Introduction

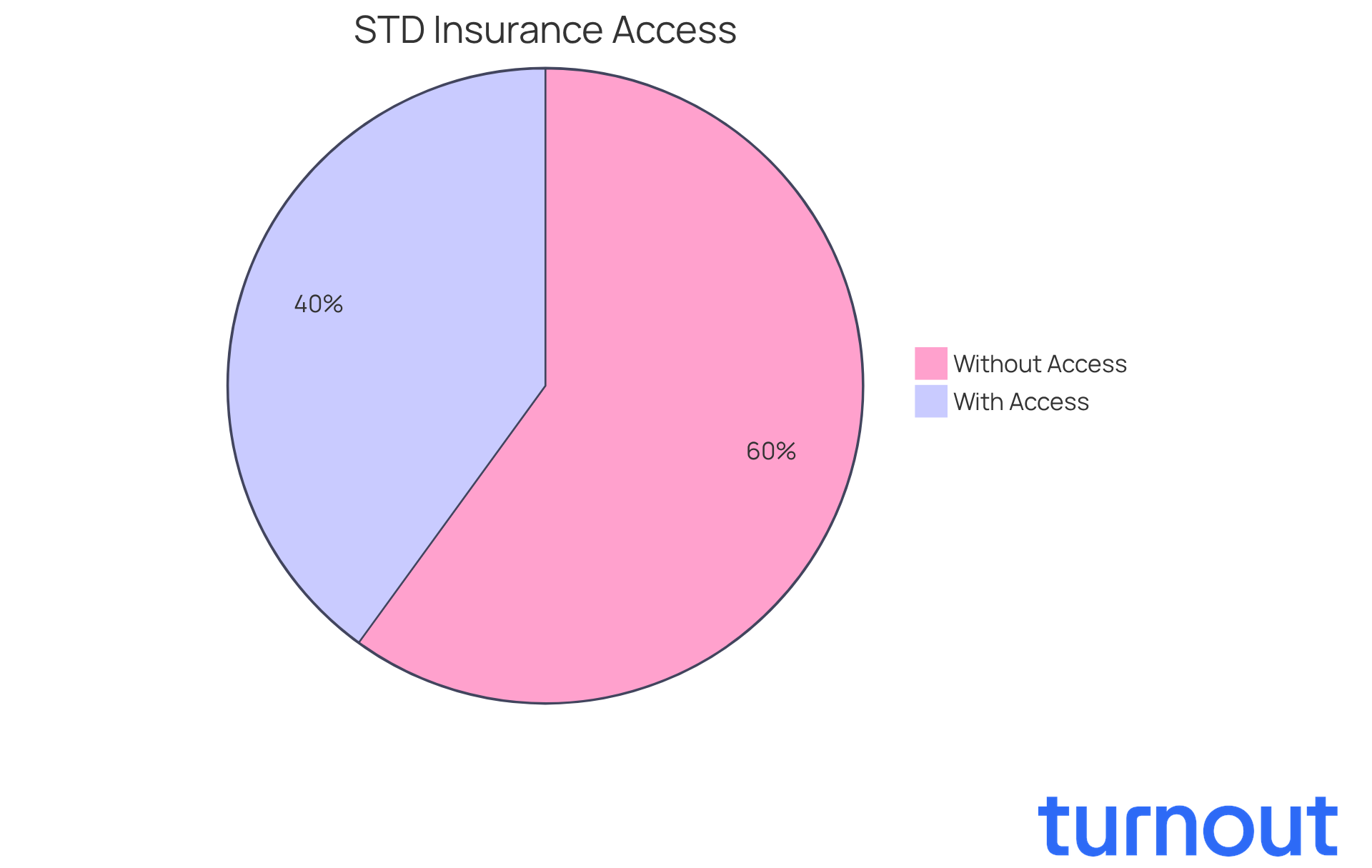

Navigating the complexities of short-term disability insurance can feel overwhelming. We understand that many employees rely on this vital safety net during times of illness or injury. With around 40% of workers having access to such coverage, it’s crucial to grasp how these benefits are taxed for effective financial planning.

