Introduction

Navigating the complexities of tax debt can feel overwhelming, especially when the stakes are high. We understand that many individuals are searching for relief, and that’s where the IRS Fresh Start Program comes in. This program has emerged as a beacon of hope for those seeking a way out of their financial struggles.

However, it’s common to have questions about its legitimacy. This article aims to provide you with a comprehensive understanding of the Fresh Start Program, including its benefits and eligibility criteria. We’ll explore the real-world impact it has made on countless taxpayers, offering insights that can help you make informed decisions.

With so much at stake, you might wonder: can you truly trust that the Fresh Start tax relief is a legitimate solution to your financial woes? Rest assured, you are not alone in this journey, and we’re here to help you navigate these challenging waters.

Turnout: Streamlined Tax Relief Solutions for Fresh Start Program Participants

Turnout is here to transform your experience with tax assistance, especially when considering if is fresh start tax relief legit through the IRS Fresh Start Program. We understand that navigating tax debt can feel overwhelming, but our AI-driven platform is designed to simplify this journey for you. With timely updates and personalized support, you’ll feel empowered every step of the way.

Imagine having advanced AI capabilities at your fingertips, making the management of tax debt not just manageable, but a more navigable experience. Our partnership with dedicated nonlawyer advocates and IRS-licensed enrolled agents means you’ll receive an efficient process tailored to your unique needs. This significantly enhances your chances of successfully acquiring the assistance you deserve.

It’s important to note that Turnout is not a law firm and does not provide legal representation. Instead, we focus on offering expert guidance without the complexities of legal advice. You can trust that we’re here to help you through this process, ensuring you feel supported and understood.

This innovative approach exemplifies how consumer advocacy can leverage technology to create effective solutions in tax assistance. Remember, you are not alone in this journey. We’re committed to helping you find the support you need.

IRS Fresh Start Program: A Legitimate Path to Tax Relief

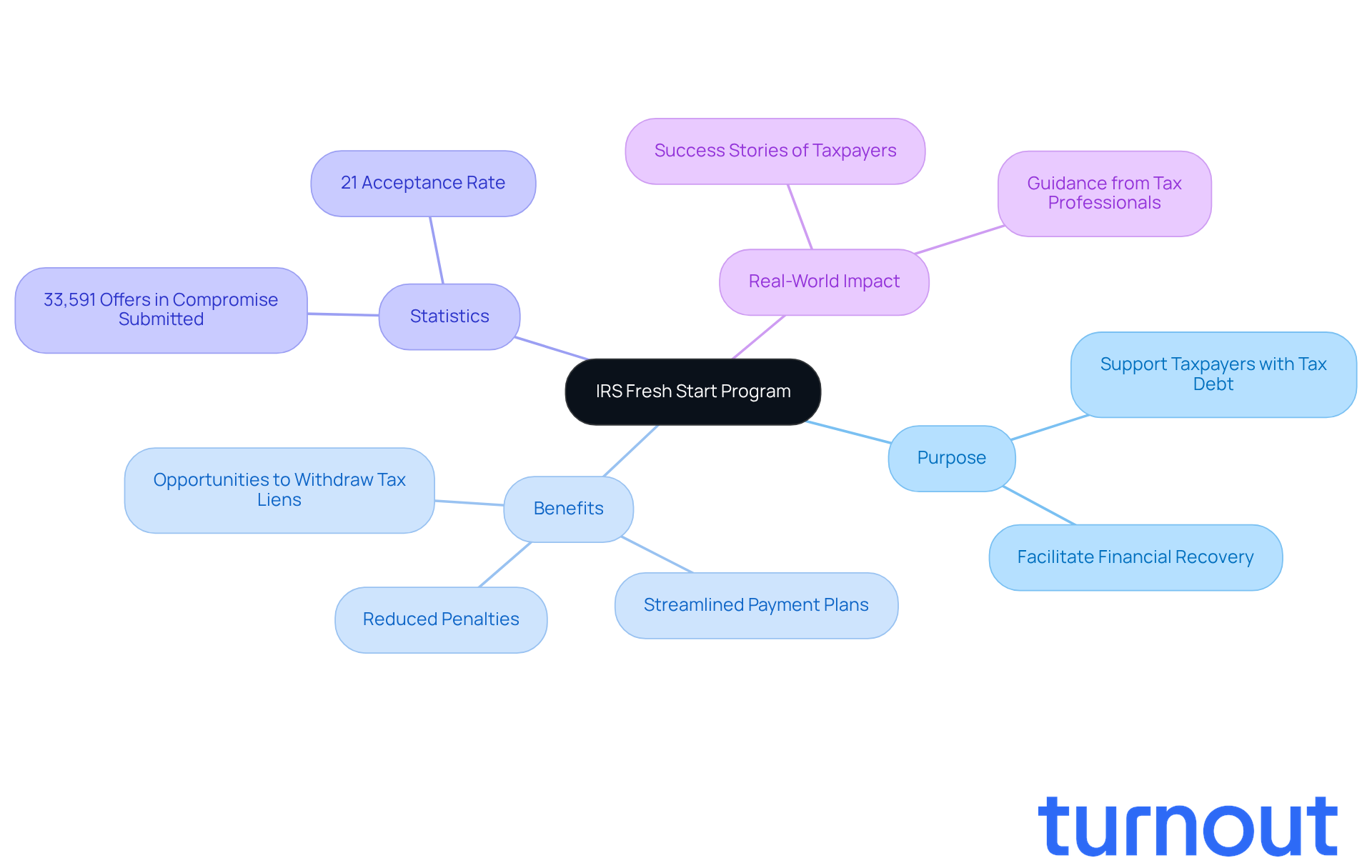

Many people wonder if the IRS New Start Program is fresh start tax relief legit, as it is a genuine initiative designed to support taxpayers who are struggling with tax debt. Since its launch in 2011, this program has offered various relief options, such as installment agreements and offers in compromise. These options empower individuals to manage their debts effectively and work towards financial recovery. As of December 2025, updates have simplified the qualification process, especially for self-employed individuals facing a 25% or more drop in income, making it more accessible than ever.

Since its inception, the New Start Program has helped millions of taxpayers. In Fiscal Year 2024 alone, over 33,591 offers in compromise were submitted, showcasing a 21% acceptance rate. This reflects the program's effectiveness in assisting individuals to settle their debts for significantly less than what they owe, often reducing total tax liabilities by 90% or more.

Key benefits of the Fresh Start Program include:

- Streamlined payment plans

- Reduced penalties

- Opportunities to withdraw tax liens

These features can greatly alleviate financial burdens. Taxpayers can apply for assistance at any time, as long as they meet IRS filing and compliance requirements. Experts agree that the program offers tailored options based on individual financial circumstances, ensuring that those in need can find a suitable path to relief, and they often ask, is fresh start tax relief legit?

