Introduction

The landscape of Social Security Disability Insurance (SSDI) is shifting, and we understand that this can bring a mix of hope and concern. Recently, the Social Security Administration announced a 2.5% cost-of-living adjustment (COLA) for 2025, which means an increase in average monthly benefits. While this adjustment is certainly a step in the right direction, it raises important questions about whether it will be enough to support you amid rising living costs and inflation.

As beneficiaries prepare for this modest increase in their payments, it’s common to feel uncertain. Will these adjustments truly ease the financial pressures many SSDI recipients face? Especially with anticipated hikes in Medicare premiums and potential tax implications, it’s natural to wonder how far this increase will go in helping you meet your needs.

We’re here to help you navigate these changes and understand what they mean for your financial future. You are not alone in this journey, and together, we can explore the options available to ensure you receive the support you deserve.

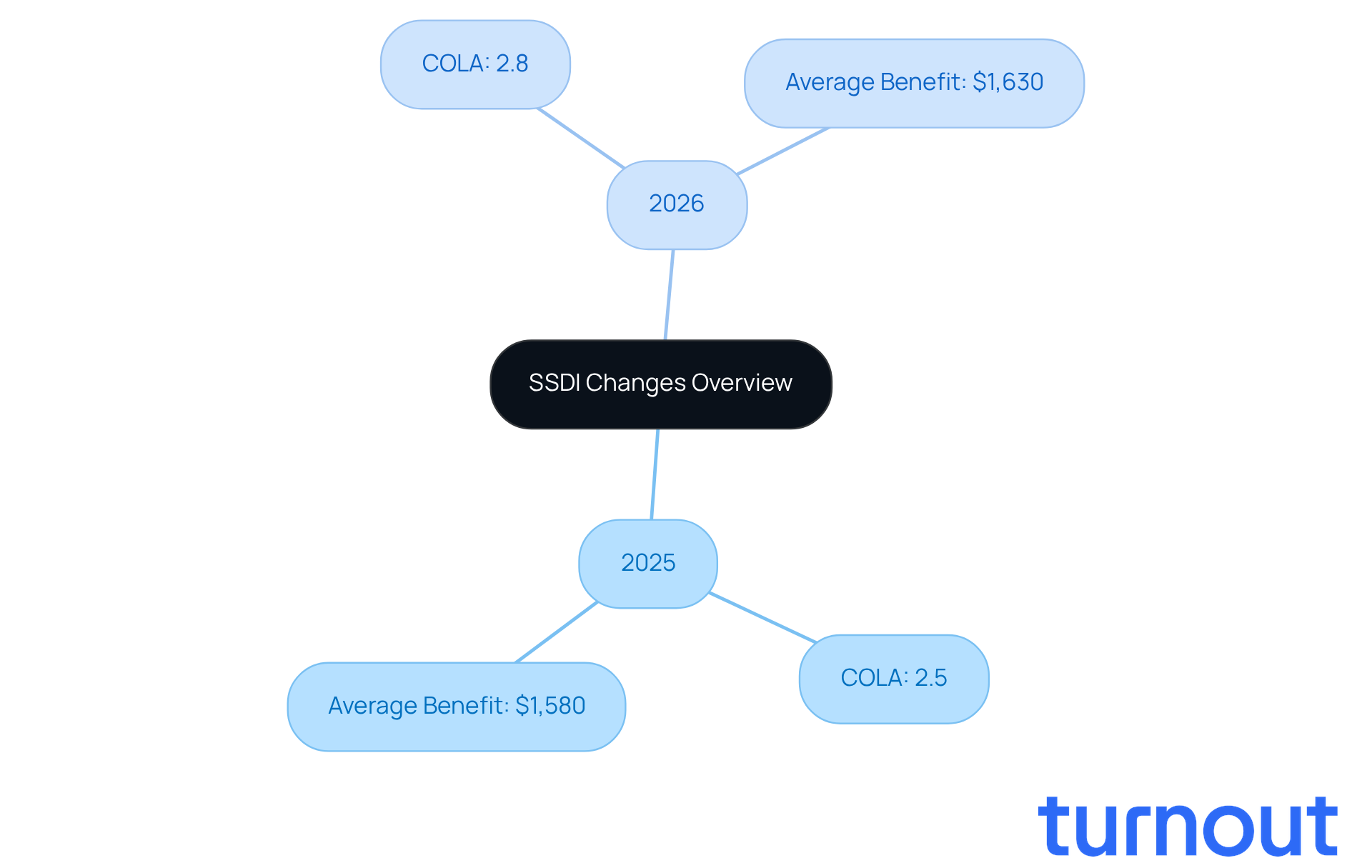

Overview of SSDI Changes for 2025 and 2026

The question of whether SSDI is getting a raise in 2025 has been addressed by the Social Security Administration (SSA) with a 2.5% cost-of-living adjustment for SSDI recipients. This change led to an average monthly benefit rise from $1,542 to approximately $1,580. We understand that these adjustments are crucial for beneficiaries trying to cope with inflation and rising living costs.

For 2026, the COLA was set at 2.8%, raising the average monthly benefit to about $1,630. This increase reflects a slight uptick in the adjustment percentage, indicating a response to ongoing economic pressures. It's common to feel overwhelmed by these changes, but know that support is available.

While the eligibility criteria and application processes have remained largely unchanged, Turnout is dedicated to simplifying access to these benefits. Through our guided platform, we offer tools for completing government forms and case support from trained nonlawyer advocates. We’re here to help you navigate the disability benefits application process efficiently.

Our AI agent, Jake, enhances this experience by providing automated communications and tracking. This ensures that you receive the assistance you need without the complexities of legal representation. Remember, you are not alone in this journey.

