Introduction

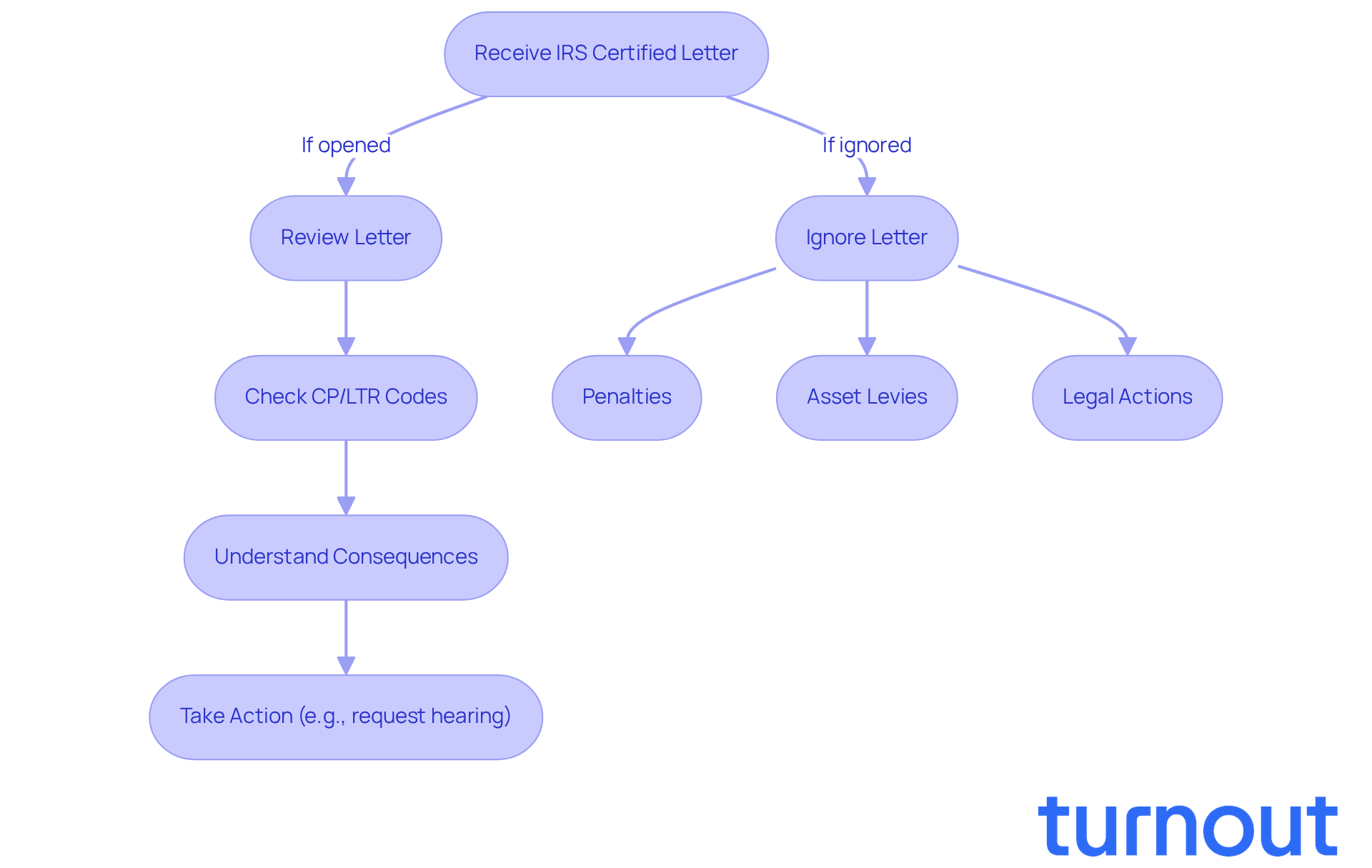

Receiving an IRS certified letter can stir up a wave of anxiety. We understand that these official communications often signal urgent matters that require your immediate attention. It's crucial for every taxpayer to grasp the implications of these letters. Neglecting them can lead to serious financial consequences, including penalties and asset seizures.

So, how can you navigate the complexities of responding to these notifications effectively? What steps can you take to ensure compliance while minimizing stress? This guide delves into essential strategies for addressing IRS certified letters. We're here to empower you to take informed actions and safeguard your financial well-being.

