Introduction

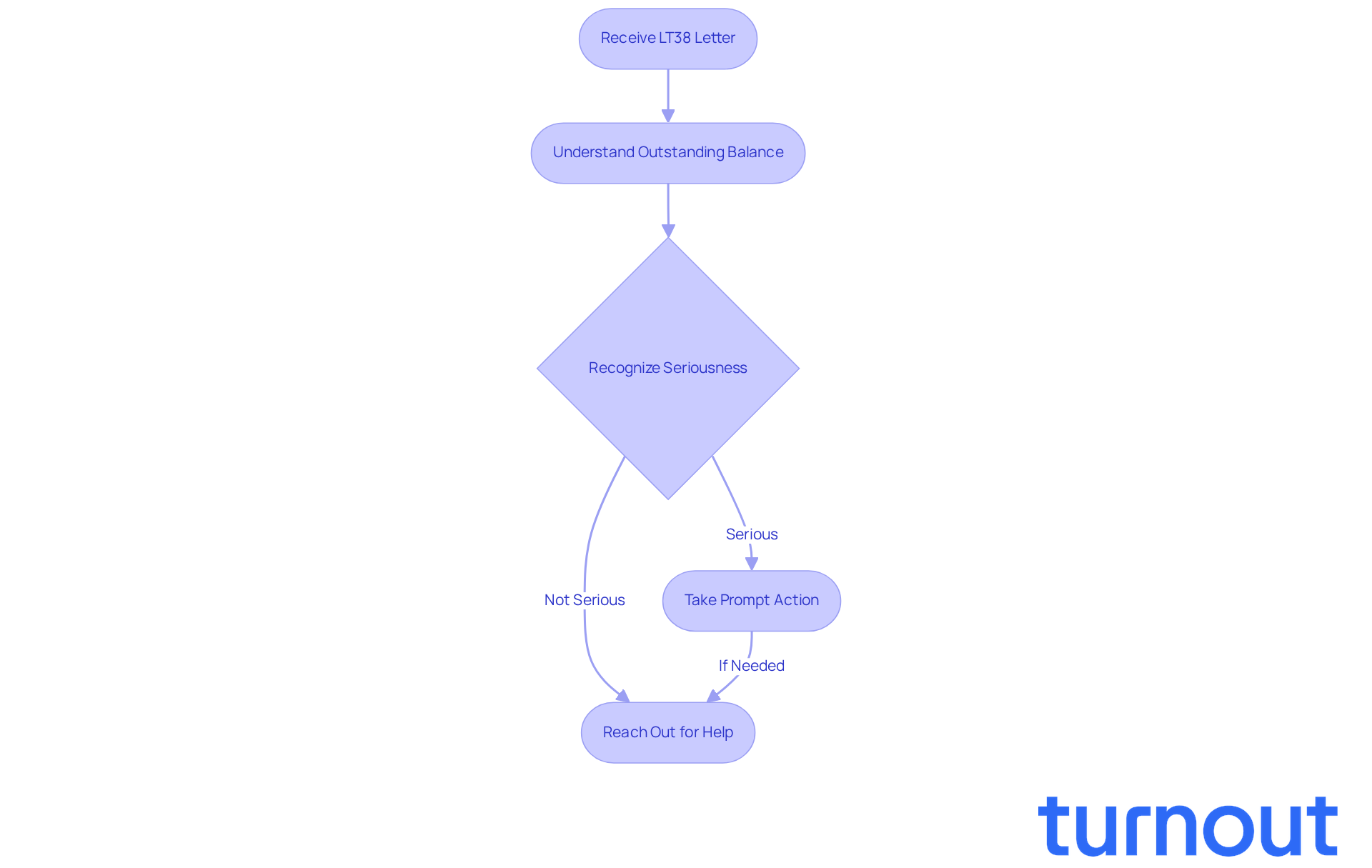

Receiving an LT38 letter from the IRS can stir up feelings of anxiety and confusion. It’s more than just a piece of mail; it’s a signal that there’s an outstanding tax balance that needs your immediate attention. We understand that this can be overwhelming, but it’s crucial to address it to avoid serious financial repercussions.

This article aims to guide you through this challenging situation. We’ll provide essential steps and resources to help you navigate your tax responsibilities effectively. Remember, you’re not alone in this journey. Many taxpayers face similar challenges, and there are ways to regain control of your financial health.

But what happens if these warnings are ignored? It’s common to feel uncertain about the next steps. We’ll explore how to ensure a successful response to this pressing issue, empowering you to take action and find peace of mind.

