Introduction

Navigating the complexities of Social Security Disability benefits can feel overwhelming, especially when it comes to understanding tax implications. Many recipients might be surprised to discover that their benefits could be considered taxable income, depending on their overall earnings.

We understand that this can raise many questions and concerns. This article explores the key factors that determine whether Social Security Disability payments are subject to taxation. By shedding light on these essential insights, we aim to help you make informed decisions that can significantly impact your financial planning.

As more individuals face the challenges of taxation on disability income, it’s common to wonder: how can you navigate these rules to ensure compliance and avoid unexpected tax liabilities? We're here to help you through this journey.

Define Social Security Disability Taxable Income

Navigating the world of Social Security Disability Taxable Income can feel overwhelming, especially when it comes to understanding how your benefits may be taxed. We understand that many recipients worry about their financial situation, and it’s important to know that while most people don’t owe taxes on their disability payments, it is social security disability taxable income for those with total earnings above certain limits.

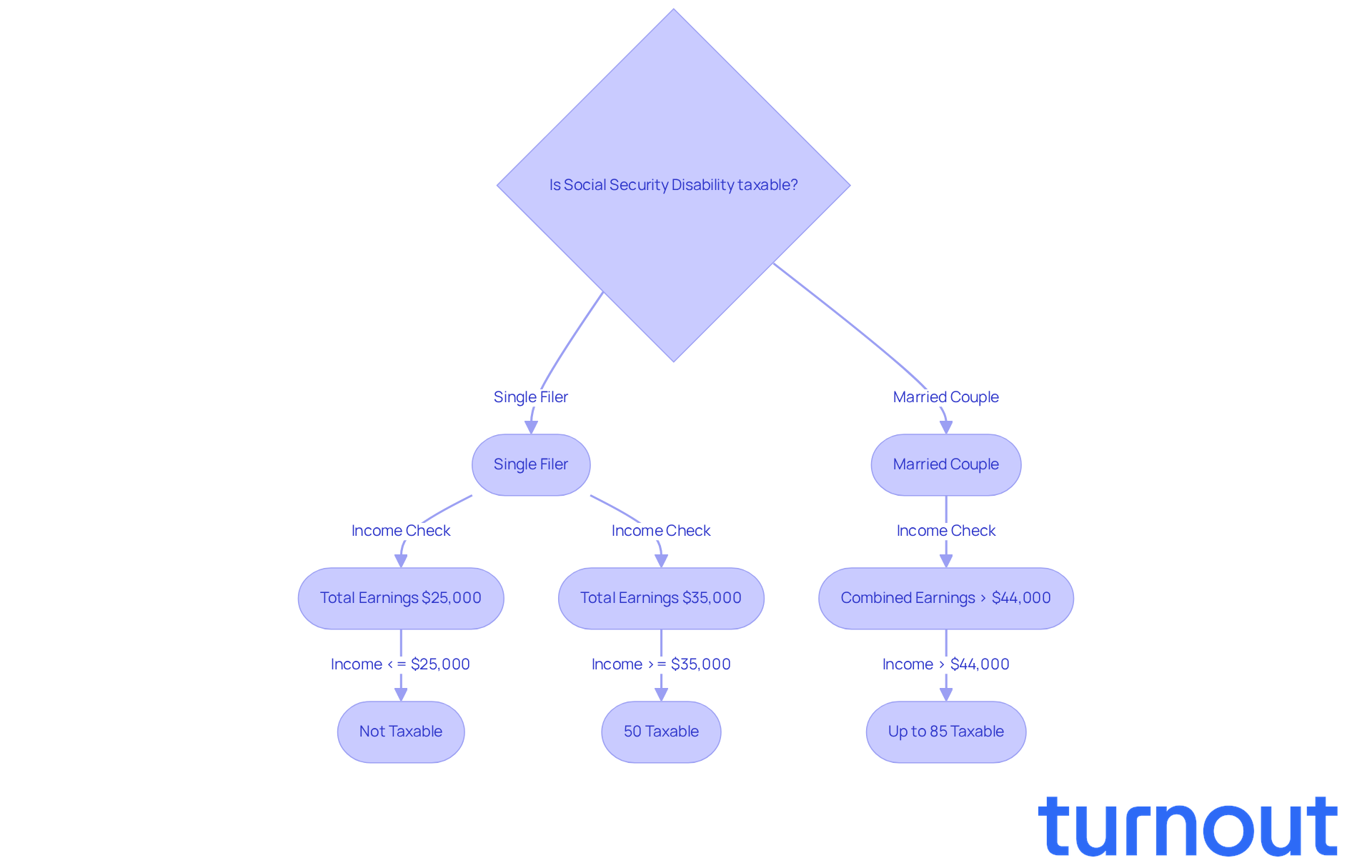

The IRS defines combined earnings as half of your Social Security Disability Insurance payments plus all other earnings, including any tax-exempt interest. For instance, if you’re filing alone and your total earnings fall between $25,000 and $34,000, you could see up to 50% of your SSDI payments subject to tax. If your total earnings exceed $34,000, that number could rise to 85%. Since 1984, those with earnings above specific thresholds have been required to pay federal tax on a portion of their benefits. Understanding these limits is crucial for you to navigate your tax obligations effectively, particularly when determining if social security disability is taxable income, to avoid any unexpected surprises.

It’s also worth noting that the average refund for American taxpayers in the 2025 filing season was $3,453. This figure can play a significant role in your financial planning, especially when it comes to disability assistance and taxes.

