Introduction

Facing financial difficulties can feel overwhelming, especially when the IRS is involved. We understand that many taxpayers find themselves in situations where meeting tax obligations threatens their ability to cover basic living expenses. This highlights the importance of understanding IRS hardship.

This article explores various relief options available for those grappling with IRS levies. Our goal is to empower you to navigate your rights and discover solutions that can ease your financial burden. But what happens when the very system meant to provide relief becomes an additional source of stress?

You're not alone in this journey. We're here to help you find the support you need.

Defining IRS Hardship: Understanding Your Rights

IRS hardship describes situations in which a taxpayer is unable to fulfill their tax obligations because of financial difficulties. We understand that this can be an overwhelming experience. Under IRS guidelines, if paying your tax obligation would hinder your ability to cover basic living expenses, you may qualify for relief options due to IRS hardship. Knowing your rights is crucial; it empowers you to seek assistance and negotiate effectively with the IRS.

Key Rights Include:

- Right to Request Relief: You can request a temporary delay in collection actions by demonstrating economic hardship. In 2025, approximately 18.6 million taxpayers are estimated to have unpaid tax obligations. This highlights the importance of knowing you have the right to ask for help.

- Right to Appeal: If the IRS denies your request for hardship status, you have the right to appeal the decision. This ensures that your case is reconsidered, giving you another chance.

- Right to Representation: You can seek help from tax professionals or advocates to navigate the complexities of IRS processes. Expert assistance can significantly increase your chances of securing an IRS hardship.

Becoming acquainted with these rights can greatly improve your ability to handle tax obligations and explore available relief options. Real-world examples show how effective these rights can be. For instance, one taxpayer successfully negotiated a payment plan that allowed them to keep their home. Another resolved a substantial tax obligation for a fraction of the amount due through an Offer in Compromise. Remember, knowing your rights and leveraging them can lead to more favorable outcomes in your dealings with the IRS. You're not alone in this journey; we're here to help.

