Introduction

Navigating the complexities of financial support during challenging times can be overwhelming. We understand that understanding the tax implications surrounding disability income is essential for anyone in this situation. With various sources of assistance, like Social Security Disability Insurance (SSDI) and private insurance, knowing how these benefits are taxed can significantly impact your financial planning.

But here’s a common question: is disability income always tax-free? It’s a misconception that many hold. This article delves into the nuances of disability income taxation, revealing critical distinctions that can affect recipients. We’re here to help you understand these complexities and avoid unexpected tax liabilities.

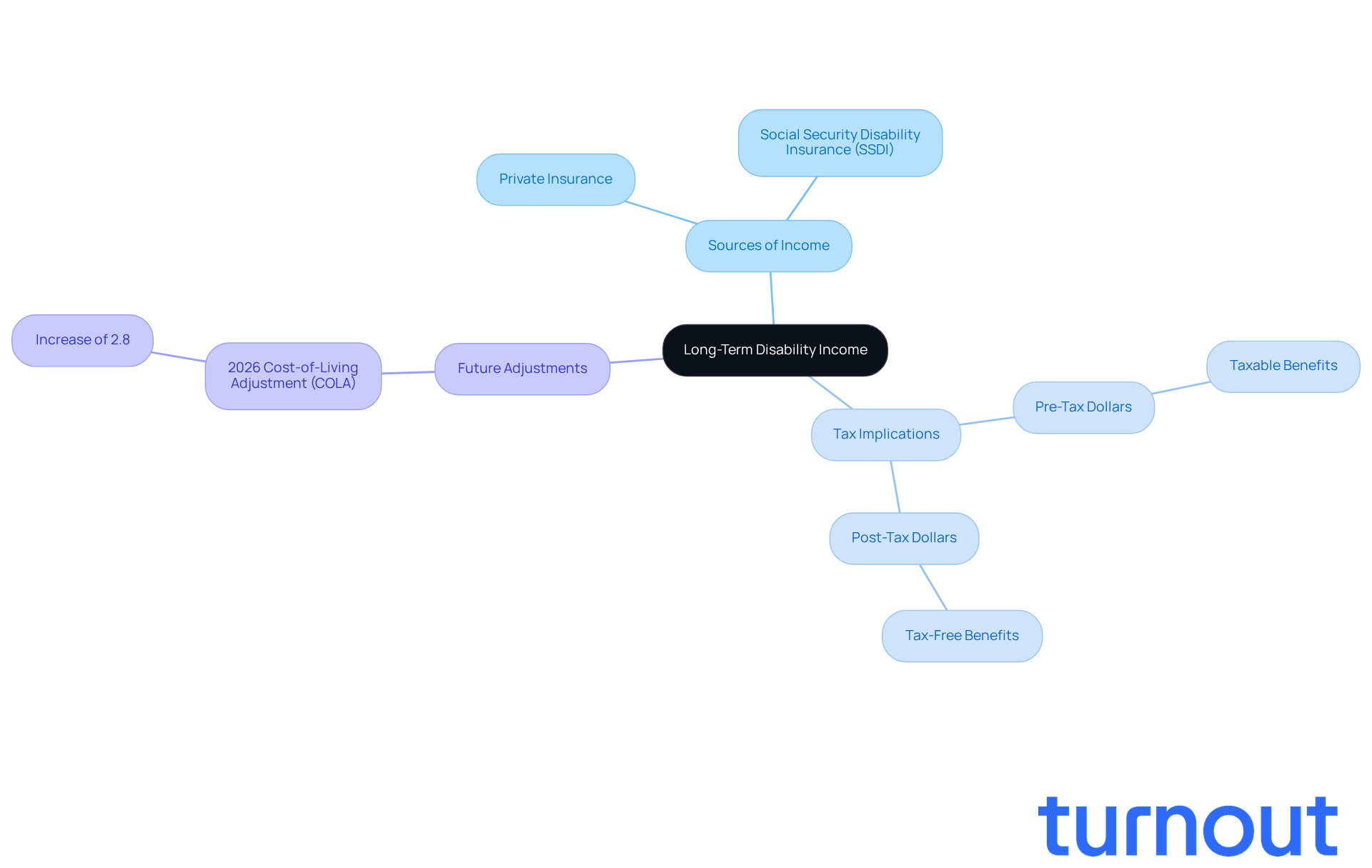

Define Long-Term Disability Income and Its Tax Implications

If you’re facing a long-term medical condition that keeps you from working for more than six months, it’s important to know that there’s support available. Financial assistance can come from various sources, like private insurance plans or state programs such as Social Security Disability Insurance (SSDI).

