Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially during times of financial hardship. We understand that this can be a challenging experience. Fortunately, the IRS offers various forgiveness programs designed to ease the burden of tax debt for those who qualify. This guide will walk you through the essential steps and criteria needed to secure IRS forgiveness, shedding light on options like the Offer in Compromise and the Currently Not Collectible status.

However, with acceptance rates hovering around 30%, you might wonder: what strategies can you implement to enhance your chances of approval? You're not alone in this journey, and we're here to help you navigate the application process with confidence.

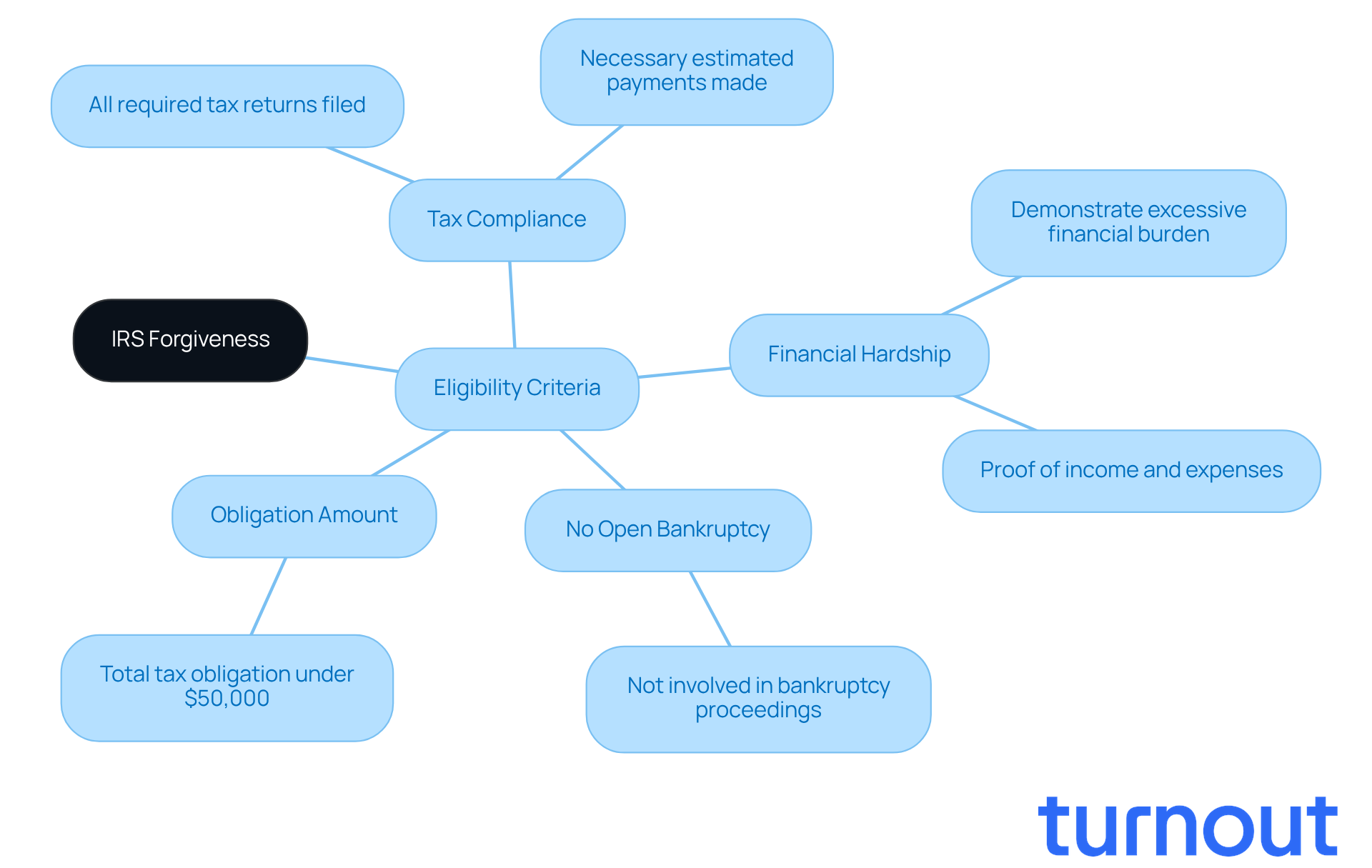

Understand IRS Forgiveness: Definition and Eligibility Criteria

IRS forgiveness offers various programs that can help you resolve your tax obligations for less than what you owe. The Offer in Compromise (OIC) is the most common option, specifically designed for individuals facing financial difficulties who can’t pay their taxes. If you’re considering this path, here are the eligibility criteria you need to meet:

