Introduction

Navigating the complexities of tax relief can feel overwhelming, especially when faced with mounting IRS debts. We understand that many individuals find themselves at a crossroads: should they enlist professional IRS tax relief companies, or tackle their tax issues on their own? This article aims to explore the advantages and disadvantages of both approaches, shedding light on how each option can affect your financial outcomes and personal stress levels.

With so much at stake, it’s common to wonder: is it wiser to seek expert help, or take matters into your own hands? You are not alone in this journey, and we’re here to help you find the best path forward.

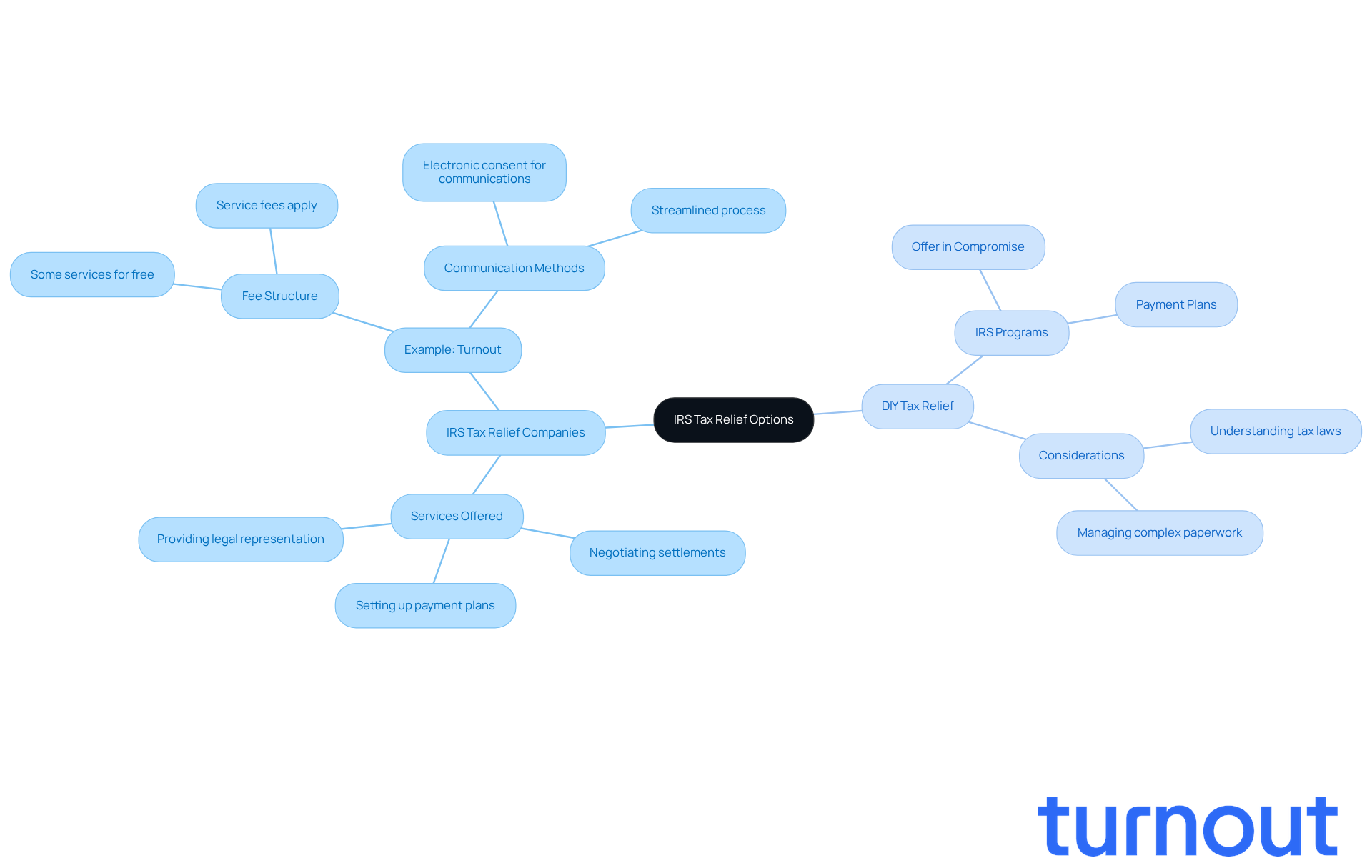

Understanding IRS Tax Relief Companies and DIY Tax Relief

Navigating tax debts can be overwhelming; that's where the services of IRS tax relief companies are essential. These IRS tax relief companies are dedicated to helping individuals negotiate with the IRS to resolve their tax issues. They offer a range of services, including:

- Setting up payment plans

- Negotiating settlements

- Providing legal representation

With tax professionals on their team, these IRS tax relief companies understand the complexities of tax law and can effectively guide you through the IRS's processes.

