Introduction

Understanding the nuances of long-term disability (LTD) taxation is crucial for anyone relying on these benefits for financial stability. We understand that navigating this complex landscape can feel overwhelming. The tax implications can significantly impact your net income, especially since many individuals are unaware that the taxability of their benefits depends on how the premiums were paid.

How can you ensure compliance while avoiding unexpected tax burdens? This article delves into the critical factors that determine whether LTD payments are taxable. We aim to provide clarity and actionable insights for recipients, so you can feel more confident in managing your financial future. Remember, you are not alone in this journey; we're here to help.

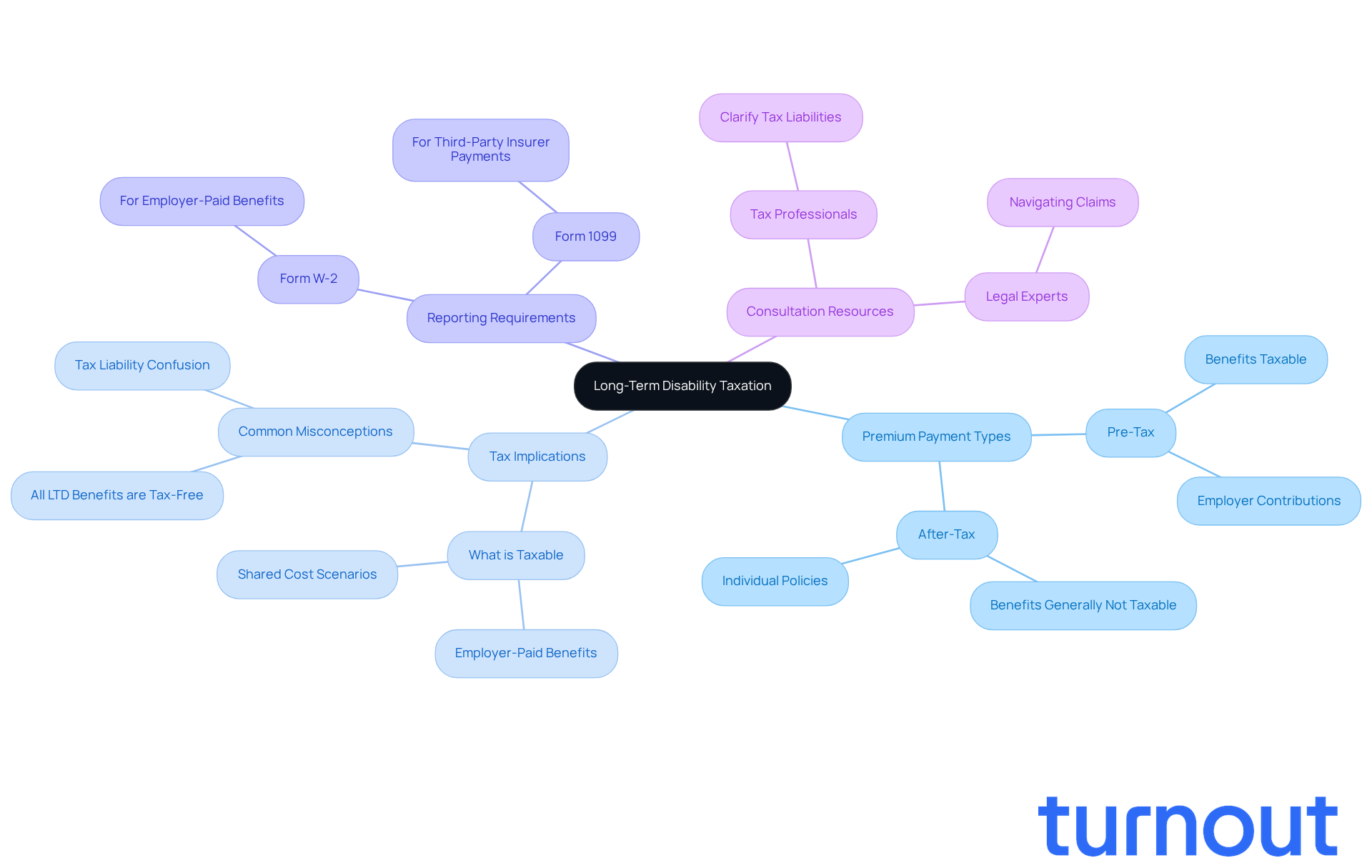

Define Long-Term Disability Taxation

Understanding how long-term disability (LTD) taxation works, including whether it is ltd taxable, is crucial for your financial well-being. When you receive payments from long-term disability insurance policies, the tax implications can vary based on how the premiums were paid. If your premiums were covered with pre-tax funds, then the benefits are typically what is ltd taxable. On the other hand, if you paid with after-tax dollars, the benefits received is ltd taxable, meaning you usually won’t owe taxes on them. Recognizing this difference is essential for accurately reporting your income and meeting IRS requirements.

We understand that navigating these regulations can be confusing. Employer-sponsored long-term disability insurance policies fall under the Employee Retirement Income Security Act (ERISA), which affects how payments are taxed. If both you and your employer contribute to the premiums, the tax treatment may differ. This means that part of your compensation could be taxable, depending on how much each party contributed. It’s a common misconception that all LTD benefits are tax-free, but understanding what is ltd taxable can help prevent unexpected tax bills come tax season. Consulting a tax expert can help clarify your individual responsibilities regarding LTD benefits.

Additionally, it’s important to note that individual long-term disability insurance premiums are generally not tax-deductible. This knowledge is vital for understanding your overall tax situation. Recent updates show that nearly 90% of Social Security recipients will no longer pay federal income taxes on their benefits, underscoring the need to stay informed about tax regulations. As we look ahead to 2026, understanding if the LTD is ltd taxable according to IRS guidelines will be essential for compliance and avoiding penalties.

You should also be aware of the specific tax forms required for reporting benefits. For employer-paid benefits, you’ll need Form W-2, while third-party insurer payments require Form 1099. Engaging with legal experts can provide clarity as you navigate the complexities of long-term disability claims and their tax implications. Remember, you’re not alone in this journey, and there are resources available to help you every step of the way.