Identifying Hardship Situations: When Levies Impact Your Finances

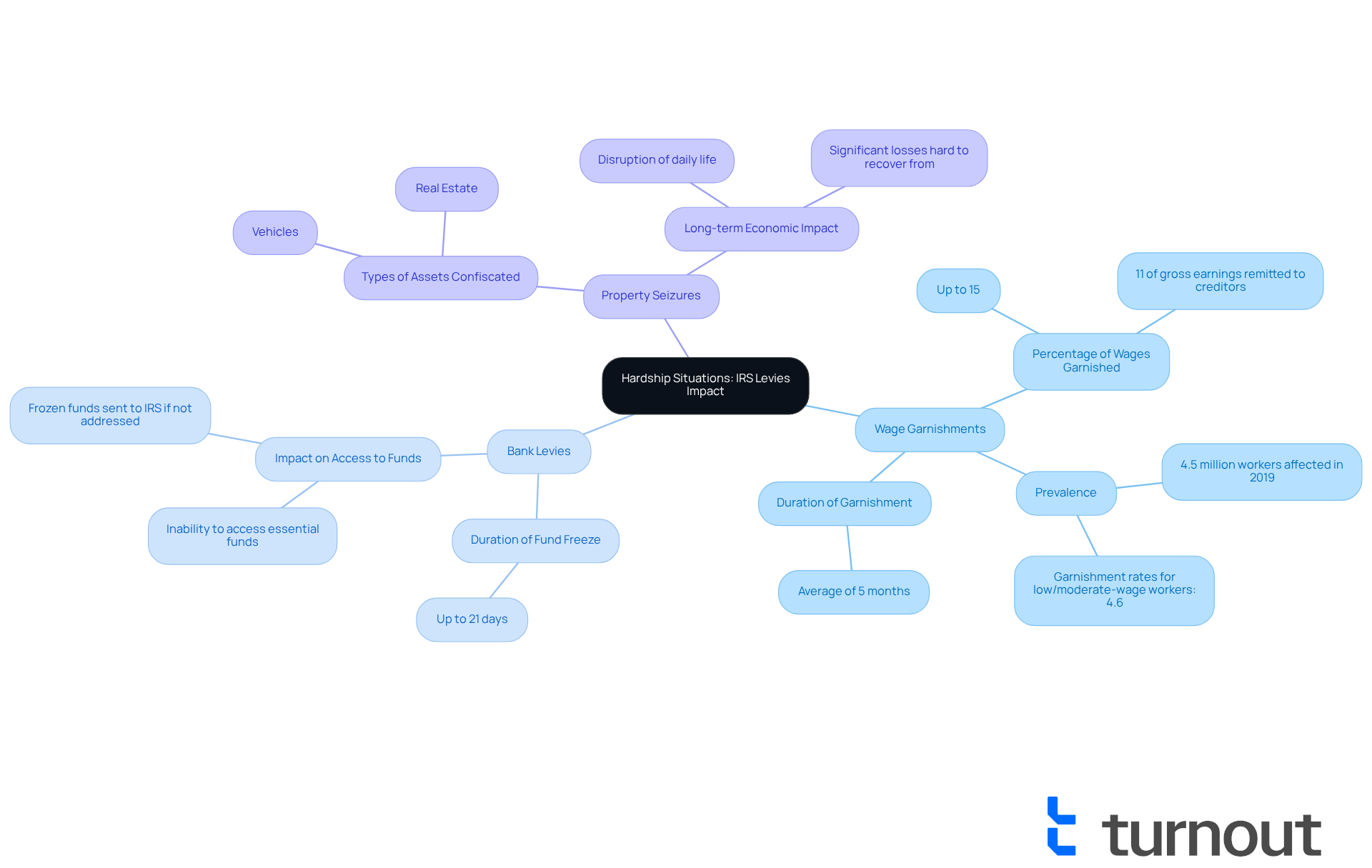

Hardship situations can be incredibly challenging, especially when facing IRS hardship due to levies that significantly impact your financial stability. We understand that facing these circumstances can feel overwhelming. Here are some common scenarios you might encounter:

-

Wage Garnishments: The IRS has the authority to garnish wages, taking up to 15% of your disposable earnings to satisfy tax debts. This can create severe difficulties in covering essential expenses. In fact, nearly 11% of gross earnings are remitted to creditors by those whose wages are garnished. In 2019, over 4.5 million workers experienced wage garnishments for consumer debts, highlighting just how prevalent this issue is.

-

Bank Levies: If the IRS levies your bank account, it can freeze your funds for up to 21 days. This can make it impossible to access the money you need for daily living costs. It’s common to feel anxious when you can’t access essential funds, and if the levy isn’t addressed promptly, the bank will send the frozen funds to the IRS, complicating your situation even further.

-

Property Seizures: In severe cases, the IRS may confiscate assets, including vehicles or real estate. Such actions can lead to long-term economic instability, disrupting your daily life and resulting in significant losses that are hard to recover from.

Recognizing these situations is vital for taking timely action. To qualify for a levy release, you must demonstrate IRS hardship. If you find yourself facing wage garnishments, bank levies, or potential property seizures, it’s essential to evaluate your financial situation and explore available relief options.

Remember, you are not alone in this journey. Turnout offers support through trained nonlawyer advocates and IRS-licensed enrolled agents who can help you navigate these challenges without the need for legal representation. We’re here to help you access the assistance you need.

Exploring Relief Options: Steps to Address IRS Levies

If you’re facing an IRS levy, it’s understandable to feel overwhelmed. But there are several relief options that can help you manage your tax debt and regain your financial stability:

-

If the levy is causing you economic hardship, you can request a release from the IRS hardship. Just provide documentation that shows how the levy is preventing you from meeting your basic living expenses.