Take Turnout, for example. They have a clear fee structure, offering some services for free while others come with service fees. It's important to remember that government fees, which are separate, need to be paid before any paperwork can be submitted on your behalf. Turnout also ensures that clients consent to receive all communications electronically, including notices, agreements, and disclosures. This approach streamlines the process for those seeking financial assistance, making it easier for you to focus on what matters most.

On the other hand, some individuals choose the DIY route for tax relief. This means taking the initiative to resolve tax issues without professional help. You might apply for IRS programs like the Offer in Compromise or set up payment plans directly with the IRS. While this can save you money on fees, it’s essential to have a solid understanding of tax laws and the ability to manage complex paperwork on your own.

We understand that dealing with tax issues can feel daunting, but you are not alone in this journey. Whether you choose to work with a professional or tackle it yourself, there are options available to help you find relief.

Pros and Cons of IRS Tax Relief Companies

Pros and Cons of IRS Tax Relief Companies

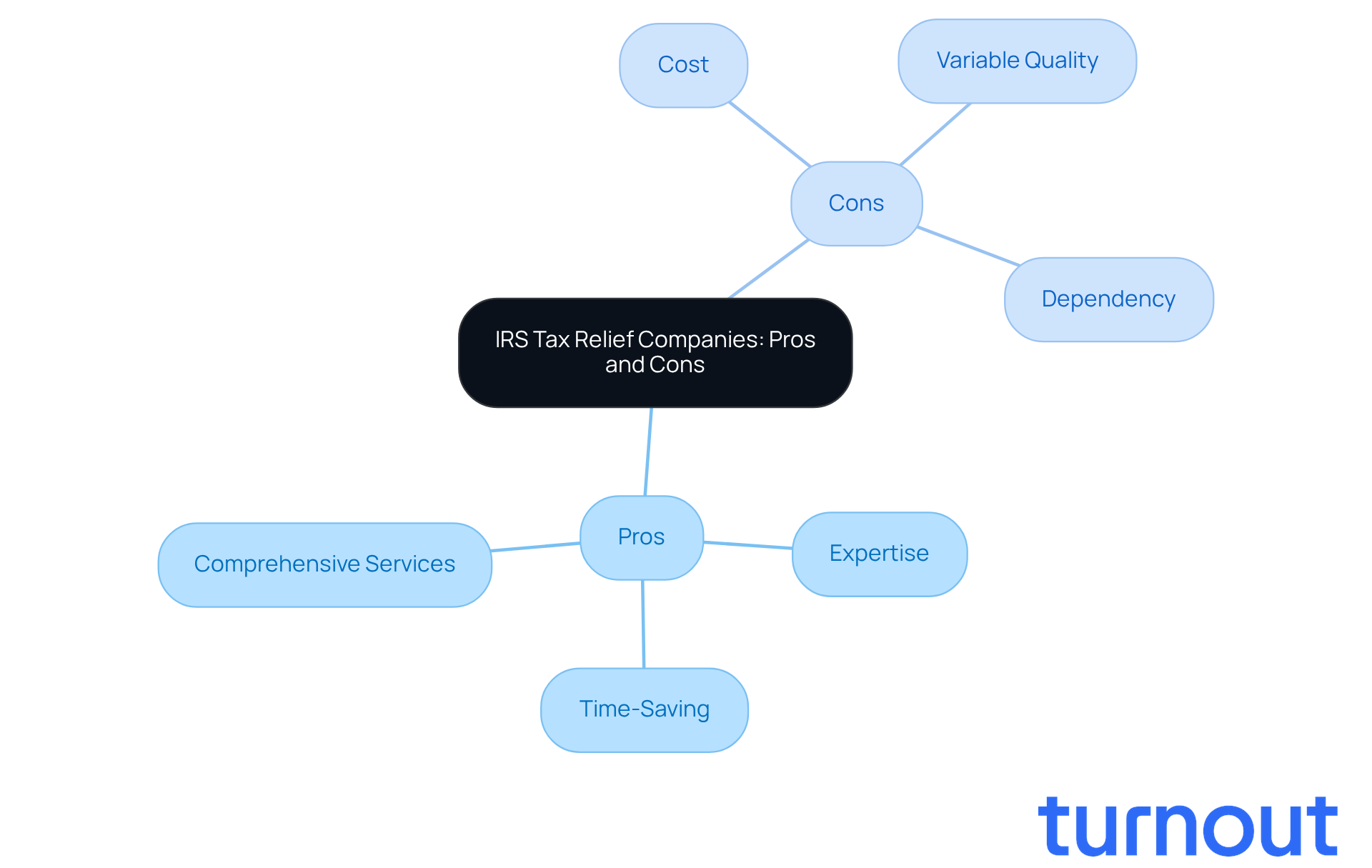

Pros:

- Expertise: We understand that navigating tax law can be overwhelming. IRS tax relief companies employ professionals who have a deep understanding of tax regulations. This expertise can significantly increase your chances of achieving a favorable outcome. Their familiarity with IRS procedures can be invaluable when dealing with complex tax issues.

- Time-Saving: It’s common to feel stressed about tax-related concerns. These IRS tax relief companies can alleviate that burden by managing all communications and negotiations with the IRS. This allows you to focus on what truly matters in your life. In 2025, taxpayers will spend an estimated 7.1 billion hours complying with the tax code, so utilizing these services can save you substantial time. Many IRS tax relief companies provide a comprehensive range of services, including tax preparation, audit representation, and ongoing tax monitoring. This can be especially beneficial if you’re facing various tax challenges.

Cons:

- Cost: We know that financial concerns can weigh heavily on your mind. Engaging IRS tax relief companies can be costly, with fees typically ranging from hundreds to thousands of dollars, depending on the complexity of your case. Some companies may charge upfront fees that don’t guarantee successful outcomes, which can lead to financial strain. Americans will face at least $148 billion in out-of-pocket expenses for filing, highlighting the financial implications of hiring these services.

- Variable Quality: Variable quality is a crucial consideration, as the quality of service can vary significantly among IRS tax relief companies. Some may overpromise results, leaving clients feeling disappointed when expectations aren’t met. This inconsistency can lead to frustration and a lack of trust in the process.

- Dependency: Relying too heavily on a tax relief company can hinder your understanding of your own tax situation. This lack of personal insight may prove detrimental in the long run, especially if you face future tax issues without their support.

In conclusion, while the average time saved by utilizing these services can be substantial, it’s essential to weigh these benefits against the potential drawbacks. Remember, you’re not alone in this journey, and we’re here to help you make the best decision for your situation.

Pros and Cons of DIY Tax Relief

Pros and Cons of DIY Tax Relief

Pros:

- Cost-Effective: Choosing DIY tax relief can really help you save money. By avoiding professional fees, you can use those funds for other important things, especially if you're on a tight budget.

- Control: You have complete control over your tax situation. This means you can make informed decisions that fit your unique circumstances, which can boost your confidence in managing your finances.

- Learning Opportunity: Engaging in the tax relief process can deepen your understanding of tax laws and personal finance. This knowledge can be invaluable for your future financial decisions.

Cons:

- Complexity: Tax laws can be quite complicated. Without expert guidance, it’s easy to feel overwhelmed and confused about your options and requirements.

- Risk of Errors: Mistakes in paperwork or negotiations can lead to serious consequences, like increased tax liabilities or penalties. Many people who attempt DIY tax relief face issues that could have been avoided with the help of IRS tax relief companies.

- Time-Consuming: The DIY approach often demands a lot of time and effort. You’ll need to research tax regulations and communicate with the IRS, which can take away from other important responsibilities and lead to frustration.