Real-world examples illustrate the program's impact: many taxpayers, including those who faced significant financial difficulties, have successfully navigated the complexities of tax debt through the New Start initiative. They have regained their financial stability and peace of mind. With ongoing support from tax professionals, individuals can confidently explore their options within this robust framework designed to foster financial stability.

We understand that seeking help can feel overwhelming, but remember, you are not alone in this journey. The New Start Program is here to guide you towards a brighter financial future.

Key Benefits of the IRS Fresh Start Program for Taxpayers

The IRS Fresh Start Program offers several significant advantages for taxpayers, and we’re here to help you navigate them:

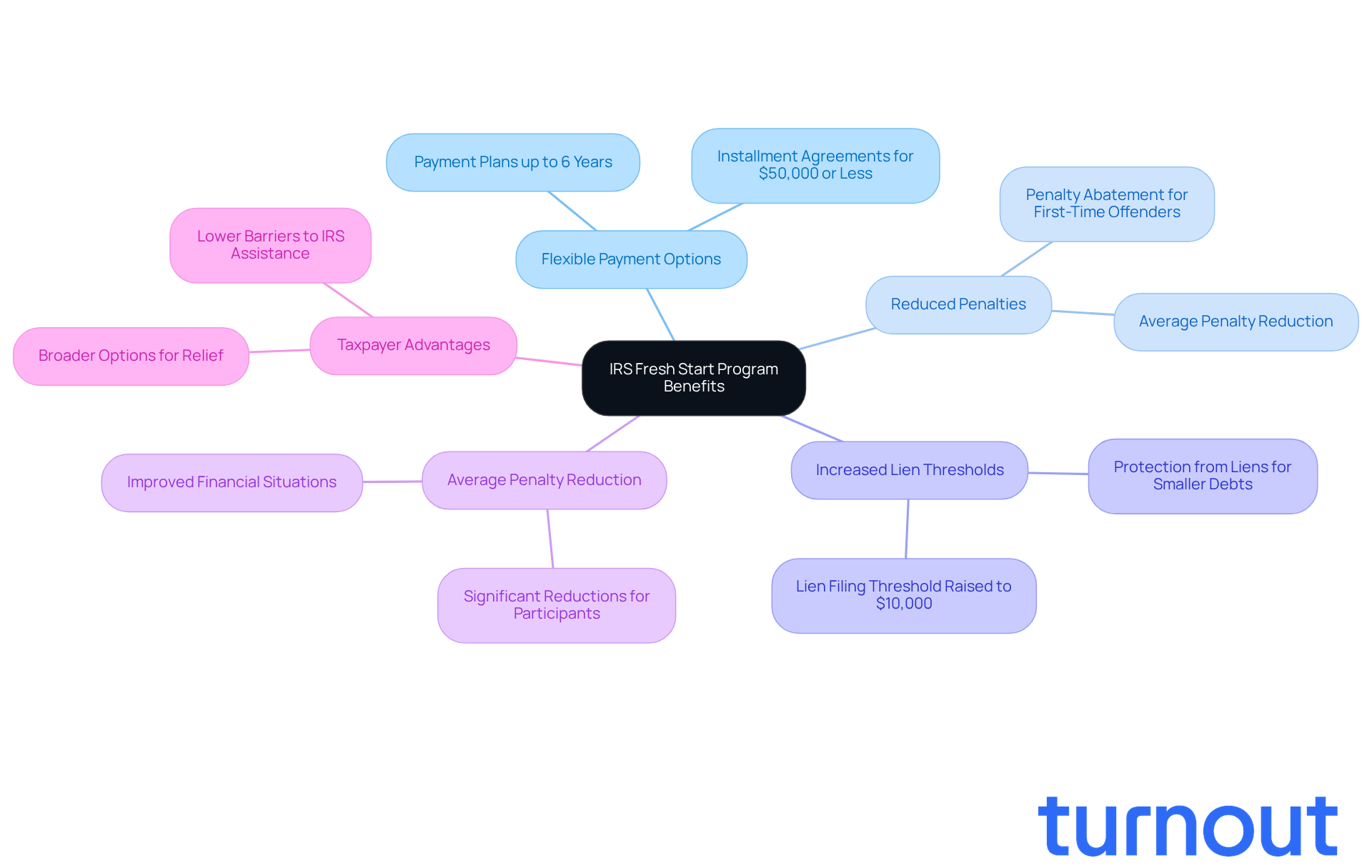

- Flexible Payment Options: You can choose from a variety of payment plans tailored to your financial situation. If you owe $50,000 or less, installment agreements can last up to six years, giving you the breathing room you need.

- Reduced Penalties: This program allows for penalty abatement, meaning first-time penalties for late filing or payment can be waived. This can significantly lower your total tax liability, easing some of the financial burden.

- Increased Lien Thresholds: Generally, the IRS won’t file a lien unless your tax debt exceeds $10,000. This helps protect your credit report from negative impacts if your debts are smaller.

- Average Penalty Reduction: Many participants in the New Start Program see significant reductions in penalties, improving their overall financial situation and paving a clearer path to debt resolution.

- Taxpayer Advantages: This program not only broadens your options for relief but also lowers barriers to accessing IRS assistance, ensuring that more individuals can benefit from available tax relief measures.

However, it’s important to recognize that if you’re in an active bankruptcy proceeding, you won’t qualify for the program, which raises the question: is fresh start tax relief legit? Additionally, all required tax returns must be filed to be eligible, and the qualification criteria can be complex. We highly recommend consulting with a licensed professional for personalized advice. Remember, ongoing interest charges apply to tax debts even under the New Start program. If you’re considering this program, taking action sooner rather than later can lead to significant benefits. You are not alone in this journey.

Debunking Myths: What the IRS Fresh Start Program Does Not Promise

Navigating tax debt can be overwhelming, and one important consideration is whether the IRS Fresh Start tax relief is legit, despite its benefits.

