Overview

This article addresses the IRS rules surrounding GoFundMe and their significant implications for disabled individuals. We understand that navigating these regulations can be overwhelming, especially when it comes to how funds raised might affect eligibility for government assistance programs. It’s essential to recognize that funds from crowdfunding are often classified as income. This classification can impact critical benefits like Medicaid and SSI.

By understanding these tax implications, you can avoid unexpected liabilities or a loss of support. It’s common to feel uncertain about how these rules apply to your situation. We’re here to help you navigate this complex landscape, ensuring you have the information you need to make informed decisions.

Remember, you are not alone in this journey. We encourage you to explore your options and seek guidance to protect your benefits while still receiving the support you deserve.

Introduction

Navigating the financial landscape of crowdfunding can feel overwhelming, especially for individuals with disabilities who may depend on government assistance. As platforms like GoFundMe become increasingly popular for raising funds to meet essential needs, it’s important to understand the tax implications that come with these initiatives.

In this article, we will explore the intricate IRS rules surrounding GoFundMe donations, shedding light on the potential risks and rewards of crowdfunding. We understand that maintaining eligibility for vital benefits is a delicate balance.

How can you ensure that your fundraising efforts do not unintentionally jeopardize your financial support? We’re here to help you find clarity and confidence in this journey.

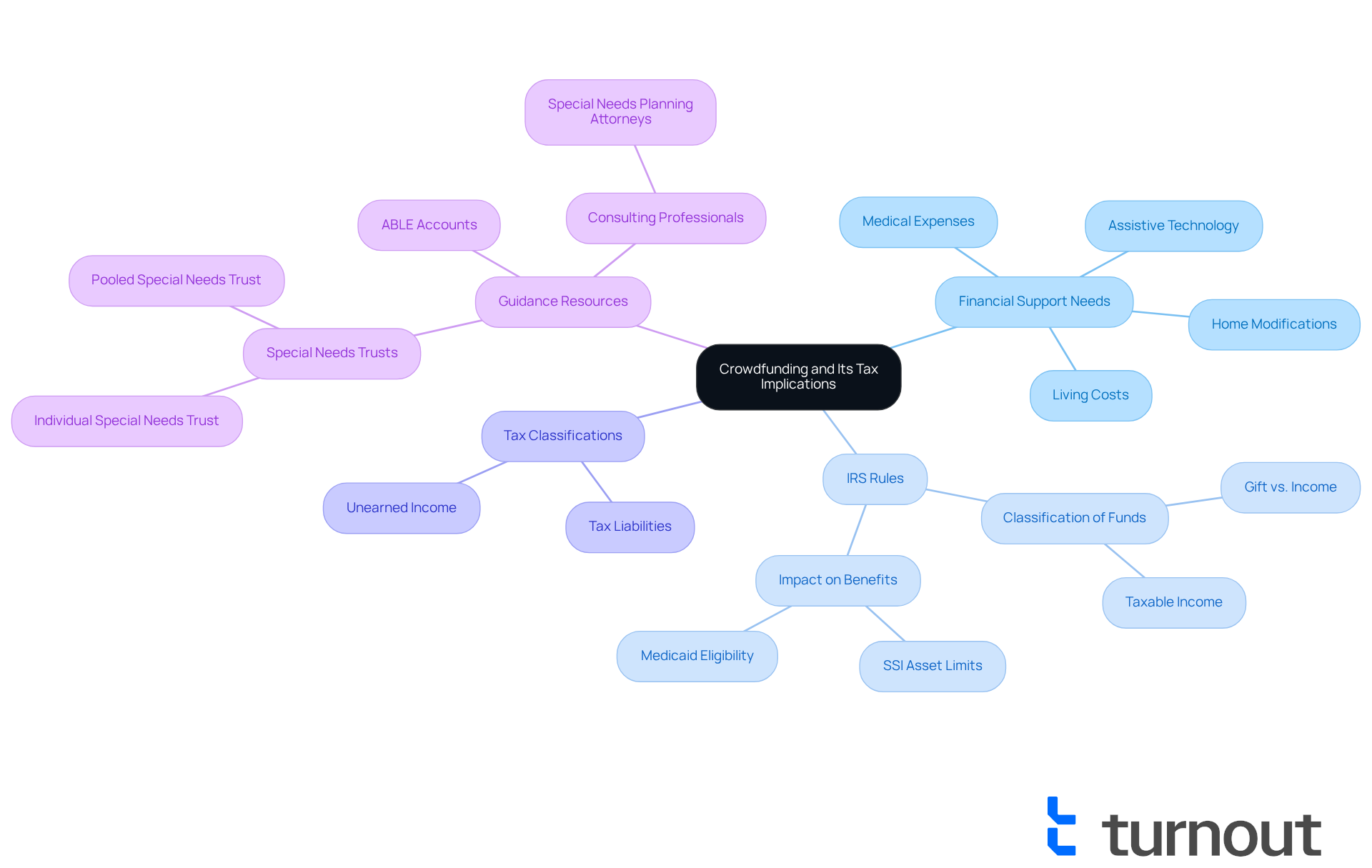

Explore Crowdfunding and Its Tax Implications

Crowdfunding has become a widely embraced method for individuals seeking financial support for various needs, such as medical expenses, living costs, and other financial challenges. Platforms like GoFundMe empower users to create campaigns and reach out for donations from friends, family, and the broader community. However, it’s vital to understand that funds raised through public fundraising can lead to significant tax implications, especially for disabled individuals relying on government assistance, in accordance with IRS rules on GoFundMe.

