Overview

Long-term disability insurance truly matters. It offers essential financial security by replacing a significant portion of lost income when you can’t work for an extended period. This safeguard helps protect you and your family from economic instability during difficult times.

Did you know that nearly one in four employees may face a physical limitation before retirement? This statistic emphasizes the necessity of having coverage in place. It’s crucial for maintaining your quality of life and preventing financial strain during health crises.

We understand that contemplating such coverage can feel overwhelming. However, having this safety net can provide peace of mind, knowing you’re prepared for the unexpected. You are not alone in this journey; many others are seeking the same reassurance.

In this way, long-term disability insurance becomes more than just a policy. It’s a vital step toward securing your financial future and protecting what matters most to you.

Introduction

Long-term disability insurance acts as a vital safety net for those facing unexpected health challenges that may prevent them from working for extended periods. It provides essential financial support, typically covering a significant portion of lost income, helping individuals maintain stability during their recovery. We understand that many may question its value, and the real challenge is to discern whether the benefits truly outweigh the complexities of securing such coverage.

What factors should you consider when evaluating the necessity of long-term disability insurance in today’s unpredictable economic landscape? It's common to feel uncertain about such decisions, but know that you are not alone in this journey. We're here to help you navigate these important considerations.

Define Long-Term Disability Insurance

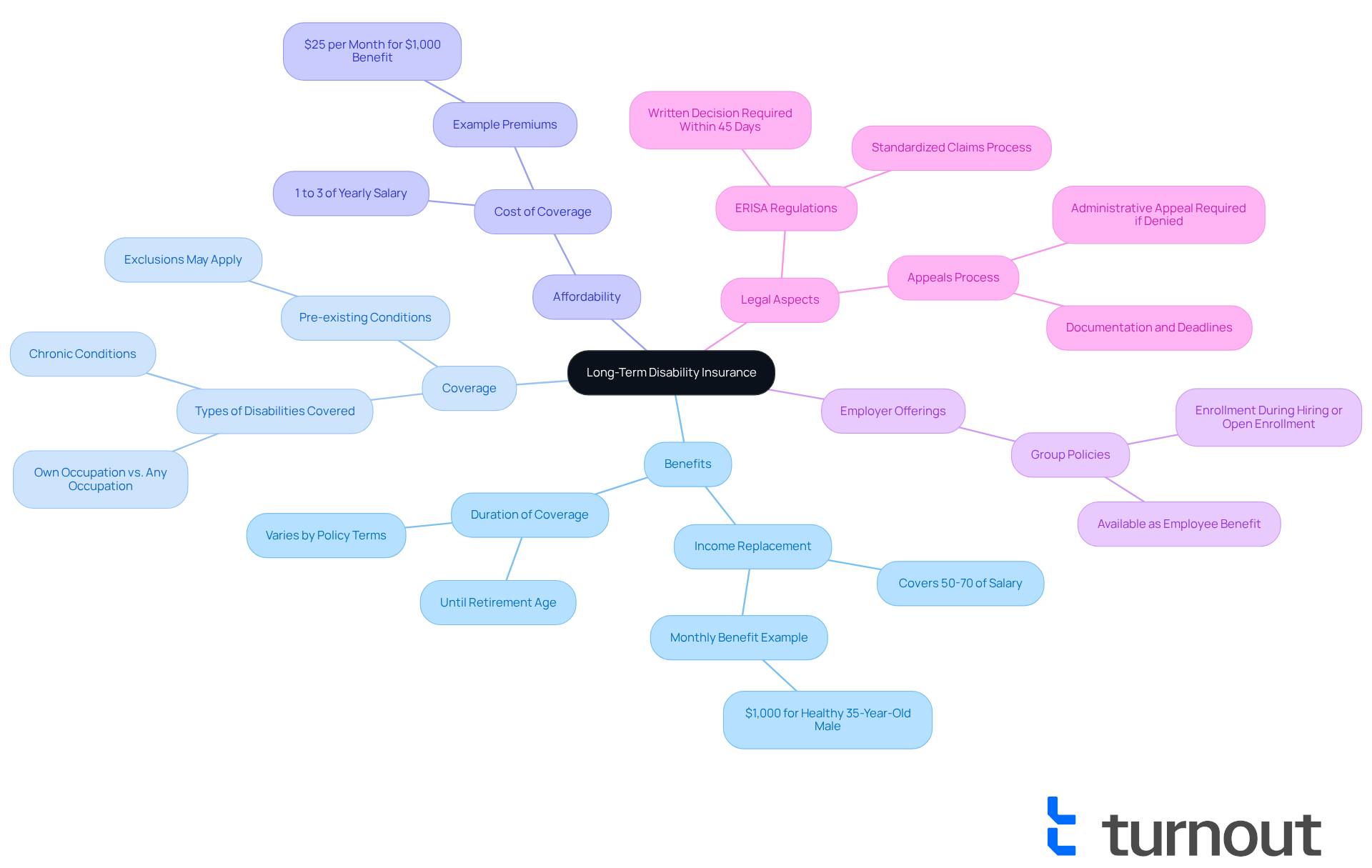

For those facing the challenges of qualifying injuries or illnesses that prevent them from working for three to six months or more, a vital safety net is provided by long-term income protection (LTD), leading to the question: is long term disability worth it? This policy typically covers 50% to 70% of your salary, helping you maintain financial stability during recovery.

Unlike short-term coverage, which offers benefits for a limited time, the question of is long term disability worth it arises as it can provide support for several years or even until you reach retirement age, depending on your policy's specific terms. We understand that navigating these options can be overwhelming, so it's crucial for you to fully grasp the precise meanings of impairments and conditions outlined in your plan, as these can vary significantly among providers.

For instance, a healthy 35-year-old male might secure a $1,000 monthly benefit for an initial premium of about $25 per month. This example illustrates the affordability and potential value of such coverage. In fact, statistics show that a significant percentage of workers have access to long-term disability coverage through their employers, which leads to the consideration of whether is long term disability worth it as a standard employee benefit.

Additionally, providers are required to issue a written decision on LTD claims within 45 days. The Employee Retirement Income Security Act (ERISA) also mandates a standardized claims and appeals process for benefit claims. Understanding these components can empower you to make informed choices regarding your financial security when faced with unexpected health challenges. Remember, you're not alone in this journey, and we're here to help.

