Introduction

Long-term disability (LTD) payments are more than just financial support; they’re a lifeline for those unable to work due to medical conditions or injuries. We understand that navigating the tax implications of these benefits can feel overwhelming. What exactly counts as taxable income? This article is here to help you untangle the complexities of LTD taxation, offering essential insights and practical steps to make tax filing a little easier.

It’s common to feel uncertain when the details of your LTD policy seem to conflict with IRS regulations. But don’t worry; you’re not alone in this journey. Together, we’ll explore how to navigate this intricate landscape, ensuring you remain compliant while finding peace of mind. Let’s take this step by step, so you can focus on what truly matters - your health and well-being.

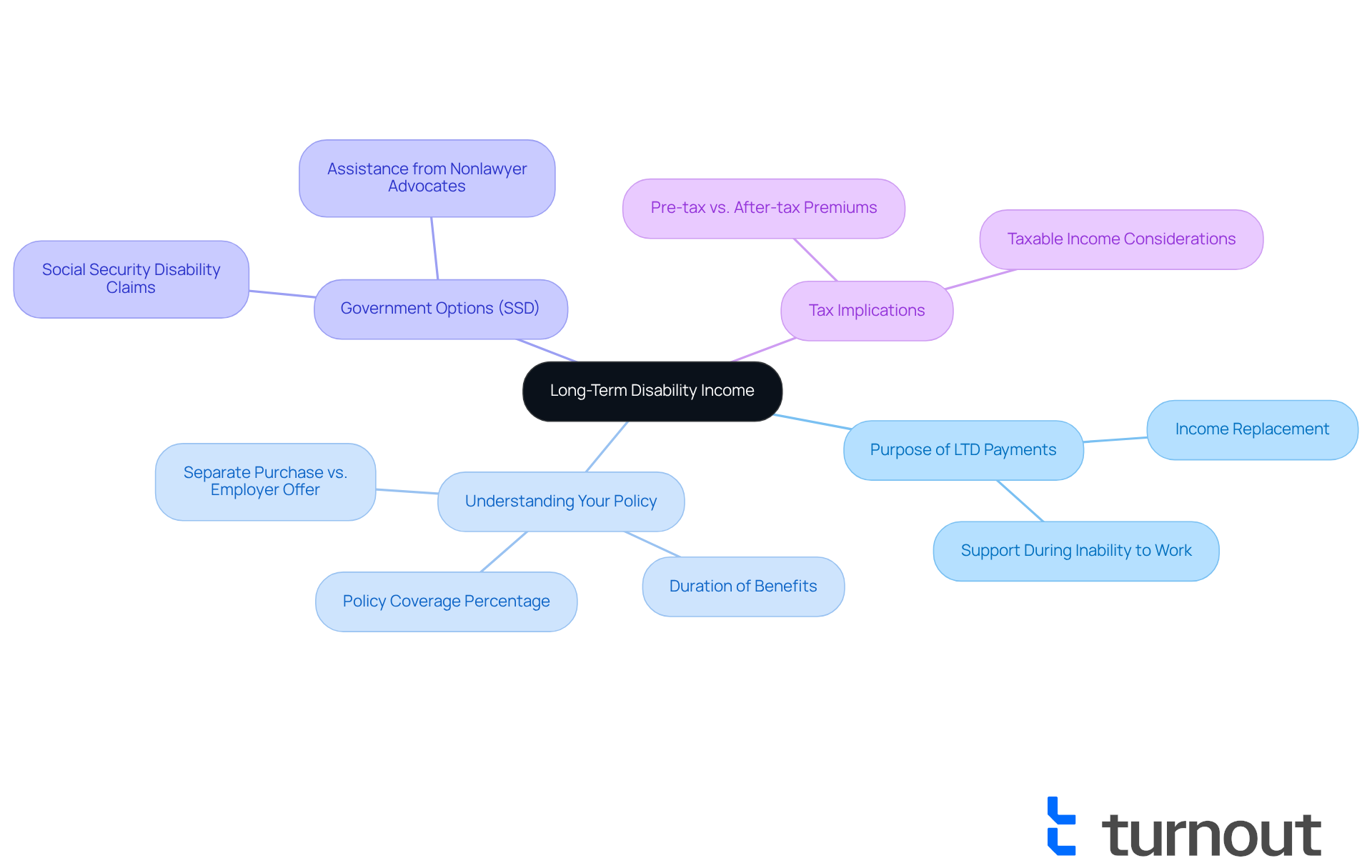

Understand Long-Term Disability Income

Long-term disability payments can be a vital lifeline for those unable to work due to a qualifying medical condition or injury. These payments aim to replace a portion of the income lost when you can’t perform your job duties. You might find that LTD policies are available for purchase separately or offered through your employer as part of a compensation package. Understanding the specifics of your LTD policy - like the percentage of income it covers and how long assistance lasts - is essential for effective financial planning.