We understand that navigating these financial waters can be daunting. According to the IRS rules on GoFundMe, funds obtained through crowdfunding are typically classified as income, which may impact eligibility for means-tested programs. For example, if these funds are deemed unearned income, they could affect asset limits for programs like Medicaid or Supplemental Security Income (SSI). Therefore, clarifying whether these funds are considered gifts or income is crucial to maintaining eligibility for essential benefits.

Moreover, the IRS rules on GoFundMe have established specific guidelines regarding the taxation of fundraising income, which can vary based on the intended use of the funds and the campaign's structure. It’s important for individuals to be aware of these implications to avoid unexpected tax liabilities or the loss of benefits. Successful funding initiatives can enhance a person's quality of life, but without adequate preparation, they may face challenges that jeopardize their benefits eligibility.

Turnout offers valuable tools and services, including trained non-professional advocates, to assist individuals in navigating these complexities. We’re here to help clients understand how collective funding can influence their financial situation and government support. For instance, we’ve seen real-world examples where a fundraising effort raised substantial funds, but according to IRS rules on GoFundMe, the amount was classified as taxable income, resulting in significant tax obligations. Conversely, funds raised through a properly established pooled special needs trust can enable individuals with disabilities to remain eligible for public benefits, as these funds do not count toward SSI or Medicaid limits.

Understanding these dynamics is essential for anyone considering collective funding as a means to meet financial needs while managing the intricacies of government assistance. Remember, you are not alone in this journey; we’re here to support you every step of the way.