Understanding the tax implications of whether disability income is taxed can feel overwhelming, but it’s crucial. The question of how disability income is taxed arises, as benefits funded by pre-tax dollars are generally taxable, while those covered by after-tax dollars usually remain tax-free. For instance, if your insurance premiums are deducted from your salary before taxes, you might question whether disability income is taxed, since any payments you receive will be subject to taxation. Conversely, if you pay premiums with post-tax earnings, this raises the question of whether disability income is taxed on those benefits. This distinction matters greatly, as it directly affects how disability income is taxed in your tax reporting and compliance.

Looking ahead, in 2026, SSDI recipients will receive a cost-of-living adjustment (COLA) of 2.8%. This change could significantly impact your financial planning.

We understand that navigating these details can be challenging. Comprehending the nuances of assistance programs and tax responsibilities is vital. Remember, you’re not alone in this journey. We’re here to help you make sense of it all.

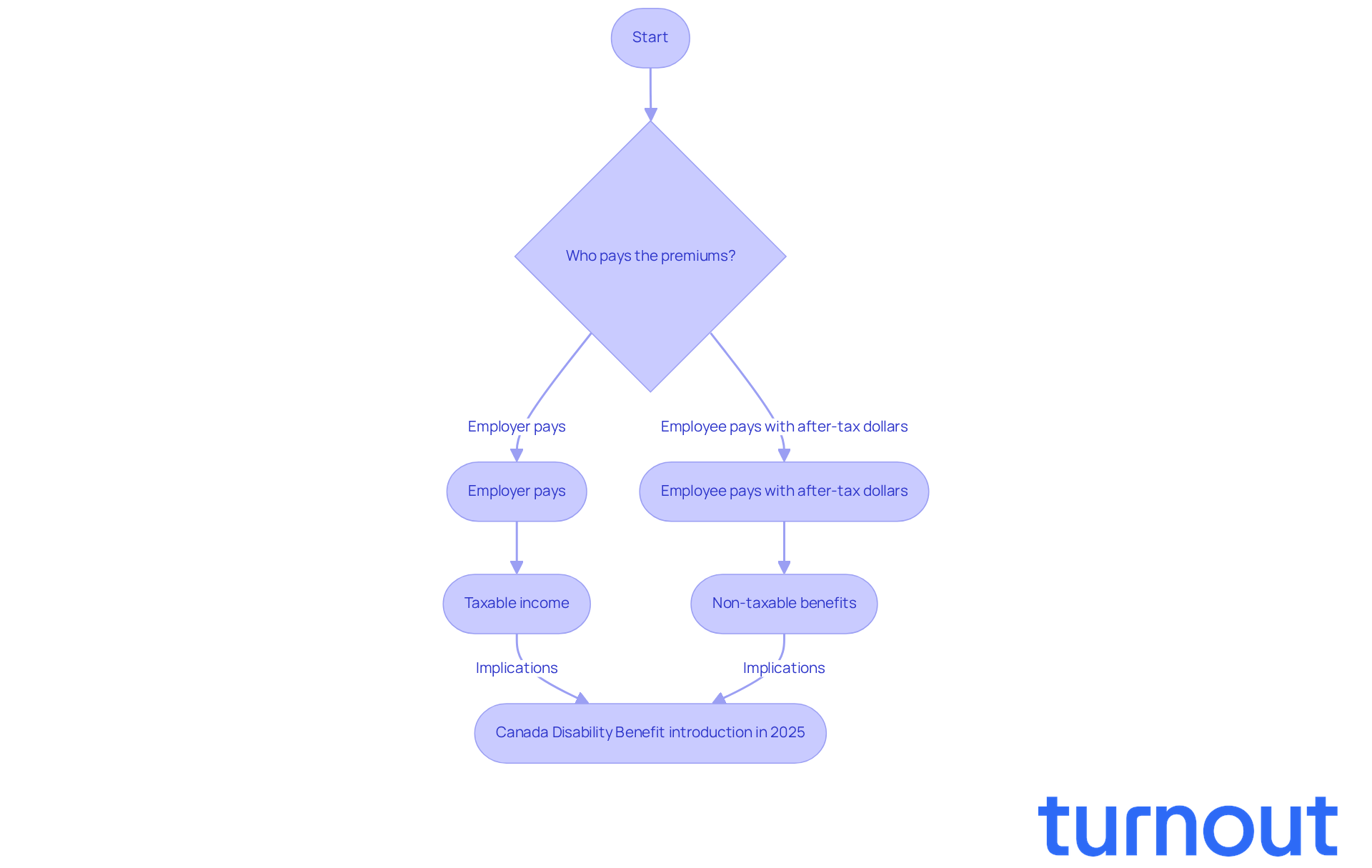

Contextualize Taxation of Long-Term Disability Income in Canada

In Canada, a common inquiry is whether disability income is taxed, as long-term support payments are generally considered taxable income. We understand that navigating these financial waters can be challenging. According to the Canada Revenue Agency (CRA), if an employer pays the premiums for income protection insurance, the payments received by the employee are subject to taxation. However, if the employee pays the premiums using after-tax dollars, those advantages remain non-taxable. This distinction is crucial for Canadians obtaining support, as it significantly impacts their net income and tax obligations.

The introduction of the Canada Disability Benefit in 2025 aims to provide additional financial support to individuals with disabilities. It's common to feel overwhelmed by the tax implications linked to these benefits, especially when wondering if disability income is taxed, which can lead to unexpected tax liabilities. For instance, if a worker receives benefits from a plan where the employer covered the premiums, they must disclose this income on their tax return, potentially affecting their overall tax situation.

Real-life examples highlight these complexities: individuals who have paid their premiums entirely with after-tax dollars can enjoy tax-free benefits, while those whose employers contributed may face tax obligations on the benefits received. Understanding whether disability income is taxed is vital for effective financial planning and ensuring compliance with CRA regulations regarding tax guidelines for individuals with disabilities.

At Turnout, we’re here to help you navigate these complexities, especially if you’re seeking Social Security Disability (SSD) claims and tax relief. Our trained nonlawyer advocates are ready to assist you in understanding your benefits and tax obligations, ensuring you feel informed and prepared. Remember, you are not alone in this journey. As Matt Lalande emphasizes, navigating these tax implications is essential to avoid financial surprises.

