Introduction

Navigating the complexities of IRS payment plan fees can feel overwhelming for many taxpayers. We understand that with various costs tied to setting up and managing these plans, it’s common to feel lost in a maze of fees, interest rates, and potential penalties. This article aims to shed light on ten key costs that could impact your financial strategy when dealing with IRS payment plans.

We’re here to help you uncover valuable insights and actionable information, empowering you to make informed decisions. What hidden fees might be lurking in the fine print? How can you effectively manage your obligations without falling into financial traps? Let’s explore these questions together.

Turnout: Streamlined IRS Payment Plan Management

We understand that managing tax responsibilities can feel overwhelming. Turnout is here to help. By utilizing advanced AI technology, we streamline the management of IRS payment plan fees, making it easier for you to handle your tax obligations effortlessly.

Imagine receiving timely updates and tailored support that transforms a traditionally daunting process into a more manageable experience. With our AI-driven tools, you can increase your involvement and significantly improve your chances of adhering to financial commitments. You deserve to regain control over your financial situation, benefiting from a system that prioritizes clarity and accessibility.

Tax professionals emphasize the crucial role of AI in consumer advocacy. It not only streamlines compliance but also fosters a supportive environment for individuals facing tax challenges. Remember, Turnout is not a law firm and does not provide legal advice. Instead, we utilize trained nonlawyer advocates and IRS-licensed enrolled agents to assist you in navigating tax debt relief.

This approach exemplifies how technology can revolutionize tax advocacy, making it more efficient and user-friendly. You are not alone in this journey; we are committed to ensuring you receive the necessary support without the complexities of legal representation.

IRS Payment Plan Setup Fees: What to Expect

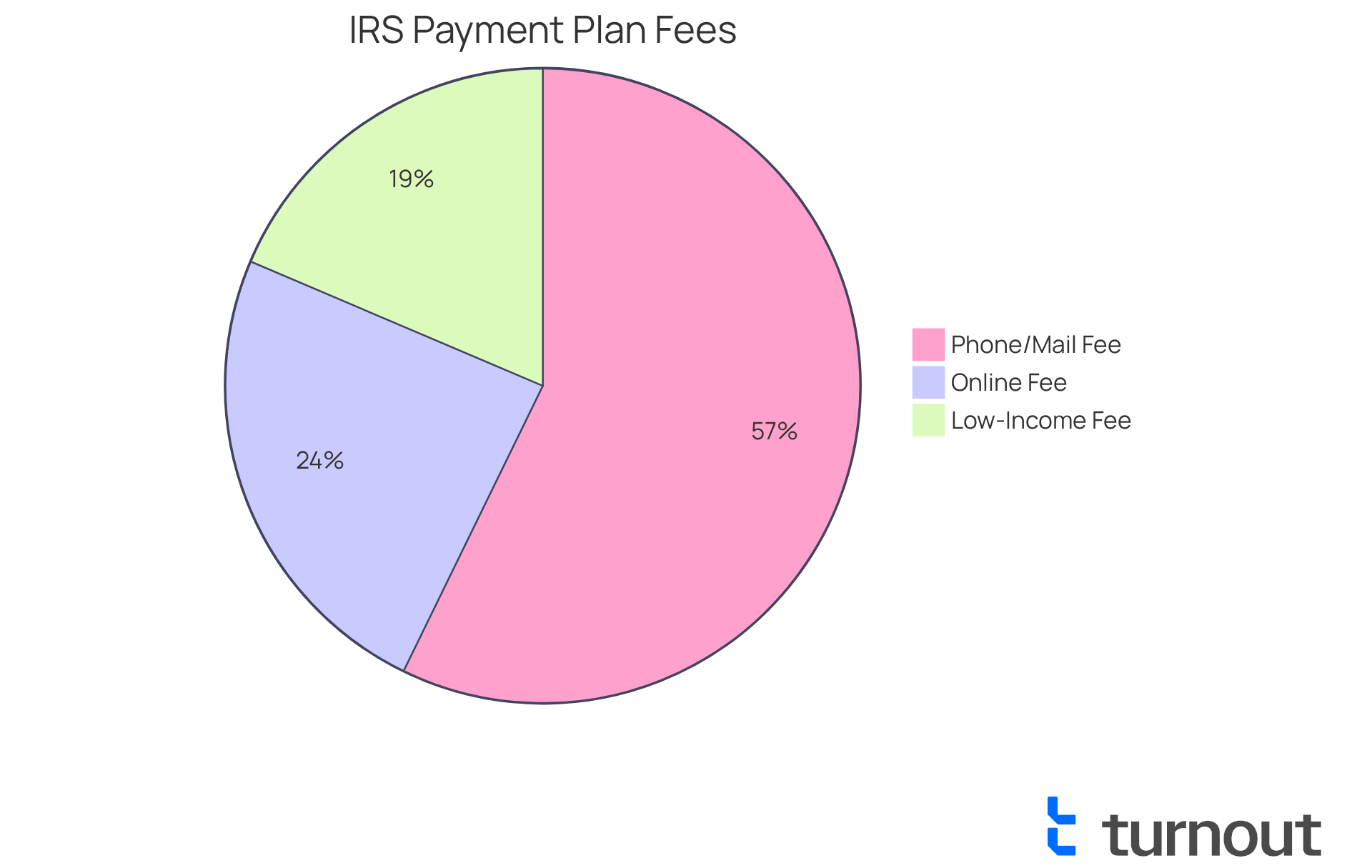

When creating an IRS installment arrangement, it’s important to be aware of the IRS payment plan fees that can vary significantly based on how you apply. For instance, applying online incurs IRS payment plan fees of $69, while applications submitted by phone or mail can reach up to $178. If you’re a low-income individual, you might qualify for a reduced fee of $43 related to the IRS payment plan fees. Considering these costs is essential for your overall financial strategy.

