Overview

When facing a notice of federal tax lien, it’s essential to take a moment to verify its accuracy. We understand that this can be a stressful situation, and prompt action is crucial to address your tax obligations. Ignoring the notice can lead to serious consequences, and we’re here to help you navigate this challenge.

Exploring your options is vital. You might consider:

- Full payment

- Setting up installment agreements

- Seeking professional assistance

Each of these paths can provide a way to manage the impact of the lien effectively. Remember, you are not alone in this journey, and there are structured approaches to help you find resolution.

Taking these steps can alleviate some of the burden you may be feeling. We encourage you to reach out for support and explore the best options available to you. Together, we can work towards a solution that brings you peace of mind.

Introduction

Receiving a notice of federal tax lien can indeed feel overwhelming, casting a shadow over your personal and financial well-being. We understand that this legal claim by the IRS not only complicates financial dealings but can also impact credit ratings and ownership of your assets. It’s common to feel anxious in such situations, but knowing the implications and understanding the steps to take can empower you to regain control over your financial situation.

What options exist for addressing a federal tax lien? How can you effectively navigate the complexities of this process to secure a favorable outcome? You're not alone in this journey, and there are ways to find relief and clarity amidst the uncertainty.

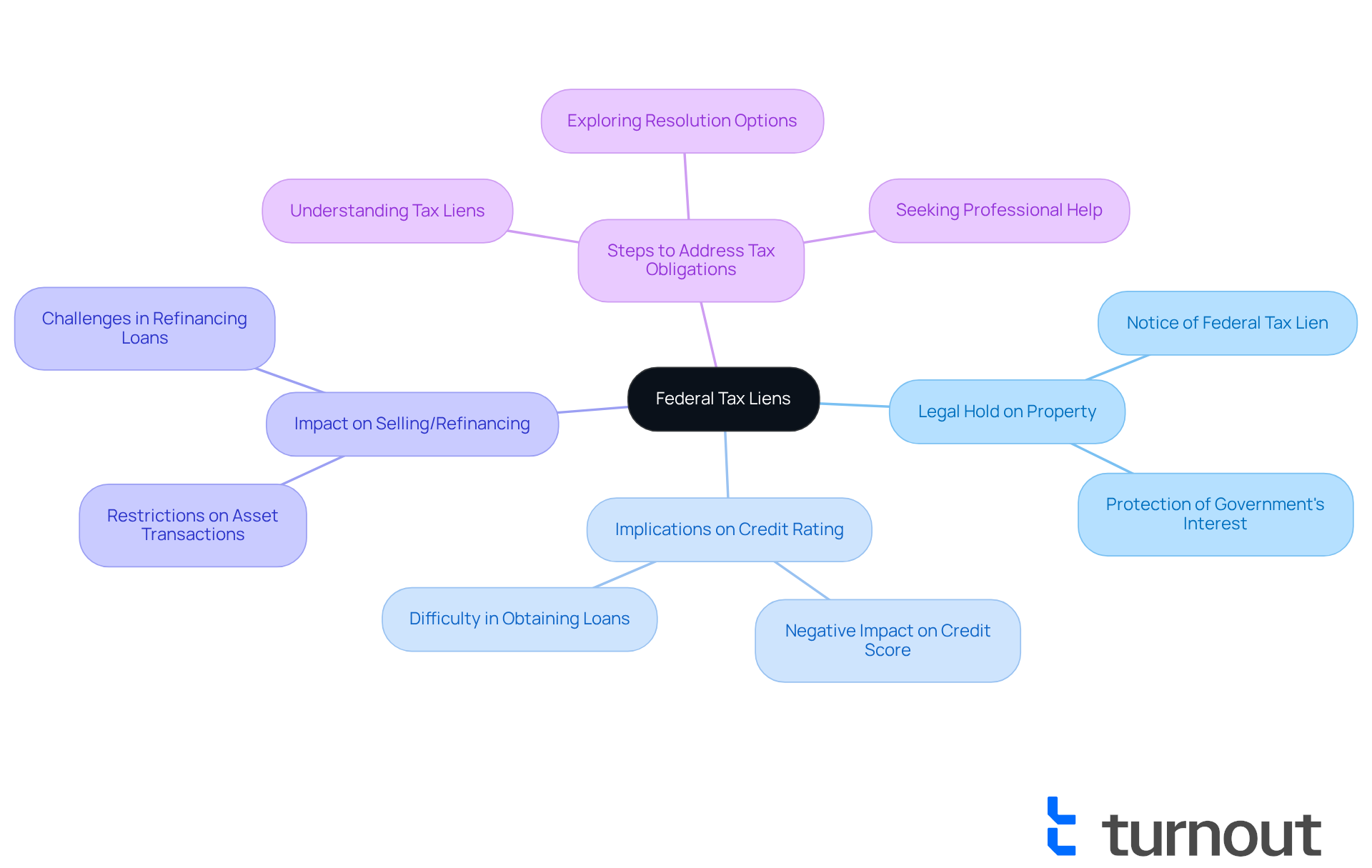

Understand Federal Tax Liens

A federal tax claim can feel overwhelming, but understanding it is the first step toward regaining control. When tax obligations are not met, the government places a legal hold on your property known as a notice federal tax lien. It protects the government's interest in your assets, including real estate, personal belongings, and financial accounts. This claim arises automatically when the IRS assesses a tax against you that remains unpaid, resulting in a notice federal tax lien.

We understand that navigating this process can be daunting. A tax claim can affect your credit rating, limit your ability to sell or refinance assets, and complicate your financial dealings. It's common to feel anxious about these implications. By familiarizing yourself with the terms and conditions related to federal tax claims, you can better manage your situation and explore your options for resolution.

Remember, you're not alone in this journey. We're here to help you find the best path forward. Take a moment to reflect on your circumstances and consider the steps you can take to address your tax obligations effectively.