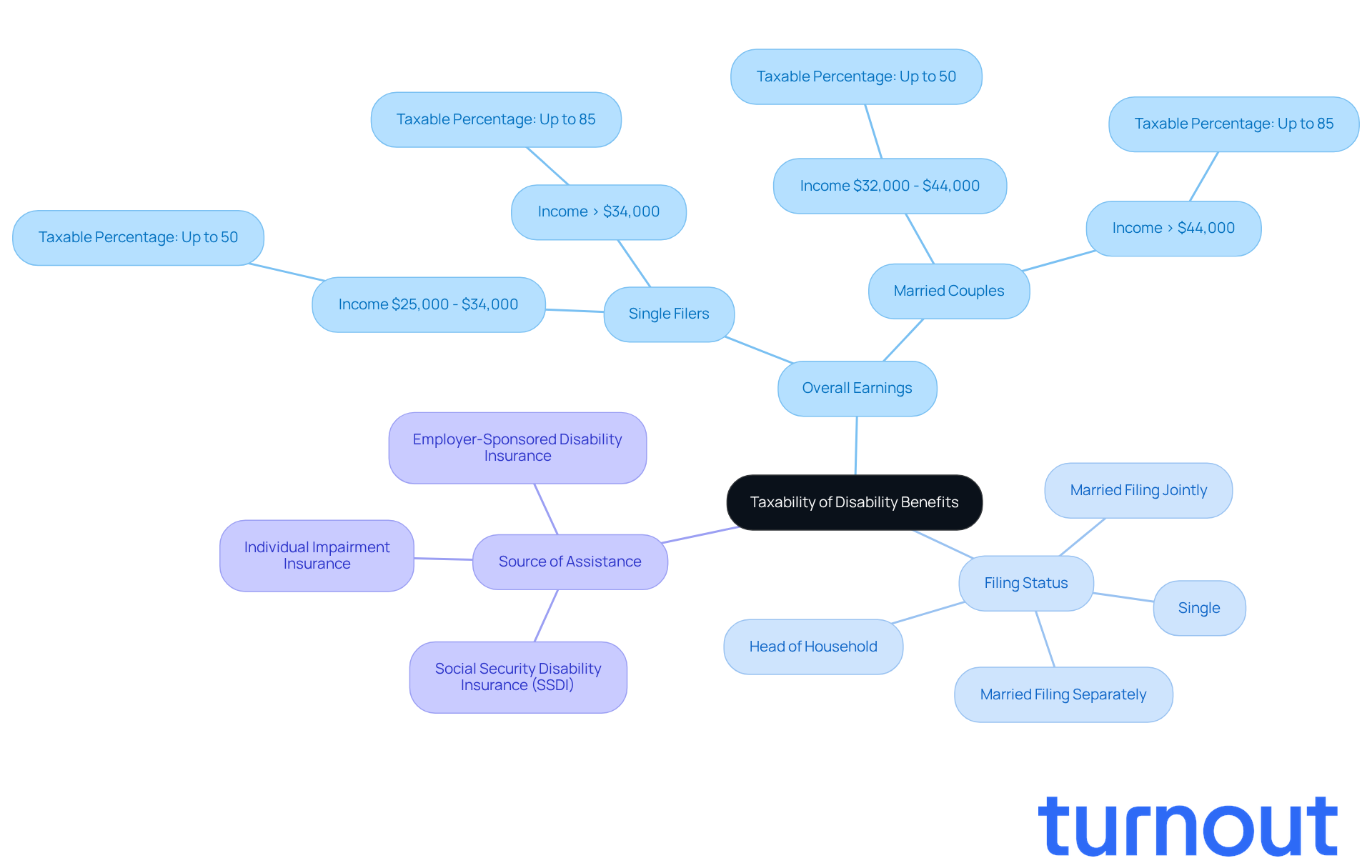

Identify Key Factors Influencing Taxability of Disability Benefits

Navigating the tax implications of disability assistance, particularly regarding how disability income is taxed, can feel overwhelming, and we understand that. Various essential elements come into play, such as your overall earnings, filing status, and the source of your assistance. In the U.S., if your combined earnings exceed $25,000 as a single filer or $32,000 as a married couple filing jointly, a portion of your Social Security Disability Insurance (SSDI) payments may be taxable.

Specifically:

- If you're a single filer earning between $25,000 and $34,000, up to 50% of your SSDI payments could be taxed.

- For married couples filing jointly with earnings between $32,000 and $44,000, the same applies.

- If your total earnings go beyond $34,000 as an individual or $44,000 as a couple, you might face taxation on up to 85% of your SSDI payments.

It's also important to consider the type of income protection insurance you have-whether it's employer-sponsored or privately acquired-as this can significantly affect your tax liability. For instance, while SSDI payments are generally taxable if you have additional earnings, individual impairment insurance payouts are often not taxable if you paid the premiums with after-tax funds.

Understanding these factors is crucial for you to accurately assess whether disability income is taxed and plan accordingly. Remember, you’re not alone in this journey. Turnout offers access to trained nonlawyer advocates who can help you navigate these complexities, ensuring you’re aware of your rights and responsibilities.

We encourage you to consult a tax professional to gain a clearer understanding of your obligations. Additionally, keep in mind that starting in 2025, eight states will tax Social Security payments, which could further influence your tax situation based on where you live. We're here to help you through this process.