A long-term financing plan allows you to settle your tax obligations in monthly installments for up to six years. This can greatly influence your financial planning. For example, if you owe $51,900, the setup fee and the IRS's minimum monthly charge of $590 require careful planning to avoid financial strain. Understanding these expenses in advance, such as IRS payment plan fees, can help you make informed choices and ensure compliance with IRS regulations.

The fastest way to establish a financial plan is through the online transaction agreement available on IRS.gov, which simplifies the process. If you’re facing uncontrollable circumstances, you may qualify for penalty relief, providing additional support in managing your tax obligations. Remember, direct debit is required for certain balances, so keep this in mind as you plan your finances.

We understand that navigating these financial waters can be overwhelming, but you are not alone in this journey. We're here to help you find the best path forward.

Interest Rates on IRS Payment Plans: Key Considerations

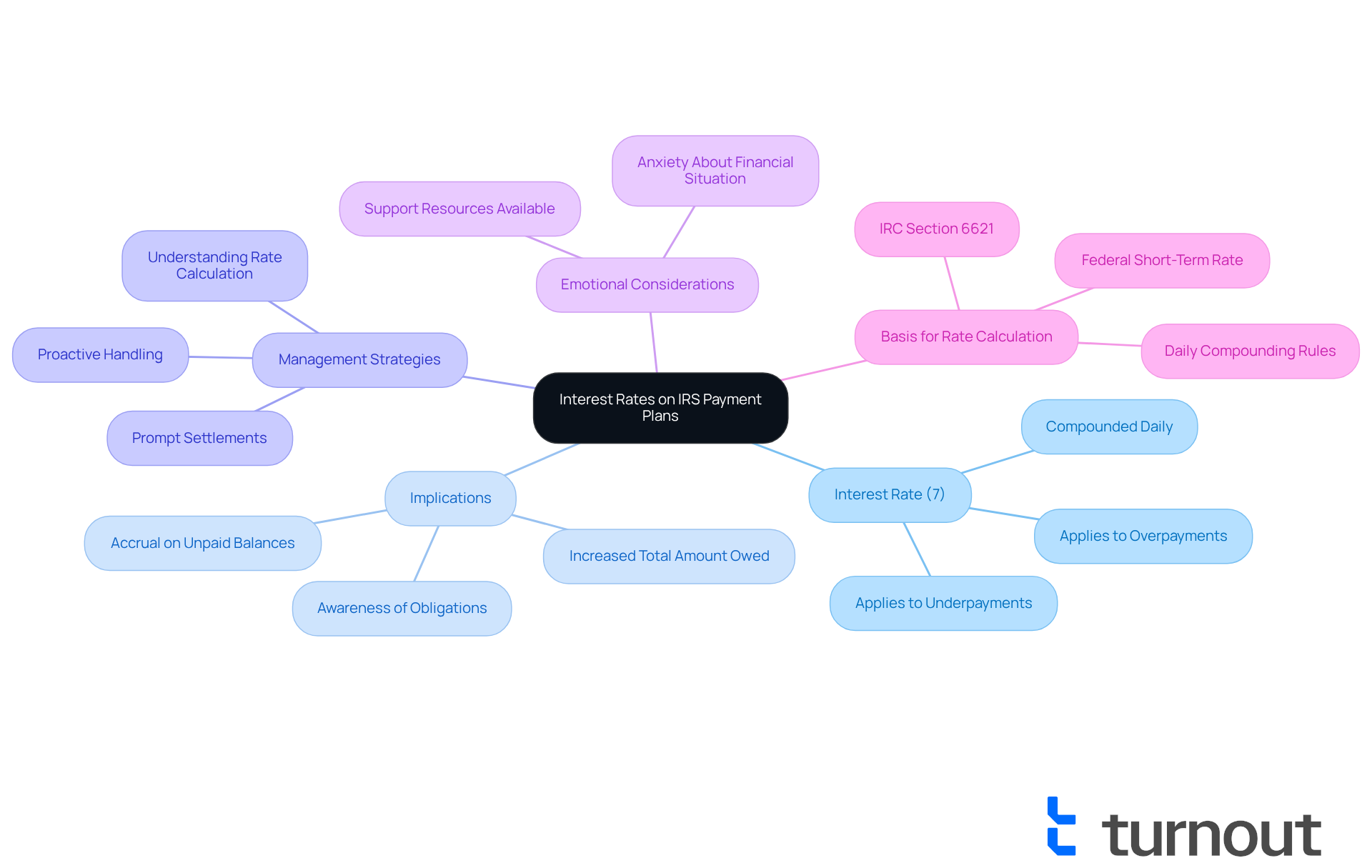

As of 2025, the interest rate for IRS repayment arrangements is set at 7% annually, compounded daily. This rate applies to both underpayments and overpayments. We understand that managing these rates can be overwhelming, especially when interest continues to accrue on any unpaid balance. This can significantly increase the total amount owed over time.