We understand that navigating these waters can be overwhelming. Alongside the benefits of LTD, you may want to explore government-related options, such as Social Security Disability (SSD) claims, which can provide additional financial support. Turnout offers assistance through trained nonlawyer advocates who can help you maneuver through these complex systems without needing an attorney-client relationship.

It's important to note that LTD benefits can vary significantly based on your policy's terms. For instance, whether your premiums were paid with pre-tax or after-tax dollars can directly affect what is LTD taxable income. Familiarizing yourself with these details can prepare you for tax season and help you manage your finances effectively. Remember, you’re not alone in this journey; we’re here to help you make the most of all available resources, including SSD assistance.

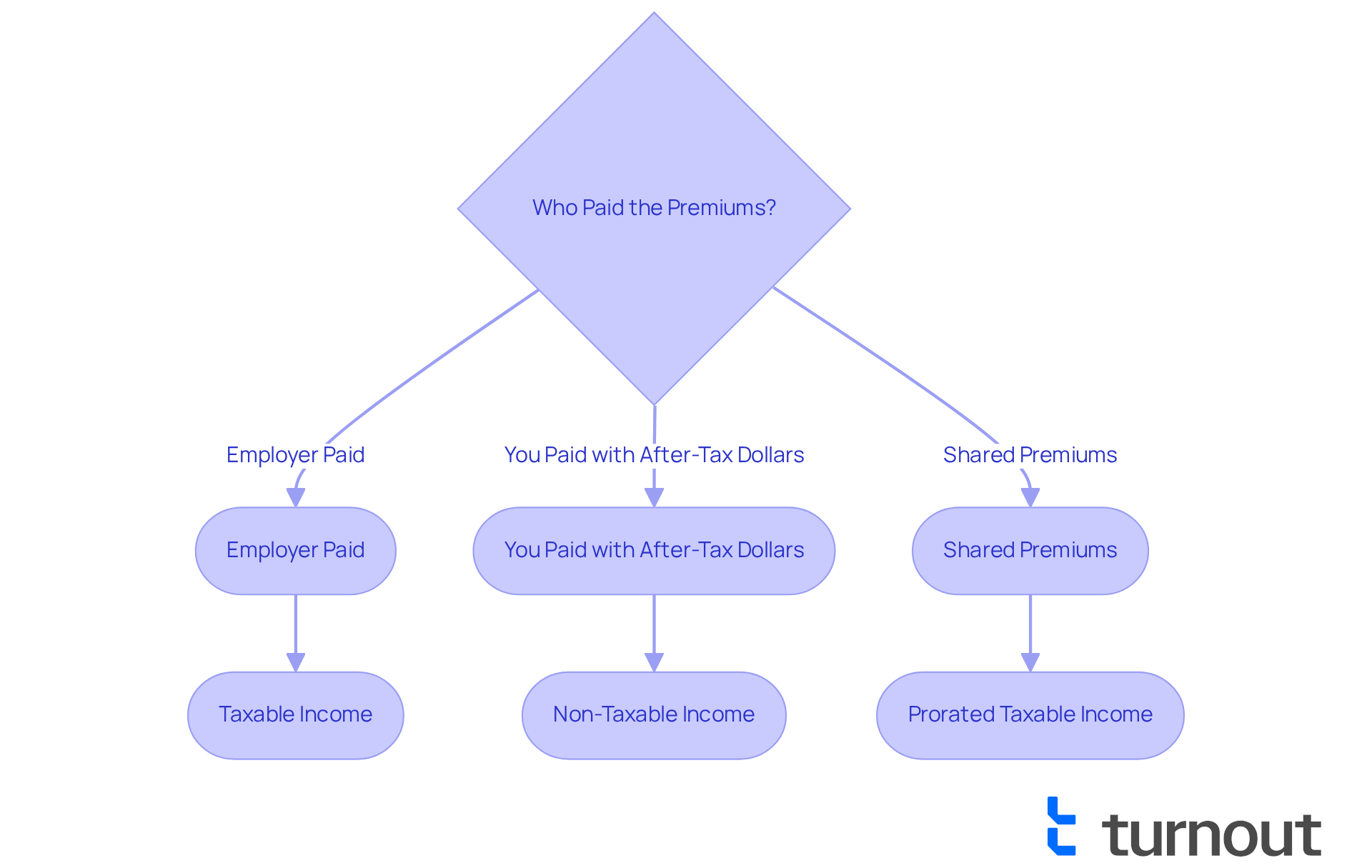

Identify Taxable vs. Non-Taxable LTD Income

Understanding the tax implications of your long-term disability benefits can feel overwhelming. We know that navigating these waters is not easy, especially when it comes to finances. So, let’s break it down together.