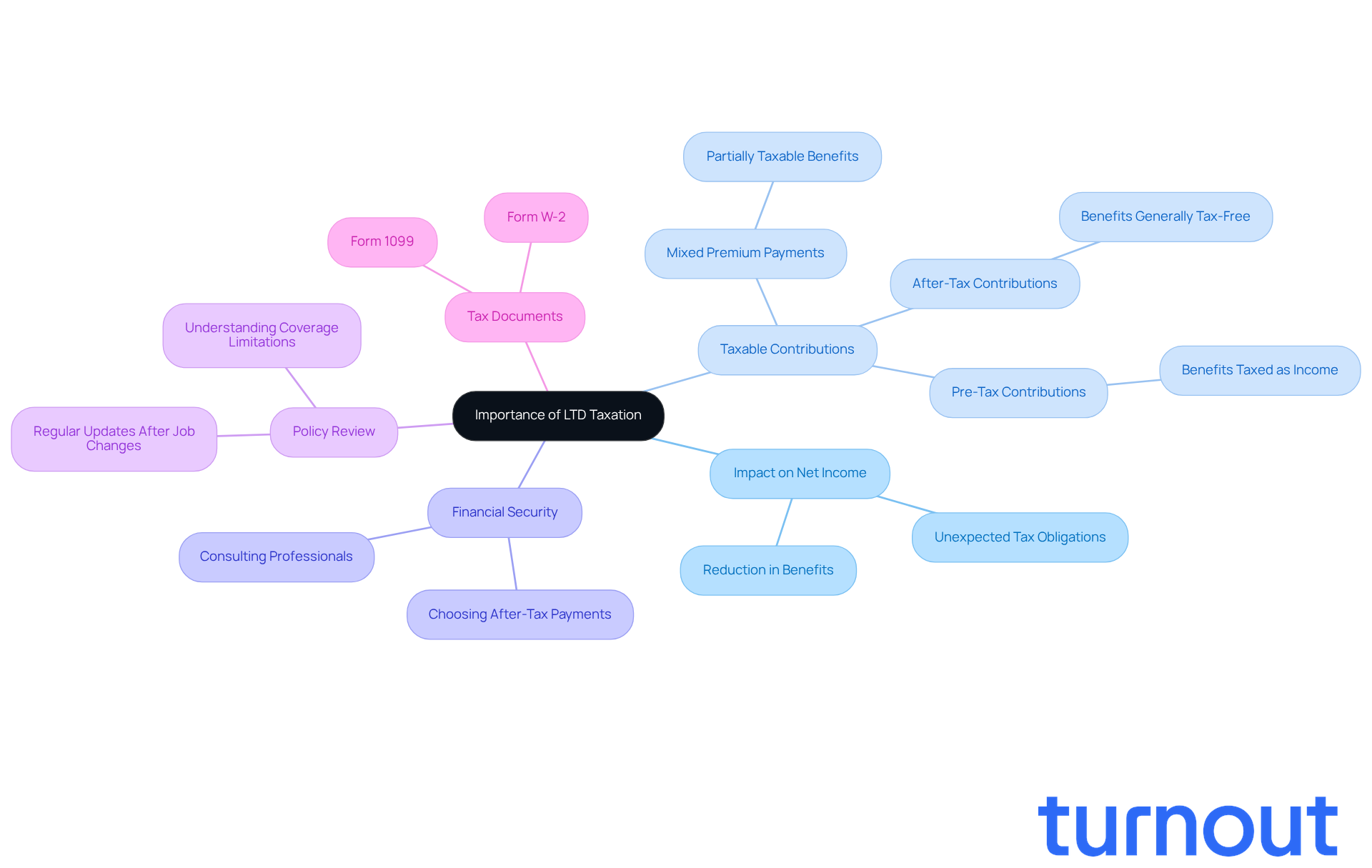

Explain the Importance of LTD Taxation

Understanding whether LTD payments are taxable is crucial for your financial well-being. It directly impacts the net income you receive, which can significantly affect your stability. Many people don’t realize that their benefits might be taxed if contributions weren’t made with after-tax funds. This can lead to unexpected tax obligations that add financial stress.

We understand that navigating these complexities can be overwhelming. Understanding whether your employment and insurance coverage is LTD taxable can help you make informed decisions. For example, you might choose to pay contributions with after-tax funds to ensure your benefits remain tax-exempt. This choice can enhance your financial security during times of incapacity.

It's also important to regularly review your LTD policies, especially after job changes or plan adjustments. Staying informed about your coverage and tax obligations is key. You may receive tax documents like Form W-2 or Form 1099 to accurately report your income.

Overall, understanding whether your income is LTD taxable empowers you to make better financial decisions and avoid potential pitfalls. Remember, you’re not alone in this journey; we’re here to help you navigate these challenges.