Highlight Benefits of Long-Term Disability Insurance

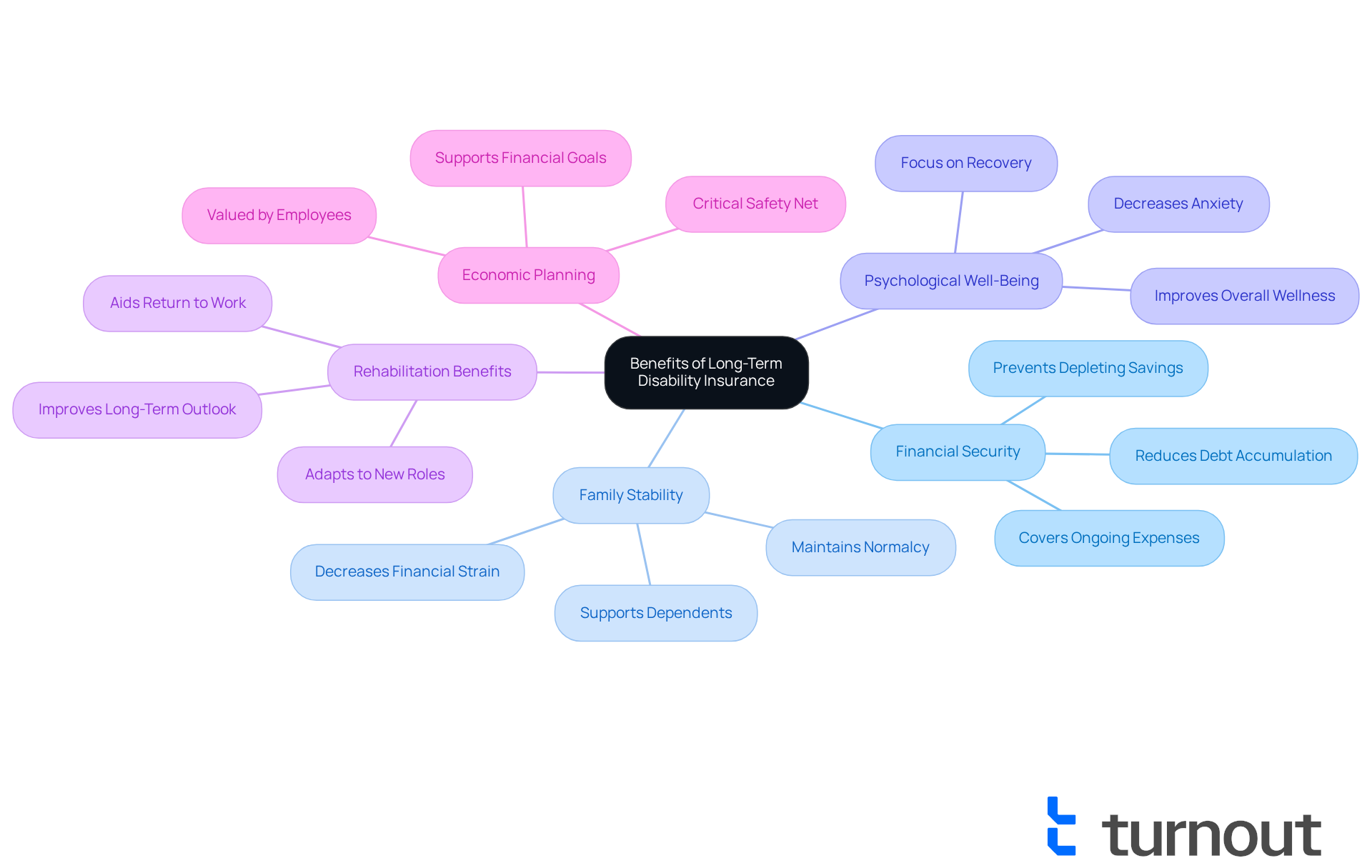

Long-term disability insurance offers significant advantages that can profoundly impact individuals and their families. It provides essential financial security by replacing a portion of lost income, which is crucial for covering ongoing expenses like mortgage payments, medical bills, and daily living costs. This support helps prevent individuals from depleting their savings or accumulating debt during challenging times. We understand that nearly 1 in 4 Americans will face a physical limitation before retirement, highlighting the necessity of this coverage.

Moreover, long-term coverage for impairments plays a vital role in maintaining family stability. It allows families to continue supporting dependents without the added burden of financial strain, fostering a sense of normalcy during difficult moments. Families who have utilized long-term support plans often report decreased anxiety and improved overall wellness, as they can focus on healing rather than financial worries. For instance, Michael's story illustrates this concept; he secured coverage for impairments early on, providing him with stability during an unexpected health crisis.

Additionally, many policies offer rehabilitation benefits, aiding individuals in returning to work or adapting to new roles, thereby improving their long-term financial outlook. Financial advisors frequently highlight the importance of long-term disability coverage, emphasizing that it serves as a critical safety net and raising the question of whether long-term disability is worth it for allowing people to navigate unforeseen health issues with confidence. As Amy Friedrich, President of benefits and protection at Principal, states, "Disability coverage safeguards an employee's income through income replacement in the event that an employee experiences an accident or illness that leaves them unable to work for a period of time."

Ultimately, the peace of mind that comes from having this safety net is invaluable; it empowers individuals to prioritize their recovery while ensuring their families remain financially secure. Furthermore, with over 60% of employees considering extensive benefits, including long-term support coverage, as highly valuable, it is clear that such protection is a fundamental aspect of economic planning. Remember, you are not alone in this journey; we’re here to help.

