefits?

Yes, there is a five-month waiting period for disability support payments, which applicants should consider when setting expectations for receiving assistance.

How long does the SSDI application process take?

The initial determination for SSDI applications can take nearly eight months, with appeals potentially extending the wait by an additional seven months.

How does Turnout assist with the SSDI application process?

Turnout simplifies access to SSDI benefits by providing tools and services that help consumers navigate disability claims, employing skilled nonlegal advocates to assist applicants without offering legal advice.

What other services does Turnout provide?

In addition to SSDI assistance, Turnout offers services related to tax debt relief, helping individuals manage their financial challenges.