- Tax Compliance: Make sure all required tax returns are filed, and necessary estimated payments are made.

- Financial Hardship: You need to demonstrate that paying your tax obligation would create an excessive financial burden.

- No Open Bankruptcy: You cannot be involved in an open bankruptcy proceeding.

- Obligation Amount: For the OIC, your total tax obligation should generally be under $50,000.

In 2022, the IRS accepted over 25,000 Offers in Compromise, showing that relief is possible. However, keep in mind that acceptance rates for OIC submissions were around 30% in 2021, which highlights the importance of thorough preparation. Many individuals have successfully reduced their tax liabilities by strategically presenting their financial difficulties. For example, one taxpayer settled an $11,000 state tax obligation for just $200 through a well-documented OIC application.

It’s important to note that eligibility standards for tax obligation forgiveness programs are tightening, focusing on current financial hardship. The IRS Fresh Start Initiative will still be available in 2026, providing ongoing opportunities for taxpayers seeking relief. Understanding these criteria is vital for assessing your situation and determining how do you qualify for IRS forgiveness in order to seek tax forgiveness. Remember, timely tax filing is crucial for maintaining eligibility for relief programs.

We’re here to help you navigate this journey, and you are not alone in seeking the relief you deserve.

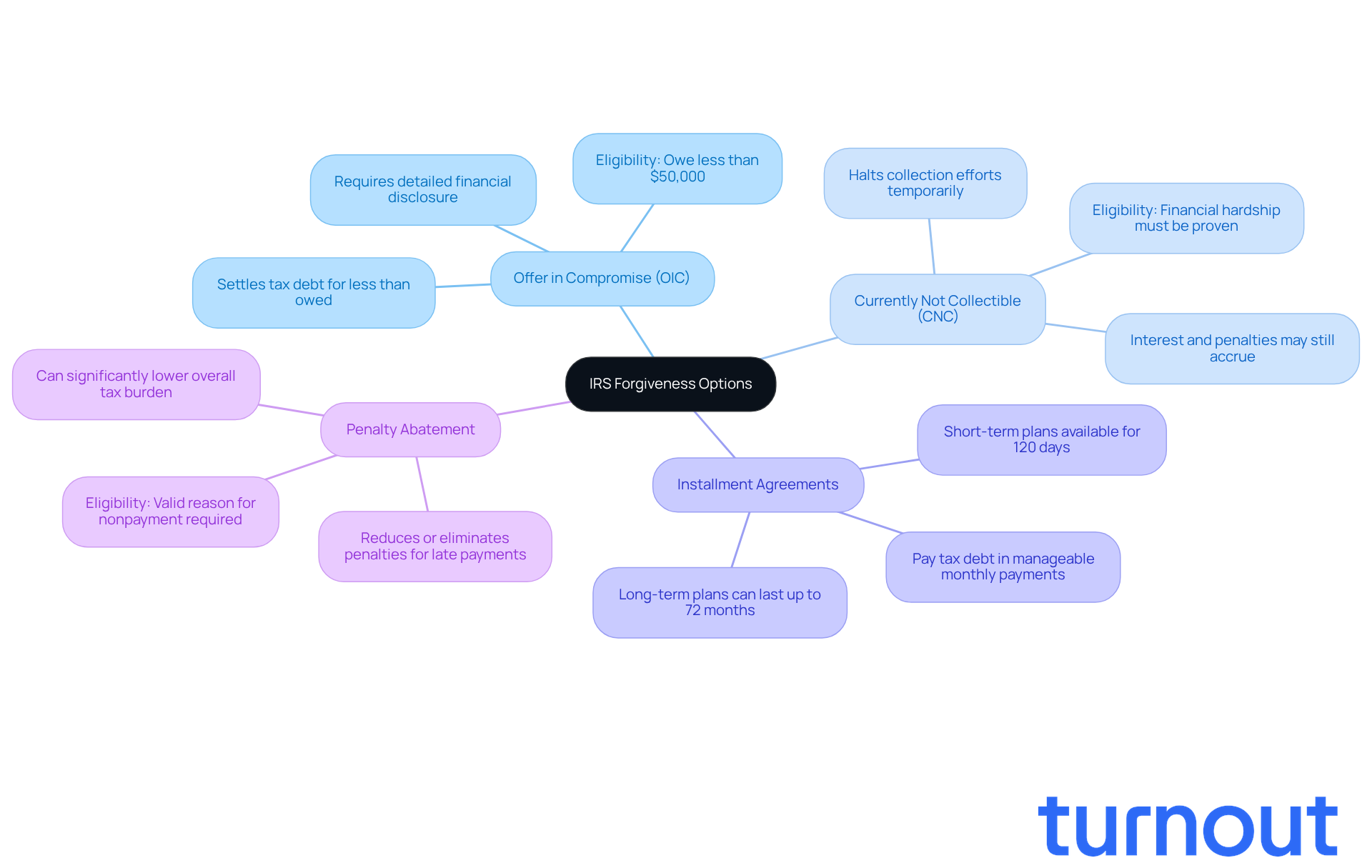

Explore Types of IRS Forgiveness Options

If you're feeling overwhelmed by tax obligations, know that you're not alone. There are several IRS forgiveness options available to help ease your burden:

- Offer in Compromise (OIC): This program allows you to settle your tax debt for less than what you owe. It’s a great option for those facing financial hardship who can’t pay their full tax liability.

- Currently Not Collectible (CNC): If you can show that paying your tax obligation would mean sacrificing basic living expenses, you might qualify for CNC status. This status temporarily halts collection efforts, giving you some breathing room.

- Installment Agreements: This option lets you pay your tax debt in manageable monthly payments over time, making it easier to handle.

- Penalty Abatement: If you have a valid reason for not paying your taxes on time, you can request a penalty abatement to reduce or eliminate those penalties.

It is important to understand how do you qualify for IRS forgiveness, as each of these options has its own eligibility criteria and submission processes. It’s essential to assess which one fits your circumstances best. Remember, we’re here to help you navigate this journey.