Understand IRS Certified Letters and Their Importance

IRS certified letters are official communications sent by the Internal Revenue Service to inform taxpayers about important matters concerning their tax accounts. We understand that receiving such notices can be stressful, as they often indicate that the IRS requires your immediate attention-whether it’s regarding outstanding balances, verification of information, or other critical issues. It’s crucial to grasp the essence of these messages, as overlooking them can lead to serious repercussions.

Certified mail is necessary for certain IRS procedures, like deficiency and levy notices, ensuring that you’re aware of these important communications. Ignoring them can escalate problems, resulting in penalties, interest, or even legal actions. Each year, the IRS sends around 170 million notices to individual taxpayers, with many delivered through IRS certified letters. This highlights the volume of communications and the likelihood of receiving certified correspondence.

For instance, a failure-to-pay penalty of 0.5% per month can add up quickly, leading to significant financial burdens over time. Real-world examples illustrate the stakes involved. Taxpayers who ignore certified communications may face measures such as asset levies or liens. For example, receiving a Final Notice of Intent to Levy (LT11/Letter 1058) gives you a 30-day window to request a Collection Due Process hearing. If you don’t act, it could lead to wage garnishment or bank levies. Additionally, serious delinquent tax debts exceeding $64,000 can result in passport issuance denial.

The IRS's commitment to sending IRS certified letters as part of their modernization efforts highlights their significance. These communications are not just formalities; they represent time-sensitive actions that require your prompt response. We encourage you to prioritize reviewing and understanding these documents to avoid negative consequences and to explore your rights and options effectively.

To confirm the authenticity of IRS documents, look for official CP/LTR codes. This ensures you’re responding to genuine communications and not falling victim to scams. Remember, you’re not alone in this journey; we’re here to help you navigate these challenges.