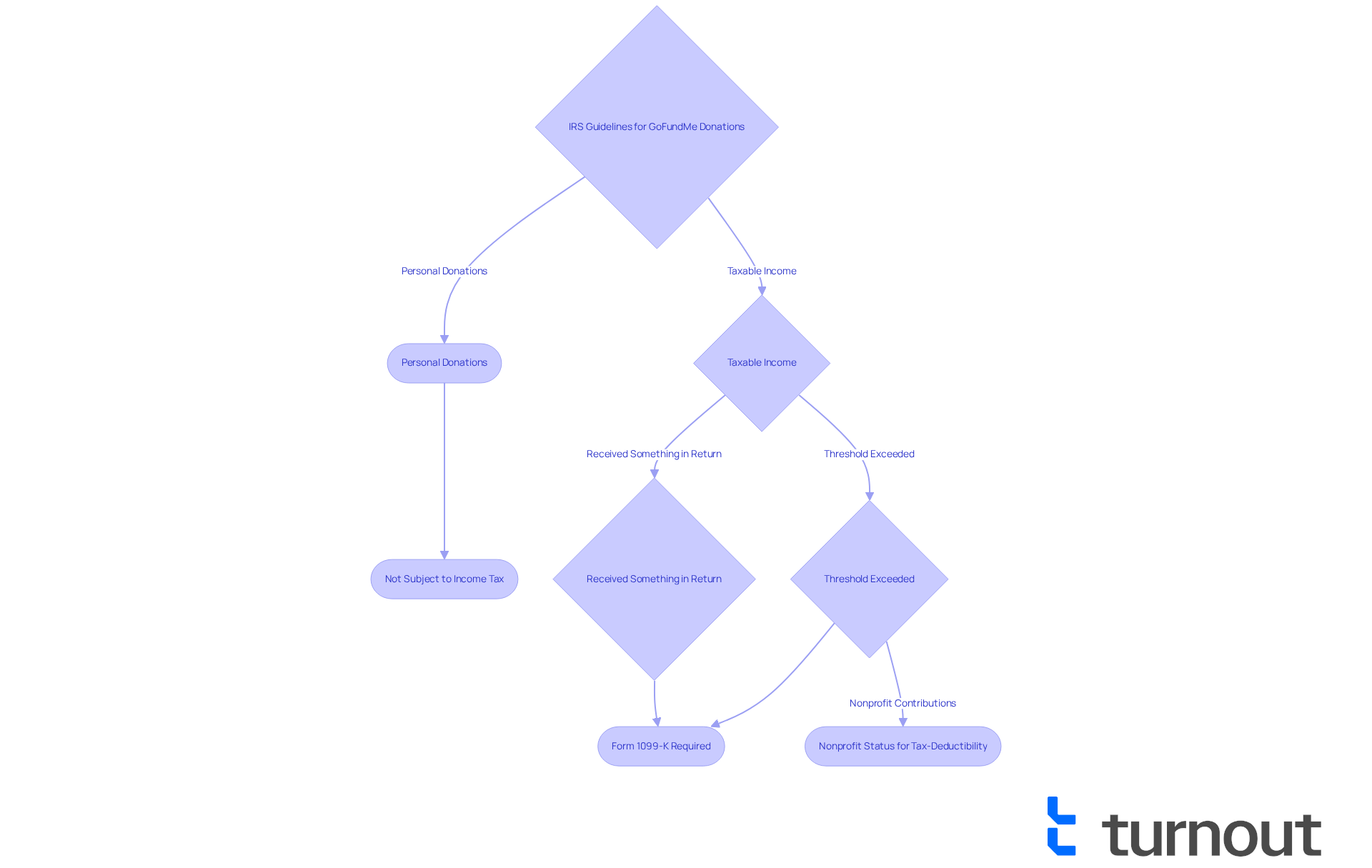

Understand IRS Guidelines for GoFundMe Donations

The IRS rules on GoFundMe have established clear guidelines regarding the tax treatment of donations from collective funding sources. We understand that navigating these rules can be overwhelming, but typically, money collected through individual fundraising initiatives is categorized as personal donations, which are not subject to income tax. However, this classification can change based on the specific circumstances surrounding the donations.

For instance, if funds are raised for a particular purpose—such as covering medical expenses—and the donor receives something in return, like a service or product, the IRS may classify these funds as taxable income. It's common to feel uncertain about these details. Furthermore, if the total amount raised exceeds certain thresholds—specifically if contributions surpass $600 or if there are more than 200 transactions—the crowdfunding platform is required to follow IRS rules on GoFundMe by issuing a Form 1099-K, reporting the income to the IRS.

It's also important to recognize that under the IRS rules on GoFundMe, donations made to campaigns organized by recognized nonprofit organizations can be tax-deductible for the donor, provided the organization has 501(c)(3) status. This distinction is crucial for those considering launching a campaign, as it can significantly influence potential donors' willingness to contribute. Additionally, we encourage both organizers and recipients to maintain complete and accurate records of fundraising and fund distribution for at least three years to ensure compliance with the IRS rules on GoFundMe.

In summary, understanding these tax implications is essential for individuals using fundraising platforms. We’re here to help you ensure compliance and optimize the benefits of your fundraising efforts. Remember, you are not alone in this journey.

