Overview

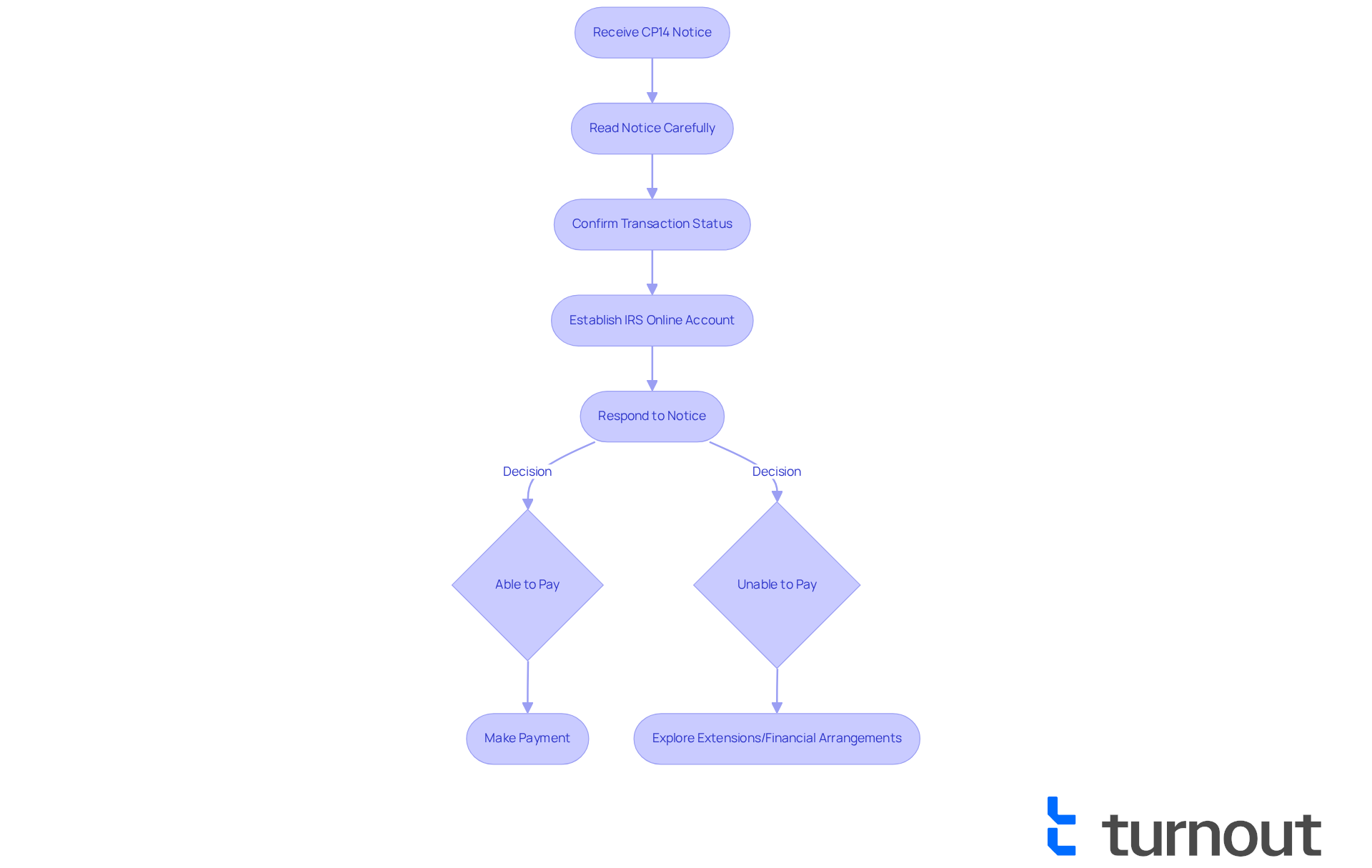

We understand that receiving a CP14 notice from the IRS can be unsettling. This article offers a step-by-step guide on how to respond effectively, highlighting the importance of prompt action and careful verification of the notice's details. By reviewing the notice, confirming the amount owed, and exploring payment or dispute options, you can take charge of your tax obligations.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and minimize potential penalties.