Take Immediate Action Upon Receipt

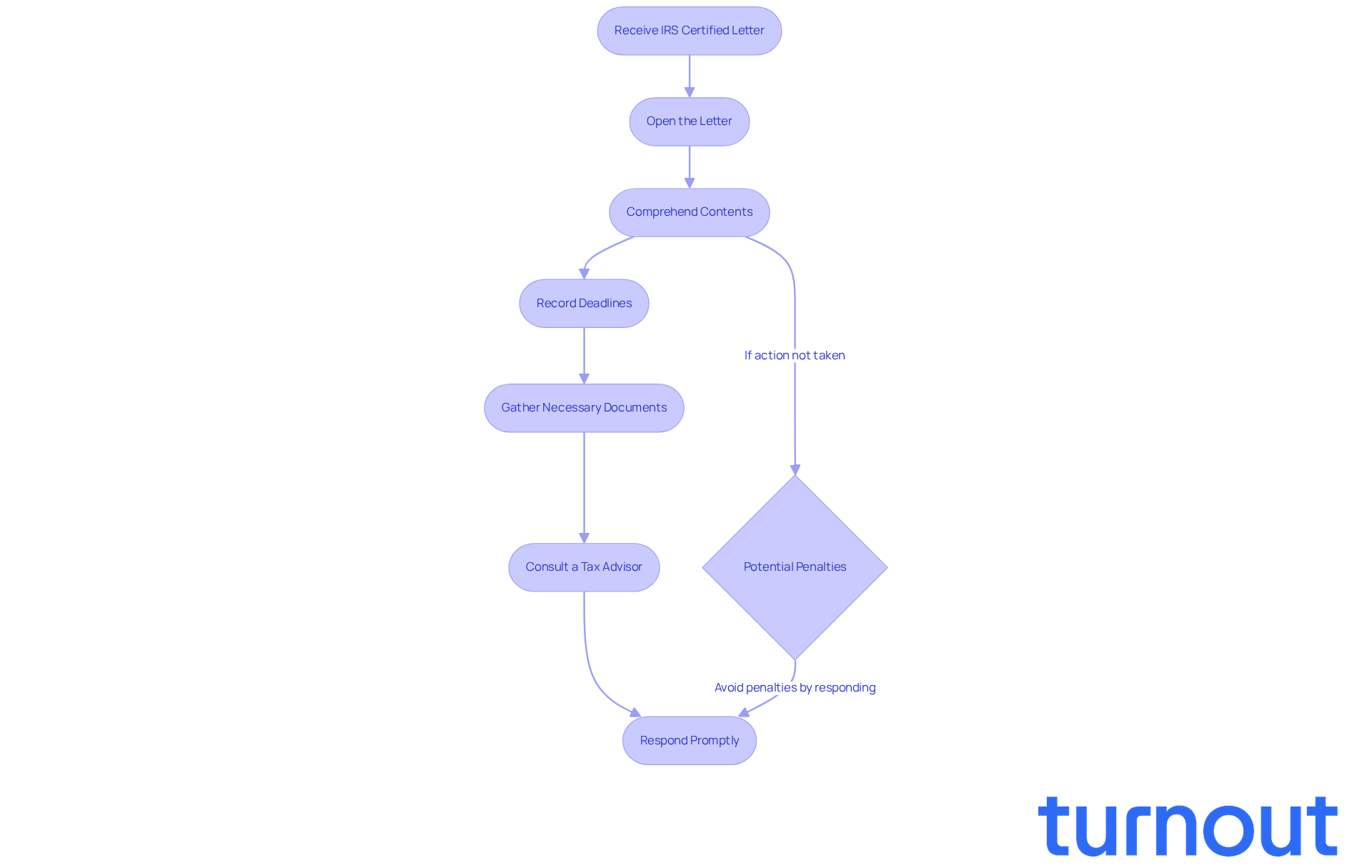

Receiving IRS certified letters can be stressful, and we understand that prompt response is essential. Open that message without delay. It’s important to comprehend its contents and identify the actions you need to take. Make sure to record any deadlines mentioned in the correspondence on your calendar. This will help you respond in a timely manner.

If the correspondence requests specific information or payment, gather the necessary documents as soon as possible. Did you know that taxpayers incur over $160 million annually in postage costs due to IRS mail? This highlights just how crucial it is to address these communications swiftly to avoid additional penalties.

Delaying your response can lead to a failure-to-pay penalty of 0.5% per month, which can accumulate to a maximum of 25%. That’s a significant financial consequence. For instance, a small construction firm received a Final Notice of Intent to Levy regarding a $48,000 tax balance. They acted within 30 days to request a Collection Due Process hearing and successfully avoided asset seizures.

Consulting a tax advisor can provide clarity on how to respond effectively. You don’t have to navigate the complexities of IRS communications alone. As Timothy S. Hart emphasizes, 'Never ignore IRS certified letters.' Remember, we're here to help you through this journey.