Define the LT38 Letter and Its Purpose

The form 38 is an important notification from the IRS, letting you know that you have an outstanding tax balance that needs your immediate attention. This message marks the restart of collection activities that were paused during the COVID-19 pandemic. It’s crucial to understand that this isn’t just a routine communication; it’s a warning. Ignoring this balance could lead to serious consequences, like wage garnishments or bank levies. Recognizing the purpose of this correspondence is key to managing your tax responsibilities effectively and avoiding further complications.

For instance, if you receive this notification in 2026, it serves as a reminder of your outstanding balance and the potential repercussions of ignoring it. Many taxpayers find that taking prompt action - like reaching out to the IRS or seeking professional help - can prevent escalating penalties and collection actions. As IRS Commissioner Danny Werfel mentioned, "The IRS wants to help taxpayers and provide them easy options to deal with unpaid tax bills and avoid additional interest and penalties." Ultimately, it’s your responsibility to respond to this communication in a timely manner to minimize any negative impacts.

We understand that dealing with tax issues can be overwhelming, but you are not alone in this journey. Taking the first step can make a significant difference. Remember, reaching out for help is a sign of strength.

Identify Why You Received the LT38 Letter

You may have received the lt38 letter for several reasons, and we understand how concerning this can be. Here are some common reasons:

-

Outstanding Tax Balance: One of the main reasons is that you owe taxes from previous years that remain unpaid. In 2026, about 15% of taxpayers are reported to have outstanding balances, which highlights how common this issue is. If you're facing financial hardships, Turnout can assist you in navigating these complexities.

-

Missed Payments: If you were on a payment plan and missed a scheduled payment, the IRS might send this letter as a reminder of your obligations. Ignoring such notices can complicate your tax issues and lead to more severe consequences. Remember, Turnout's trained nonlawyer advocates are here to help you understand your options.

-

Unfiled Tax Returns: The IRS may send this notice if you haven't submitted your tax returns for specific years. This is a prompt for you to file and resolve any owed amounts. Turnout can guide you through this process, ensuring you take the necessary steps.

-

Accrued Interest and Penalties: This communication may also indicate additional charges due to late payments or unfiled returns. Understanding the specific reason for your lt38 is crucial for determining the appropriate steps to take next. It's common to feel overwhelmed by financial hardships that lead to missed payments or unfiled returns, which can complicate your tax situation further.

Additionally, consider exploring the IRS Fresh Start Program 2026, which offers tax relief options for those struggling with tax debts. Keeping accurate tax records is essential to avoid future IRS notices, and remember, Turnout is here to support you in this journey. You're not alone in this.

