Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that many rely on this program for financial support during tough times. It’s not just about income levels; SSDI hinges on your work history, which can add to the confusion.

What happens when your earnings exceed the limits? How can you effectively manage the application process? These are common concerns, and it’s crucial to grasp how income impacts your eligibility and benefits.

This article aims to shed light on the essential elements of SSDI. We’re here to help you understand the path to securing the benefits you may desperately need. Remember, you are not alone in this journey.

Explore the Fundamentals of Social Security Disability Insurance (SSDI)

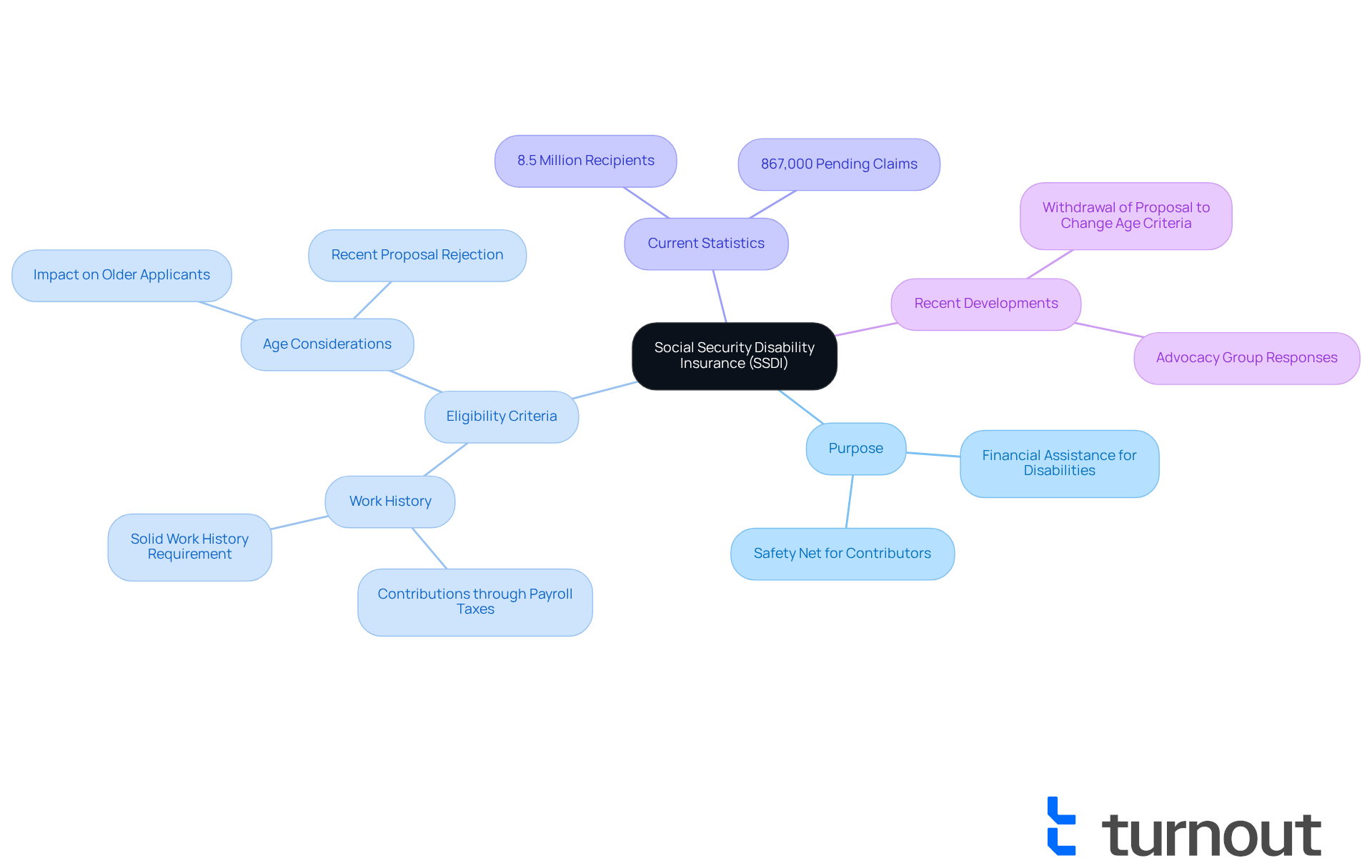

Social Security Disability Insurance (SSDI) is a vital federal program designed to provide financial assistance to those who can’t work due to significant disabilities. We understand that navigating this process can be overwhelming, but knowing the basics can make a difference. To qualify for benefits, applicants need to demonstrate a solid work history and show that they’ve contributed to Social Security through payroll taxes. Unlike needs-based programs, SSDI eligibility is based on income, primarily hinging on work history rather than earnings or assets. This structure ensures that benefits focus on replacing a portion of lost income due to disability, helping recipients manage essential living expenses.