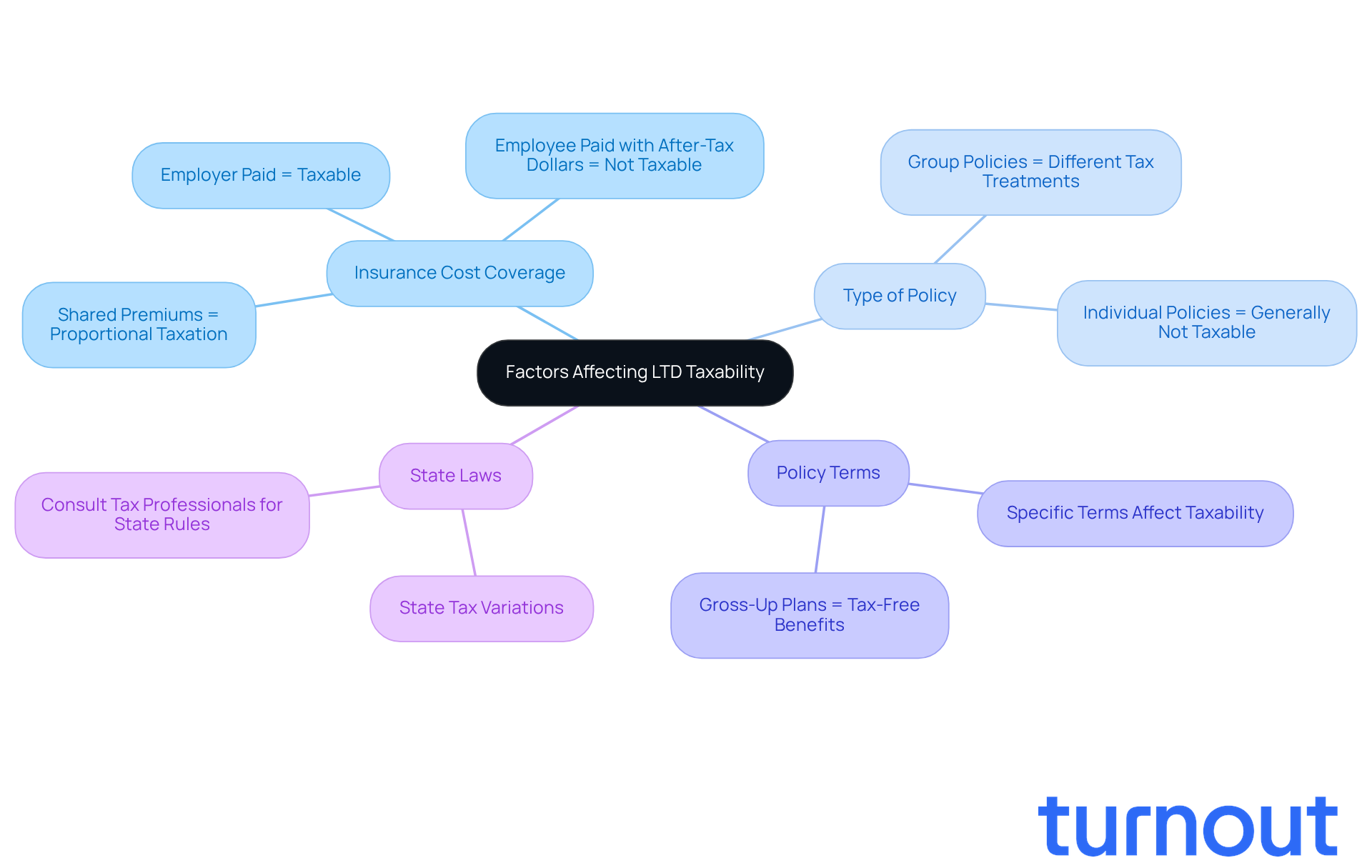

Identify Factors Affecting LTD Taxability

Navigating the taxability of long-term disability payments can feel overwhelming, and we understand that. Several factors come into play, and it’s important to know how they affect you.

One of the main factors is who covered the costs for the insurance policy. If your employer paid for it, the benefits you receive are generally subject to taxation and are considered taxable. On the other hand, if you paid the premiums with after-tax dollars, those benefits are usually not taxable.

The type of policy you have also matters. Individual and group policies can have different tax implications. For instance, group policies often face different tax treatments compared to individual ones.

Moreover, the specific terms of your policy and any applicable state laws can add layers of complexity. Understanding these factors is essential. It helps you accurately assess your tax obligations and plan accordingly. Remember, you’re not alone in this journey, and we’re here to help you navigate these challenges.