Discuss the Necessity of Long-Term Disability Insurance for Financial Security

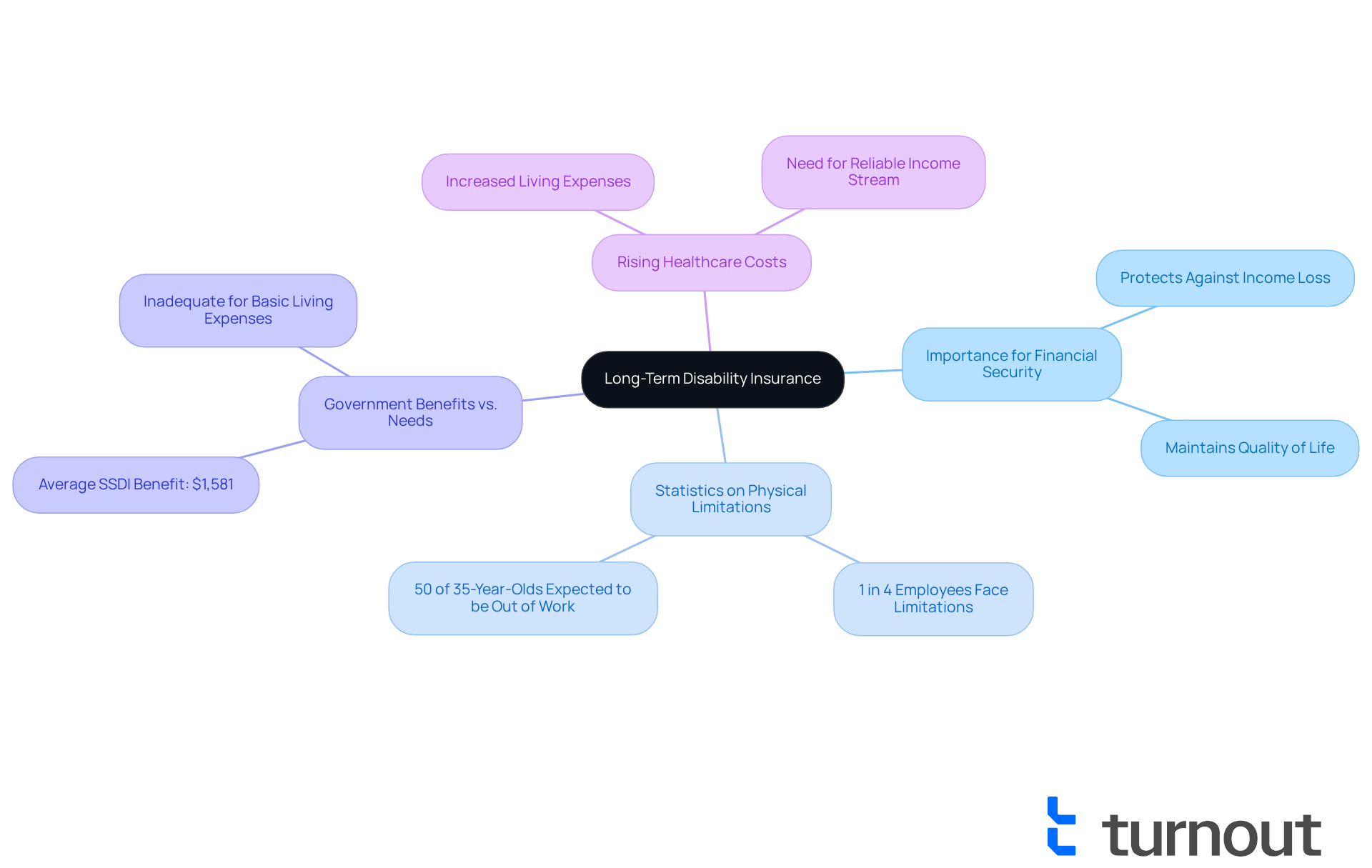

In today’s uncertain economic climate, many are asking if long-term disability is worth it, as it is more than just a financial product; it’s a vital pillar of security for you and your loved ones. Did you know that nearly one in four employees may encounter a physical limitation before they retire? This statistic underscores the importance of adequate coverage to safeguard your future.

Relying solely on government benefits can leave you vulnerable. Unfortunately, these benefits often fall short of covering basic living expenses. For instance, the average monthly Social Security Disability Insurance (SSDI) benefit is around $1,581, which may not be enough to cover essential costs like housing, utilities, and groceries.