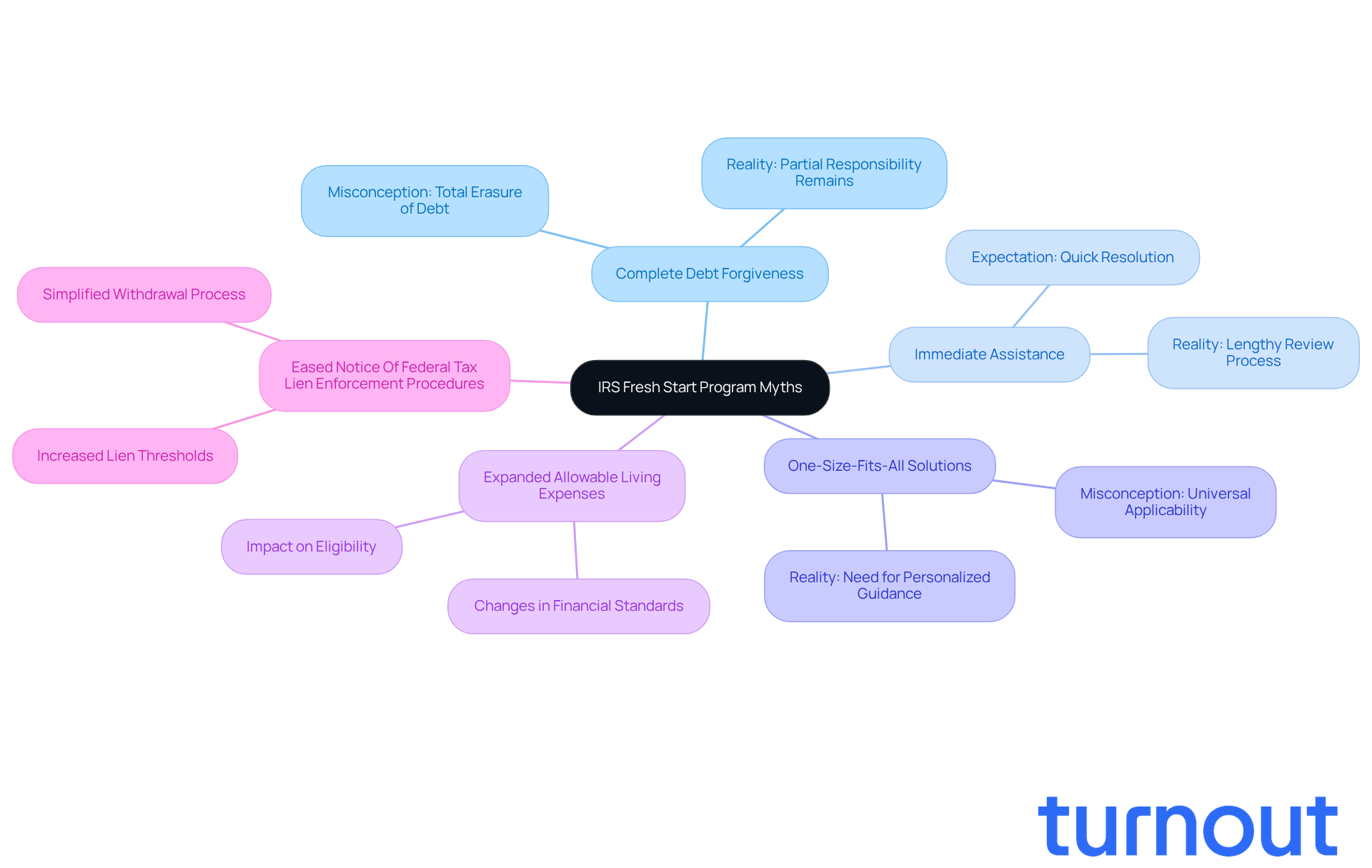

-

Complete Debt Forgiveness is a common misconception. While this program can significantly reduce what you owe, it rarely wipes out tax debts entirely. Many taxpayers find themselves still responsible for a portion of their original debt after questioning if fresh start tax relief is legit.

-

Immediate Assistance is another expectation that can lead to disappointment. The process of seeking support can be lengthy. It’s common to feel anxious about waiting; the review process for options like the Offer in Compromise can take several months. During this time, collection activities may still occur, adding to your stress.

-

Moreover, there are One-Size-Fits-All Solutions. Each taxpayer's financial situation is unique, raising the question of whether fresh start tax relief is legit and how the effectiveness of the Fresh Start Program varies widely. What works for one person may not be applicable to another, making personalized guidance essential.

-

It’s also important to consider the Expanded Allowable Living Expenses that the IRS has updated. These changes can affect your eligibility for the Offer in Compromise. Additionally, the Eased Notice Of Federal Tax Lien Enforcement Procedures has modified lien thresholds, providing more options for taxpayers. However, be aware of the Fees Associated with the New Start Program, as these can add to the overall cost of seeking assistance.

-

The program has evolved to increase taxpayer eligibility for the offer in compromise, raising questions about whether fresh start tax relief is legit for more individuals to qualify for help. Yet, it’s crucial to recognize the drawbacks of the New Start Program, such as the requirement for detailed financial disclosures and the high rejection rates for Offers in Compromise, which necessitate proof of inability to pay.

Understanding these limitations is vital for taxpayers navigating their options. Many individuals enter the program believing they will achieve complete debt forgiveness, only to discover they must still manage a portion of their tax obligations. This reality underscores the importance of consulting with licensed professionals who can provide tailored advice and help set realistic expectations.

Remember, you are not alone in this journey. We’re here to help you find the best path forward.