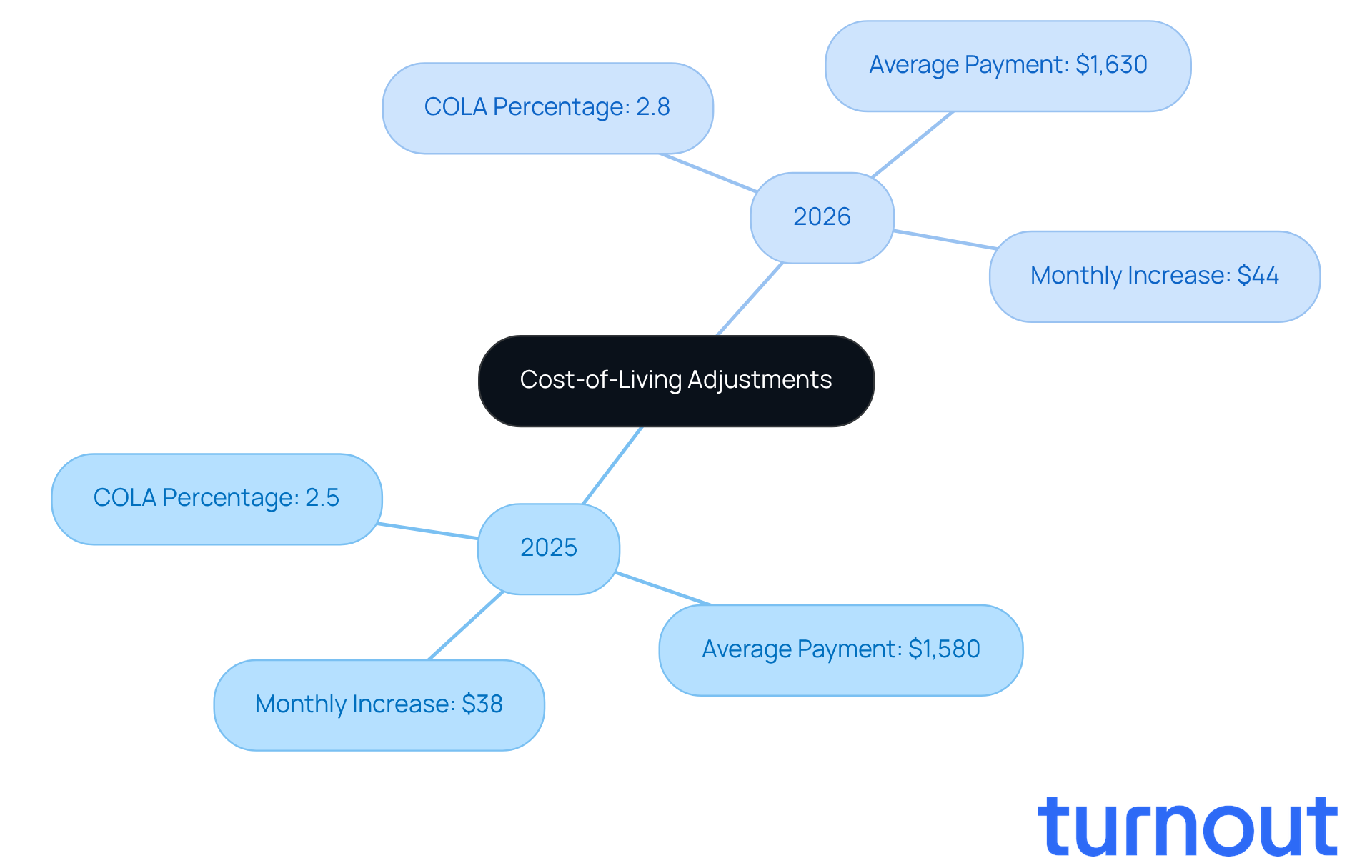

Cost-of-Living Adjustments: 2025 vs. 2026

The question of whether the Cost-of-Living Adjustment (COLA) for 2025 is SSDI getting a raise in 2025 is set at 2.5%. This indicates that the question of whether SSDI is getting a raise in 2025 pertains to the average SSDI payment rising from $1,542 to $1,580. In 2026, the adjustment increases to 2.8%, bringing the average payment to $1,630. That’s an extra $44 each month for beneficiaries compared to the previous year.

These adjustments are designed to help you maintain your purchasing power, especially during tough times of rising costs. We understand that inflation can be overwhelming, and every bit helps. However, the real impact of these changes can vary greatly depending on your unique situation. Factors like additional income or specific expenses related to your disabilities can influence how much these adjustments truly benefit you.

The modest rise in the COLA percentage from 2025 to 2026 raises concerns about whether SSDI is getting a raise in 2025, highlighting the ongoing economic challenges many SSDI recipients face. Rising living costs and healthcare expenses are realities that can weigh heavily on your shoulders. Remember, you are not alone in this journey. We’re here to help you navigate these changes and find the support you need.

Medicare Premium Changes and Their Impact on SSDI

In 2025, the standard monthly premium for Medicare Part B was set at $185, showing a gradual increase over the years. However, we understand that in 2026, this premium is expected to rise to $202.90, which is a significant jump of about 9.7%. This increase can overshadow the benefits of the Cost-of-Living Adjustment for Social Security Disability Insurance (SSDI) beneficiaries, leading to concerns about whether SSDI is getting a raise in 2025.

It's common to feel concerned about how these rising Medicare premiums might eat into that gain, leaving many beneficiaries with less extra income than they anticipated. While the hold-harmless provision protects some beneficiaries from premium hikes that exceed their COLA, not everyone qualifies for this safeguard. This situation highlights the importance of considering healthcare costs when evaluating the overall financial impact of SSDI adjustments.

At Turnout, we're here to help individuals navigate these complexities. We offer access to trained nonlawyer advocates who can assist with SSD claims and help beneficiaries understand their financial landscape. Real-world examples show that many recipients are already feeling the pressure of increasing healthcare expenses, which can diminish their purchasing power and overall quality of life.