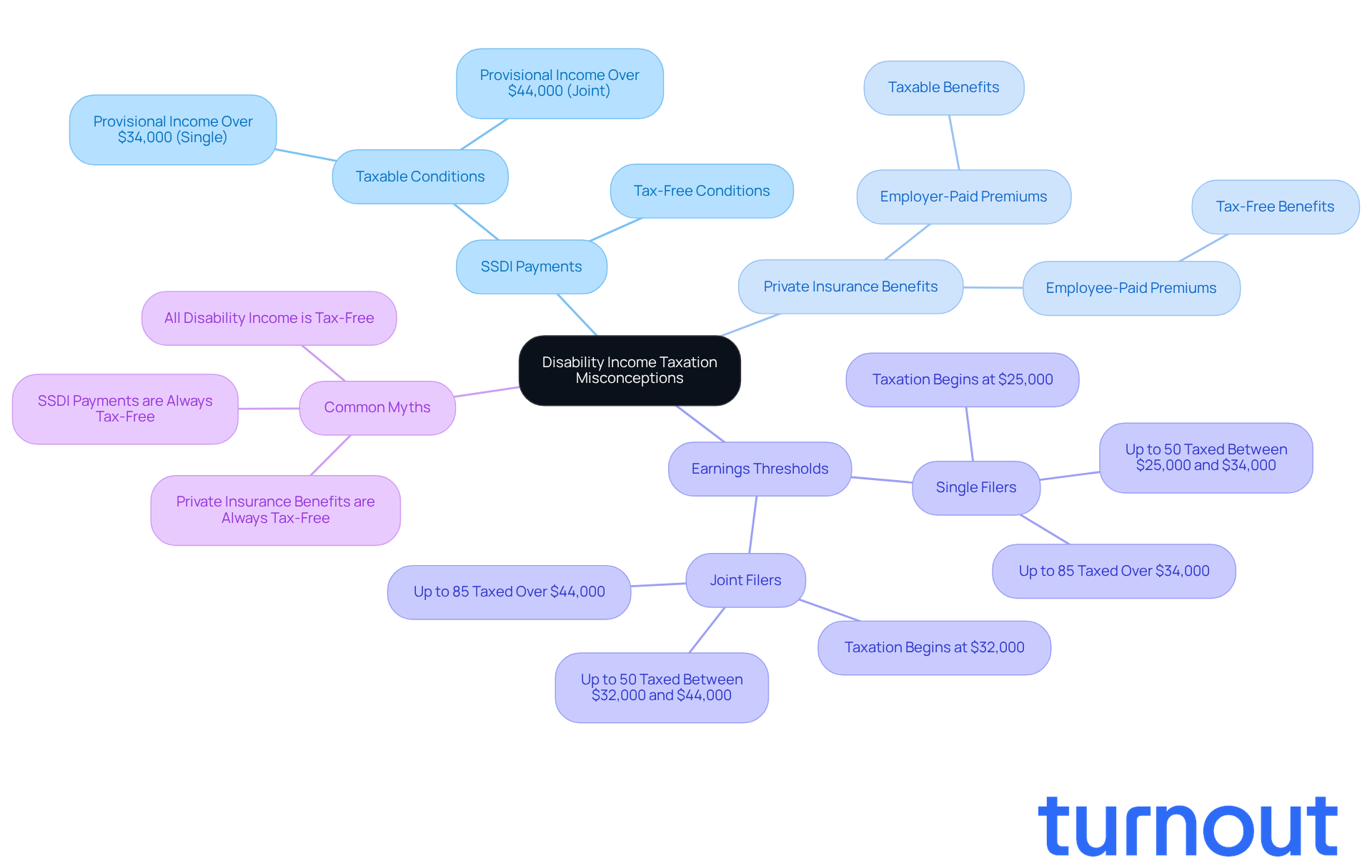

Address Common Misconceptions About Disability Income Taxation

Misunderstandings about whether disability income is taxed can lead to significant financial stress for recipients. It’s a common belief that all disability assistance is tax-free, but the question remains: is disability income taxed in certain circumstances? For instance, while Social Security Disability Insurance (SSDI) payments may remain untaxed for individuals with lower earnings, they can become taxable once earnings exceed certain thresholds. Specifically, SSDI recipients might find their payments taxed at rates of up to 85% if their provisional income goes over $34,000 for single filers or $44,000 for joint filers. Additionally, benefits from private insurance aren’t automatically tax-free; whether they are taxable depends on how the premiums were paid. If an employer covered the premiums, those benefits may be subject to taxation, while rewards from premiums paid solely by the employee typically remain tax-free.