Outline Steps to Respond to the LT38 Letter

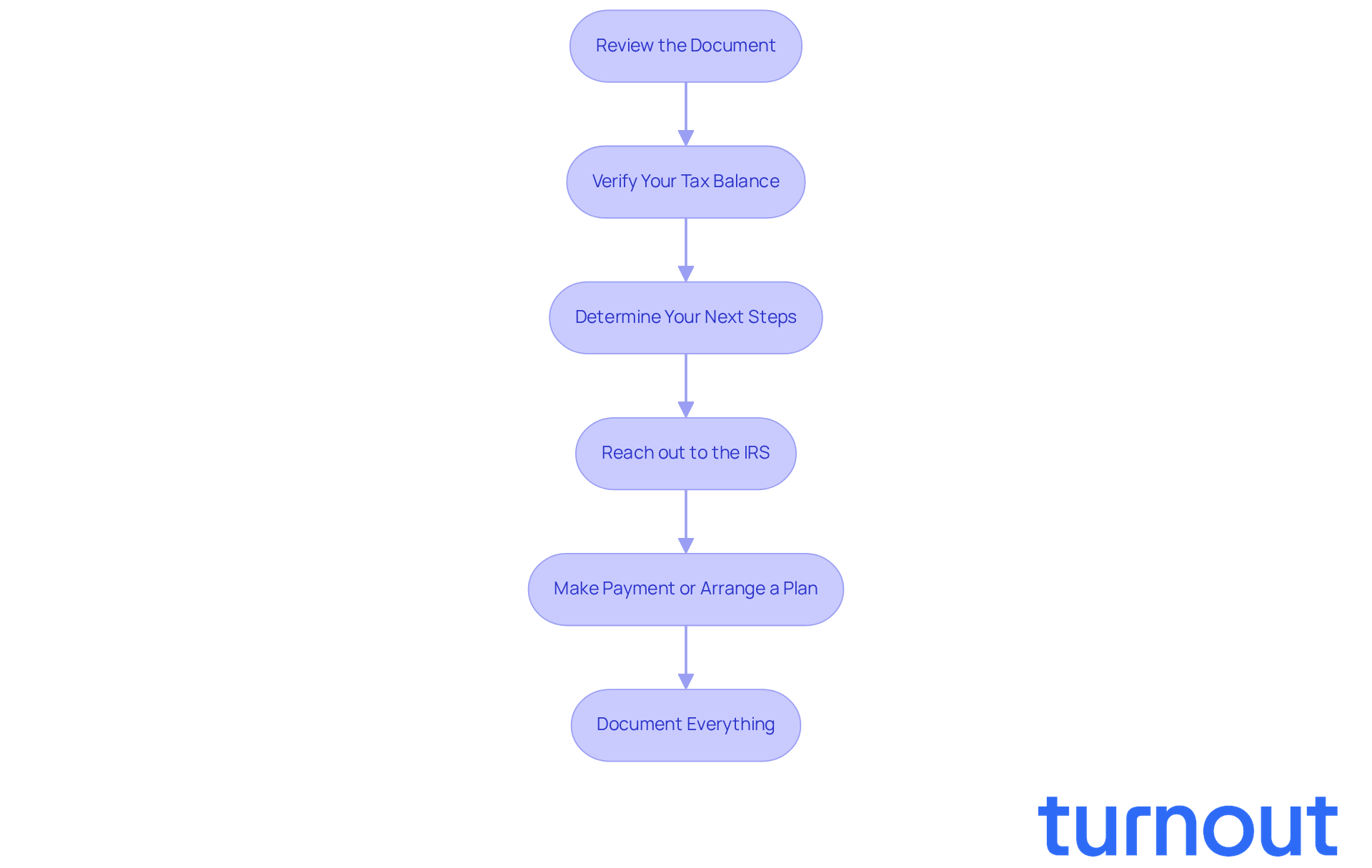

To respond effectively to your LT38 letter, follow these essential steps:

-

Review the document thoroughly, since we understand that receiving an lt38 notice can be stressful. Take a moment to carefully read the correspondence. It outlines the amount owed and any deadlines you need to be aware of. This notice serves as a final warning from the IRS, indicating that immediate action is required to avoid severe consequences like levies or garnishments. Remember, as noted by Hayes Tax Relief, 'Procrastination is not an option when it comes to dealing with an lt38 notice.'

-

Verify Your Tax Balance: It's common to feel overwhelmed when dealing with tax matters. Cross-check your records against the amount mentioned in the document. If you suspect an error, gather supporting documentation to substantiate your claim. Ignoring discrepancies can lead to accumulating penalties and interest. Remember, owing the IRS more than $10,000 can feel daunting, making it crucial to address any inaccuracies promptly.

-

Determine Your Next Steps: Assess your financial situation to decide whether you can pay the balance in full, set up a payment plan, or dispute the amount. Options like installment agreements or offers in compromise may be available to make your tax debt more manageable. For individuals unable to pay their full tax balance, the IRS offers solutions that can help alleviate financial strain, as highlighted in the case study on payment solutions for tax debt.

-

Reach out to the IRS: If you have inquiries or require clarification, don’t hesitate to get in touch with the IRS using the contact number included in the correspondence. Be prepared with your tax information to facilitate the conversation. Remember, you’re not alone in this journey.

-

Make Payment or Arrange a Plan: If you can pay the balance, do so promptly to avoid further penalties. If full payment isn't feasible, request a payment plan or explore other tax relief options. Acting quickly can help prevent further financial strain. You deserve peace of mind.

-

Document everything: Keep detailed records of all communications and payments made in response to the correspondence regarding lt38. This documentation is crucial for your records and can be beneficial if disputes arise in the future. Remember, we’re here to help you navigate this process.