As we look ahead to 2025, the SSDI program continues to support millions, with around 8.5 million individuals currently receiving benefits. Recent discussions about eligibility criteria have brought attention to the importance of age and work background in evaluations. It’s common to feel concerned about these changes, especially for older applicants. Notably, the Social Security Administration (SSA) recently decided against a proposal that would have reduced the role of age in determining eligibility. This decision is crucial, as it helps protect older individuals who face unique challenges in the workforce.

Understanding these fundamentals is essential for successfully managing the disability benefits application process. The program is designed to be a safety net for those who have contributed to the system, ensuring they receive the support they need during tough times. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Understand How Income Affects SSDI Benefit Calculations

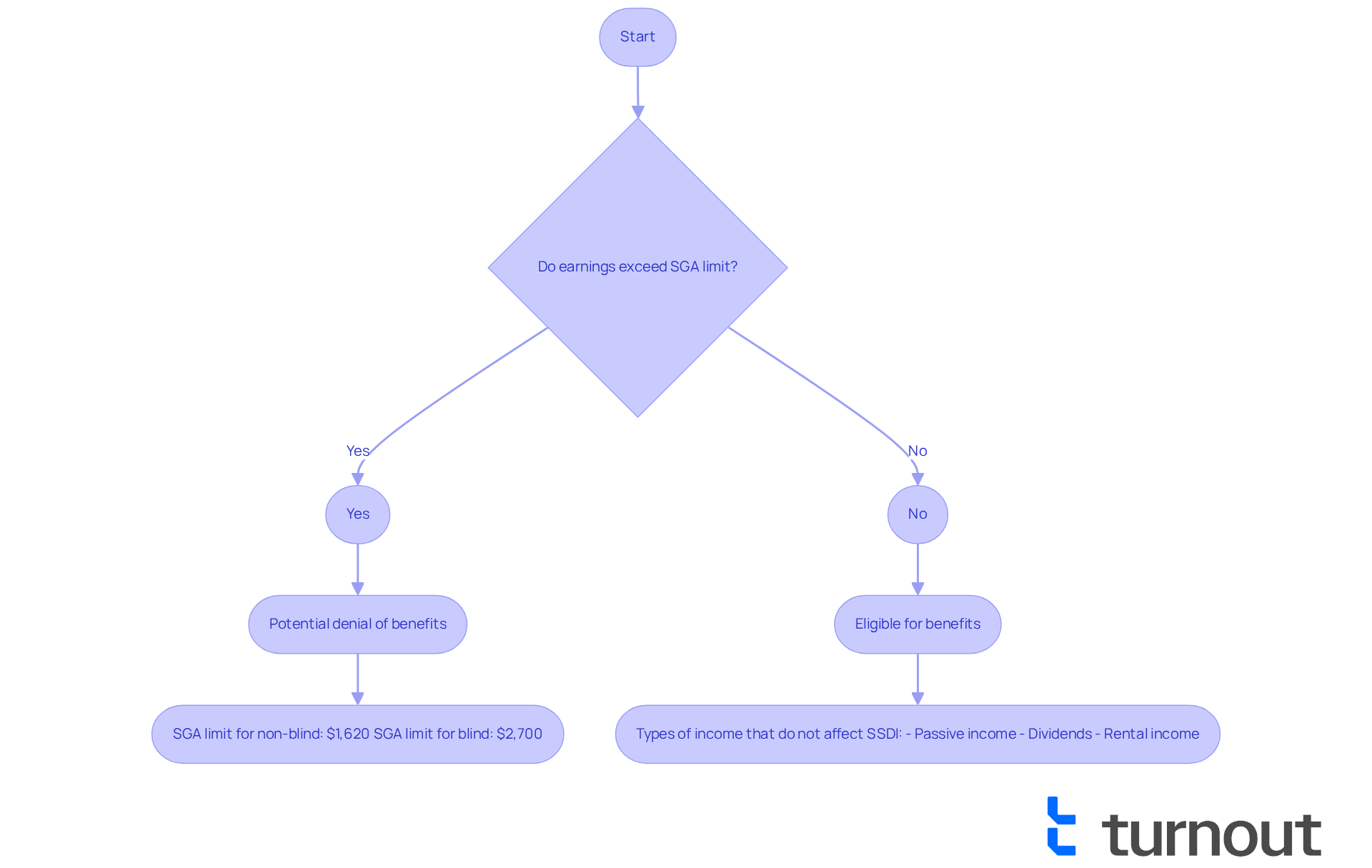

It is important to know that eligibility for disability support payments is SSDI based on income, as earnings play a significant role in this determination and not every type of earnings affects it. The Social Security Administration (SSA) sets a threshold called the Substantial Gainful Activity (SGA) limit, which is essential for assessing eligibility.

In 2025, the SGA limit is $1,620 per month for non-blind individuals and $2,700 for those who are blind. If earnings exceed these limits, it could lead to a denial of disability assistance. However, it’s reassuring to know that certain income types, like passive income from investments, typically do not impact SSDI eligibility, which is SSDI based on income.

Understanding these distinctions is vital for applicants as they navigate their financial situations, particularly because support is SSDI based on income. For example, if a sighted person earns $1,700 in a month, they would exceed the SGA limit and risk losing their assistance. On the flip side, passive income sources, such as dividends or rental income, are excluded from SGA calculations. This means individuals can maintain their disability benefits while still earning income.

We understand that managing finances can be overwhelming, but you are not alone in this journey. By grasping these rules, you can make informed decisions that support your well-being.

