Introduction

Receiving an intent to levy notice from the IRS can truly shake anyone's financial world. It signals a serious threat to your personal assets due to unpaid tax debts. We understand that this can be overwhelming, and that’s why this guide is here for you. It offers essential steps to help you navigate the complexities of responding to such notices, empowering you with the knowledge to protect your financial well-being.

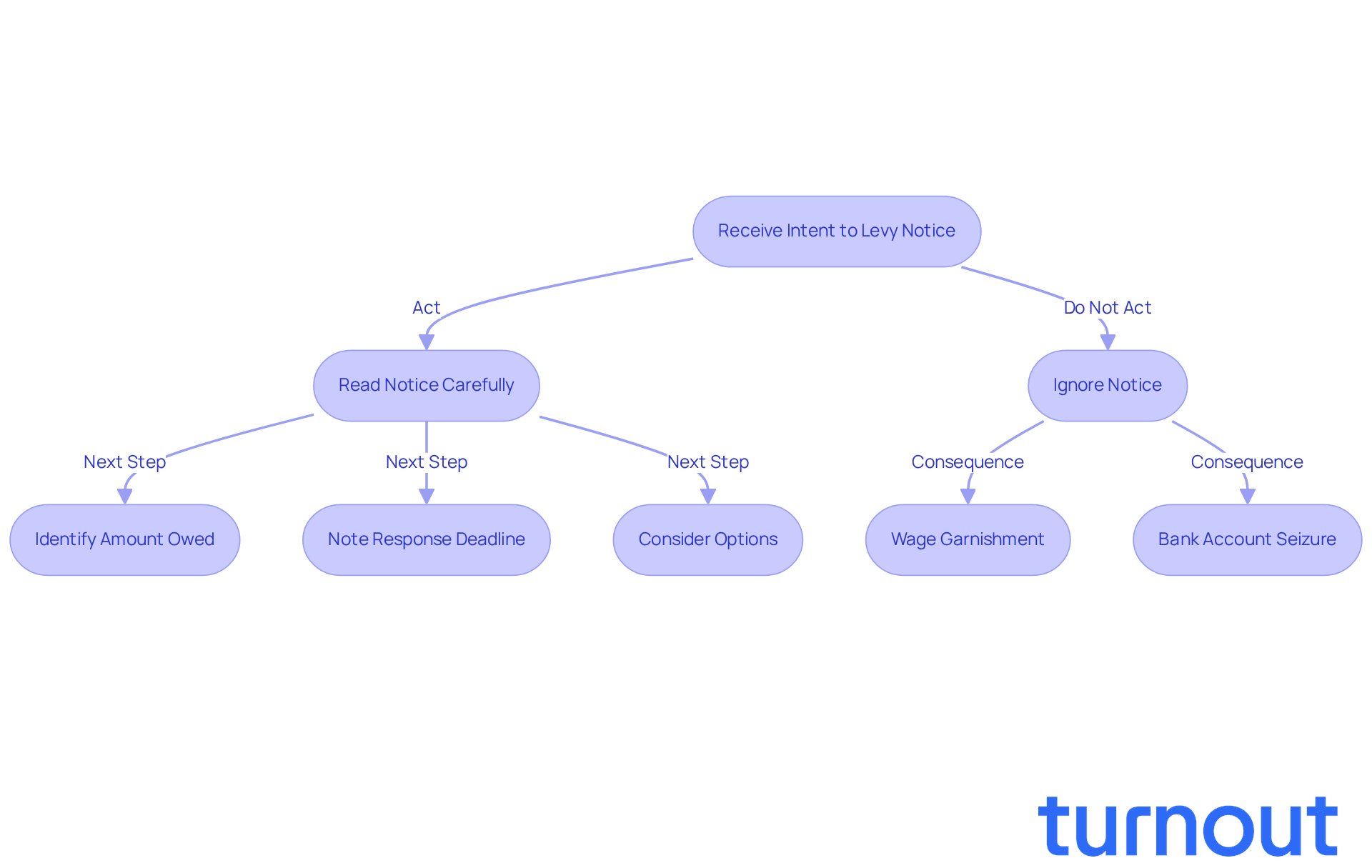

But what happens if you choose to ignore this critical communication? It’s common to feel uncertain about the next steps. The stakes are high, and understanding the implications of inaction could mean the difference between financial recovery and severe penalties. Remember, you are not alone in this journey; we’re here to help you through it.