However, the relationship between employer-paid premiums and personal contributions raises important questions:

- Are these benefits taxable?

- How does that vary across different states?

It’s common to feel uncertain about these intricacies. By delving into them, you can empower yourself to make informed decisions and avoid unexpected tax liabilities during your recovery journey. Remember, you are not alone in this process; we’re here to help.

Define Short-Term Disability Insurance

Short-term income protection insurance (STD) is designed to provide income replacement for employees who find themselves temporarily unable to work due to non-work-related illnesses or injuries. We understand that facing such challenges can be overwhelming. Typically, STD policies cover a percentage of your salary, often between 40% and 70%, for a limited duration that can last from a few weeks to six months. This coverage is essential for maintaining financial stability during your recovery, allowing you to focus on what truly matters - your health - without the added stress of lost income.

As of 2025, around 40% of employees have access to short-term impairment insurance. This statistic highlights just how important this coverage is in the workplace. Comprehending the details of STD insurance, including whether short term disability is taxed on the payments you may receive, is crucial. We want you to explore your options fully and ensure you optimize your assistance during these difficult times. Remember, you are not alone in this journey; we're here to help.

Understand the Context of Short-Term Disability Insurance

Short-term income protection insurance (STD) has become a crucial financial safety net for workers who find themselves temporarily unable to work due to illness or injury. We understand that facing such challenges can be overwhelming, and many employees have historically felt significant financial pressure during these times. This concern has led employers to include STD in their compensation packages, recognizing the importance of supporting their teams.