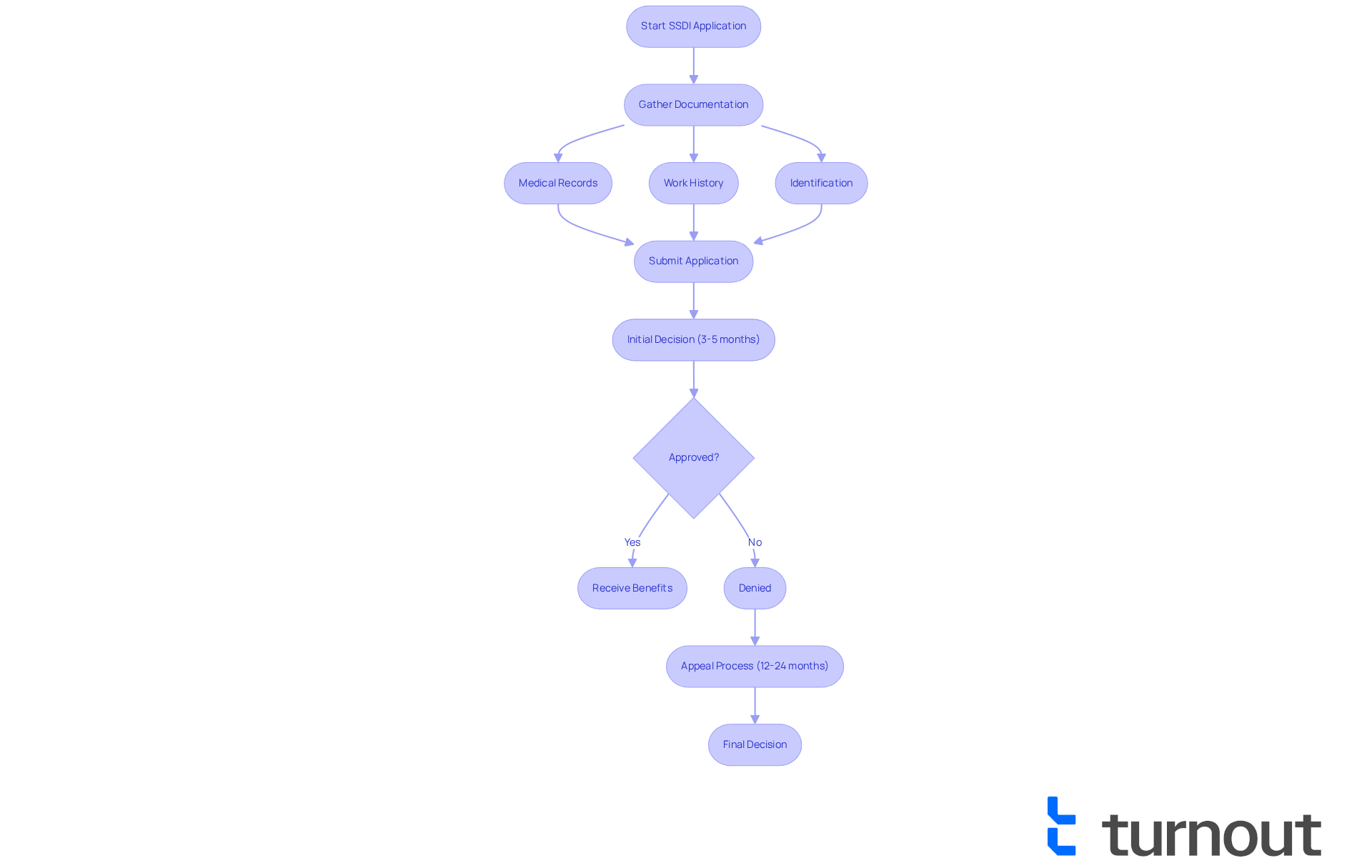

Navigate the Challenges of SSDI Applications and Documentation

Navigating the disability benefits application can feel overwhelming. We understand that the complexity and extensive documentation required can be daunting. Applicants often find themselves needing to provide detailed medical records, proof of work history, and personal identification. It's common to feel frustrated when insufficient medical evidence leads to denials, which account for over 40% of initial rejections.

Gathering enough medical evidence to support your claim can be a significant challenge. Ensuring that all forms are completed accurately adds to the stress. Typically, the initial decisions on disability claims take about 3-5 months. However, if you need to appeal, that timeline can stretch to 12-24 months or even longer, depending on the complexity of your case.

To improve your chances of approval, it's essential to start early. Keep detailed records of your medical treatments, and don’t hesitate to seek help from advocacy groups like Turnout. Remember, Turnout is not a law office and does not provide legal representation. Instead, they have trained nonlawyer advocates ready to assist you in navigating the Social Security Disability Insurance claims process.

Professional guidance can be invaluable. It helps you interpret denial reasons and develop targeted response strategies. By understanding these challenges and preparing accordingly, you can significantly enhance your chances of a successful SSDI application, which is SSDI based on income. You're not alone in this journey; we're here to help.

Conclusion

Social Security Disability Insurance (SSDI) is more than just a program; it’s a vital financial lifeline for those unable to work due to disabilities. We understand that navigating this system can feel daunting, especially when it’s tied to your work history rather than your current financial situation. By grasping this key aspect, you can demystify the SSDI application process and ensure that you receive the benefits you’ve earned during tough times.