Understand Your Intent to Levy Notice

An intent to levy communication, commonly referred to as a CP504 or LT11 document, is a serious message from the IRS. It indicates their intent to levy your assets due to unpaid tax debts. We understand that receiving such a notice can be overwhelming, especially after previous attempts to collect the debt have failed. It’s crucial to read this announcement carefully, as it outlines the amount owed and the deadline for your response. Ignoring this alert can lead to significant consequences, like wage garnishments or bank account seizures.

Statistics show that about 30% of taxpayers don’t respond to their intent to levy notices, which can worsen their financial situation. Tax experts emphasize the importance of acting quickly when you receive a CP504 communication. One expert noted, "Responding promptly to the LT11 alert is crucial for managing tax obligations effectively."

Real-life stories highlight the stakes involved. Many individuals who engaged proactively with the CP504 process reported that their timely responses helped them avoid additional penalties and interest. For instance, one case study featured someone who quickly replied to the LT11 communication and successfully set up a manageable payment plan, preventing a levy on their bank account. In contrast, another individual who overlooked the alert faced serious financial hardship, including the loss of their earnings.

Recent updates from the IRS show ongoing efforts to improve communication about these alerts, ensuring taxpayers know their rights and the procedures that protect them. It’s important to recognize that neglecting these notices can lead to severe consequences, such as the potential denial or cancellation of a United States passport due to overdue tax obligations. By understanding the implications of an intent to levy and taking timely action, you can protect your financial well-being and explore options to resolve your tax debts. Remember, you are not alone in this journey, and we’re here to help.