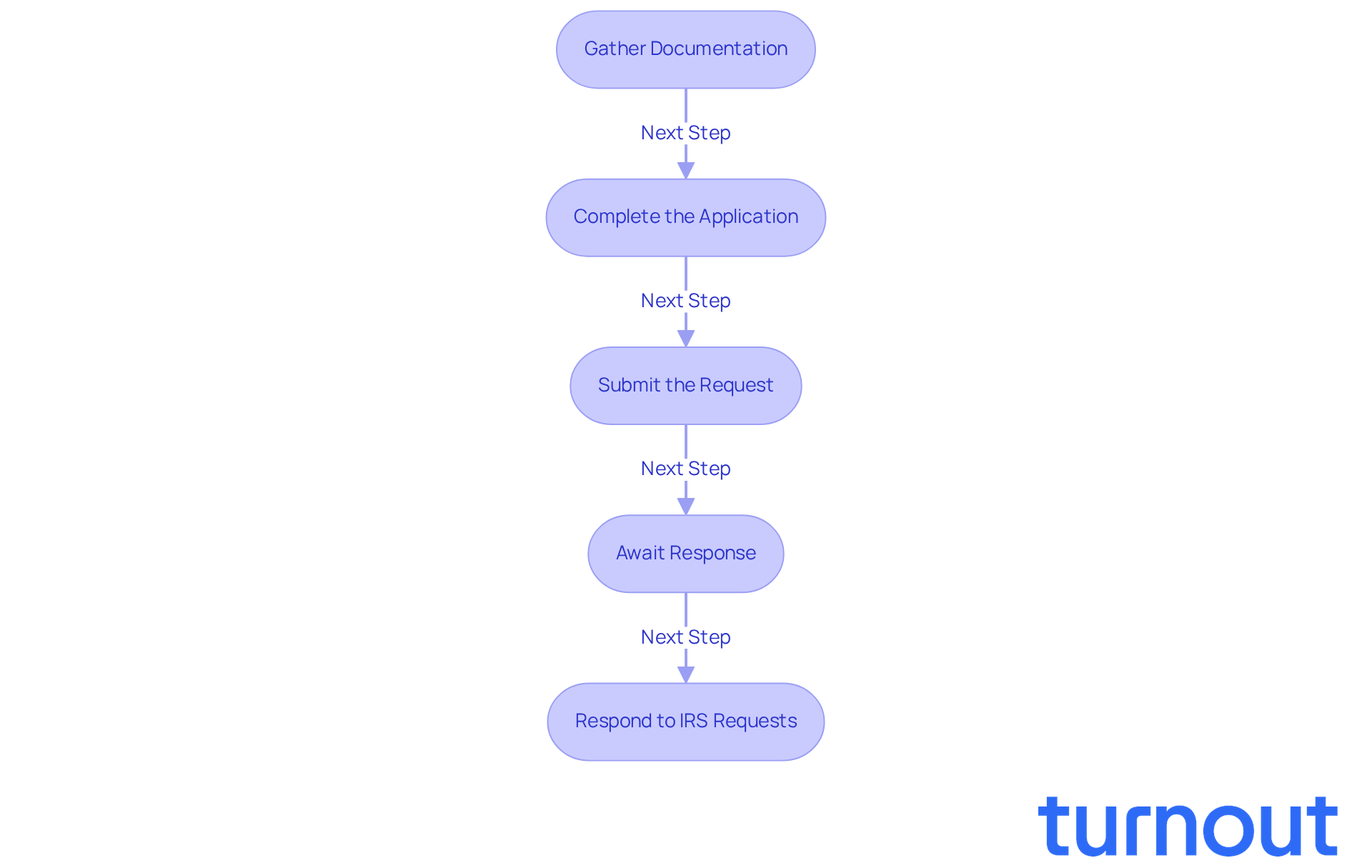

Follow the Step-by-Step Application Process for IRS Forgiveness

Applying for IRS forgiveness can feel overwhelming, but you’re not alone in this journey. Here are some essential steps to help you navigate the process with confidence:

-

Gather Documentation: Start by collecting all necessary financial documents, like income statements, bank statements, and proof of expenses. This documentation is vital for demonstrating your financial situation and understanding how do you qualify for IRS forgiveness. Remember, as tax attorneys from Segal, Cohen & Landis say, "The key is to determine which specific option fits your financial situation."

-

Complete the Application: If you’re considering an Offer in Compromise, fill out IRS Form 656 and Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses. Make sure all information is accurate and complete - mistakes can lead to delays or even rejection. Before you apply, it’s helpful to use the IRS Offer in Compromise Pre-Qualifier Tool to determine how do you qualify for IRS forgiveness.

-

Submit the Request: Once your forms are ready, send them along with the submission fee, which is typically $205. If you’re a low-income applicant, this fee may be waived, making the process more accessible. Just a reminder: all necessary federal tax deposits must be up to date for the quarter of your request and the two prior quarters for businesses.

-

Await Response: After you submit your request, the IRS will evaluate it. This process can take several months, so it’s important to be patient and keep an eye on your status. Keep in mind that penalties and interest on unpaid tax debts will continue to accumulate during this time.

-

Respond to IRS Requests: If the IRS asks for additional information or documentation, respond promptly. Quick replies are crucial to avoid delays in processing your request and to determine how do you qualify for IRS forgiveness. Also, staying compliant with tax obligations during the review period is essential for the success of your request.

By carefully following these steps and ensuring thorough documentation, you can significantly enhance your chances of successfully obtaining IRS forgiveness. The IRS Fresh Start program's fundamental qualifications remain unchanged for 2026, providing a solid framework for relief options available to taxpayers. Remember, we’re here to help you through this process.