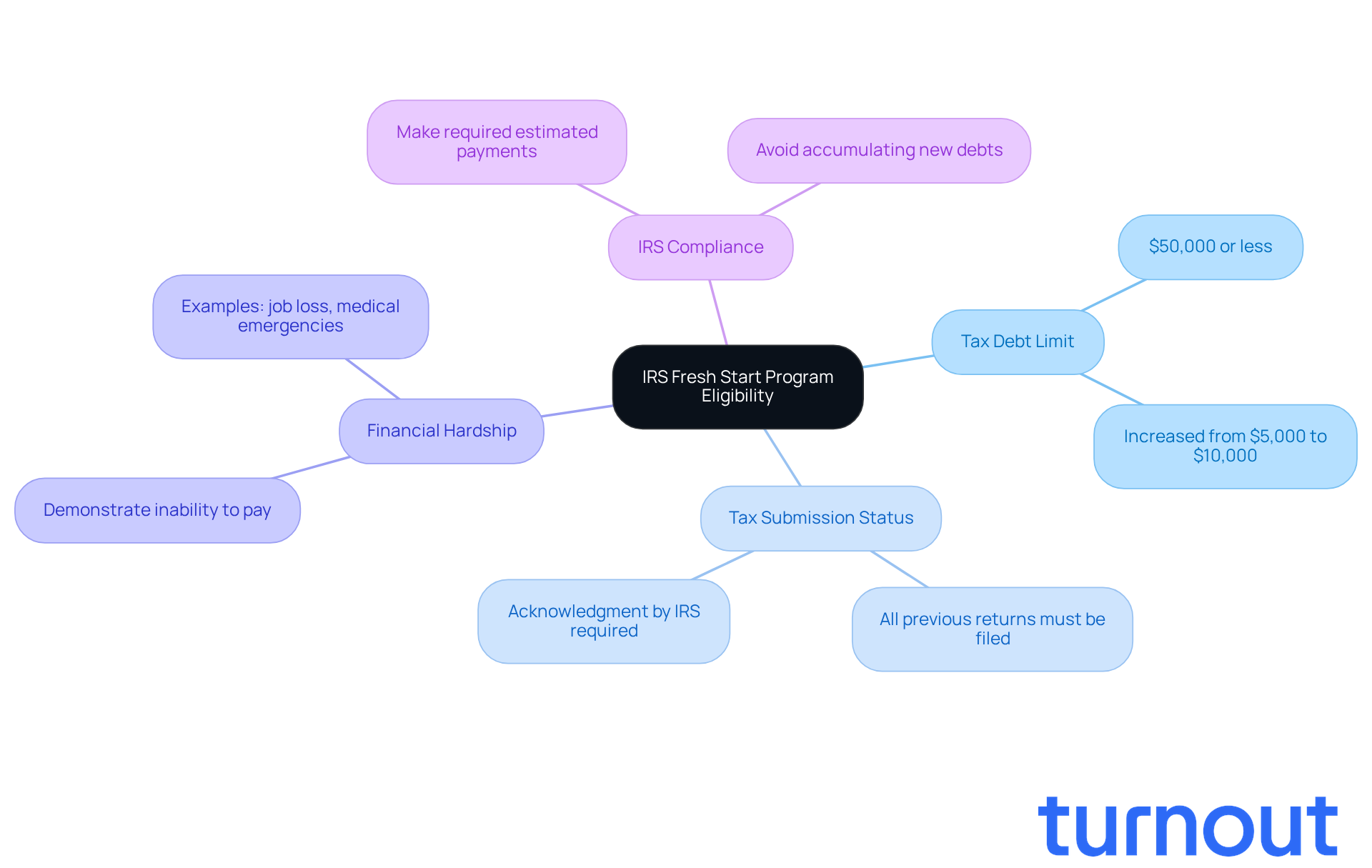

Eligibility Requirements for the IRS Fresh Start Program

If you're feeling overwhelmed by tax debt, you're not alone. The IRS Fresh Start Program offers a way to ease that burden, but there are specific eligibility criteria you need to meet:

- You must owe $50,000 or less in total tax debt. This threshold has been raised from $5,000 to $10,000, making it more attainable for many.

- It's essential to be up to date on all your tax submissions. The IRS requires that all previous returns be filed and acknowledged before they can consider any assistance options.

- You need to demonstrate financial difficulties that prevent you from fully settling your tax obligations. This is crucial for accessing various assistance options.

- Compliance with IRS regulations is necessary, including making all required estimated payments to maintain your eligibility.

Statistics show that a significant number of taxpayers, especially those facing financial challenges, may qualify for the Fresh Start Program, raising the question of whether is fresh start tax relief legit, particularly if their tax debt is under $50,000. For example, individuals who have experienced job loss or medical emergencies often find themselves eligible for this program, which can help them manage their tax liabilities more effectively.

Moreover, recent changes to the program have simplified the qualification process, making it more accessible for those in need of assistance. As attorney Nick Nemeth puts it, "The New Start Initiative is the broader effort by the IRS to make tax debt assistance more accessible."

We understand that navigating tax issues can be daunting, but remember, there are options available to help you through this challenging time.

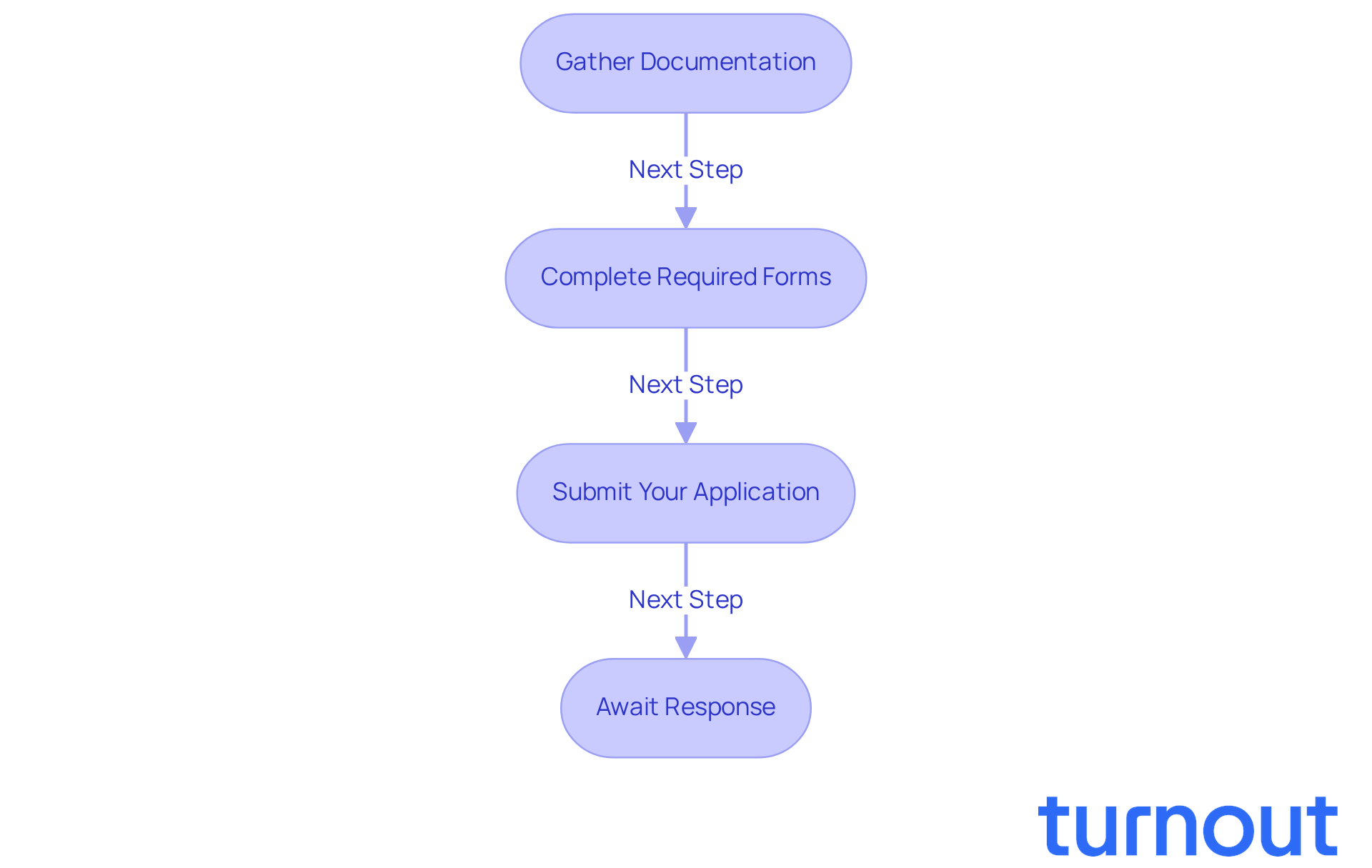

Steps to Apply for the IRS Fresh Start Program

While applying for the IRS Fresh Start Program can feel overwhelming, many wonder, is fresh start tax relief legit? We're here to help you navigate this journey with ease. Here are some essential steps to ensure a smooth process:

-

Gather Documentation: Start by collecting all necessary financial documents, such as income statements, tax returns, and any relevant records that showcase your financial situation. Precise documentation is crucial, as it supports your application and helps the IRS evaluate your eligibility for assistance. Remember, filing all required tax returns is a critical eligibility requirement.