Introduction

Receiving a CP14 notice can understandably trigger a wave of anxiety for taxpayers. This document signifies the IRS's assertion that additional taxes may be owed, and it outlines the amount due while initiating a time-sensitive collection process that requires your immediate attention. We understand how daunting this can feel. Knowing how to respond effectively is vital; it can mean the difference between resolving the issue swiftly or facing escalating penalties and complications.

What steps should you take to ensure a proper response? How can you navigate this potentially overwhelming situation with confidence? You're not alone in this journey, and we're here to help you through it.

Understand the CP14 Notice

The cp14 document, known as the ',' is issued by the IRS when it believes that additional taxes may be owed. This notice includes important information, such as the total amount owed, which encompasses any fees and interest, and sets a payment deadline, typically within 21 days. We understand that ; comprehending its contents is crucial, as it initiates the .

Prompt action is necessary. If you fail to respond, it could lead to further penalties or collection measures, adding to your worries. It’s essential to read the notice carefully to grasp all details, including the relevant tax year and any specific instructions from the IRS. Remember, you have the right to contest any IRS correspondence, which can empower your response to the related communication.

It's common to feel overwhelmed, especially since some taxpayers might receive CP14 notices in error, even after settling their dues. This highlights the importance of . Establishing an online account with the IRS can be a helpful step in tracking your status and managing responses effectively.

Tax specialists emphasize the importance of to minimize potential repercussions. If you find yourself unable to settle the balance by the alert date, consider exploring options for short-term extensions or financial arrangements. Many individuals have successfully navigated their responses by verifying their transaction status and seeking guidance from tax experts. Remember, you are not alone in this journey; we’re here to help.