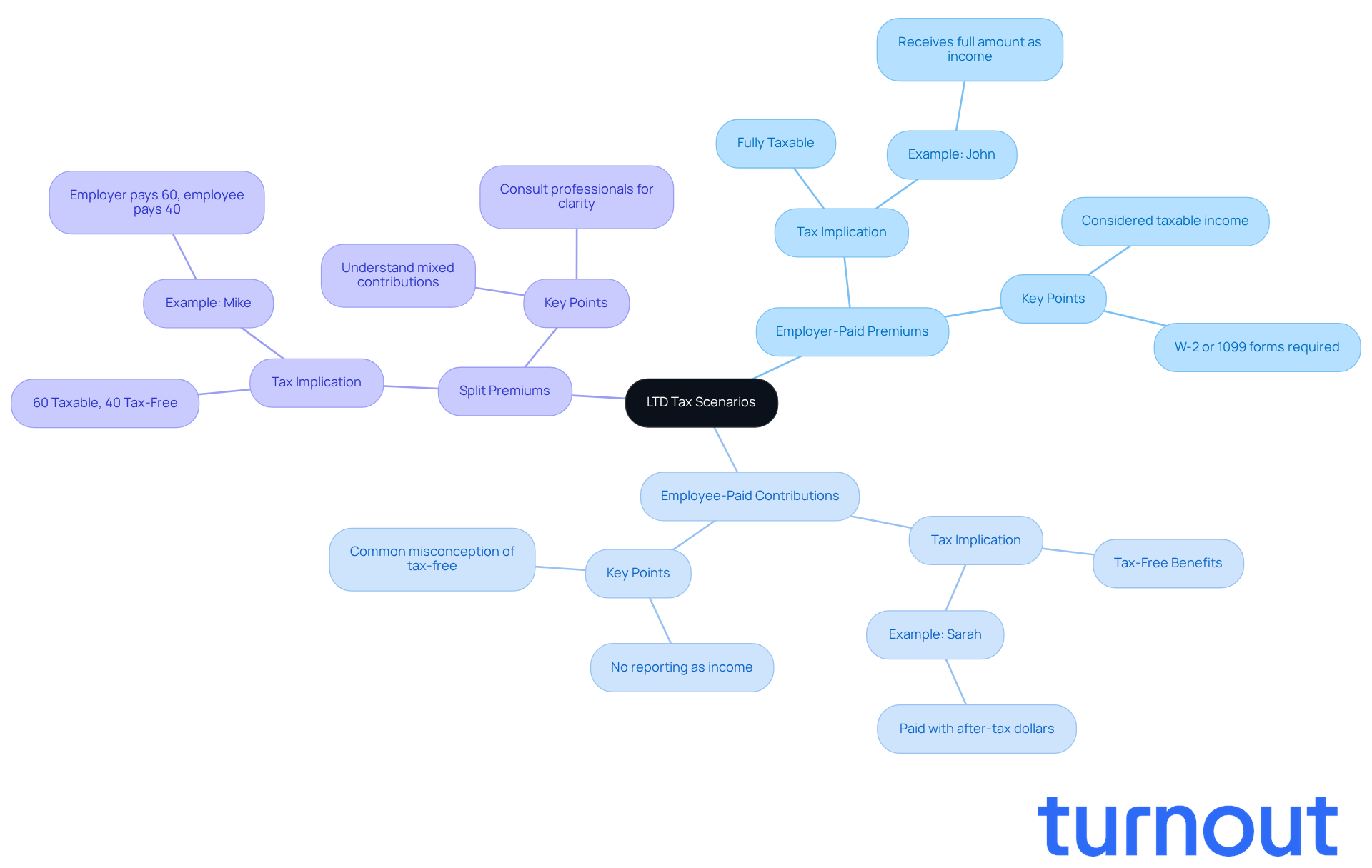

Provide Examples of LTD Tax Scenarios

Understanding whether long-term disability (LTD) benefits is ltd taxable can feel overwhelming. Let’s break it down together with some relatable scenarios:

-

Employer-Paid Premiums: Imagine John, who receives LTD payments from a policy fully funded by his employer. Since he didn’t pay taxes on those contributions, he finds that his benefits is ltd taxable. He needs to report the full amount as income on his tax return. As BenGlassLaw points out, "If your employer covers the entire expense of your long-term disability policy, then the monthly payments you receive are regarded as taxable."