Identify the Type of IRS Certified Letter Received

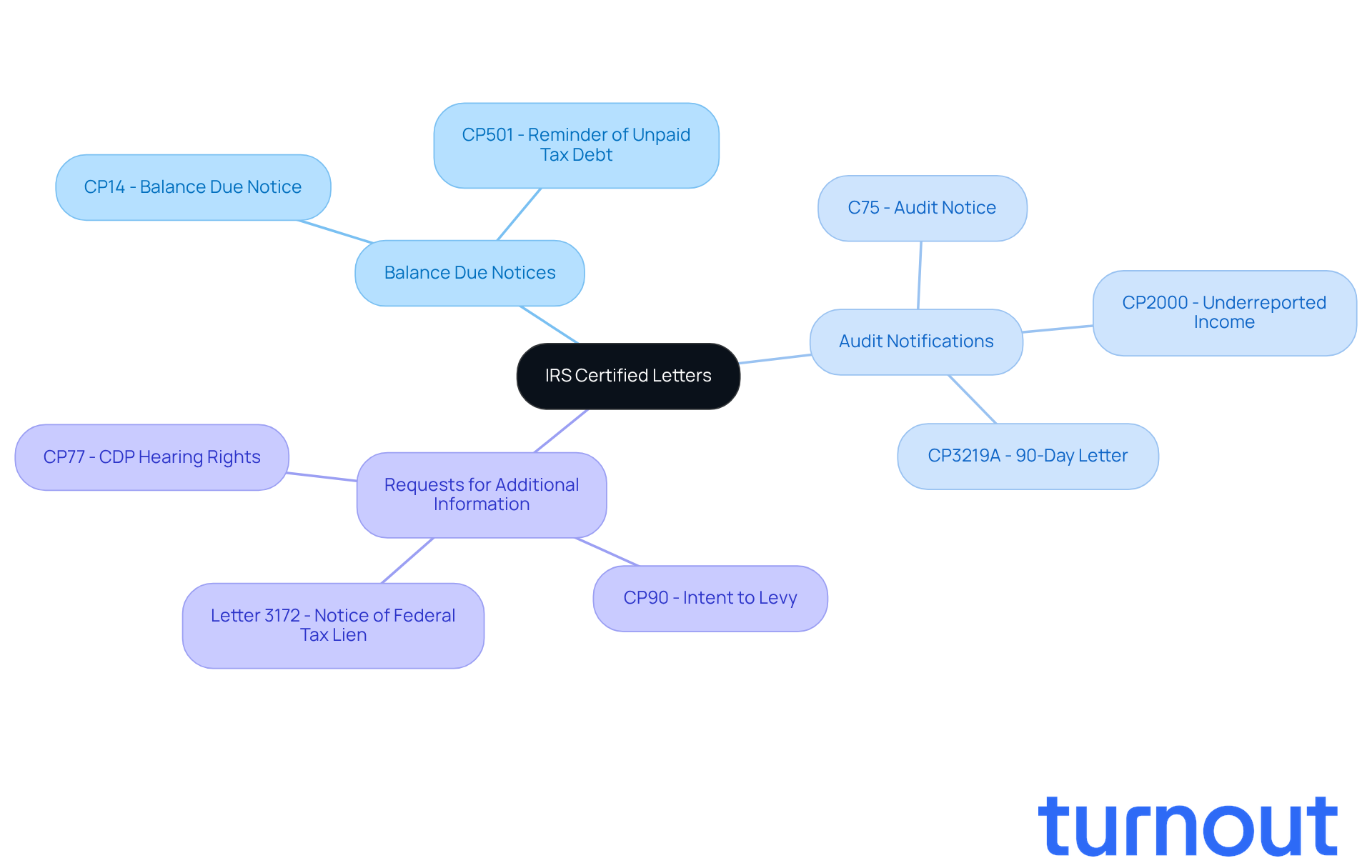

IRS certified communications come in various types, each serving a different purpose. Common types include:

- Balance due notices

- Audit notifications

- Requests for additional information

Search for the notice number, usually located in the upper right corner of the document, which can assist you in determining its type. For example, a CP2000 notice indicates proposed changes to your tax return, while a CP14 indicates a balance due. Understanding the kind of correspondence you received will direct your response strategy and assist you in grasping the urgency of the matter.