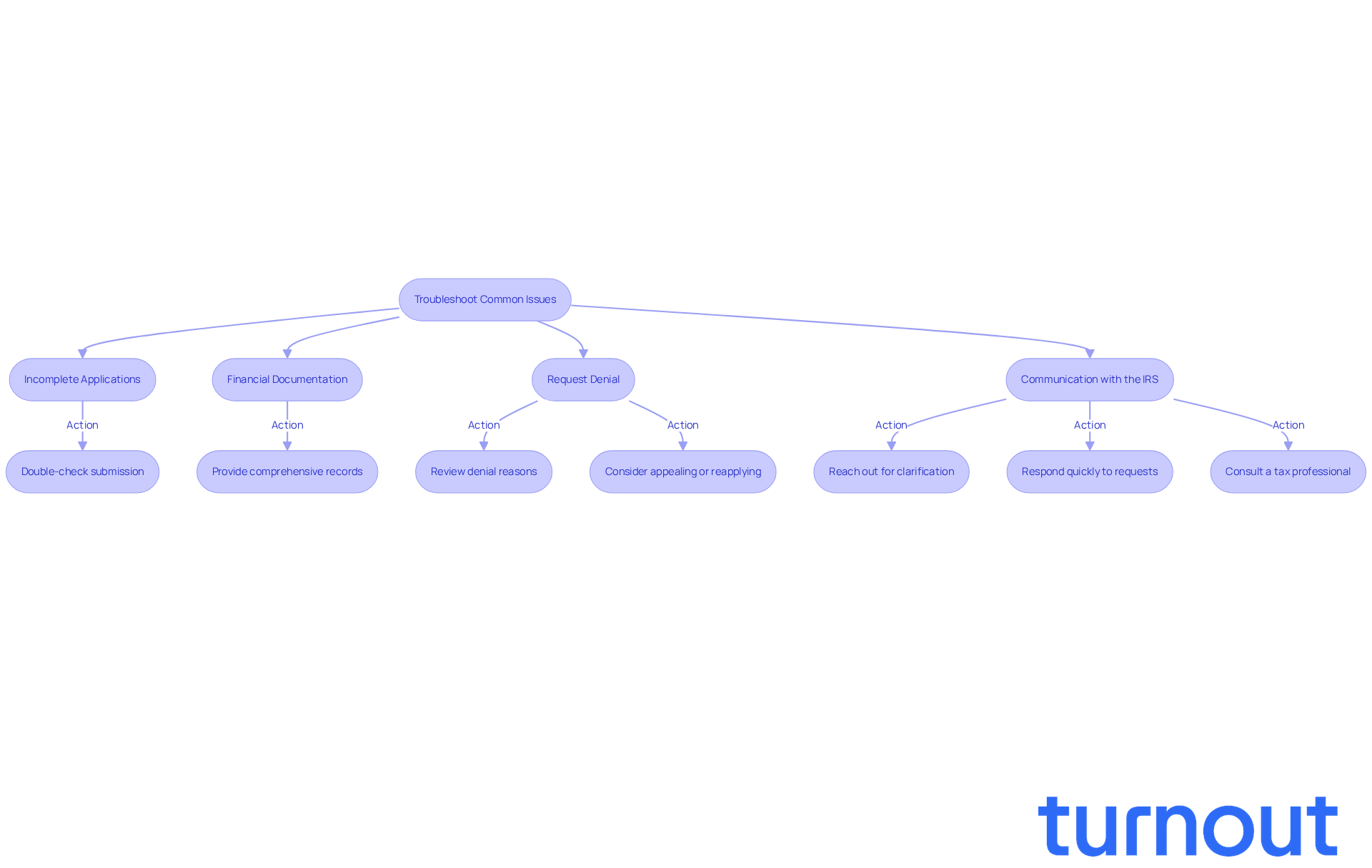

Troubleshoot Common Issues and Questions During the Application

When considering how do you qualify for IRS forgiveness, it’s common to encounter a few challenges that can feel overwhelming. But don’t worry; we’re here to help you navigate through them.