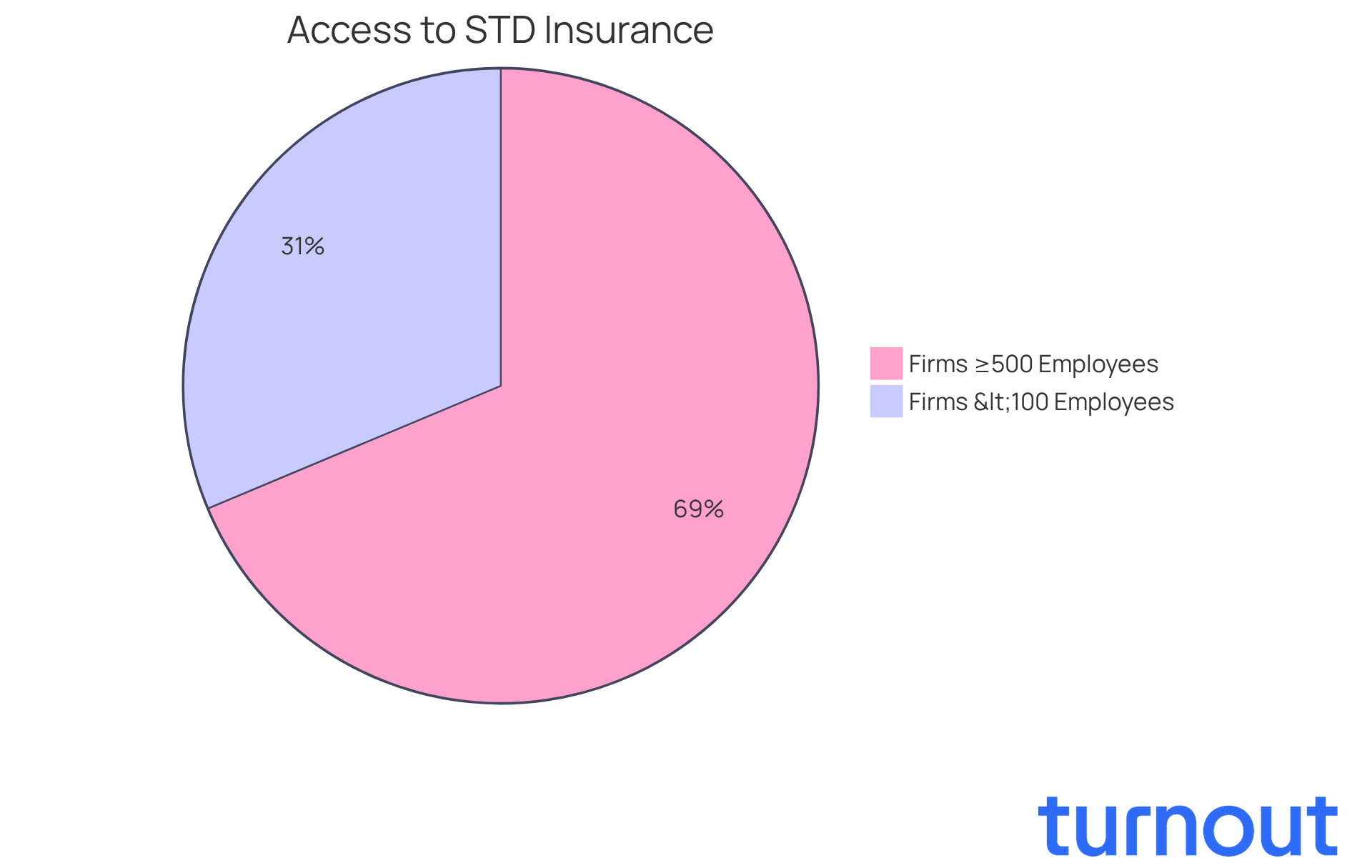

By 2025, approximately 31% of private sector employees in firms with fewer than 100 staff members will have access to temporary assistance programs. This number rises to 68% in larger companies with 500 or more employees. This disparity highlights how the size of an establishment can impact access to these essential benefits, and it’s common to feel frustrated by such inequalities.

The role of temporary illness insurance in employee well-being is vital; it provides a necessary safety net that allows individuals to focus on their recovery without the looming threat of financial instability. As our workforce continues to evolve, understanding the context and accessibility of these benefits becomes increasingly important. More workers are seeking comprehensive support during tough times, and the demand for accessible temporary coverage is expected to grow. This shift indicates a broader movement towards enhancing employee perks in today’s work environment.

You are not alone in this journey. We’re here to help you navigate these challenges and ensure you have the support you need.