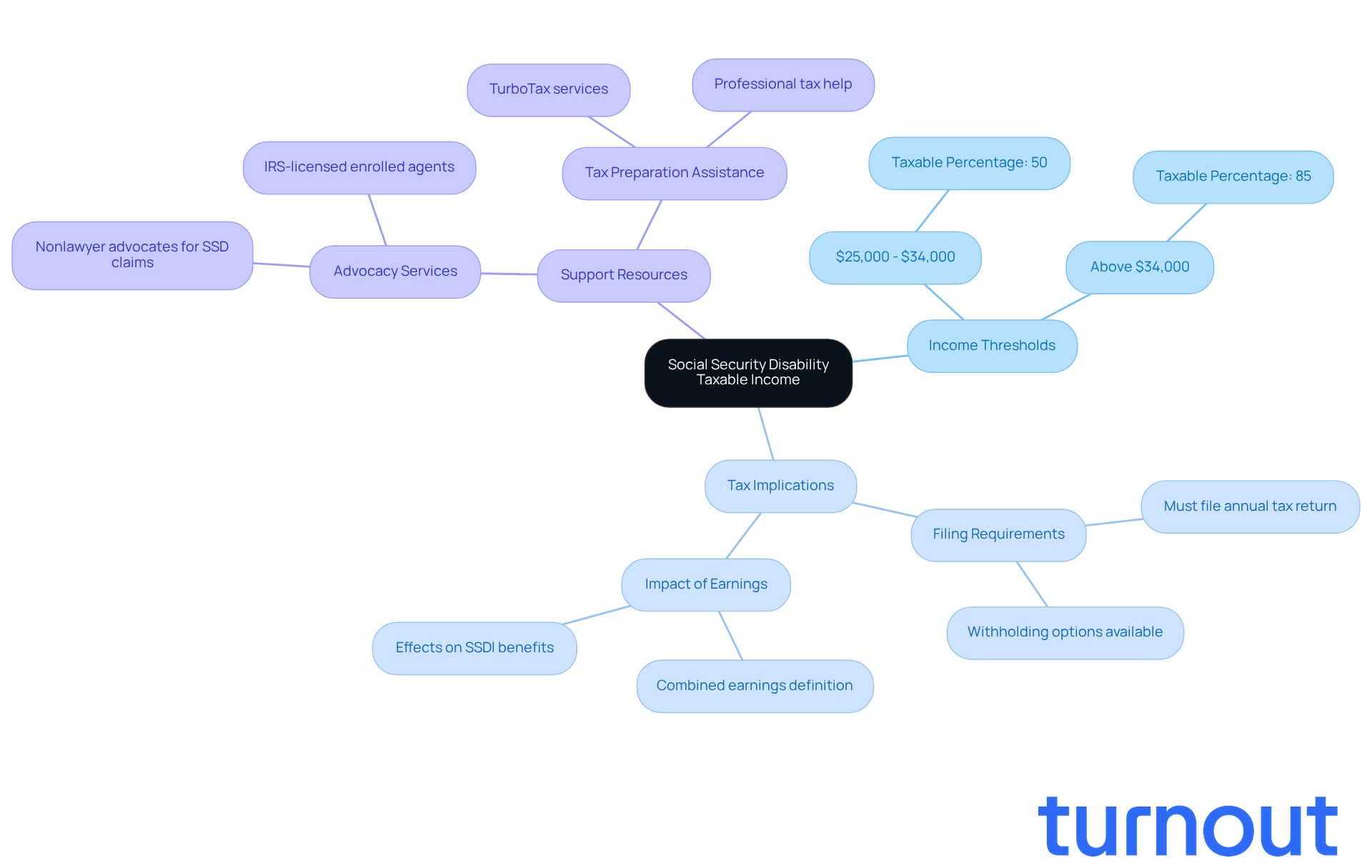

You’re not alone in this journey. Turnout is here to help you navigate these complexities. With trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, we ensure you receive the support you need without the burden of legal representation. Remember, we’re here to help you every step of the way.