As we look ahead to 2025, the risks of DIY tax relief become even more pronounced. The IRS is dealing with significant backlogs and outdated technology, making it harder to resolve tax issues. While DIY might seem appealing, the potential for costly mistakes is high. Many taxpayers find themselves in challenging situations that could have been avoided with professional support. Real-life stories illustrate how mismanagement can lead to prolonged disputes with the IRS and unexpected financial burdens.

Moreover, the IRS's Level of Service (LOS) metric shows that only 32% of incoming calls are answered by a live assistor. This highlights the difficulties you might face when seeking help. The compliance burden for Form 1040 reached a staggering $144 billion, emphasizing the financial implications of tax compliance. Taxpayers are expected to spend 7.1 billion hours complying with the tax code for Tax Year 2024, costing the economy $316 billion in lost productivity. This further illustrates how time-consuming DIY tax relief can be.

Remember, you’re not alone in this journey. If you’re feeling overwhelmed, seeking professional assistance might be the best step forward.

Comparative Analysis: Choosing Between IRS Tax Relief Companies and DIY Solutions

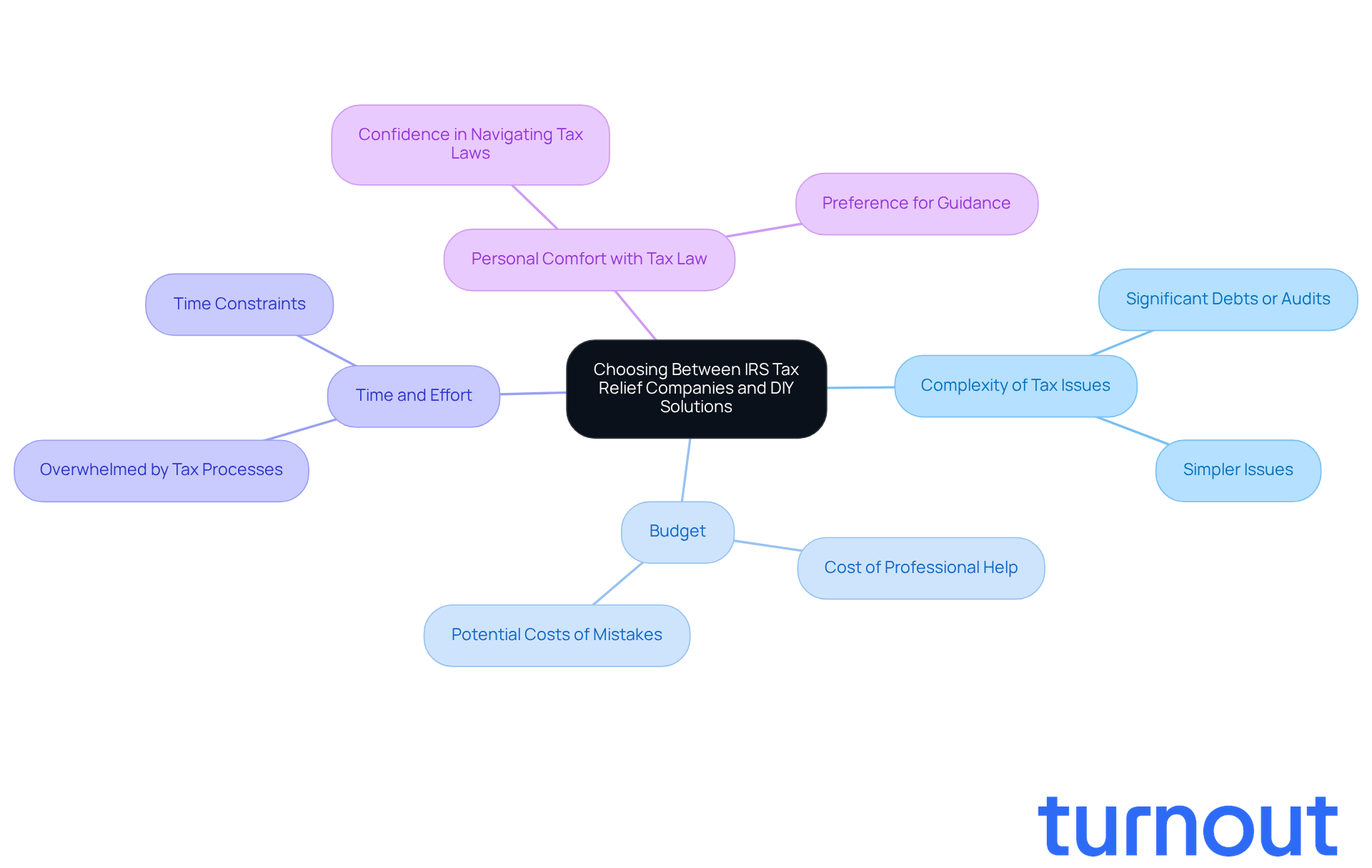

When choosing between DIY solutions and IRS tax relief companies, it's important to consider a few key factors that can significantly impact your experience.

-

Complexity of Tax Issues: We understand that tax situations can be complicated. If you’re facing significant debts or ongoing audits, professional assistance might be the best path forward. On the other hand, if your issues are simpler, you might find that DIY methods are manageable.

-

Budget: Cost is often a primary concern. If you’re watching your budget closely, DIY could be the way to go. However, it’s essential to weigh the potential costs of mistakes against the savings from not hiring a professional.

-

Time and Effort: Many people feel overwhelmed by tax processes, especially when time is limited. If this sounds like you, hiring IRS tax relief companies to handle negotiations and paperwork can relieve a lot of stress.

-

Personal Comfort with Tax Law: Do you feel confident navigating tax laws? If you have a solid understanding and are comfortable with the IRS, DIY might suit you. But if you prefer guidance, seeking professional help could be the right choice.

Ultimately, your decision should reflect your unique circumstances, financial situation, and comfort level with tax processes. Remember, you’re not alone in this journey, and we’re here to help you find the best solution.

Conclusion

Navigating the complexities of tax relief can feel overwhelming. Whether you’re considering the help of IRS tax relief companies or thinking about a DIY approach, it’s important to recognize that each option has its own pros and cons. We understand that assessing your unique situation is crucial before making a decision. Factors like your budget, the complexity of your tax issues, and your comfort level with tax regulations will guide your choice.