First, consider who paid the premiums for your policy. If your employer covered the costs, the benefits you receive is LTD taxable income. On the other hand, if you paid the premiums with after-tax dollars, those benefits are usually non-taxable. This distinction is crucial for your financial planning.

For example, if you receive LTD payments from a policy funded by your employer, you’ll need to report those payments as income on your tax return. However, if you purchased the policy yourself using after-tax income, the benefits you receive will not be considered LTD taxable income. It’s a relief to know that your hard-earned money can remain yours in this case.

If the premiums were shared between you and your employer, the question of what is LTD taxable income might be prorated based on how much each party contributed. It’s common to feel uncertain about these details, but remember, you are not alone in this journey. Taxpayers are responsible for paying taxes on what is LTD taxable income, regardless of whether withholdings occurred.

Always consult your policy documents or a tax expert to clarify your specific situation. Tax obligations on disability payments can vary widely based on individual circumstances. And don’t forget, state and local taxes may also apply to disability assistance. Being aware of these factors is essential for thorough financial planning. We’re here to help you navigate this process.

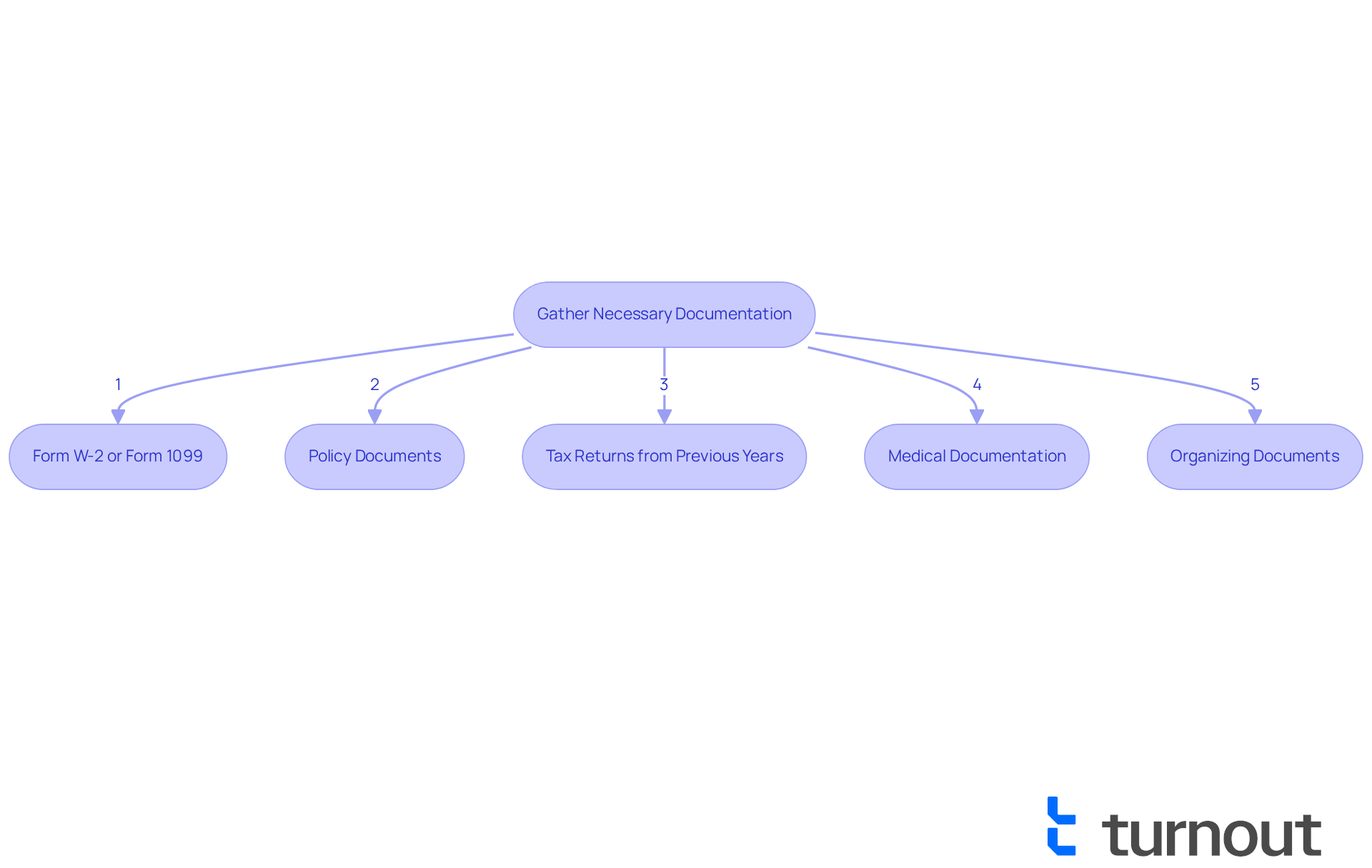

Gather Necessary Documentation

When preparing to file your taxes with long-term disability income, we understand that gathering the right documentation can feel overwhelming. Here’s a helpful guide to make the process smoother:

-

Form W-2 or Form 1099: These forms detail the amount of long-term disability (LTD) payments you’ve received and whether taxes were withheld. If you haven’t received these forms, don’t hesitate to reach out to your employer or insurance provider for copies. Remember, it’s essential to have these forms, as up to 50% of SSDI payments might be subject to federal tax depending on your income level.

-

Policy Documents: Take a moment to review your LTD policy. Understanding the terms, including who paid the premiums and the total benefits received, is crucial for determining the tax implications of your benefits.

-

Tax Returns from Previous Years: Having your past tax returns handy can help you identify trends in your earnings reporting. Many individuals find it beneficial to compare their previous filings to ensure consistency and accuracy in their current return.

-

Medical Documentation: Keep records of your medical condition and any correspondence with your insurance provider. This documentation may be necessary to substantiate your claim if the IRS has questions.

Organizing these documents in advance can significantly streamline your tax filing process and enhance accuracy. It’s common to feel stressed about gathering necessary tax documentation; in fact, approximately 30% of individuals struggle with this, leading to delays and errors. By proactively organizing your paperwork, you can avoid common pitfalls and ensure a smoother filing experience.

For instance, one individual shared how they created a dedicated folder for all tax-related documents, making it easier to access everything when tax season arrived. This proactive approach can save you time and reduce stress during the filing process. Remember, you’re not alone in this journey; we’re here to help!