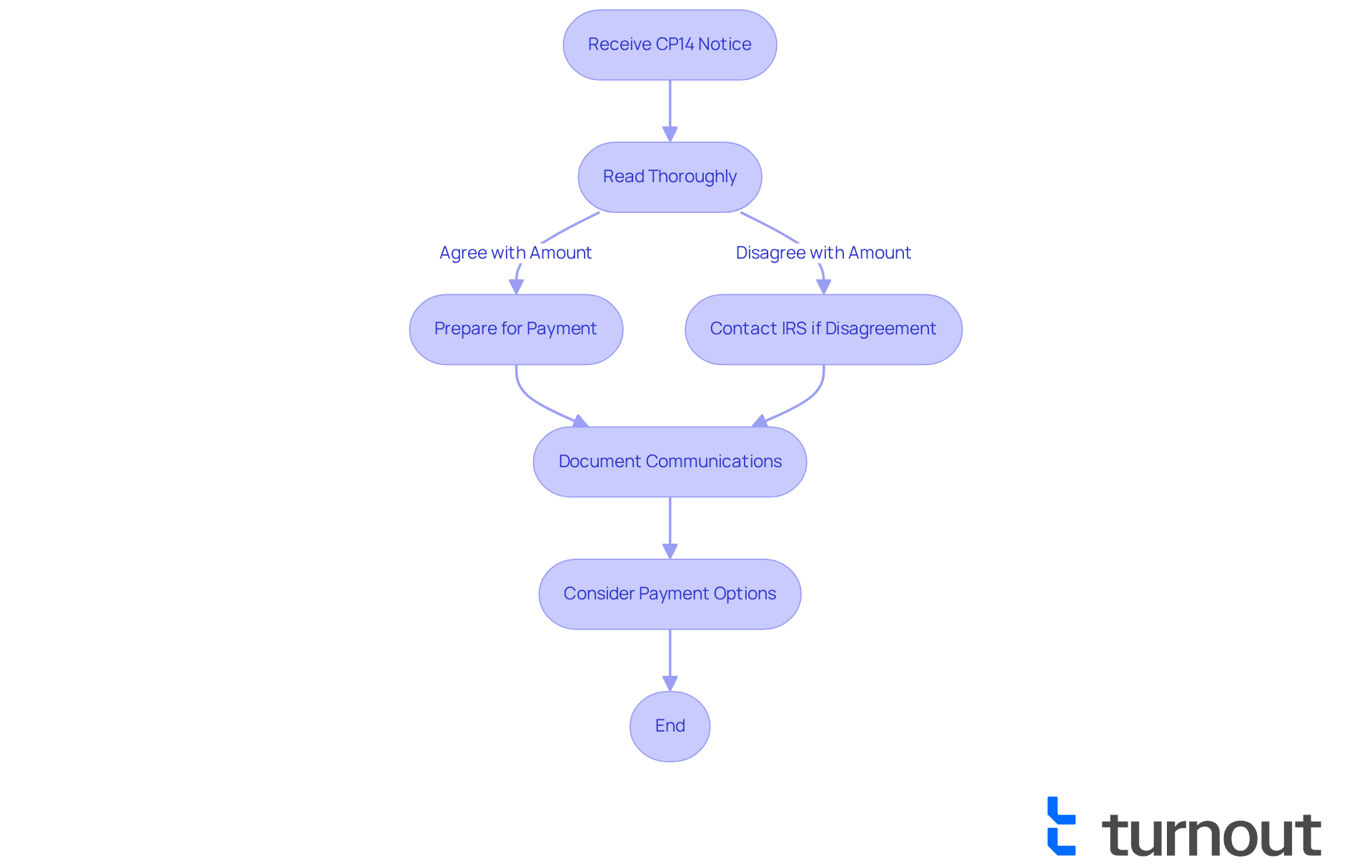

Take Immediate Action Upon Receipt

Upon receiving a , we realize that the first step can feel overwhelming. Take a moment to read it thoroughly, paying close attention to the due date for settling the bill and any specific instructions provided. If you agree with the amount owed, we encourage you to prepare for payment as soon as possible. This can help you avoid additional penalties, as interest and late fees can accumulate quickly.

However, if you see things differently, please don’t hesitate to reach out to the IRS using the phone number provided. Acting within the specified timeframe is crucial; it preserves your options and prevents escalation of the issue. emphasize that prompt action can save you time, stress, and money.

Remember to , including canceled checks and amended returns. Keeping a record of your actions can be invaluable if further disputes arise. Generally, taxpayers who react promptly to correspondence can settle their concerns within a few weeks, while those who postpone may encounter extended difficulties.

It's important to keep in mind that a tax alert is not a reason for alarm; it’s an opportunity to before they intensify. As pointed out by tax consultants, 'A tax communication isn’t a reason for alarm—it’s a chance to manage the situation before it intensifies.' If you cannot pay the full amount owed, consider options such as a or an Offer in Compromise to manage your . Remember, you are not alone in this journey, and .