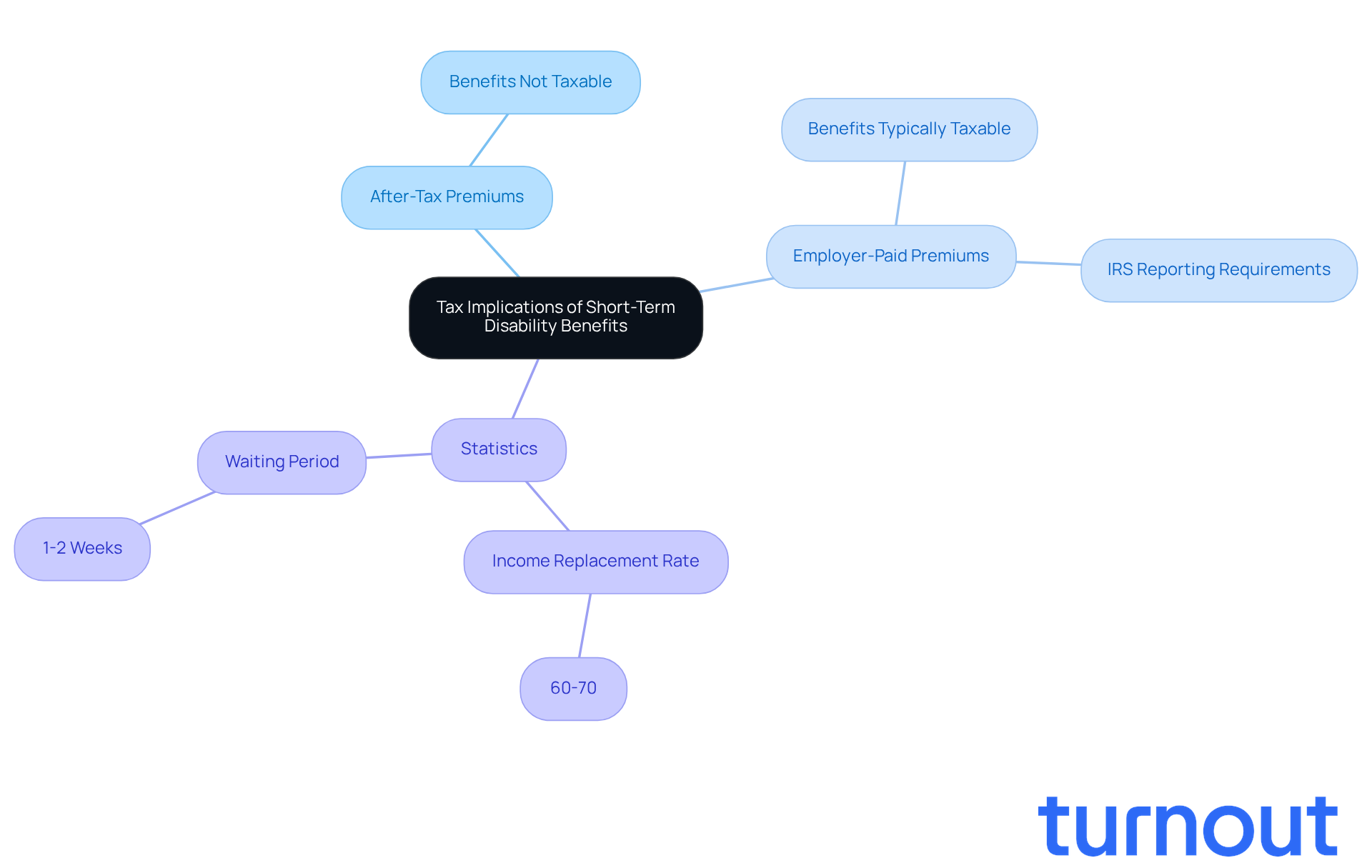

Explore Tax Implications of Short-Term Disability Benefits

Navigating the tax consequences of short-term disability assistance, including whether short term disability is taxed, can feel overwhelming, but understanding how insurance premiums are paid is crucial. If you’ve covered the premiums with after-tax dollars, you may wonder if short term disability is taxed; generally, the amounts you receive are not taxable. However, if your employer has taken care of those premiums, it is important to know if short term disability is taxed, as those benefits are typically considered taxable income.

It’s common to feel confused about this distinction, but it’s important to know that the IRS requires any sum received for a health condition through an employer-paid plan to be reported as income, which raises the question of whether short term disability is taxed. This knowledge can significantly impact your overall tax liability. For instance, if you receive $1,000 each month in temporary assistance and your employer covered the premiums, you may owe taxes on that amount. This could affect your financial planning during recovery, and we understand how vital it is to prepare for such scenarios.

Statistics show that temporary incapacity assistance usually replaces 60%-70% of your regular income. This highlights the importance of grasping the payment framework to avoid unexpected tax obligations. Furthermore, the waiting period for temporary assistance is typically one to two weeks. Knowing this can help you organize your finances during your recovery. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