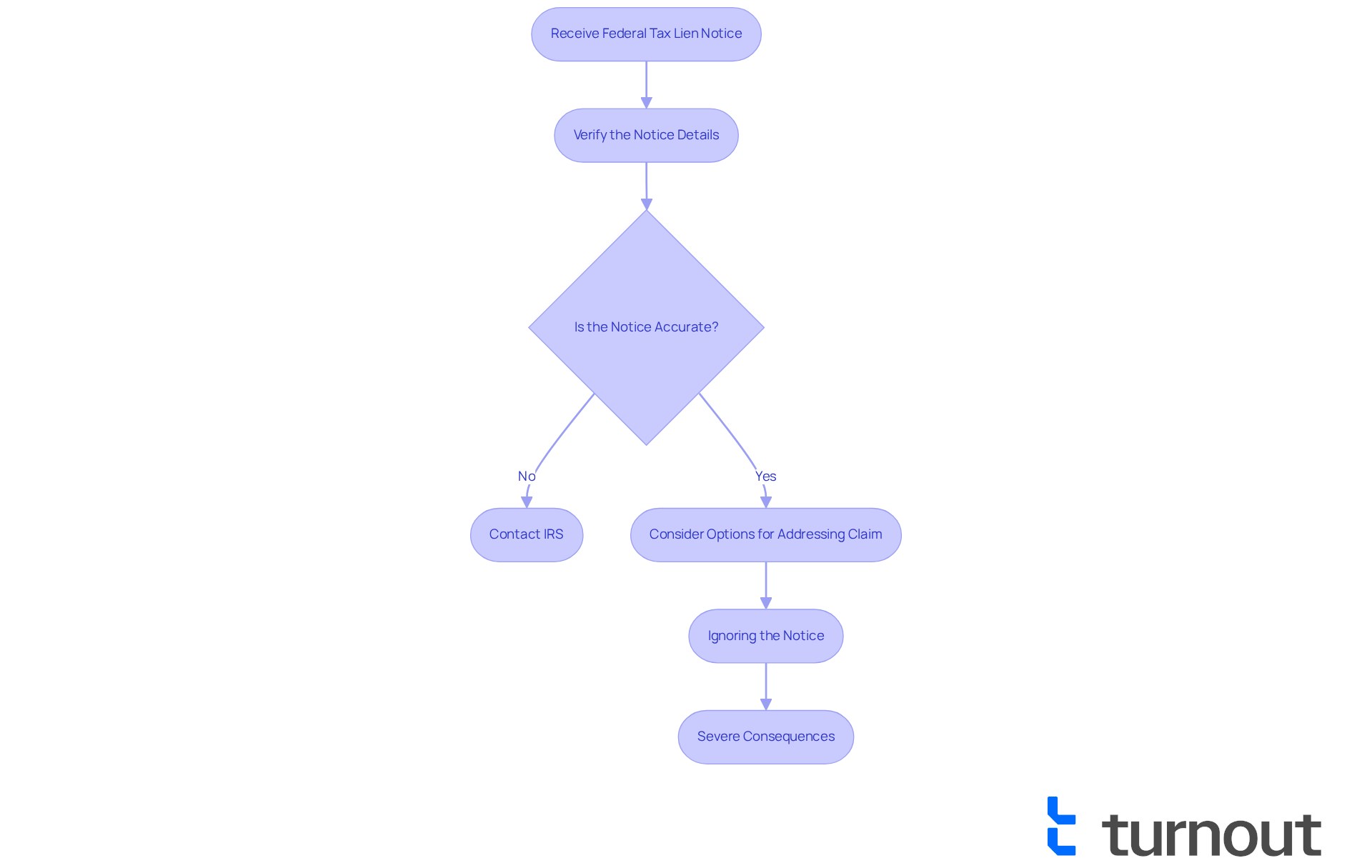

Take Immediate Action Upon Receiving the Notice

Receiving a notice federal tax lien can be overwhelming, and we understand that you may feel anxious about the situation. It’s essential to act quickly. Start by verifying the accuracy of the notice—check the details, including the tax periods and amounts owed. If you believe there is an error, please contact the IRS immediately using the number provided in the notice. Prepare to discuss your case, and have relevant documentation ready.

If the announcement is correct, consider your options for addressing the claim. Ignoring the notice is not advisable, as it can lead to severe consequences, including asset seizure or further legal action. Remember, you are not alone in this journey. Prompt action can help mitigate these risks and set the stage for resolution. We're here to help you navigate this process with care and support.