Throughout this article, we’ve highlighted several important points. For instance, the Substantial Gainful Activity (SGA) limit plays a crucial role in determining eligibility, and it’s comforting to know that passive income sources generally don’t impact your SSDI benefits. We’ve also touched on the complexities of the application process, stressing the importance of thorough documentation and the invaluable support of advocacy groups. These insights remind us that being well-informed and prepared is essential when navigating SSDI.

Ultimately, the journey to securing SSDI benefits can be intricate and often overwhelming. But remember, by understanding the eligibility criteria, income implications, and the application process, you can advocate for yourself more effectively. Seeking support from professionals and advocacy groups can significantly enhance your chances of a successful claim. Empowerment through knowledge is key-taking proactive steps today can lead to the financial security you need for tomorrow. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial assistance to individuals who cannot work due to significant disabilities.

What are the eligibility requirements for SSDI?

To qualify for SSDI benefits, applicants must demonstrate a solid work history and show that they have contributed to Social Security through payroll taxes.

How does SSDI eligibility differ from needs-based programs?

Unlike needs-based programs, SSDI eligibility is based on work history rather than income, earnings, or assets.

How does SSDI assist recipients?

SSDI benefits are designed to replace a portion of lost income due to disability, helping recipients manage essential living expenses.

How many individuals currently receive SSDI benefits?

As of now, approximately 8.5 million individuals are receiving SSDI benefits.

What recent discussions have taken place regarding SSDI eligibility criteria?

Recent discussions have focused on the importance of age and work background in evaluations for SSDI eligibility.

What decision did the Social Security Administration (SSA) make regarding age in eligibility assessments?

The SSA decided against a proposal that would have reduced the role of age in determining eligibility, which helps protect older individuals facing unique workforce challenges.

Why is understanding SSDI fundamentals important?

Understanding the basics of SSDI is essential for successfully managing the disability benefits application process and ensuring that those who have contributed to the system receive the support they need.