-

Employee-Paid Contributions: Now, consider Sarah, who has an individual LTD policy and pays for it with after-tax dollars. Because of this, her benefits are tax-free, and she doesn’t have to report them as income. BenGlassLaw states, "If you paid your long-term disability fees with after-tax dollars, your advantages are typically tax-free."

-

Split Premiums: Then there’s Mike. His employer covers 60% of the premiums, while he pays the remaining 40% with after-tax dollars. In this case, 60% of Mike’s benefits will be taxable, while the other 40% will be exempt. This illustrates how benefits from employer-paid portions is ltd taxable, while those from individually purchased policies may not be.

These examples highlight the importance of understanding how different premium payment structures can affect if LTD payments is ltd taxable. It’s common to believe that all LTD benefits are tax-free, which can lead to unexpected tax bills come tax season. By grasping these nuances, you can navigate your financial obligations more effectively and avoid potential penalties or audits for failing to report taxable income.

Additionally, it’s crucial to obtain W-2 or 1099 forms for reporting taxable long-term impairments, as this is essential for understanding your tax responsibilities. Remember, state tax rules on disability benefits can vary, so consulting with a tax professional can provide clarity tailored to your specific situation. We’re here to help you through this journey.

Conclusion

Understanding the tax implications of long-term disability (LTD) payments is crucial for your financial well-being. We know that navigating these waters can be challenging, especially when it comes to how premiums were paid. Being aware of whether your LTD payments are taxable can help you avoid unexpected financial burdens during tough times.

Let’s break it down. The source of your premium payments plays a critical role in determining taxability. There are differences between employer-sponsored and individual policies that can significantly affect your situation. It’s essential to familiarize yourself with tax forms like W-2 and 1099, as they can provide clarity on your obligations. Consulting with a tax professional can be a valuable step in understanding these complexities.

Staying informed about long-term disability taxation empowers you to make decisions that protect your financial future. You’re not alone in this journey; many face similar challenges. As regulations change, keeping a close eye on your LTD policies will be vital for ensuring your financial security and compliance. Remember, we’re here to help you navigate these waters with confidence.

Frequently Asked Questions

What is long-term disability (LTD) taxation?

Long-term disability taxation refers to the tax implications of receiving payments from long-term disability insurance policies, which can vary based on how the premiums were paid.

Are LTD benefits taxable?

Yes, LTD benefits can be taxable. If premiums were paid with pre-tax funds, the benefits are typically taxable. Conversely, if premiums were paid with after-tax dollars, the benefits received are usually not taxable.

Why is it important to understand LTD taxation?

Understanding LTD taxation is crucial for accurately reporting income and meeting IRS requirements, which helps prevent unexpected tax bills during tax season.

How do employer-sponsored LTD policies affect taxation?

Employer-sponsored LTD policies fall under the Employee Retirement Income Security Act (ERISA), which influences how payments are taxed. If both you and your employer contribute to the premiums, the tax treatment may differ based on the contributions.

Are all LTD benefits tax-free?

No, it is a common misconception that all LTD benefits are tax-free. The taxability depends on how the premiums were paid, so understanding what is taxable is essential.

Can individual long-term disability insurance premiums be deducted from taxes?

Generally, individual long-term disability insurance premiums are not tax-deductible, which is important for understanding your overall tax situation.

What recent updates should I be aware of regarding taxes on benefits?

Recent updates indicate that nearly 90% of Social Security recipients will no longer pay federal income taxes on their benefits, highlighting the importance of staying informed about tax regulations.

What tax forms are required for reporting LTD benefits?

For employer-paid benefits, you will need Form W-2, while payments from third-party insurers require Form 1099.

How can I get help with LTD tax implications?

Consulting a tax expert or engaging with legal professionals can provide clarity and assistance in navigating the complexities of long-term disability claims and their tax implications.