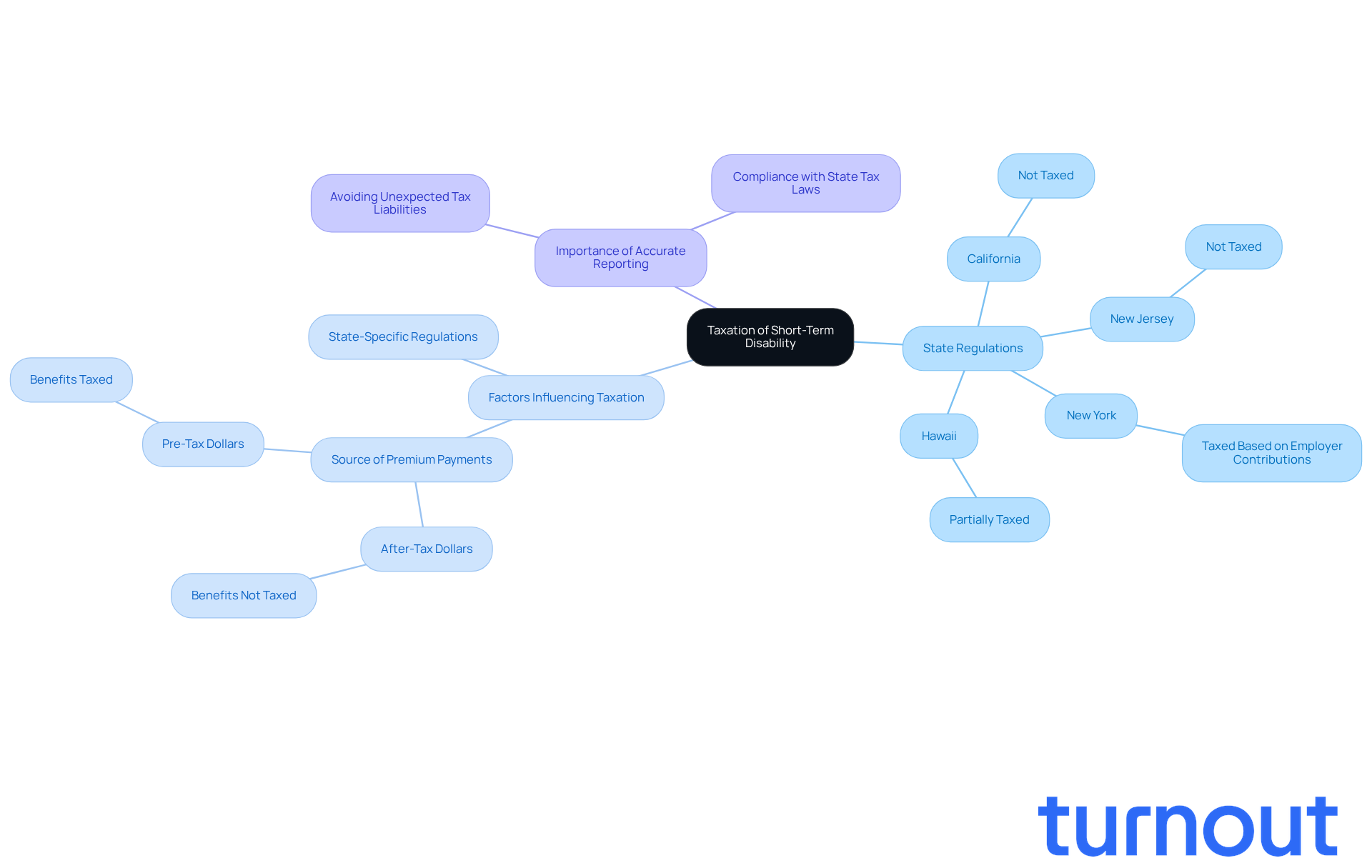

Examine Variations in Taxation for Short-Term Disability

Navigating the taxation of temporary incapacity payments can feel overwhelming, particularly when considering whether short term disability is taxed and how much it varies from state to state. We understand that this can be a source of stress for many. Factors like where your premium contributions come from and specific state tax regulations play a significant role in determining how is short term disability taxed.

For example, in California and New Jersey, state-funded short-term disability payments are generally not subject to taxation. This can be a relief, providing a financial cushion during tough times. However, in states like New York, it is relevant to consider how is short term disability taxed based on employer contributions to the premiums. If your premiums are paid with a mix of pre-tax and post-tax dollars, it can complicate how is short term disability taxed.