-

Complete Required Forms: Next, fill out the appropriate IRS forms based on the relief option you’re pursuing. For an Offer in Compromise, you’ll need to complete Form 656, while Form 9465 is required for an installment agreement. Make sure all information is accurate and complete to avoid any delays.

-

Submit Your Application: Once your forms are ready, submit them along with any required fees to the IRS. The application process has been streamlined, allowing for online submissions that can expedite your request. Applying early in the year can lead to faster processing times, as the IRS typically has fewer backlogged cases outside of peak tax season.

-

Await Response: After submission, the IRS will review your application. This process can take several weeks, so it’s important to remain patient. If they request additional documentation, respond promptly to keep your application active and avoid unnecessary delays. It’s good to know that applying for New Start options doesn’t create a credit inquiry, but be aware that the IRS can file a Notice of Federal Tax Lien, which might make you wonder, is fresh start tax relief legit?

Real-life examples illustrate why many people wonder if fresh start tax relief is legit. Take Dana, for instance. She originally owed almost $50,000 but successfully lowered her debt to $41,800 and now pays $490 monthly under a Start Over agreement. Similarly, Tyrell faced a tax bill of $72,000 but negotiated a Partial Payment Installment Agreement, allowing him to pay just $365 per month while avoiding liens or levies on his home.

As we move into 2025, the IRS continues to stress the importance of accurate documentation and compliance with tax obligations. By following these steps and keeping comprehensive records, you can navigate the Start Program effectively and work towards resolving your tax debts. Remember, you are not alone in this journey.

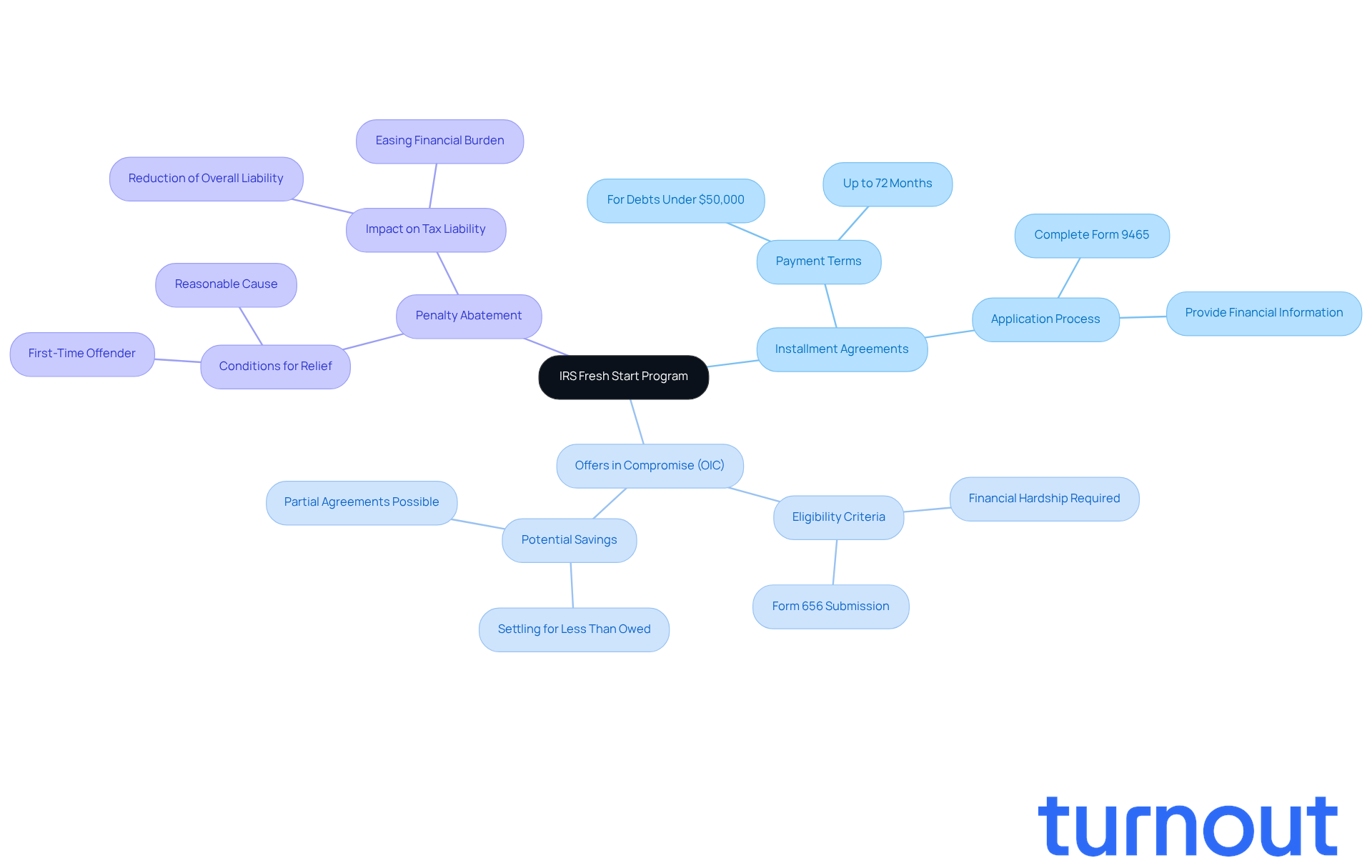

Exploring Tax Relief Options Under the IRS Fresh Start Program

The IRS Fresh Start Program offers several compassionate tax relief options designed to help you manage your tax obligations with ease:

-

Installment Agreements: If you're feeling overwhelmed by tax debt, this option allows you to pay it off over time with manageable monthly payments. For those who owe less than $50,000, you can set up long-term payment plans lasting up to 72 months. This way, you can tackle your financial burdens without the added stress.

-

Offers in Compromise (OIC): We understand that sometimes life can throw unexpected challenges your way. This program lets you settle your tax debts for less than what you owe, based on your financial situation. While complete debt relief is rare, many have found partial agreements achievable. The OIC process has become more accessible, and you’ll need to show financial hardship and provide detailed disclosures to qualify.