We understand that navigating these complexities, particularly regarding how disability income is taxed, can be overwhelming. Insights from tax professionals emphasize the importance of clarity and careful planning to avoid unexpected tax liabilities. The 2025 Act did not eliminate federal taxation on Social Security payments, underscoring the need for recipients to grasp the current tax landscape.

Turnout, which is not a law firm and does not provide legal advice, offers essential tools and services to help individuals manage these challenges, especially concerning SSD claims and tax debt relief. By utilizing trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout ensures that beneficiaries receive the support they need without the requirement of legal representation.

Consider this: many SSDI recipients mistakenly believe their assistance is entirely tax-free, only to face tax obligations due to increased earnings from other sources. Another example highlights the importance of understanding the nuances of tax treatment for support benefits; even small changes in earnings can lead to significant tax consequences.

Overall, it’s crucial for beneficiaries to recognize these myths and understand how disability income is taxed. This understanding empowers them to make informed financial decisions regarding their support payments. Consulting with tax advisors, along with the support from Turnout, is a recommended step to effectively navigate the complexities of whether disability income is taxed. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding the taxation of disability income is crucial for anyone facing long-term medical conditions that hinder their ability to work. We know that navigating these complexities can be overwhelming. The taxability of disability income depends on several factors, including the source of the premiums and the recipient's overall earnings. Gaining clarity on these points can significantly influence your financial planning and compliance with tax regulations.

Key insights show that:

- Benefits funded by pre-tax dollars are generally taxable.

- Benefits covered by after-tax dollars may remain tax-free.

- In the U.S., income thresholds determine the taxability of Social Security Disability Insurance (SSDI) payments, with potential taxation of up to 85% for higher earners.

- In Canada, understanding the difference between employer-paid and employee-paid premiums is essential for determining tax obligations.

- As new benefits like the Canada Disability Benefit emerge, grasping these distinctions becomes even more critical.

Ultimately, it’s vital for individuals receiving disability income to recognize the nuances of taxation to avoid unexpected financial burdens. We encourage you to consult with tax professionals and utilize resources like Turnout for support in navigating these challenges. Remember, empowerment through knowledge is key. You can make informed decisions about your financial future, and you are not alone in this journey.

Frequently Asked Questions

What is long-term disability income?

Long-term disability income refers to financial assistance available to individuals facing a long-term medical condition that prevents them from working for more than six months. This assistance can come from private insurance plans or state programs such as Social Security Disability Insurance (SSDI).

How is long-term disability income taxed?

The taxation of long-term disability income depends on how the benefits are funded. Benefits funded by pre-tax dollars are generally taxable, while those funded by after-tax dollars usually remain tax-free. If insurance premiums are deducted from your salary before taxes, the disability income received will be subject to taxation. Conversely, if premiums are paid with post-tax earnings, the disability income may not be taxed.

What is the significance of the cost-of-living adjustment (COLA) for SSDI recipients?

In 2026, SSDI recipients will receive a cost-of-living adjustment (COLA) of 2.8%. This adjustment is significant as it can impact financial planning for those relying on SSDI for support.

Why is it important to understand the tax implications of disability income?

Understanding the tax implications of disability income is crucial because it affects how individuals report their income and comply with tax responsibilities. Knowing whether benefits are taxable can significantly influence financial planning and budgeting.

What resources are available for individuals navigating long-term disability and tax issues?

Various resources are available, including private insurance plans and state programs like SSDI. Additionally, there are support services to help individuals understand the nuances of assistance programs and tax responsibilities related to long-term disability income.