Explain the Importance of Taxable Income for Disability Benefits

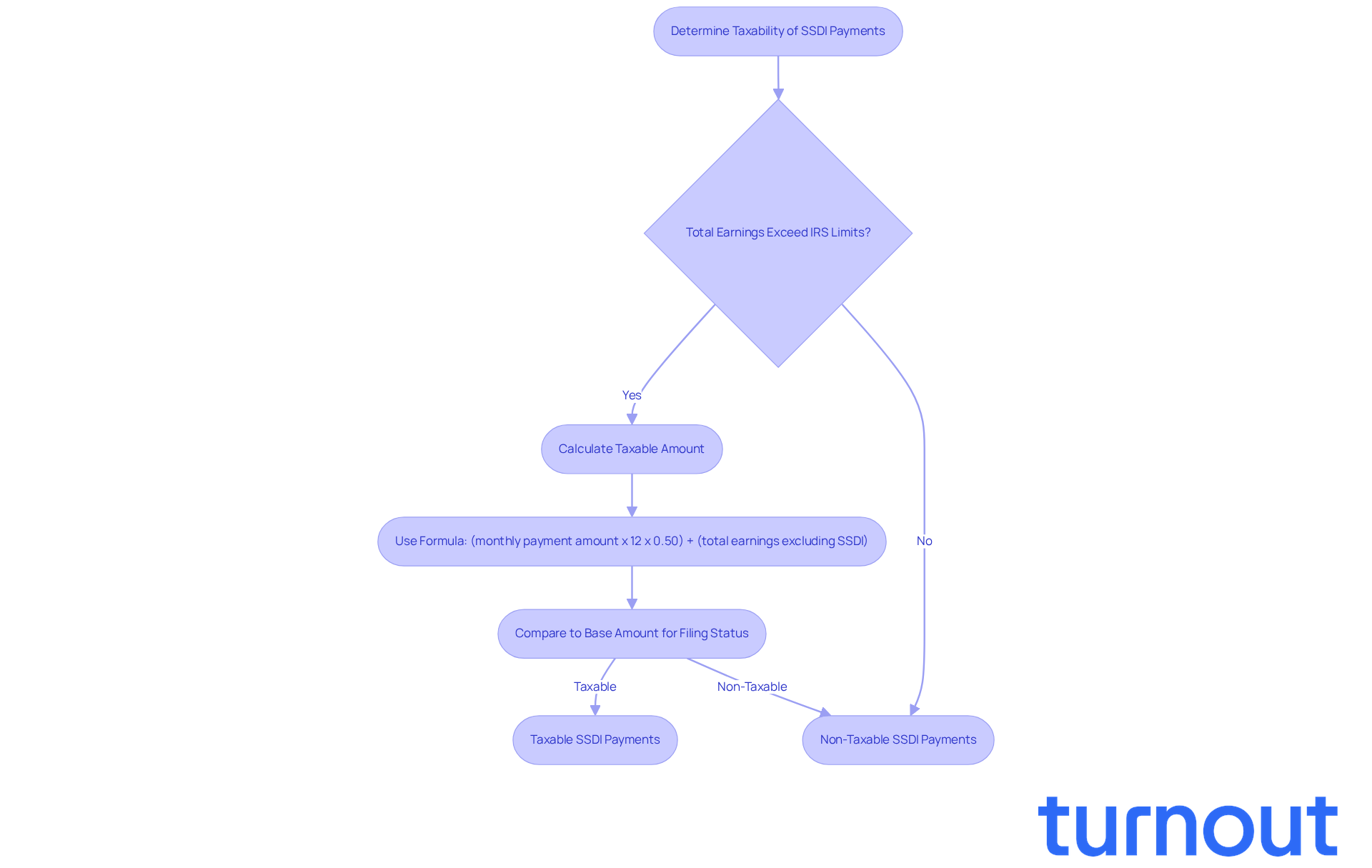

Understanding whether social security disability is taxable income is crucial for assessing its impact on your Social Security Disability Insurance (SSDI) benefits. It can feel overwhelming, but knowing this information can help you navigate your financial landscape more effectively. When your total earnings exceed IRS limits, you might discover that a significant portion of your disability payments is social security disability taxable income. For instance, if your earnings fall between $25,000 and $34,000, this situation raises the question of whether social security disability is taxable income, as up to 50% of your disability payments could be subject to taxation.

To determine if your payments are taxable, you can use this simple formula:

(monthly payment amount x 12 x 0.50) + (total earnings excluding SSDI)

Compare this total to the base amount for your filing status. This knowledge empowers you to anticipate potential tax liabilities, allowing for better financial planning.

We understand that managing these complexities can be daunting. That’s why Turnout offers access to trained nonlawyer advocates who are here to help you navigate these challenges without needing legal representation. By grasping how taxable earnings affect your overall financial situation, including the potential impact of increasing investment returns, you can make informed choices. This proactive approach helps you avoid unexpected tax liabilities and enhances your benefits.

Remember, you are not alone in this journey. We’re here to support you every step of the way.