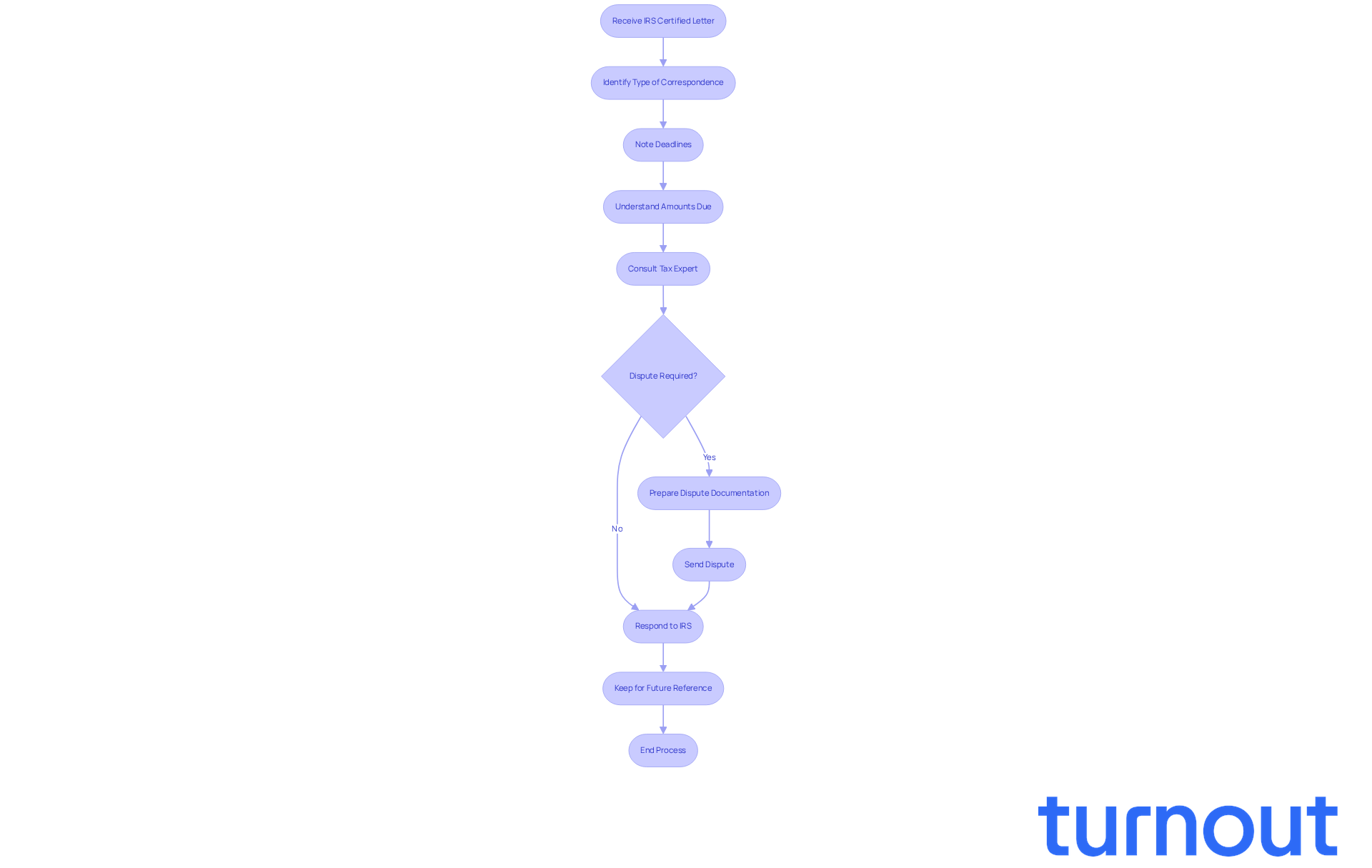

Review the Contents of the Letter Thoroughly

Receiving IRS certified letters can be daunting. We understand that it’s essential to read it carefully and grasp its contents. Start by identifying the type of correspondence and the specific requests made by the IRS, including any deadlines for your response. Pay close attention to details like amounts due, the tax years involved, and the actions required. Highlighting key points or jotting down notes in the margins can really help clarify things.

As Harmony Tax Associates LLC wisely points out, "IRS communications are quite significant, and you must handle them with care and reply within the designated timeframe." Taking the time for a thorough review is vital for crafting an appropriate response and ensuring compliance with IRS requirements. Many taxpayers find themselves seeking help after receiving these notifications, often due to uncertainty about the implications of the requests.

It’s common to feel overwhelmed, but consulting with a tax expert can make a world of difference. As Harmony Tax Associates LLC suggests, "If you receive a notice, the first thing you should do is reach out to your accountant or tax preparer so they can assist you in comprehending the notice and what information is required." Remember, prompt action is essential; ignoring the correspondence can lead to penalties and further complications. By understanding the message's contents and responding appropriately, you can navigate the complexities of IRS certified letters and communications more effectively.

Furthermore, it’s crucial to keep IRS communications for future reference. The IRS recommends that "taxpayers should keep notices or correspondence they receive from the IRS." You are not alone in this journey; we’re here to help you every step of the way.