-

Currently Not Collectible (CNC) status may be granted if you can demonstrate that paying your tax obligation would lead to IRS hardship. This status temporarily suspends collection actions, allowing you to focus on essential living expenses. In 2025, the IRS continues to recognize CNC status as a vital option for taxpayers. Many have successfully achieved CNC status, finding relief from aggressive collection tactics. However, keep in mind that while in CNC status, interest and penalties still accrue, which can affect the total amount owed. Typically, CNC status lasts from six months to two years, giving you some breathing room as you stabilize your situation.

-

Installment Agreements: Setting up a payment arrangement with the IRS lets you settle your tax obligation gradually. This can ease the immediate financial strain, especially if you can manage smaller, regular payments.

-

Offer in Compromise (OIC): If paying your tax obligation in full isn’t feasible, you may qualify for an OIC. This option allows you to resolve your tax liability for less than the total amount owed, providing a strategic way to handle your tax obligations without the pressure of full payment.

-

Seek Professional Help: Engaging a tax professional or advocate can offer personalized guidance and support as you navigate the complexities of IRS relief options. Tax advocates emphasize that understanding your rights and available options is crucial in effectively addressing tax issues. As TaxRise states, 'When the IRS assigns you Currently Not Collectible (CNC) status, it signifies that the agency acknowledges you can’t pay your tax obligation because of IRS hardship.'

Taking these steps can significantly alleviate the stress of dealing with IRS levies and help you regain control of your financial situation. Remember, the IRS prefers to work with taxpayers to resolve debt issues amicably, often opting for solutions that allow for manageable payments rather than aggressive collection actions. You are not alone in this journey, and we’re here to help.

Conclusion

Understanding IRS hardship is crucial for taxpayers grappling with financial challenges that make it tough to meet tax obligations. We recognize that navigating these situations can feel overwhelming, but knowing your rights can empower you. You have the right to request relief, appeal decisions, and seek professional representation. This knowledge can help you effectively manage the complexities of IRS processes.

This article highlights various hardship scenarios, such as:

- wage garnishments

- bank levies

- property seizures

These can significantly disrupt your financial stability. But there’s hope! We detail actionable relief options like:

- requesting a levy release

- applying for Currently Not Collectible (CNC) status

- setting up installment agreements

- considering an Offer in Compromise (OIC)

Each of these options offers a pathway for you to regain control over your financial situation and ease the burden of tax debt.

Ultimately, understanding IRS hardship and exploring available relief options is vital. We encourage you to take proactive steps, leverage your rights, and seek professional assistance when needed. Remember, you are not alone in this journey. By reaching out for help, you can work towards resolving your tax issues in a manageable way, paving the path to financial stability.

Frequently Asked Questions

What is IRS hardship?

IRS hardship refers to situations where a taxpayer cannot meet their tax obligations due to financial difficulties, particularly if paying taxes would prevent them from covering basic living expenses.

What rights do taxpayers have under IRS hardship guidelines?

Taxpayers have several rights, including the right to request relief, the right to appeal a denial of hardship status, and the right to seek representation from tax professionals or advocates.

How can a taxpayer request relief due to IRS hardship?

A taxpayer can request a temporary delay in collection actions by demonstrating their economic hardship to the IRS.

What should a taxpayer do if their request for hardship status is denied?

If the IRS denies a request for hardship status, the taxpayer has the right to appeal the decision, allowing for reconsideration of their case.

How can seeking representation help in dealing with IRS hardship?

Seeking help from tax professionals or advocates can assist taxpayers in navigating the complexities of IRS processes, significantly increasing their chances of securing an IRS hardship.

Can you provide examples of how taxpayers have successfully utilized their rights?

Yes, one example includes a taxpayer who negotiated a payment plan that enabled them to keep their home, and another who resolved a significant tax obligation for a fraction of the amount owed through an Offer in Compromise.

Why is it important to know your rights regarding IRS hardship?

Knowing your rights empowers taxpayers to seek assistance and negotiate effectively with the IRS, improving their ability to handle tax obligations and explore available relief options.