Explain Consequences of Not Responding

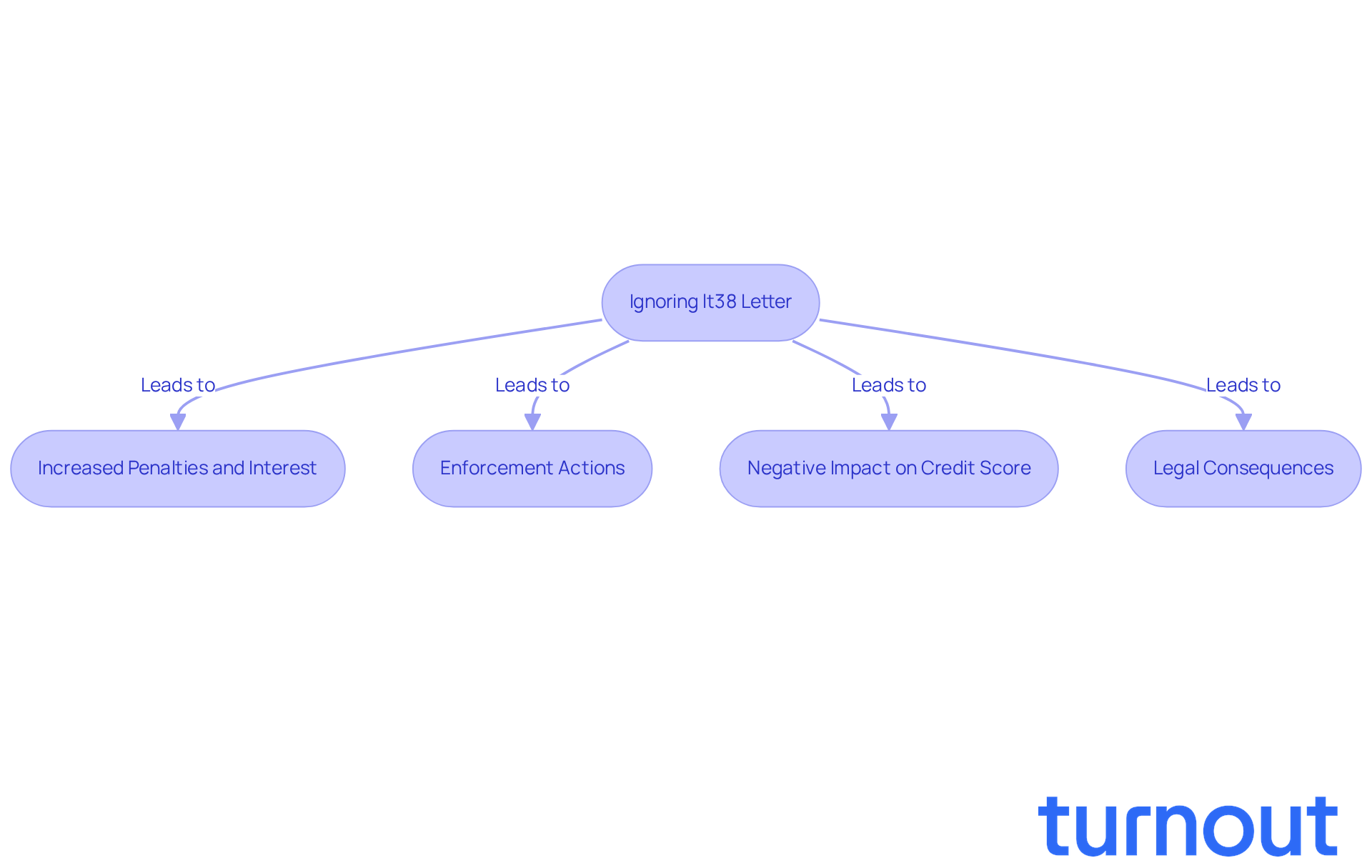

Ignoring your lt38 letter can lead to some serious consequences, and we understand how overwhelming this can feel. Here’s what you need to know:

-

Increased Penalties and Interest: If you delay addressing your tax balance, penalties and interest can pile up quickly. For example, the IRS can impose penalties that reach up to $680 per form for late information returns. Plus, interest continues to accrue on any unpaid balance until it’s fully settled. After August 1, the penalty for late corrections jumps to $340 per form. It’s common to feel anxious about these growing amounts, but taking action can help.

-

Enforcement Actions: The IRS might resort to aggressive collection measures, like wage garnishments or bank levies. Ignoring the lt38 letter can set off a chain of notices, leading to a Final Intent to Levy. This gives you just 30 days to respond before serious actions are taken. Remember, the IRS may allow 30, 60, or even 90 days to respond to different notices, so it’s crucial to act promptly.

-

Negative Impact on Credit Score: Unresolved tax debts can hurt your credit score, making future loans or credit applications more challenging. A federal tax lien filed by the IRS signals to creditors that the government has an interest in your assets, which can further damage your creditworthiness. We know how important your credit score is, and addressing these issues can help protect it.