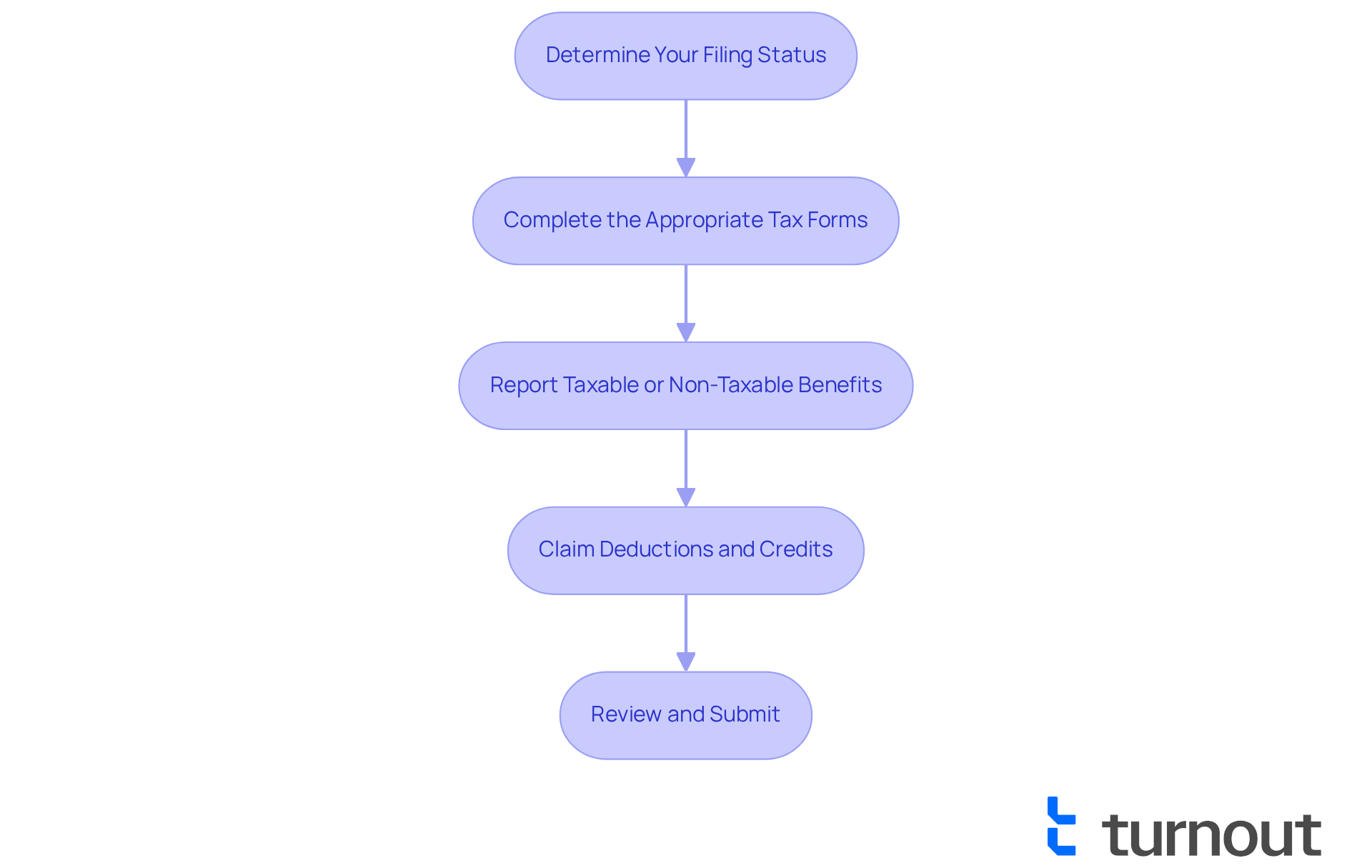

File Your Taxes Accurately

Filing your taxes accurately with long-term disability income can feel overwhelming, but we're here to help. By following these essential steps, you can navigate this process with confidence:

-

Determine Your Filing Status: First, think about how you’ll file-whether as single, married, or head of household. This choice can significantly impact your tax brackets and available deductions.

-

Complete the Appropriate Tax Forms: Use Form 1040 or Form 1040-SR to report your earnings. Don’t forget to include your LTD benefits in the earnings section, referencing your W-2 or 1099 forms for accuracy.

-

If your benefits are taxable, it is important to report the total amount received as earnings, which is LTD taxable income. If they’re non-taxable, confirm that they’re excluded from your total earnings.

-

Claim Deductions and Credits: Explore any deductions and credits that might apply to your situation, like medical expenses or disability-related credits. These can really help in understanding what is LTD taxable income.

-

Review and Submit: Take a moment to double-check all your entries for accuracy. Ensure that all income is reported correctly and that you’ve claimed all eligible deductions. Finally, submit your tax return electronically or by mail before the deadline.

By following these steps, you can ensure that your tax filing is accurate and compliant with IRS regulations. This minimizes the risk of common errors that could affect your financial situation. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Conclusion

Understanding the nuances of long-term disability (LTD) income and its tax implications is crucial for effective financial management. We know that LTD can be a vital source of support for individuals unable to work due to medical conditions. However, knowing whether these benefits are taxable can significantly influence your financial planning and tax filing.

It's important to recognize the distinction between taxable and non-taxable LTD income, which often hinges on who paid the premiums - employers or individuals. Gathering necessary documentation, such as tax forms and policy details, is essential for accurate reporting. We’ve outlined steps for filing taxes correctly with LTD income, providing a comprehensive roadmap for navigating this complex process.