Discuss the Origins and Regulations of Taxable Disability Income

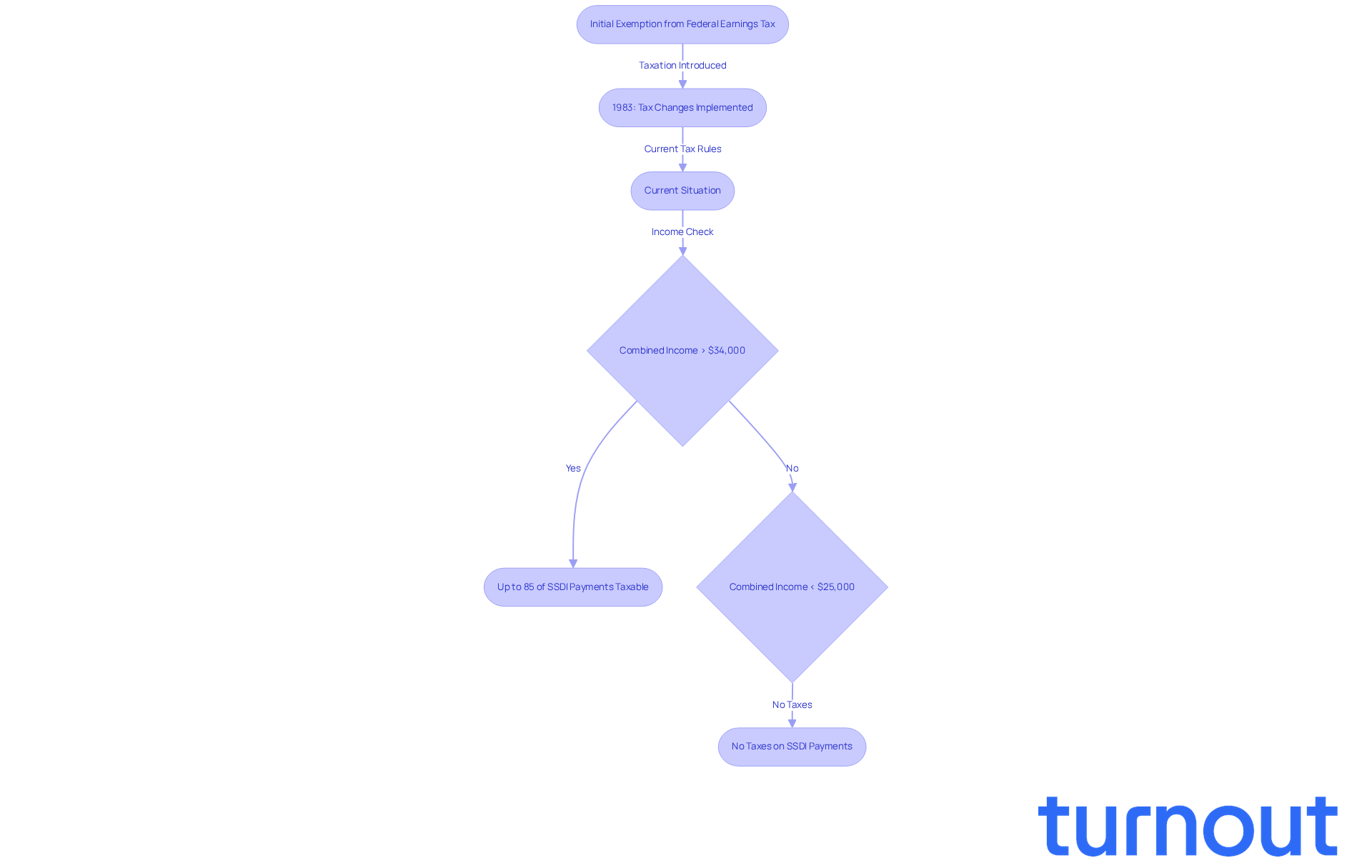

Understanding if social security disability is taxable income can feel overwhelming, especially when navigating financial challenges. It’s important to know that these payments were initially exempt from federal earnings tax. However, in 1983, Congress made a significant change regarding what is social security disability taxable income, allowing a portion of SSDI payments to be taxed for higher-income recipients. This decision aimed to ease the financial strain on the Social Security Trust Fund.

Today, if your total earnings exceed $34,000, you might find that up to 85% of your disability payments is social security disability taxable income. This shift is not just a number; it reflects a growing trend where the percentage of beneficiaries facing tax obligations has surged from less than 10% in 1984 to over 50% now.

We understand that this can be a lot to digest. Comprehending these historical and regulatory contexts is crucial for you as a beneficiary. By grasping how these changes affect your tax obligations, you can better manage your finances and optimize your benefits. Remember, you are not alone in this journey. We're here to help you navigate these complexities.

Identify Key Characteristics of Taxable Disability Income

Navigating the tax status of Social Security Disability Insurance payments can feel overwhelming, especially when considering if social security disability is taxable income. We understand that many recipients worry about how their benefits relate to the question of whether social security disability is taxable income and how it might affect their taxes. It's important to understand that several factors, including your filing status, overall earnings, and the type of assistance you receive, determine if social security disability is taxable income.

Starting in 2026, it will be important to determine if the payments you receive is social security disability taxable income, especially if your total earnings exceed certain IRS limits:

- $25,000 for individual filers

- $32,000 for couples

- If you’re married and filing jointly, you’ll benefit from a higher threshold of $44,000.

This can significantly impact your tax obligations. For example, if a married couple earns $50,000, including $2,000 monthly in disability payments, they could find that the question of whether social security disability is taxable income arises, as up to 85 percent of their payments may be taxable due to exceeding this threshold.

To help you keep track, Social Security Disability Insurance recipients will receive an SSA-1099 form. This document outlines the taxable portion of your payments, which is crucial for understanding whether social security disability is taxable income. On the other hand, it's comforting to know that Supplemental Security Income (SSI) is not subject to taxation, providing a vital distinction for beneficiaries.