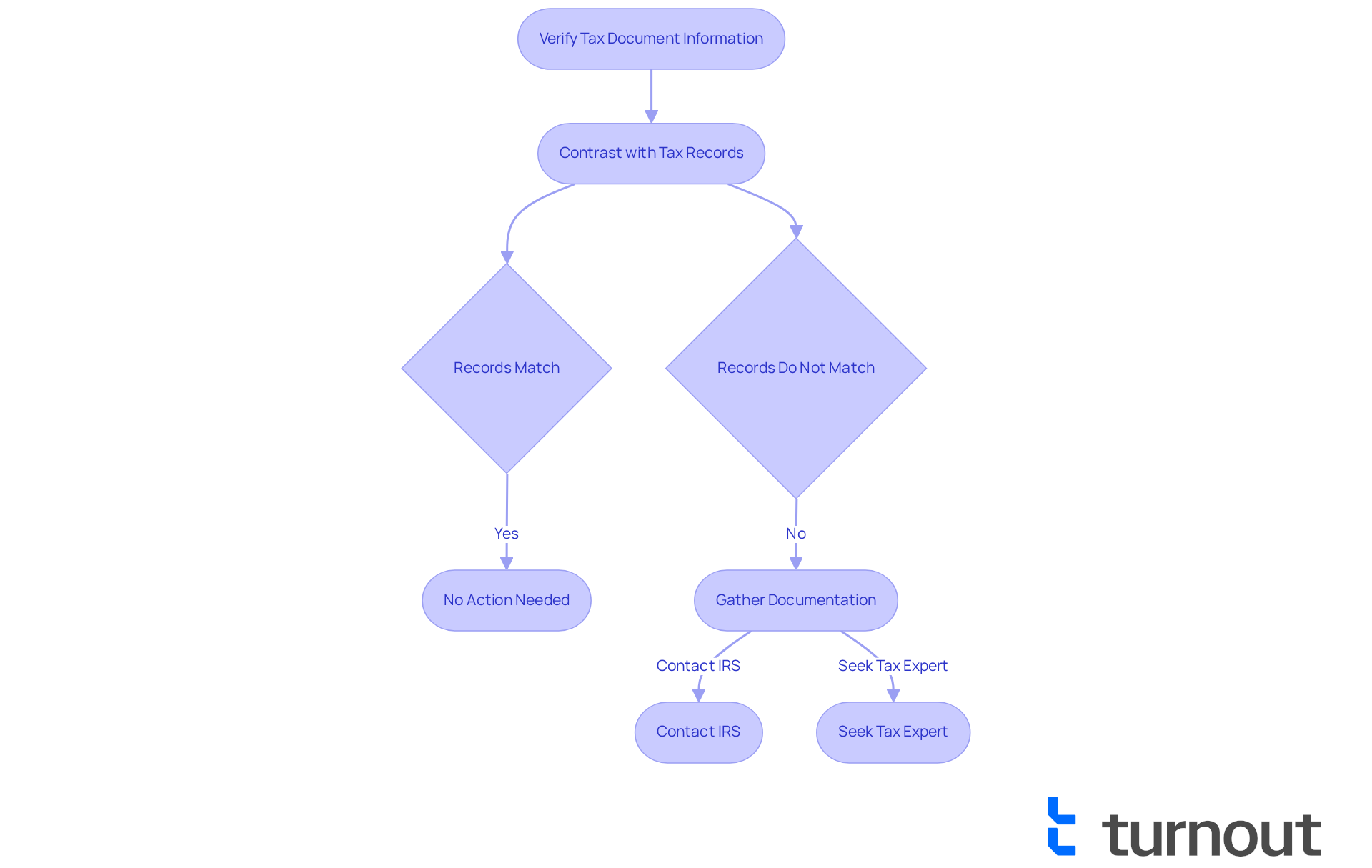

Verify the Information on the Notice

To confirm the information on your tax document, we understand that it can be a daunting task. Begin by contrasting the details with your tax records. Verify the tax year, the amount due, and any contributions you have already made. If you believe you have paid the amount listed, gather supporting documentation such as canceled checks or bank statements. It's common to feel concerned when discrepancies arise, so be prepared to . Accurate verification is crucial, as it forms the basis for any disputes or appeals you may need to initiate.

Many taxpayers have faced similar challenges. that thousands of individuals erroneously received . This makes careful verification essential. Alex Beene, a financial literacy educator, emphasizes that ' are indeed frightening, but not unprecedented.' Therefore, we recommend waiting six to eight weeks to about any missed payments, especially considering the IRS's backlog issues.

If you discover that your records do not correspond with the communication, it’s wise to who can aid you in addressing these matters effectively. Remember, if you received a specific communication but have settled the amount completely, you do not need to reply. This can help reduce some of the stress that such messages can create. You're not alone in this journey, and we're here to help you navigate through it.