Respond to the IRS: Options and Strategies

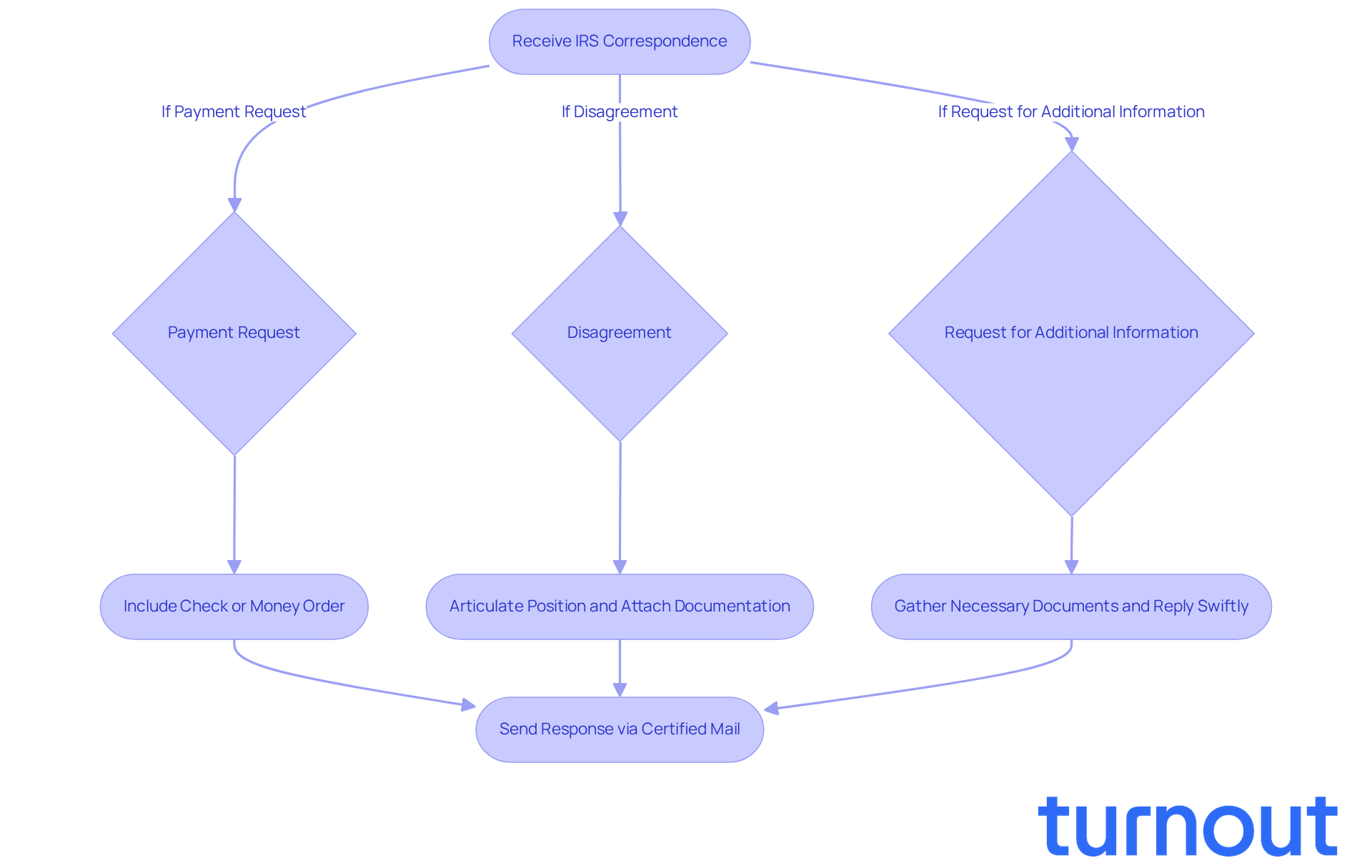

When replying to IRS certified letters, we understand that your approach will depend on the specific request outlined in the correspondence. If the correspondence demands payment, such as a CP90 or LT11, it’s important to include a check or money order with your response. If you disagree with the IRS's findings, clearly articulate your position in writing and attach supporting documentation to bolster your argument. Always send your response via certified mail to maintain a record of delivery, which is crucial for tracking purposes.

If the message asks for additional information, gather the necessary documents and reply swiftly to prevent further complications. It’s common to feel overwhelmed in these situations, but statistics show that taxpayers who seek assistance from experts when dealing with IRS communications achieve more beneficial results. Many successful replies include the knowledge of tax attorneys who can manage the intricacies of tax law efficiently. As Timothy S. Hart, a founding partner of the tax law firm of Timothy S. Hart Law Group, P.C., wisely notes, 'Ignoring it? That’s the mistake that causes the most damage.'