Understanding whether social security disability is taxable income is essential for accurately determining your tax responsibilities and ensuring compliance with IRS regulations. At Turnout, we’re here to help you navigate these complexities. Our trained nonlawyer advocates specialize in SSD claims, and our IRS-licensed enrolled agents are ready to assist with tax debt relief. You don’t have to face this journey alone; we provide the support you need without requiring legal representation.

Provide Examples of Taxable Scenarios for Disability Benefits

Navigating the world of taxes can be overwhelming, especially when it comes to disability payments. For instance, consider a single filer who receives $20,000 in Social Security Disability, which raises the question of whether social security disability is taxable income, and has an additional $10,000 in other earnings. In this case, their total earnings amount to $25,000, meaning they won’t owe taxes on their Social Security Disability payments. However, if this individual earns $15,000 from a part-time job, their overall earnings rise to $35,000, which raises the question of whether social security disability is taxable income, as 50% of their disability assistance becomes taxable.

Now, let’s think about a married couple filing jointly. If their combined earnings exceed $44,000, it is social security disability taxable income that could result in taxes on as much as 85% of their disability payments. These examples highlight how different sources of income, such as whether social security disability is taxable income, can significantly impact tax obligations. It’s crucial for disability recipients to keep Form SSA-1099 with their tax records. This form details the total payments received and is essential for accurate tax preparation.

Many disability recipients may not encounter tax issues for years, but changes in income - like returning to work or receiving additional assistance - can shift that balance. We understand that this can be a stressful situation. Consulting with a tax expert can provide personalized guidance tailored to your unique financial circumstances, ensuring you’re prepared for any potential tax obligations related to your SSDI payments.

For more detailed information, IRS Publication 915 is a valuable resource on the taxation of Social Security benefits. Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

Conclusion

Understanding the tax implications of Social Security Disability benefits is crucial for you as a recipient aiming to manage your finances effectively. We know that many individuals may not owe taxes on their disability payments, but if your total earnings exceed certain thresholds, a significant portion of your benefits could be subject to taxation. Recognizing the criteria that determine whether Social Security Disability is taxable income is vital for avoiding unexpected financial burdens.

Throughout this article, we’ve highlighted key points, including:

- The specific income thresholds that dictate tax liability

- The historical context of these regulations

- Practical examples illustrating how different earnings can affect tax obligations

Staying informed about these factors is essential. It empowers you to make informed decisions about your financial future and ensures compliance with IRS regulations.

Navigating the complexities of Social Security Disability taxation can feel overwhelming, but you’re not alone in this journey. By understanding the nuances of taxable income and seeking assistance from knowledgeable advocates, you can better manage your financial landscape and avoid potential pitfalls. Taking the time to educate yourself on these matters not only promotes financial stability but also fosters confidence in addressing tax-related challenges. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is Social Security Disability Taxable Income?

Social Security Disability Taxable Income refers to the portion of Social Security Disability Insurance (SSDI) payments that may be subject to federal taxes based on your total earnings exceeding certain limits.

How does the IRS define combined earnings for SSDI recipients?

The IRS defines combined earnings as half of your Social Security Disability Insurance payments plus all other earnings, including any tax-exempt interest.

What are the income thresholds for SSDI taxability?

If your total earnings fall between $25,000 and $34,000, up to 50% of your SSDI payments may be subject to tax. If your total earnings exceed $34,000, up to 85% of your payments could be taxed.

When did the requirement to pay federal tax on SSDI benefits begin?

The requirement for individuals with earnings above specific thresholds to pay federal tax on a portion of their benefits has been in place since 1984.

How can I determine if my SSDI payments are taxable?

You can determine if your payments are taxable using the formula: (monthly payment amount x 12 x 0.50) + (total earnings excluding SSDI). Compare this total to the base amount for your filing status.

What is the average tax refund for American taxpayers in the 2025 filing season?

The average tax refund for American taxpayers in the 2025 filing season was $3,453, which can be significant for financial planning regarding disability assistance and taxes.

How can Turnout assist SSDI recipients with tax-related issues?

Turnout provides access to trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, helping individuals navigate the complexities of SSDI and taxes without the need for legal representation.