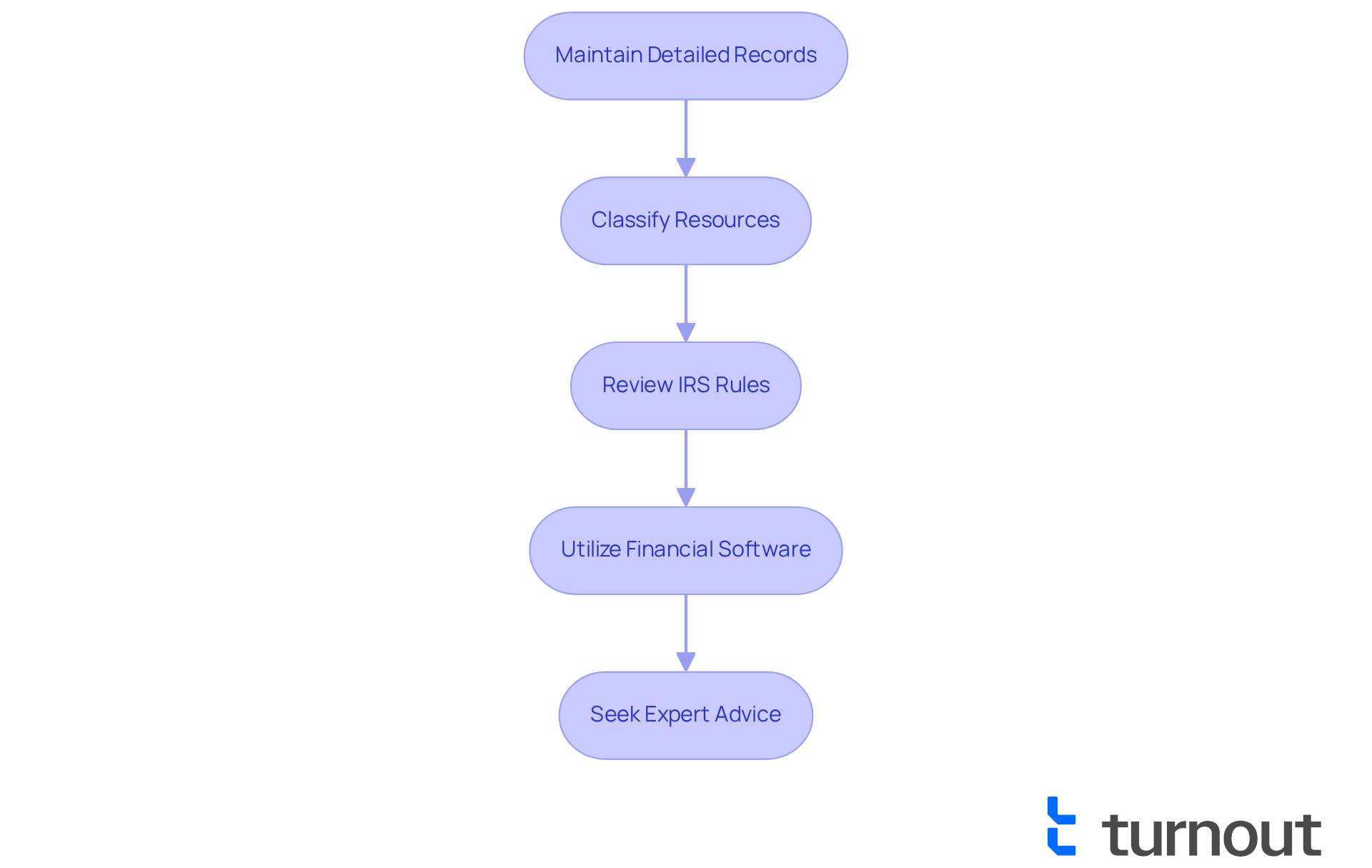

Implement Effective Recordkeeping and Reporting Practices

Navigating the complexities of crowdfunding and the IRS rules on GoFundMe regarding its tax implications can feel overwhelming, especially for disabled individuals. We understand that managing these aspects requires careful attention. To help you on this journey, here are some actionable steps to consider:

-

Maintain Detailed Records: It's important to keep a comprehensive log of all donations received. Document the date, amount, and purpose of each contribution. This information will be essential for tax reporting and understanding the characteristics of your resources.