-

Legal Consequences: Overlooking this notification might lead to legal actions, including court proceedings to collect the debt. For instance, if you don’t respond to audit notices, the IRS may proceed with audits without your input, resulting in higher tax assessments and potential penalties. As Jason Wiggam wisely points out, "If you don’t respond to initial notices, collection actions may escalate to filing a federal tax lien or issuing a tax levy to seize your assets."

We’re here to help you navigate this situation. It’s essential to take the lt38 letter seriously and respond promptly to avoid these potential outcomes. You are not alone in this journey.

Provide Resources and Tools for Effective Response

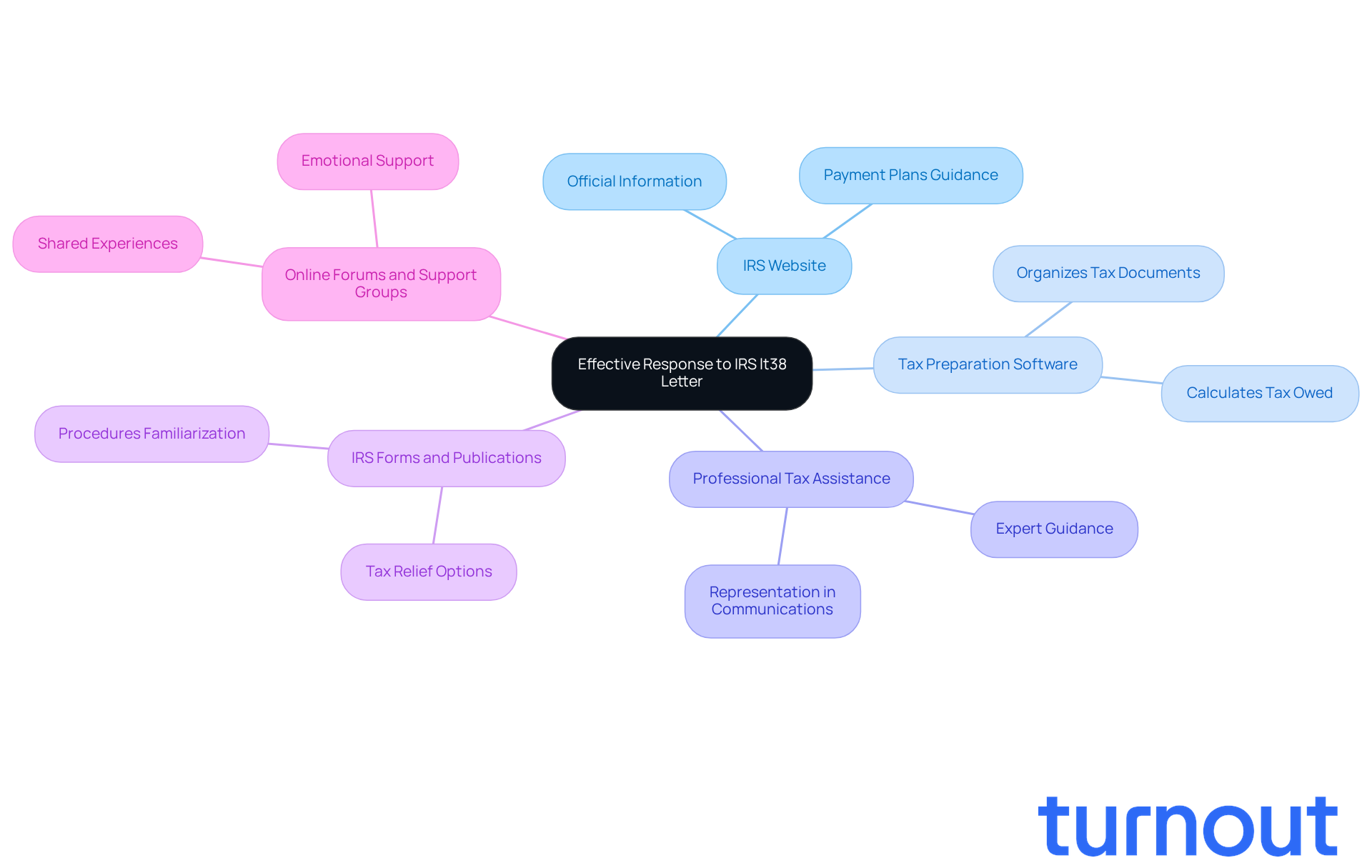

To effectively respond to your lt38 letter, we understand that it can feel overwhelming. Here are some resources that can help you navigate this situation:

-

IRS Website: The IRS website is a crucial starting point for official information regarding your tax obligations and available payment plans. It offers guidance tailored to your specific situation.