Take Immediate Action After Receiving the Notice

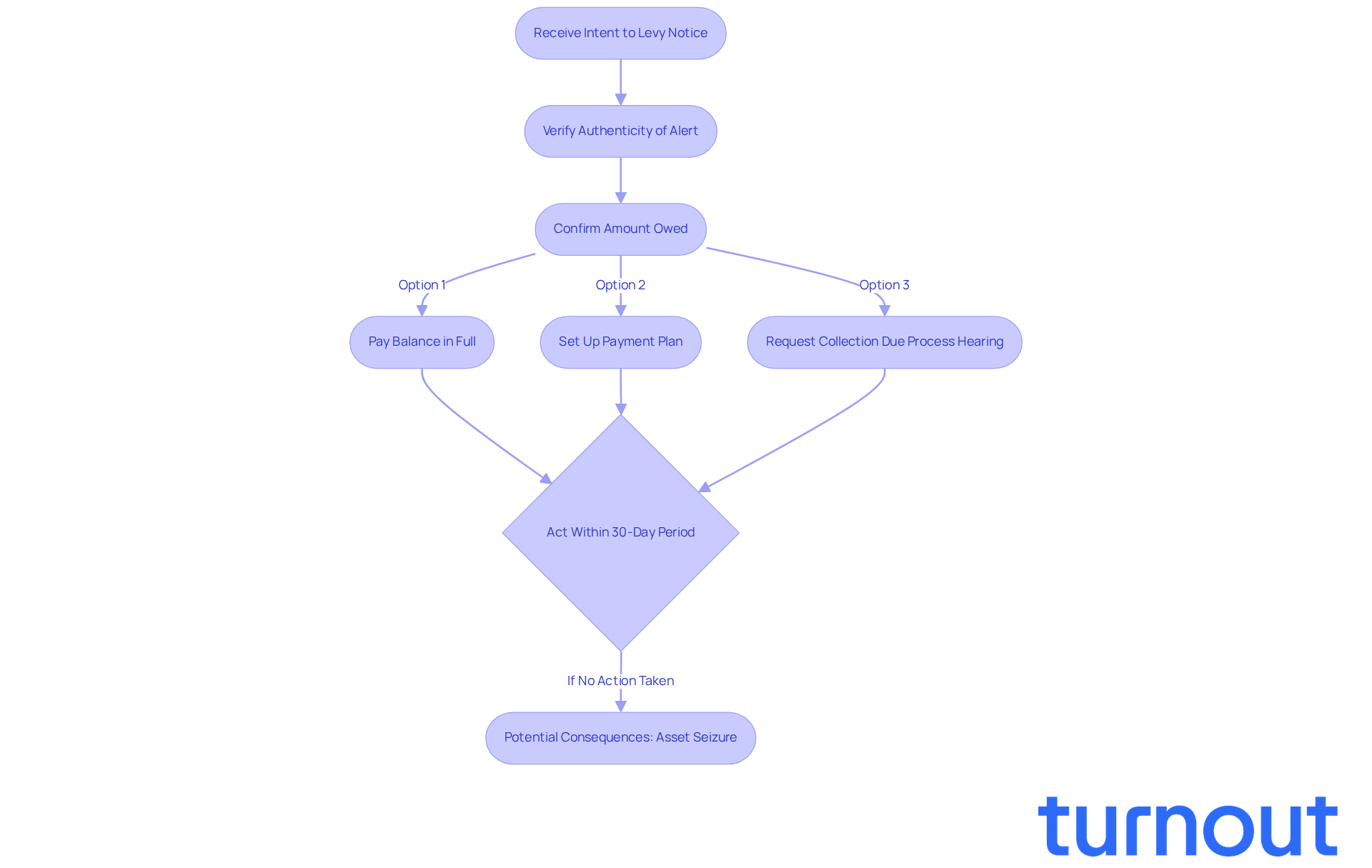

Receiving an intent to levy alert can be overwhelming, and we understand that your first step should be to verify the authenticity of the alert. Look for key details like the IRS logo and the reference number. Once you’ve done that, confirm the amount owed by cross-referencing it with your records. If everything checks out, consider your options: you can pay the balance in full, set up a payment plan, or even request a Collection Due Process hearing.

It’s crucial to act within the 30-day period mentioned in the intent to levy notification. This helps you avoid additional collection measures, as the IRS can initiate the intent to levy and start asset seizures, including bank levies and wage garnishments, if you don’t respond. Remember, tax scams are common, and counterfeit IRS communications can complicate your situation. Document all your communications with the IRS and keep copies of any correspondence for your records.

Tax specialists emphasize that understanding your rights and confirming the validity of IRS communications can significantly impact your ability to manage tax matters effectively. For example, tax resolution expert Stephen K. Galgoczy points out that 'at this early stage, resolving the issue is far easier, and you retain the best chance of disputing any inaccurate assessments.' Many individuals have successfully confirmed their communications by following these steps, ensuring they are informed and ready to take appropriate action.

You are not alone in this journey, and we’re here to help you navigate through it.