The IRS states, "Interest will accrue on any unpaid tax, penalties and interest until the balance is paid in full." Grasping these rates is crucial for individuals to evaluate the affordability of their plans and to strategize their repayment efficiently. It's common to feel anxious about how these rates affect your financial situation.

Financial specialists stress that being proactive in handling these interest rates can lead to improved outcomes. Prompt settlements can lessen the impact of accumulating interest. Statistics show that taxpayers who are aware of their interest obligations are more likely to stick to their repayment schedules, ultimately reducing their overall tax burden.

Understanding how the 7% rate is determined is essential. The federal short-term rate serves as a basis for calculating this interest. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

Penalties for Late Payments: Avoiding Additional Costs

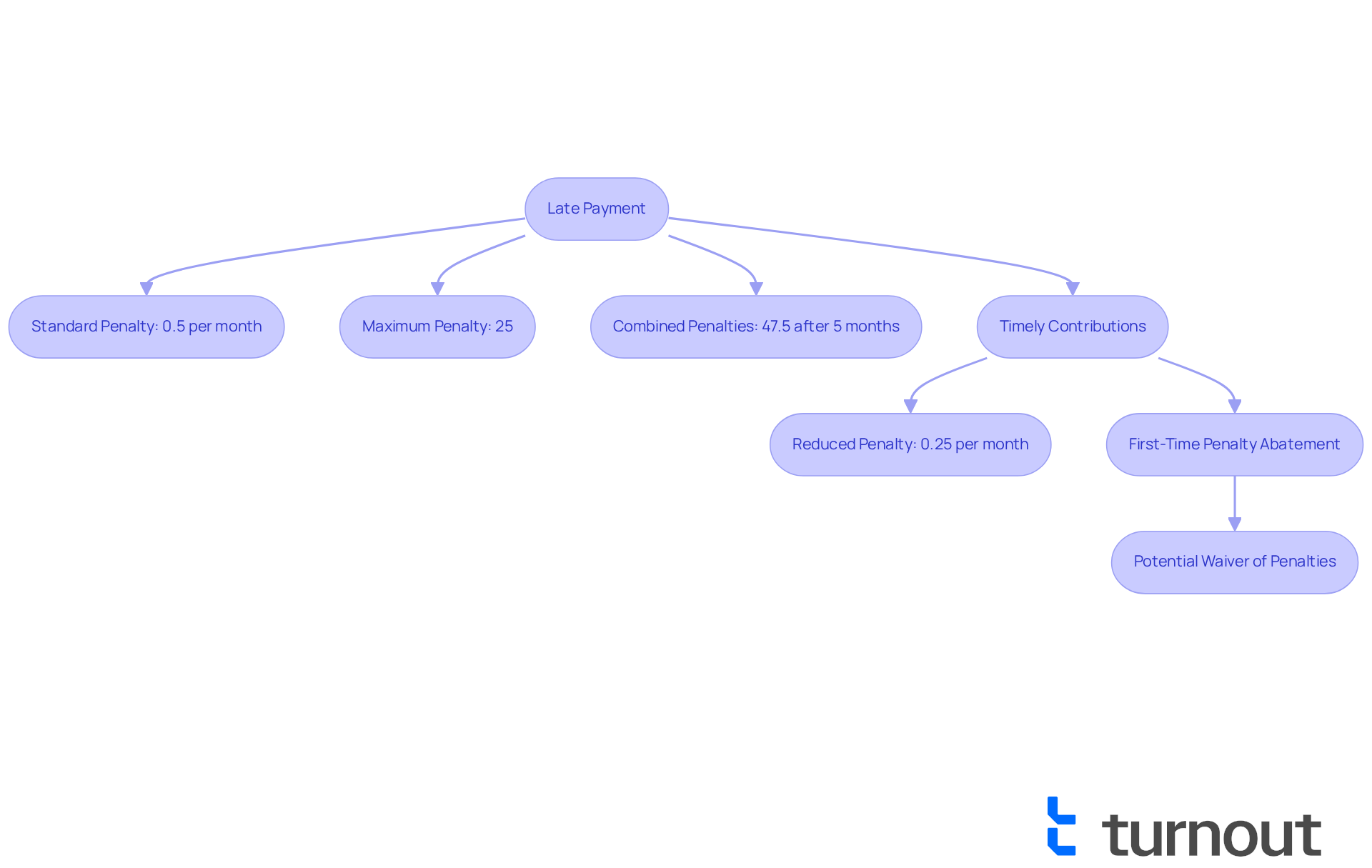

We understand that managing tax payments can be overwhelming, and overlooking scheduled dues may lead to significant penalties from the IRS. The standard late charge penalty is 0.5% per month on the unpaid balance, which can add up to a maximum of 25%. When both filing and payment are late, combined penalties can soar to a maximum of 47.5% after five months.