Tax specialists emphasize the importance of understanding if short term disability is taxed in accordance with these state-specific regulations. They can significantly impact the net income you receive from support payments. It's crucial for beneficiaries to be diligent in reporting their income accurately. This helps avoid unexpected tax liabilities and ensures compliance with state tax laws.

Remember, you are not alone in this journey. We're here to help you navigate these complexities and find the best path forward.

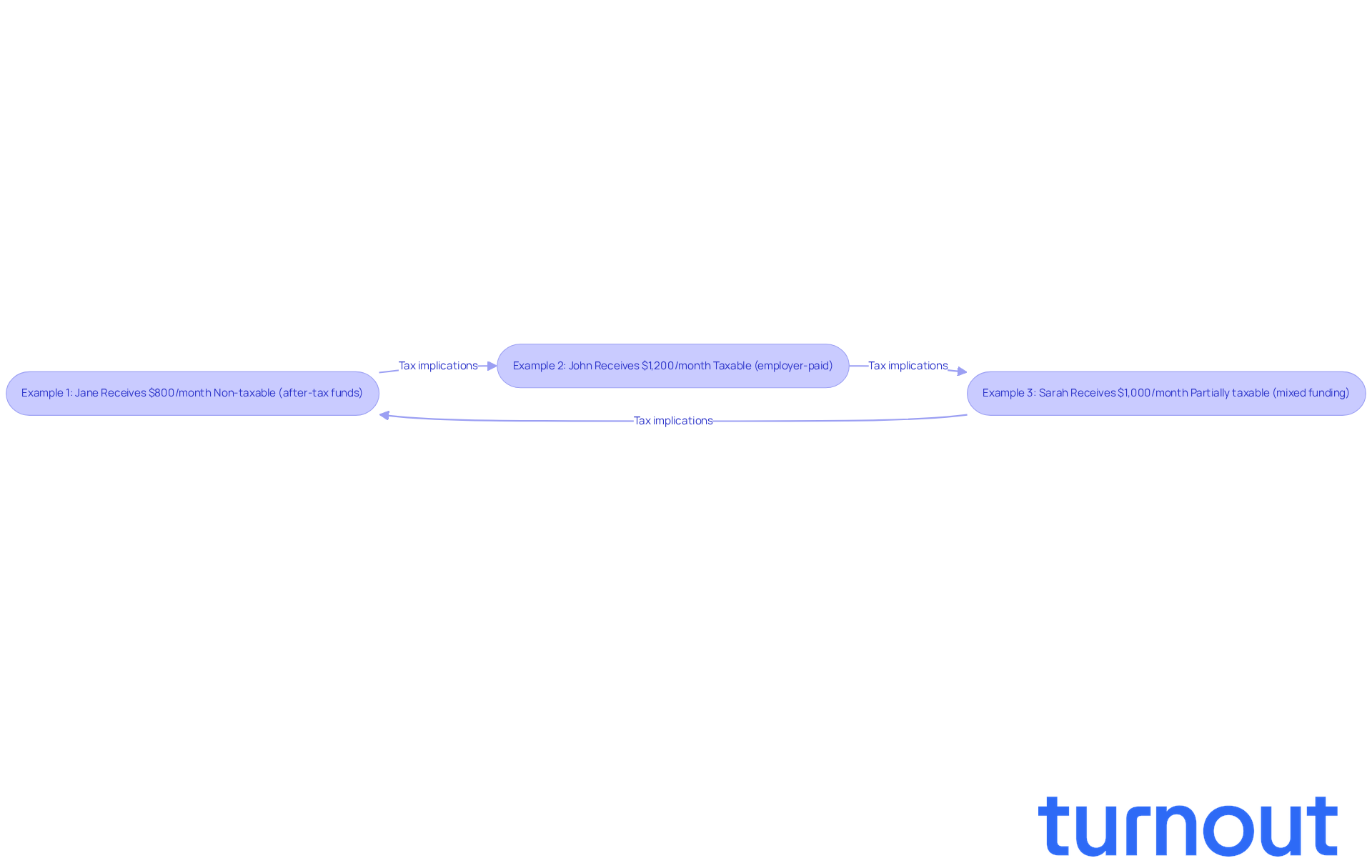

Review Examples of Taxation on Short-Term Disability Benefits

Understanding whether short term disability is taxed can feel overwhelming, but we're here to help. Let’s explore a few scenarios that illustrate how different payment methods can impact your tax responsibilities:

-

Example 1: Jane finances her temporary incapacity insurance with after-tax funds. When she receives $800 each month in assistance, she doesn’t have to worry about taxes on this amount.

-

Example 2: John's employer covers his short-term disability insurance. He receives $1,200 monthly in assistance, which he must declare as taxable income on his tax return, prompting the question of how much is short term disability taxed.

-

Example 3: Sarah contributes partially with pre-tax dollars and partially with after-tax dollars for her premiums. If she receives $1,000 in assistance, she may owe taxes on a portion of that amount, especially if is short term disability taxed, which is calculated based on the ratio of her pre-tax to after-tax contributions.

These examples highlight how understanding your premium payment methods can empower you to make informed choices about your assistance.

It's common to feel uncertain about these financial implications. Statistics show that the typical rejection rate for claims related to impairments is at 68%. This underscores the importance of being well-prepared when managing these entitlements. Consulting with a tax professional can provide tailored advice based on your unique circumstances, ensuring you navigate this journey with confidence. Remember, you are not alone in this process.

Conclusion

Understanding the nuances of short-term disability insurance is essential for anyone navigating the complexities of temporary income protection. This coverage not only provides critical financial support during times of illness or injury but also raises important questions about taxation. Have you ever wondered whether short-term disability benefits are taxed? Knowing the answer can significantly impact your financial planning and recovery.

Throughout this article, we’ve shared key insights, including:

- How short-term disability insurance functions

- The percentage of salary it typically replaces

- The varying tax implications based on how premiums are paid

It’s important to note that if premiums are paid with after-tax dollars, the benefits are generally not taxable. On the other hand, employer-paid premiums usually result in taxable income. Additionally, state-specific regulations can further complicate these tax obligations, making it crucial for you to understand your unique situation.

Ultimately, being informed about short-term disability insurance and its tax implications is vital. As more employees seek comprehensive support, understanding these benefits empowers you to make informed decisions and avoid unexpected financial burdens. Remember, consulting with tax professionals can enhance clarity and ensure compliance. This way, you can focus on what truly matters: your recovery and well-being. We’re here to help you navigate this journey.

Frequently Asked Questions

What is short-term disability insurance (STD)?

Short-term disability insurance (STD) is designed to provide income replacement for employees who are temporarily unable to work due to non-work-related illnesses or injuries. It typically covers a percentage of your salary, ranging from 40% to 70%, for a limited duration of a few weeks to six months.

Why is short-term disability insurance important?

STD insurance is essential for maintaining financial stability during recovery from illness or injury. It allows individuals to focus on their health without the added stress of lost income.

How many employees have access to short-term disability insurance?

As of 2025, approximately 40% of employees have access to short-term disability insurance, with access varying significantly based on company size.

Does access to short-term disability insurance differ by company size?

Yes, access to short-term disability insurance varies by company size. By 2025, around 31% of private sector employees in firms with fewer than 100 staff will have access, while this number increases to 68% in larger companies with 500 or more employees.

How does short-term disability insurance affect employee well-being?

Short-term disability insurance provides a necessary safety net that allows employees to focus on their recovery without the stress of financial instability, contributing positively to their overall well-being.

What should I consider regarding the taxation of short-term disability payments?

It is important to understand whether short-term disability payments are taxed, as this can impact the amount of income you receive during your recovery.