-

Tax Preparation Software: Consider using tax preparation software to streamline the organization of your tax documents and accurately calculate what you owe. This technology can simplify the process and reduce errors, making it easier to respond to the IRS.

-

Professional Tax Assistance: If it feels too much to handle alone, hiring a tax professional or advocate can be invaluable. These experts can guide you through the complexities of the IRS process and represent you in communications, ensuring your rights are protected.

-

IRS Forms and Publications: Access relevant IRS forms and publications that detail tax relief options and procedures. Familiarizing yourself with these documents can provide clarity on your next steps and available resources.

-

Online Forums and Support Groups: Engaging with online forums or support groups can be beneficial. Sharing experiences and gaining insights from others who have faced similar challenges can provide emotional support and practical advice.

In 2026, the IRS resumed its collection activities, making it essential to act promptly. Remember, you have a critical 30-day window after receiving an lt38 notice to file a Collection Due Process hearing request. For instance, taxpayers like Angelica, who ignored IRS notices, faced severe consequences such as wage garnishments. Ignoring the IRS can lead to wage garnishments, bank levies, liens, and even passport restrictions. By utilizing these resources, you can avoid such pitfalls and navigate your tax situation more effectively. We're here to help you through this journey.

Conclusion

Receiving an LT38 letter from the IRS can feel overwhelming. It’s a critical notification that indicates an outstanding tax balance requiring your immediate attention. We understand that this correspondence can be daunting, and it’s vital to recognize its seriousness. Ignoring it could lead to severe financial consequences, such as wage garnishments and legal actions. But don’t worry-understanding the importance of this letter and taking timely action can significantly mitigate potential repercussions.

In this article, we’ve outlined essential steps for responding effectively to an LT38 letter:

- Start by reviewing the letter carefully.

- Verify your tax balance and determine your next steps.

- If you have questions, reach out to the IRS for clarification or assistance.

Remember, you’re not alone in this journey. Resources like tax preparation software and professional tax assistance are available to help you navigate this challenging situation. Ignoring the letter can lead to increased penalties, interest, and negative impacts on your credit score, making prompt action crucial.

Ultimately, addressing an LT38 letter is not just about compliance; it’s about taking control of your financial situation. By utilizing the resources and strategies discussed, you can navigate your tax responsibilities with confidence. Taking proactive steps now can safeguard against future complications and ensure peace of mind. Engaging with available support systems can transform this daunting challenge into a manageable process. Remember, acting decisively when faced with tax obligations is key, and we’re here to help you every step of the way.

Frequently Asked Questions

What is the LT38 letter and what is its purpose?

The LT38 letter is a notification from the IRS indicating that you have an outstanding tax balance that requires immediate attention. It signifies the restart of collection activities that were paused during the COVID-19 pandemic and serves as a warning that ignoring this balance could lead to serious consequences, such as wage garnishments or bank levies.

Why might I have received the LT38 letter?

You may have received the LT38 letter for several reasons, including having an outstanding tax balance from previous years, missed payments on a payment plan, unfiled tax returns, or accrued interest and penalties due to late payments or unfiled returns.

What should I do if I receive the LT38 letter?

It is important to take prompt action by reaching out to the IRS or seeking professional help to address the outstanding balance. This can help prevent escalating penalties and collection actions.

What are the potential consequences of ignoring the LT38 letter?

Ignoring the LT38 letter can lead to serious consequences, including wage garnishments and bank levies, which can complicate your financial situation further.

How common is it for taxpayers to have outstanding balances?

In 2026, it was reported that about 15% of taxpayers had outstanding balances, highlighting how common this issue is.

What resources are available to help me with my tax issues?

Organizations like Turnout offer assistance in navigating tax complexities, including support for financial hardships, understanding options for missed payments, and guidance on filing unfiled tax returns.

What is the IRS Fresh Start Program 2026?

The IRS Fresh Start Program 2026 offers tax relief options for individuals struggling with tax debts, providing a way to manage outstanding balances more effectively.

Why is it important to keep accurate tax records?

Keeping accurate tax records is essential to avoid future IRS notices and complications related to your tax situation.