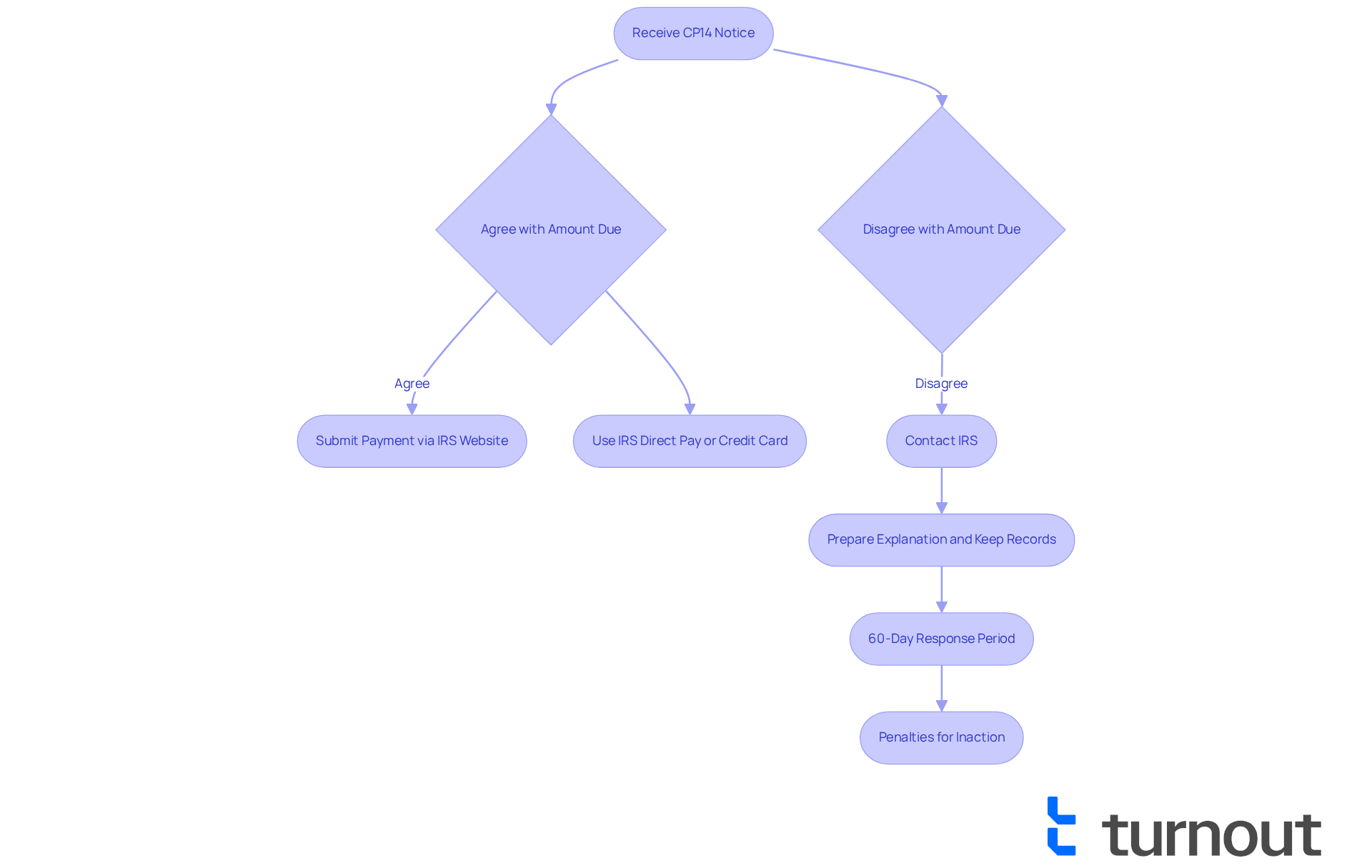

Respond to the CP14 Notice Effectively

When responding to a cp14 notice, we understand that it can feel overwhelming. You have several options based on your circumstances. If you agree with the amount due, you can easily submit your payment directly via the IRS website or by sending a check. Just remember to include your name, address, Social Security number, and the tax year associated with the payment to ensure proper processing. Payments can also be made through or with credit or debit cards via their online portal.

If you have a different opinion regarding the communication, it’s important to reach out to the IRS promptly using the number provided on the document. Prepare to explain your position clearly and provide any supporting documentation that backs your claim. Keeping a detailed record of your communication with the IRS, including dates and responses, is crucial for your records. Remember, you have a 60-day period to before the IRS .