Explore Your Rights and Resolution Options

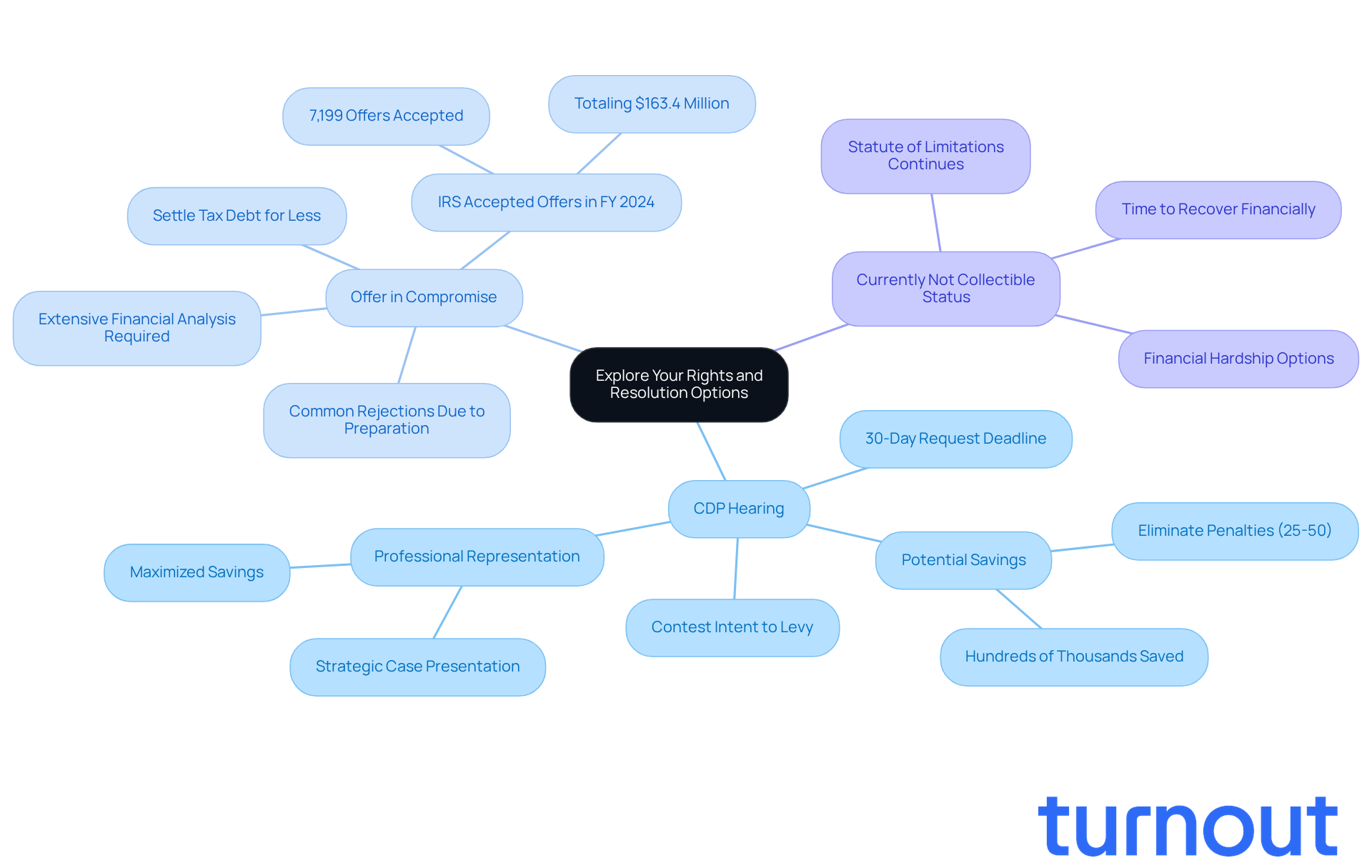

As a contributor, you have important rights that protect you from unfair collection practices. We understand that dealing with the IRS can be overwhelming, but it's essential to know that they are required to inform you of your right to appeal any intent to levy through a notice. By requesting a Collection Due Process (CDP) hearing, you can contest the intent to levy and suggest alternative payment arrangements that fit your situation.

You might also consider submitting an Offer in Compromise, which allows you to settle your tax debt for less than what you owe. If you're facing financial hardship, applying for Currently Not Collectible status could be a viable option. Understanding IRS Publication 594 is crucial, as it outlines your rights and the collection process, empowering you to navigate these challenges effectively.

In 2026, the IRS continues to stress the importance of CDP hearings. Many individuals are taking advantage of this option to safeguard their interests. Successful appeals against the IRS's intent to levy have demonstrated that with the right representation and preparation, you can achieve favorable outcomes, including the removal of penalties that can reach 25-50% of your total debt. Clients have saved hundreds of thousands in penalties through CDP hearings, highlighting the potential benefits of this process.