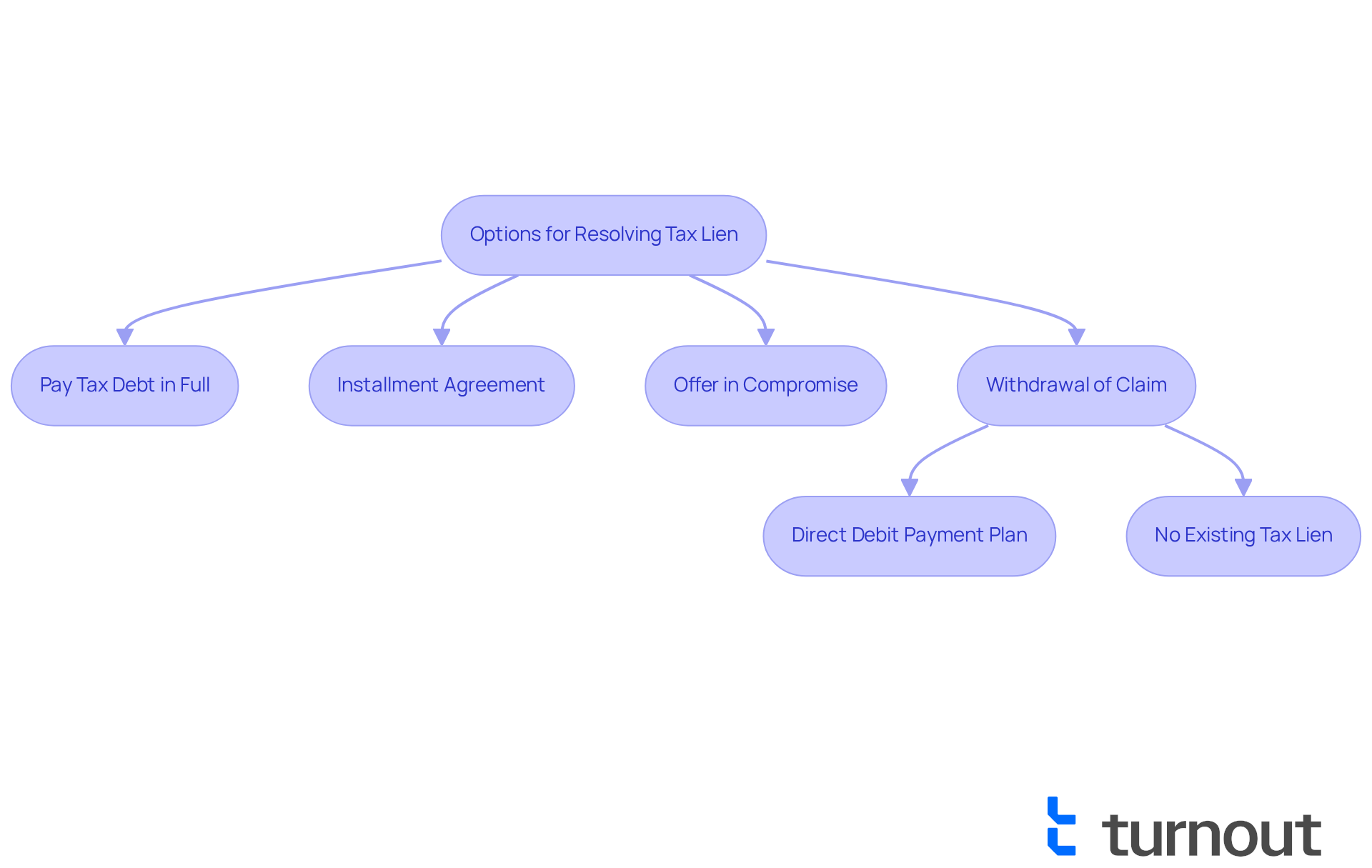

Explore Options for Resolving the Tax Lien

We understand that facing a notice federal tax lien can feel overwhelming. There are several options available to help you navigate this situation. The most straightforward method is to pay the tax debt in full. Once the IRS receives your payment, they will remove the claim within 30 days. If paying in full isn't feasible, you might consider setting up an installment agreement, which allows you to pay off your debt over time.

Alternatively, you may qualify for an Offer in Compromise, which lets you settle your tax debt for less than the full amount owed. Additionally, you can request a withdrawal of the claim if you meet certain conditions, such as:

- Establishing a direct debit payment plan

- Ensuring there is no notice federal tax lien against you

Each choice comes with its own requirements and implications, so it’s important to assess your financial situation thoroughly before moving forward. Remember, you are not alone in this journey, and we’re here to help you find the best solution.