-

Classify Resources: Distinguishing between resources gathered for specific aims, like medical costs, and general contributions is crucial. This classification can clarify whether the funds are gifts or taxable income. Remember, the IRS rules on GoFundMe indicate that collective funding proceeds are generally seen as taxable unless they meet specific conditions, such as being loans, equity contributions, or gifts.

-

Regularly reviewing the IRS rules on GoFundMe concerning fundraising is vital. Staying informed about any changes can help you understand your tax obligations. For instance, the IRS will require fundraising platforms to issue Form 1099-K for total payments exceeding $2,500 in 2025, which will decrease to $600 in 2026.

-

Utilize Financial Software: Consider employing financial management software to monitor donations and expenses related to your fundraising campaign. Many disabled individuals find such tools beneficial, as they simplify the process of reporting income and managing finances.

-

Seek Expert Advice: If you're uncertain about how to report your fundraising income or its effects on your benefits, don't hesitate to consult with a financial advisor or tax expert. They understand the unique challenges faced by people with disabilities and can provide valuable guidance.

By implementing these practices, you can better manage your crowdfunding income and ensure compliance with the IRS rules on GoFundMe. This proactive approach ultimately protects your financial well-being. Additionally, it's advisable to maintain records for at least three years to prepare for potential IRS audits. Remember, you're not alone in this journey—we're here to help.

Conclusion

Understanding the IRS rules on GoFundMe is essential for disabled individuals seeking financial support through crowdfunding. These regulations not only dictate how funds are classified but also influence eligibility for vital government benefits. We understand that navigating these complexities can be overwhelming. However, by grasping the nuances of tax implications associated with crowdfunding, you can better navigate the financial landscape while safeguarding your access to necessary assistance.

It's important to recognize how funds raised via platforms like GoFundMe can be treated as income, potentially impacting benefits such as Medicaid and SSI. Key points to consider include:

- The significance of proper recordkeeping

- The distinction between gifts and income

- The necessity of staying informed about IRS guidelines

By implementing effective practices, you can manage your crowdfunding income while ensuring compliance with tax obligations.

The journey through crowdfunding and its tax implications may seem daunting, but awareness and proactive measures can lead to positive outcomes. Remember, you are not alone in this journey. By utilizing available resources and seeking expert advice, you can optimize your fundraising efforts while protecting your financial well-being. Embracing this knowledge empowers you to make informed decisions, ensuring that the support you receive enhances your quality of life without jeopardizing your essential benefits.

Frequently Asked Questions

What is crowdfunding and how is it commonly used?

Crowdfunding is a method for individuals to seek financial support for various needs, such as medical expenses and living costs, by creating campaigns on platforms like GoFundMe to reach out for donations from friends, family, and the broader community.

Are there tax implications associated with crowdfunding?

Yes, funds raised through crowdfunding can have significant tax implications, particularly for disabled individuals relying on government assistance, as these funds are typically classified as income by the IRS.

How can crowdfunding affect eligibility for government assistance programs?

If crowdfunding funds are deemed unearned income, they may impact asset limits for means-tested programs like Medicaid or Supplemental Security Income (SSI), potentially affecting an individual's eligibility for these benefits.

What determines whether crowdfunding funds are considered gifts or income?

The classification of crowdfunding funds as gifts or income is crucial and can vary based on the intended use of the funds and the structure of the campaign, which can influence eligibility for essential benefits.

What are the potential consequences of not understanding crowdfunding tax implications?

Without proper understanding, individuals may face unexpected tax liabilities or loss of government benefits due to misclassification of the funds raised through crowdfunding.

How can individuals navigate the complexities of crowdfunding and its tax implications?

Organizations like Turnout offer tools and services, including trained non-professional advocates, to help individuals understand how collective funding can influence their financial situation and government support.

What is a pooled special needs trust and how does it relate to crowdfunding?

A pooled special needs trust is a properly established fund that allows individuals with disabilities to raise money while remaining eligible for public benefits, as these funds do not count toward SSI or Medicaid limits.

What support is available for individuals considering crowdfunding?

Support is available through organizations that provide guidance on managing the intricacies of government assistance and understanding the implications of crowdfunding efforts.