As Mary Johnson, an independent Social Security and Medicare analyst, points out, "The standard monthly Part B premium will rise 9.7% in 2026, which is the second-highest growth in the program's history." You're not alone in this journey, and we're committed to supporting you every step of the way.

Tax Implications for SSDI Recipients: A Yearly Comparison

In 2025, disability benefits became subject to federal income tax for individuals whose combined income exceeded certain thresholds:

- $25,000 for single filers

- $32,000 for married couples filing jointly

As we approach 2026, we anticipate a slight increase in these thresholds, leading us to wonder if SSDI is getting a raise in 2025 to reflect necessary adjustments for inflation. However, the tax rate for disability beneficiaries remains steady at 7.65%.

We understand that while beneficiaries may see a modest rise in their benefits due to the Cost of Living Adjustment (COLA), particularly in light of the question of whether SSDI is getting a raise in 2025, they could also face increased tax liabilities if their income surpasses the updated thresholds. For instance, a single filer with a combined income of $30,000 might find that up to 50% of their disability benefits are taxable. This highlights the importance of understanding these tax implications for effective financial management.

It's common to feel overwhelmed by these changes, but proactive planning is essential for disability benefit recipients to navigate this landscape and secure their financial future. We're here to help! Turnout offers tools and services designed to assist individuals in understanding these complexities. Our trained nonlawyer advocates are ready to guide clients through SSDI claims and tax relief processes, ensuring you don’t have to face this journey alone.

Conclusion

The anticipated changes to Social Security Disability Insurance (SSDI) for 2025 and 2026 reflect a critical adjustment to support beneficiaries facing rising living costs. With a 2.5% cost-of-living adjustment (COLA) in 2025, the average monthly benefit increases modestly. However, the subsequent rise to 2.8% in 2026 suggests a continued acknowledgment of economic pressures. These adjustments, while necessary, highlight the ongoing challenges that SSDI recipients must navigate in their daily lives.

We understand that these changes can feel overwhelming. Key insights reveal the nuanced impact of these adjustments, including the significant increase in Medicare premiums that could offset the benefits of the COLA. Additionally, the tax implications for SSDI recipients further complicate financial planning, as rising income thresholds may lead to increased tax liabilities. It’s important to recognize that while adjustments are made, the real-world effects can vary greatly among individuals. This emphasizes the need for tailored support and resources.

In light of these developments, it’s crucial for SSDI beneficiaries to stay informed and proactive about their financial situations. Utilizing available resources, such as advocacy platforms and financial planning tools, can help individuals navigate these complexities and secure a more stable future. Remember, embracing these changes with the right support can empower SSDI recipients to manage their benefits effectively. You are not alone in this journey; we’re here to help you face these challenges together.

Frequently Asked Questions

What is the cost-of-living adjustment (COLA) for SSDI in 2025?

The COLA for SSDI in 2025 is set at 2.5%, which raises the average monthly benefit from $1,542 to approximately $1,580.

What is the COLA for SSDI in 2026?

The COLA for SSDI in 2026 is set at 2.8%, increasing the average monthly benefit to about $1,630.

Why are these adjustments important for SSDI beneficiaries?

These adjustments are crucial for beneficiaries as they help cope with inflation and rising living costs.

Have the eligibility criteria and application processes for SSDI changed?

No, the eligibility criteria and application processes for SSDI have largely remained unchanged.

How can Turnout assist individuals with the SSDI application process?

Turnout simplifies access to benefits by offering tools for completing government forms and providing case support from trained nonlawyer advocates.

What role does the AI agent, Jake, play in the SSDI application process?

Jake enhances the application experience by providing automated communications and tracking, ensuring that users receive the assistance they need without the complexities of legal representation.

Is support available for individuals navigating the SSDI application process?

Yes, support is available to help individuals navigate the SSDI application process efficiently.