Engaging with a tax professional can significantly boost your chances of success during a CDP hearing. They can ensure that your case is presented strategically and effectively. As a tax controversy attorney points out, professional representation guarantees a proper case presentation and maximized savings. Remember, you are not alone in this journey; we're here to help you every step of the way.

Consult with a Tax Professional or Advocate

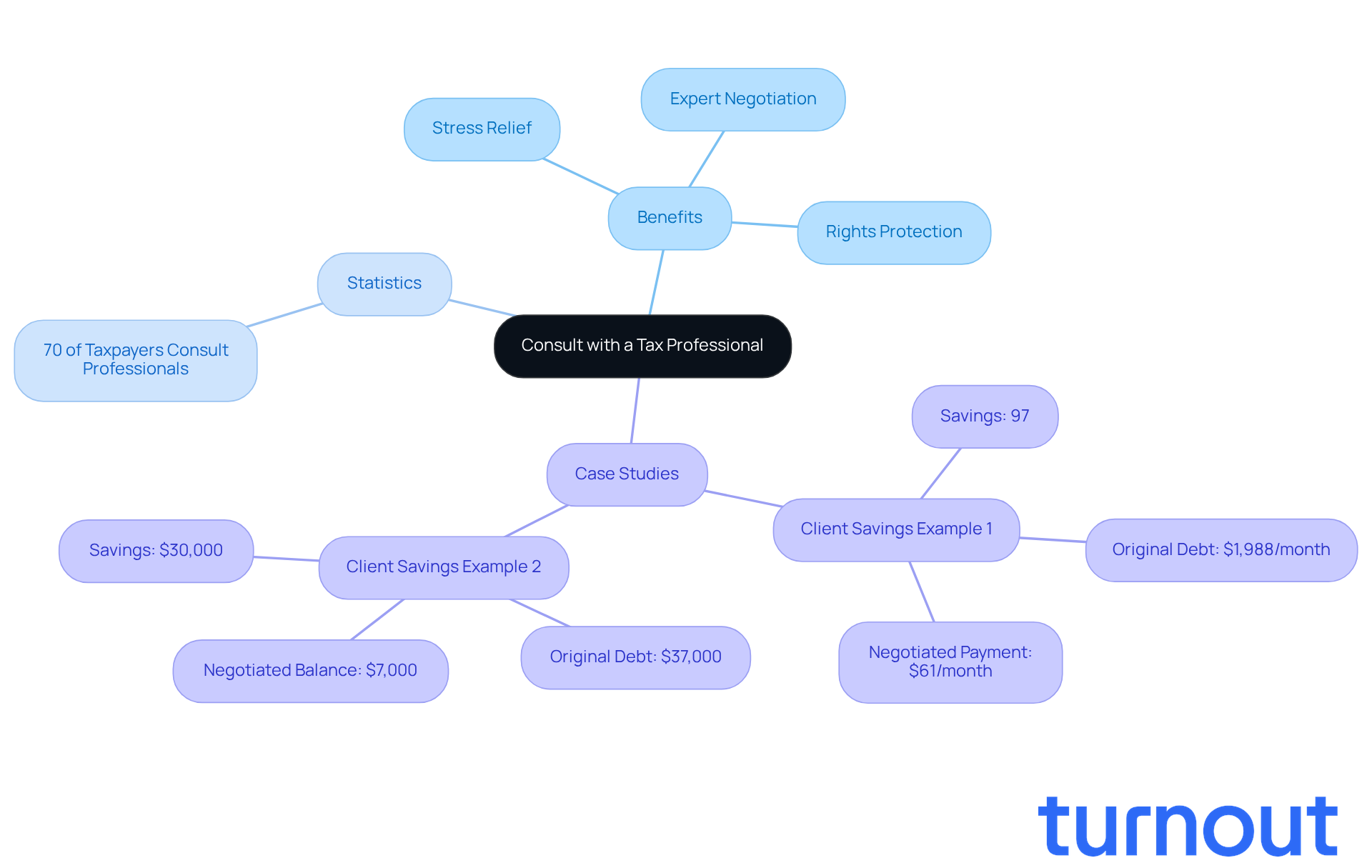

When you receive a notice of intent to levy, engaging a tax professional or advocate is essential. We understand that this can be a stressful time, and these experts are here to help. They have a deep understanding of tax law and can assess your unique situation to develop a strategic response. By representing you in communications with the IRS, they negotiate payment arrangements and assist in filing necessary forms, such as requests for a Collection Due Process hearing. It's common to feel overwhelmed, but studies show that about 70% of taxpayers who receive an intent to levy notice consult with tax professionals to navigate their options effectively.