It's crucial to stay on top of your billing timelines and reach out to the IRS if you foresee any challenges in meeting your obligations. For instance, if you set up a financial arrangement and make timely contributions, you can benefit from a reduced penalty rate of just 0.25% per month. The IRS states, "When you make timely contributions under your agreement, your failure-to-pay penalty drops from 0.5% per month to 0.25% per month."

Additionally, if you have a history of compliance, you might qualify for the First-Time Penalty Abatement program, which can waive certain penalties for isolated late submissions. It's common to feel stressed about prompt remittances, and statistics show that many individuals face similar difficulties. Understanding the consequences of delayed contributions and the available options for assistance, such as IRS payment plan fees, is essential.

Interacting with tax experts can provide valuable insights into managing your schedule effectively, helping you stay compliant and avoid unnecessary penalties. Remember, the interest rate for unpaid taxes is currently 4% annually, compounded daily, which can add to the financial strain of delayed obligations.

You're not alone in this journey. We're here to help you navigate these challenges and find the best path forward.

Changing Your IRS Payment Plan: Associated Fees

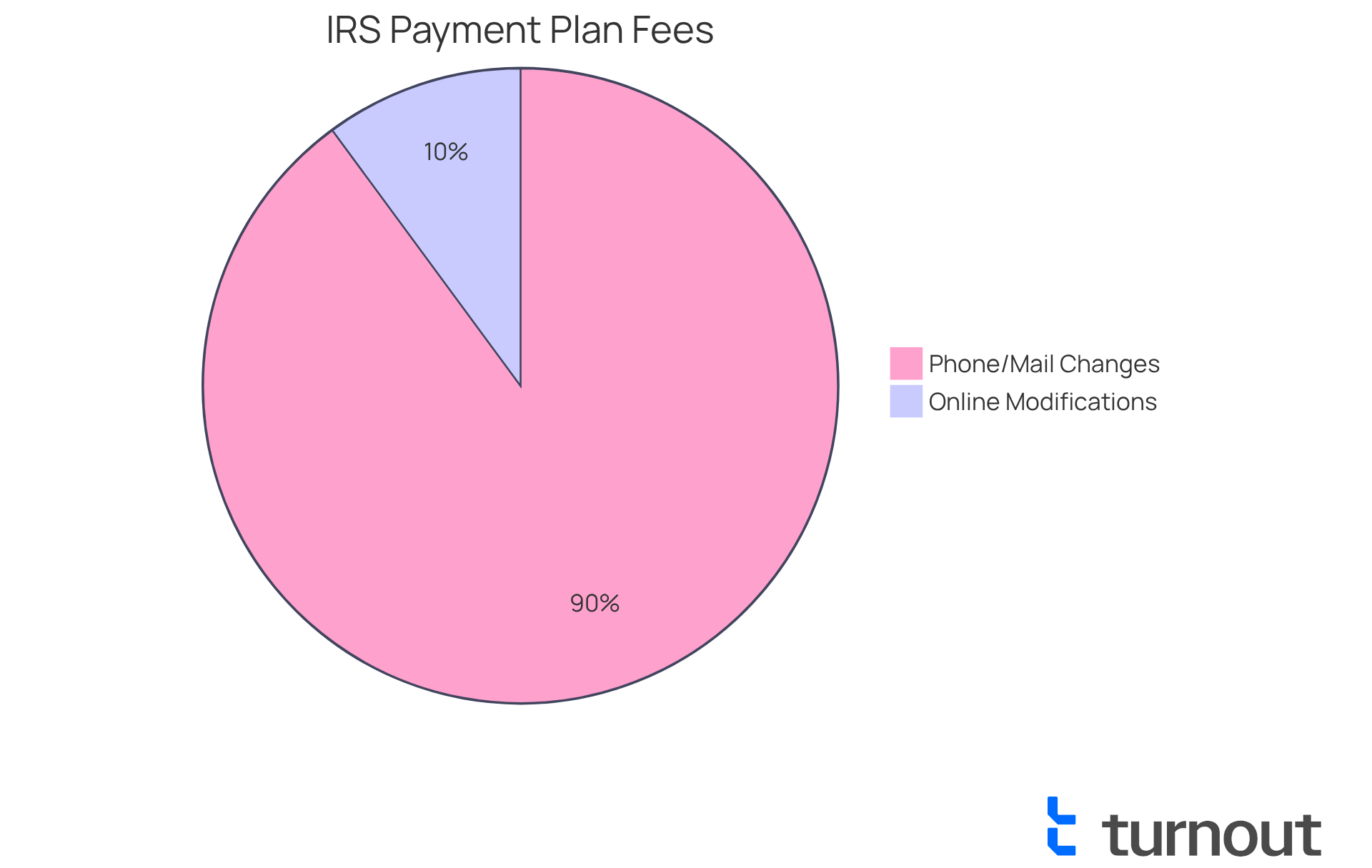

If you're thinking about changing your IRS financial arrangement, it's important to be aware of the potential IRS payment plan fees. For online modifications, the fee is usually around $10. However, if you choose to make changes via phone or mail, you may incur IRS payment plan fees of up to $89.

We understand that navigating these financial decisions can be overwhelming. Before making any adjustments to your contribution arrangements, take a moment to thoughtfully evaluate your financial situation. These IRS payment plan fees can add up and may impact your overall repayment strategies.