Tax professionals emphasize the importance of . As one expert noted, "The sooner you act, the fewer penalties you’ll face and the more options you’ll have to resolve the debt!" Furthermore, statistics indicate that a notable fraction of taxpayers contest tax notifications, underscoring the necessity of resolving discrepancies swiftly. Ignoring a CP14 notice can lead to accruing penalties and interest, so it is essential to act quickly on the cp14.

If you need assistance, consider reaching out to a , which may provide support tailored to your situation. You can also contact the for unresolved issues. Remember, acting quickly can help you avoid escalating penalties and interest. You're not alone in this journey, and we're here to help you navigate through it.

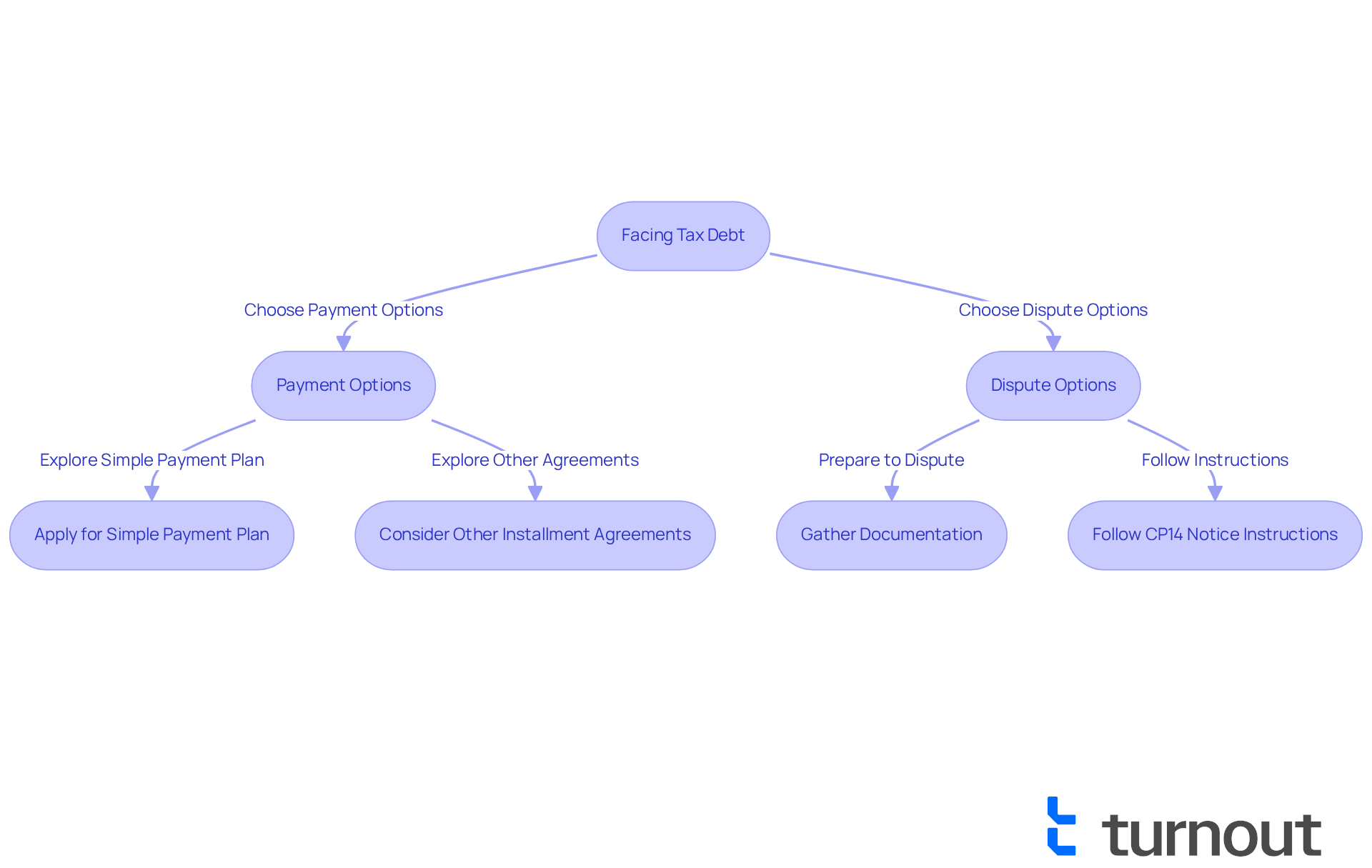

Explore Payment and Dispute Options

If you find yourself unable to cover the total amount due, please know that the IRS offers various . Among these are . In fact, approximately 90% of individual taxpayers with tax debt qualify for a Simple , introduced in 2025, making it a viable option for many. You can easily apply for a or by contacting the IRS directly.

We understand that receiving a can be concerning. If you believe the information in this communication is inaccurate, you have the right to contest it. Presenting proof of your payments or other relevant documentation can support your case. Be sure to carefully follow the instructions on the notice for disputing the claim, and keep copies of all correspondence. Maintaining documentation is crucial in these situations.

Tax advisors emphasize the importance of taking timely action. As one advisor noted, "Addressing IRS claims promptly can prevent further complications and penalties." Additionally, it's important to file and pay what you can by the April 18 deadline. This can help limit penalties and interest charges, which can accrue during the installment agreement.

Understanding these options can empower you to manage your more effectively. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

Conclusion

Receiving a CP14 notice can indeed be an alarming experience, and we understand how unsettling that can feel. However, knowing how to respond effectively is essential for managing your tax obligations. In this guide, we've outlined the necessary steps to take upon receipt of the notice. We emphasize the importance of prompt action, verifying your information, and exploring your options for payment or dispute. By following these steps, you can navigate your concerns with greater confidence and clarity.

Key points discussed include:

- The significance of thoroughly reading the notice