For example, individuals undergoing audits or disputes frequently discover that having a tax expert examine their correspondence can clarify the IRS's inquiries and assist in crafting a strategic reply. This proactive approach not only alleviates stress but also enhances the likelihood of a positive resolution. Remember, prompt measures are essential; delays can lead to escalated collection efforts, including potential asset seizures. Therefore, if you're uncertain about how to proceed, seeking professional guidance is highly advisable. We're here to help you navigate this journey.

Understand the Consequences of Ignoring IRS Letters

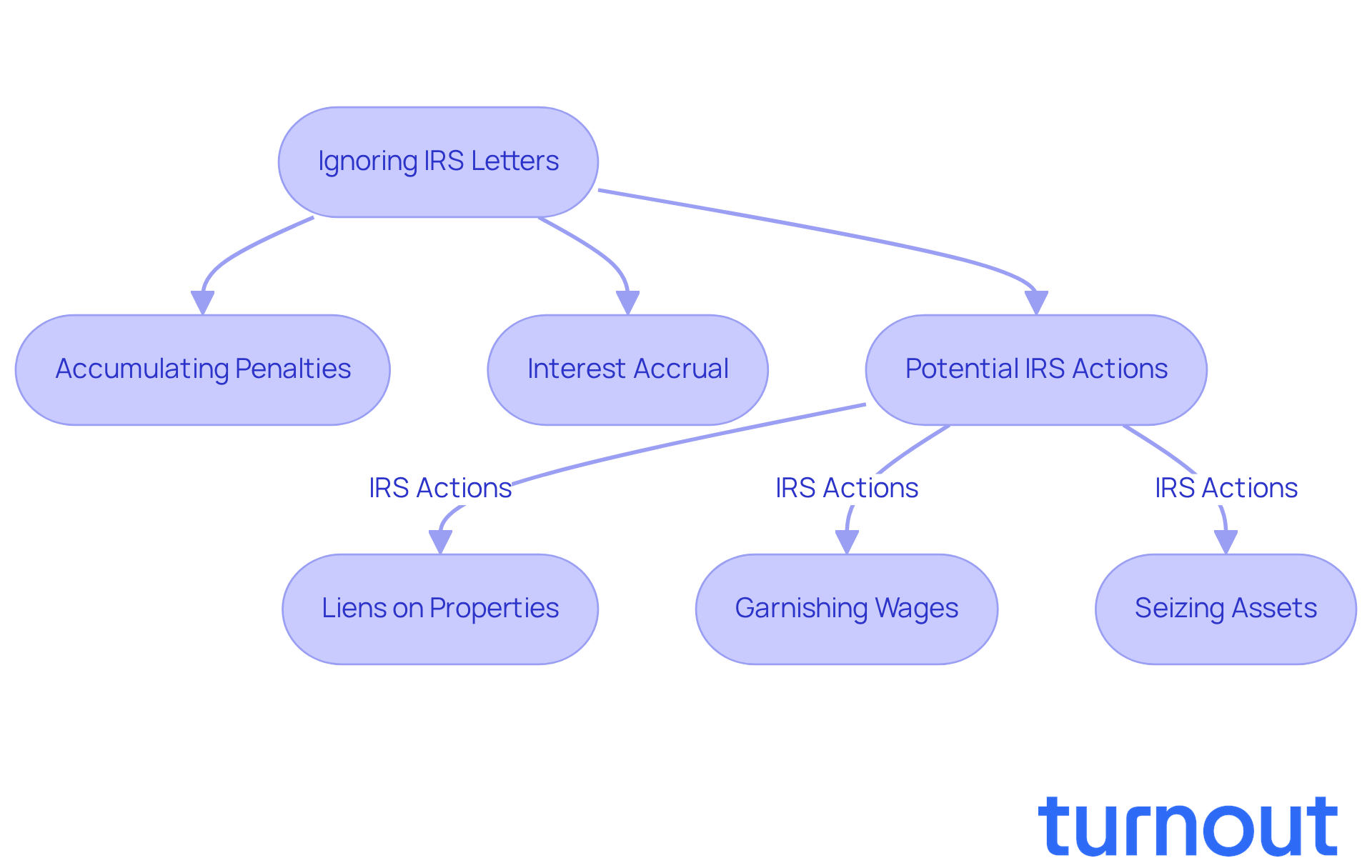

Ignoring IRS certified letters can lead to serious consequences, and we recognize how overwhelming that situation can feel. Accumulating penalties and interest can escalate quickly, adding to your stress. In FY 2024 alone, the IRS collected a staggering $120.2 billion in unpaid assessments, underscoring the financial stakes involved. When taxpayers don’t respond, the IRS may take more aggressive actions, such as:

- Placing liens on properties

- Garnishing wages

- Seizing assets

For instance, the CP504 notice serves as an official warning that the IRS might impose state tax refunds and confiscate property if no action is taken within 30 days. This notice is crucial; responding can open the door to a Collection Due Process hearing, which may halt levy measures. On the flip side, ignoring it can lead to swift enforcement actions, complicating your situation even further.

Moreover, the IRS can make unilateral decisions about your tax account, often resulting in outcomes that aren’t favorable for you. Did you know that penalties can reach up to 25% of the unpaid tax balance? Plus, interest on unpaid taxes accrues daily. In extreme cases, the IRS can seize physical assets, a reality many taxpayers face after overlooking initial notices. The escalation of IRS actions typically starts with balance-due reminders and can lead to aggressive collection measures if ignored.

Real-life examples show the consequences faced by those who neglect IRS communications. Taxpayers who delay their responses often see their balances grow significantly due to accumulating penalties and interest. This can lead to wage garnishments and bank levies without any further warning. Therefore, it’s essential to take every IRS certified letter seriously and respond promptly. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Conclusion

Receiving an IRS certified letter can feel overwhelming. We understand that this experience can bring about a lot of anxiety. However, knowing how to respond effectively is crucial to avoiding serious consequences. These letters are official notifications from the IRS, often requiring immediate action to address issues with your tax account. By recognizing the importance of these communications and responding promptly, you can mitigate potential penalties and protect your financial well-being.

In this article, we’ve outlined essential steps for responding to IRS certified letters:

- Open the correspondence immediately.

- Identify its type and thoroughly review its contents.

- If you feel uncertain, seeking professional assistance can be invaluable.

Ignoring these letters can lead to dire consequences, including asset seizures and significant financial penalties. Understanding these aspects is vital for navigating the complexities of IRS communications.

Ultimately, the key takeaway is that proactive engagement with IRS certified letters is paramount. By taking timely and informed actions, you can shield yourself from the fallout of neglecting these important notices. Approach each letter with diligence, ensuring that all necessary steps are taken to respond appropriately. Remember, you are not alone in this journey; we’re here to help you turn a potentially stressful situation into a manageable one.

Frequently Asked Questions

What are IRS certified letters?

IRS certified letters are official communications sent by the Internal Revenue Service to inform taxpayers about important matters concerning their tax accounts, such as outstanding balances or verification of information.

Why are IRS certified letters important?

They are important because they require immediate attention and can indicate critical issues that, if overlooked, may lead to serious repercussions, including penalties, interest, or legal actions.

What types of notices are sent via IRS certified letters?

Certain IRS procedures, like deficiency and levy notices, are sent via certified mail to ensure taxpayers are aware of these important communications.

What happens if I ignore an IRS certified letter?

Ignoring IRS certified letters can escalate problems, potentially resulting in penalties, interest, asset levies, or liens, and may lead to wage garnishment or bank levies.

How many notices does the IRS send to taxpayers each year?

The IRS sends around 170 million notices to individual taxpayers each year, many of which are delivered through certified letters.

What is a failure-to-pay penalty?

A failure-to-pay penalty is 0.5% per month on unpaid taxes, which can accumulate to a maximum of 25%, leading to significant financial burdens over time.

What should I do upon receiving an IRS certified letter?

Open the letter immediately, understand its contents, identify required actions, and record any deadlines mentioned in the correspondence on your calendar.

How can I confirm the authenticity of IRS documents?

To confirm authenticity, look for official CP/LTR codes on the documents to ensure you are responding to genuine communications and not falling victim to scams.

Should I consult a tax advisor when dealing with IRS certified letters?

Yes, consulting a tax advisor can provide clarity on how to respond effectively to IRS communications and help navigate the complexities involved.

What resources are available to help me with IRS certified letters?

There are resources available, including tax advisors and support services, to help you understand and respond to IRS certified letters effectively.