Remember, you’re not alone in this journey. We're here to help you make informed choices that suit your needs.

Consequences of Defaulting on IRS Payment Plans

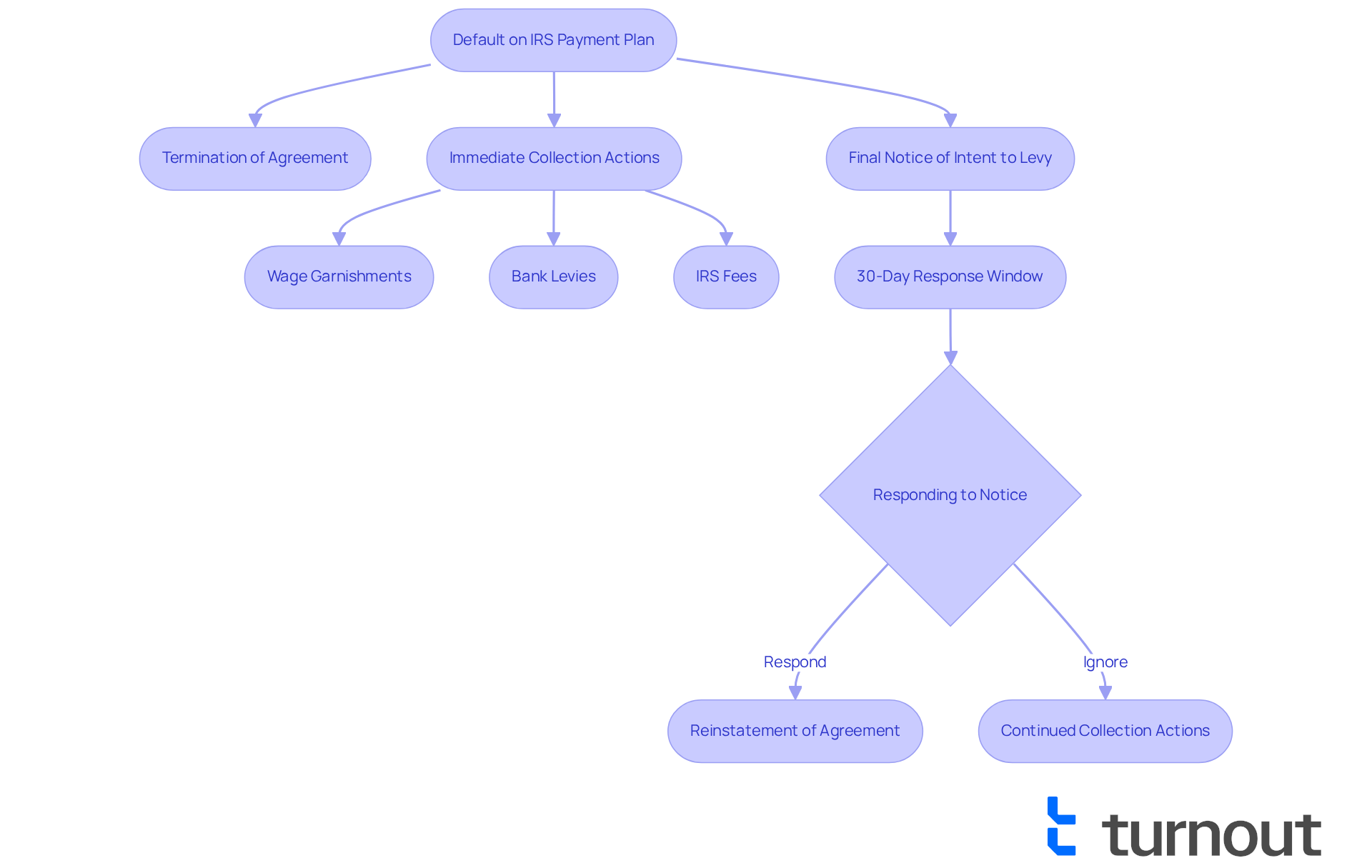

Defaulting on an IRS payment plan can be a daunting experience, resulting in serious consequences such as the termination of your agreement and immediate collection actions, including wage garnishments or bank levies, which may also involve IRS payment plan fees. We understand that this can feel overwhelming, especially when additional penalties and interest start piling up on your outstanding balance. If you find yourself in this situation, it's crucial to act quickly. Once you default, the IRS may issue a Final Notice of Intent to Levy, giving you a critical 30-day window to respond before enforcement actions begin. Ignoring the LT11 notice could mean losing up to 25% of your paycheck, which underscores the urgency of addressing this matter.

But there’s hope. Even if you lose your payment plan, the IRS has the discretion to reinstate a defaulted or terminated installment agreement based on various factors. This can provide a lifeline for those facing tough times. Additionally, you can request a Collection Appeal Program hearing to contest a default or termination of your installment agreement, offering another path toward resolution.

Consider the case of Angelica. After ignoring multiple IRS notices, including the LT11 notice, she faced the risk of wage garnishment and bank levies. Her story highlights the critical need for timely responses to IRS communications.