As healthcare and living expenses continue to rise, it is crucial to evaluate if long-term disability is worth it to ensure a dependable income stream during a prolonged inability to work. When considering whether long-term disability is worth it, it's important to note that investing in long-term illness coverage protects you from economic instability and helps maintain your quality of life during unexpected health challenges.

This proactive approach to financial planning is essential. Remember, you are not alone in this journey; we’re here to help you navigate these important decisions.

Analyze Challenges in Claiming Long-Term Disability Benefits

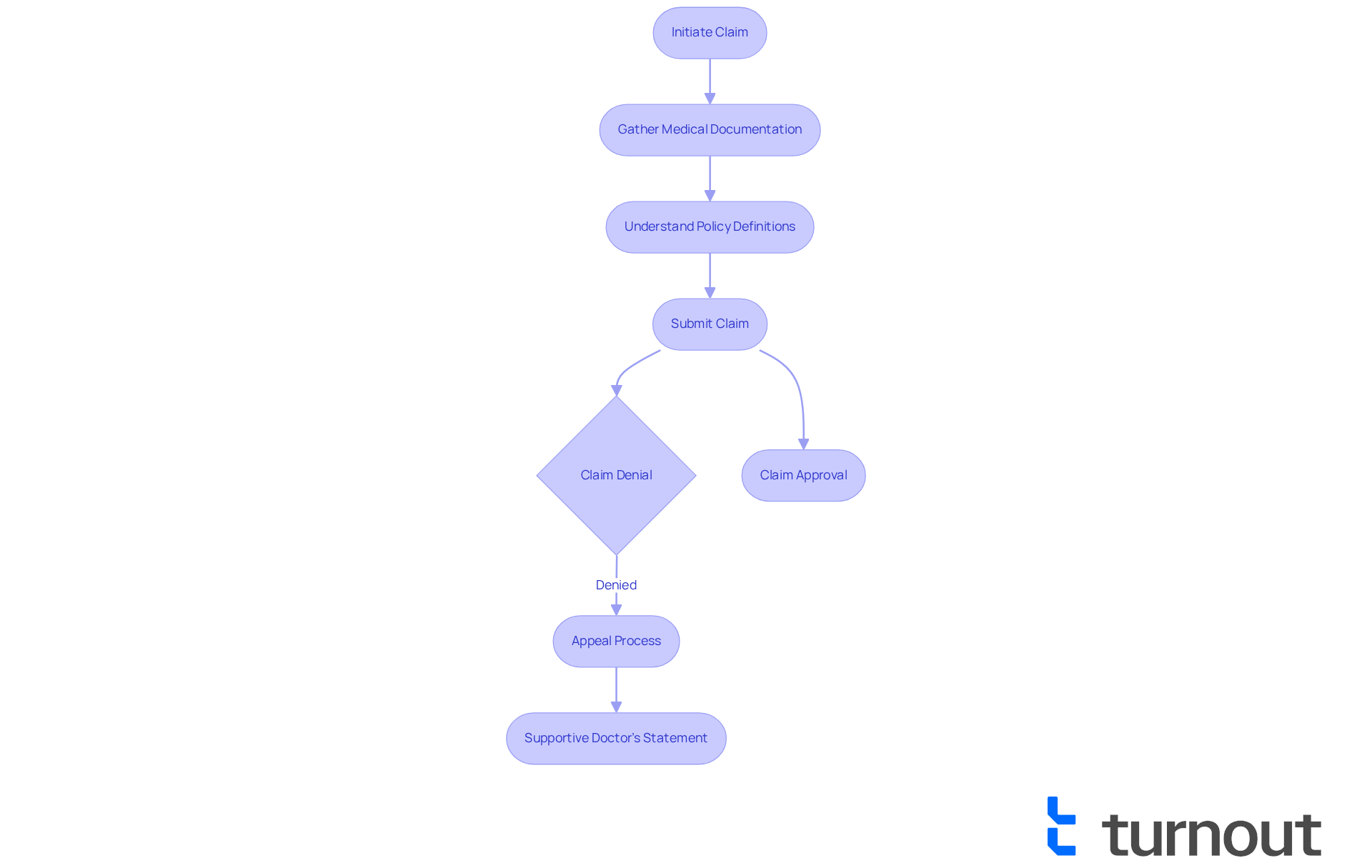

Requesting long-term assistance benefits can feel overwhelming, and it's common to encounter obstacles that may discourage you from pursuing your rightful claims. One of the most significant challenges is the need for comprehensive medical documentation to substantiate your claim. Insurers often require extensive evidence of your impairment, which can be difficult to secure, especially if your condition isn't easily visible or measurable.

Moreover, many policies have specific definitions of impairment that can complicate claims. For example, some may only cover conditions that prevent you from performing your current job, while others might require proof that you cannot engage in any productive work. To add to the complexity, insurers might use surveillance footage or social media to question discrepancies in your reported impairments.

The claims process can also be lengthy and bureaucratic, leading to frustration and delays. Many claims are initially denied due to insufficient documentation or not meeting the policy's criteria. This can understandably dissuade you from appealing the decision. A supportive doctor's statement is crucial for strengthening your claims and appeals, as it provides detailed insights into your medical condition and limitations.

Understanding these challenges is essential if you're evaluating whether long-term disability is worth it. It highlights the importance of being proactive and well-prepared when submitting a claim. Remember, you have the right to appeal denied claims, which can pave the way to securing the benefits you deserve. You are not alone in this journey; we're here to help.

Conclusion

Long-term disability insurance serves as a critical safety net, providing essential financial support during unforeseen health challenges. We understand that the question of whether long-term disability is worth it goes beyond mere numbers; it encompasses the peace of mind that comes from knowing you can maintain financial stability while focusing on recovery. The long-term implications of securing such coverage can significantly influence your quality of life and that of your family.

This article highlights several key benefits of long-term disability insurance:

- Income replacement that helps cover essential expenses

- The ability to maintain family stability

- The provision of rehabilitation benefits

With nearly one in four employees facing potential physical limitations before retirement, the necessity of this coverage becomes increasingly apparent. It's common to feel overwhelmed by the complexities of the claims process, but understanding these intricacies equips you with the knowledge needed to navigate potential challenges effectively.

Ultimately, investing in long-term disability insurance is a proactive approach to financial security. It not only protects against economic instability but also fosters a sense of confidence in facing life's uncertainties. As healthcare costs and living expenses continue to rise, taking steps to secure long-term disability coverage is not just wise—it's essential for safeguarding your future. Remember, you and your family can thrive despite unexpected challenges. We're here to help you on this journey.

Frequently Asked Questions

What is long-term disability insurance (LTD)?

Long-term disability insurance provides financial protection for individuals who are unable to work due to qualifying injuries or illnesses for three to six months or longer. It typically covers 50% to 70% of your salary, helping maintain financial stability during recovery.

How does long-term disability insurance differ from short-term disability insurance?

Long-term disability insurance offers benefits for an extended period, potentially for several years or until retirement age, while short-term disability insurance provides coverage for a limited time.

Is long-term disability insurance worth it?

Long-term disability insurance can be worth it as it offers significant financial support during recovery from serious health issues, helping individuals maintain their financial stability over an extended period.

How much does long-term disability insurance typically cost?

For example, a healthy 35-year-old male might secure a $1,000 monthly benefit for an initial premium of about $25 per month, illustrating the affordability and potential value of such coverage.

Do many employers offer long-term disability coverage?

Yes, a significant percentage of workers have access to long-term disability coverage through their employers, making it a common employee benefit.

What are the requirements for long-term disability claims?

Providers are required to issue a written decision on LTD claims within 45 days. Additionally, the Employee Retirement Income Security Act (ERISA) mandates a standardized claims and appeals process for benefit claims.

How can understanding the terms of my long-term disability policy help me?

Fully grasping the precise meanings of impairments and conditions outlined in your plan can empower you to make informed choices regarding your financial security when faced with unexpected health challenges.