-

Penalty Abatement: If you’re a first-time offender or have a reasonable cause for non-compliance, this option can help you reduce certain penalties. By having penalties removed, you could significantly lessen your overall tax liability, easing your financial burden.

The IRS New Start Program has been revised to make the application process simpler and raise eligibility thresholds, making it more attainable for individuals facing tax debt. For example, the threshold for filing a lien has increased from $5,000 to $10,000, which means fewer taxpayers will face liens on their credit reports. Plus, faster processing times for applications have been implemented, enhancing the program's overall efficiency.

Real-world examples show just how effective these options can be. Many taxpayers who successfully navigate the Offer in Compromise process report significant savings, allowing them to regain their financial stability. Additionally, maintaining a steady payment record under Installment Agreements can improve your chances of approval for future assistance options, highlighting the importance of proactive financial management.

Overall, the IRS New Start Program represents a genuine and organized way to ease tax burdens, prompting inquiries about whether is fresh start tax relief legit. It provides various pathways for individuals like you to address tax obligations and regain control over your financial situation. Remember, you’re not alone in this journey; we’re here to help.

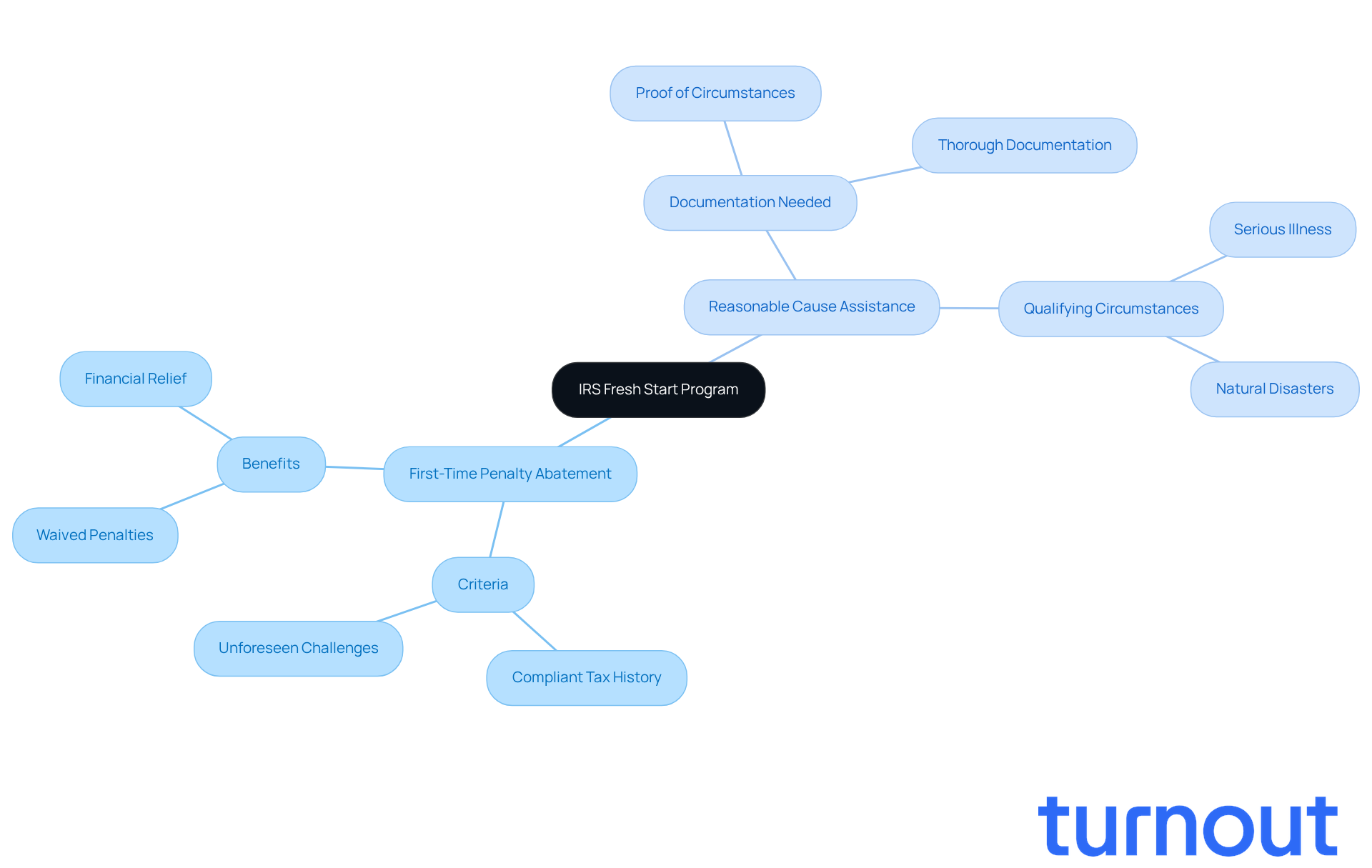

Penalty Relief: How the IRS Fresh Start Program Can Help

Many taxpayers wonder if the IRS Fresh Start Program is fresh start tax relief legit, as it offers significant benefits, especially for those facing financial challenges. If you’re feeling overwhelmed, know that there are options available to help you navigate this tough time.

-

First-Time Penalty Abatement: This provision allows first-time offenders to have specific penalties waived, provided they meet certain criteria. It can truly be a game-changer for those who have maintained a compliant tax history but have encountered unforeseen challenges.

-

Reasonable Cause Assistance: You can request penalty assistance by showing that your non-compliance was due to circumstances beyond your control, like serious illness or natural disasters. This option acknowledges that life can throw curveballs, even to the most diligent taxpayers.

Real-life examples highlight how effective these assistance options can be. Many taxpayers have successfully utilized first-time penalty abatement to eliminate penalties that would otherwise add significant financial strain. Additionally, data shows that reasonable cause assistance requests often lead to favorable outcomes for individuals who provide thorough documentation of their circumstances.

The IRS Fresh Start Program has been revised to improve access to these options, making it easier for you to navigate the complexities of penalty abatement. However, it’s important to recognize that the IRS has a backlog in processing penalty waivers, which may lead to delays in obtaining assistance. We understand that this can be frustrating, but these programs provide legitimate pathways to reduce tax burdens, leading to the question of whether is fresh start tax relief legit, especially for those who have faced temporary hardships.

By leveraging these options, you can regain control over your financial situation and work towards a more stable future. In fact, the IRS abated $50.9 billion in penalties during the last fiscal year, underscoring the program's effectiveness. Just remember, penalties can still apply even if you’re owed a refund due to underpayment of estimated taxes. You are not alone in this journey, and we’re here to help.

Timeline for Relief: How Long Does the IRS Fresh Start Program Take?