Tax professionals emphasize the importance of proactive communication with the IRS. As one expert noted, "Clients facing IRS collections are often anxious and overwhelmed; timely action and client education are crucial to avoid severe consequences." If you’re experiencing financial challenges, don’t hesitate to reach out to the IRS to discuss adjusting your contribution arrangements. It’s better to address the situation than to let it worsen.

Ultimately, understanding the possible outcomes of defaulting on an IRS payment plan fees is vital for anyone who owes taxes. By staying informed and engaged, you can navigate these challenges more effectively and protect your financial well-being. Remember, you are not alone in this journey; we're here to help.

Fee Waivers for Low-Income Taxpayers: Eligibility and Process

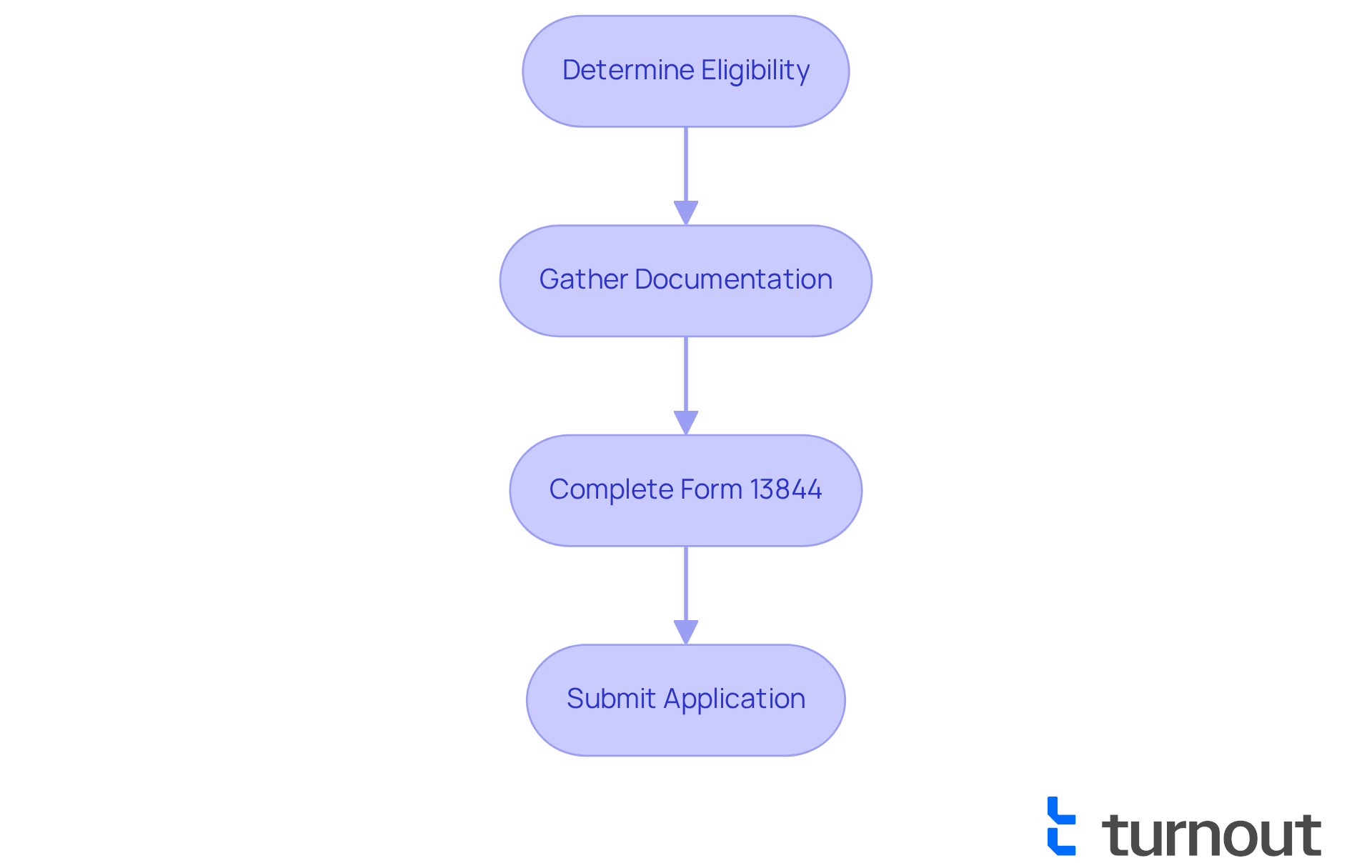

If you're facing financial challenges, you might be relieved to know that individuals with limited income can apply for fee waivers on IRS payment plan fees when setting up or changing their repayment arrangements. This can significantly ease your financial burden. To qualify, you generally need to show that your income is below 250% of the federal poverty line. This threshold is important because it aligns with the IRS's criteria for IRS payment plan fees reduction.

The application process is straightforward. You’ll need to submit Form 13844, which requests a waiver of the fees associated with the IRS payment plan when establishing or altering a repayment plan. Statistics show that many low-income taxpayers successfully secure these fee waivers, underscoring the importance of awareness and accessibility in this process. Advocacy groups stress that these waivers are vital for helping financially vulnerable individuals manage their tax obligations without incurring additional costs like IRS payment plan fees.