- Verifying the details against your personal tax records

- Understanding the options available for payment or contesting the claim

It’s crucial to document all communications and act within the specified timeframes to avoid escalating penalties and complications. Tax professionals stress that timely responses can lead to quicker resolutions and reduce the stress associated with tax issues.

Ultimately, the message is clear: taking immediate and informed action upon receiving a CP14 notice can significantly alleviate your worries. Remember, you are not alone in this process. If you need assistance, don’t hesitate to reach out. By empowering yourself with knowledge and resources, you can manage your tax responsibilities effectively and maintain peace of mind.

Frequently Asked Questions

What is a CP14 notice?

The CP14 notice, known as the 'Notice of Tax Due and Demand for Payment,' is issued by the IRS when it believes that additional taxes may be owed. It includes the total amount owed, encompassing any fees and interest, and sets a payment deadline, typically within 21 days.

What should I do upon receiving a CP14 notice?

Upon receiving a CP14 notice, read it thoroughly, paying attention to the due date and any specific instructions. If you agree with the amount owed, prepare for payment as soon as possible to avoid additional penalties. If you disagree, contact the IRS using the phone number provided on the notice.

What happens if I fail to respond to a CP14 notice?

Failing to respond to a CP14 notice can lead to further penalties or collection measures, adding to your financial worries.

How can I confirm the status of my tax transactions?

Establishing an online account with the IRS can help you track your status and manage responses effectively, confirming whether the CP14 notice was issued in error.

What options do I have if I cannot pay the full amount owed?

If you cannot pay the full amount owed, consider options such as a Short-Term Payment Plan or an Offer in Compromise to manage your tax obligations effectively.

Why is it important to document all communications regarding a CP14 notice?

Documenting all communications, including canceled checks and amended returns, can be invaluable if further disputes arise and helps keep a clear record of your actions.

Can I contest the CP14 notice?

Yes, you have the right to contest any IRS correspondence, which can empower your response to the notice.

How quickly can I resolve issues related to a CP14 notice?

Taxpayers who react promptly to the notice can often settle their concerns within a few weeks, while those who delay may encounter extended difficulties.