Ultimately, being informed about the tax implications of long-term disability income empowers you to make sound financial decisions. Staying proactive and organized is key. Ensure all necessary documents are in order, and don’t hesitate to consult with tax professionals when needed. By taking these steps, you can alleviate stress during tax season and secure your financial well-being. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is long-term disability (LTD) income?

Long-term disability income refers to payments provided to individuals who are unable to work due to a qualifying medical condition or injury. These payments aim to replace a portion of the income lost when a person cannot perform their job duties.

How can I obtain long-term disability payments?

Long-term disability policies can be purchased separately or may be offered through your employer as part of a compensation package.

Why is it important to understand my LTD policy?

Understanding the specifics of your LTD policy, such as the percentage of income it covers and the duration of assistance, is essential for effective financial planning.

What additional support options are available alongside LTD?

In addition to LTD, individuals may want to explore government-related options like Social Security Disability (SSD) claims, which can provide additional financial support.

Can I get help with SSD claims?

Yes, Turnout offers assistance through trained nonlawyer advocates who can help navigate the SSD claims process without requiring an attorney-client relationship.

How do the terms of my LTD policy affect my benefits?

LTD benefits can vary significantly based on the terms of your policy, including whether premiums were paid with pre-tax or after-tax dollars, which can affect the taxable income from LTD payments.

How can I prepare for tax season concerning my LTD benefits?

Familiarizing yourself with the details of your LTD policy, such as the tax implications of your benefits, can help you manage your finances effectively and prepare for tax season.