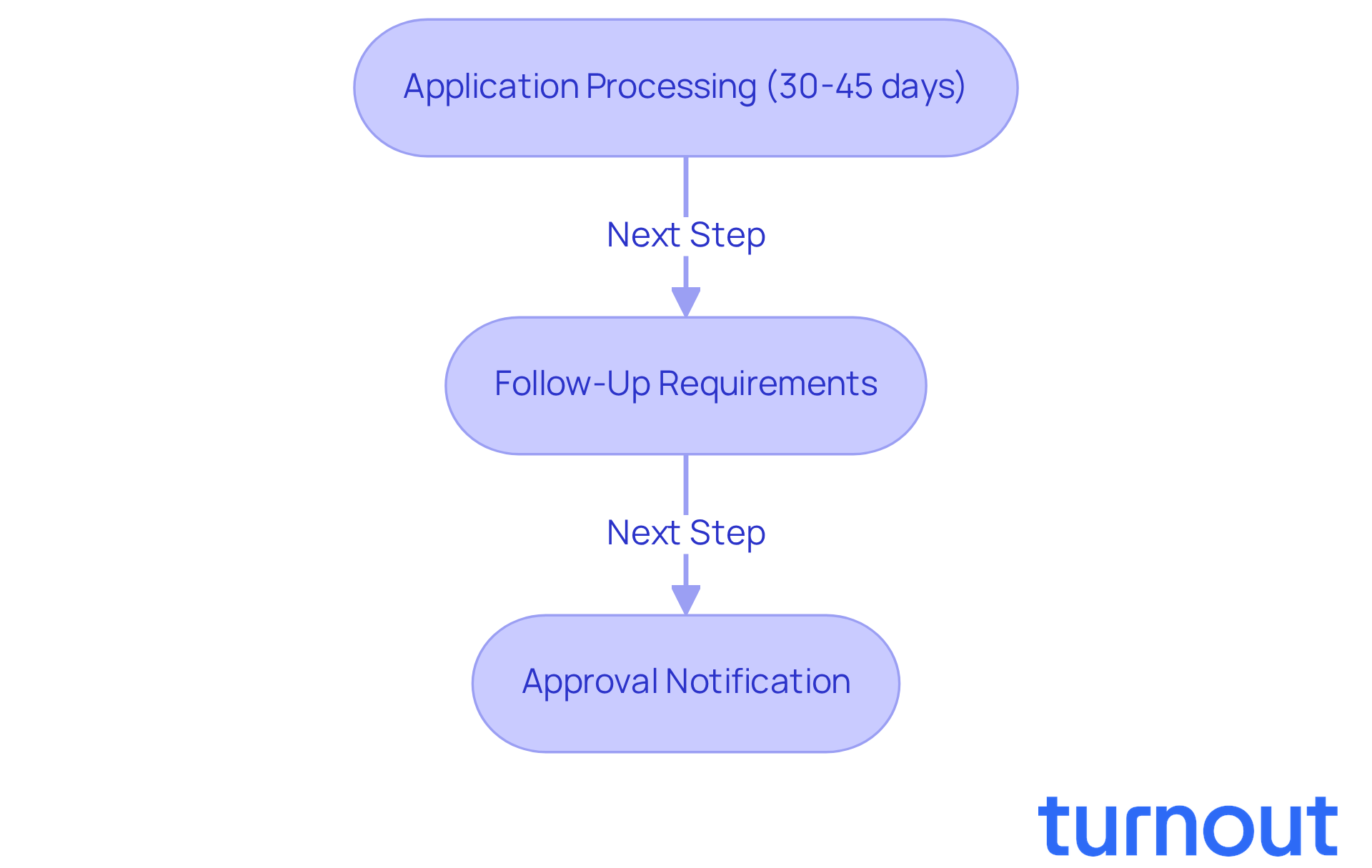

Navigating tax relief can feel overwhelming, but many wonder, is fresh start tax relief legit, as the IRS Fresh Start Program offers a path forward. Understanding the timeline for relief is crucial, and it can vary based on several factors:

- Application Processing Time: Typically, the IRS takes about 30 to 45 days to process applications for installment agreements or offers in compromise. Tax attorney Alyssa Whatley shares, "Nearly all of the OICs I have drafted have been accepted by the IRS, which means my clients were able to settle their tax debt for less than the total they originally owed."

- Follow-Up Requirements: Sometimes, the IRS may request additional documentation or information, which can extend the timeline. It’s common to feel anxious about possible follow-ups, but being prepared can help. The National Taxpayer Advocate notes that timely responses to IRS requests can significantly impact processing times.

- Approval Notification: Once your application is approved, you’ll receive a notification detailing your payment plan or settlement terms. This communication is essential for understanding your next steps in the assistance process.

Statistics show that timely follow-ups can greatly influence relief timelines. For instance, taxpayers who respond promptly to IRS requests often experience faster processing times. Engaging with a tax professional can also streamline this process, ensuring that all necessary documentation is submitted correctly and on time.

Many taxpayers wonder, is fresh start tax relief legit, as the IRS New Start Program allows more individuals to qualify for an Offer in Compromise (OIC), leading to a more favorable resolution of tax debts. Remember, you’re not alone in this journey. We’re here to help you navigate these challenges and find the relief you deserve.