-

Incomplete Applications: It’s crucial to ensure that all forms are thoroughly completed. Missing information can lead to significant delays or even denials. Take a moment to double-check your submission before sending it in to avoid these pitfalls.

-

Financial Documentation: Be prepared to provide comprehensive financial records. If the IRS requests more documentation, respond quickly to prevent processing delays that could hinder your request. As J. David Tax Law advises, "Ensure that your appeal package is complete and well-organized."

-

Request Denial: If your request is denied, carefully review the reasons provided by the IRS. You have the option to appeal the decision or reapply with the necessary additional information to strengthen your case. Remember, "There are several proactive steps you can take to address the denial and strengthen your case for an appeal."

-

Communication with the IRS: Keeping lines of communication open is essential. If you have questions or need clarification, don’t hesitate to reach out to the IRS directly or consult a tax professional for guidance. Be mindful of the deadlines for filing an appeal, as missing them can jeopardize your chances of success.

By proactively addressing these common concerns, you can manage the process more efficiently and better understand how do you qualify for IRS forgiveness to achieve a positive outcome. It’s also worth noting that the IRS has reported a 21% approval rate for Offer in Compromise submissions, which highlights the challenges you may face in this application process. If you need to appeal a denial, be ready to fill out Form 9423 (Collection Appeal Request) or other relevant forms.

Conclusion

Navigating the complexities of IRS forgiveness can feel overwhelming, and we understand that. It’s crucial to grasp the eligibility criteria and the options available for those seeking relief from tax burdens. Programs like the Offer in Compromise (OIC), Currently Not Collectible status, and Installment Agreements are here to help individuals facing financial hardships find viable solutions.

Key insights from this guide highlight the importance of:

- Thorough documentation

- Compliance with tax obligations

- Being aware of potential challenges during the application process

By following the outlined steps and proactively addressing common issues, you can significantly enhance your chances of successfully obtaining IRS forgiveness. Did you know that the approval rate for OIC submissions is just 21%? This underscores the need for careful preparation and a solid understanding of the IRS's requirements.

Ultimately, the journey toward IRS forgiveness isn’t just about easing financial stress; it’s about reclaiming control over your financial future. The IRS Fresh Start Initiative continues to offer opportunities for relief, making it vital for you to stay informed and take action. Remember, seeking guidance from tax professionals can empower you to navigate this process effectively, ensuring you’re well-equipped to achieve the relief you deserve. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is IRS forgiveness?

IRS forgiveness refers to various programs that help individuals resolve their tax obligations for less than what they owe, with the Offer in Compromise (OIC) being the most common option for those facing financial difficulties.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program designed for individuals who cannot pay their taxes due to financial hardship, allowing them to settle their tax obligations for less than the full amount owed.

What are the eligibility criteria for the Offer in Compromise?

The eligibility criteria for the OIC include: 1. Tax Compliance: All required tax returns must be filed, and necessary estimated payments made. 2. Financial Hardship: You must demonstrate that paying your tax obligation would create an excessive financial burden. 3. No Open Bankruptcy: You cannot be involved in an open bankruptcy proceeding. 4. Obligation Amount: Your total tax obligation should generally be under $50,000.

How many Offers in Compromise were accepted by the IRS in 2022?

In 2022, the IRS accepted over 25,000 Offers in Compromise.

What was the acceptance rate for OIC submissions in 2021?

The acceptance rate for OIC submissions in 2021 was around 30%.

Can you provide an example of a successful OIC application?

Yes, one taxpayer successfully settled an $11,000 state tax obligation for just $200 through a well-documented OIC application.

Are eligibility standards for tax obligation forgiveness programs changing?

Yes, eligibility standards for tax obligation forgiveness programs are tightening, focusing more on current financial hardship.

Will the IRS Fresh Start Initiative still be available in the future?

Yes, the IRS Fresh Start Initiative will still be available in 2026, providing ongoing opportunities for taxpayers seeking relief.

Why is timely tax filing important for eligibility in relief programs?

Timely tax filing is crucial for maintaining eligibility for relief programs, as it ensures compliance with tax obligations.