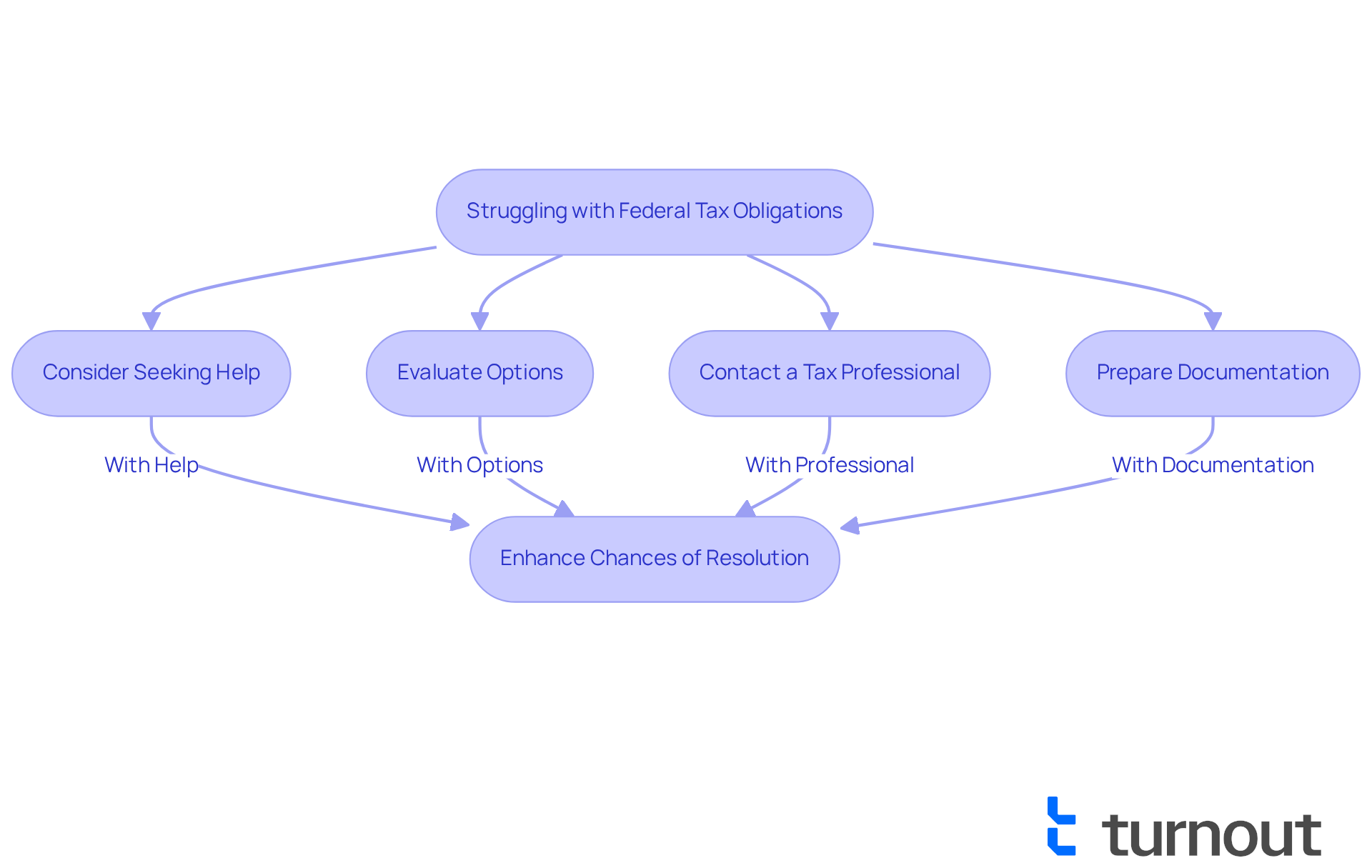

Seek Professional Assistance When Necessary

If you find yourself struggling with the complexities of federal tax obligations, know that you are not alone. It’s common to feel overwhelmed. Seeking expert assistance can be a wise choice during these challenging times. Professionals who specialize in tax resolution can provide you with the understanding you need. They can help you evaluate your options and negotiate with the IRS on your behalf.

These experts also assist in preparing necessary documentation, ensuring compliance with IRS requirements. If you feel uncertain about the best course of action, please don’t hesitate to reach out for help. Remember, professional guidance can significantly enhance your chances of effectively and efficiently resolving the notice federal tax lien.

We understand that navigating these issues can be daunting, but you don’t have to face it alone. You deserve support and clarity as you move forward. Take that first step today—your peace of mind is worth it.

Conclusion

Understanding how to effectively respond to a notice of federal tax lien is crucial for regaining control over your financial situation. We understand that this process may seem intimidating. However, by taking informed steps and exploring available options, you can mitigate the impact of a tax lien and work towards resolution.

Upon receiving a notice, it is essential to verify the details and not ignore the claim. There are various pathways to resolve a tax lien, including:

- Full payment

- Installment agreements

- Offers in compromise

Additionally, seeking professional assistance when faced with complexities can provide the support needed to navigate the IRS's requirements.

Responding to a federal tax lien notice with promptness and clarity can significantly influence the outcome. Taking that first step towards resolution not only alleviates anxiety but also opens the door to regaining financial stability. Remember, empowerment through knowledge and support is key; you are not alone in this journey. Don't hesitate to reach out for help and explore the best strategies tailored to your unique circumstances.

Frequently Asked Questions

What is a federal tax lien?

A federal tax lien is a legal hold placed by the government on your property when tax obligations are not met. It protects the government's interest in your assets, including real estate, personal belongings, and financial accounts.

When does a federal tax lien arise?

A federal tax lien arises automatically when the IRS assesses a tax against you that remains unpaid.

How can a federal tax claim impact my financial situation?

A federal tax claim can affect your credit rating, limit your ability to sell or refinance assets, and complicate your financial dealings.

What should I do if I receive a notice of a federal tax lien?

It's important to familiarize yourself with the terms and conditions related to federal tax claims and consider the steps you can take to effectively address your tax obligations.

Can I get help in dealing with a federal tax lien?

Yes, there are resources available to help you navigate the process of dealing with a federal tax lien and to explore your options for resolution.