This article sheds light on both IRS tax relief companies and DIY tax relief methods. Professional services can provide expertise, save you time, and offer comprehensive support - especially valuable if you’re facing complicated tax situations. However, we know that costs and varying service quality can be concerning. On the other hand, the DIY route might be more budget-friendly and empowering. It allows you to take control and learn along the way, but it also comes with risks, such as potential errors and significant time commitments, particularly given the current challenges with the IRS.

In conclusion, choosing between IRS tax relief companies and DIY solutions isn’t just about preference; it’s about carefully considering your personal circumstances and financial implications. As tax laws and compliance burdens evolve, staying informed is key. Remember, you’re not alone in this journey. Whether you seek professional assistance or embark on a DIY path, understanding your options is essential for achieving effective tax relief. We’re here to help you find the best way forward.

Frequently Asked Questions

What are IRS tax relief companies and what services do they offer?

IRS tax relief companies help individuals negotiate with the IRS to resolve tax issues. Their services include setting up payment plans, negotiating settlements, and providing legal representation.

How do IRS tax relief companies assist clients with tax issues?

They employ tax professionals who understand the complexities of tax law and guide clients through the IRS's processes to effectively resolve tax debts.

Can you give an example of an IRS tax relief company?

Turnout is an example of an IRS tax relief company. They have a clear fee structure, offering some services for free while others come with service fees.

Are there any additional fees associated with IRS tax relief services?

Yes, government fees are separate and must be paid before any paperwork can be submitted on your behalf.

How does Turnout communicate with clients?

Turnout ensures that clients consent to receive all communications electronically, including notices, agreements, and disclosures, streamlining the process for financial assistance.

What is DIY tax relief?

DIY tax relief involves individuals taking the initiative to resolve their tax issues without professional help, such as applying for IRS programs like the Offer in Compromise or setting up payment plans directly with the IRS.

What are the benefits of choosing the DIY route for tax relief?

The DIY approach can save money on fees, but it requires a solid understanding of tax laws and the ability to manage complex paperwork independently.

What should individuals consider when deciding between IRS tax relief companies and DIY tax relief?

Individuals should consider their understanding of tax laws, their comfort with managing paperwork, and whether they prefer professional assistance or want to handle the process themselves.