Tax advocates have a proven track record of successful negotiations with the IRS. For instance, one client faced a demand of $1,988 per month on a long-standing debt. Through effective negotiation, this was reduced to just $61 per month, achieving a remarkable 97% savings. Another case involved a client who received an unexpected IRS notice for $37,000 in unreported taxes; the advocate successfully negotiated the balance down to $7,000, saving the client $30,000. These stories highlight the difference that professional support can make.

When selecting a tax professional, prioritize those with experience in tax resolution and a strong history of helping clients in similar situations. This support not only alleviates stress but also ensures that your rights are protected throughout the process. Remember, you are not alone in this journey. We're here to help you find the right path forward.

Conclusion

Receiving an intent to levy notice can feel overwhelming. We understand that this situation may bring up a lot of emotions and concerns about your financial future. It’s crucial to know how to respond effectively to protect what matters most to you. This article has outlined essential steps to take once you receive such a notice, emphasizing the importance of acting promptly and being aware of your rights. By addressing the situation quickly, you can reduce potential penalties and explore various options that may ease your tax burden.

Key insights shared throughout the article highlight the necessity of verifying the notice's authenticity. Ignoring it can lead to serious consequences, and consulting with a tax professional can be incredibly beneficial. Engaging with experts can significantly improve your chances of a favorable outcome, whether through:

- Negotiating payment plans

- Contesting the levy

- Applying for relief options like Currently Not Collectible status

Real-life examples illustrate how taking proactive measures can lead to substantial savings and help you avoid serious financial repercussions.

In conclusion, navigating an intent to levy notice requires vigilance and informed decision-making. It’s vital to act within the stipulated timeframe and utilize available resources, including tax professionals, to advocate for your rights. By taking these steps, you can regain control over your tax situation and work towards a resolution that aligns with your financial capabilities. Remember, addressing these challenges head-on not only safeguards your assets but also paves the way for a more secure financial future. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is an intent to levy notice?

An intent to levy notice, commonly known as a CP504 or LT11 document, is a communication from the IRS indicating their intent to levy your assets due to unpaid tax debts.

What should I do when I receive an intent to levy notice?

It is crucial to read the notice carefully, as it outlines the amount owed and the deadline for your response. Acting quickly is important to avoid severe consequences.

What are the consequences of ignoring an intent to levy notice?

Ignoring this notice can lead to significant consequences, including wage garnishments or bank account seizures.

What percentage of taxpayers respond to intent to levy notices?

Statistics show that about 30% of taxpayers do not respond to their intent to levy notices, which can worsen their financial situation.

How can responding promptly to an intent to levy notice help?

Timely responses can help avoid additional penalties and interest. For instance, some individuals have successfully set up manageable payment plans after responding quickly.

What are some real-life examples of the outcomes of responding to an intent to levy notice?

One case study featured an individual who quickly replied to the LT11 communication and set up a payment plan, preventing a levy on their bank account. In contrast, another person who overlooked the alert faced significant financial hardship.

Are there any recent updates from the IRS regarding intent to levy notices?

Yes, the IRS has been working to improve communication about these alerts to ensure taxpayers understand their rights and the procedures that protect them.

What serious implications can arise from neglecting an intent to levy notice?

Neglecting these notices can lead to severe consequences, including the potential denial or cancellation of a United States passport due to overdue tax obligations.

How can individuals protect their financial well-being regarding tax debts?

By understanding the implications of an intent to levy and taking timely action, individuals can explore options to resolve their tax debts and protect their financial situation.