What to Do If Your IRS Fresh Start Program Application Is Denied

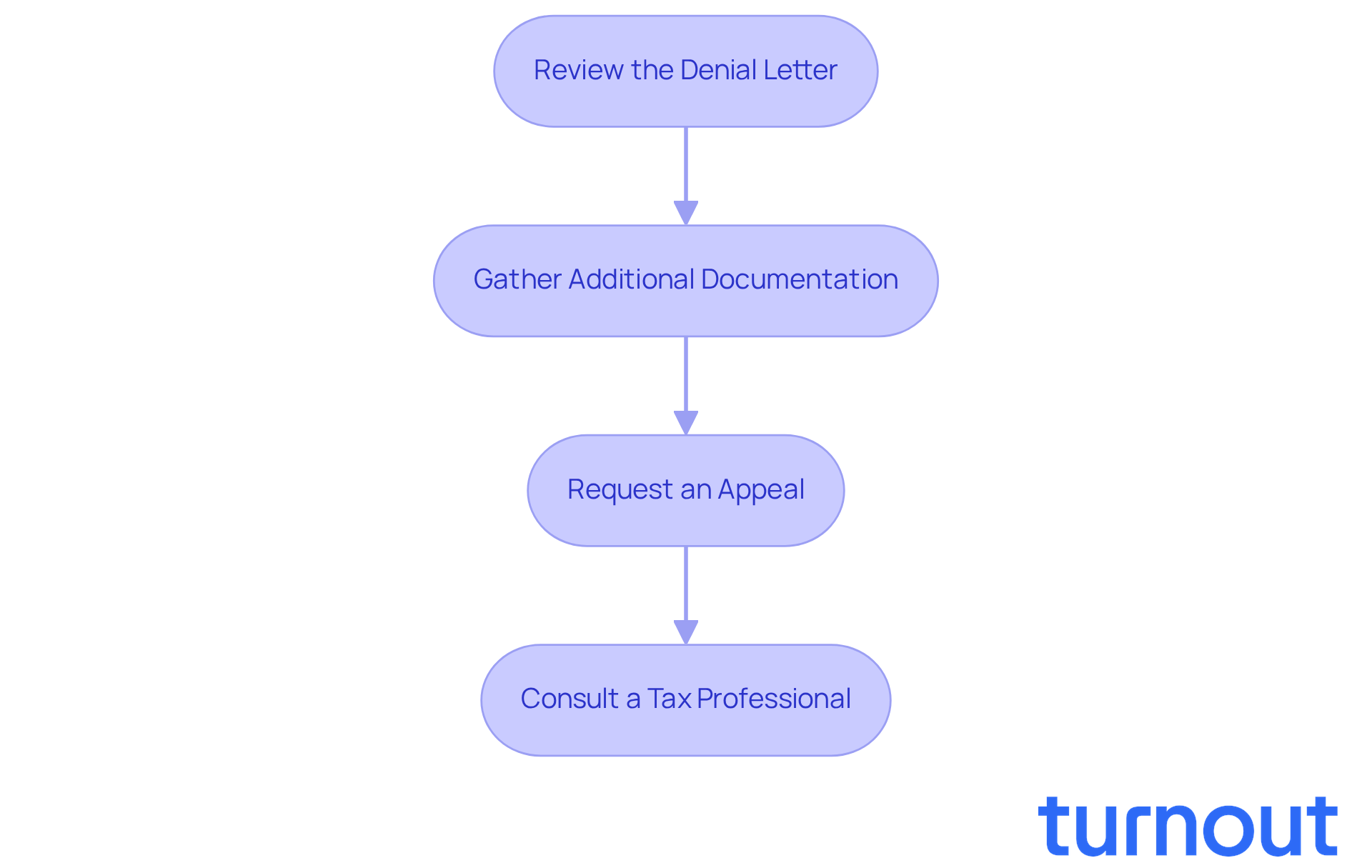

If your application for the IRS Fresh Start Program is denied, don’t worry. You can take steps to improve your chances of a successful appeal. Here’s how:

-

Review the Denial Letter: Take a moment to carefully examine the letter. Understanding the specific reasons for the denial is crucial. Common issues often include incomplete documentation or not meeting eligibility criteria.

-

Gather Additional Documentation: If the denial was due to insufficient information, it’s time to compile the necessary documents that can support your case. This may include financial records, tax returns, and any other relevant paperwork.

-

Request an Appeal: You can initiate the appeal process by submitting IRS Form 13711 within 30 days of receiving the denial. Make sure your appeal clearly addresses the reasons outlined in the denial letter.

-

Consult a Tax Professional: Engaging a tax professional can significantly enhance your appeal's success. They can provide expert guidance on alternative options and help you navigate the complexities of the IRS process. Remember, having a knowledgeable representative can make a substantial difference in the outcome of your appeal.

Real-life examples show just how effective this approach can be. For instance, one taxpayer who faced a denial successfully appealed by providing extra financial documentation and working closely with a tax expert. This collaboration ultimately raised the question of whether is fresh start tax relief legit under the Fresh Start Program. It highlights the importance of thorough preparation and expert assistance in overcoming application challenges.

By following these steps and seeking professional support, you can enhance your chances of a favorable resolution to your IRS Fresh Start Program application. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

The IRS Fresh Start Program offers a genuine and effective way for taxpayers facing tax debt to find relief. We understand that dealing with financial challenges can be overwhelming, but this program provides various options tailored to your unique situation. With a focus on flexibility and accessibility, it empowers you to take control of your finances, reminding you that support is available when you need it most.

Since its inception, the Fresh Start Program has successfully assisted millions, offering benefits like streamlined payment plans, reduced penalties, and the chance to withdraw tax liens. It’s crucial to grasp the eligibility requirements and the application process, as well as to dispel common myths that may lead to misunderstandings about what the program can truly offer.

Ultimately, the IRS Fresh Start Program shines as a beacon of hope for those navigating financial difficulties. By utilizing the resources available and seeking professional guidance, you can confidently navigate this complex landscape. Embracing these opportunities not only opens the door to immediate relief but also fosters long-term financial stability. Remember, you are not alone in this journey; support is readily available to help you achieve a fresh start.

Frequently Asked Questions

What is Turnout and how does it assist with tax relief?

Turnout is an AI-driven platform designed to simplify the experience of managing tax debt, particularly for those considering the IRS Fresh Start Program. It provides timely updates and personalized support through a partnership with nonlawyer advocates and IRS-licensed enrolled agents.

Is Turnout a law firm?

No, Turnout is not a law firm and does not provide legal representation. Instead, it offers expert guidance and support without the complexities of legal advice.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is a legitimate initiative launched in 2011 to assist taxpayers struggling with tax debt. It offers various relief options, including installment agreements and offers in compromise, to help individuals manage their debts and work towards financial recovery.

How has the IRS Fresh Start Program changed since its launch?

As of December 2025, the qualification process for the Fresh Start Program has been simplified, particularly for self-employed individuals facing significant income drops, making it more accessible.

What are some key benefits of the IRS Fresh Start Program?

Key benefits include flexible payment options, reduced penalties, opportunities to withdraw tax liens, and a broader range of relief options tailored to individual financial situations.

What are the eligibility requirements for the IRS Fresh Start Program?

To be eligible, all required tax returns must be filed, and individuals in active bankruptcy proceedings do not qualify. It is also important to meet IRS filing and compliance requirements.

What kind of financial relief can taxpayers expect from the Fresh Start Program?

Many participants see significant reductions in their total tax liabilities, with some settling debts for 90% or more less than what they owe. The program has a 21% acceptance rate for offers in compromise submitted.

How can taxpayers apply for assistance through the Fresh Start Program?

Taxpayers can apply for assistance at any time, provided they meet the necessary IRS filing and compliance requirements. Consulting with a licensed professional is recommended for personalized advice.

Are there any ongoing costs associated with tax debts under the Fresh Start Program?

Yes, ongoing interest charges continue to apply to tax debts even while participating in the Fresh Start Program.

What should individuals do if they feel overwhelmed by their tax debt?

Individuals are encouraged to seek help and remember that they are not alone in their journey. Utilizing resources like Turnout and the IRS Fresh Start Program can provide guidance and support towards financial stability.