If you're considering applying, it’s a good idea to gather the necessary documentation that verifies your income levels. Completing Form 13844 accurately can lead to a more manageable tax obligation experience. This proactive approach allows you to focus on your financial recovery without the added stress of user fees. Remember, you’re not alone in this journey, and we’re here to help.

Overall Costs of IRS Payment Plans: A Breakdown

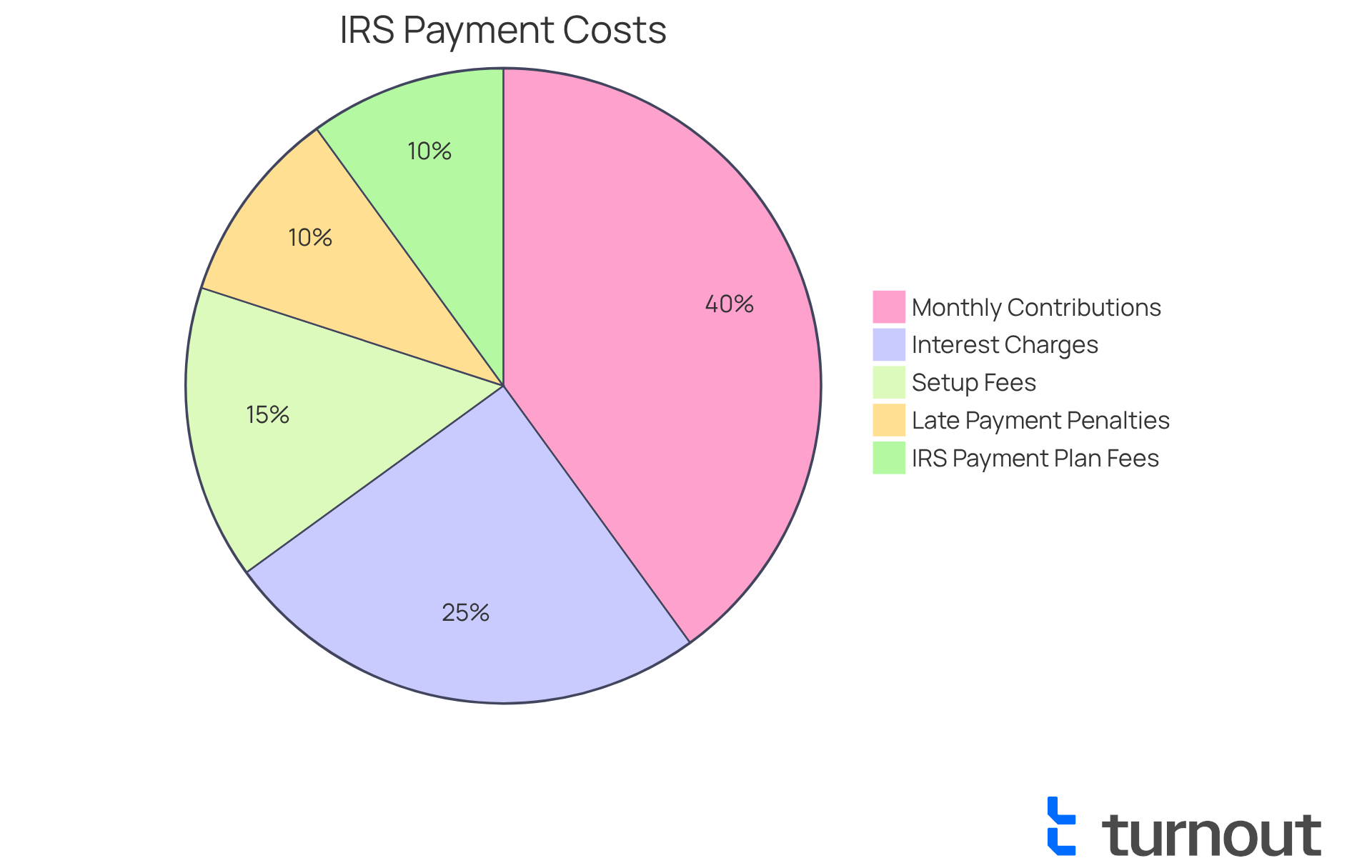

Understanding your financial obligations can be overwhelming, especially when it comes to IRS installment options. The total expenses include:

- Setup fees

- Monthly contributions

- Interest charges

- Potential penalties for late payments

- IRS payment plan fees

For example, if you're setting up a long-term repayment plan, you might encounter IRS payment plan fees, including an initial setup fee of $69, followed by monthly payments based on your total tax liability. Plus, keep in mind that interest at a rate of 7% per year will accrue on any unpaid balance. It’s comforting to know that during an Installment Agreement, the penalty for failing to pay tax is reduced to just 0.25%. This can help ease some of the financial pressure you may be feeling.

In 2025, the IRS introduced new Simple Payment Plans designed to be more straightforward and accessible. Over 90% of individual taxpayers with tax debt qualify for these plans, which is a significant relief. We understand that navigating these options can be daunting, but consulting a tax professional, like those at Meaden & Moore, can provide you with valuable guidance. They can help you manage these obligations effectively.

Understanding the IRS payment plan fees is crucial for effective financial planning and ensuring compliance with IRS requirements. Remember, you’re not alone in this journey. We’re here to help you navigate through these challenges.

Understanding Payment Plan Terms: Impact on Fees

Navigating the conditions of an IRS installment plan can feel overwhelming, but understanding them can significantly ease your financial burden. For example, choosing a direct debit approach can lead to lower setup costs, just $22 for direct debit compared to $69 for online applications, which can help reduce IRS payment plan fees. If you're facing financial challenges, you might even qualify for reduced setup fees or fee waivers related to IRS payment plan fees, making this option more accessible.

It's common to feel uncertain about how long these financing arrangements last, as they can influence the overall interest paid over time. That's why it's essential to carefully examine your choices. Did you know that around 94 percent of individual filers already use direct deposit for refunds? This statistic highlights the efficiency of direct debit methods.

If you have debts up to $250,000, you may qualify for time-based installment agreements, allowing you to manage your dues more effectively. Tax consultants often recommend direct debit as a cost-effective approach, emphasizing that it simplifies management and helps in managing IRS payment plan fees while ensuring timely transactions.

By understanding these terms and selecting the most beneficial transaction method, you can take significant steps toward reducing your financial stress. Remember, you are not alone in this journey, and we're here to help you navigate these options.

Staying Informed: Changes in IRS Payment Plan Policies

Taxpayers, we understand that managing IRS payment plan fees can feel overwhelming. These updates can change frequently, impacting your financial responsibilities significantly. For example, to qualify for a Simple Payment Plan, you need to owe no more than $50,000 in assessed taxes, penalties, and interest, and you must be current on filing your tax returns. Did you know that over 90% of individual filers with an outstanding balance are eligible for this program? Yet, many remain unaware of their options.

Engaging with the IRS website and trusted tax advocacy organizations is crucial for navigating these changes effectively. Hearing stories of individuals who have successfully adapted to new regulations can be inspiring. As Jim Buttonow, Senior Vice President for Post-Filing Tax Services at Jackson Hewitt, points out, 'The good news is that individuals who owe up to $250,000 now have a simpler route to manage their IRS payment plan fees.' This means you can make informed decisions that align with your financial situation and ensure compliance with evolving IRS policies.

If you don’t meet the criteria for a Simple Payment Plan, don’t worry. We recommend consulting Tax Topic 202 for alternative options. It’s also important to stay informed about upcoming changes due to Executive Order 14247, which requires a shift to electronic payments by September 30, 2025. This will affect how you manage your obligations. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Understanding the complexities of IRS payment plan fees is crucial for anyone striving to manage their tax obligations effectively. We know that navigating these costs can feel overwhelming, but familiarizing yourself with the various fees associated with setting up and maintaining these plans can empower you to make informed decisions that suit your financial situation.

It's common to feel stressed about tax payments, but being proactive and informed about fees, interest rates, and potential penalties can significantly ease that burden. Key insights include:

- Recognizing setup fees

- Understanding interest rates

- Being aware of the consequences of late payments

These factors can accumulate and impact your overall financial health.

Additionally, there are resources available, such as fee waivers for low-income taxpayers and streamlined management tools, that can provide valuable support in navigating these obligations. Knowing that assistance is out there can help you take control of your tax responsibilities without feeling overwhelmed.

Ultimately, staying informed about IRS payment plan policies and engaging with available resources is vital for successful financial management. By taking proactive steps and utilizing technology, you can simplify your tax obligations, avoid unnecessary penalties, and ensure compliance with IRS regulations. Embracing these strategies can lead to a more manageable and less stressful experience when dealing with tax payments. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Turnout and how does it assist with IRS payment plan management?

Turnout is a service that utilizes advanced AI technology to streamline the management of IRS payment plan fees, making it easier for individuals to handle their tax obligations. It provides timely updates and tailored support to help users manage their financial commitments effectively.

What types of professionals does Turnout employ to help with tax issues?

Turnout employs trained nonlawyer advocates and IRS-licensed enrolled agents to assist individuals in navigating tax debt relief, rather than offering legal advice or representation.

What are the IRS payment plan setup fees when creating an installment arrangement?

The IRS payment plan fees vary based on the application method: applying online incurs a fee of $69, while applications submitted by phone or mail can cost up to $178. Low-income individuals may qualify for a reduced fee of $43.

How long can one set up a long-term IRS payment plan?

A long-term IRS payment plan allows individuals to settle their tax obligations in monthly installments for up to six years.

What is the interest rate for IRS repayment arrangements as of 2025?

As of 2025, the interest rate for IRS repayment arrangements is set at 7% annually, compounded daily.

How does the interest rate affect unpaid balances on IRS payment plans?

Interest accrues on any unpaid tax, penalties, and interest until the balance is paid in full, which can significantly increase the total amount owed over time.

What is the fastest way to establish an IRS payment plan?

The fastest way to establish a financial plan is through the online transaction agreement available on IRS.gov, which simplifies the process of setting up a payment plan.

Is direct debit required for IRS payment plans?

Yes, direct debit is required for certain balances when setting up IRS payment plans, so it is essential to consider this in financial planning.

What should individuals do if they are facing uncontrollable circumstances regarding tax payments?

Individuals facing uncontrollable circumstances may qualify for penalty relief, which can provide additional support in managing their tax obligations.